- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Bank Transfers from Germany to the U.S.: Choosing the Best Transfer Method and Avoiding Potential Fees

Image Source: unsplash

When you want to transfer money from Germany to the USA, choosing a digital platform often provides lower fees and faster speeds. You need to evaluate the best option based on your needs, such as the transfer amount, urgency, and whether the recipient has a U.S. local account. Common reasons for transfers include family support, business transactions, education, travel, retirement, charity, or gifts. You should pay special attention to hidden fees, such as exchange rate losses and intermediary bank handling fees, to avoid a reduced received amount.

Key Points

- Choosing a digital platform for transfers typically offers lower fees and faster delivery times.

- Before transferring, ensure you understand all possible fees, including handling fees, exchange rate margins, and hidden costs.

- Flexibly select the most suitable transfer channel based on the transfer amount and speed requirements.

- Ensure accurate recipient information is provided to avoid delays or failures due to errors.

- Pay attention to tax reporting requirements to ensure compliance and avoid penalties for non-reporting.

Transfer Methods

Image Source: unsplash

There are multiple channels available for transfers from Germany to the USA. You can choose the most suitable method based on your needs. Below, I will detail four mainstream channel types and analyze their characteristics.

Traditional Banks

You can use traditional banks for international wire transfers. Banks typically use the SWIFT network to transfer funds from a German account to a U.S. account.

You need to provide the recipient’s name, U.S. bank account number, SWIFT code, and other information.

The advantage of bank wire transfers is high security, suitable for large fund transfers. Delivery typically takes 2 to 4 business days. Fees are generally high, ranging from 20-50 USD per transaction. Some banks also charge intermediary bank fees, reducing the actual received amount.

You should note that bank exchange rates are often less favorable than digital platforms, potentially leading to exchange rate losses.

Digital Platforms

Digital platforms offer a more convenient option for transfers from Germany to the USA. You can submit transfer requests online, enjoying lower fees and faster delivery times.

- Digital platforms typically support multiple currency exchanges, with transparent exchange rates and fees as low as 5 USD or less.

- Many platforms support real-time or same-day delivery, ideal for urgent transfer needs.

- You only need to register an account, complete identity verification, and provide recipient information to proceed.

- Digital platforms are subject to strict financial regulation, ensuring transaction security.

Many consumers have become accustomed to using digital wallets and platforms for cross-border payments. Data shows that nearly 60% of users tried digital wallets in the past year, especially younger demographics.

Digital platforms demonstrate faster processing speeds and lower transaction fees for transfers from Germany to the USA, making them an ideal choice for international remittances.

Mobile Apps

Mobile apps allow you to complete transfers from Germany to the USA anytime, anywhere. You only need to download the app, register an account, link a bank card or credit card, and initiate the transfer.

- Mobile apps support multiple payment methods, including bank transfers, credit cards, and debit cards.

- Many services offer instant or same-day delivery, ensuring funds reach the recipient’s account quickly.

- You can monitor the transfer status at any time to ensure fund safety.

- Mobile apps are regulated by financial authorities, complying with anti-money laundering and consumer protection standards.

When choosing a mobile app, you should compare fees and exchange rates across services and select reputable providers.

Multi-Asset Wallets

Multi-asset wallets provide a flexible new option for transfers from Germany to the USA. You can manage multiple currencies in the wallet, exchanging and transferring funds anytime.

- Multi-asset wallets support multi-currency accounts, facilitating transfers between different countries.

- You can enjoy lower fees and real-time exchange rates, reducing exchange rate losses.

- Wallet platforms typically support instant delivery, ideal for frequent cross-border transactions.

- You only need to complete identity verification and link a bank card or credit card to proceed.

Multi-asset wallets are increasingly popular in cross-border payments, especially among millennial users. Data shows that 67% of millennials tried digital wallet transactions in the past 12 months.

You can flexibly choose the most suitable channel based on the transfer amount, delivery speed, and recipient needs. Regardless of the method, focus on fees, exchange rates, and security to ensure funds arrive smoothly.

Germany to USA Transfer Fees

Image Source: pexels

When transferring money from Germany to the USA, fees are a primary concern. Fee structures vary significantly across channels, and the actual received amount may be affected by multiple factors. You need to understand handling fees, exchange rates, and hidden costs to make informed choices.

Handling Fees

When choosing traditional bank wire transfers, handling fees are typically high. Banks charge fixed fees, usually between 20-50 USD. Some banks also charge intermediary bank fees, increasing total costs. Digital platforms and multi-asset wallets have lower fees, with some providers charging less than 5 USD per transaction. For large transfers, some platforms offer tiered fee structures to help save costs. Mobile app fees vary, with some providers charging higher percentages for small transfers.

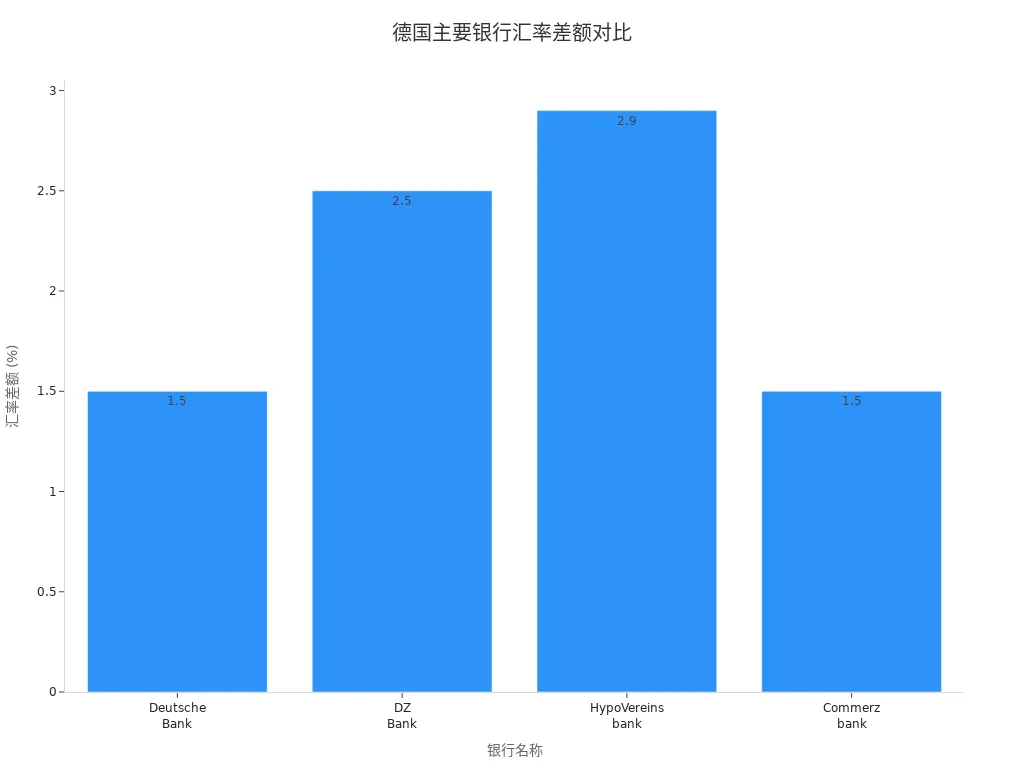

You can refer to the table below to understand the handling fees and exchange rate margins of major German banks:

| Bank Name | Exchange Rate Margin | Other Fees |

|---|---|---|

| Deutsche Bank | 1.5% | $1.55 SWIFT fee + $25 fixed fee |

| DZ Bank | 2.5% | N/A |

| HypoVereinsbank | 2.9% | N/A |

| Commerzbank | 1.5% | N/A |

Exchange Rates

When transferring from Germany to the USA, exchange rate margins directly affect the received amount. Banks typically add a 1.5% to 2.9% profit margin to the mid-market exchange rate. Digital platforms and multi-asset wallets offer rates closer to the mid-market rate, minimizing exchange rate losses. Some providers, while not charging explicit fees, profit through exchange rate markups. You need to carefully compare each channel’s exchange rate policies to avoid reduced received amounts due to exchange rate losses.

For example, when transferring $100,000, exchange rate margins alone can result in $1,500 to $2,900 in costs. Choosing a platform with transparent exchange rates can effectively reduce this loss.

Hidden Costs

During the transfer process from Germany to the USA, you should also be cautious of various hidden costs. Common hidden fee types include:

- Intermediary bank fees: If your transfer involves multiple financial institutions, intermediary banks may charge additional fees, increasing total costs.

- Exchange rate markups: Some providers don’t charge upfront fees but add a margin to the exchange rate, reducing the received amount.

- Recipient bank fees: Some U.S. banks charge recipients for receiving transfers, reducing the actual amount received.

When choosing a channel, you should inquire about all potential fees in advance to ensure funds arrive safely at the recipient’s account.

After understanding the main fee structures for transfers from Germany to the USA, you can choose the most suitable channel based on your needs. You should focus on handling fees, exchange rates, and hidden costs to avoid losses due to fee traps.

Transfer Speed and Limits

Delivery Time

When choosing a transfer method from Germany to the USA, delivery time is a key consideration. Processing speeds vary significantly across channels. You can refer to the table below to understand typical delivery times for common transfer methods:

| Transfer Method | Processing Time |

|---|---|

| ACH Payment | Typically three business days |

| Wire Transfer | Domestic wires average 24 hours, international wires typically 1-5 business days |

| Electronic Check | Processing time approximately three business days |

If you choose traditional bank wire transfers, delivery typically takes 1-5 business days. Digital platforms and some mobile apps support expedited services, with the fastest offering same-day delivery. ACH payments and electronic checks are suitable for non-urgent scenarios, with processing times around three days. In urgent cases, you can prioritize digital platforms or expedited wire transfer services for faster delivery.

Reminder: Delivery times may be affected by holidays, time zone differences, and bank review processes. You should plan ahead to avoid delays impacting fund availability.

Amount Limits

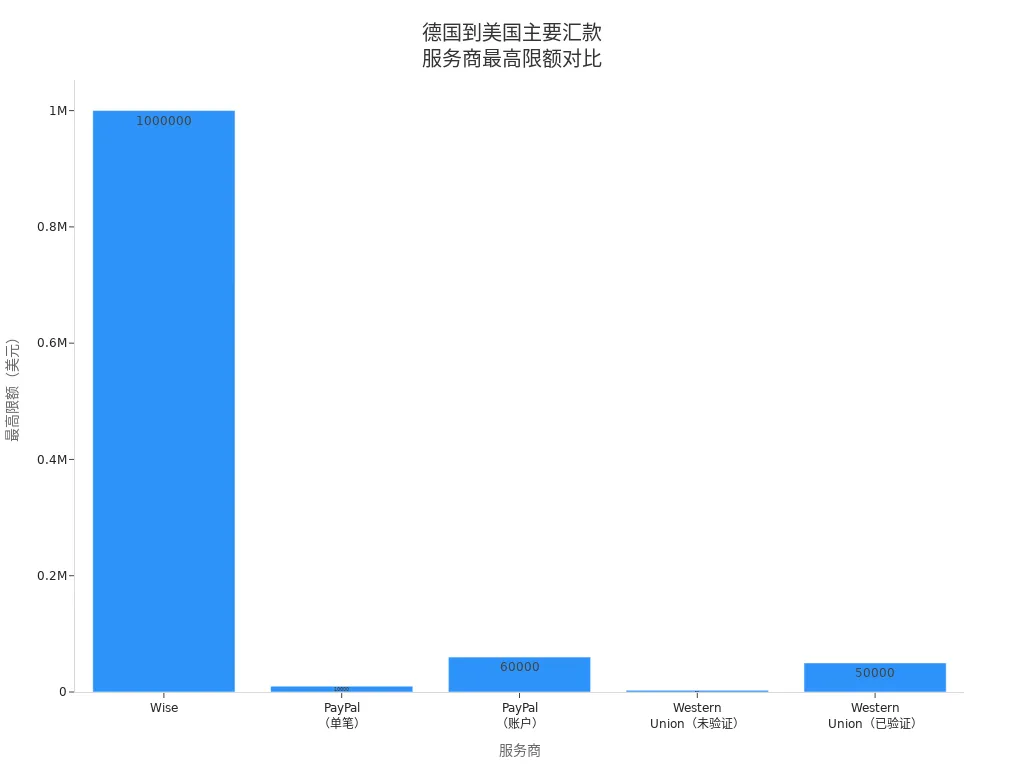

When transferring from Germany to the USA, you need to be aware of each channel’s amount limits. Different providers have varying rules for single and cumulative transfer limits. The table below shows the limits for mainstream channels:

| Provider | International Transfer Limits |

|---|---|

| Wise | Maximum limit of 1,000,000 USD per transaction, multiple transfers allowed on the same day. |

| MoneyGram | International payment limits apply but are not disclosed. Limits vary by payment type and market conditions. |

| Revolut | No limits in most cases, no restrictions for transfers to the USA. |

| PayPal | Verified accounts can send up to 60,000 USD, but individual transfers may be limited to 10,000 USD. |

| Western Union | Unverified accounts have a 3,000 USD limit for international transfers; verified accounts can send up to 50,000 USD. |

If you need to transfer large amounts, you can choose platforms like Wise or Revolut with higher limits. PayPal and Western Union are suitable for small to medium transfers. Some platforms support unlimited transfers but require strict identity verification. When choosing a channel, you should consider your needs and the recipient’s situation, planning transfer amounts to avoid delays due to limit restrictions.

Operating Procedures

Document Requirements

When transferring from Germany to the USA, you must prepare the necessary documents in advance. Requirements vary slightly by channel, but core documents are generally consistent. You can refer to the table below to understand common required documents and their purposes:

| Required Document | Description |

|---|---|

| Valid Government-Issued ID | Such as a passport or residence permit, used to verify the sender’s identity. |

| Proof of Address | Such as utility bills or lease agreements, to confirm the sender’s residence address. |

| Proof of Fund Source | For larger transactions, may require payslips, employment contracts, or bank statements. |

| Recipient Information | Including full name, bank account number, and SWIFT/BIC code. |

When preparing documents, ensure all information is accurate and valid. Some platforms require scanned copies or photos, while banks may require original documents for verification. For large transfers, proof of fund source is particularly important to pass compliance reviews smoothly.

Step-by-Step Instructions

Completing a transfer from Germany to the USA typically involves the following steps:

- Choose a suitable channel and register an account.

- Complete identity verification by uploading ID and proof of address.

- Enter recipient information, including name, bank account, and SWIFT/BIC code.

- Input the transfer amount and confirm the exchange rate and fees.

- Review all information for accuracy and submit the application.

Reminder: When entering recipient information, carefully verify the name and account number. Common errors include misspelled beneficiary names, incorrect account numbers, and missing or incorrect SWIFT/IBAN codes. These issues can lead to transfer delays or failures, and recovery may take significant time.

Throughout the process, prepare all documents in advance to avoid delays due to incomplete information. You can consult customer service at any time to ensure each step is completed smoothly. The transfer process from Germany to the USA is standardized, but attention to detail determines success.

Taxation and Security

Tax Reporting

When transferring from Germany to the USA, you must understand the relevant tax reporting requirements. U.S. citizens and green card holders, even if residing overseas, must file an annual U.S. tax return. You need to report global income, not just income earned in the U.S. In some cases, you must also file additional forms, such as the FBAR (Foreign Bank Account Report) and FATCA report (Form 8938).

- U.S. tax returns must be filed annually

- Global income must be reported

- Additional forms like FBAR and FATCA may be required

If you transfer large amounts, consult a professional tax advisor in advance to ensure compliance and avoid penalties for non-reporting or misreporting.

Risk Mitigation

During transfers from Germany to the USA, you must be aware of compliance reviews and security risks. Financial institutions conduct KYC (Know Your Customer) checks, screen sanction lists, and maintain detailed records. These measures help prevent money laundering and illicit fund flows.

- KYC identity verification

- Sanction list screening

- Transaction record retention

The threat of financial crime in cross-border payments is increasing. Fraudsters may use AI-generated deepfake technology, synthetic identities, and real-time payment scams to bypass traditional security measures. You may encounter risks such as money mule networks, synthetic identities, and Business Email Compromise (BEC). Common scams include impersonating U.S. military personnel, romance and online dating scams, fund transfers, contracts promising high commissions, grandparent scams, inheritance notifications, and job opportunities.

You can take the following measures to protect personal and financial information:

- Choose reputable remittance services with positive customer reviews and strong security histories

- Verify whether the provider uses SSL encryption

- Use platforms that allow transaction tracking to monitor fund status

- Avoid transferring to unknown recipients or sharing personal information on insecure platforms

When transferring from Germany to the USA, stay vigilant, mitigate tax and security risks appropriately, and ensure funds reach the recipient’s account safely.

Selection Tips

When choosing a transfer method from Germany to the USA, you should weigh fees, speed, and security based on your needs. The best option varies by scenario. Below are selection tips for three common priorities.

Cost Priority

If you prioritize transfer costs, opt for low-fee channels. You can choose platforms offering fee-free first transactions, such as BOSS Money, where the first three transfers cost $0, requiring only the actual transfer amount. Subsequent transfers using a debit card cost as low as $0.00, and credit card transfers are only $4.99, among the lowest in the market. You can also:

- Compare fees and exchange rates across platforms to select the service with the lowest total cost.

- Use online calculators to estimate received amounts, ensuring fee transparency.

- Take advantage of tiered fee structures for large transfers by splitting transactions strategically.

You should prioritize platforms with clear fee structures and no hidden costs to avoid reduced received amounts due to exchange rate markups or intermediary fees.

Speed Priority

If you need funds to arrive quickly, choose channels with expedited services. International courier companies like FedEx, UPS, and DHL offer efficient fund or document delivery services. The table below shows typical delivery times for major courier companies:

| Courier Company | Service Name | Delivery Time |

|---|---|---|

| FedEx | International Priority | 1-3 business days |

| FedEx | International First | By 10 a.m. on the second business day |

| UPS | Worldwide Express Plus | Morning delivery in major cities |

| DHL | Express Worldwide | Next-day delivery |

You can also choose digital platforms or mobile apps with fast delivery, some offering same-day transfers. In urgent cases, confirm the provider’s processing times in advance to avoid delays due to holidays or reviews.

Security Priority

If you prioritize fund security, choose channels with strong compliance and strict regulation. Common secure transfer methods include:

- International transfer services: Typically low fees, favorable rates, and regulated, suitable for most cross-border scenarios.

- Bank transfers: High security, ideal for large amounts, but higher fees.

- Mobile wallets: Convenient, supported in some countries and services, suitable for small transfers.

- Cash delivery: Requires in-person presence, suitable for specific needs.

When choosing, prioritize providers with strong compliance credentials and security measures. Verify whether the platform uses SSL encryption and has robust identity verification processes. You should also avoid transferring to unknown recipients and protect personal information from leaks.

You can flexibly choose the most suitable transfer method from Germany to the USA based on your needs, considering fees, speed, and security.

When choosing a transfer method from Germany to the USA, you can refer to the table below for a quick overview of each channel’s advantages and disadvantages:

| Transfer Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Convenient, suitable for large transfers | Higher fees, longer processing times |

| International Remittance Agents | No bank account required, fast and convenient | High costs, may charge 7% to 10% commission |

| Forex Brokers | Transparent fees, ability to lock in rates, suitable for regular transfers | May incur local bank transfer fees |

To avoid hidden fees and exchange rate losses, you can take the following measures:

- Choose platforms with transparent fees and rates, understanding all charges in advance.

- Use local payment networks to reduce intermediary bank fees and delays.

- Consolidate payments to minimize per-transaction fixed fees.

- Compare real-time exchange rates to avoid losses due to rate fluctuations.

During operations, verify recipient information, use reliable services, and retain transaction records. Large transfers must be reported as required to ensure tax compliance. You can flexibly choose the most suitable transfer method from Germany to the USA based on amount, speed, and security needs.

FAQ

What basic information is needed for transfers from Germany to the USA?

You need to provide the recipient’s name, U.S. bank account number, and SWIFT/BIC code. Some channels also require the recipient’s address and bank name.

It’s recommended to prepare all documents in advance to avoid delays due to incomplete information.

How long does it take for a transfer to arrive?

Delivery time depends on the chosen channel. Traditional bank wire transfers typically take 1-5 business days, while digital platforms can deliver on the same day or next day.

| Channel Type | Estimated Delivery Time |

|---|---|

| Bank Wire Transfer | 1-5 business days |

| Digital Platforms | Same day or next day |

Are there limits on transfer amounts?

You can choose suitable amounts based on the channel. Some digital platforms allow up to 1,000,000 USD per transaction, and banks typically support large transfers.

- Small transfers: Mobile apps are more flexible

- Large transfers: Banks or multi-asset wallets are more suitable

What are common fees during transfers?

You will encounter handling fees, exchange rate margins, and intermediary bank fees. Digital platform fees can be as low as 5 USD, while bank wire transfers are typically 20-50 USD.

Verify all fees in advance to ensure accurate received amounts.

Do cross-border transfers require tax reporting?

If you have a U.S. tax status, you must report global income. For large transfers, consult a professional tax advisor to ensure compliance.

U.S. tax reporting includes forms like FBAR and FATCA to avoid non-reporting risks.

Transferring funds from Germany to the US requires caution against steep fees ($20-$50), exchange rate markups (1.5-2.9%), and tax reporting obligations (FBAR/FATCA), which can inflate costs or delay arrivals. As a user prioritizing secure efficiency, you need a low-cost, transparent platform to streamline cross-border remittances and ensure safe delivery.

BiyaPay offers the perfect solution, featuring real-time exchange rate queries to track EUR-to-USD rates (around 1.05 now) and convert fiat to crypto, sidestepping volatility losses. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to business deals, it cuts costs and boosts speed. Don’t let high fees and compliance hurdles stall your fund flow—join BiyaPay today for a smoother remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.