- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Comprehensive Guide to Remittance from the U.S. to Indonesia: Choosing the Best Transfer Method

Image Source: unsplash

When remitting money from the US to Indonesia remittance, you need to consider fees, delivery speed, security, and convenience. You can choose a suitable option based on the remittance amount, frequency, and recipient’s preferred receiving method.

- If you are more concerned about service fees and delivery time, you can prioritize comparing different channels.

- You can also refer to the comprehensive analysis of remittance methods to find the most suitable transfer option.

Key Points

- When choosing a remittance method, focus on fees, delivery speed, and security to ensure you select the most suitable option.

- Bank transfers are ideal for large amounts, offering high security, but fees are higher, and delivery takes longer.

- Traditional transfer companies like Western Union are suitable for cash pickup needs, with fast delivery, ideal for urgent remittances.

- Online remittance services like Wise and Remitly are user-friendly, transparent in fees, and suitable for small and frequent transfers.

- Before remitting, verify the recipient’s identity to avoid common scams and ensure fund security.

Comprehensive Analysis of Remittance Methods

Image Source: pexels

When choosing a remittance method from the US to Indonesia, you typically encounter three main channels: bank transfers, traditional transfer companies, and online remittance services. Each method has unique features and applicable scenarios. Below is a detailed breakdown to help you quickly understand the core content of the comprehensive analysis of remittance methods.

Bank Transfers

Bank transfers are suitable when you need to send funds directly to the recipient’s bank account in Indonesia. You can initiate an international wire transfer through a licensed bank in the US or Hong Kong. The advantage of bank transfers is high security, making them ideal for large remittances. The downside is higher fees (typically USD 25–50) and longer delivery times (1–5 business days). Recipients may also incur receiving bank fees. Bank transfers do not support cash pickup and are suitable for scenarios where both you and the recipient have bank accounts.

Traditional Transfer Companies

If you want the recipient to collect cash directly at a local branch in Indonesia, traditional transfer companies like Western Union, MoneyGram, and Ria are common choices. These companies have wide coverage, support cash pickup, and offer fast delivery (minutes to same-day). Fees vary by amount and service type, typically ranging from USD 6.50–37.60. You can process transfers online or offline, making them suitable for urgent remittances or when the recipient lacks a bank account.

Online Remittance Services

Online remittance services like Wise, Remitly, and Paysend have become increasingly popular. These platforms are user-friendly, transparent in fees, and offer fast delivery. For example, Wise supports bank deposits with fees as low as USD 7.50 and delivery times from minutes to 2 days. Remitly and Paysend support both bank deposits and cash pickup, with fees as low as USD 0.99–1.99, and first transfers are sometimes free. You can operate via mobile or computer, ideal for users seeking cost-effectiveness and convenience.

You can use the table below to quickly compare the fees, speed, and cash pickup support of major remittance methods, further understanding the comprehensive analysis of remittance methods:

| Provider | Transfer Fees (Typical $1,000) | Delivery Speed | Cash Pickup |

|---|---|---|---|

| Wise | ACH: $7.50, Wire: $11.89 | Minutes–2 days | No |

| Remitly | $0.99–$1.99 (First free) | Minutes/3–5 days | Yes |

| Western Union | $6.50–$37.60 | Minutes–Same day | Yes |

| Paysend | $1.99 fixed | Same day (Hours) | Limited |

| Ria | ~$7 (First free) | Minutes–Days | Yes |

| OFX | No fees, exchange rate margin | 3–5 business days | No |

| XE | No fees, 2.3% exchange rate margin | 1–3 business days | No |

| Bank Transfer | $25–$50 + receiving bank fees | 1–5 business days | No |

You can choose the most suitable channel based on your needs, combining the comparison from the comprehensive analysis of remittance methods.

Detailed Breakdown

Operation Process

The operation process varies depending on the remittance method you choose.

For bank transfers, you typically need to follow these steps:

- Register or log into your online banking account, click “Send Now”.

- Select Indonesia as the recipient destination and enter the amount you wish to send.

- Choose the recipient’s preferred receiving method and your payment method.

- Provide the recipient’s name, address, phone number, email, bank name, and account number.

- Add your payment information.

- Upon completion, you will receive a confirmation email with a unique tracking number (e.g., MTCN), which you can share with the recipient.

If you choose a traditional transfer company, such as through a licensed bank partner in Hong Kong, the process is straightforward. You can fill out a remittance form online or at a physical branch, provide recipient details and the amount, and receive a pickup code after payment. The recipient can use the code to collect cash at a branch in Indonesia.

Online remittance services like Paysend or Remitly are even more convenient. You simply:

- Create your account.

- Set up the first transfer, entering recipient details and amount.

- Confirm the details and submit.

- Track progress via mobile app or website.

These platforms typically support multiple receiving methods, including bank deposits, card transfers, and cash pickup. You can choose flexibly based on your needs.

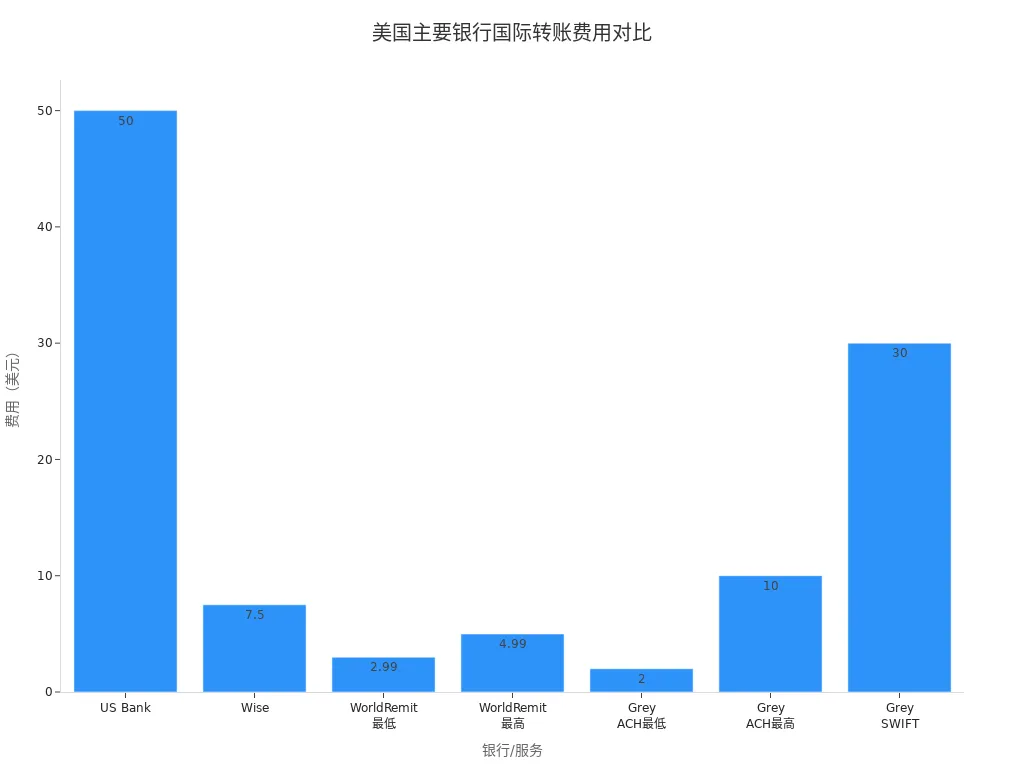

Fees

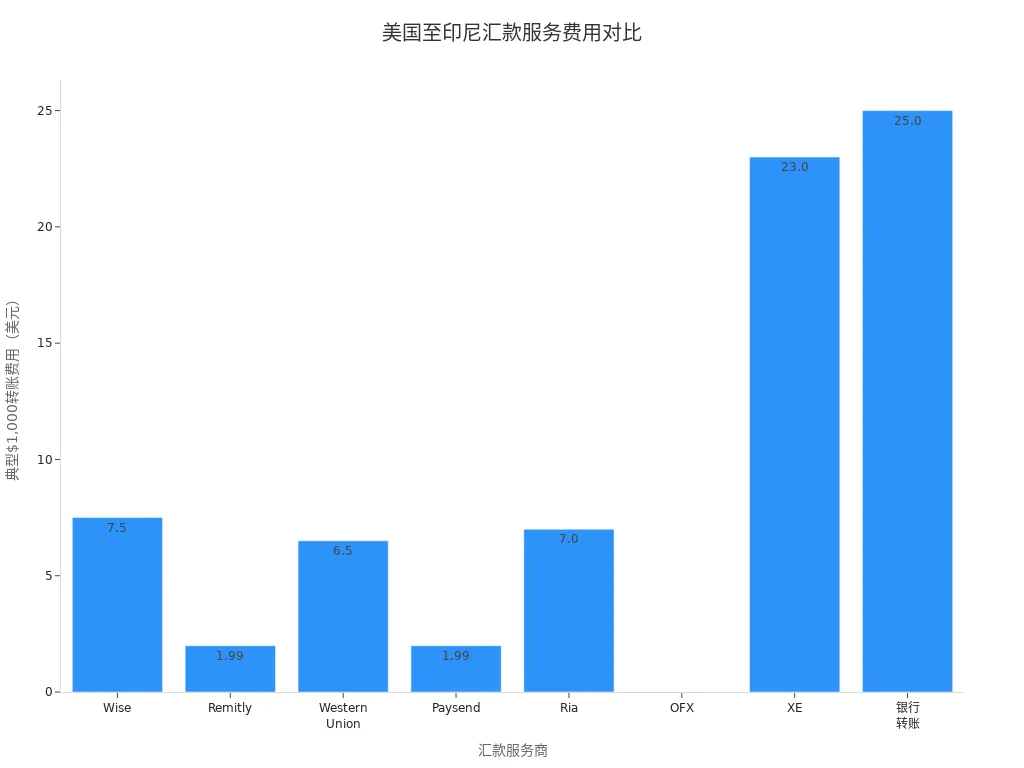

Fees vary significantly across remittance methods. You should focus on the fee structure when choosing.

The table below shows typical fees for major channels (in USD):

| Bank/Service | Fees (Per Transaction) |

|---|---|

| Licensed Hong Kong Banks | $25–$50 |

| Wise | $7.50 ($1,000) |

| WorldRemit | $2.99–$4.99 |

| Paysend | $1.99 (Fixed) |

| Remitly | $0.99–$1.99 |

| Grey | ACH 0.5% ($2–$10), SWIFT $30 |

You can see that bank transfers have the highest fees, suitable for large remittances. Online services like Paysend and Remitly offer low, transparent fees. Traditional transfer companies fall in between, with some offering free first transfers.

When conducting a comprehensive analysis of remittance methods, be sure to combine fees and exchange rate differences to evaluate the total cost.

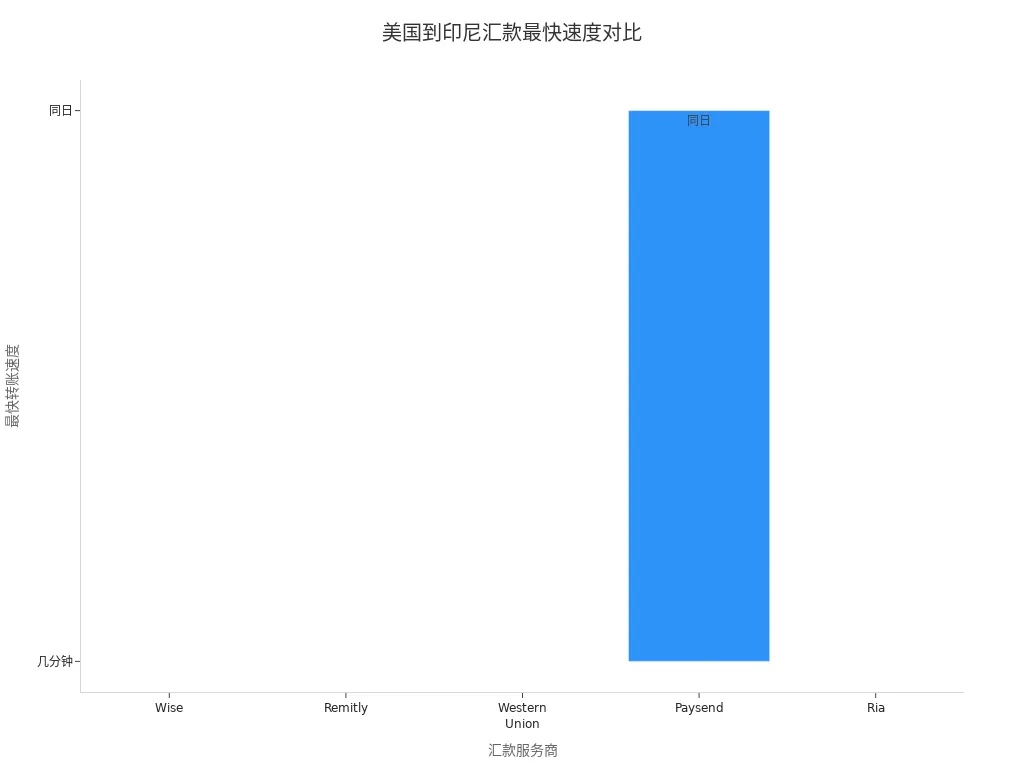

Delivery Speed

Delivery speed directly impacts the recipient’s experience. Bank transfers typically take 1 to 5 business days, depending on the initiation time and the processing efficiency of the banks involved. Traditional transfer companies deliver funds in minutes to the same day.

Online remittance services excel in speed. For example, with Paysend and Remitly, 90% of transfers can be completed in minutes, while economy options may take 1 to 3 days. You can choose the service based on the recipient’s urgency.

Security

When making cross-border remittances, security is a top priority.

Bank transfers and major online remittance services employ multiple security measures, including:

- Encryption technology to protect your account and transaction information.

- Compliance with strict financial regulations for lawful operations.

- Two-factor authentication to prevent account theft.

- Transaction tracking features to monitor fund movements.

- Platforms licensed by relevant financial regulators.

When choosing any channel from the comprehensive analysis of remittance methods, prioritize these security measures. Platforms like Paysend and Remitly also verify recipient identities to ensure funds reach the intended account safely.

Target Audience

Different remittance methods suit different needs.Bank transfers are ideal for sending large amounts when the recipient has a bank account and you prioritize high security and formal processes.Traditional transfer companies are suitable when the recipient lacks a bank account or needs to collect cash at a local branch in Indonesia, especially in urgent situations.

Online remittance services like Paysend and Remitly are ideal for users seeking cost-effectiveness, convenience, and fast delivery. Paysend offers fixed rates and fees, suitable for predictable costs. Remitly provides multiple delivery options to meet various recipient needs.

You can flexibly choose the most suitable channel based on your situation and the recipient’s needs.

Pros and Cons Comparison

Image Source: pexels

Fee Comparison

Fees are a key consideration when choosing a remittance method. Bank transfers typically charge USD 25–50, suitable for large amounts. Traditional transfer companies have a wider fee range, with some offering free first transfers. Online services like Wise, Paysend, and Remitly have fees as low as USD 0.99–7.50, with transparent structures, ideal for small and frequent transfers.

Be aware of the following hidden fees:

- Transfer fees: Upfront fees per transaction, either fixed or percentage-based.

- Exchange rate margins: Some providers add a margin to the exchange rate, reducing the recipient’s amount.

- Payment method fees: Using a credit card may incur additional costs.

- Receiving method fees: Cash pickup is typically more expensive than bank deposits.

Speed Comparison

Delivery speed directly affects the recipient’s experience. Licensed Hong Kong banks or SWIFT transfers typically take 1–5 business days. Traditional transfer companies take 1–5 business days. Online services excel, with Wise delivering 50% of payments instantly (within 20 seconds) and 90% within 24 hours. Remitly and Paysend also support same-day delivery.

| Type | Typical Delivery Time |

|---|---|

| Wise | 50% instant (within 20 seconds), 90% within 24 hours |

| Traditional Transfer Companies | 1–5 business days |

| SWIFT/Bank Transfer | Typically a few days |

Security Comparison

Security is paramount when remitting. Licensed Hong Kong banks and major online remittance services use encryption and comply with regulations to ensure fund safety. Traditional transfer companies have strict identity verification processes. When using legitimate channels, the risk to funds is minimal. Online platforms like Wise and Remitly offer real-time transaction tracking for added peace of mind.

Convenience Comparison

Convenience determines your operation experience. Online remittance services are the most convenient, allowing transfers in seconds via mobile without queuing. Funds can go directly to Indonesian bank accounts or mobile wallets. Traditional transfer companies support cash pickup, ideal for recipients without bank accounts, but require branch visits. Bank transfers are more cumbersome, suitable for those with accounts and no urgency.

Factors affecting convenience include cost, speed, ease of use, and recipient preferences. Digital platforms are increasingly popular due to low fees and high efficiency, especially for small, frequent transfers.

Selection Recommendations

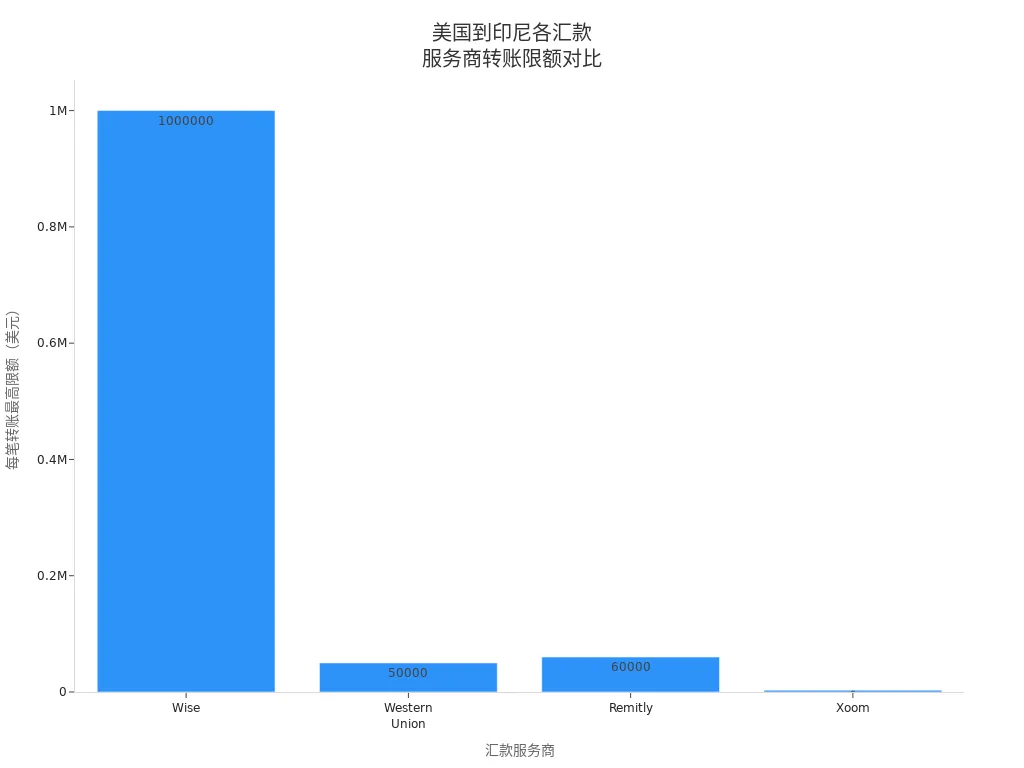

Amount-Based Selection

The remittance amount directly affects the best channel. For small amounts (USD 100–2,000), prioritize Wise, Paysend, or Remitly for low fees and fast delivery, ideal for frequent transfers. For large amounts (USD 10,000+), bank transfers or Wise are better. Bank transfers offer high security and relatively lower fees but take longer. The table below shows limits and fees for different channels to help you decide:

| Provider | Transfer Speed | Fees | Transfer Limit |

|---|---|---|---|

| Wise | 1–3 business days | $6.79+0.46% | $1,000,000 |

| Western Union | Instant/Same day | $5–$30+ | $50,000 |

| Remitly | Instant–3 business days | $0–$49.99 | $60,000 |

| Xoom | Instant–2 business days | $4.99–$59.99 | $2,999 |

You can choose the right platform based on the amount to avoid issues with limits or high fees.

Receiving Method Selection

Choose the receiving method based on the recipient’s situation. If they have a bank account, bank deposits are the safest, ideal for large amounts. For recipients without accounts, cash pickup or mobile wallets are more convenient. The table below summarizes common receiving methods:

| Payment Option | Description | Examples |

|---|---|---|

| Cash Pickup | Collect cash at designated locations | PT Bank, etc. |

| Bank Deposit | Funds deposited directly into a bank account | Bank Central Asia, Bank Mandiri |

| Mobile Wallet | Transferred to recipient’s mobile wallet account | LinkAja, Ovo, Gopay, Dana |

Communicate with the recipient in advance to choose the most suitable receiving method for smooth delivery.

Urgent Needs Selection

For urgent remittances, delivery speed is critical. Wise, Remitly, and Western Union support transfers in minutes, ideal for immediate needs. The table below compares speed and fees for major services:

| Provider | Transfer Fees ($1,000) | Delivery Speed | Cash Pickup |

|---|---|---|---|

| Wise | $7.50–$11.89 | Minutes–2 days | No |

| Remitly | $0.99–$1.99 | Minutes/3–5 days | Yes |

| Western Union | $6.50–$37.60 | Minutes–Same day | Yes |

| Paysend | $1.99 | Same day (Hours) | Limited |

| Ria | $7 | Minutes–Days | Yes |

Prioritize platforms with instant delivery to ensure the recipient receives funds promptly.

Other Recommendations

When choosing a remittance method, consider the following:

- Check platform fees and exchange rates in advance to avoid hidden costs.

- Prioritize platforms licensed by financial regulators for fund safety.

- Adjust remittance channels and receiving methods based on recipient needs.

- For large transfers, use licensed Hong Kong banks or Wise for safety and cost balance.

- For small or urgent transfers, Remitly and Western Union are more suitable.

You can flexibly choose a remittance method based on your needs to improve efficiency and security.

Practical Tips

Avoiding Pitfalls

When remitting, beware of common scams. Fraudsters may use social media or fake marketplaces to lure you into transferring money for goods that are never delivered. Phishing scams may trick you into entering account details via fake bank or e-commerce links. Fake job interview invitations may claim to be from reputable companies, demanding upfront fees. Some investment scams promise high returns without legitimate financial licenses. Illegal online loan platforms may collect personal information and charge high interest under the guise of quick loans.

Before transferring, verify the recipient’s identity, avoid trusting strangers or suspicious links, and never disclose personal information lightly.

Enhancing Security

You can enhance remittance security in several ways. Prioritize platforms licensed by financial regulators, such as Hong Kong banks or reputable online services. Enable two-factor authentication and change passwords regularly. Avoid transferring funds on public networks. Check transaction records promptly after each transfer and contact customer service if anomalies arise.

Save remittance receipts and communication records for traceability. Legitimate platforms typically encrypt transaction data to ensure fund safety.

Saving on Fees

You can reduce remittance costs in multiple ways. Compare platform fees and exchange rates in advance to choose the lowest total cost. Some online services like Paysend and Remitly offer free or discounted first transfers. For large transfers, prioritize platforms with fixed fees to avoid escalating costs with higher amounts.

Opt for bank deposits over cash pickup for lower fees. Plan transfer frequency to reduce small, repeated transactions and save on total costs.

When choosing a remittance method from the US to Indonesia, combine your needs with a thorough comparison of fees, delivery speed, and security. List the pros and cons of each channel and decide based on the amount and receiving method. Prioritize transparent, regulated platforms. Communicate with the recipient in advance to ensure smooth delivery.

FAQ

1. What methods can you use to remit money from the US to Indonesia?

You can choose licensed Hong Kong bank transfers, traditional transfer companies, or online remittance services. Each method has different fees and delivery speeds. Choose the most suitable channel based on your needs.

2. What recipient information is required for remittances?

You need the recipient’s name, bank account number, bank name, and contact details. For cash pickup, provide the recipient’s ID information. Confirm these details with the recipient in advance.

3. How long does it take to remit money to Indonesia?

Online remittance services deliver funds in minutes. Bank transfers typically take 1 to 5 business days. Choose based on urgency.

4. How can you ensure fund safety during remittances?

Choose regulated platforms like licensed Hong Kong banks or reputable online services. Enable two-factor authentication and regularly check account security settings.

5. How can you save on remittance fees?

Compare platform fees and exchange rates in advance. Some online services offer free first transfers. Bank deposits are usually cheaper than cash pickup.

You have thoroughly analyzed the remittance methods from the US to Indonesia, clearly understanding the pros and cons of bank transfers (suitable for large amounts, high security), traditional transfer companies (for cash pickup, emergencies), and online services like Wise and Remitly (for small, low-cost transfers). Facing complex fee structures and varying speeds, you need a modern solution that balances cost, efficiency, and security, especially when dealing with large transfers or frequent, low-cost remittances.

Traditional bank wires are expensive (USD 25–50), and while online platforms are cheaper, they still involve exchange rate markups or amount restrictions. For users with global asset allocation needs or who require flexible switching between fiat and digital assets, a more comprehensive, modern financial solution is necessary.

BiyaPay is your ideal choice for achieving high-efficiency fund transfers to Indonesia. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively lowering your transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to ensure your funds reach Indonesia safely, compliantly, and quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.