- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

USD to CAD Remittance: A Comprehensive Analysis of Fees, Regulations, and Security

Image Source: unsplash

Are you concerned about how much the fees for USD to CAD remittance actually cost? Are you wondering what documents and identity verification steps are required for remittance? Do you want to ensure fund safety and avoid scams or loss risks?

- You often focus on fee details and want to know which channels are more cost-effective.

- You want to understand whether the remittance process is compliant and if the required documents are complete.

- You prioritize fund safety and are concerned about platform credentials and risks.

This article addresses these concerns to provide clear answers, helping you remit with confidence.

Key Points

- Choosing the right remittance channel can significantly reduce fees. Compare fee structures across platforms to select the most cost-effective payment method.

- Monitor exchange rate fluctuations and choose platforms with rates better than the market average to lower remittance costs.

- Prepare complete identity and transaction documents to ensure a smooth remittance process and avoid delays due to missing files.

- Select regulated platforms to ensure fund safety, regularly check account security settings, and prevent scam risks.

- Understand legal remittance limits and plan amounts carefully to avoid triggering compliance reviews due to exceeding limits.

USD to CAD Remittance Fees

Image Source: unsplash

Transaction Fees

When remitting USD to CAD, transaction fees are the most direct cost. Fee standards vary significantly across platforms and banks. For mainstream channels, BiyaPay, Remitly, and major U.S. banks offer various payment methods. When choosing direct debit or wire transfer, fees vary with the amount. The table below shows fee changes for different amounts and payment methods:

| Transfer Amount | Old Fee | New Fee | Difference | Payment Method |

|---|---|---|---|---|

| $100 | $3.00 | $1.70 | $1.30 cheaper | Direct Debit |

| $250 | $3.00 | $2.90 | $0.10 cheaper | Direct Debit |

| $500 | $5.00 | $4.70 | $0.30 cheaper | Direct Debit |

| $750 | $7.50 | $6.60 | $0.90 cheaper | Direct Debit |

| $1,000 | $10.00 | $8.50 | $1.50 cheaper | Direct Debit |

| $2,500 | $25.00 | $19.70 | $5.30 cheaper | Direct Debit |

| $5,000 | $50.00 | $38.50 | $11.50 cheaper | Direct Debit |

| $10,000 | $85.00 | $61.00 | $24.00 cheaper | Wire Transfer |

| $25,000 | $190.00 | $151.00 | $39.00 cheaper | Wire Transfer |

| $50,000 | $365.00 | $301.00 | $64.00 cheaper | Wire Transfer |

You can optimize fee expenses by selecting the appropriate payment method and remittance amount.

Tip: The larger the remittance amount, the higher the absolute fee value, but the unit cost may decrease. You should choose the optimal solution based on your actual needs.

Exchange Rate Difference

The total cost of USD to CAD remittance depends not only on fees but also on exchange rate fluctuations. When choosing a remittance, you need to check if the platform’s exchange rate is better than the market average. The table below summarizes the main factors affecting exchange rate differences:

| Influencing Factor | Description |

|---|---|

| CAD Average Exposure to USD | CAD exchange rate fluctuations directly affect your remittance costs. |

| Interest Rate Differences Between Countries | Interest rate differences impact exchange rates, thus affecting total costs. |

| Oil Price Fluctuations | Changes in oil prices affect CAD value, indirectly impacting remittance amounts. |

You can reduce additional costs due to exchange rate differences by monitoring rate trends and platform quotes.

Hidden Costs

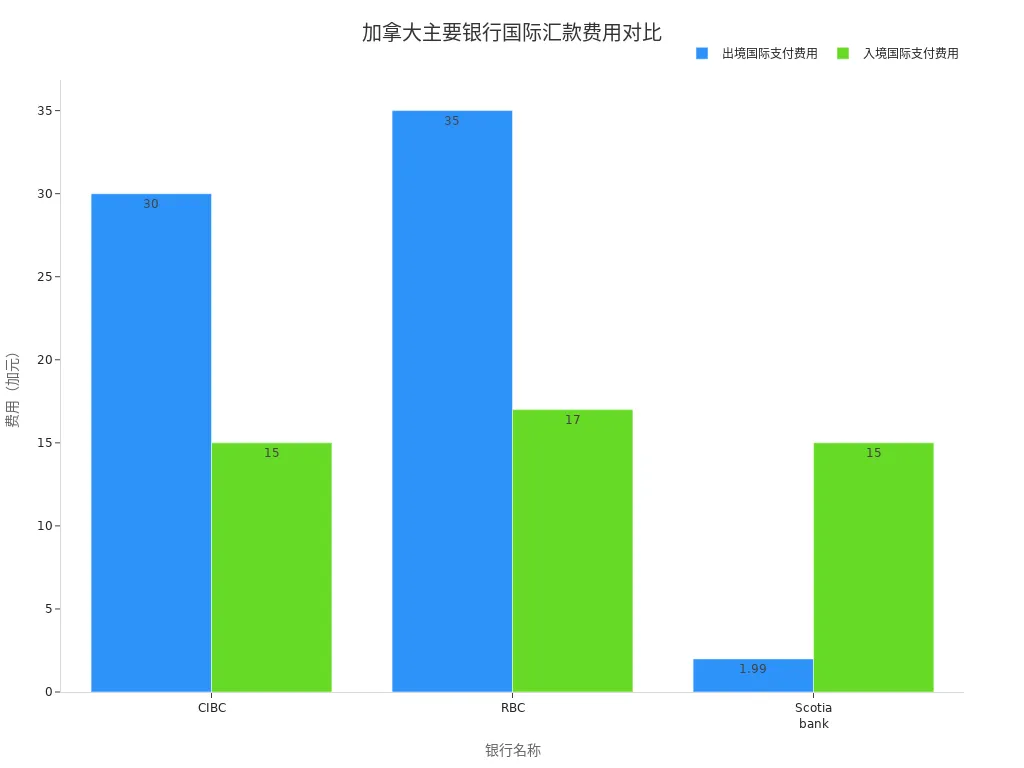

In addition to explicit fees and exchange rate differences, USD to CAD remittances may involve hidden costs. You may encounter additional fees from intermediary banks or receiving bank charges. For example, if you remit through a traditional bank, you may face a 3% exchange rate markup. When sending $5,000, this markup could cost an extra $150; for $10,000, an additional $300. The table below shows international remittance fees for some banks:

| Bank | Outgoing International Payment Fee | Incoming International Payment Fee |

|---|---|---|

| CIBC | $30 (≤$10,000) | $15 + exchange rate difference |

| RBC | $35 (wire transfer) | $17 (≥$50) |

| Scotiabank | $1.99 (online transfer) | $15 (other wire transfers) |

You also need to watch for the following hidden cost sources:

- Intermediary banks may charge additional fees.

- Exchange rate differences may affect the final received amount.

Channel Comparison

When choosing USD to CAD remittance channels, you need to weigh the pros and cons of traditional banks versus online platforms. The table below compares the main cost structures of the two types:

| Type | Traditional Banks | Online Platforms |

|---|---|---|

| Fees | Typically higher | Typically lower |

| Exchange Rate Competitiveness | Less competitive, may lead to extra costs | More competitive, transparent fee structure |

| Hidden Costs | Includes exchange rate markups, up to 5% | Fewer hidden costs, more transparent fees |

When remitting through traditional banks, you typically pay $30 to $80 in fees and may lose about 5% due to exchange rate markups. Online platforms offer lower fees and transparent structures, ideal for cost-conscious users.

Suggestion: For small remittances, consider fixed-fee channels. Some platforms charge $3.99 per transaction, regardless of the amount. Fixed fees provide predictability and transparency but may not be cost-effective for small remittances. You should choose the most suitable channel based on remittance amount and frequency.

Remittance Regulations

Amount Limits

When remitting USD to CAD, you must pay attention to legal limits in both the U.S. and Canada. Whether using banks or online platforms, regulatory bodies set clear standards for per-transaction and annual totals. The table below shows limits for different account types:

| Account Type | Per Transaction Limit (USD) | Annual Limit (USD) |

|---|---|---|

| Personal Account | 1,000,000 | 5,000,000 |

| Business Account | 3,000,000 | 15,000,000 |

You should plan amounts according to your account type to avoid triggering compliance reviews due to exceeding limits. For large fund transfers, banks and platforms require additional documents and stricter identity verification.

Reminder: If you plan multiple remittances, consult bank or platform customer service in advance to ensure annual totals stay within limits, avoiding rejections or delays.

Document Requirements

During USD to CAD remittances, you must prepare complete identity and transaction documents. Banks and mainstream platforms require different documents based on remittance amount and transaction type. The table below summarizes common identity verification requirements:

| Transaction Type | Identity Verification Requirements |

|---|---|

| Remittance of $1,000 or more | Verify the identity of the sender and recipient |

| Cash or virtual currency transport of $1,000 or more | Verify identity before transport |

| Check cashing of $3,000 or more | Verify identity during the transaction |

| Crowdfunding donations of $1,000 or more | Verify identity during the donation |

You typically need to provide valid government-issued identification, such as a passport or driver’s license. For larger transfers, banks may also require proof of address, such as utility bills or bank statements. For business remittances, additional documents like invoices, contracts, or business registration certificates are needed to prove the purpose of funds.

- When remitting through licensed banks in Hong Kong, the identity verification process is equally strict, and all documents must be valid.

- In the U.S. market, banks require detailed transaction background explanations per anti-money laundering regulations.

Process Steps

When remitting USD to CAD, you can choose bank counters, online platforms, or mobile apps. Different channels have slightly varying processes, but the core steps are consistent. Below is the standard process:

- Choose a suitable remittance channel (e.g., bank, online platform, or transfer app).

- Register and verify account information, uploading required identity and address proof.

- Enter recipient information, including name, bank account number, and receiving bank details.

- Specify the remittance amount and select the payment method (e.g., wire transfer, EFT, or Interac e-Transfer).

- Review all information, confirm accuracy, and submit the remittance application.

- Wait for the platform or bank to process, with some services supporting real-time tracking.

- After the recipient receives the funds, verify the received amount and details.

When using online platforms, you typically enjoy lower fees and greater convenience. Platforms provide real-time tracking, allowing you to monitor remittance status. Bank counters are suitable for large or special-purpose remittances with more rigorous processes.

Note: When handling cash deposits or check remittances, strictly follow bank guidelines to ensure routing and transit numbers are correct. Checks must be marked “U.S. FUNDS” or “U.S. DOLLARS” to avoid rejections or delays due to classification errors.

Policy Highlights

During USD to CAD remittances, you must comply with financial regulations in both the U.S. and Canada. Banks and platforms regularly update compliance requirements to ensure safe and transparent fund flows. Below are the main policy highlights:

- Canadian financial institutions must implement Part XVIII verification and due diligence procedures to identify U.S. reportable accounts.

- Institutions collect and review account information to determine if it’s a U.S. reportable account.

- Once identified as a U.S. reportable account, it must be reported in the current and subsequent years until it no longer qualifies.

- Before submitting Canadian checks, you must register for check collection services, ensuring all project routing and transit numbers contain only eight digits.

- Canadian postal money orders and government checks cannot be deposited as copies, and postal money orders over $999.99 will be returned.

- Check classification must be accurate to avoid placing CAD items in USD cash letters.

Recently, the Consumer Financial Protection Bureau (CFPB) proposed amendments clarifying disclosure requirements for remittance companies, encouraging consumers to contact companies first for issues. The proposal accepts public comments until November 4, 2024. During operations, you should closely monitor policy changes and adjust remittance strategies accordingly.

Professional Advice: Before remitting USD to CAD, regularly check the latest policy announcements from banks and platforms to ensure all processes and documents meet the latest compliance requirements, reducing transaction risks.

Safety and Risks

Image Source: pexels

Platform Safety Measures

When choosing USD to CAD remittance channels, platform security mechanisms are critical. Mainstream platforms like Remitly, BiyaPay, and major U.S. banks employ multiple security measures to protect your funds and personal information. The table below summarizes the core safety measures of these platforms:

| Safety Measure | Description |

|---|---|

| Account Verification Process | New users must submit personal information and complete email verification to ensure account ownership. |

| Password Security | Platforms require unique passwords protected by 256-bit encryption technology. |

| Anti-Fraud Protection | Provide anti-fraud advice to help you identify suspicious transactions. |

| Advanced Data Security | Automated and manual risk management programs monitor unusual activity to block risks promptly. |

| Internal Security Team | Professional teams monitor transactions 24/7 to protect funds and sensitive information. |

When using these platforms, you’ll also undergo phone verification and multi-factor authentication to further prevent unauthorized access. Platforms like Remitly comply with national regulations, using modern encryption protocols like AES256 and 2048-bit RSA to ensure secure data transmission.

Risk Prevention

When remitting USD to CAD, you must stay vigilant against scams and fund loss risks. Common scam types include family emergency scams, impersonation scams, investment scams, and tech support scams. You can take the following measures to enhance safety:

- Choose platforms with good reputations and regulatory credentials, and review user feedback.

- Learn about common remittance scam tactics to improve recognition.

- Implement secure payment processes and verify the authenticity of each payment instruction.

- Regularly update passwords, use strong passwords, and enable multi-factor authentication.

- Handle personal information cautiously to avoid leaking account details.

- Regularly train relevant personnel to enhance cybersecurity awareness.

If you encounter suspicious situations, contact platform customer service immediately for professional assistance. Mainstream platforms enhance safety by educating customers, verifying transactions, and collaborating with reputable financial institutions.

USD to CAD Remittance Safety

You can further ensure USD to CAD remittance safety by verifying platform credentials and compliance. You should focus on the following points:

- Check if the platform is regulated by financial authorities to ensure compliant operations.

- Choose providers with transparent fees and full information disclosure to avoid hidden costs.

- Verify if the platform supports multi-factor authentication to prevent unauthorized access.

- Carefully check each transaction’s details to ensure recipient information is accurate.

- Monitor platform security announcements to stay updated on the latest protective measures.

Professional Advice: Before remitting USD to CAD, prioritize regulated, reputable platforms, regularly check account security settings, and ensure each remittance is completed in a secure, controlled environment.

When remitting USD to CAD, you need to focus on actual costs, compliance processes, and platform safety. Recent market exchange rate fluctuations are as follows:

| Metric | Value |

|---|---|

| Highest Rate | 1.4392 CAD |

| Lowest Rate | 1.3574 CAD |

| Average Rate | 1.3840 CAD |

| Current Rate | 1.3779 CAD |

| Past Week Change | -0.728% |

You can choose transparent, fast platforms like Wise or Panda Remit to enhance your experience. It’s recommended to regularly review financial news, consult professional advisors, and adjust remittance strategies to ensure compliance and fund safety.

FAQ

What are the mainstream channels for USD to CAD remittance?

You can choose licensed bank counters in Hong Kong, wire transfer services, or mainstream online platforms in the U.S. market. Each channel has different fee structures and delivery speeds, so choose flexibly based on your needs.

What documents are needed for remittance?

You need to prepare valid identification (e.g., passport), recipient bank information, and proof of address. For large remittances, banks may require additional transaction background explanations or related contract documents.

How long does it take for a remittance to arrive?

Remittances via online platforms typically arrive in 1 to 2 business days. Bank wire transfers may take 3 to 5 business days, depending on the amount and channel.

How are fees and exchange rate differences calculated?

Fees are charged based on the channel and amount, with some platforms using fixed fees. Exchange rate differences are determined by real-time platform quotes, so check in advance to avoid extra costs.

How can I ensure remittance safety?

Choose platforms regulated by financial authorities and enable multi-factor authentication. Regularly check account security settings and contact platform customer service promptly for anomalies to ensure fund safety.

USD-to-CAD remittances involve fees, rate spreads, and hidden costs like intermediary bank charges or 3-5% rate markups, significantly raising expenses. Compliance includes a $1M per-transaction limit for individuals, $3M for businesses, with >$10,000 requiring reporting. As an efficiency-focused user, you need a low-fee, transparent platform to streamline cross-border transfers.

BiyaPay offers the perfect solution, with real-time exchange rate queries to track USD-to-CAD rates and convert fiat to crypto, mitigating volatility risks. Remittance fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, engage in US and Hong Kong stock trading without overseas accounts, smartly managing funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to business payouts, it cuts costs and boosts speed. Don’t let high fees and rate spreads disrupt your fund flow—join BiyaPay today for a budget-friendly remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.