- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Sending Money from the U.S. to Indonesia: Exchange Rates, Limits, and Digital Remittance Service Options

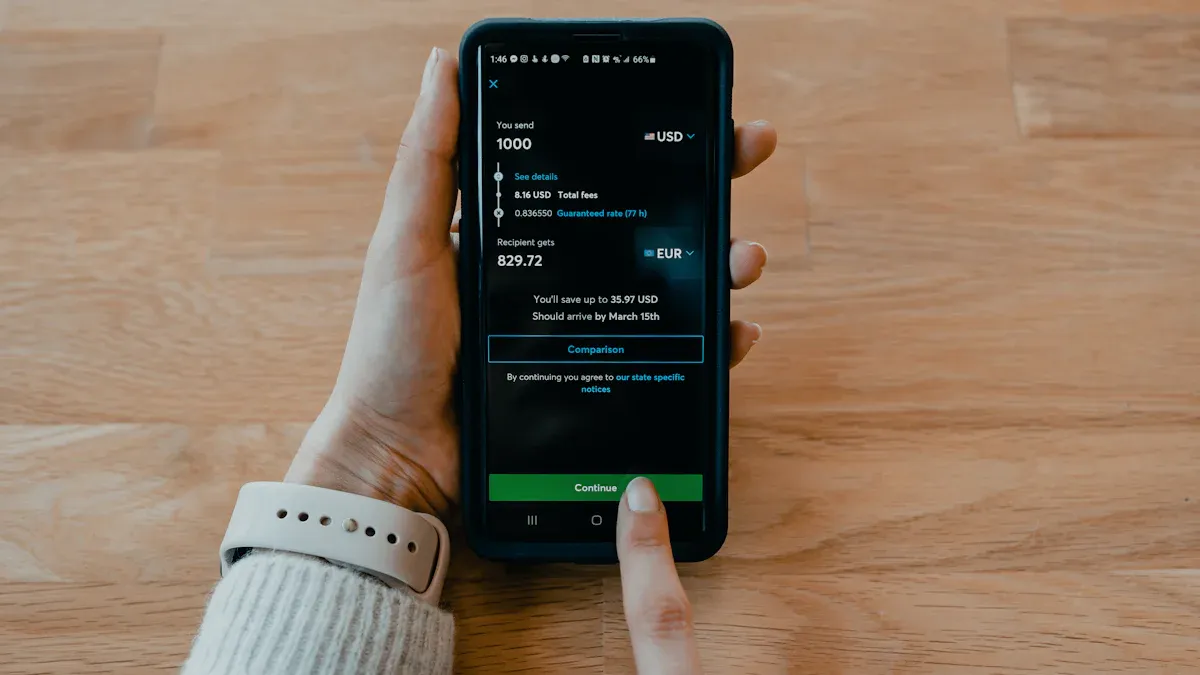

Image Source: unsplash

When you remit to Indonesia via remittance, safety, convenience, and low cost are the three key standards to focus on. Choosing the right channel ensures your money reaches the recipient faster and more securely. Exchange rate analysis is particularly important, as even small fluctuations can affect the actual received amount. The table below shows that Indonesia’s annual inbound remittances reach USD 9.95 billion with a year-on-year growth rate of 2.9%, while outbound remittances are USD 4.63 billion with a growth rate of 3.3%.

| Type | Current Amount (USD) | Forecasted Annual Growth Rate (CAGR) |

|---|---|---|

| Inbound Remittances | 9.95 billion | 2.9% |

| Outbound Remittances | 4.63 billion | 3.3% |

You can observe that, although Indonesia’s remittance scale is smaller than that of the Philippines and Vietnam, it shows steady growth overall.

- The Philippines received USD 37 billion in remittances in 2021.

- Vietnam received USD 18 billion in the same year.

When selecting the optimal channel, you need to balance transfer speed, fees, and security to ensure every penny is delivered efficiently and safely.

Key Points

- When choosing a remittance channel, focus on transfer speed, fees, and security to ensure funds are delivered efficiently.

- Exchange rate fluctuations directly impact the actual amount received by the recipient, so it’s advisable to monitor real-time exchange rate data.

- Digital remittance platforms typically offer transparent fees and exchange rates close to the market mid-rate, suitable for frequent small remittances.

- Understand remittance amount restrictions and compliance requirements to ensure each transfer adheres to local regulations.

- Choose platforms with high security and regularly update account information to protect fund safety.

Exchange Rate Analysis

Image Source: unsplash

Exchange Rate Impact

When you remit to Indonesia, exchange rate analysis is a critical factor affecting the actual amount received by the recipient. Even small exchange rate fluctuations can significantly change the received amount. For example, when you remit in USD to Indonesia, every 0.1% change in the Indonesian Rupiah (IDR) to USD exchange rate adjusts the recipient’s actual received amount accordingly. You can refer to the table below to understand the impact of exchange rate fluctuations on remittance inflows:

| Research Finding | Description |

|---|---|

| Exchange Rate Fluctuations Affect Remittance Inflows | When the domestic currency depreciates, overseas workers tend to remit more funds. |

| Remittances Do Not Decrease When Domestic Currency Appreciates | Overseas workers do not reduce remittances due to domestic currency appreciation. |

| Impact of Remittances on Foreign Exchange Supply | The impact of remittance inflows on foreign exchange supply should be noted by monetary authorities. |

You can see that when the Indonesian Rupiah depreciates, overseas remittances increase, indicating a direct impact of exchange rate analysis on remittance behavior. You also need to monitor recent exchange rate fluctuation trends. Below are the recent USD to IDR exchange rate changes:

| Date | USD/IDR Exchange Rate | Percentage Change |

|---|---|---|

| 2025-09-18 | 16,493.4000 | +0.26% |

| Past Month | - | -1.29% |

| Past 12 Months | - | -8.66% |

| Historical High | 17,107 | - |

You can observe that over the past year, the Indonesian Rupiah has depreciated by 8.66% against the USD. This means the same USD remittance results in more IDR for the recipient. You can also refer to the following points to understand the specific performance of short-term exchange rate fluctuations:

- Over the past week, the Indonesian Rupiah’s value has been relatively stable, declining by 0.393%.

- Over the past week, the USD/IDR exchange rate fluctuated between 0.0000611172 (high) and 0.0000605144 (low).

- The largest 24-hour price fluctuation occurred on September 16, 2025, with a 0.328% decline.

When operating, it’s advisable to monitor real-time exchange rate analysis data and choose a favorable exchange rate period for remitting to maximize the recipient’s funds.

Exchange Rate Comparison

When choosing a remittance channel, in addition to focusing on the exchange rate itself, you should compare the exchange rate policies of different platforms. Mainstream digital remittance services (e.g., Wise, PayPal, Paysend) typically use real-time exchange rates with low markups. Traditional banks (e.g., licensed Hong Kong banks) often add a markup to the base exchange rate and charge intermediary bank fees. You can refer to the table below for a clear comparison of fees and exchange rate policies across different channels:

| Type | International Bank (SWIFT) Fees | Wise Fees |

|---|---|---|

| Sending Transfer Fees | Typically between $10-35 | Starting from 0.33% |

| Intermediary Bank Fees | Yes, depending on the intermediary bank and number of banks involved | None |

| Exchange Rate Markup | Yes | None |

| Receiving Transfer Fees | Varies, typically $0-9 | Wise has no fees, and most banks do not charge for local transfers (Wise uses local transfers to deposit your funds). Confirm with your bank. |

You can see that digital remittance platforms offer more transparent exchange rate analysis and simpler fee structures. Platforms like Wise typically do not add exchange rate markups, using the market mid-rate directly, ensuring every dollar you send maximizes the Indonesian Rupiah received. Traditional banks may reduce the recipient’s actual amount due to intermediary bank fees and exchange rate markups.

When choosing a remittance platform, it’s advisable to prioritize platforms with transparent exchange rate analysis and low fees to maximize the recipient’s benefits.

Remittance Fees and Restrictions

Fee Structure

When selecting a remittance service, the fee structure directly affects the final received amount. Traditional banks and digital remittance platforms have significant fee differences. You can refer to the table below for the fee ranges of different methods:

| Sending Method | Fee Range |

|---|---|

| Traditional Banks | Up to $40 |

| Digital Remittance Platforms | $3 to $10 |

When remitting through traditional banks, in addition to basic handling fees, you may encounter various hidden fees. For example, intermediary bank fees are deducted from the transfer amount, reducing the amount received by the recipient. Banks may also offer less favorable exchange rates, further eroding your funds. The destination bank may charge additional fees. If funds pass through multiple intermediary banks, each may charge separately, and these fees often become apparent only after the transfer is complete.

Tip: High fees reduce the received amount, impacting family spending on essentials like education and healthcare. When choosing a service, prioritize platforms with transparent fee structures, focus on exchange rate analysis, and avoid unnecessary losses.

Amount Restrictions

When remitting, you need to be aware of amount restrictions. Most digital platforms and banks have clear limits on single and monthly remittance amounts:

| Minimum Transfer Amount | Maximum Transfer Amount |

|---|---|

| 2,000 JPY | 100,000,000 IDR |

| Monthly Maximum Transfer Amount | 1,500,000 JPY |

Additionally, Indonesian government and international compliance requirements affect your remittance limits. You need to comply with KYC (Know Your Customer) principles, and banks will verify your identity information. According to Indonesian regulations, foreign currency transfers exceeding IDR 1 billion (approximately USD) require identity and transfer purpose documentation. Failure to declare may result in a fine of up to 10% of IDR 3 million. When bringing in cash exceeding IDR 100 million, you must declare the amount.

| Regulation/Requirement | Description |

|---|---|

| Investment Remittance Restrictions | The government imposes no limits or time restrictions on investment remittances but has certain reporting requirements. |

| KYC Principles | Banks must adopt Know Your Customer (KYC) principles to carefully verify customer information to match transactions. |

| Foreign Currency Transfers | Transfers exceeding IDR 1 billion require identity and transfer purpose documentation. |

| Reporting Penalties | Failure to report may result in fines, and excess cash brought in must be declared. |

Before remitting, it’s advisable to thoroughly understand the platform and Indonesian regulations to ensure compliance and avoid unnecessary risks.

Platform Selection

Image Source: unsplash

Platform Advantages and Disadvantages

When choosing a remittance platform, you need to understand the advantages and disadvantages of different platforms. Mainstream digital platforms like Wise, PayPal, and Paysend typically offer lower fees and more transparent exchange rate analysis. You can view real-time exchange rates directly on the platform, avoiding hidden markups. Traditional banks (e.g., licensed Hong Kong banks) may charge higher handling fees and exchange rate markups, with more complex processes.

- Wise: Low fees, exchange rates close to the market mid-rate, simple operation, suitable for frequent small remittances. Transfer speed is fast in some cases but may be delayed during holidays or special circumstances.

- Paysend: Also supports low fees and real-time exchange rates, with fast transfer speeds, suitable for users needing same-day delivery. Some countries or banks may have limits.

- PayPal: Wide global coverage, suitable for recipients with PayPal accounts. Handling fees are relatively high, with noticeable exchange rate markups, ideal for small, urgent remittances.

- Traditional Banks: Suitable for large, high-compliance remittances. Processes are complex, fees are high, and transfers are slower, ideal for users with stringent security requirements.

You can also consider digital wallets and mobile payment services. Digital wallets like Indonesia’s DANA and OVO support instant transfers, suitable for recipients without bank accounts. Mobile payment services are often integrated into mobile apps, allowing recipients to use funds anytime.

| Advantage | Description |

|---|---|

| Convenience | Recipients can access funds instantly on their phones. |

| No Bank Account Required | Suitable for people without traditional bank accounts. |

| Additional Services | Digital wallets often provide other financial services, such as bill payments and online shopping. |

When choosing, you can flexibly combine platforms based on the recipient’s needs and usage habits.

Transfer Speed

Transfer speed is a key consideration when selecting a remittance platform. Different platforms have varying average transfer times:

| Service | Average Transfer Speed |

|---|---|

| Wise | Minutes–2 days |

| Paysend | Same day (often hours) |

| Traditional Bank | 1–5 business days |

You can see that digital platforms like Wise and Paysend typically complete transfers within the same day or even minutes. Traditional banks may take 1 to 5 business days, with longer times during holidays or when multiple intermediary banks are involved.

Common reasons for transfer delays include:

- Non-compliance with regulations: Different countries have varying regulations, leading to complex compliance issues.

- Use of multiple intermediary banks: Funds often pass through multiple intermediary banks before reaching the final destination, causing variations in processing times and fees.

- Currency exchange: Cross-border remittances require currency conversion, which may lead to additional fees and processing delays.

- Payment channels: Recipients may not be able to receive funds in their preferred method, especially for those without bank accounts.

- Government restrictions: Sanctions and embargoes on specific countries or entities can cause transaction delays.

- High transfer fees and hidden fees: These fees significantly impact the cost and efficiency of international transactions.

When operating, it’s advisable to understand each platform’s transfer times, focus on exchange rate analysis and fee structures, and choose the most suitable option.

Security

Security is a critical factor you cannot overlook when remitting. Mainstream digital platforms and banks implement multiple security measures to protect your funds and information:

- Indonesian fintech companies face challenges in implementing effective anti-money laundering (AML) strategies, including complex regulatory requirements and customer due diligence processes.

- These companies must adhere to strict customer due diligence (CDD) and Know Your Customer (KYC) requirements, verifying identities and fund sources.

- Implement advanced transaction monitoring systems to identify suspicious activities and high-risk transactions, ensuring compliance.

You should note that with the digitization of financial services in Indonesia, scams and fraud incidents are increasing. In 2024, approximately 23% of Indonesian consumers reported financial losses, a 4% increase from the previous year. High-value fraud cases (exceeding USD 4,300) accounted for 8% of all reported cases. This trend indicates that major remittance platforms face greater security challenges.

When remitting, it’s advisable to choose platforms with strong compliance and robust risk control measures, avoiding operations through unknown channels. Regularly updating account passwords and enabling two-factor authentication can further enhance account security.

Tip: You can check whether platforms use blockchain technology and QR code payment systems, as these innovative technologies enhance remittance security and convenience. The Indonesian market is expected to see continued strong growth in digital remittance platforms by 2028, with major companies integrating new technologies to meet user needs.

Remittance Strategy Recommendations

Strategy Selection

When choosing a remittance strategy for Indonesia, you can weigh speed, fees, and convenience. Different services suit different needs. The table below compares the speed and fees of several mainstream remittance services:

| Service | Speed | Fees (USD) |

|---|---|---|

| Ria | As fast as 15 minutes | Low fees |

| Western Union | Typically available in minutes | $5 – $30+ |

| Xoom | Typically available in minutes | $4.99 – $59.99 |

| Wise | 1-3 business days | Fixed $6.79 + 0.46% |

| Remitly | Instant to 3 business days | $0 – $49.99 |

If you prioritize speed, you can choose Ria, Western Union, or Xoom, which typically complete transfers in minutes, ideal for urgent remittances. If you focus on fees, Wise and Ria offer more transparent pricing and lower overall costs. Remitly adjusts fees based on transfer speed, accommodating different budgets. You can also select services based on the recipient’s circumstances. For example, many Indonesian workers’ families live in remote areas, making service point accessibility and reliability crucial. You can prioritize platforms with wide coverage and assured fund security.

It’s recommended to compare fees, speed, and exchange rates across platforms before remitting to choose the most suitable strategy.

Avoiding Pitfalls

During the remittance process, you may encounter hidden fees and delivery delays. The following tips can help you avoid common issues:

- Monitor exchange rate fluctuations. You can remit when the USD to Indonesian Rupiah exchange rate is high to maximize the recipient’s funds.

- Compare fees and speed between banks and third-party platforms. Typically, third-party platforms like Wise and Ria are more cost-effective.

- Verify recipient information. You need to ensure the recipient’s name and account number are accurate to avoid delays or fund loss due to errors.

- Choose platforms with accessible service points. Prioritize services with wide coverage and cash withdrawal support to enhance convenience.

- Focus on platform compliance and security measures. Choose platforms with strict KYC and AML processes to ensure fund safety.

Reminder: Before remitting, thoroughly understand the platform’s fee structure and exchange rate policies to avoid losses due to non-transparent fees or information errors. Choose legitimate channels to ensure funds arrive safely and securely.

When choosing a remittance method for Indonesia, you should focus on exchange rates, fees, amount restrictions, and platform security. The table below shows that digital wallets, bank transfers, and QRIS are mainstream choices, each with advantages:

| Payment Method | Popularity | Features |

|---|---|---|

| Digital Wallets | 39% | Promote financial inclusion, suitable for unbanked populations |

| Bank Transfers | High | Utilize real-time payment infrastructure BI-FAST |

| QRIS | Widely accepted | Unifies fragmented payment environments, widely used by merchants and consumers |

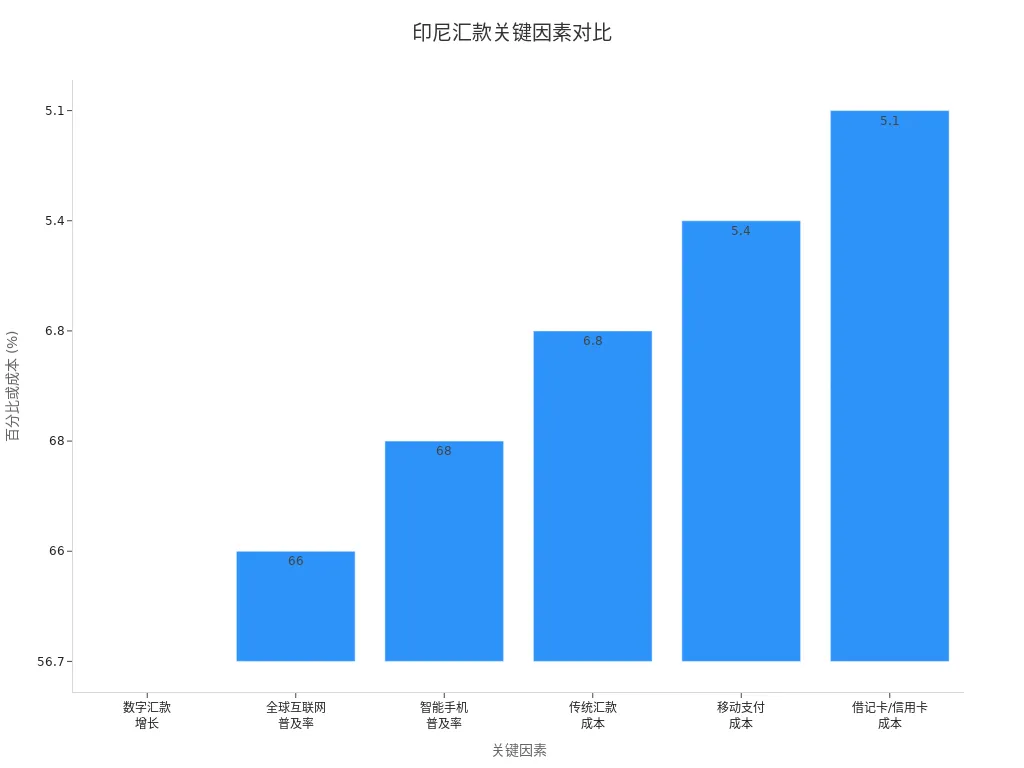

You also need to monitor policy changes, such as Indonesia’s e-commerce tax and VAT on cross-border digital services, which affect platform compliance and fee structures. In the future, digital remittances will continue to grow, driven by increasing mobile payment and smartphone penetration, making security and compliance increasingly important.

You can flexibly choose channels based on your needs, regularly monitor policy and platform updates, and ensure every remittance arrives safely and smoothly.

FAQ

How long does it take to remit to Indonesia?

When using digital platforms, funds typically arrive in minutes to two days. Traditional banks may take 1 to 5 business days. Holidays or multiple intermediary banks can extend the time.

How are remittance fees calculated?

When using digital platforms, fees are generally a fixed USD amount plus a percentage. Traditional banks have higher fees, which may include intermediary bank charges. You can check the platform’s fee details before remitting.

Do exchange rates affect the actual received amount?

The exchange rate used by the platform directly determines the amount received. Digital platforms typically use real-time rates, while traditional banks may add a markup.

Are there limits on remittance amounts?

Digital platforms have maximum limits for single and monthly remittances. For amounts exceeding regulatory thresholds, you need to submit identity and purpose documentation to ensure compliance.

Can recipients without bank accounts receive funds?

You can choose digital wallets or mobile payment services. Recipients can receive funds directly through local apps like DANA or OVO without a bank account.

Remitting to Indonesia demands focus on exchange rate swings (IDR depreciated 8.66% over the past year), hefty fees (up to $40 for traditional banks), and compliance caps (e.g., over 10 billion IDR per transfer requires declaration), which can cut receipts or cause delays. As an efficiency-focused user, you need a low-cost, clear platform to simplify cross-border flows and ensure secure delivery.

BiyaPay delivers a full solution, with real-time exchange rate queries to monitor USD-to-IDR rates (around 16,747 now) and convert fiat to crypto for optimal timing. Remittance fees start at just 0.5%, with zero charges for contract orders, offering same-day arrivals to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, adeptly handling remittance funds.

Sign up for BiyaPay today to launch seamless cross-border finance. From family aid to business payouts, it trims costs and amps up speed. Don’t let rates and fees block your Indonesia ties—join BiyaPay now for dependable remittance support!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.