- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Transfer Money from the U.S. to Germany: A Guide to Choosing the Best Transfer Method and Fees

Image Source: pexels

When transferring money from the US to Germany remittance, you should first clarify your remittance purpose and needs. Different amounts and speed requirements will influence your choice. You also need to consider the fees and security of each channel. The following sections will detail the operational process and the necessary documents to help you complete the remittance smoothly.

Key Points

- When choosing a remittance method, consider the amount and transfer speed. Large transfers are suitable for bank wires, while fast transfers can use online services.

- Understand the fee structure of each channel. Bank wire handling fees are higher, while online services are usually more transparent and lower-cost.

- Ensure accurate recipient information and SWIFT codes are provided. Incorrect information may lead to transfer failure or delays.

- Pay attention to exchange rate fluctuations. Choose platforms offering real-time exchange rates to avoid losses due to rate markups.

- Prepare identity proof and related documents in advance. Ensure all information is valid to improve remittance efficiency.

US to Germany Remittance Methods

Image Source: pexels

There are multiple channels for remitting money from the US to Germany. You can choose the most suitable method based on your needs. Below, I will introduce four mainstream methods, highlighting the operational processes for bank wires and online services.

Bank Wire Transfer

Bank wire transfer is one of the most common ways to send money from the US to Germany. You can transfer funds directly through a US bank to the recipient’s bank account in Germany. Bank wires are fast and suitable for large transfers requiring immediate arrival. You need to prepare the recipient’s name, account number, address, and the German bank’s SWIFT code, name, and address. You can visit any US bank branch to process the transfer, and it’s recommended to book an appointment in advance to have sufficient time for consultation and handling.

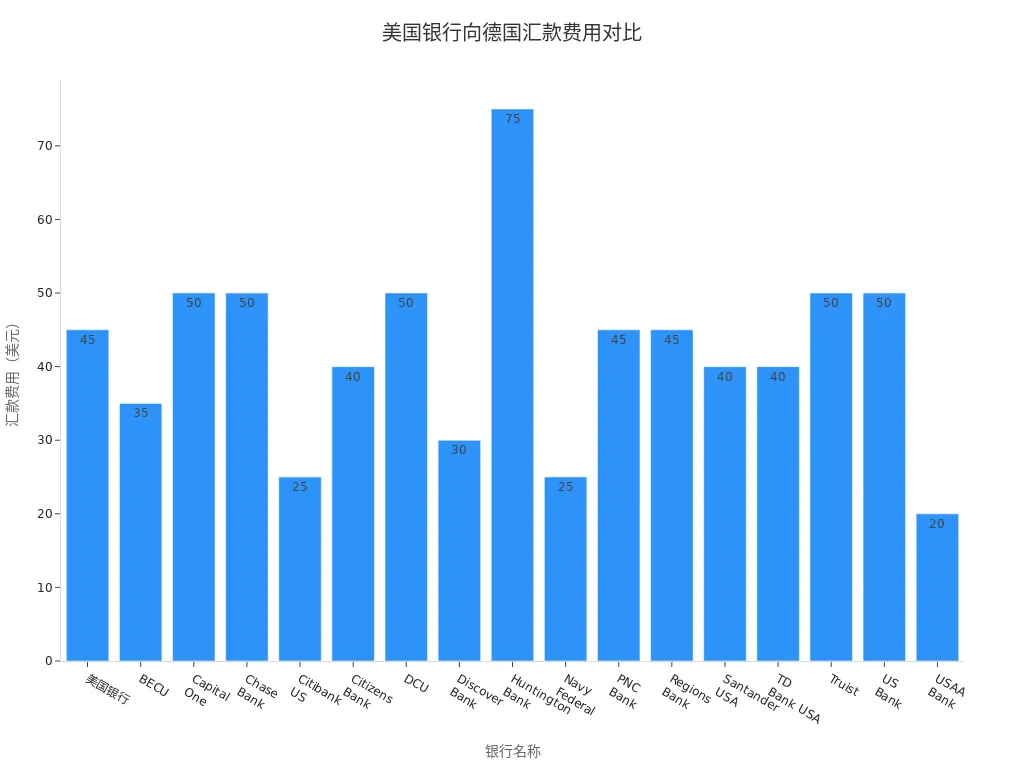

Bank wire transfer fees vary by bank. The following table shows the fees for transferring to Germany from some major US banks:

| Bank Name | Fees for Transfers to Germany | Exchange Rate |

|---|---|---|

| Bank of America | $45 | Exchange rate + possible markup |

| BECU | $35 | Exchange rate + possible markup |

| Capital One | $50 | Exchange rate + possible markup |

| Chase Bank | $50 (in-person) / $40 (online) | Exchange rate + possible markup |

| Citibank US | $17.5–25 or free | Exchange rate + possible markup |

| Citizens Bank | $40 | Exchange rate + possible markup |

| DCU | $50 | Exchange rate + possible markup |

| Discover Bank | $30 | Exchange rate + possible markup |

| HSBC USA | None | Exchange rate + possible markup |

| Huntington Bank | $75 | Exchange rate + possible markup |

| Navy Federal | $25 | Exchange rate + possible markup |

| PNC Bank | $45 | Exchange rate + possible markup |

| Regions Bank | $45 | Exchange rate + possible markup |

| Santander USA | $40 | Exchange rate + possible markup |

| TD Bank USA | $40 | Exchange rate + possible markup |

| Truist | $50 | Exchange rate + possible markup |

| US Bank | $50 | Exchange rate + possible markup |

| USAA Bank | $20 | Exchange rate + possible markup |

| Wells Fargo | Fees disclosed at transaction | Exchange rate + possible markup |

When processing a bank wire transfer, you typically need to complete the following steps:

- Provide the receiving bank’s information: including SWIFT code, bank name, and address.

- Provide the recipient’s information: name, account number, and address.

- Visit a US bank branch to process, and it’s recommended to book an appointment in advance.

Bank wire transfers are suitable for large amounts, with fast arrival times, but handling fees are higher. When choosing a bank, you can compare fees and services.

Tip: While bank wire transfers are secure, handling fees and exchange rate markups are high. You can consult the bank in advance to understand all fee details.

Online Remittance Services

Online remittance services offer a convenient option for transferring money from the US to Germany. You can operate via computer or mobile phone without visiting a bank. Mainstream providers include Azimo, Small World, and Western Union. These platforms have a large user base and cover multiple countries globally.

- Azimo has over one million customers, supporting instant or one-hour transfers, covering over 80 countries.

- Small World has 15 million customers, supporting real-time payment tracking and local support, covering 90 countries.

- Western Union has over 57,000 agent locations in the US, supporting both online and in-person remittances to ensure fund safety.

When using online remittance services, you typically need to register an account, enter recipient information and remittance amount, and select a payment method. Some platforms support instant transfers, while others take 1–2 business days.

Online remittance services use advanced encryption technology to protect customer data, comply with anti-money laundering and KYC policies, and monitor suspicious transactions in real-time to ensure your fund safety.

Recommendation: When choosing online remittance services, prioritize platforms with good reputations and security measures. You can check user reviews to ensure the provider’s reliability.

PayPal and E-Wallets

PayPal is a commonly used e-wallet for transferring money from the US to Germany. You can transfer funds to the recipient’s PayPal account through your PayPal account. PayPal supports international remittances, widely used for personal transfers and e-commerce. You need to note account types and verification status, as unverified accounts may have remittance limits, which can be lifted after verification.

- PayPal accounts linked to a bank or credit card typically have no specific international remittance cap.

- Unverified accounts have limits, which can be lifted through identity verification.

- It’s recommended to check PayPal’s official guide or contact customer service to confirm specific limits before remitting.

Besides PayPal, other e-wallets like Apple Pay, Google Pay, and Klarna are gaining popularity. Apple Pay and Google Pay support contactless payments, offering convenience and speed. Klarna provides a “buy now, pay later” feature to meet flexible payment needs. Wise (formerly TransferWise), Xoom, and Revolut also offer transparent fees and competitive exchange rates, suitable for users with different needs.

Note: When using e-wallets for remittances, ensure account security and avoid leaking personal information. Choosing well-known platforms can reduce risks.

International Remittance Companies

International remittance companies provide diverse options for transferring money from the US to Germany. You can send funds to a German bank account or directly to the recipient through these companies. Mainstream companies like Western Union and MoneyGram have extensive service networks and multiple remittance methods.

These companies typically comply with strict regulatory requirements. For example, Germany requires transfers exceeding €12,500 to be reported to the German Central Bank, while the US requires transfers over $10,000 to be reported to the Financial Crimes Enforcement Network (FinCEN). You should pay attention to amount limits and compliance requirements during remittances to ensure fund safety.

| Country | Regulatory Requirement |

|---|---|

| Germany | Transfers exceeding €12,500 must be reported to the German Central Bank to ensure transparency and prevent illegal activities like money laundering. |

| US | Transfers exceeding $10,000 must be reported to the Financial Crimes Enforcement Network (FinCEN). |

When choosing international remittance companies, prioritize providers with good records and compliance qualifications. You can check company credentials and user reviews to ensure secure and efficient remittances.

Reminder: Before remitting, verify the latest regulations and amount limits to avoid issues due to exceeding limits.

Fee Comparison

When choosing a remittance channel from the US to Germany, fees are a critical consideration. The handling fees, exchange rates, and hidden costs vary significantly across methods. You need to understand these fees in advance to make informed choices.

Handling Fees

When remitting, you will first encounter handling fees. Bank wire transfers, online remittance services, and international remittance companies charge different fees. Bank wire transfers typically have higher fees, especially for large transfers. The following table shows the average international wire transfer fees for major US banks:

| Bank | International Wire Transfer Fees (USD) |

|---|---|

| Industry Average | $44 |

| Bank of America | $0–$45 |

| JPMorgan Chase | $0–$50 |

| Citibank | $0–$35 |

| Fidelity | $0 |

| Huntington | $75 |

| PNC | $5–$50 |

| State Employees Credit Union | $25 |

| Wells Fargo | $0–$40 |

You can see that fees vary widely across banks. Some banks offer discounts for specific customers or online operations, while others charge higher fees. Online remittance services like Wise and OFX typically have lower and more transparent fees. International remittance companies like Western Union and MoneyGram have fees that vary based on the amount and transfer speed. When choosing, you can prioritize comparing handling fees to select the most suitable channel.

Tip: Before remitting, consult the bank or provider to understand all fee details to avoid increased costs due to high handling fees.

Exchange Rates

Exchange rates directly affect the amount received. Banks, online services, and international remittance companies offer different rates. Banks typically use marked-up rates, with markups as high as 4%. Online services like Wise use mid-market exchange rates with almost no hidden markups. OFX adds a 0.4% to 1.2% fee on top of the mid-market rate. Some international remittance companies like Western Union advertise “free” transfers but use poor exchange rates, reducing the actual received amount.

| Service Type | Exchange Rate Type | Fee Description |

|---|---|---|

| Traditional Banks | Marked-up Rates | Charge up to 4% exchange rate markup plus transfer fees |

| Western Union | Poor Rates | Offer “free” transfers but with unfavorable exchange rates |

| Wise | Mid-Market Rate | No hidden markups, transfers at real-time rates |

| OFX | Retail Rate | Adds 0.4% fee on mid-market rate |

When remitting, you should pay attention to exchange rate markups. Even with low handling fees, rate markups can lead to significant losses. Platforms like Wise and OFX offer real-time exchange rate queries, allowing you to compare and choose the best rate.

Recommendation: Spend a few minutes comparing exchange rates and handling fees across services to find the most cost-effective remittance method.

Hidden Costs

In addition to explicit handling fees and exchange rate markups, you should also watch for hidden costs. Common hidden costs in US to Germany remittances include intermediary bank fees, receiving bank fees, and currency conversion fees. If a bank wire lacks a direct channel, it may pass through one or more intermediary banks, each potentially charging a fee. These fees are often only visible after the transfer is completed, making them easy to overlook. The receiving bank may also charge an arrival fee, further reducing the received amount.

Common hidden costs include:

- Intermediary Bank Fees: When your bank lacks a direct link to the receiving bank, intermediary banks process the payment, each potentially charging a fee deducted from the transfer amount.

- Receiving Bank Fees: The German receiving bank may charge an arrival handling fee.

- Exchange Rate Markups: Banks and some remittance companies offer less favorable rates, reducing your funds.

- Multiple Intermediaries: Each intermediary bank may charge independently, significantly impacting the total cost.

You can reduce hidden costs through the following methods:

- Compare multiple remittance services and choose the most transparent fee structure.

- Send large amounts in a single transfer to avoid multiple handling fees from small transfers.

- Pay attention to total costs, including handling fees and exchange rate markups, rather than focusing on a single fee.

- If not urgent, choose regular transfers to avoid expedited fees.

Reminder: Before remitting, inquire about all possible fees, including intermediary and receiving bank charges, to ensure fund safety and maximize the received amount.

When transferring money from the US to Germany, only by fully understanding handling fees, exchange rates, and hidden costs can you make the best choice. It’s recommended to use each platform’s fee calculator before the official remittance to calculate total costs in advance and avoid unnecessary losses.

Transfer Speed and Security

Bank Wire Transfer Speed

When choosing a bank wire transfer, you need to consider the arrival time. International wire transfers are typically processed through the SWIFT network, involving multiple intermediary banks.

- Generally, bank wire transfers from the US to Germany take 1 to 5 business days.

- The specific arrival time is affected by bank policies, clearing processes, currency conversions, and time zone differences.

- If you initiate a transfer after the bank’s cutoff time, the bank will delay processing until the next business day.

- Bank holidays in the US and Germany can cause processing delays. For example, during Christmas in the US or Easter in Germany, banks may suspend services.

- If the bank requires additional identity or tax documents or if information is incorrect, delays may occur.

During actual operations, it’s recommended to prepare all documents in advance and ensure information accuracy to avoid unnecessary delays.

Online Service Speed

If you choose online remittance services, the arrival time is typically faster.

- Mainstream online platforms like PayPal and Wise support instant or same-day transfers.

- Some platforms complete transfers within 1 to 3 business days, suitable for users needing quick transactions.

- Online services usually validate information automatically, reducing manual review time and improving efficiency.

You can choose different services based on your urgency. If you need same-day arrival, prioritize platforms supporting instant transfers.

Security Measures

When transferring money from the US to Germany, security is equally important. Different methods have varying risks. The following table summarizes common risks and mitigation measures:

| Risk Type | Description | Mitigation Measures |

|---|---|---|

| Fraud | Using unverified platforms may lead to fund and information loss | Choose reputable providers with good records |

| Hidden Fees | Some platforms have opaque fee structures, increasing costs | Carefully review all fees before remitting |

| Exchange Rate Fluctuations | Rate changes affect the actual received amount | Choose platforms with real-time, transparent rates |

When choosing a provider, it’s recommended to review user feedback and regulatory qualifications. Reputable platforms use encryption technology and compliance processes to effectively protect your funds and information.

Operational Process

Bank Wire Transfer Process

When processing a bank wire transfer from the US to Germany, you need to prepare detailed recipient and sender information. You can refer to the following table to prepare required documents in advance:

| Information Type | Description |

|---|---|

| Recipient’s Full Name | Must provide the recipient’s complete name |

| Sender’s Full Name | Must provide the sender’s complete name |

| Recipient’s Phone Number | Recipient’s contact phone number |

| Sender’s Phone Number | Sender’s contact phone number |

| Recipient’s Address | Recipient’s address |

| Receiving Bank Name and Information | Name and related information of the receiving bank |

| Recipient’s Account Information | Recipient’s bank account information |

| International Bank Account Number (IBAN) | Account number required for international transfers |

| SWIFT/BIC Code | Code used to identify banks and financial institutions |

| Transfer Amount | Amount to be transferred |

| Transfer Reason | May need to provide the reason for the transfer |

You need to bring identity proof, address proof, and Social Security Number. At the bank counter, fill out the remittance application form, submit all documents, and the bank will verify the information and complete the transfer.

Online Service Process

When using online remittance services, the process is straightforward. You can follow these steps:

- Log in or register an account, entering your name and email address.

- Enter the amount to send, recipient information, and the receiving location in Germany.

- Choose a payment method (e.g., bank account, credit card, or debit card), confirm, and complete the transaction.

During operation, ensure information accuracy to avoid delays due to errors.

PayPal Process

When remitting through PayPal, the steps are intuitive:

- Log into your PayPal account.

- Enter the recipient’s PayPal-associated email address.

- Select the transfer amount (USD or EUR).

- Confirm the information and submit; the recipient will receive funds directly to their PayPal wallet.

Before transferring, verify the recipient’s email to ensure fund safety.

International Remittance Company Process

When choosing an international remittance company, you need to prepare the following information:

| Required Information | Description |

|---|---|

| Recipient’s Full Name | Provide the recipient’s full name, matching their ID. |

| Recipient’s Bank Account Details | Include the recipient’s bank account number, possibly requiring IBAN. |

| Recipient’s Bank SWIFT/BIC Code | Unique code to ensure transfer to the correct financial institution. |

| Sender’s Personal Information | Provide the sender’s full name, address, and sometimes ID documents. |

| Transfer Amount and Currency | Specify the amount and currency to be transferred. |

You fill out the information at the counter or online, upload identity proof, and submit the remittance request after verification. The company will process and notify you of the remittance progress.

Tip: For any method, prepare all documents in advance and ensure information is valid to improve remittance efficiency.

Required Documents

Image Source: pexels

When preparing to transfer money from the US to Germany, having all required documents ready can make the process smoother. Different remittance methods have slightly varying requirements, but the following three categories of information are the most common.

Identity Proof

When processing a remittance, banks or remittance companies typically require valid identity proof. This is to comply with anti-money laundering regulations and ensure the legitimacy of fund sources. Common identity proof documents include:

- Passport

- US Driver’s License

- Proof of Residence (e.g., utility bill or bank statement)

Some online remittance platforms may require you to upload ID photos or complete video verification. When using licensed Hong Kong banks or US local banks, you also need to prepare these documents. It’s recommended to check the validity of your documents in advance to avoid delays due to expired IDs.

Reminder: The first time using certain remittance services, identity verification may take longer. Plan sufficient time for the review process.

Recipient Information

You need to accurately fill in the recipient’s detailed information. Incomplete or incorrect information can lead to transfer failure or delays. The following table lists the main recipient information you need to prepare:

| Information Type | Description |

|---|---|

| Recipient’s Name | Name on the recipient’s bank account, which can be an individual or company name |

| Account Number or IBAN | International Bank Account Number (IBAN) used to identify the German bank account |

| BIC or SWIFT Code | International code to identify the German receiving bank |

| Bank Name | Name of the receiving bank |

| Bank Address | Full address of the receiving bank branch |

| Message to Recipient | Optional, can include payment purpose or notes |

You must be particularly careful when filling in this information. IBAN and SWIFT codes are critical for international remittances, and any errors may result in funds being returned or delayed.

Bank SWIFT Code

The SWIFT code is essential for international remittances. You need to ensure the SWIFT code is accurate. You can obtain the German receiving bank’s SWIFT code through the following methods:

- Check the recipient’s bank statement

- Log into the recipient’s online banking account

- Contact the German or US bank’s customer service directly

- Visit the German bank’s official website help page

SWIFT codes typically consist of 8 to 11 letters and numbers, used to uniquely identify a bank. When filling in, verify each character to avoid transfer failures due to errors.

Tip: If you’re unsure about the SWIFT code, confirm directly with the recipient or bank to ensure accuracy.

Selection Recommendations

Amount Needs

When choosing a remittance method, first consider the remittance amount. If you need to send large amounts, bank wire transfers are usually more suitable. Bank wires support high-amount transfers with high security, ideal for tuition, home purchases, or business payments. For small amounts, online remittance services or e-wallets are more flexible with lower fees. Some platforms have limits on single or cumulative amounts, so check the regulations in advance to avoid failures due to exceeding limits.

Tip: For large remittances, confirm amount limits and compliance requirements with the bank or platform in advance to ensure smooth arrival.

Speed Needs

If you have high requirements for arrival speed, prioritize online remittance services or e-wallets. These platforms typically support instant or 1–2 business day transfers. Bank wire transfers are slower, usually taking 1–5 business days. If arrival time is not urgent, choose lower-fee regular transfer methods. Balance speed and fees based on your actual needs.

- Need same-day arrival: Prioritize online platforms supporting instant transfers.

- Not urgent: Choose bank wires or regular online transfers to save on fees.

Fee Sensitivity

If you’re highly sensitive to fees, focus on comparing handling fees and exchange rates across services. Bank wire transfers have high fees and significant rate markups. Online services like Wise and OFX have transparent fee structures and near mid-market rates. International remittance companies and some e-wallet platforms offer various fee plans. Use each platform’s fee calculator to estimate total costs in advance.

- Fee Structure: Some platforms charge fixed fees, others charge by percentage.

- Exchange Rates: Choose platforms with competitive rates to ensure recipients receive more funds.

- Hidden Costs: Watch for intermediary bank fees and potential extra charges from the receiving bank.

Recommendation: Before the official remittance, verify the latest fee and exchange rate information to avoid losses due to rate fluctuations or fee adjustments.

Other Needs

You also need to consider the convenience of the receiving method and the platform’s compliance. If the recipient prefers USD or EUR deposits, choose platforms supporting multi-currency services. If the recipient cannot easily visit a bank, opt for direct bank account or e-wallet transfers. Pay attention to the platform’s security measures and user reviews, prioritizing providers with good reputations and compliance qualifications.

- Receiving Method: Ensure the recipient can conveniently receive funds.

- Compliance Requirements: Understand US and German regulations to avoid failures due to exceeding limits or incomplete documents.

- Platform Security: Choose platforms with encryption and anti-money laundering measures to ensure fund safety.

When making the final choice, combine factors like amount, speed, fees, and receiving convenience to select the most suitable remittance method.

You can choose the most appropriate remittance method based on your needs. Bank wire transfers are suitable for large amounts and high-security needs, while online services and e-wallets are more flexible with lower fees. Prioritize reputable channels to ensure fund safety and compliance. Prepare identity proof, recipient information, and SWIFT codes in advance. With the recommendations in this article, you can smoothly complete remittances from the US to Germany.

FAQ

What basic documents are needed for remitting from the US to Germany?

You need to prepare valid identity proof, recipient’s name, German bank account information, and SWIFT code. Some platforms also require ID photo uploads or proof of address.

How long does it take for a remittance to arrive?

When choosing bank wire transfers, it typically takes 1 to 5 business days. Online remittance services can be instant, with some platforms completing in 1 to 3 business days.

Are there limits on remittance amounts?

When remitting, banks and platforms set single or daily limits. Large remittances (e.g., exceeding USD 12,500) must comply with China/mainland China and US reporting regulations.

How to check exchange rates and handling fees?

You can check real-time exchange rates and handling fees on the remittance platform or licensed Hong Kong bank websites. It’s recommended to use fee calculators before remitting to estimate total costs.

What to do if a remittance fails?

If a remittance fails, contact the platform or bank’s customer service promptly. Verify recipient information and documents, and resubmit the application after corrections.

Sending money from the US to Germany involves balancing bank wires ($17.5-$75 fees), rate markups (1.5-4%), and compliance rules (over $10,000 requires FinCEN reporting), often inflating costs or delaying funds. With EUR/USD at ~1.17 in September 2025, picking the optimal method is key. As an efficiency-focused user, you need a low-cost, transparent platform to ease cross-border transfers.

BiyaPay offers the perfect solution, featuring real-time exchange rate queries to track USD-to-EUR rates (around 1.17 now) and convert fiat to crypto, sidestepping volatility losses. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to business deals, it cuts costs and boosts speed. Don’t let fees and rates hinder your US-Germany links—join BiyaPay today for a smoother remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.