- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Can AMD achieve greater breakthroughs in 2025 with the dual promotion of AI and GPU?

Among technology stocks, AMD is undoubtedly an undervalued potential stock. Despite its relatively poor stock performance this year, its potential in the AI and semiconductor fields cannot be ignored. With the rapid development of AI technology, AMD is rapidly narrowing the gap with industry leader Nvidia, especially in the AI accelerator and data center GPU markets, demonstrating strong competitiveness.

The company has not only made significant breakthroughs in chip technology, but also gained rapid market share growth in cooperation with tech giants such as Microsoft, Meta, and Oracle. Despite fierce market competition, especially facing strong competition from Nvidia, AMD still occupies a place in the AI and semiconductor industries with its unique competitiveness such as technological innovation, lower price advantages, and open source platforms.

Next, let’s take a detailed look at why it may become an investment highlight in 2025.

With the rise of technological innovation and AI, AMD is expected to gain more market share

In recent years, the rapid development of artificial intelligence (AI) technology is changing the pattern of various industries around the world, especially in data processing, automation, and intelligence. Nowadays, AI is not only a trend, but also deeply driving the transformation of industries such as technology, healthcare, and finance. The core of AI technology cannot be separated from powerful computing capabilities, especially GPUs (graphics processing units) and AI accelerators, which play a crucial role in modern data centers and Cloud Service platforms.

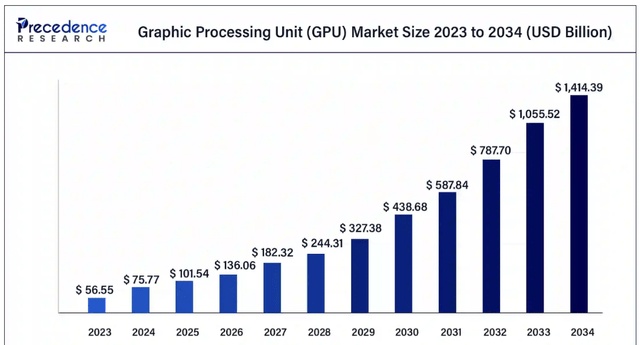

With the widespread application of AI, the semiconductor industry has also ushered in huge development opportunities. The demand for efficient computing devices in the market has surged, especially the demand for GPUs, which has become more urgent. Compared with traditional CPUs, GPUs have shown higher efficiency and computing power in parallel processing and Deep learning tasks, becoming one of the key technologies supporting the development of AI technology. According to research, the global AI market is expected to continue to grow, and in the next few years, the demand for AI-related hardware will further increase, driving the development of the entire semiconductor industry.

In this fiercely competitive market, Nvidia has always been in a leading position, especially in the field of AI accelerators. It almost monopolizes the GPU market in the Data Center and Cloud Service platforms. However, it is worth noting that despite Nvidia’s dominant position, AMD, as its biggest competitor, is constantly narrowing the gap through technological innovation. Although AMD’s market share is still small compared to Nvidia, as it continues to advance new technological breakthroughs in the GPU and AI accelerator fields, AMD’s market share is expected to grow rapidly in the next few years. AMD’s MI series AI accelerators have begun to compete with Nvidia’s high-end GPUs and have gained a certain market share.

The global GPU market is expected to grow at an annual rate of 34% in the next few years, and the market size is expected to reach $440 billion by 2030. This provides huge growth space for semiconductor companies such as AMD. If AMD can continue to make progress in technology and further expand its share in the AI field with its strong foundation in the CPU market, its sales could rapidly climb to billions of dollars in the next few years.

However, the competition is still very fierce. Nvidia’s leadership position in the market cannot be broken in the short term. In order for AMD to stand out, it also needs to continuously innovate, strengthen marketing activities, and maintain excellent execution. In the next few years, the further development of AI technology will undoubtedly bring huge opportunities to AMD, but it also comes with many challenges.

Technical signals indicate that AMD’s stock price may rebound

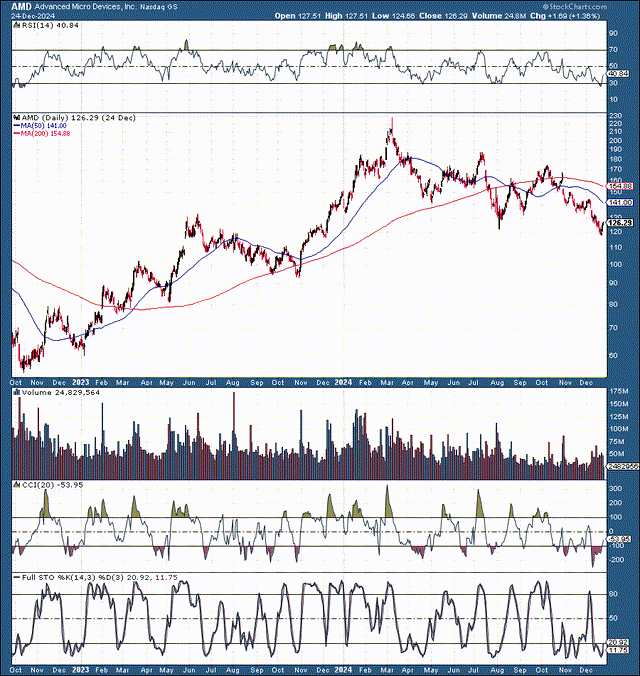

AMD’s stock price has experienced severe fluctuations since the beginning of this year, especially in the context of market adjustments, where the stock price has fallen sharply. From a high of $230 to a recent low of $116, it has fallen by 50%. This drastic adjustment has shocked many investors, but for us long-term investors, this may be an extremely favorable buying opportunity.

Firstly, from a technical analysis perspective, AMD’s stock price is currently in oversold territory. Its Relative Strength Index (RSI) is far below 30, indicating that the stock has entered an oversold state, which may indicate an imminent rebound. According to technical indicators, AMD’s stock price has ended the so-called “fifth wave” downward cycle and may enter a period of recovery. In recent months, the decline of AMD’s stock price is quite close to the bottom of the bear market, which provides technical support for the potential rebound of the market.

From the chart, AMD’s stock price shows significant signs of undervaluation. Multiple technical indicators, such as the Commodity Channel Index (CCI), also show that AMD is in a downturn. CCI has fallen to -300, hitting a new low in five years, which means that market sentiment has become too pessimistic.

For investors who can wait patiently, this may be a good time to enter AMD stock. AMD’s price is already so cheap that it is hard to ignore, and the next rebound may be very strong. If you want to seize investment opportunities, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account, making it convenient to invest in AMD. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensuring fund safety and liquidity needs.

Looking at the potential from the valuation, is AMD worth entering?

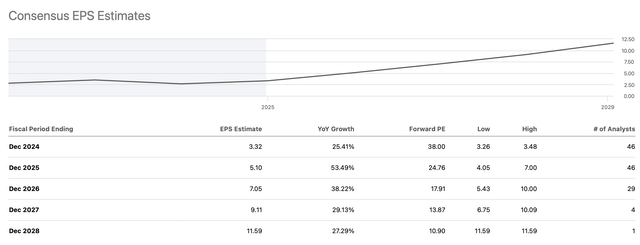

With the stock price correction, AMD’s Price-To-Earnings Ratio (P/E) has become extremely attractive. According to the current profit forecast, AMD’s earnings per share (EPS) for 2025 are expected to be $5. Some analysts believe that this expected number may be underestimated, and the actual profit may be higher, reaching between $5.50 and $6. Considering AMD’s strong growth potential, this expectation does not seem exaggerated.

If we further speculate on AMD’s future earnings, the consensus expectation for earnings per share in 2026 is $7, but some optimistic analysts believe that AMD’s earnings per share can reach $9. This means that even in a relatively mild scenario, AMD’s Price-To-Earnings Ratio is still very attractive. Taking earnings per share of $8 as an example, the current stock price is only $125, so AMD’s Price-To-Earnings Ratio is about 15.6 times. If AMD’s earnings reach $9, the Price-To-Earnings Ratio will drop to 13.9 times, making it even cheaper.

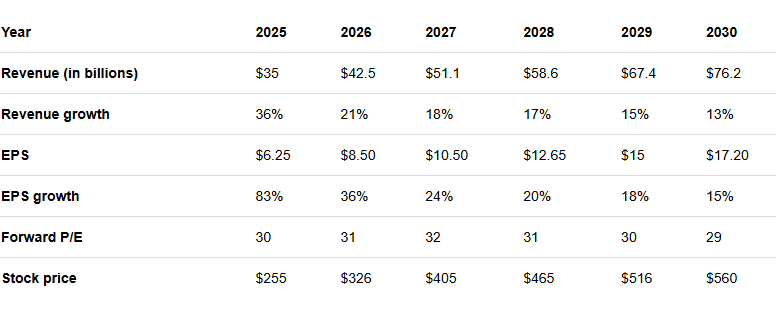

With AMD’s market share gradually expanding in high-growth areas such as AI, GPU, and Data center, it is expected that the company’s financial performance will significantly improve in the coming years. According to current forecasts, AMD’s revenue and earnings per share will maintain strong growth in the coming years.

As shown in the table above, AMD’s revenue and earnings per share are expected to grow at a stable rate, and the company’s earnings per share will significantly increase in the coming years. In particular, with the rapid development of AI technology and the data center market, AMD will benefit from it, further driving revenue and profit growth. On this basis, the stock price may rise significantly with the company’s performance, especially from 2025 to 2026, where the stock price is expected to exceed $250 and even exceed $326.

If AMD’s growth potential is realized, its stock price is expected to show a strong upward trend in the next few years, possibly rising from the current $125 to $560, further expanding its market value.

What risks does AMD face?

Of course, AMD’s investment is not without risks. Firstly, execution risk remains one of the biggest challenges. Although AMD has made significant progress in AI, GPU and other fields, it is still in a catch-up phase compared to competitors such as Nvidia. If AMD makes any mistakes in future technology and market expansion, it may affect its stock price performance.

In addition, AMD also faces strong competitive pressure from companies such as Intel and Broadcom. Especially in the CPU and GPU fields, technology iteration is rapid, and any company’s mistakes may be quickly surpassed. Therefore, AMD must constantly innovate and maintain a leading position in the market in order to stand out in fierce competition.

Macroeconomic factors and external factors such as potential tariffs are also risk factors to consider when investing in AMD. The global semiconductor industry is very sensitive to external factors, and any sudden global event may affect AMD’s financial performance.

In summary, although AMD faces certain risks, the company still has great investment appeal in terms of technological innovation, market potential, and financial performance. If it can continue to leverage its technological advantages in the next few years and maintain strong growth in the AI and data center fields, AMD’s stock price is expected to continue to rise and become one of the most worthwhile technology stocks to invest in the next few years.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.