- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

US to Indonesia Remittance: Methods, Costs and Choice Tips

Image Source: pexels

When you want to send money from the US to Indonesia, your primary concern is how to choose the most cost-effective remittance method. You need to consider fees, exchange rates, and transfer speed. You seek efficiency, want security, and of course, hope for the lowest costs. By comparing the service details of different channels, you can find the solution that truly suits your needs.

Key Points

- When choosing a remittance method, comparing fees, exchange rates, and transfer speed is crucial. The fee differences between channels may impact your decision.

- Bank transfers are highly secure and suitable for large amounts, but they have higher fees and longer transfer times. When considering other methods, pay attention to costs and speed.

- International remittance companies and online platforms typically offer lower fees and faster transfer times, ideal for users seeking efficiency and low costs.

- When using digital wallets for remittances, you can enjoy near-instant transfers and transparent fees, suitable for young people and tech-savvy users.

- Before sending money, always verify all fee details, including transfer fees and exchange rates, to ensure the recipient receives the expected amount.

Comparison of Remittance Methods

Image Source: unsplash

When sending money from the US to Indonesia, you can choose from multiple remittance methods. Each method has different processes, fees, and transfer speeds. You need to select the most suitable channel based on your needs.

Bank Transfer Method

Bank transfers are the most traditional remittance method. You can transfer funds directly to the recipient’s bank account in Indonesia through a US local bank or a licensed Hong Kong bank. Bank transfers typically support multiple sending and receiving methods, such as using a bank account, debit card, or credit card to send, and options to send or receive cash at designated locations.

The advantage of bank transfers is high security, making them suitable for large fund transfers. You can initiate transfers through bank counters, online banking, or mobile banking. Recipients can receive funds directly at major Indonesian banks (such as state-owned or commercial banks).

Bank transfer fees and processing times vary by bank. Generally, processing takes 1 to 5 business days, with fees ranging from $20 to $50 depending on the bank and transfer method. You should note that bank transfers often include hidden exchange rate markups, which may result in the recipient receiving less than expected.

| Processing Time | Fees |

|---|---|

| 1 to 5 business days | Varies by bank and transfer method |

The bank transfer method is suitable when you need high security and are transferring large amounts, but if you prioritize speed and cost, consider other remittance methods.

International Remittance Companies

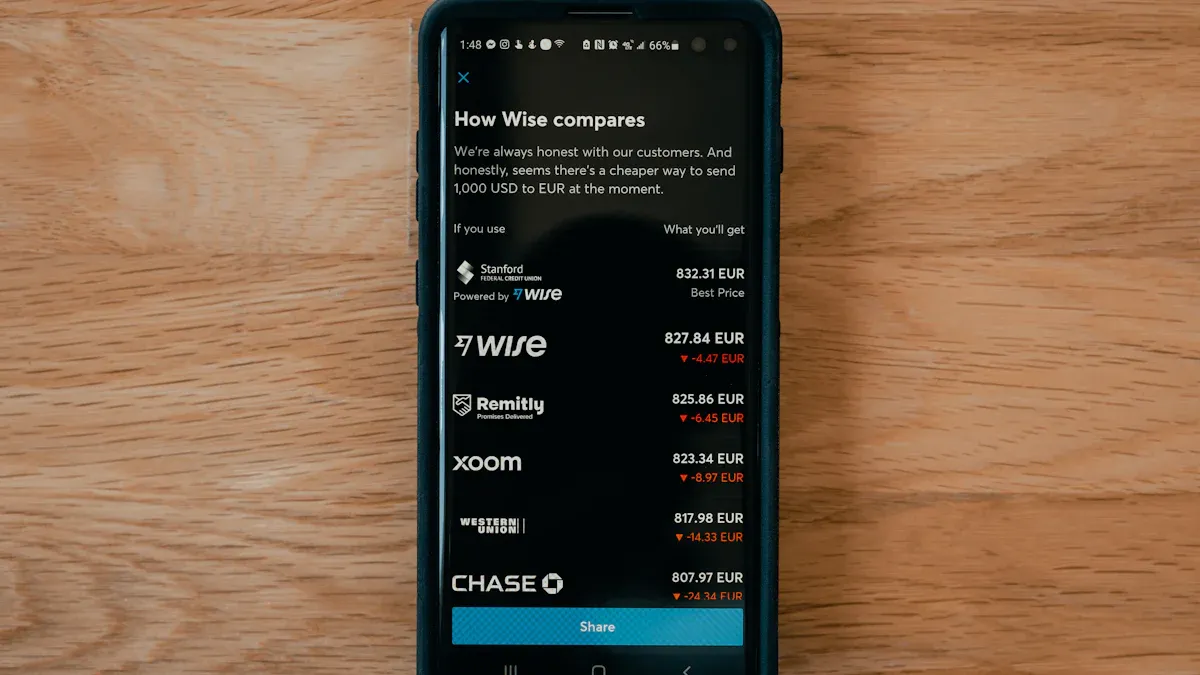

International remittance companies offer diverse remittance options. You can send funds to the recipient’s bank account, mobile wallet, or cash pickup point in Indonesia through these companies’ websites, mobile apps, or physical locations. Major international remittance companies include Western Union, MoneyGram, and Wise (specific brands are mentioned for reference only and not included in headings).

| Company Name | Description |

|---|---|

| Western Union | Leading international remittance company |

| MoneyGram | Major remittance service provider |

| Wise | Offers low-cost international remittance services |

| PayPal | Well-known online payment platform supporting remittances |

| DANA | Indonesia’s local digital wallet |

| OVO | Another popular digital payment method |

| GoPay | Payment service provided by Gojek |

| Xendit | Offers multiple payment solutions |

You can choose to have funds received at a location, bank account, or mobile wallet. International remittance companies typically have lower fees and faster transfer times than banks. Some companies use mid-market exchange rates with transparent fees, making them suitable for low-cost and high-efficiency remittance needs.

| Service Provider | Exchange Rate Type | Fee Type |

|---|---|---|

| Banks | Hidden exchange rate markup | Conversion fees |

| Wise | Mid-market exchange rate | Transparent upfront fees |

International remittance companies are ideal when you need flexible recipient options and fast transfers.

Online Remittance Methods

Online remittance methods have become increasingly popular in recent years. You can use online platforms like Wise or SentBe to transfer funds directly from the US to the recipient’s bank account or mobile wallet in Indonesia. Online platforms typically support multiple payment methods, including bank accounts, debit cards, and credit cards.

| Platform | Features | User Rating/Comments |

|---|---|---|

| SentBe | Specializes in international remittances, supports multi-country transfers, fees may vary by amount and destination. | N/A |

| Wise | Offers mid-market exchange rates and low fees, facilitates fast bank transfers. | N/A |

The advantages of online remittance services include low fees, transparent exchange rates, and ease of use. You can initiate transfers anytime via mobile or computer, check exchange rates and fees in real-time. Some platforms support real-time transfer tracking to ensure your funds’ safety.

| Platform | Maximum Transfer Limit | Processing Time |

|---|---|---|

| Western Union | Up to $5,000 | Varies, check local partner |

| Airwallex | N/A | 1 to 5 business days |

When choosing an online remittance method, you can compare platforms based on fees, exchange rates, and transfer limits to find the most suitable option.

Digital Wallets and Cash Remittances

Digital wallets and cash remittances are very popular in Indonesia. You can use US-based online platforms or international remittance companies to send funds directly to the recipient’s digital wallet in Indonesia, such as GoPay, Ovo, LinkAja, or Dana. You can also opt for cash pickup services at convenience stores or partner locations in Indonesia.

- Sendwave: Allows you to transfer money quickly and economically from the US to Indonesia’s mobile wallets.

- WorldRemit: Supports major mobile wallets like GoPay, Ovo, LinkAja, and Dana.

- GoPay, Ovo, LinkAja, Dana: Indonesia’s most popular mobile wallets, used by nearly all young people.

According to a 2024 Statista survey, 96% of Indonesians use digital wallets, especially among young and tech-savvy individuals. When choosing digital wallet remittances, you can enjoy near-instant transfers, transparent fees, and real-time tracking. Cash pickup services are typically completed within minutes, ideal for scenarios requiring quick cash access.

| Service Name | Description | Acceptance |

|---|---|---|

| Sendwave | Allows quick and economical transfers from the US to Indonesia’s mobile wallets. | Compatible with multiple mobile wallets. |

| WorldRemit | Enables instant transfers to GoPay, Ovo, LinkAja, and Dana mobile wallets. | These are Indonesia’s major mobile wallet services. |

Digital wallet and cash remittance methods are highly secure. You can check exchange rates and track transfer progress in real-time via mobile apps, with all transactions using data encryption and 24/7 fraud monitoring to ensure your funds’ safety.

Platforms like Xoom offer fast, secure, and affordable online remittance services, supporting transfers to Indonesia’s bank accounts, debit cards, mobile wallets, and cash pickups. When using these services, all fees and exchange rates are displayed upfront, ensuring you understand every expense.

When choosing a remittance method, you can consider fees, transfer speed, and security based on your actual needs to find the most suitable channel.

Fee Comparison

Image Source: unsplash

When choosing a remittance method from the US to Indonesia, fees are the most direct factor influencing your decision. The differences in fees, exchange rates, and hidden costs across channels are significant. You need to fully understand each fee to make an informed choice.

Fee Details

You can send money through banks, international remittance companies, online platforms, and digital wallets. Each channel has a different fee structure. Banks typically charge higher fixed fees, while international remittance companies and online platforms attract users with lower rates and transparent pricing.

| Remittance Channel | Fee Range (USD) | Description |

|---|---|---|

| Banks | 20 - 50 | Suitable for large transfers, higher fees |

| International Remittance Companies | 3 - 15 | Lower fees, faster transfers |

| Paysend | 1.99 | Low-cost, suitable for small transfers |

| Wise | 2 - 5 | Uses mid-market exchange rates, transparent fees |

| WorldRemit | 3 - 10 | Supports multiple recipient methods |

| Online Platforms | 2 - 10 | Fees vary by amount and method |

| Digital Wallets | 1.5 - 5 | Suitable for instant and small transfers |

When using bank transfers, fees are typically the highest. Online platforms and international remittance companies are better suited for those seeking low costs and flexibility. Some platforms like Paysend and Wise offer fees as low as around $2, ideal for small, quick transfers.

Tip: When choosing a remittance method, don’t just look at surface fees. Some platforms may charge additional fees through exchange rates or other channels.

Hidden Costs

During the remittance process, in addition to visible fees, you should be wary of hidden costs. Common hidden fees include exchange rate differences, recipient bank fees, and intermediary bank fees. These fees are often not shown in the initial quote but can affect the amount the recipient actually receives.

You can refer to the table below to understand how major remittance providers disclose fees:

| Disclosure Content | Description |

|---|---|

| Transfer Amount | The amount disclosed in the currency of the transfer |

| Transfer Fees and Taxes | Any fees and taxes imposed by the provider |

| Total Amount | The total transaction amount, including transfer amount, fees, and taxes |

| Exchange Rate | The exchange rate used by the provider for the transfer |

| Other Fees and Taxes | Fees imposed by third parties outside the provider |

| Recipient Total | The amount the recipient will receive, excluding non-covered third-party fees |

| Statement | Statement about potential non-covered third-party fees or taxes |

When using bank transfers, you often encounter intermediary bank fees and recipient bank fees. These fees may only appear during the transfer process, resulting in the recipient receiving less than expected. Online platforms and some international remittance companies disclose all fees upfront, including exchange rates and third-party fees, so you know every expense clearly.

You also need to pay attention to exchange rate differences. Some banks and remittance companies use their own rates, which reduce the actual amount received due to markups. Platforms like Wise use mid-market exchange rates, making fees more transparent and the recipient’s received amount closer to your expectations.

Recommendation: Before sending money, always verify all fee details, including transfer fees, exchange rates, and potential third-party fees. You can use the platform’s fee calculator or contact customer service to ensure the recipient receives the expected amount.

When comparing different remittance methods, consider both fees and hidden costs to select the most cost-effective channel.

Exchange Rates and Transfer Times

Exchange Rate Differences

When sending money from the US to Indonesia, the exchange rate directly determines the amount the recipient actually receives. Different channels have varying exchange rate policies. Some banks and traditional remittance companies add markups to exchange rates, resulting in fewer Indonesian Rupiah for the recipient. Online platforms like Wise typically use mid-market exchange rates, making fees more transparent and the recipient’s received amount closer to your expectations.

- When exchange rates are favorable, sending $1,000 allows the recipient to receive more Indonesian Rupiah. When rates are low, the same amount results in fewer Rupiah for the recipient.

- Exchange rate fluctuations can affect the recipient’s financial situation. If the Indonesian Rupiah depreciates, the received amount may decrease significantly, impacting family life.

- When choosing a remittance channel, prioritize platforms with transparent exchange rate policies to avoid losses due to rate markups.

You can check real-time exchange rates on platforms before sending money to select the most favorable channel for the recipient. Online platforms typically display exchange rates and fees upfront, helping you make informed decisions.

Transfer Speed

When sending money, transfer speed is also a key consideration. Different channels have varying transfer times. Bank transfers typically take 1 to 3 business days, while some online platforms and international remittance companies offer real-time transfers, especially to major Indonesian banks or digital wallets.

| Remittance Method | Fund Arrival Time |

|---|---|

| Real-Time Transfer | Funds arrive instantly to BRI, BNI, BCA, and Bank Mandiri accounts. |

| Other Bank Transfers | For amounts less than 100,000 IDR, funds arrive within the same banking day. |

| Transfers Before 11 AM | Sent before 11 AM Eastern Time, typically arrive within the same banking day. |

Transfer speed is affected by multiple factors. You should consider the following:

- Fund security and timely delivery are critical for recipients, especially for migrant workers supporting families.

- Some services, though more expensive, guarantee fast transfers, suitable for scenarios with high time sensitivity.

- The recipient’s access to banks or digital wallets in Indonesia also affects transfer speed. Choose a channel convenient for the recipient.

When choosing a remittance method, consider the recipient’s actual needs, balancing transfer speed and fees to ensure funds arrive securely and on time.

Selection Tips and Precautions

Fee and Exchange Rate Comparison

When choosing a remittance method, you should consider fees, exchange rates, and transfer times comprehensively. Different channels have significant differences in fee structures and exchange rate policies.

You can select the most suitable channel based on your transfer amount and frequency. For small transfers, low-fee platforms are more cost-effective. If you’re concerned about exchange rate changes, choosing a platform with favorable rates ensures the recipient gets more Rupiah. Transfer time is also important; some online platforms offer transfers within minutes, ideal for urgent needs.

Tip: When making decisions, don’t focus on a single factor. Compare fees, exchange rates, and transfer speed comprehensively to find the most cost-effective remittance method.

Safety and Compliance

During the remittance process, safety and compliance are equally important. The US and Indonesia have strict regulations on cross-border remittances. You should choose regulated, reputable service providers to ensure fund safety. According to federal law, remittance providers must provide information on fees, exchange rates, and estimated delivery amounts before and after payment. You have the right to cancel a transfer free of charge within 30 minutes of payment, unless the funds have already been withdrawn or deposited into the recipient’s account. Providers must also investigate error notifications within 180 days and inform you of the results within 90 days.

In recent years, fraud risks in Indonesia’s financial sector have risen. Issues like cyberattacks, identity theft, and bank/credit card fraud are frequent. When using digital platforms, beware of phishing and account theft. The table below lists common fraud types:

| Fraud Type | Description |

|---|---|

| Cyberattacks | Phishing, e-commerce fraud, exploiting online system vulnerabilities. |

| Identity Theft | Unauthorized financial operations using stolen personal information. |

| Bank and Credit Card Fraud | Includes card skimming, account takeovers, and more. |

| Business Email Fraud | Intercepting communications to impersonate sellers and steal funds. |

You can take the following measures to reduce risks:

- Choose reputable, regulated remittance providers.

- Protect personal information and avoid clicking unknown links.

- Use official apps or websites with encryption and security certifications.

- Check if providers use AI and big data analytics to detect fraud.

Materials and Process

When initiating a remittance from the US to Indonesia, you need to prepare relevant materials. Generally, you need to provide a valid government-issued ID (such as a driver’s license or passport) and the recipient’s full name, address, and bank account details. Some platforms may require you to upload ID photos or perform facial recognition.

You can follow these steps:

- Choose a suitable remittance method and provider.

- Register and verify your identity.

- Enter the recipient’s details and confirm the transfer amount and fees.

- Review all information and submit the transfer.

- Track the transfer progress to ensure the recipient receives the funds on time.

Recommendation: Before sending money, prepare all materials in advance and carefully verify recipient information to avoid delays or fund losses due to errors.

When choosing a remittance method from the US to Indonesia, you need to balance your needs, weighing fees, transfer time, and security.

- You should consider transfer fees, exchange rates, processing times, and the recipient’s preferred withdrawal method.

- Digital solutions like DSGPay typically have lower transaction fees.

- You can balance cost, speed, and convenience to find the most suitable channel.

| Date | Policy/Regulation Name | Impact Description |

|---|---|---|

| November 2022 | Foreign Exchange Export Proceeds and Import Payment Regulations | Supports monetary policy, encourages repatriation of export proceeds. |

| January 2023 | Financial Sector Omnibus Law | Strengthens the financial sector, promotes digitalization, and protects consumers and investors. |

| March 2023 | Government Regulation No. 36/2023 | Requires certain export companies to deposit 30% of export proceeds in Indonesia’s financial system for at least three months. |

You should stay updated on the latest policies and platform changes, consulting professionals if necessary to ensure safe and efficient remittances.

FAQ

What materials are needed to send money from the US to Indonesia?

You need to prepare a valid ID (such as a passport or driver’s license), the recipient’s name, and bank account information. Some platforms may require uploading ID photos.

How long does it take for a remittance to arrive?

Bank transfers typically take 1 to 3 business days. Online platforms and digital wallets can deliver in minutes, depending on the provider.

How much are remittance fees?

Bank remittance fees are generally $20 to $50. Online platforms and international remittance companies have lower fees, typically $2 to $10.

How do exchange rates affect the actual amount received?

When choosing a remittance channel, the exchange rate determines the amount of Indonesian Rupiah the recipient receives. Some platforms use mid-market rates, resulting in higher received amounts.

How can I ensure remittance safety?

Choose regulated, reputable providers. Avoid sharing personal information casually. Use official platforms and beware of cyberattacks and identity theft.

You have gained a comprehensive understanding of the methods, fees, and selection techniques for remitting money from the US to Indonesia, recognizing the high security and high cost of bank transfers, the lower fees and greater efficiency of international companies and online platforms, and the instant transfer benefits of e-wallets. Faced with complex fee structures (transaction fees, exchange rate markups, hidden costs) and strict compliance requirements, you need a modern financial platform that can offer a lower overall cost, faster transfer speeds, and support for global asset management.

However, traditional international remittance processes are complicated and expensive, and you still have to deal with opaque exchange rates across multiple banks and platforms. For users with global asset allocation needs or those who require flexible switching between fiat and digital assets, a more integrated and modern financial solution is necessary.

BiyaPay is your ideal choice for high-efficiency fund transfers. We provide real-time exchange rate inquiry and conversion services for fiat currencies, with remittance fees as low as 0.5% and zero commission on contract limit orders, effectively reducing your transfer costs. BiyaPay supports most countries and regions globally and enables same-day fund arrival, significantly improving capital turnover efficiency. Furthermore, you can use one platform to manage global asset allocation, including US and Hong Kong stocks, without needing a complex overseas account, and benefit from the seamless conversion between fiat and digital currencies like USDT. Register quickly with BiyaPay now, and use transparent fees and exceptional efficiency to ensure your funds reach Indonesia safely, compliantly, and quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.