- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Most Cost-Effective and Efficient Way to Transfer Money from the U.S. to Germany

Image Source: unsplash

For remittance from the US to Germany, you can choose digital payment services or bank wire transfers. Digital payment services (such as Wise or Revolut) typically offer better exchange rates, lower fees, and faster processing times. Bank transfers have higher fees and may take longer to arrive. You can refer to the table below, which shows that the average remittance fee in Germany is 5.8%, while the total remittance amount from the US reaches 93 billion USD.

| Country | Remittance Amount (Billion USD) | Remittance Fee (%) |

|---|---|---|

| US | 930 | N/A |

| Germany | 230 | 5.8 |

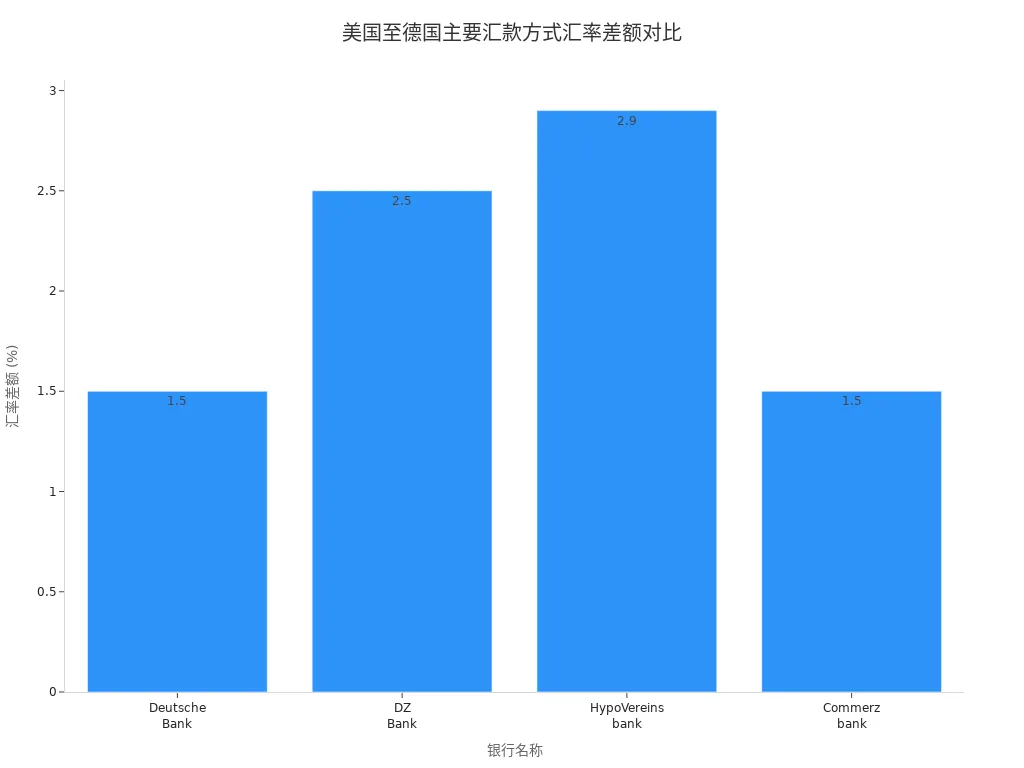

If you prioritize the fastest delivery, online services generally arrive on the same day, while bank transfers take 1 to 3 business days. The chart below displays the exchange rate differences among major banks:

You should flexibly choose the most suitable transfer method based on the remittance amount, time requirements, and fees.

Key Points

- When choosing a remittance method, consider fees, processing speed, and exchange rates. Online services typically have lower fees and faster delivery.

- Bank wire transfers are suitable for large amounts but have higher fees and longer processing times, so choose carefully.

- Online remittance services like Wise and Revolut offer better exchange rates and transparent fees, ideal for daily small transfers.

- Ensure accurate recipient information is provided to avoid delays or failed remittances due to errors.

- Understand compliance requirements and tax declarations to ensure large remittances comply with both countries’ laws, avoiding unnecessary issues.

US to Germany Remittance Methods

Image Source: unsplash

When choosing a remittance channel from the US to Germany, you can consider multiple options. Common channels include bank wire transfers, online remittance services, ACH transfers, and Zelle instant transfers. Each method has distinct features in terms of fees, speed, and applicability. You need to select the most suitable channel based on your needs.

When choosing a remittance service, you should focus on these three points:

- Whether the exchange rate is better than the bank’s mid-market rate

- Whether the fees are transparent and reasonable

- Whether the processing time meets your needs

Bank Wire Transfers

Bank wire transfers are a traditional method for remitting from the US to Germany. You can initiate an international wire transfer through a US local bank or a Hong Kong-licensed bank. Most banks support the SWIFT system, enabling funds to be directly transferred to the recipient’s account in Germany.

- The average fee for international remittances is 44 USD.

- Processing time typically ranges from 24 to 72 hours, though some banks may take 1 to 5 business days.

- You need to provide the recipient’s name, German bank account number, SWIFT/BIC code, and other details.

| Type | Average Fee |

|---|---|

| International Remittance | 44 USD |

- The processing speed of international wire transfers is affected by bank systems, holidays, and currency differences. Most banks process funds within 24 hours, but final delivery may take one to five business days.

Online Remittance Services

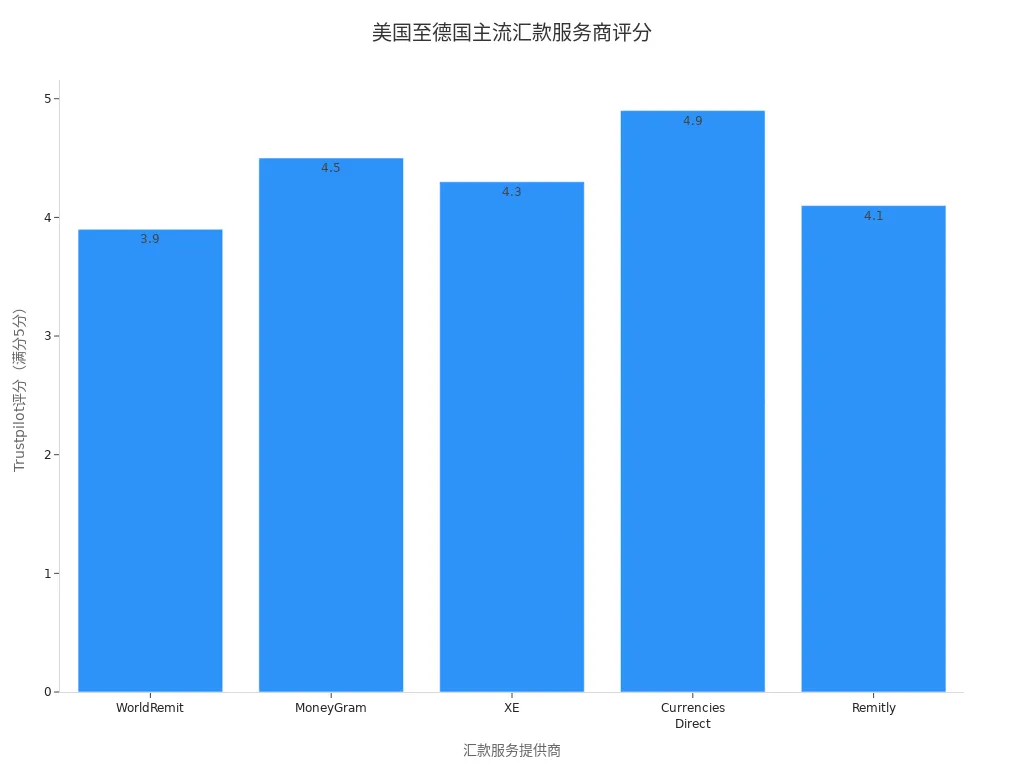

Online remittance services provide a more convenient option for transferring money from the US to Germany. You can operate through websites or mobile apps, with some services supporting payments via credit cards, debit cards, or bank accounts. Major services include Remitly, WorldRemit, MoneyGram, XE, and Currencies Direct.

| Remittance Service Provider | Trustpilot Rating | User Feedback |

|---|---|---|

| WorldRemit | 3.9/5 | Positive reputation, low fees, and transparency, user-friendly platform. |

| MoneyGram | 4.5/5 | Excellent customer support, global coverage, but may have high transfer fees. |

| XE | 4.3/5 | Competitive exchange rates and low fees, occasional platform issues. |

| Currencies Direct | 4.9/5 | High reputation, good user experience, occasional additional document requirements. |

| Remitly | 4.1/5 | Reliable service, generally positive user feedback. |

- Online remittance services have varied fee structures, with some offering discounts for new customers.

- Processing times typically range from 1 to 5 business days, with some services enabling instant delivery.

- Exchange rates are generally better than those of traditional banks, with lower transaction fees.

| Service Type | Speed | Exchange Rate |

|---|---|---|

| Online Remittance Services | 1 - 5 business days or instant | Lower transaction fees and better exchange rates |

| Traditional Banks | Slower | Higher transaction fees and poorer exchange rates |

ACH Transfers

ACH transfers are electronic transfers between US local bank accounts. You can initiate an ACH transfer through a US bank account, but this method cannot directly remit to German accounts. You can only use ACH to transfer funds to a US-based third-party remittance platform, which then completes the international transfer.

- ACH transfers typically take 3 to 5 business days, making them slower.

- Fees are lower than wire transfers but unsuitable for urgent remittances.

- Only supports transfers between US accounts, unable to directly complete US to Germany remittances.

| Transfer Method | Transfer Time |

|---|---|

| SWIFT | Up to 4 business days |

| ACH | Up to 4 business days |

| PEER | Instant transfer |

Zelle Instant Transfers

Zelle is a US-based instant transfer service. You can transfer funds for free between US bank accounts using Zelle. Zelle does not support international remittances, making it unsuitable for US to Germany transfers.

- Zelle is limited to US domestic transactions, requiring both sender and recipient to have US bank accounts.

- Cannot be used for German recipients.

- No fees related to international transfers.

If you need to transfer funds from the US to Germany, Zelle cannot meet your needs. Consider bank wire transfers or online remittance services instead.

Summary of Common US to Germany Remittance Channels

- Online transfers

- Cash withdrawals

- Bank transfers

- Sending via credit or debit card

- Sending through apps

- In-person sending

When choosing a remittance method from the US to Germany, prioritize the service’s reliability, fee transparency, and processing speed. Mainstream online services and bank wire transfers can meet most needs, but you should choose flexibly based on your specific situation.

Fees and Speed

US to Germany Remittance Fees

When choosing a remittance method from the US to Germany, fees are a critical consideration. Fee structures vary significantly across channels. You can refer to the table below for fee ranges and potential hidden costs of major methods:

| Remittance Method | Fee Range | Hidden Fee Notes |

|---|---|---|

| Traditional Banks | $30 - $50+ | Possible unfavorable exchange rates |

| Online Transfer Services | $5 - $25 | Possible additional recipient fees |

| Free Transfer Services | May be zero | Possible hidden fees or recipient charges |

If you choose traditional banks for international wire transfers, you typically need to pay fees of $30 to $50 or more. Some banks also charge additional fees through exchange rate markups. Online remittance services have lower fees, usually between $5 and $25, but some platforms may charge recipients extra fees. Free transfer services may appear fee-free but beware of hidden costs or recipient-side charges.

Tip: Before remitting, carefully review the service terms to understand all possible fees, including exchange rates, transaction fees, and potential recipient charges.

If you’re transferring large amounts, fees and exchange rate markups significantly impact total costs. You can compare different services’ fee structures to choose the most cost-effective method.

Processing Time

Processing speed is another key factor when remitting from the US to Germany. Different channels have varying processing times. Refer to the table below for the average processing times of major methods:

| Remittance Method | Average Time |

|---|---|

| International Wire Transfer | 1-5 business days |

| Western Union | 1-5 business days |

If you choose international wire transfers or Western Union, funds typically arrive within 1 to 5 business days. Some online remittance services can achieve faster delivery, even same-day arrival, depending on the provider and bank system.

Processing speed is affected by multiple factors, including:

- Bank relationships: If your bank lacks a direct relationship with the recipient bank, intermediary banks may be involved, extending processing time.

- Bank hours and time zones: Cross-time-zone transactions may face delays due to differing bank operating hours.

- Compliance and regulation: You must comply with international and local regulations, which may add extra review steps.

- Geopolitical events: Global political instability or sudden events may affect international payment processing speeds.

- Currency and country: Some currency pairs have better transaction infrastructure, enabling faster processing.

- Payment method: Different payment methods have varying speeds and fees, with some being faster.

When choosing a remittance channel, balance processing speed and fees based on your needs. If you need urgent delivery, prioritize online remittance services or expedited options. If delivery time is flexible, opt for lower-cost methods.

Operation Process

Bank Wire Transfer Process

If you choose bank wire transfers for remitting from the US to Germany, follow these steps:

- Log into your bank account or a Hong Kong-licensed bank’s online platform and navigate to the “Accounts” or “Send Funds” page.

- Prepare the recipient and receiving bank’s details, including recipient’s full name, address, phone number, receiving bank name, address, SWIFT/BIC code, and IBAN number.

- Enter the payment amount and target currency (USD or EUR), ensuring recipient information is accurate.

- Pay the international wire transfer fee, typically between $40-$50.

- Submit the remittance request, and the bank will process your transfer, with funds arriving in 1 to 5 business days.

Reminder: Ensure all information is accurate when filling out details to avoid delays or returns.

Online Service Process

If you choose online remittance services, the process is more straightforward. You can complete the following steps via the website or mobile app:

- Register and log into your account.

- Enter the recipient’s name, bank details, IBAN, and SWIFT/BIC code.

- Select the remittance amount and currency, with the system automatically displaying real-time exchange rates and fees.

- Choose a payment method (e.g., bank account, credit card, or debit card).

- Verify all information and submit the remittance request.

- The platform will complete the transfer within the specified time, with some services offering same-day delivery.

You can track remittance progress on the platform, and some services send SMS or email notifications.

ACH Process

If you use ACH transfers, you need to first transfer funds from a US bank account to a third-party remittance platform. The process is as follows:

- Log into your US bank account and select the “ACH Transfer” function.

- Enter the third-party platform’s receiving account details.

- Input the transfer amount and confirm the information.

- Submit the transfer request and wait for bank processing.

- Once funds arrive, the third-party platform will complete the international remittance process.

ACH transfers are slower, typically taking 3 to 5 business days. If you need faster delivery, consider other methods.

Zelle Process

If you use Zelle for transfers, it’s limited to US local bank accounts. The process is as follows:

- Log into your US bank account or Zelle app.

- Enter the recipient’s US bank account details or phone number.

- Input the transfer amount and confirm the information.

- Submit the transfer request, and funds will arrive instantly.

Zelle does not support international remittances and cannot be used for US to Germany transfers. You need to choose other channels for cross-border transfers.

Pros and Cons

Bank Wire Transfer Pros and Cons

When choosing bank wire transfers for remitting from the US to Germany, you’ll notice clear advantages and disadvantages. Bank wire transfers are suitable for large fund transfers and offer high reliability, with many Hong Kong-licensed banks supporting international wires. You can refer to the table below for the main pros and cons of bank wire transfers:

| Pros | Cons |

|---|---|

| High reliability | Hidden fees and opaque exchange rates |

| Suitable for large transfers | Higher international transfer fees |

| Fast processing (some banks) | Exchange rates may increase costs by 5% to 7% |

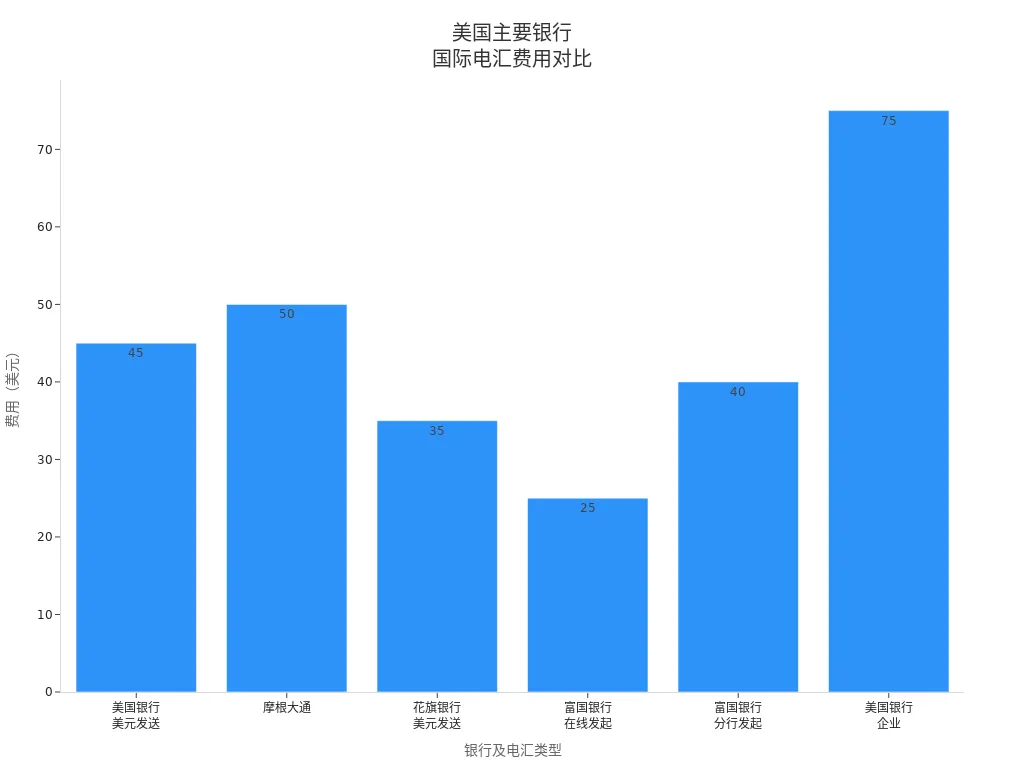

If you choose bank wire transfers, you typically need to pay higher fees, ranging from $55 to $135. Banks may apply unfair exchange rates, reducing the actual amount received. You should also note that bank wire transfers cannot be reversed once initiated, posing some fraud risks. The chart below shows a comparison of international wire transfer fees for major US banks:

Before remitting, thoroughly understand the bank’s fee structure and exchange rate policies to avoid increased costs due to hidden fees.

Online Service Pros and Cons

If you choose online remittance services, you can enjoy a more convenient experience. You can complete remittances via websites or mobile apps without visiting a bank. Online services typically have lower fees, better exchange rates, and faster processing. You can refer to the table below for the pros and cons of online services:

| Pros | Cons |

|---|---|

| Convenient, no need to visit a bank | Limited daily transaction volume |

| Fast transfer speed | Possible fees |

| Potential cost savings | Exchange rates may affect total costs |

When using online services, you can often achieve same-day delivery, with some platforms offering instant transfers. Note that daily transaction limits may apply, and some services charge fees. The table below compares traditional banks and online remittance services:

| Feature | Traditional Banks | Online Remittance Services |

|---|---|---|

| Fees | Higher | Lower |

| Transfer Speed | Slower (days) | Faster (minutes or hours) |

| User-Friendliness | Lower | Higher |

When choosing online services, focus on platform security and exchange rate changes to ensure fund safety and cost control.

ACH Pros and Cons

If you use ACH transfers, they are primarily suitable for fund transfers between US local bank accounts. You can transfer funds to a third-party platform, which then completes the international remittance. ACH transfers have lower fees and are suitable for non-urgent small transfers. Refer to the pros and cons below:

- Pros:

- Low fees, suitable for small transfers

- Simple operation for US local accounts

- Cons:

- Slow processing, typically 3 to 5 business days

- Cannot directly complete US to Germany remittances

- Requires reliance on third-party platforms for international transfers

If you have delivery time requirements, prioritize bank wire transfers or online services.

Zelle Pros and Cons

When transferring between US local bank accounts, you can choose Zelle. Zelle is convenient, with instant fund delivery and no fees. Note that Zelle does not support international remittances and cannot be used for US to Germany transfers. Pros and cons are as follows:

- Pros:

- Instant delivery, simple operation

- No fees

- Cons:

- Limited to US local bank accounts

- Cannot be used for international remittances

- Does not support German recipients

If you need cross-border remittances, Zelle cannot meet your needs. Choose bank wire transfers or online remittance services instead.

Applicable Scenarios

Urgent Remittances

If you face an emergency, such as a family member in Germany needing funds immediately, choosing a fast-delivery remittance method is crucial. Many online remittance services and international payment platforms can meet your needs. Common urgent remittance channels include:

- Western Union: You can transfer via the app or pay in cash at branches, with recipients able to collect cash directly at German branches.

- Remitly: User-friendly interface, supports multiple payment methods, suitable for quick remittances.

- Wise: Supports multi-currency accounts, enabling fast international transfers.

- Revolut: Offers multi-currency management and overseas transfers, ideal for those needing flexible fund management.

- OFX: Suitable for large urgent transfers, with currency risk management tools.

These services typically achieve same-day delivery, with some platforms completing transfers in minutes. When choosing, focus on fees and exchange rates to ensure funds arrive securely and promptly.

Non-Urgent Remittances

If you’re not in a rush for funds to arrive, you can choose methods with lower fees and better exchange rates. Bank wire transfers and some online remittance services are suitable for non-urgent scenarios. You can plan remittance timing in advance, taking advantage of off-peak periods for better fees. Bank wire transfers, while slower, are ideal for large or recurring remittances. Some platforms also support scheduled remittances to lock in ideal exchange rates.

Reminder: For non-urgent remittances, compare fees and rates across services to choose the most cost-effective option.

Small Remittances

If you only need to send a few hundred USD, opt for online remittance services with low fees and convenient operations. Platforms like Wise, Remitly, and Revolut are ideal for small remittances. You can complete operations quickly via mobile apps, tracking exchange rates and progress in real time. Some platforms even waive fees for small remittances, making them perfect for daily family support or bill payments.

| Remittance Method | Suitable Amount Range | Fees | Processing Speed |

|---|---|---|---|

| Online Remittance Services | $10-$1,000 | $0-$10 | Instant to 1 day |

| Bank Wire Transfers | $500+ | $30-$50 | 1-5 days |

Large Remittances

If you need to send large amounts, such as for tuition, property purchases, or investments, bank wire transfers and platforms like OFX are more suitable. Bank wire transfers offer high security for one-time large transfers. OFX and similar platforms provide currency risk management tools to lock in exchange rates, reducing risks from rate fluctuations. When sending large amounts, pay close attention to exchange rates and fees, as these significantly impact the received amount.

Suggestion: Before large remittances, consult with banks or platforms to confirm all procedures and compliance requirements to ensure smooth delivery.

When remitting from the US to Germany, choose the most suitable method based on your needs. Whether for urgent, non-urgent, small, or large remittances, selecting the right channel can save costs and improve efficiency.

Compliance and Taxation

Compliance Requirements

When remitting from the US to Germany, you must comply with both countries’ financial regulations. The US government has strict requirements for large transfers, with any transaction exceeding $10,000 requiring financial institutions to report to the Financial Crimes Enforcement Network (FinCEN) and file a Currency Transaction Report (CTR). Germany, while lacking a similar reporting threshold, conducts compliance reviews for large fund flows, particularly focusing on anti-money laundering regulations. Choosing Hong Kong-licensed banks or other compliant providers can help avoid unexpected fees or delays.

- US financial institutions must report transactions exceeding $10,000.

- Any transfer over $10,000 must be reported to FinCEN.

- Germany conducts compliance reviews for large transfers, focusing on anti-money laundering.

- Transfers for commercial or investment purposes may require additional documentation and approval.

- Choosing compliant remittance providers ensures fund safety.

Before remitting, understand the relevant regulations and ensure all documents are complete to avoid funds being temporarily frozen or returned due to incomplete information.

Tax Declarations

When remitting from the US to Germany, tax declarations are equally important. The US Internal Revenue Service (IRS) stipulates that single remittances exceeding $16,000 may be considered taxable gifts, requiring declaration and potential federal gift tax. If you’re transferring to your own overseas account, gift tax declaration is typically not required, but large payments should involve a professional tax advisor. In Germany, international remittances exceeding €12,500 must be reported to the Deutsche Bundesbank, with gift tax depending on the amount and the relationship between sender and recipient.

| Reporting Obligation | Amount Threshold |

|---|---|

| US IRS Gift Tax | Over $16,000 |

| Germany AWV Report | Over €12,500 |

For large remittances, prepare relevant declaration documents in advance to ensure compliance. Consult professionals to understand the latest tax policies and avoid additional tax liabilities or legal risks due to untimely declarations.

Security

Image Source: pexels

Risk Prevention

When remitting from the US to Germany, security risks are a critical concern. During the remittance process, compliance costs may increase, sometimes passed on to you. Complex regulatory frameworks may affect fund liquidity, making remittances less smooth. High IT system development costs may lead some financial institutions to reduce inflows through formal channels.

You can take the following measures to reduce risks:

- Choose reputable remittance providers, prioritizing regulated Hong Kong-licensed banks or internationally recognized platforms.

- Before initiating a remittance, carefully verify recipient information to ensure account and bank codes are accurate.

- Avoid operating remittances in public places or insecure network environments to reduce the risk of information leaks.

- Regularly monitor your bank statements and transaction history to promptly detect any unusual activity.

Reminder: Before remitting, understand relevant regulations and prepare all necessary documents to avoid delays or freezes due to compliance reviews.

Information Security

When conducting cross-border remittances, protecting personal and financial information is equally important. Many remittance providers use encryption to ensure sensitive data isn’t accessed unauthorizedly during transmission. You can enable two-factor authentication (2FA) to verify identity through multiple methods before each transaction, enhancing account security.

You can also follow these information security suggestions:

- Choose remittance providers with robust security protocols to ensure platforms actively monitor transactions and address suspicious activity promptly.

- Use secure internet connections for transfers, avoiding public Wi-Fi networks.

- Regularly check your account settings and security options, updating passwords promptly to prevent account theft.

| Information Security Measure | Purpose |

|---|---|

| Encryption Technology | Protects financial information, preventing data leaks |

| Two-Factor Authentication | Enhances account security, preventing unauthorized access |

| Transaction Monitoring | Detects anomalies promptly, preventing fraud |

When choosing a remittance channel, prioritize security. Only by ensuring information security can your funds safely and smoothly reach the recipient’s account in Germany.

Comparison and Recommendations

Remittance Method Comparison

When choosing a remittance method from the US to Germany, compare fees, speed, security, and convenience. The table below helps you quickly understand the key features of different channels:

| Remittance Method | Fees (USD) | Processing Speed | Convenience | Security |

|---|---|---|---|---|

| Bank Wire Transfer | 30-50+ | 1-5 business days | Requires bank visit or online | High |

| Online Remittance Services | 5-25 | Instant to 3 business days | Website/app operation | High |

| ACH Transfer | Low to free | 3-5 business days | US local only | High |

| Zelle | Free | Instant | US local only | High |

You can see that bank wire transfers are suitable for large amounts and high-security needs. Online remittance services are ideal for users seeking speed and low fees. ACH and Zelle are limited to US local accounts and cannot directly handle cross-border transfers.

Selection Recommendations

During operations, choose the most suitable method based on your needs. If you need fast delivery, prioritize online remittance services. For large amounts, bank wire transfers are more secure and reliable. When selecting a service, focus on exchange rates and all potential fees. Compare real-time rates and fees across platforms to choose the lowest-cost channel. You can also consult Hong Kong-licensed banks for professional advice to ensure smooth fund delivery. Remitting from the US to Germany involves multiple methods, and by choosing flexibly based on your needs, you can achieve cost-effective international transfers.

When selecting a remittance method from the US to Germany, make flexible decisions based on amount, processing speed, and recipient circumstances. Bank wire transfers are suitable for large amounts and high-security needs, while online remittance services are better for low fees and fast delivery. Compare fees and rates in advance to ensure funds are secure and compliant.

Suggestion: Choose the most cost-effective remittance method based on your needs to avoid unnecessary costs and risks.

FAQ

What basic information is needed for remitting from the US to Germany?

You need to provide the recipient’s name, German bank account number, SWIFT/BIC code, and IBAN. Hong Kong-licensed banks also require the recipient’s address and contact details.

Reminder: Carefully verify all information to avoid remittance delays.

Are there limits on remittance amounts?

You can remit any amount, but transfers exceeding 10,000 USD require US banks to report to regulators. German recipients receiving over 12,500 EUR must also declare.

| Country | Reporting Threshold |

|---|---|

| US | 10,000 USD |

| Germany | 12,500 EUR |

Are online remittance services secure?

Choosing regulated Hong Kong-licensed banks or international platforms ensures fund safety. Platforms use encryption and two-factor authentication to protect your account information.

How long does it take for a remittance to arrive?

Bank wire transfers typically take 1-5 business days. Online remittance services can be as fast as same-day delivery, depending on the provider and bank system.

How are remittance fees calculated?

Bank wire transfers typically charge 30-50 USD. Online remittance services charge lower fees, around 5-25 USD. Some platforms may have exchange rate markups or additional recipient fees.

Sending money from the US to Germany, Wise and Revolut offer fees as low as 0.57% ($5.70 for $1,000 transfer), with fast arrival (64% instant, 95% <1 day), outperforming bank wires ($30-$50 + 3-6% markup). Current EUR/USD ~1.1753 (2025-09-19), and >$10,000 requires FinCEN reporting for compliance. As a cost-efficiency-focused user, you need a low-fee, transparent platform to streamline transfers.

BiyaPay delivers the optimal solution, featuring real-time exchange rate queries to track USD-to-EUR rates (around 1.1753 now) and convert fiat to crypto, dodging volatility losses. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to business payouts, it cuts costs and amps up speed. Don’t let bank premiums and markups burden your US-Germany links—join BiyaPay today for a more budget-savvy remittance path!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.