- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Precautions for Remitting Money to Students in Germany: Identity Verification, Anonymity Options, and Anti-Money Laundering Regulations

Image Source: unsplash

When you remit funds from mainland China to international students in Germany via remittance services, you need to provide valid identification. Anonymous remittances are generally not feasible. Banks and remittance institutions strictly enforce anti-money laundering regulations. You must comply with relevant regulations to successfully complete the remittance. Understanding key remittance considerations can help you avoid common compliance risks.

Key Points

- You must provide valid identification, such as a passport or national ID, during remittance to ensure compliance.

- Anonymous remittances are nearly impossible, as all legitimate channels require identity verification to prevent money laundering risks.

- Large remittances require proof of funds’ origin to pass bank scrutiny smoothly.

- When selecting remittance channels, pay attention to fees and exchange rates to avoid hidden costs impacting total expenses.

- Prepare all materials in advance and ensure information accuracy to minimize unnecessary issues during the remittance process.

Identity Verification Requirements

Image Source: pexels

Common Documents

When remitting funds from mainland China to international students in Germany, banks or remittance institutions will require you to submit a series of official documents. Common documents include:

- Valid government-issued identification, such as a passport or national ID.

- The recipient’s bank account details, including the International Bank Account Number (IBAN) and Bank Identifier Code (BIC).

- For large remittances (e.g., exceeding 15,000 USD), you may also need to provide proof of funds’ origin, such as payslips or bank statements.

- Proof of address, typically utility bills or bank statements from the past three months.

- Documents related to the transaction purpose, which help the bank assess the funds’ use.

When processing cross-border remittances through licensed Hong Kong banks, these documents are also applicable. Banks may flexibly request additional documents based on the remittance amount and transaction context.

Verification Process

Banks will conduct strict identity verification. You need to provide personal information, including name, date of birth, nationality, and residential address. Bank staff will verify the original copies of your identification documents and take photos for record-keeping. For large remittances, banks will also require you to explain the source of funds and submit supporting documents. The recipient in Germany may also need to cooperate with their local bank to complete identity verification to ensure fund security.

Tip: You can contact the remittance service provider in advance to confirm required documents, avoiding delays due to incomplete materials.

Common Issues

When processing remittances, you may encounter the following issues:

- Incomplete documents, leading to banks rejecting the transaction or requesting additional files.

- For large remittances, banks require additional proof of funds’ origin, such as payslips or tax documents.

- The recipient in Germany may need to undergo secondary identity verification, which may involve answering security questions or submitting identification.

- Incorrectly filled identity information, affecting transaction progress.

You can prepare all documents in advance and carefully verify information to reduce unnecessary issues during the remittance process. If special circumstances arise, it is recommended to promptly communicate with the bank for professional assistance.

Anonymous Remittance

Feasibility Analysis

You may wish to remit funds anonymously to international students in Germany, but in practice, this is nearly impossible. German financial institutions and licensed Hong Kong banks require you to provide authentic identity information. When processing remittances, banks will ask you to provide detailed information such as name, address, and date of birth. Even if you choose cash transfers or third-party remittance services, institutions will still require you to present identification.

You need to understand that Germany and the international financial system place high importance on the transparency of funds’ origins. All legitimate channels must verify the remitter’s identity to prevent money laundering and illicit fund flows.

Legal Restrictions

German law imposes strict restrictions on anonymous remittances. You can refer to the table below for relevant regulations:

| Evidence Type | Content |

|---|---|

| Ban on Anonymous Accounts | According to the final draft of the Anti-Money Laundering Regulation (AMLR), all forms of anonymous accounts, including bank and payment accounts, are prohibited. |

| Identity Verification Requirement | Financial institutions must verify and record the identity and address of each account holder and beneficial owner. |

| Ban on False Identities | Using false or fictitious names when opening accounts is strictly prohibited. |

When remitting, banks will require both you and the recipient to provide authentic names, addresses, account numbers, and other information. For transfers exceeding 1,000 USD, banks will further verify the accuracy of the information. You need to prepare official documents such as a passport or driver’s license to prove your identity.

Alternative Options

Although anonymous remittances are not feasible, you can choose methods with relatively higher privacy. Common alternatives include:

- Cash transfers: You can process remittances with cash directly through services like Western Union without a bank account, but identity verification is still required.

- Prepaid card transfers: You can purchase prepaid cards for transfers, with recipients choosing to receive funds in cash or via a bank account, but identity verification is required during purchase and use.

- Online services: Some digital remittance services allow operations without traditional bank accounts, but registration and transfers still require personal information.

When choosing these methods, you must still comply with regulations in mainland China and Germany. Legitimate channels protect your funds’ security and ensure smooth delivery to the recipient’s account.

Anti-Money Laundering Regulations

Image Source: pexels

German Regulations

When remitting to international students in Germany, you must comply with Germany’s strict anti-money laundering (AML) regulations. Germany implemented the Sixth Anti-Money Laundering Directive in 2021, clearly defining money laundering offenses. You need to understand that banks, financial service companies, and law firms bear the responsibility of preventing money laundering and terrorist financing. The Funds Transfer Regulation requires you to provide detailed information, including the full name, address, and account number of both the payer and recipient, during electronic fund transfers. German financial institutions review all remittances to ensure each transaction is traceable to a real identity.

- Sixth Anti-Money Laundering Directive: Implemented in 2021, clearly defining money laundering offenses.

- Funds Transfer Regulation: Requires detailed identity information to facilitate tracking of suspicious transactions.

- Responsible Entities: Banks, financial service companies, and law firms must prevent money laundering and terrorist financing.

International Regulations

When processing cross-border remittances from mainland China or through licensed Hong Kong banks, you must also comply with international AML regulations. The global financial system requires all fund transfer service providers to verify customer identities to prevent illicit fund flows. International regulations mandate that both you and the recipient provide authentic identity information. Banks conduct Enhanced Due Diligence (EDD) for large or complex transactions, identifying Politically Exposed Persons (PEPs) or high-risk entities and reporting suspicious transactions to Financial Intelligence Units (FIUs).

- International regulations require identity verification to prevent illicit fund flows.

- Banks must identify PEPs and high-risk entities, conducting Enhanced Due Diligence.

- Suspicious transactions must be reported to Financial Intelligence Units.

Amount Limits

When remitting, you must pay attention to amount limits. For single transactions exceeding 10,000 USD, banks initiate additional compliance reviews and report to the Financial Crimes Enforcement Network (FinCEN). This regulation aims to prevent money laundering and other illegal activities. When processing large remittances, you need to prepare proof of funds’ origin and related documents in advance to pass reviews smoothly.

- Single remittances exceeding 10,000 USD must be reported to the Financial Crimes Enforcement Network.

- Large remittances require proof of funds’ origin.

- Amount limits help mitigate money laundering risks.

Compliance Process

When processing remittances, you need to follow a series of compliance processes. Banks first verify your identity information, checking for PEP status. For large or unusual transaction patterns, banks conduct Enhanced Due Diligence. When dealing with high-risk entities, banks intensify scrutiny. Suspicious transactions are proactively reported to Financial Intelligence Units.

- Banks verify identity information and check for PEP status.

- Large or complex transactions trigger Enhanced Due Diligence.

- Transactions involving high-risk entities face intensified scrutiny.

- Suspicious transactions are reported to Financial Intelligence Units.

Tip: You can consult your bank in advance to understand required documents and processes, avoiding delays due to compliance issues.

Risk Warnings

When choosing remittance channels, you need to be cautious of various money laundering risks. While digital remittance services are convenient, their identity verification processes may be bypassed by criminals. Some prepaid cards can be loaded anonymously, increasing money laundering risks. Money launderers may employ third-party “money mules” for transactions or attempt to gain ownership of remittance companies to evade regulation. Regulatory differences across jurisdictions may also be exploited for illicit fund flows. Money launderers may use multiple small transactions to obscure funds’ origins.

- Digital remittance services have high identity verification risks.

- Prepaid cards can be loaded anonymously, posing money laundering risks.

- Money launderers employ “money mules” or gain company ownership to evade regulation.

- Regulatory differences and structured transactions increase illicit fund flow risks.

Recommendation: You should choose compliant, regulated remittance channels to ensure fund security and avoid involvement in money laundering risks.

Key Remittance Considerations and Recommendations

Fees and Exchange Rates

When processing cross-border remittances, fees and exchange rates directly impact costs. Different remittance providers have varying fee structures and exchange rates. You can refer to the table below for fees and exchange rates of major remittance channels (priced in USD):

| Provider | Transfer Fee (USD) | Exchange Rate (Mid-Market) | Total Cost (USD) |

|---|---|---|---|

| Wise | $5.60 | 1.16463 | $5.60 |

| Starling Bank | $2.90 | 1.15764 (includes hidden fees) | $6.90 |

| NatWest | $0 | 1.11519 (includes hidden fees) | $27.80 |

| Nationwide | $25.80 | 1.14000 (includes hidden fees) | $38.80 |

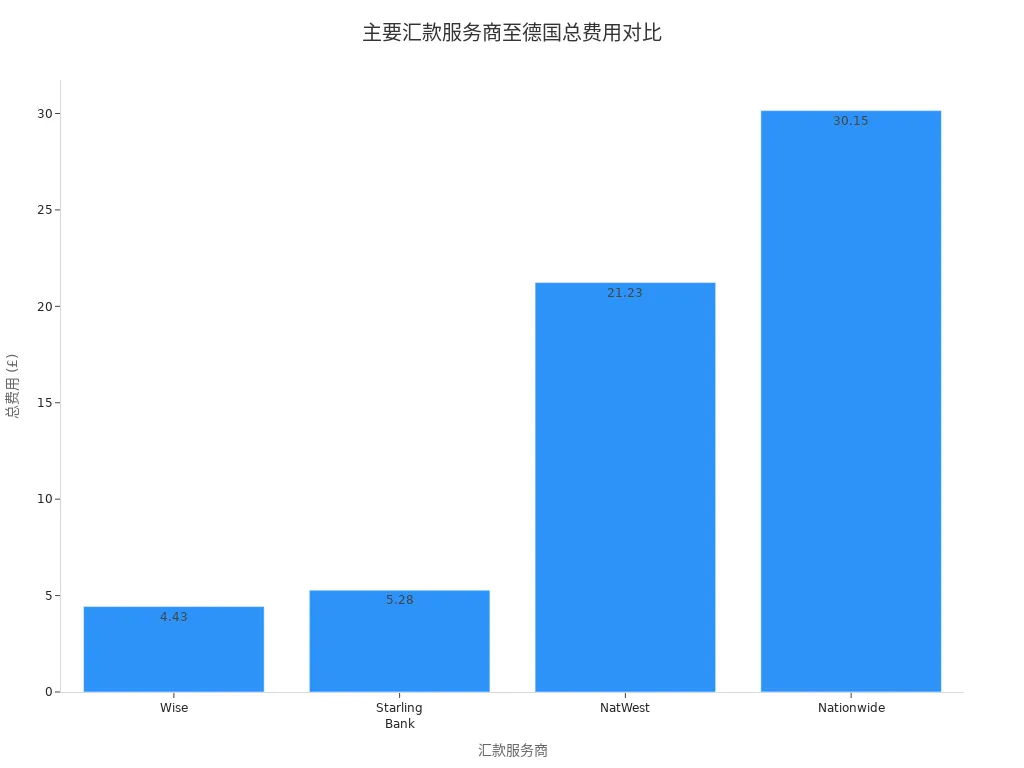

You can see that some providers with lower apparent fees include hidden costs in the exchange rate. When choosing, focus on the total cost rather than just the handling fee. The chart below illustrates a comparison of total costs for major providers:

Additionally, exchange rates vary significantly across financial institutions. You can refer to the table below to compare actual received amounts and total costs across institutions:

| Financial Institution | Exchange Rate (1 EUR) | Amount Received (USD) | Fee (USD) | Total Cost (USD) |

|---|---|---|---|---|

| CurrencyFair | 0.8523 | 999.80 | $3.50 | $1,176.00 |

| XE | 0.8445 | 994.50 | N/A | $1,183.00 |

| Western Union | 0.8335 | 983.53 | $3.40 | $1,199.00 |

| Small World | 0.8248 | 974.81 | $35.50 | $1,212.00 |

When processing remittances, it is recommended to use online platforms to compare fees and exchange rates, effectively reducing costs. Germany’s average remittance cost is approximately 5.8%, lower than many other G20 countries, but you should remain vigilant about hidden fees.

Tip: You can reduce remittance frequency and increase the amount per transaction to lower the total cost of multiple fees.

Speed and Security

Remittance speed directly affects the time funds reach the recipient. When choosing a channel, pay attention to the processing times of different methods. The processing times for common channels are as follows:

| Channel | Processing Time |

|---|---|

| SEPA Transfer | Typically completed within 1 business day |

| SWIFT Transfer | Up to 14 business days |

| Exceptions | Depends on the bank, country, and other factors |

If you process SEPA transfers through licensed Hong Kong banks, funds typically arrive within 1-2 days. SWIFT transfers may take longer due to multiple intermediary banks. In urgent situations, prioritize channels with faster processing times.

Regarding security, focus on the encryption technology and compliance measures of remittance providers. The table below summarizes common security measures:

| Security Measure | Description |

|---|---|

| Encryption Technology | Uses advanced encryption to protect customer data and transaction privacy. |

| Compliance | Strictly enforces Anti-Money Laundering (AML) and Know Your Customer (KYC) policies to prevent fraud. |

| Trusted Financial Institution Partnerships | Collaborates with trusted financial institutions, monitoring suspicious activities in real-time to enhance security. |

When remitting, ensure you choose compliant, regulated channels to guarantee fund security. In case of suspicious activities, promptly contact the bank or remittance institution.

Channel Selection

When choosing remittance channels, consider fees, speed, security, and service reputation comprehensively. The table below lists common channels and their features:

| Channel | Features |

|---|---|

| BOSS Money | Low fees, fast and reliable, 20 years of trusted history |

| Western Union | Available online and offline, wide coverage, numerous agent locations |

You can prioritize these regulated, highly rated channels. For example, BOSS Money and Western Union have high user ratings of 4.8 and 4.7, respectively, with over 50,000 reviews each. When processing cross-border remittances through licensed Hong Kong banks, you can also benefit from high security and compliance support.

Recommendation: Avoid using informal channels or “intermediaries” for remittances. Non-regulated channels lack security guarantees, and issues may lead to fund loss or legal risks without contractual or institutional protection.

Avoiding Pitfalls

When processing remittances, common pitfalls include incorrect information, choosing non-compliant channels, and overlooking fee structures. Below are key remittance considerations to focus on:

- Ensure accurate recipient information: Before transferring, verify the recipient’s full name and bank account details to avoid delays or loss of funds due to errors.

- Choose appropriate payment methods: Bank transfers are the most common and secure method for international remittances. Prioritize regulated banks or legitimate remittance platforms.

- Retain transaction documents: Save all transaction receipts, such as receipts and confirmation numbers, as evidence of initiating and completing transfers, facilitating quick dispute resolution.

- Beware of hidden fees: When selecting providers, look beyond apparent fees and consider actual exchange rates and total costs.

- Comply with regulatory requirements: Actively cooperate with bank identity verification and proof of funds’ origin to avoid remittance failures due to compliance issues.

You should also understand Germany’s regulatory environment. The German financial regulator BaFin oversees and enforces AML policies to ensure the compliance of international remittance transactions. When remitting from mainland China or through licensed Hong Kong banks, strictly adhere to relevant regulations to avoid unintentional legal disputes.

Reminder: Consult your bank or remittance institution in advance to understand the latest remittance considerations and compliance requirements, ensuring funds reach the international student’s account in Germany smoothly and securely.

FAQ

Must I be present in person to process remittances to international students in Germany?

You can choose to process remittances online or offline. Some licensed Hong Kong banks support online remittances. You only need to prepare identification and relevant documents in advance.

How long does it take for funds to be refunded if a remittance fails?

Banks typically refund funds to the original account within 3-7 business days. You can contact bank customer service at any time to check refund progress.

Are there limits on remittance amounts?

For single remittances exceeding 10,000 USD, banks require additional documents. Prepare proof of funds’ origin in advance to avoid delays.

Can I use a third-party account to remit on behalf of someone?

Banks generally require you to use your own account for remittances. If using a third-party account, you must provide identification for both parties and an explanation of the fund relationship.

Do recipients in Germany need to pay taxes on remittances?

Under German law, remittances for regular tuition and living expenses are typically tax-exempt. You should advise the recipient to retain remittance receipts for verification by banks or tax authorities.

Remitting to German students requires caution against high fees ($5-$40), exchange rate markups (up to 2.9%), and China’s annual forex cap ($50,000), which can inflate costs or delay funds. Strict KYC and anti-money laundering rules mandate identity verification, ruling out anonymous transfers. As a security-focused user, you need a low-cost, compliant platform to streamline cross-border payments.

BiyaPay offers an efficient solution, with real-time exchange rate queries to track CNY-to-EUR rates (around 0.126 now) and convert fiat to crypto, dodging volatility losses. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock secure cross-border finance. From tuition to living expenses, it cuts costs and boosts efficiency. Don’t let fees and compliance hurdles disrupt your support—join BiyaPay today for a seamless remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.