- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding the Indonesian Rupiah (IDR): Remittance, Currency Stability, and International Transaction Guide

Image Source: pexels

When you remit to Indonesia, you often encounter various challenges. Regulatory requirements are strict, and compliance processes are complex. The exchange rate of the Indonesian Rupiah fluctuates significantly, which may affect the actual amount received. Traditional channels have high fees and slow processing times. The table below shows the amount of international remittances to Indonesia in USD over recent years:

| Time | Remittance Amount (Million USD) |

|---|---|

| Q1 2025 | 4163.91 |

| Q2 2025 | 4248.27 |

| Average (2005-2025) | 2260.65 |

| Historical High | 4248.27 |

| Historical Low | 1202.00 |

When selecting channels and planning funds, you should focus on these practical issues to improve fund transfer efficiency and ensure fund safety. The importance of the Indonesian Rupiah in international remittances cannot be overlooked.

Key Points

- Understand the currency code IDR and symbol Rp for the Indonesian Rupiah to ensure correct usage in international transactions.

- When choosing remittance channels, focus on processing speed, fees, and convenience to enhance fund transfer efficiency.

- During international transactions, closely monitor exchange rate fluctuations and arrange fund flows reasonably to reduce exchange rate risks.

- When preparing for remittances, ensure the recipient’s information is accurate to avoid delays or failures.

- Pay attention to Indonesia’s economic policies and market dynamics to better assess exchange rate trends and fund safety.

Introduction to the Indonesian Rupiah

Image Source: pexels

Currency Code and Symbol

When learning about the Indonesian Rupiah, you first need to understand its official currency code and symbol. According to the ISO 4217 standard, the currency code for the Indonesian Rupiah is IDR, and the currency symbol is “Rp”. You will frequently see these identifiers in international remittances or transactions.

- IDR represents the Indonesian Rupiah, an internationally recognized code.

- The symbol for the Indonesian Rupiah is “Rp,” which you can find on bills, receipts, and bank documents.

Common Denominations

In daily life or transactions in Indonesia, you will encounter various denominations of the Indonesian Rupiah. Different denominations are suitable for different scenarios. The table below shows the main denominations and their uses:

| Denomination | Best Use |

|---|---|

| Rp 1,000, Rp 2,000, Rp 5,000 | Purchasing small items, such as snacks, tips, and street food |

| Rp 10,000, Rp 20,000 | Local transportation and beverages |

| Rp 50,000, Rp 100,000 | Dining, activities, and shopping |

When making payments, you can choose the appropriate denomination based on actual needs to improve transaction efficiency.

Applications in International Transactions

In international trade and cross-border payments, the Indonesian Rupiah has specific applications. Indonesian regulations mandate the use of Rupiah for domestic transactions, but there are exceptions for international trade. When trading with countries such as Malaysia, Thailand, Japan, and China, you can directly use the Indonesian Rupiah through Local Currency Settlement (LCS) agreements. These agreements help you reduce reliance on the USD and lower exchange rate risks. When planning international fund flows, you should pay attention to these policy changes to enhance fund management flexibility.

If you need to conduct international settlements, it is recommended to prioritize understanding Indonesia’s local currency settlement policies with partner countries to better control costs and risks.

Remittance Methods

Mainstream Channels

When remitting to Indonesia, you can choose from various mainstream channels. Each channel has different advantages and applicable scenarios. Common remittance methods include:

- PayPal

- Wise

- MoneyGram

- Western Union

- DANA

- Bank Transfers

These channels support you in transferring funds to Indonesia from countries like the United States. When choosing a channel, you should focus on processing speed, fees, and convenience. Note that Indonesian regulations require all transactions to use the Indonesian Rupiah, and credit or debit cards cannot be used directly to pay remittance fees in Rupiah.

Operational Process

When conducting bank transfers, you typically need to follow these steps:

- Obtain recipient information: Including the recipient’s full name (matching the bank statement), bank name, branch name, bank account number (7-18 digits), recipient’s address, and phone number.

- Choose the transfer method: You can opt to transfer to a bank account or a mobile wallet.

- Enter the transfer amount: The transfer limit for bank accounts is IDR 10,000,000,000, and for mobile wallets, it is IDR 20,000,000.

- Confirm the transfer time: Most channels process funds within one business day after receipt and conversion.

- Provide the reason for the remittance: Such as “family or friend support” or “service purchase.”

- Optional: Provide the recipient’s email for receiving transaction details.

When remitting, recipients typically need to provide valid identification (such as a passport or national ID). Some banks also require SWIFT codes, detailed payment purposes, and SKN information (e.g., SKNINFO/2/1/0/1/1) to meet compliance requirements.

Tip: When filling out recipient information, ensure all details are accurate to avoid delays or returns.

Fees and Processing Time

Remittance fees and processing times vary significantly across channels. You can refer to the table below to compare the fees of major service providers:

| Remittance Provider | Transfer Method | Transfer Fee |

|---|---|---|

| Wise | ACH Bank Payment | $7.50 (~0.75%) |

| Wire Transfer | $11.89 (~1.19%) | |

| Remitly | Mobile Wallet | $0.99 |

| Bank Deposit | $1.99 | |

| Cash Pickup | $1.99 | |

| Paysend | Any Transfer | $1.99 |

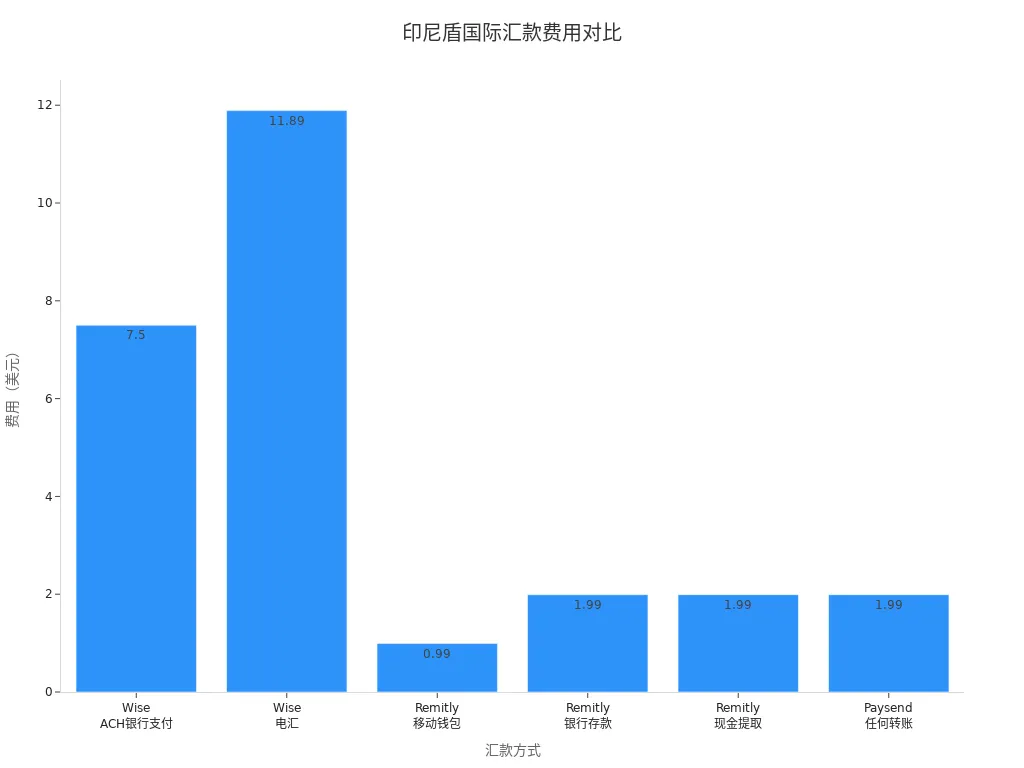

You can also refer to the chart below for a visual comparison of fees across different providers and methods:

Regarding processing times, the average processing times for different channels are as follows:

| Channel | Average Processing Time |

|---|---|

| Bank Transfer | 1 to 5 business days |

| WorldRemit | 1 to 2 business days |

| Inpay | Average 30 minutes |

When choosing a channel, you can weigh fees and processing times based on your actual needs. Digital payment solutions and government policies also affect processing speeds. Choosing digital channels often provides a faster transfer experience.

Common Issues

During the remittance process, you may encounter the following issues:

- Incorrect Information: Inconsistent recipient names, account numbers, or bank details may lead to transfer failures or delays.

- Exchange Rate Fluctuations: Exchange rate changes can affect the amount received by the recipient. You can monitor exchange rate trends and choose the right timing for remittances.

- Insufficient Compliance Documents: Some banks or channels require additional documents, such as identification, SWIFT codes, or SKN information. You should prepare relevant documents in advance.

- Channel Selection Confusion: With multiple channels available, you can compare based on fees, processing speed, and convenience to choose the most suitable option.

- Regulatory Requirements: Indonesian regulations mandate that all transactions use the Indonesian Rupiah, and refusing to accept Rupiah as a payment method is prohibited. You must comply with these policies during remittances.

Before remitting, it is recommended to carefully verify all information, understand the fees and processing times of each channel, and plan fund flows reasonably to ensure safe and efficient transfers.

Currency Stability

Influencing Factors

When monitoring the exchange rate of the Indonesian Rupiah, you need to understand various influencing factors. Global market uncertainties directly impact the value of the Rupiah. Domestic fiscal health and government spending determine the country’s economic foundation. Capital outflows and corporate foreign currency borrowing can exacerbate exchange rate fluctuations. The communication strategies of the government and central bank can stabilize market expectations.

Political stability is equally important. You will find that political turmoil, such as the dismissal of a finance minister, can trigger market uncertainty, leading to increased Rupiah volatility. GARCH analysis shows that the Rupiah’s volatility remains high (beta 0.9072), and even with central bank interventions, the annual depreciation rate reaches 6.1%. Currency weakness increases debt risks, but if the government promotes growth-oriented reforms, long-term benefits may emerge.

When conducting international transactions, it is recommended to closely monitor Indonesia’s economic performance and policy changes to assess exchange rate trends and reduce financial risks.

- Global market uncertainties

- Domestic fiscal health

- Government spending

- Capital outflows

- Impact of corporate foreign currency borrowing

- Government and central bank communication strategies

- Political turmoil and policy adjustments

Recent Trends

When analyzing recent trends of the Indonesian Rupiah, you can refer to the following data. Over the past five years, the Rupiah’s exchange rate against the USD has fluctuated significantly. The table below shows exchange rate changes for key dates in 2025:

| Date | Exchange Rate (USD) | Percentage Change |

|---|---|---|

| 2025-09-16 | 0.0000611172 | -0.328% |

| 2025-09-18 | 0.0000605327 | N/A |

| Current Date | 0.0000605473 | -0.521% |

| Past 7 Days Change | N/A | -0.339% |

You can see that the Rupiah’s exchange rate against the USD has experienced a slight decline in the short term. Global economic events also affect exchange rates. For instance, Bank Indonesia has enhanced the Rupiah’s resilience through monetary policy adjustments and market operations. A weaker USD has created a more favorable environment for emerging market currencies like the Rupiah.

You will also notice that the Rupiah has depreciated against the Euro, mainly due to the strong economic performance of the Eurozone and the stable monetary policies of the European Central Bank. On July 21, 2025, the Rupiah’s exchange rate against the USD was approximately 16,323 IDR, showing improvement compared to the beginning of the year. The exchange rate against the Euro reached approximately 18,995,300 IDR in mid-July 2025.

During cross-border transactions, you should monitor the trends of major currencies and global economic dynamics to arrange fund flows reasonably.

Exchange Rate Risks

In international transactions, you must pay attention to exchange rate risks. Exchange rate fluctuations can affect your costs and profits. Businesses typically adopt various strategies to mitigate risks. You can use forward contracts and options to lock in exchange rates. Natural hedging strategies are also common, such as conducting sales and purchases in the same foreign currency. Diversified procurement strategies can reduce reliance on a single foreign currency. You also need to assess parts of the supply chain exposed to foreign exchange risks, including upstream and downstream suppliers and customers.

In practice, it is recommended to select appropriate risk management tools based on your business characteristics to enhance fund safety.

- Use forward contracts and options to lock in exchange rates

- Adopt natural hedging strategies

- Implement diversified procurement strategies

- Assess foreign exchange risk exposure in the supply chain

If you can plan and manage exchange rate risks in advance, you will better ensure the stability of international transactions and fund safety. While the Indonesian Rupiah’s exchange rate fluctuates, effective management can significantly reduce risks and achieve efficient fund flows.

International Transaction Guide

Image Source: unsplash

Cross-Border Payments

When making cross-border payments, the Indonesian Rupiah is often used for settlements with Indonesian partners. Indonesian regulations mandate the use of the local currency for all domestic financial transactions, but exceptions exist for international trade and foreign currency bank deposits. If your transfer exceeds IDR 10 billion, you need to provide identification documents for both the sender and recipient, along with supporting documents for the transfer purpose. The table below summarizes the relevant regulations:

| Regulation Number | Content |

|---|---|

| 21/15/PBI/2019 | Foreign currency transfers exceeding IDR 10 billion require identification and supporting documents for the transfer purpose |

| 17/3/PBI/2015 | All domestic financial transactions must be conducted in Indonesian Rupiah |

| Exceptions | National budget, international trade, and foreign currency bank deposits may use foreign currencies |

When choosing a payment system, you can consider the following channels:

- MassPay: Seamlessly integrates with local payment methods, supporting Indonesian Rupiah transactions.

- PayPal: Supports international transactions, suitable for various scenarios.

- Visa and Mastercard: Available for online and offline payments.

- QRIS: Enables fast cash transactions via QR codes.

- GoPay, OVO, DANA: Digital wallets suitable for e-commerce and daily payments.

Trade Settlement

In international trade settlements, you often encounter restrictions on local currency usage. The Indonesian government provides guarantees for fund transfers and repatriation for investors, but transactions with Indonesian distributors must use the Indonesian Rupiah, increasing settlement complexity. You will also find that currency depreciation affects trade costs. Insufficient intellectual property protection and opaque pricing environments pose additional challenges. When exporting, you need to pay attention to these issues and plan fund flows reasonably.

Risk Mitigation

In cross-border transactions, you need to prioritize risk mitigation. Choosing secure channels is crucial. Providers like Wise, WorldRemit, and Remitly use encryption technology to ensure the safety of customer data and transaction details. When remitting, it is recommended to prioritize platforms with international financial licenses and check for promotional offers or fee waivers. Compliance checks and anti-fraud systems further enhance fund safety.

Channel Selection

When selecting international transaction channels, you should focus on the following criteria:

| Required Field | Description |

|---|---|

| Payment Purpose Code | Required for foreign currency priority payments and inter-account transfers |

| Recipient Type | Specify whether the recipient is an individual, business, government, or remittance service |

| Recipient Identity Status | Indicate whether the recipient is a resident, non-resident, or remittance service |

In practice, it is recommended to prepare all required documents in advance to ensure accuracy and enhance transaction efficiency while reducing risks.

When remitting to Indonesia and conducting international transactions, you should prioritize channel safety, fee transparency, and transfer efficiency. You can select the appropriate remittance method based on your needs and prepare the required documents in advance. You also need to monitor exchange rate changes and arrange fund flows reasonably. Through effective management, you can significantly reduce risks and ensure fund safety.

FAQ

How to choose the most suitable Indonesian Rupiah remittance channel?

You can compare channels based on processing speed, fees, and convenience. It is recommended to prioritize channels that support USD transfers. You should also consider the provider’s compliance qualifications and user reviews.

How to avoid errors when filling out information for remittances to Indonesia?

You need to carefully verify the recipient’s name, bank account number, and SWIFT code. It is recommended to prepare all documents in advance. You can refer to templates provided by licensed Hong Kong banks to ensure accuracy.

How to reduce risks when the Indonesian Rupiah exchange rate fluctuates significantly?

You can choose to remit when exchange rates are relatively stable. You can also use forward contracts to lock in exchange rates. Some providers offer exchange rate alert functions to help you seize the best timing.

What are the compliance requirements for large remittance amounts?

For remittances exceeding USD 70,000, you need to provide identification for both the recipient and sender, along with a statement of the fund’s purpose. You should prepare relevant documents in advance to avoid delays.

How can U.S. market users quickly complete international Indonesian Rupiah remittances?

You can choose digital payment platforms that support USD to IDR transfers. Commonly used international remittance providers in the U.S. market typically offer 1-2 business day processing times, transparent fees, and convenient operations.

You have gained a comprehensive understanding of the Indonesian Rupiah (IDR) international transaction guide, covering everything from the currency code (IDR) and common denominations to the costs and speed of remittance methods (banks, Wise, etc.), as well as exchange rate volatility and risk mitigation. You are aware of Indonesia’s strict regulations regarding local currency transactions and the supporting documents required for large transfers. When sending money to Indonesia, you need a platform that can guarantee fund security and compliance while offering a low-cost, high-efficiency service.

However, traditional bank wires come with high fees, slow transfer times (1-5 business days), and less transparent exchange rates. For users with global asset allocation needs or those who require flexible switching between fiat and digital assets, you need a more comprehensive, modern financial solution.

BiyaPay is your ideal choice for achieving high-efficiency fund transfers to Indonesia. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively lowering your transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to ensure your funds reach Indonesia safely, compliantly, and quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.