- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Right Canadian Bank: Banking Services and Account Options to Meet Personal and Business Needs

Image Source: unsplash

When living or starting a business in Canada, choosing the right bank is crucial. You need to consider service types, account options, fees, convenience, and security based on your needs. Individuals and businesses have different priorities when selecting a bank. You should prepare account opening materials in advance, understand the process, address common questions, and improve efficiency.

Key Points

- Clarify your needs and list the priorities for personal or business banking services to help quickly filter suitable bank products.

- Compare services and products from different banks, choosing account types that match your identity to meet daily financial needs.

- Focus on account fees and interest rates, selecting banks with reasonable monthly and transaction fees to reduce daily expenses.

- Consider the bank’s convenience, choosing one with widespread branch and ATM coverage to enhance daily operational efficiency.

- Prioritize bank security, ensuring the chosen bank employs multiple safety measures to protect accounts and safeguard personal information.

Core Criteria for Choosing the Right Bank

Defining Needs

When choosing the right bank, you first need to clarify your actual needs. Different customer groups have varying priorities for banking services. You can outline your goals from the following aspects:

- Managing cash flow

- Paying bills

- Tracking expenses

- The importance of modern banking solutions

If you are a business user, you also need to consider business scale, industry characteristics, and future development plans. Banks use optimized customer journeys and customer segmentation to help you quickly find suitable service solutions. You can use bank websites or third-party account comparison tools, input your needs, and quickly filter the most matching bank products.

Tip: You can create a list of your core needs in advance to make targeted comparisons when evaluating banks.

Services and Products

Canadian banks continually optimize services and products to meet diverse customer needs. You can choose corresponding account types and additional services based on your identity (individual, business, new immigrant, etc.). Banks typically use a subscription-based model, allowing you to flexibly add or remove products and services. For small and medium enterprises, banks integrate multiple service providers to create a comprehensive ecosystem, enhancing the overall experience.

- Personal accounts: Suitable for daily deposits, withdrawals, transfers, and financial planning.

- Business accounts: Support bulk payments, payroll, and financial management.

- Investment and wealth management: Includes savings, term deposits, funds, and more.

- Credit cards and loans: Meet consumption and financing needs.

You can compare service offerings and product combinations on bank websites or third-party platforms to find the most suitable solution.

Fees and Interest Rates

Account fees and interest rates directly impact your daily expenses and financial returns. When choosing the right bank, you should focus on account monthly fees, transaction fees, and savings interest rates. The table below shows the monthly fees for common Canadian account types (in USD):

| Account Type | Monthly Fee (USD) |

|---|---|

| Ultimate Package | $0* or $30.95 |

| Basic Chequing | $0* or $16.95 |

| No-Fee Chequing | $0* or $11.95 |

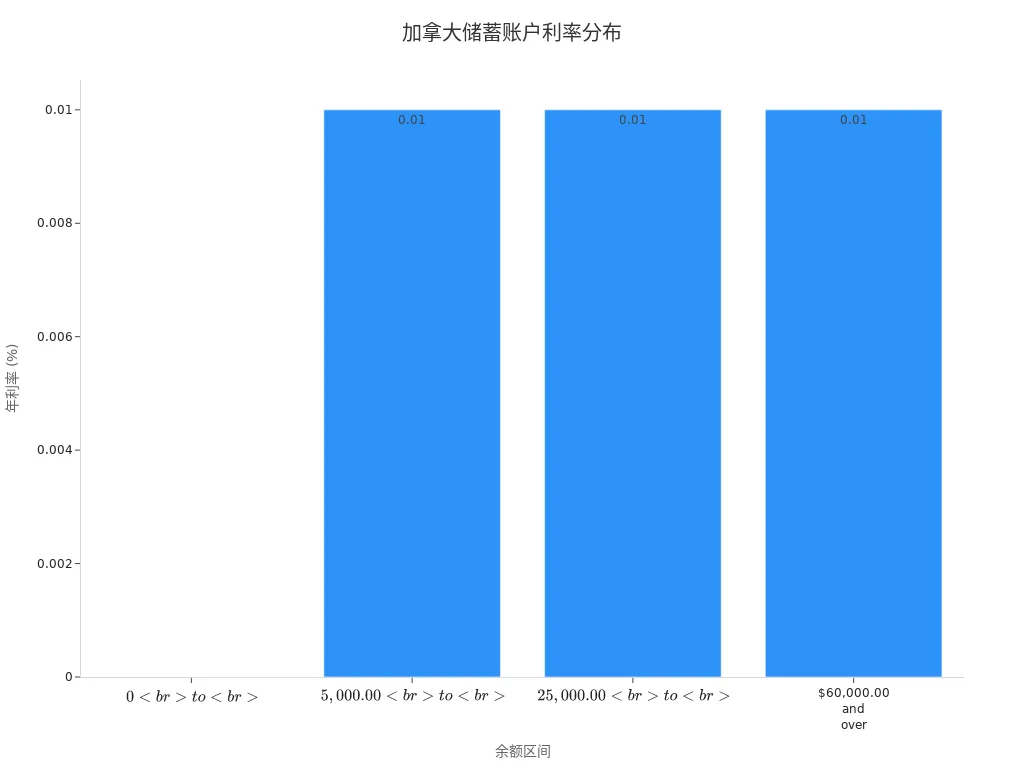

Savings account interest rates are typically tied to the balance, as shown below:

| Balance Range (USD) | Interest Rate |

|---|---|

| $0 to $4,999.99 | 0.000% |

| $5,000.00 to $24,999.99 | 0.010% |

| $25,000.00 to $59,999.99 | 0.010% |

| $60,000.00 and over | 0.010% |

You can refer to the bar chart below to visually understand savings account interest rates for different balance ranges:

Suggestion: You can use the account comparison tools on bank websites, input your fund size and transaction frequency, and quickly filter products with the lowest fees and optimal interest rates.

Convenience

Convenience is a critical factor when choosing the right bank. You need to consider the coverage of bank branches and ATMs, operating hours, and digital service experience.

You can prioritize banks with extensive branch and ATM networks to ensure convenient daily withdrawals and business transactions. Many banks also offer mobile banking apps and online customer service, allowing you to manage accounts, check transactions, and handle business anytime, anywhere.

Reminder: You can check the target bank’s branch and ATM distribution in your residential or business area in advance to ensure efficient daily operations.

Security

Financial security is a must-consider standard when choosing the right bank. The Canadian banking industry adheres to strict regulatory requirements, employing multiple security measures to protect customer accounts. The table below outlines key security measures and their descriptions:

| Security Measure | Description |

|---|---|

| Multi-Factor Authentication | Many Canadian banks have adopted multi-factor authentication to enhance security, though some still rely on SMS authentication. |

| Guideline B-13 | Requires financial institutions to implement risk-based identity and access management controls, including multi-factor authentication and privileged access management. |

| Cybersecurity | Specifies how to design, implement, and maintain preventive cybersecurity controls and measures to protect technological assets. |

Additionally, banks have established whistleblowing programs, allowing employees to report misconduct and prohibiting retaliation against whistleblowers. You can confidently choose the right bank and enjoy high-standard financial security.

Note: When opening an account and using banking services, protect your personal information, regularly update passwords, and enable multi-factor authentication to enhance account security.

Overview of Major Canadian Banks

Image Source: unsplash

Big Five Banks

In Canada, you can access the five major banks. These banks have extensive branch and ATM networks nationwide, offering comprehensive financial services. The Big Five banks include:

- Offering personal and business accounts, supporting daily deposits, withdrawals, transfers, and financial planning.

- Providing various credit card and loan products to meet different consumption and financing needs.

- Employing dedicated financial advisors to assist with investment planning.

- Featuring robust digital platforms, allowing you to manage accounts anytime, anywhere.

Choosing one of the Big Five banks ensures stable services and high-level security. Regardless of which Canadian province you are in, you can easily find branches and ATMs.

Specialty Banks and Credit Unions

If you prefer more personalized services, you can consider specialty banks or credit unions. Credit unions have the following characteristics:

- Member ownership: You are not only a customer but also an owner, able to participate in decision-making.

- Personalized financial services: Smaller membership allows for services tailored to your needs.

- Better interest rates: Typically offer more favorable deposit rates to help grow your financial assets.

- Community support: Some profits are used to support local businesses and charities.

- Flexible loan eligibility criteria: Easier to obtain loans, especially for those struggling with traditional bank approvals.

- Digital banking services: Support online account opening and mobile banking for greater convenience.

- Free extensive ATM network: You can use ATMs nationwide for free.

- Excellent customer service: Focuses on your best interests, offering a better service experience.

- Support for local businesses: Actively provides affordable loans to small and medium enterprises.

Choosing a credit union offers a greater sense of participation and community belonging.

Online Banking

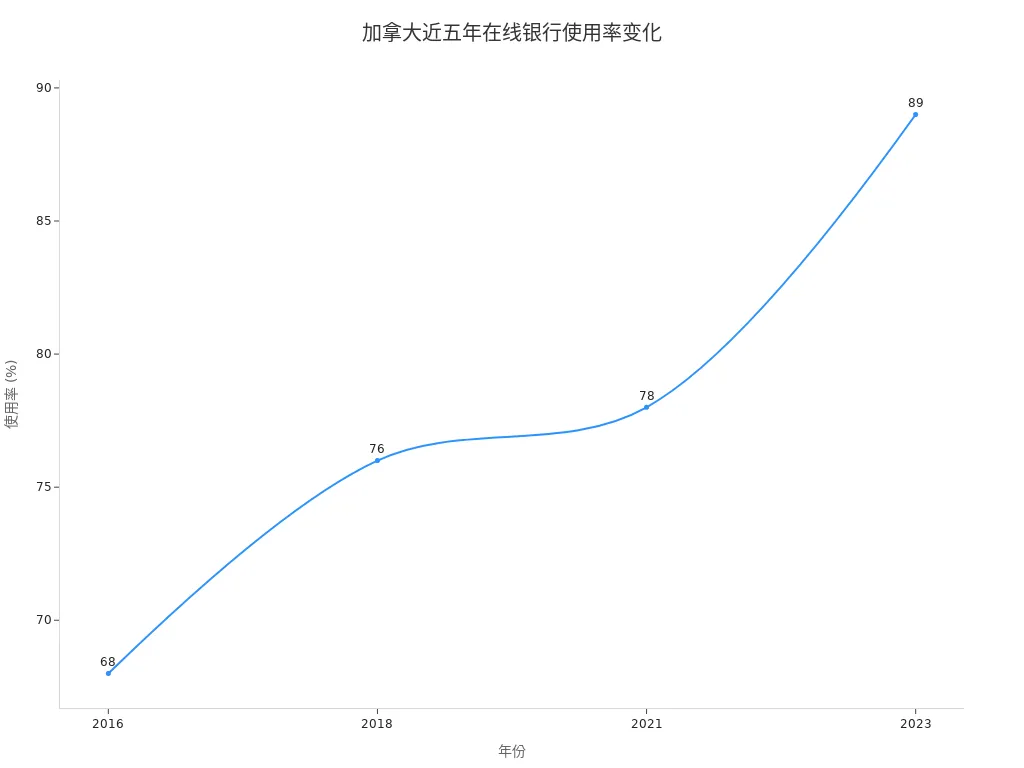

Online banking has grown rapidly in recent years. You can complete account opening, transfers, and financial management via mobile or computer without visiting a physical branch. The table below shows the trend in online banking usage rates in Canada in recent years:

| Year | Online Banking Usage Rate |

|---|---|

| 2016 | 68% |

| 2018 | 76% |

| 2021 | 78% |

| 2023 | 89% |

You can see that more and more people are choosing online banking. 46% of Canadians report increased use of online banking in recent years, with 58% of consumers under 30 preferring online operations. 93% of users are satisfied with online banking, and nearly 40% plan to further increase its use in the future. Online banking offers you greater efficiency and convenience, ideal for those seeking a digital experience.

Personal Bank Account Selection

Account Types

When choosing the right bank, you first need to understand different personal account types. Canadian banks offer multiple options:

- Chequing accounts: Suitable for daily transactions, bill payments, and salary deposits.

- Savings accounts: Used for storing idle funds, offering higher interest earnings.

- Term deposit accounts: Fixed deposit periods with typically higher interest rates than savings accounts.

- Foreign currency accounts: Suitable for international transactions or holding foreign currencies.

Even if you are unemployed or lack funds, you can open a bank account. You only need to provide valid identification (e.g., driver’s license or passport) and personal information, including name, address, email, date of birth, employment or student status, and tax residency. Banks will verify your identity using this information.

Tip: When opening an account, prepare all materials in advance to improve processing efficiency.

Wealth Management and Investments

You can access diverse wealth management and investment services through banks. Common services include investment management, tax planning strategies, retirement planning, estate planning, wealth transfers, and charitable giving. Bank financial advisors will help you create tailored investment plans based on your risk tolerance and financial goals. You can choose products like savings accounts, term deposits, or funds to achieve steady asset growth.

Credit Cards and Loans

When applying for a credit card or personal loan in Canada, banks will review your credit score. Credit scores range from 300 to 900, with higher scores increasing your chances of credit card approval. The table below shows the interest rate ranges for common loan types (in USD):

| Loan Type | Interest Rate Range |

|---|---|

| Personal Loan | 6% - 46.99% |

| Credit Card | N/A |

You can choose suitable credit products based on your needs and credit status. Proper use of credit cards and loans helps build a strong credit history.

Services for New Immigrants and Students

Several Canadian banks offer specialized services for new immigrants and students. For example, some banks provide chequing accounts with no monthly fees for the first year, credit score inquiries, and various credit card options. You can also enjoy welcome packages, free accounts, and flexible credit solutions. Even without a Canadian credit history, you have opportunities to access credit cards and financial services. Choosing the right bank can help you adapt to Canada’s financial environment more quickly.

How Businesses Choose the Right Bank

When operating a business in Canada, choosing the right bank is critical to your business development. You need to consider account types, service fees, financing channels, and specialized services based on your business scale, industry characteristics, and actual needs. Different types of businesses have distinct priorities for banking services. You can systematically evaluate and compare each bank’s strengths through the following aspects.

Business Account Types

When choosing a business account, you should focus on account features, fee structures, and transaction convenience. Major Canadian banks offer diverse account options for businesses of varying sizes and types. The table below shows business account types, monthly fees, and key features for several major banks:

| Bank | Account Type | Monthly Fee (USD) | Features | Transaction Limits |

|---|---|---|---|---|

| Scotiabank | Right Size Account | $6.00 | Online access, per-transaction fees | Transaction fees apply |

| BMO | eBusiness Plan | $0 | Online access, 2 free transfers | Electronic transaction limits |

| CIBC | Basic Business Operating | $6.00 | Online banking, pay-as-you-go | No transactions included |

| TD | Unlimited Business Plan | N/A | Flexible banking plan | N/A |

| TD | Everyday Business Plan A | N/A | Everyday business banking | N/A |

| TD | Basic Business Plan | N/A | Suitable for low transaction volume | N/A |

You can choose the most suitable account type based on your business’s transaction frequency, cash flow, and needs. For example, retailers typically need low-cost and convenient POS services, manufacturing businesses prioritize overdraft and loan approval speed, service-based businesses value customized features and credit card benefits, and tech startups often need growth support and flexible debt solutions. Healthcare and professional service businesses benefit from specialized packages and extended credit options.

Suggestion: You can prioritize account options, customized credit cards, small business support programs, tax filing convenience, streamlined payroll processing, digital banking services, merchant services, and compatibility with accounting systems.

Service Fees

Business account service fees directly impact your operational costs. You need to focus on monthly account maintenance fees, transaction fees, overdraft fees, insufficient funds fees, and inactive account fees. The table below summarizes common fee ranges (in USD):

| Fee Type | Fee Range (USD) |

|---|---|

| Monthly Account Maintenance Fee | $10 - $50 |

| Transaction Fees | Per-transaction charges, some free |

| Overdraft Fees | $5 - $45 |

| Insufficient Funds Fee (NSF) | $5 - $45 |

| Inactive/Dormant Fee | Varies by bank |

You can compare fee structures across banks to choose accounts that align with your business budget and transaction habits. Some banks offer low-fee or no-monthly-fee accounts for small businesses to reduce financial pressure during the startup phase.

Reminder: Before signing up, review the fee details thoroughly, paying attention to hidden fees and charges for special services to avoid unnecessary expenses later.

Financing and Payments

Businesses often need flexible financing and efficient payment solutions during operations. Canadian banks and third-party platforms offer diverse options:

- Plooto: Suitable for electronic payments to suppliers, with convenient operations and fast delivery.

- MazumaGo: Supports large payments with no transaction amount limits, ideal for businesses with high cash flow.

- Wise: Focuses on international remittances, with transparent fees, suitable for cross-border businesses.

- Stripe: Provides comprehensive payment solutions for various businesses, supporting multi-channel collections.

- Square: A payment processing tool commonly used by small merchants, easy to integrate.

- PayPal: Widely used for online payments with high customer acceptance.

You can also choose accounts receivable financing, equipment financing, and government-guaranteed loans to meet daily operations and expansion needs. These financing channels provide flexible funding support, helping you seize market opportunities.

Tip: When choosing payment and financing tools, consider your business scale, transaction types, and international business needs, prioritizing security and operational convenience.

Small Business Services

Small businesses enjoy specialized services in the Canadian banking system. You can choose accounts and financing products designed for small businesses to receive more tailored support. The table below shows specialized services offered by some banks for small businesses:

| Bank Name | Service Type | Description |

|---|---|---|

| RBC | Digital Choice Business Account | Unlimited free electronic transactions, integrated financial tools, built-in fraud prevention |

| BMO | Business Start Plan | Flexible banking solutions, personalized advice, and strategic insights |

| CIBC | Everyday Business Operating Account | Low cost, supports women entrepreneurs, diverse business services |

You can also leverage short-term loans (e.g., overdraft protection, credit cards, lines of credit) and long-term financing (e.g., term loans, mortgages, leases) to meet funding needs at different stages. The Canada Small Business Financing Program (CSBFP) also offers additional opportunities to secure loans.

Note: When choosing the right bank, consider your business development stage and industry characteristics, prioritizing banks that offer customized services and growth support for small businesses.

By systematically comparing account types, service fees, financing channels, and specialized services, you can efficiently choose the right bank, laying a solid foundation for your business’s steady growth.

Fees and Interest Rates

Image Source: unsplash

Account Monthly Fees

When choosing a Canadian bank account, monthly fees are a key cost to consider. Monthly fees vary significantly across banks and account types. The table below shows the monthly fee ranges for several major banks (in USD):

| Bank | Monthly Fee Range |

|---|---|

| BMO | $6 |

| RBC | Higher fees |

| Scotiabank | Tiered plans with additional transaction fees |

Many banks’ monthly fee accounts allow a certain number of free transactions per month. Additional transactions beyond the limit incur per-transaction fees. You can choose a monthly fee plan that suits your transaction frequency and account needs.

Suggestion: Before opening an account, thoroughly understand the monthly fees and included free transactions to avoid unnecessary expenses due to frequent overages.

Transaction Fees

Transaction fees directly impact your daily operational and financial management costs. Common transaction fees include:

- Per-transaction fees for exceeding free transaction limits

- ATM withdrawal fees (especially for cross-bank or international withdrawals)

- International remittance fees

- Cheque processing fees

You can quickly review the main fee types through the unordered list. Some banks offer a set number of free transactions for specific accounts, with per-transaction charges for excess. When choosing an account, consider transaction fee structures that align with your transaction habits.

Interest Rates and Promotions

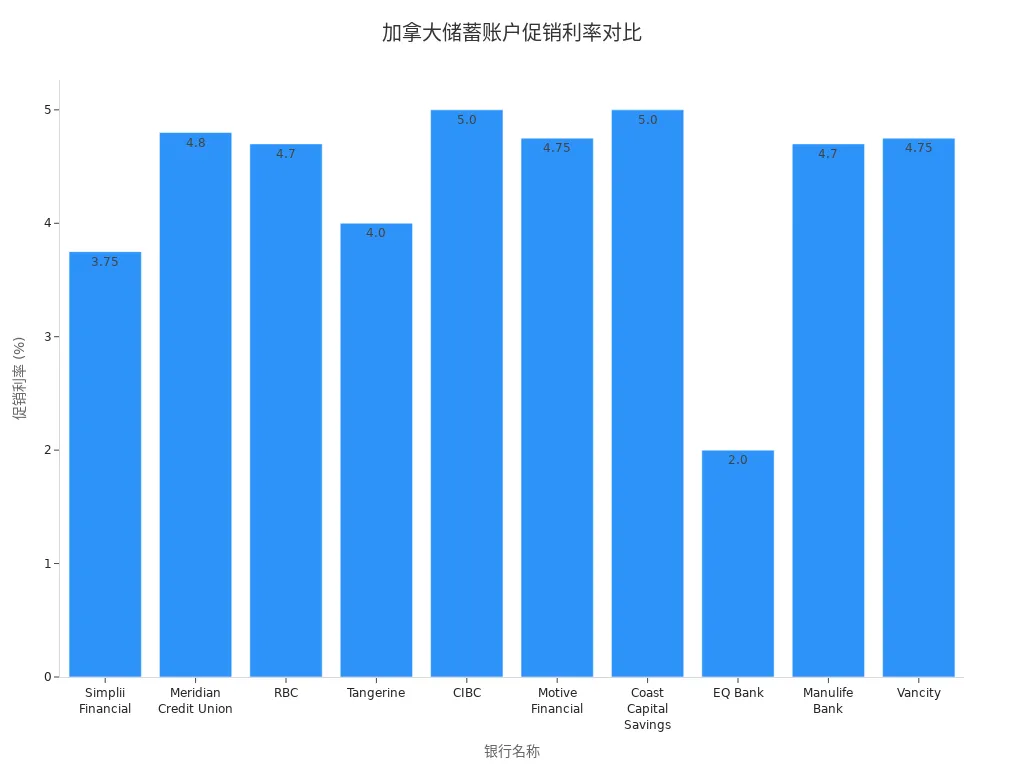

Savings account interest rates and promotional offers directly affect your financial returns. Several Canadian banks offer promotional interest rates above market averages for new clients or new deposits. The table below summarizes the current savings account interest rates and promotional periods for major banks (in USD):

| Bank Name | Interest Rate | Promotional Period |

|---|---|---|

| Simplii Financial | 2.25%-3.75% | March 4 to June 30, 2025 |

| Meridian Credit Union | 4.80% | First 4 months for new accounts |

| RBC | 4.70% | First 3 months for accounts opened before June 3, 2025 |

| Tangerine | 3.75%-4.00% | March 6 to May 31, 2025 |

| CIBC | 5.00% | First 4 months for new eAdvantage savings accounts |

| Motive Financial | 4.75% | First 120 days for new clients |

| Coast Capital Savings | 5.00% | For accounts opened before April 30, 2025 |

| EQ Bank | 2% | New deposits before February 28, 2025 |

| Manulife Bank | 4.70% | New deposits before April 30, 2025 |

| Vancity | 4.75% | New deposits before October 31, 2025 |

You can visually compare the promotional interest rates of major Canadian banks through the bar chart below:

Reminder: When choosing a savings account, pay attention to the validity period and conditions of promotional interest rates, and align them with your cash flow plans to maximize returns.

Convenience and Service Network

Branches and ATMs

When choosing a Canadian bank, the coverage of branches and ATMs directly impacts daily operational convenience. Most major banks have branches and ATMs in major Canadian cities. You can easily find bank locations near your residence for convenient deposits, withdrawals, transfers, and consultations. Many banks also share ATM resources with partner networks, helping you reduce fees for out-of-network withdrawals. When selecting a bank, prioritize institutions with extensive branch and ATM coverage to save time and costs.

Operating Hours

Bank operating hours determine the flexibility of handling business. Major Canadian banks typically operate on Saturdays, with some branches in certain cities open on Sundays. The table below shows weekend operating hours for major banks:

| Bank Name | Saturday Hours | Sunday Hours |

|---|---|---|

| Royal Bank of Canada | 9:00 a.m. - 3:00 p.m. | Open in some cities |

| TD Canada Trust | 9:00 a.m. - 4:00 p.m. | Open in some cities |

| Scotiabank | 9:00 a.m. - Afternoon | Open in some cities |

| BMO | 9:00 a.m. - Afternoon | Open in some cities |

| CIBC | 9:00 a.m. - 3:00 p.m. | Open in some cities |

You can choose bank branches with more flexible hours based on your schedule and needs to improve efficiency.

Digital Experience

Digital services are a key consideration when choosing a bank. Canadian banks generally offer mobile banking apps, online banking, and self-service options. You can check accounts, transfer funds, and pay bills anytime, anywhere. Surveys show that mobile banking features, fraud protection, and seamless identity verification are the top three digital features valued by customers. The table below summarizes the importance of these features:

| Feature | Importance |

|---|---|

| Mobile Banking Features | High |

| Fraud Protection | High |

| Seamless Identity Verification | High |

- 32% of consumers consider strong fraud protection one of the top three factors when choosing a new account.

- 62% of consumers prefer fingerprint-based identity verification.

- 81% of consumers rate bank security as good or excellent.

When choosing a bank, prioritize products with excellent digital experiences, convenient identity verification, and robust security measures to make your financial management more efficient and secure.

Account Opening Process

Personal Account Opening

When opening a personal bank account in Canada, you can follow these steps:

- Confirm eligibility. You need to be at least 13 years old (14 in Quebec) and reside in Canada. Banks will require government-issued photo ID.

- Choose an account type. You can select a chequing or savings account based on your needs.

- Select an application method. You can apply online, by phone, or in person at a branch.

- Sign all documents. Banks will require you to complete digital or paper signatures to ensure a compliant process.

- Set up debit card and online banking passwords. This ensures account security and allows you to start using banking services immediately.

After completing these steps, the bank will activate your account. You can immediately perform deposits, transfers, and daily financial operations.

Business Account Opening

Opening a business bank account is more complex. Banks typically require you to book an appointment and prepare detailed company information. You need to submit identity proof for all directors, shareholders, and ultimate beneficial owners, along with the company registration certificate and articles of association. Banks will also review your business plan to understand the operational model and expected transactions. After completing the process, the bank will assign a dedicated manager to assist with subsequent business transactions.

Required Documents

When opening an account, you need to prepare the following documents:

- Valid passport and government-issued ID for all relevant individuals.

- Proof of residential address, such as utility bills or lease agreements.

- Company registration certificate or extra-provincial registration documents (for business accounts).

- Articles of association or equivalent incorporation documents.

- Business Number (BN), if applicable.

- Partnership agreement or board resolution authorizing the account opening.

- Detailed business plan outlining operations and market services.

- Invoices, contracts, or trade references proving active business operations.

Preparing these documents in advance can significantly improve account opening efficiency.

Considerations

When opening an account, note the following:

It’s recommended to book a branch appointment in advance to avoid waiting. You should carefully verify all documents to ensure information is accurate and valid. When setting passwords, choose complex combinations to enhance account security. If you have questions, consult the bank’s relationship manager for professional guidance. For business accounts, clearly define account authorization scopes to prevent operational risks.

By following these steps and suggestions, you can smoothly open a personal or business bank account and enjoy the efficient services of the Canadian banking system.

When choosing the right bank, you should align with your needs, focusing on service types, fee structures, and digital experiences. Banks offer diverse products for mainland Chinese clients and businesses, supporting economic growth. You can rationally evaluate account options and use digital tools to streamline processes and improve management efficiency.

Banks continue to offer personalized services and limited-time promotions to help you optimize fund allocation. Paying attention to ongoing account management can continuously enhance your financial experience.

- The banking industry contributes approximately 3.7% to GDP, supporting small businesses and individual financing.

- Competitive interest rates and customer loyalty programs help attract and retain clients.

- Personalized mortgage solutions and digital tools simplify application processes.

FAQ

How do I choose the right bank account type?

You can choose an account type based on your financial management needs. Chequing accounts are suitable for daily transactions, savings accounts for deposits and interest earnings, and business accounts for company operations. You can consult a bank manager for advice.

What documents are needed for account opening?

You need to prepare a valid passport, ID, and proof of residential address. Business accounts also require a company registration certificate and articles of association. Preparing materials in advance can speed up the process.

Can new immigrants or students apply for credit cards?

You can apply for credit cards. Some banks offer specialized credit card products for new immigrants and students. You can access basic credit limits even without a Canadian credit history.

How are account monthly fees and transaction fees calculated?

You need to consider monthly fees and per-transaction charges. Fees vary by bank and account type. Review the fee structure before opening an account to choose the most suitable option.

How can I ensure bank account security?

You can set complex passwords and enable multi-factor authentication. Banks use multiple security measures to protect your account. Regularly check account transactions and contact the bank promptly if anomalies occur.

Choosing the right Canadian bank requires attention to account types (chequing, savings, business), fees ($6-$30 monthly, $0-$5 per transaction), convenience (branch/ATM coverage), and security (multi-factor authentication, fraud protection). Individuals need a passport and address proof; businesses require registration documents and plans. As an efficiency-focused user, you need a low-fee, convenient platform to optimize fund management.

BiyaPay offers an ideal solution, with real-time exchange rate queries to track USD-to-CAD rates and convert fiat to crypto, mitigating volatility risks. Remittance fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, smartly managing funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From personal banking to business operations, it cuts costs and boosts efficiency. Don’t let high fees and complex processes hinder your Canadian financial journey—join BiyaPay today for smarter fund management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.