- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Precise Guide to Remitting Money to Indonesia: Considerations of Reputation, Fees, Speed, and Choosing the Best Remittance Option

Image Source: unsplash

When choosing a remittance solution for Indonesia, you often focus on fund security, remittance costs, and transfer speed. Many users consider digital applications to be the safest way to send and receive remittances. The following table summarizes the main concerns for users remitting to Indonesia:

| Concern | Description |

|---|---|

| Security | Digital applications are considered the safest way to send/receive remittances. |

| Cost | Fees for digital applications are seen as a major pain point in the Asia-Pacific region. |

| Speed | Speed and trust are the primary reasons for choosing digital remittance methods. |

| User Experience | Ease of use, security, privacy, and safety are users’ top priorities. |

Through this Indonesia remittance guide, you can learn how to combine the reputation of service providers, fee structures, exchange rates, and limits to choose the remittance channel that suits you best.

Key Points

- When selecting a remittance channel, security is the primary consideration. Prioritize regulated service providers to ensure fund safety.

- Fee structures directly impact decisions. Carefully review all fees, including hidden costs and exchange rate differences, to ensure transparency.

- Transfer speed is equally important. Digital wallets and third-party platforms often enable instant transfers, suitable for urgent remittance needs.

- When evaluating service provider reputation, focus on their legal financial licenses and user reviews to ensure a reliable platform.

- Before remitting, ensure recipient information is accurate, carefully checking all details to avoid delays due to errors.

Remittance Channels

When choosing remittance channels for Indonesia, you can see various options available in the market. Different channels have distinct characteristics in terms of market share, fees, transfer speed, and security. The following table shows the main channel types and their market performance:

| Channel Type | Market Share | Growth Rate |

|---|---|---|

| Banks | Dominant | N/A |

| Non-Banks | Growing | 6.3% |

| Digital Platforms | Growing | N/A |

Bank Remittance

Bank remittance is a traditional method for users in China/mainland China to transfer funds to Indonesia. You can handle international remittances through licensed Hong Kong banks. Bank channels dominate the market, offering high security and suitability for large fund transfers.

- Fees typically range between USD 25–50, with some banks also charging recipient fees.

- Transfer times generally take 1 to 5 business days, potentially delayed by identity verification or compliance checks.

- Bank remittances are suitable for users with high fund security requirements, but handling fees are higher, and transfer speeds are slower.

Wire Transfer

Wire transfer is another common cross-border remittance method. You can operate through banks or specialized wire transfer companies.

- Fees vary by provider, typically lower than banks. For example, Wise wire transfer fees are USD 11.89, with transfer times ranging from minutes to 2 days.

- Wire transfers are suitable for users needing faster transfers while ensuring fund security.

- You should note that some wire transfer methods do not support cash pickups, making them suitable for direct transfers to recipient accounts.

Third-Party Platforms

Third-party platforms like WorldRemit, Remitly, and Wise have seen rapid growth in the Indonesia remittance market in recent years.

- These platforms support multiple payment methods, offer transparent fees, and are generally lower than traditional banks.

- For example, Remitly fees range from USD 0.99–1.99, with transfers arriving in as little as a few minutes.

- You can enjoy a flexible remittance experience, but some platforms have exchange rate markups or transfer limits.

- These platforms are suitable for individual users, especially for small and frequent remittances.

| Platform | Key Features | Advantages | Disadvantages |

|---|---|---|---|

| WorldRemit | Multi-currency, multiple payment options | Flexible, transparent fees | Exchange rate markups, limited to individual transfers |

| Remitly | Simple experience, supports multiple payment methods | Fast, good customer support | Limited amounts, services vary by region |

| Wise | Focused on currency exchange, supports multiple currencies | Competitive rates, low fees | Digital-only channels, possible handling fees |

Digital Wallets

Digital wallets like Gopay and OVO are highly popular in Indonesia. You can achieve real-time transfers through these platforms, suitable for daily small payments.

- Digital wallets have a growing market share with an annual growth rate of 6.3%.

- You can enjoy low fees and convenient operations, but some platforms have limited support for users in China/mainland China.

- Digital wallets are suitable for recipients living or working in Indonesia with relevant accounts.

Cash Services

Cash services are suitable for recipients without bank accounts or digital wallets. You can send cash to Indonesia through companies like Western Union or Ria.

- Fees are relatively high, but funds can be withdrawn within minutes.

- Many migrant workers choose cash services for their security, timeliness, and accessibility.

- You should focus on the distribution of service points and fund safety measures when choosing.

When selecting a remittance channel, you should prioritize the service provider’s reputation, fund security, and transfer speed. The Indonesia remittance guide recommends combining your needs to choose the most suitable channel.

Indonesia Remittance Guide: Channel Selection

Image Source: unsplash

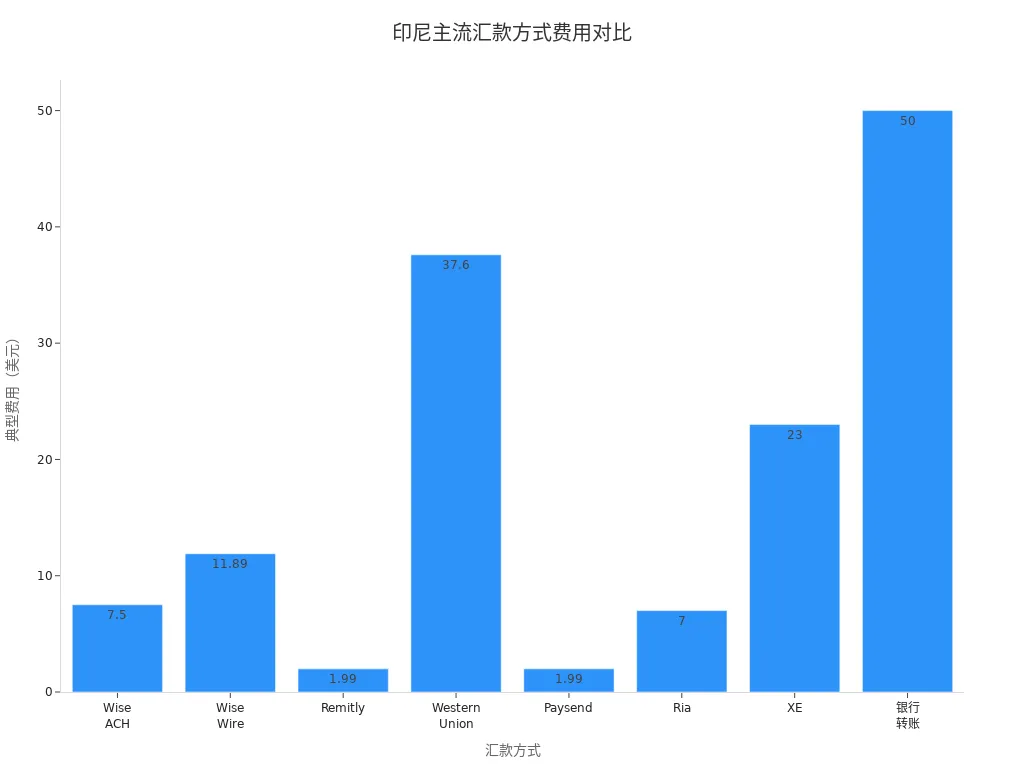

Fee Comparison

When choosing a remittance channel, fees are one of the most direct factors affecting your decision. In 2025, the Indonesia remittance market has seen significant changes. The rise of mobile payments and digital remittance platforms allows you to complete cross-border transfers with lower transaction fees. World Bank data shows that remittance costs have been declining over the past decade, with intensified competition among service providers, making digital platforms the mainstream choice.

You can refer to the following table to understand the fees, speed, and limits of different channels:

| Provider | Transfer Speed | Fees | Transfer Limit |

|---|---|---|---|

| Wise | 1-3 business days | Fixed fee: USD 6.79 + 0.46% of converted amount | Up to USD 1,000,000 per transfer |

| Western Union | Instant or same-day | USD 5–30+ (higher for urgent transfers) | Up to USD 50,000 per transfer |

| Remitly | Instant to 3 business days | USD 0–49.99 (depends on speed) | Up to USD 60,000 per transfer |

| Xoom | Instant to 2 business days | USD 4.99–59.99 (card transfers more expensive) | Up to USD 2,999 per transfer |

| GoPay | Instant | 1.5%–3% transaction fee, up to USD 2,500 per transfer | |

| OVO | Instant | 1%–2.5% transfer fee, up to USD 5,000 per transfer | |

| DANA | Instant | Fixed fee USD 0.50–1.50, up to USD 2,500 per transfer | |

| LinkAja | Instant | 1%–2% transfer fee, up to USD 1,500 per transfer |

You can see that digital wallets and third-party platforms generally have lower fees than traditional banks or cash services. If you need large transfers, you can choose Wise or Remitly for transparent fees and high limits. For small remittances, digital wallets like GoPay and OVO are more suitable, with low fees and fast transfers. When choosing, it’s recommended to compare handling fees and exchange rates, selecting the most cost-effective channel from low to high fees.

Tip: Before remitting, you should carefully review all fees, including hidden costs and exchange rate differences. Some providers may add markups to exchange rates, resulting in lower-than-expected received amounts.

Speed Analysis

When making cross-border remittances, transfer speed is equally important. The Indonesia remittance guide recommends choosing channels based on your actual needs. Digital wallets and third-party platforms typically enable instant transfers, suitable for urgent remittances or daily small payments. Cash services and third-party platforms like Western Union, Remitly, and Xoom also support fast transfers, with some providers completing transfers within minutes.

Bank remittances and some wire transfer channels take longer, typically 1 to 3 business days. If you process international remittances through licensed Hong Kong banks, fund security is high, but transfer speed may be affected by compliance reviews, potentially causing delays. When choosing, you should consider the purpose and urgency of the funds to arrange the remittance method reasonably.

You can refer to the following points:

- For instant transfers, prioritize digital wallets or third-party platforms.

- For larger amounts, bank channels are safer but slower.

- During holidays or peak periods, transfer times may be extended.

Reputation Evaluation

When choosing a remittance provider, reputation is key to ensuring fund security. The Indonesia remittance guide recommends prioritizing licensed financial institutions and well-known third-party platforms. Digital platforms like Wise, Remitly, and Xoom gain user trust due to strict compliance, transparent fees, and excellent customer service. When using licensed Hong Kong banks for international remittances, fund security is highest, suitable for large transfers.

You can evaluate provider reputation through the following methods:

- Check whether the provider holds a valid financial license.

- Review user feedback and third-party evaluation reports.

- Pay attention to the provider’s customer service response speed and problem-solving capabilities.

- Compare the fund protection measures and privacy policies of each platform.

When choosing, it’s recommended to prioritize fund security and provider reputation, avoiding unlicensed or opaque platforms for the sake of low fees. If you encounter issues, high-quality customer service can help resolve them promptly, ensuring a smooth remittance experience.

Summary: When selecting a remittance channel for Indonesia, you should evaluate fees, transfer speed, and provider reputation comprehensively to choose the most suitable option. The Indonesia remittance guide provides detailed comparisons and practical advice to help you make informed decisions.

Selection Criteria

Image Source: pexels

Security

When choosing a remittance solution for Indonesia, security is the primary consideration. You should prioritize regulated service providers to ensure fund safety. Remittance services in Indonesia are regulated by Bank Indonesia (BI) and the Financial Services Authority (OJK). The following table shows the main regulatory bodies and related regulations:

| Regulatory Body | Function |

|---|---|

| Bank Indonesia (BI) | Regulates payment systems, including remittance services. |

| Financial Services Authority (OJK) | Supervises financial institutions to ensure compliance with regulatory standards. |

| Regulation Number | Content |

|---|---|

| BI Regulation No. 22/23/PBI/2020 | Specifies licensing and operational requirements for payment service providers. |

| BI Regulation No. 23/6/PBI/2021 | Allows foreign ownership of up to 85% in payment service providers. |

If you process international remittances through licensed Hong Kong banks, fund security is higher. You should avoid choosing unlicensed or opaque platforms.

Fee Structure

When comparing remittance channels, you must pay attention to the fee structure. Many providers charge various fees, some of which are easily overlooked. Common hidden costs include:

- Transfer Fees: Fixed or proportional fees paid when initiating a remittance.

- Exchange Rate Margins: Some platforms add markups to market exchange rates, reducing the amount received by the recipient.

- Payment Method Fees: Additional fees may apply when using bank transfers or credit card payments.

- Receiving Method Fees: Cash pickups typically incur higher fees than direct bank deposits.

When using the Indonesia remittance guide, you should carefully review all fees to ensure transparency and avoid hidden costs affecting the actual received amount.

Tip: Before remitting, you should confirm the limits for each transfer, as some platforms impose restrictions on single or daily transfer amounts.

Exchange Rate Impact

When making cross-border remittances, exchange rate fluctuations directly affect the amount received by the recipient. Exchange rate changes significantly impact remittance inflows to Indonesia. You can note the following points:

- Exchange rate fluctuations can cause variations in the received amount.

- When the local currency depreciates, overseas workers typically increase remittance amounts.

- When the local currency appreciates, remittance amounts do not significantly decrease.

- There is a two-way causal relationship between remittance inflows and exchange rates, with mutual influence.

When choosing a provider, you should prioritize platforms with transparent exchange rates to avoid losses due to rate markups.

Customer Service

When encountering remittance issues, high-quality customer service can help you resolve them promptly. You should focus on the provider’s response speed, problem-solving capabilities, and support channels. You can choose platforms offering multilingual support and 24/7 service to enhance the remittance experience. When selecting, it’s recommended to prioritize platforms with high customer service ratings to ensure fund safety and smooth operations.

Practical Advice

Individual Remittance

When remitting to individuals in Indonesia, it’s recommended to prioritize digital wallets or third-party platforms. These channels have low fees and fast transfers, suitable for small and frequent remittances. When filling out recipient information, you must accurately enter the full name and bank account details to avoid delays due to errors. You should carefully verify the transfer amount, considering all handling fees and exchange rate adjustments. Before confirming the transfer, it’s recommended to double-check all details and retain transaction receipts for future reference.

Business Remittance

As a business user, remitting to Indonesia requires meeting stricter compliance requirements. You should prepare detailed transaction documentation, including shipping documents, commodity prices, and beneficiary verification. You need to conduct regular risk assessments to identify and mitigate anti-money laundering risks. You should also establish internal controls to monitor and enforce anti-money laundering policies. For large remittances, it’s recommended to process through licensed Hong Kong banks to ensure compliance with KYC principles and relevant foreign exchange regulations. If carrying or remitting large amounts of cash, you need to report to Bank Indonesia and customs in advance to avoid hefty fines or legal penalties due to non-compliance.

Emergency Remittance

In emergencies, you can choose cash services like Western Union or MoneyGram. These channels support withdrawals within minutes, suitable for urgent needs. You can also consider PayPal or TransferWise for larger amounts, with transfer times of 1–3 business days. The following table compares the speed and fees of common emergency remittance methods:

| Remittance Method | Speed | Fee Description |

|---|---|---|

| Western Union | Withdrawals within minutes | Fees vary by transfer amount, payment method, and withdrawal method; check full fees and rates. |

| MoneyGram | Withdrawals within minutes | Similar to Western Union, uses a global agent network, suitable for urgent transactions. |

| PayPal | 1–3 business days | Offers flexibility and competitive rates, suitable for larger transfers or individual payments. |

| TransferWise | 1–3 business days | Competitive rates, suitable for larger transfers, longer transfer times. |

When choosing, you should balance speed and fees based on actual needs, prioritizing fund safety.

Precautions

During the remittance process, common pitfalls include incorrect information entry, overlooking fee structures, and exchange rate changes. You should ensure recipient information and amounts are accurate, including all necessary reference or purpose codes. Before transferring, you should thoroughly check all details and keep contact information updated. You should use secure networks and trusted devices to protect financial information. After completing the transfer, it’s recommended to retain all transaction receipts. If you have questions, contact customer support promptly. You should also understand the fee structures and exchange rate transparency of each provider to avoid losses due to hidden fees.

When choosing a remittance method for Indonesia, you should focus on security, fees, and transfer speed simultaneously. You can use the comparisons and advice in this guide to quickly select the most suitable channel. It’s recommended to regularly monitor changes in provider fees and exchange rates, adjusting your remittance strategy flexibly to ensure fund safety and optimize the remittance experience.

FAQ

How to choose the safest remittance channel for Indonesia?

You can prioritize regulated service providers. Licensed Hong Kong banks and well-known third-party platforms typically offer higher security. You should verify the provider’s license and user reviews to ensure fund safety.

How to avoid hidden fees during remittances?

You should carefully read the provider’s fee descriptions. You can compare handling fees, exchange rate markups, and withdrawal fees. Before transferring, you can use fee calculators to ensure the actual received amount meets expectations.

How long does it take for a remittance to arrive?

When choosing digital wallets or third-party platforms, funds typically arrive within minutes. Bank channels generally take 1 to 3 business days. You should choose the appropriate channel based on actual needs.

What are the regulations for remittance limits?

When using different channels, single or daily transfer limits vary. For example, Wise allows up to USD 1,000,000 per transfer, while digital wallets have lower limits. You should confirm the provider’s limit requirements in advance.

How to handle remittance issues?

You can contact the provider’s customer support promptly. You should retain transaction receipts and accurately describe the issue. When choosing platforms with high customer service ratings, issues are typically resolved quickly.

Selecting a reliable, low-cost, and swift remittance option to Indonesia is key, but cross-border transfers often encounter regulatory hurdles (like OJK mandates), rate markups, and large-amount declaration requirements. These can cause delays or added expenses, impacting family aid or business disbursements. As a security-focused user, you need a compliant platform for secure, transparent, and efficient fund flows.

BiyaPay is optimized for Indonesia remittances, offering real-time exchange rate queries to monitor USD-IDR rates (around 15,800 currently) and convert fiat to crypto for optimal timing. Fees are as low as 0.5%, with zero charges on contract orders, ensuring same-day arrivals to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly handling remittance surpluses.

Sign up for BiyaPay right away to tap these essentials. From urgent small sends to corporate volumes, it sidesteps hidden costs and boosts performance. Avoid compliance and expense barriers in your Indonesia links—join BiyaPay today for a more dependable cross-border path!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.