- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Best Exchange Rates and Lowest Fees: Safe Options for Remitting Money from the US to Indonesia

Image Source: unsplash

When remitting money from the US to Indonesia remittance, you often focus on how to obtain the best exchange rate in the safest and most convenient way. Different channels such as banks, wire transfers, third-party platforms, and cash remittances have varying fees and speeds. The table below shows that remittance amounts reached 4163.91 million USD in the first quarter of 2025, with frequency continuing to grow. You can refer to the fee structure below to choose the remittance method that suits you:

| Remittance Service | Fee Type | Exchange Rate Type |

|---|---|---|

| Bank | Fixed fees or percentage fees | May be lower than the official mid-market rate |

| Online Transfer Platform | Fixed fees or hidden fees | May be higher than the official mid-market rate |

| Specialized Remittance Service | Fees may vary by transfer amount | May include a margin in service fees |

Key Points

- When choosing a remittance method, consider ease of operation, settlement speed, and fee transparency to ensure you select the most suitable channel.

- Using third-party platforms like Wise and WorldRemit often provides better exchange rates and lower fees, ideal for cost-conscious users.

- Before remitting, verify recipient information to ensure accuracy and avoid transfer failures or delays.

- Pay attention to exchange rate fluctuations and choose to remit when rates are favorable to increase the recipient’s amount and reduce costs.

- Ensure you select a compliant platform to protect personal information and avoid financial losses due to improper operations.

Remittance Method Options

When choosing a method to remit money from the US to Indonesia, you can refer to the following key criteria:

| Selection Criteria | Description |

|---|---|

| Ease of Operation | Choose cross-border payment methods that are easy to set up and manage to save time and effort. |

| Fast Settlement | Shorter settlement times reduce losses due to exchange rate fluctuations. |

| Regulation and Compliance | Understand the regulatory requirements of each method to ensure compliance and reduce risks. |

| Data Transparency | Fees, processing times, and reasons for failure should be transparent to facilitate tracking and planning. |

| Risk and Resilience | Evaluate the safety and success rate of the method to ensure fund security. |

| Customer Experience | Choose methods with good user experience to reduce operational complexity and improve satisfaction. |

Bank Remittance

You can perform international remittances through banks. Banks typically have strict verification processes to ensure fund safety. You need to provide recipient and bank account information. Bank remittance fees are generally high, and exchange rates may be lower than the market mid-rate. Settlement typically takes 2-5 business days. If you prioritize safety and compliance, bank remittance is a reliable choice, but it may not offer the best exchange rate.

Wire Transfers

Wire transfers are another common international transfer method. You can initiate a wire transfer through a bank counter or online banking. Once sent, wire transfers are typically irreversible, so you must carefully verify recipient information. Wire transfers offer high security with multiple identity verifications by the bank. Fees generally range from USD 20-50 per transaction, with delivery in 1-3 business days. Wire transfers are suitable for large amounts and high-security scenarios.

Tip: Both wire transfers and electronic funds transfers are considered safe methods of fund transfer, but wire transfers are irreversible, so proceed with caution.

Third-Party Platforms

You can also choose third-party remittance platforms, such as Wise, WorldRemit, Remitly, MoneyGram, and Western Union. These platforms are generally easy to use, supporting online or mobile app operations. Wise is known for transparent low fees and exchange rates close to the market mid-rate, ideal for users seeking the best rates. WorldRemit and Remitly offer real-time tracking and multiple receiving options, suitable for users needing flexibility. MoneyGram and Western Union have extensive offline networks, convenient for recipient cash pickup. Fees and delivery speeds vary, with some platforms enabling transfers in minutes.

Cash Remittance

If the recipient lacks a bank account, you can opt for cash remittance. You need to visit a designated location (e.g., Western Union or MoneyGram) to process the transfer, and the recipient can collect cash at a branch in Indonesia. Cash remittances are fast, ideal for emergencies, but fees are higher, and you must consider safety risks associated with carrying and collecting cash.

By comparing the safety, speed, and fees of different channels, you can choose the most suitable remittance method to ensure fund security while potentially securing the best exchange rate.

Best Exchange Rates and Fee Comparison

Image Source: unsplash

Exchange Rate Inquiry Methods

When choosing a remittance channel, you should first learn to check real-time exchange rates. Most third-party platforms and bank websites display the current USD to IDR exchange rate. You can use the platform’s rate calculator, input the remittance amount, and the system will automatically calculate the IDR amount the recipient will receive.

Fee Structure

The fee structures of different remittance methods vary significantly. You should focus on the following when choosing:

- Traditional bank transfers typically have lower fees but longer processing times.

- Third-party transfer services may offer faster speeds and lower fees.

- Online transfer services are convenient but often have higher fees than traditional banks or money orders.

You can weigh fees against delivery speed based on your needs. If you prioritize delivery speed, third-party platforms may be more suitable. If you aim to save on fees, bank channels may be more advantageous.

Additionally, exchange rates from different providers affect the actual amount received by the recipient. You must consider both fees and exchange rates to achieve the best rate and lowest total cost.

Hidden Fees

When remitting, beyond visible fees, you should beware of hidden fees. Many providers claim “zero fees” but actually charge extra costs through exchange rate markups. For example, some platforms set rates below the market mid-rate, reducing the recipient’s amount.

The table below shows hidden fee scenarios for common providers:

| Service Provider | Hidden Fees | Remarks |

|---|---|---|

| Remitly | $101.85 | ~2% exchange rate markup, displayed as zero fees but high actual cost |

| Traditional Banks | 3-6% | High fees and exchange rate inflation |

You should note that even companies advertising “zero fees” can impose over $100 in additional costs for a $5,000 transfer due to a 2% rate markup.

Tip: You can determine hidden fees by comparing the platform’s displayed rate with the market mid-rate.

Best Exchange Rate Channels

To secure the best exchange rate, you need to consider exchange rates, fees, and delivery speed comprehensively. Most third-party platforms like Wise and WorldRemit offer rates close to the market mid-rate with transparent fees. Bank channels, while secure, typically offer lower rates than third-party platforms.

You should also monitor exchange rate fluctuations. Rate changes directly affect the recipient’s amount. Studies show a two-way relationship between exchange rate fluctuations and remittance inflows. When the IDR depreciates, the recipient’s amount increases. You can remit when rates are favorable to maximize the recipient’s amount.

You can achieve the best exchange rate through these methods:

- Check real-time rates across platforms and choose the highest rate.

- Consider fees and hidden costs to calculate total cost.

- Time remittances with favorable exchange rate fluctuations.

- Prioritize platforms with transparent fees and rates close to the mid-market rate.

By mastering these methods, you can secure the best exchange rate and lowest fees while ensuring safety.

Fund Safety and Compliance

Legal Requirements

When remitting from the US to Indonesia, you must comply with relevant legal regulations. US law requires that any single or cumulative international remittance exceeding $10,000 be reported to the IRS. Banks or financial institutions typically assist with these reports, but in some cases, you may need to file independently. For large remittances, you need to prepare the following:

- Government-issued identification (e.g., passport)

- Social Security Number (SSN)

- Relevant tax forms (e.g., Currency Transaction Report, CTR)

- Detailed trade documents and transaction records

Failure to comply with reporting requirements may result in fines, even for unintentional oversights. You should also note that Indonesia has strict requirements for large remittances. The table below lists common compliance documents:

| Document Requirement | Description |

|---|---|

| Detailed Trade Documents | Detailed records of all transactions |

| Verified Shipping Documents | Ensure authenticity of shipping documents |

| Goods Price Verification | Verify the market price of goods |

| Beneficiary Verification | Ensure the beneficiary’s identity and legitimacy |

| Record Maintenance Standards | Transaction and identity information must be retained for at least 5 years |

| Suspicious Transaction Reporting | Report suspicious transactions to PPATK promptly |

| Cash Transaction Reporting | Cash transactions exceeding IDR 500 million must be reported |

Risk Prevention

When choosing a remittance channel, prioritize the platform’s compliance and security measures. Compliant platforms use multiple identity verifications to ensure every fund transfer is traceable. You should beware of fraud risks and avoid transferring to unknown accounts. Legitimate platforms monitor suspicious transactions and report to regulators promptly. You should regularly review your remittance records and contact customer service immediately if anomalies are detected.

Reminder: You can choose platforms with good reputations and compliance credentials to avoid financial losses due to improper operations or non-compliant platforms.

User Privacy

When making cross-border remittances, personal information security is equally important. Major remittance platforms implement multiple data protection measures to ensure your privacy. Platforms must ensure data protection adequacy and obtain your consent when transferring personal or corporate client information.

The table below shows common data protection measures used by major platforms:

| Data Protection Measure Type | Specific Requirements |

|---|---|

| Personal Client Information Transfer | Adequacy of protection, appropriate safeguards, data subject consent |

| Corporate Client Information Transfer | OJK-defined protection standards, OJK-approved safeguards, client consent |

| Appropriate Safeguards | Intergovernmental agreements, standard contractual clauses, binding corporate rules, etc. |

When choosing a platform, prioritize those with robust data protection measures and transparent privacy policies. This effectively prevents personal information leaks, enhancing the remittance experience and fund safety.

Operation Process and Precautions

Image Source: unsplash

Remittance Preparation

You need to prepare thoroughly before remitting. First, confirm the recipient’s needs, such as whether they have a bank account, require cash pickup, or use a mobile wallet. You should verify the recipient’s name, address, phone number, and account information to ensure accuracy.

It’s recommended to understand each platform’s remittance amount limits in advance. Some platforms impose caps on single or daily transfers, typically between USD 2,000 and USD 10,000. You can choose the appropriate service based on your needs. Prepare valid identification and payment methods (e.g., bank account, credit, or debit card) to improve remittance efficiency.

Step-by-Step Process

You can complete remittances through online platforms, typically following these steps:

- Log into your account or register a new one, providing your name and email address.

- Enter the amount you wish to send.

- Provide the recipient’s name, address, and phone number.

- Choose the receiving method, such as bank account, cash pickup point, or mobile wallet.

- Enter the recipient’s bank or mobile wallet account information in Indonesia.

- Select a payment method (e.g., bank account, credit card, debit card, or PayPal).

- Confirm all information is correct and submit the remittance request for processing.

You should carefully verify each piece of information during the process to avoid transfer failures or delays due to errors.

Issue Handling

You may encounter common issues during remittances:

- High transaction fees: You can compare platforms and choose services with transparent fees and competitive rates.

- Exchange rate fluctuations: You can select platforms that allow locking in rates to minimize losses.

- Transfer delays: You can prioritize platforms with fast delivery and check processing times in advance.

- Security issues: You should choose reputable platforms to avoid personal information leaks.

- Accessibility challenges: You can select platforms with mobile apps or local agent partnerships to enhance recipient convenience.

When issues arise, contact platform customer service promptly for professional assistance.

Fund Tracking

You can track remittance progress at any time. Many platforms offer real-time status checks. For example, you can download the Paysend or Ria Money Transfer app, enter the order number or PIN, and view the transfer status in real time. Some platforms also notify you via email when the recipient collects the funds.

You can use these tools to ensure every transfer reaches the recipient safely and promptly.

Selection Recommendations

Needs Analysis

When choosing a remittance method, first analyze your actual needs. Different users prioritize different factors, such as fees, delivery speed, or service transparency. The table below summarizes common user need factors:

| Factor | Description |

|---|---|

| High Transaction Fees | Major pain point, directly impacts costs |

| Fund Transfer Delays | Affects experience, some users need fast delivery |

| Lack of Transparency | Impacts trust in services |

| Awareness of Digital Solutions | Willingness to try new technologies |

| Trust in Service Providers | Key to choosing a service |

| Service Accessibility | Convenience of accessing services |

You can prioritize the most important factors based on your situation and choose the appropriate remittance channel.

Speed and Security

When remitting, speed and security are equally important. The performance of different methods is as follows:

| Remittance Method | Speed | Security |

|---|---|---|

| Bank Transfer (e.g., Licensed Hong Kong Banks) | Slower | Reliable |

| Online Transfer Services | Fast | Highly competitive |

| Digital Wallets and Fintech Platforms | Instant | Low fees |

If you need fast delivery, choose online transfer services or digital wallets. If you prioritize fund safety, opt for bank transfers. Ensure you verify recipient information before confirming the transfer to avoid losses due to errors.

Cost-Saving Tips

You can reduce costs and secure the best exchange rate with these methods:

- Compare transfer fees and exchange rates across services

- Choose platforms with no hidden fees

- Take advantage of promotions and discounts

- Send larger amounts to reduce transfer frequency

- Monitor exchange rates and choose favorable timing

- Use digital wallets to improve delivery speed

Monitoring exchange rates is critical, as rates fluctuate with global markets. You can remit when rates are high to maximize the recipient’s amount.

Reminder: When using credit or debit cards, choose to pay in the local currency to avoid dynamic currency conversion (DCC) and unfavorable rates or additional fees.

You can also regularly check for the latest platform promotions and select the service with the lowest total cost. This ensures both fund safety and the best exchange rate with minimal fees.

You can choose the most suitable remittance method based on your needs. The table below summarizes the pros and cons of major channels:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Traditional Bank Transfer | Competitive rates, relatively fast | Varying fees, some with additional charges |

| Mobile Wallet Transfer | Fast transactions, suitable for small amounts | Limited to supported wallets, amount restrictions |

| Cryptocurrency Transfer | Low fees, popular | Not fully supported in Indonesia, high volatility |

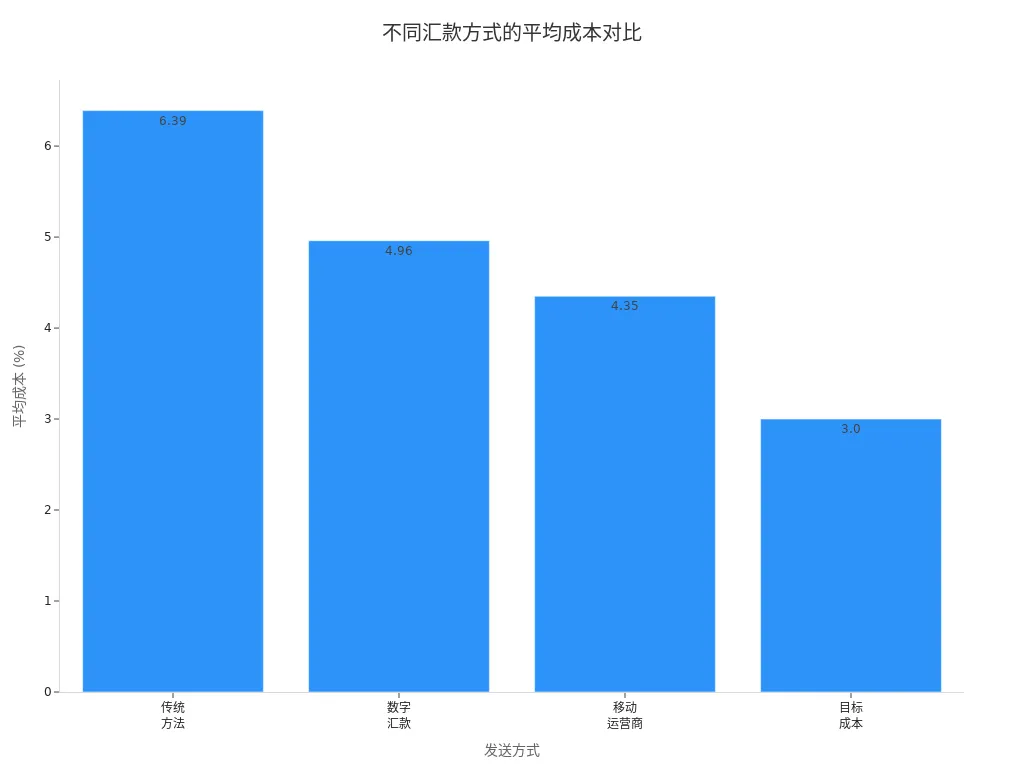

You can compare exchange rates and fees from 2-3 providers, prepare recipient information in advance, and avoid delays due to errors. Digital remittances and mobile wallets have lower average costs than traditional methods, as shown below:

Choosing legitimate channels, focusing on fee structures and delivery speed, can help you complete remittances from the US to Indonesia safely and efficiently.

FAQ

How long does it take to remit money to Indonesia?

When using third-party platforms, funds can arrive in minutes. Bank transfers typically take 1-5 business days. The exact time depends on the provider and receiving method.

Are there limits on remittance amounts?

On most platforms, single remittances are typically limited to USD 2,000 to USD 10,000. Some platforms support higher amounts but require additional identity verification.

How can you determine if a platform is safe and compliant?

You can check if the platform has a financial regulatory license. For example, licensed Hong Kong banks and reputable third-party platforms must comply with strict regulations. Legitimate platforms have clear privacy policies and security measures.

How can you avoid hidden fees during remittances?

You should carefully compare each platform’s exchange rates and fees. Choose platforms with transparent fees and rates close to the market mid-rate. You can also use the platform’s rate calculator to check the actual amount received in advance.

What if the recipient doesn’t have a bank account?

You can choose cash remittance services. The recipient can collect cash at designated locations in Indonesia with identification. Some platforms also support mobile wallet receipts, suitable for users without bank accounts.

Remitting from the US to Indonesia via secure channels ensures fund delivery, but cross-border transfers often hit snags like elevated fees, rate markups, and compliance burdens for large sums (over $10,000 requiring IRS reporting). These can diminish net receipts or delay optimal timing. As a value-seeking user, you need a transparent platform to cut costs, maintain compliance, and speed settlements.

BiyaPay is built for such scenarios, enabling real-time exchange rate queries to track USD-IDR rates (around 16,745 currently) and swap fiat to crypto for favorable locks. Remittance fees start at 0.5%, with zero charges on contract orders, offering same-day reaches to most countries and regions. What’s more, forgo overseas accounts to trade US and Hong Kong stocks on the platform, maximizing post-transfer capital.

Register with BiyaPay now to access these edges. From handling rate swings to tax filings, it sharpens your remittance prowess and gains. Skip hidden costs hampering your Indonesia aid—team up with BiyaPay today for a refined worldwide flow!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.