- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Guide to Remittances for Studying and Working in Indonesia: Fees, Methods, and Security

Image Source: pexels

Do you want to transfer money to Indonesia for study or employment safely, efficiently, and cost-effectively? Choosing the right remittance method is crucial. You need to focus on service fees, transfer speed, and fund security. Many users in Mainland China are unfamiliar with international remittance processes and often rely on intermediaries, which may lead to financial losses.

East Lombok is the area with the highest number of migrant workers in Indonesia, yet formal financial services remain scarce. Services are limited, and public awareness of available services is low. Village leader Gunanto stated: “Our remote location makes it difficult for financial services to reach our village.”

You must also be cautious of risky channels and avoid choosing unsafe intermediary services due to distrust in family members or lack of financial knowledge. Only by understanding various remittance services and comparing their fees and safety can you better protect your funds.

Key Points

- Choosing the right remittance method ensures fund safety, low costs, and fast delivery. Understanding the advantages and disadvantages of different methods is key.

- Bank wire transfers are suitable for large remittances, offering high security but higher fees. Third-party payment platforms and digital wallets are ideal for small remittances, with low fees and fast delivery.

- Before remitting, understand all fees and exchange rates to avoid hidden costs affecting the final amount. Comparing fees and exchange rates across providers can help save costs.

- Ensure you select regulated remittance channels and avoid using unknown intermediaries to ensure fund safety and compliance.

- Stay vigilant and protect against remittance scams. Verify the recipient’s identity to avoid financial losses due to impulsive actions.

Remittance Methods for Studying and Working

Image Source: pexels

When preparing to study or work in Indonesia, choosing the right remittance method is critical. Different remittance channels vary in transfer speed, fees, convenience, and safety. Below, we detail four mainstream methods and provide comparisons to help you make informed choices.

Bank Wire Transfer

Bank wire transfers are the most common international remittance method for users in China/Mainland China. You can transfer funds directly to an Indonesian bank account through licensed Hong Kong banks or major Mainland China banks. Bank wire transfers are suitable for large, formal remittances for study or employment purposes.

- You need to provide the recipient’s name, account number, and the recipient bank’s SWIFT code.

- International remittances typically take 1-3 business days to arrive, with potential delays during holidays or regulatory reviews.

- The fee structure is complex, including telegraphic transfer fees, handling fees, and exchange rate margins. For example, telegraphic transfer fees for international remittances are USD 7, handling fees are typically 0.1% of the remittance amount, with a minimum of USD 5 and a maximum of USD 100. Some banks also charge a full-amount fee (e.g., USD 20).

- Transfers within Bank of China are free, but transfers to other Indonesian banks incur IDR 2,000 (SKN) or IDR 20,000 (RTGS).

Tip: Bank wire transfers are ideal for large amounts and high-security needs in study or employment scenarios, but fees and transfer times require advance planning.

Third-Party Payment Platforms

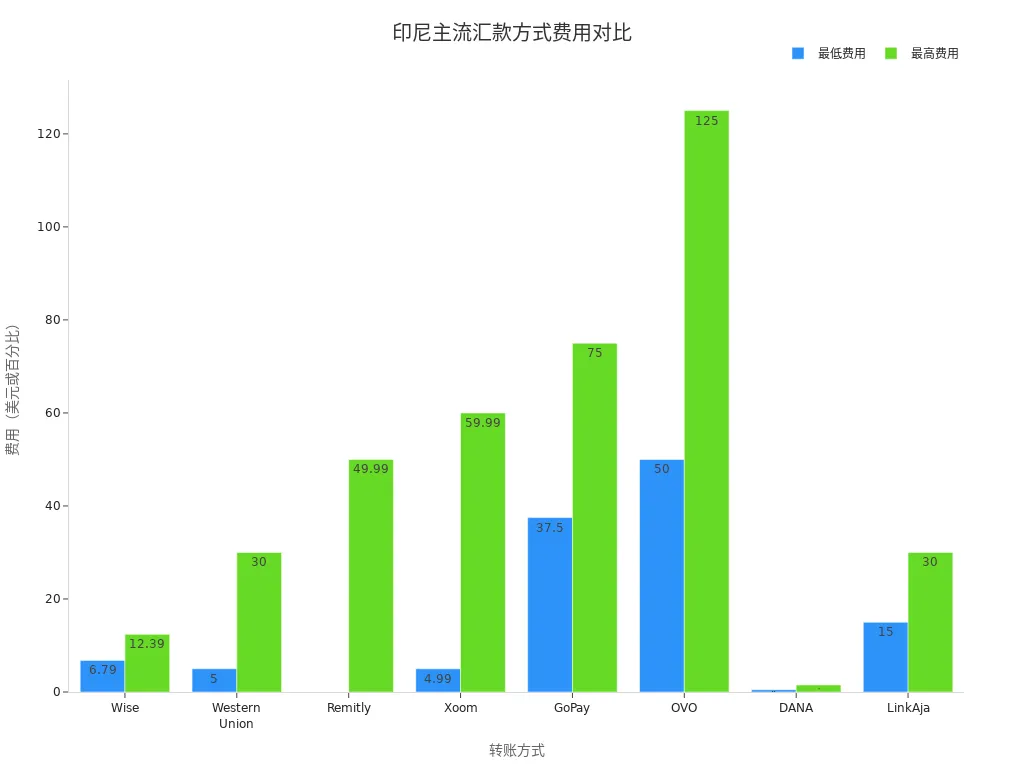

Third-party payment platforms have become a popular choice for cross-border remittances in recent years. You can use platforms like Wise, Remitly, or Xoom to transfer funds from China/Mainland China accounts to Indonesian local accounts or digital wallets. These platforms are typically user-friendly, fast, and transparent in fees.

- Wise supports transfers up to USD 1,000,000 per transaction, with a fixed fee of USD 6.79 and a variable fee of 0.46%, arriving in 1-3 business days.

- Remitly and Xoom support instant or 1-3 business day transfers, with fees ranging from USD 0 to USD 59.99 and transfer limits of USD 60,000 and USD 2,999, respectively.

- These platforms generally use encryption technology and strictly adhere to regulatory requirements to ensure your fund safety.

You can refer to the table below for transfer speed, fees, and limits of major third-party payment platforms:

| Transfer Method | Transfer Speed | Fees | Transfer Limit |

|---|---|---|---|

| Wise | 1-3 business days | Fixed USD 6.79 + 0.46% | USD 1,000,000 |

| Western Union | Instant or same-day | USD 5 – USD 30+ | USD 50,000 |

| Remitly | Instant to 3 business days | USD 0 – USD 49.99 | USD 60,000 |

| Xoom | Instant to 2 business days | USD 4.99 – USD 59.99 | USD 2,999 |

| GoPay | Instant | 1.5% – 3% | USD 2,500 |

| OVO | Instant | 1% – 2.5% | USD 5,000 |

| DANA | Instant | USD 0.50 – USD 1.50 | USD 2,500 |

| LinkAja | Instant | 1% – 2% | USD 1,500 |

When choosing a third-party payment platform, you can select based on your remittance amount, speed requirements, and fee budget.

Traditional Remittance Companies

Traditional remittance companies like Western Union and MoneyGram remain popular choices for many students and workers. You can remit cash at agent locations in China/Mainland China, and recipients can withdraw cash or deposit it into bank accounts at local Indonesian outlets.

- Many international migrants rely on employers and small migrant communities for remittance information, often sending cash through formal channels like Western Union.

- You can also remit funds to relatives’ or neighbors’ accounts for easy withdrawal in Indonesia.

- Western Union supports instant transfers with fees ranging from USD 5 to USD 30+ and a per-transaction limit of USD 50,000.

- Traditional remittance companies strictly enforce customer due diligence, suspicious transaction reporting, and record-keeping standards, ensuring compliance with anti-money laundering regulations.

Traditional remittance companies are suitable for scenarios without bank accounts or requiring cash withdrawals, offering high security but relatively high fees.

Digital Wallets

Digital wallets are widely used in Indonesia, and an increasing number of students and workers opt to receive funds through them. You can choose mainstream digital wallets like GoPay, OVO, DANA, and LinkAja, some of which support cross-border remittances and local spending.

- GoPay is deeply integrated with the Gojek app, with a large user base, suitable for daily consumption and small remittances.

- OVO has an extensive merchant network, supporting points and investment features.

- DANA focuses on security and user experience, with significant market growth.

- LinkAja, a state-owned digital wallet, connects to various digital financial services.

The table below shows account types, user requirements, and features of digital wallets:

| Account Type | User Requirements | Feature Description |

|---|---|---|

| Personal Account | Upload Indonesian ID (KTP), foreigners cannot upgrade | Pay various bills, memberships, movie tickets, and withdraw cash from designated ATMs |

| DANA Bisnis Account | Provide Indonesian business license and tax number, foreigners can register | Business cross-border remittances, supports payments to Indonesian bank accounts |

Digital wallets typically offer instant transfers with low fees. For example, PayPal, Wise, Remitly, and Xoom support fast transfers with low costs, ideal for small, frequent remittances for study or employment.

When choosing a digital wallet, consider account types, verification requirements, and local spending scenarios to ensure fund safety and ease of use.

Comparison and Selection Tips

You can choose the most suitable remittance method based on your needs, considering transfer speed, fees, limits, and convenience. The table below summarizes the features of mainstream methods:

| Remittance Method | Speed | Fees | Applicable Scenarios |

|---|---|---|---|

| Bank Wire Transfer | 1-3 days | Medium to high | Large, formal study or employment funds |

| Third-Party Payment | Instant to 3 days | Low to medium | Small amounts, flexible, cost-sensitive users |

| Traditional Remittance Companies | Instant to same-day | Medium to high | No bank account, cash withdrawal needs |

| Digital Wallets | Instant | Low | Small transactions, daily payments |

When operating, prioritize formal, compliant channels and avoid using unknown intermediaries or unofficial platforms to maximize fund safety and ensure smooth study or employment processes.

Fees and Cost-Saving

Handling Fees

When choosing to remit to Indonesia, handling fees are one of the most direct costs. Different remittance methods charge various types of fees. You can see that some services charge fixed fees for small remittances, while large remittances may incur percentage-based fees. Some services also hide fees in exchange rates, affecting the final amount received.

| Remittance Method | Fee Range |

|---|---|

| Fixed Fees | Typically charged for smaller remittance amounts |

| Percentage Fees | May apply as a percentage of the total amount for larger remittances |

| Hidden Fees | Some services include hidden fees in exchange rates, affecting the final amount |

When using bank wire transfers, you typically pay telegraphic transfer and handling fees. For example, remitting USD 1,000 through a licensed Hong Kong bank incurs fees of about USD 7-20. Third-party payment platforms like Wise, WorldRemit, and Grey offer more transparent fees, with Wise charging about USD 7.50 for USD 1,000, WorldRemit ranging from USD 2.99 to USD 4.99, and Grey charging 0.5% with a minimum of USD 2 and a maximum of USD 10. Traditional remittance companies like Western Union have a broader fee range, typically USD 5 to USD 30+. When choosing, pay attention to the fee structure to avoid increased costs due to hidden fees.

Tip: Before remitting, carefully review the service terms to understand all possible fee components and avoid unnecessary expenses.

Exchange Rates

Exchange rates are another key factor affecting remittance costs. Different providers offer varying rates, directly determining the Indonesian Rupiah amount received. When using bank transfers, you typically receive rates lower than the market rate, as banks add a profit margin. Third-party payment platforms like Wise and WorldRemit use real or competitive exchange rates, offering more transparent fees.

| Service Provider | Transfer Fees | Exchange Rate Type |

|---|---|---|

| Wise | Approx. USD 7.50 (for USD 1,000) | Transparent fees and real exchange rate |

| WorldRemit | USD 2.99 to USD 4.99 | Transparent fees |

| Grey | 0.5% (min USD 2, max USD 10) | Competitive exchange rate |

When remitting, note that exchange rate fluctuations affect the amount received. Remitting during periods of high exchange rates allows recipients to receive more local currency, while low rates reduce the amount. Banks and remittance services typically add a profit margin to the interbank rate, meaning you receive a slightly lower rate than the market rate.

- Exchange rates directly impact the amount received.

- Transfer fees may be fixed or percentage-based.

- Providers often add a profit margin to exchange rates, resulting in rates below market levels.

It’s recommended to compare real-time exchange rates across providers before remitting and choose optimal rate periods for operations.

Cost-Saving Methods

You can effectively reduce remittance costs in several ways. First, some third-party platforms like Wise offer fee-free transfers for first-time users. WorldRemit frequently releases promotional codes to reduce or waive certain fees. Remitly provides discounts for new customers and lower rates for repeat transactions. You can regularly check these platforms’ websites or subscribe to their newsletters for the latest promotional information.

- Use Wise for fee-free first transfers.

- WorldRemit offers promotional codes to reduce fees.

- Remitly provides discounts for new and repeat customers.

- Subscribe to remittance providers’ newsletters for the latest offers.

- Use comparison platforms to evaluate services and choose the best option.

You can also save by checking seasonal promotions. Sending larger amounts less frequently can reduce total handling fees. Before confirming a transfer, compare exchange rates and fees across platforms to ensure the best deal.

During study or employment, planning remittance amounts and frequency wisely and leveraging promotions and discounts can significantly reduce costs and improve fund efficiency.

Safety and Precautions

Image Source: pexels

Information Security

When conducting cross-border remittances, information security is a primary concern. Legitimate payment providers use multiple measures to protect your funds and personal information. For example, banks and non-bank payment providers use encryption to ensure your account and transaction data are not leaked. Payment system infrastructure operators maintain a secure environment for fund transfers. When using services, carefully read the service agreement, privacy policy, and terms and conditions, which clearly outline your rights and obligations, ensuring information security.

| Legal Document | Description |

|---|---|

| Service Agreement | Specifies service terms |

| Privacy Policy | Protects your personal information |

| Terms and Conditions | Governs service usage rules |

It’s recommended to prioritize platforms with robust information protection mechanisms when registering and using remittance services, and avoid entering personal information on unknown channels.

Risk Prevention

During study or employment, you may encounter various remittance scams, including family emergency scams, extortion scams, impersonation scams, investment scams, romance scams, and technical support scams. Scammers often exploit your trust or urgency to induce transfers. Stay vigilant and avoid trusting unverified information or strangers. When faced with remittance requests, verify the recipient’s identity and purpose. Use official channels or contact family directly to confirm information, avoiding losses due to impulsive actions.

- Family Emergency Scams: Fabricate emergencies involving relatives to demand remittances.

- Impersonation Scams: Pose as authorities or companies to request funds.

- Investment Scams: Promise high returns to lure investments.

- Romance Scams: Pretend to be romantic partners to solicit money.

When encountering suspicious remittance requests, stop operations immediately and consult relevant authorities or report to the police.

Compliant Channels

Choosing compliant remittance channels effectively ensures fund safety. Bank Indonesia and the Financial Transaction Reports and Analysis Center oversee the compliance and legality of payment providers’ fund flows. When using licensed Hong Kong or Mainland China banks, funds undergo strict review and reporting processes. Legitimate providers comply with local laws and international anti-money laundering regulations to ensure funds safely reach the recipient’s account.

| Regulatory Body | Regulatory Scope |

|---|---|

| Bank Indonesia | Oversees payment provider compliance, reporting, and audits |

| Financial Transaction Reports and Analysis Center | Monitors the legality and transparency of fund transfers |

During study or employment, always choose regulated banks or third-party payment platforms and avoid unofficial channels to minimize risks and ensure fund safety.

Operational Process

Preparation

Before remitting, prepare relevant documents and information to ensure smooth transfers and reduce review times. Common required materials include:

- Valid ID or passport

- Proof of income or employment

- Tax declaration forms

- Bank statements (showing transactions related to the transfer)

- Businesses need to provide a business license copy and proof of transaction purpose and fund source

Preparing these materials in advance helps expedite reviews by banks or third-party platforms. It’s recommended to consult the required document list in advance when using licensed Hong Kong or Mainland China banks.

Remittance Steps

You can complete remittances through banks, third-party payment platforms, or self-service kiosks. The common process is as follows:

- After setting up an account, enter the recipient’s details, including name, address, and bank account information (if using bank transfer).

- Select the remittance amount and confirm the payment method (e.g., bank transfer, debit/credit card, or cash deposit).

- Review exchange rates and fees to ensure the best deal.

- Track the transaction using the provider’s system, typically updated via email or SMS.

When operating at self-service kiosks, enter recipient information and remittance amount, confirm exchange rates and fees, then make the payment. After completion, save the receipt and reference number and inform the recipient for withdrawal.

Issue Resolution

You may encounter common issues during the remittance process. The table below lists major issues and solutions:

| Issue Description | Solution |

|---|---|

| Ineffective or inaccessible legal and institutional arrangements for migrant workers | Governments should simplify claim processes and provide clear information. |

| High costs and judicial bias lead to few cases entering the judicial system | Governments and civil society should collaborate to provide simple information on insurance policies and claim processes. |

| Ineffective operation of migrant worker insurance programs | Reform insurance programs to improve effectiveness and accessibility. |

If you encounter delays, information discrepancies, or fee anomalies, contact the provider’s customer service or consult local banks and relevant institutions.

Fund Tracking

You can use various tools and services to track remittance status in real-time. Common methods include:

- Use Ria Money Transfer’s “Track a Transfer” feature, entering the unique Personal Identification Number (PIN) to check status.

- Both senders and recipients can track transactions via the Ria app by clicking the “Track” option.

- Senders receive email notifications when recipients withdraw or receive funds or when significant status changes occur.

After completing a remittance, monitor transaction progress to ensure funds safely reach the recipient’s account. If anomalies occur, contact the provider promptly for resolution.

When choosing a remittance method, prioritize bank wire transfers, third-party payment platforms, traditional remittance companies, and digital wallets. Bank wire transfers are suitable for large remittances with high security but higher fees. Third-party platforms and digital wallets offer low fees and fast transfers, ideal for small, frequent needs. Traditional companies are suitable for cash withdrawals. Focus on fee structures and exchange rate changes, and choose compliant channels. Regularly review remittance policies and provider updates to ensure fund safety and cost optimization.

FAQ

What methods can you use to remit from China/Mainland China to Indonesia?

You can choose bank wire transfers, third-party payment platforms, traditional remittance companies, or digital wallets. Each method varies in speed, fees, and applicable scenarios. Select the appropriate channel based on your needs.

How long does it take for a remittance to arrive in Indonesia?

Bank wire transfers typically take 1-3 business days. Third-party platforms and digital wallets can be instant. Traditional remittance companies generally deliver same-day. Plan ahead to avoid holiday delays.

What documents are needed for remittance?

You need a valid ID or passport, recipient information, and bank account details. Businesses also require a business license and proof of fund source. Preparing documents in advance speeds up reviews.

How can you determine if a remittance channel is safe and compliant?

Choose providers regulated by Bank Indonesia or China/Mainland China financial authorities. Legitimate platforms have clear service agreements and privacy policies. Avoid using unknown intermediaries or unofficial channels.

How can you save on remittance fees?

Compare handling fees and exchange rates across platforms. Use first-transfer promotions or discount codes. Reduce transfer frequency and increase per-transaction amounts to lower total costs.

You have thoroughly reviewed all available methods for remitting funds to Indonesia, including bank wire transfers, third-party payment platforms, traditional remittance companies, and digital wallets, and you’ve learned how to compare fees (e.g., bank international transfer fees of approximately $15-$30 USD), exchange rates, and transfer speeds. Whether for paying tuition fees during your studies or managing funds for employment, you require a secure, efficient, and low-cost cross-border financial solution.

In Indonesia, traditional banking services have limitations in international remittance costs and efficiency, and you face complex issues regarding fund tracking and regulatory compliance. For users seeking lower remittance costs, more transparent exchange rates, and who have global asset allocation needs, you need a modern platform that can connect global financial markets and provide comprehensive services.

BiyaPay is your ideal choice for achieving high-efficiency fund transfers. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively reducing your cross-border fund transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to ensure your funds reach Indonesia safely, compliantly, and quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.