- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Deutsche Bank Account Opening Process: Required Documents, Fees, and Important Considerations

Image Source: pexels

When opening an account with Deutsche Bank, you need to prepare the following documents and follow these steps:

- Valid passport or EU ID card (original and copy)

- Proof of address within the last three months (utility bill, bank statement, or lease agreement)

- Proof of funds (e.g., a deposit certificate from a bank in mainland China, recommended amount of 10536 USD)

- Completed and signed account opening form and registration card

After submitting these materials according to the account opening process, the bank will verify your identity. You can choose to complete the process online or offline. Ensure you check the required documents in advance to avoid delays due to incomplete materials.

Key Points

- Before opening an account, prepare a valid passport, proof of address, and proof of funds to ensure all materials are complete and avoid delays.

- Opting for online account opening can save time; follow the steps to fill in information accurately.

- Offline account opening is suitable for users needing personalized services; booking an appointment in advance is recommended to avoid waiting.

- Understand the features of different account types and choose one that suits your needs, such as a current account or savings account.

- Pay attention to account opening fees and annual fees to select an account type wisely and avoid unnecessary expenses.

Required Documents

Image Source: pexels

Identification Documents

When opening an account with Deutsche Bank, you first need to prepare valid identification documents. The bank typically accepts the following documents:

- Valid passport

- EU or EEA national ID card

- Non-EU/EEA nationals must also provide a valid visa or German residence permit

If you choose online account opening, the bank will require you to complete identity verification through remote methods like PostIdent or VideoIdent. You need to ensure all documents are originals and prepare copies for submission.

Tip: The passport and residence permit must be valid beyond the account application date, or the bank may reject your application.

Proof of Address

Deutsche Bank requires you to provide proof of your current residential address. Common proof of address includes:

- Telephone bill from the last three months

- Electricity bill from the last three months

- Bank statement

- Lease agreement

- Driver’s license (if it includes address information)

If you cannot provide the above documents, a passport copy may serve as a supplementary proof in some cases, but the bank prefers bills or contracts with address details. You need to ensure the address information is clear and matches the details provided in the account opening form.

Proof of Funds

You also need to prove your financial capability to the bank. Deutsche Bank typically requires a deposit certificate issued by a bank in China/mainland China, with a recommended amount of 10536 USD or equivalent in foreign currency. The proof of funds must display your name, account details, deposit amount, and bear the bank’s official seal.

Note: Some account types have higher requirements for proof of funds. You should confirm the specific amount with the bank in advance to avoid delays due to insufficient funds.

Account Opening Form and Registration Card

You need to fully complete the account opening form and registration card provided by Deutsche Bank. The form typically includes personal information, contact details, and employment status. You must sign the form personally to ensure all information is accurate and truthful.

- The account opening form must be printed and signed

- The registration card must be submitted along with other documents

The bank will review the materials you submit. The application will only be processed once all materials are complete.

Recommendation: Download and complete the account opening form and registration card in advance, verifying all information to avoid rejections due to errors or omissions.

Account Opening Process

Image Source: pexels

The account opening process at Deutsche Bank offers both online and offline options. You can choose the method that suits your situation. Regardless of the method, identity verification and bank card issuance are required. Below is a detailed explanation of each step.

Online Account Opening Process

You can complete the account opening process through Deutsche Bank’s official website or mobile app. The process is generally free, with the following steps:

- Select your gender (Frau – female or Herr – male)

- Enter academic titles (optional)

- Provide your first name and surname

- If applicable, include your maiden name

- Select marital status

- Enter your date of birth (format: DD.MM.YYYY)

- Provide your place of birth

- Select your nationality

- If applying for “Das Junge Konto,” specify the year and quarter of education completion

- Indicate whether you have ties to the United States

- Select your tax residency country

- Provide your detailed address, including street, house number, postal code, and city

- If you want documents and the bank card sent to a different address, check the relevant option

- Enter your mobile number and email address

In the legal declaration section, you need to:

- Agree that you have read the deposit protection information

- Confirm you are opening the account for yourself

- Download contract details and fee overview

- Consent to the bank checking your credit history

- Agree to deposit fees (for amounts exceeding 50,000 USD)

Finally, you can review the account summary and set an online banking PIN. After completing the process, the system will prompt you to verify your identity.

Tip: The online account opening process is straightforward and ideal for users looking to save time. Ensure you have all materials ready and follow the steps to complete the process smoothly.

Offline Account Opening Process

If you prefer face-to-face service, you can opt for the offline account opening process. You need to visit any Deutsche Bank branch and follow these steps:

- Bring all required documents, including a valid passport, proof of address, proof of funds, and completed account opening form and registration card

- Submit the documents at the counter, where bank staff will assist you in filling out forms

- Complete identity verification on-site, with the bank checking your original documents

- Once all procedures are completed, the bank will open your account

The offline process is suitable for users needing personalized consultation or with specific requirements. You can discuss account types and service details with bank staff on-site.

Recommendation: Book an appointment for branch account opening in advance to avoid waiting. You can also inquire about account management and fees during the visit.

Identity Verification

Identity verification is a mandatory step, whether opening an account online or offline. Deutsche Bank offers two primary verification methods: video identification and postal identification. You need to choose the appropriate method based on your situation.

| Required Documents | Description |

|---|---|

| Completed account opening application form | Form required to apply for an account |

| Valid passport | Black-and-white copy including the signature page |

| University/language school admission letter | Supplementary document to prove financial capability |

During video identification, you need to present your documents via a webcam for remote verification by staff. For postal identification, you must mail the documents to the designated address and await bank review.

Note: The identity verification process must be completed by you personally, ensuring all materials are authentic and valid. The bank will strictly verify documents and information to ensure account security.

Bank Card Issuance

After completing the account opening and identity verification, the bank will issue a bank card for you. You can choose one of the following methods to receive your card:

- Mail delivery: The bank will send the card and account details to your specified address. You need to activate the card upon receipt to use it.

- In-person pickup: Some branches allow you to collect the card on-site. You can pick it up on the day of opening or at a designated time.

After receiving the card, you should securely store the card and account details. For first-time use, follow the bank’s instructions to set a password and activate the account.

Reminder: If the bank card is not delivered on time or activation fails, contact bank customer service promptly to avoid issues with account usage.

Account Types

Current Account

You can choose to open a current account with Deutsche Bank. Current accounts are primarily used for daily transactions. You can use them to receive salaries, pay bills, and make routine purchases. Most users treat current accounts as their primary financial account. You can manage the account via online banking, mobile banking, or at a branch. Current accounts typically come with a debit card, enabling global withdrawals and payments.

Tip: If you are new to Germany for study or work, a current account is essential for setting up mobile contracts, renting apartments, and paying tuition.

Savings Account

Savings accounts are suitable for managing funds and wealth accumulation. You can choose a flexible savings account for easy access or a fixed-term deposit account. Fixed-term accounts typically offer higher interest rates. You can deposit unused funds into a savings account to earn interest. Savings accounts are not recommended for frequent payments or receipts. You can check account balances and interest changes via online banking at any time.

- Savings accounts help you build wealth management habits.

- Fixed-term deposit accounts are suitable for long-term financial planning.

International Account

If you frequently handle multiple currencies, an international account may be more suitable. International accounts support multi-currency operations, facilitating cross-border transfers and receipts. You can benefit from flexible foreign exchange services and tax advantages. International accounts are ideal for students, cross-border workers, or users with international business needs.

When applying for an international account, you need to meet certain conditions. The table below summarizes the main requirements:

| Requirement | Description |

|---|---|

| Identification | You need to provide an ID or passport |

| Proof of Address | If necessary, submit documents for your current address |

| Proof of Income | Required for credit card or overdraft accounts, such as payslips |

Note: The account opening process and documents for international accounts differ slightly from standard accounts. Consult the bank in advance and prepare all materials to ensure a smooth process.

- Current accounts are suitable for daily transactions.

- Savings accounts are ideal for saving and wealth management.

- International accounts suit users with cross-border financial needs.

Account Opening Requirements

Age Requirements

When opening an account with Deutsche Bank, you need to meet the minimum age requirements for different account types. Most accounts require you to be at least 18 years old, but some allow minors to open accounts with parental consent. The table below summarizes the minimum age requirements for key account types:

| Account Type | Minimum Age | Notes |

|---|---|---|

| Debit Card | 12 | No credit check required |

| Credit Card | 18 | Requires credit eligibility |

| Basic Account | 7 | Requires parental or guardian consent |

If you are under 18, you can apply for a basic account with a parent or guardian. Once you reach 18, you can independently apply for credit cards and other account types. The bank will recommend suitable account types based on your age and needs.

Tip: When applying for a debit card, the bank does not assess your credit status. For credit cards, the bank evaluates your credit eligibility.

Identity Requirements

Whether you are a student or a professional, you can open an account with Deutsche Bank. You need to prepare relevant proof documents based on your status. The table below lists the main documents required for common identities:

| Document Type | Description |

|---|---|

| Passport or National ID | Required for EU citizens |

| Residence Permit | Required unless you are an EU citizen |

| Registration Certificate | Required as proof of address |

| Student Registration | Required for student account applications |

As a student, you need to provide proof of student registration and a valid passport. As a professional, you need a passport, residence permit, and proof of address registration. The bank will review materials based on your status. Preparing all documents in advance ensures a smoother process.

Recommendation: When preparing documents, ensure all information is authentic and valid to avoid rejection by the bank due to incomplete materials.

Fees

Account Opening Fees

When opening an account with Deutsche Bank, online account opening is typically free. Offline account opening may incur a fee. Generally, the basic account opening fee is 1.5‰ of the account balance, with a minimum of approximately 10-13 USD. If you choose premium accounts or value-added services, the bank may charge additional fees. You can inquire about specific fee standards before submitting materials to avoid unnecessary expenses.

Reminder: Online account opening is more cost-effective for those looking to save money. Offline opening suits users needing personalized services.

Annual Fees

Deutsche Bank imposes annual fees and maintenance requirements for different account types. If you fail to meet the minimum balance requirements, the bank will charge maintenance fees proportionally. The table below shows annual fee details for common account types:

| Account Type | Maintenance Requirement | Fee Description |

|---|---|---|

| AUM | $150,000 | $1,200 if not met, calculated proportionally to shortfall |

| AQB | $75,000 | $1,200 if not met, calculated proportionally to shortfall |

You can choose an account type based on your financial situation. Maintaining a balance above the requirement helps avoid additional annual fees.

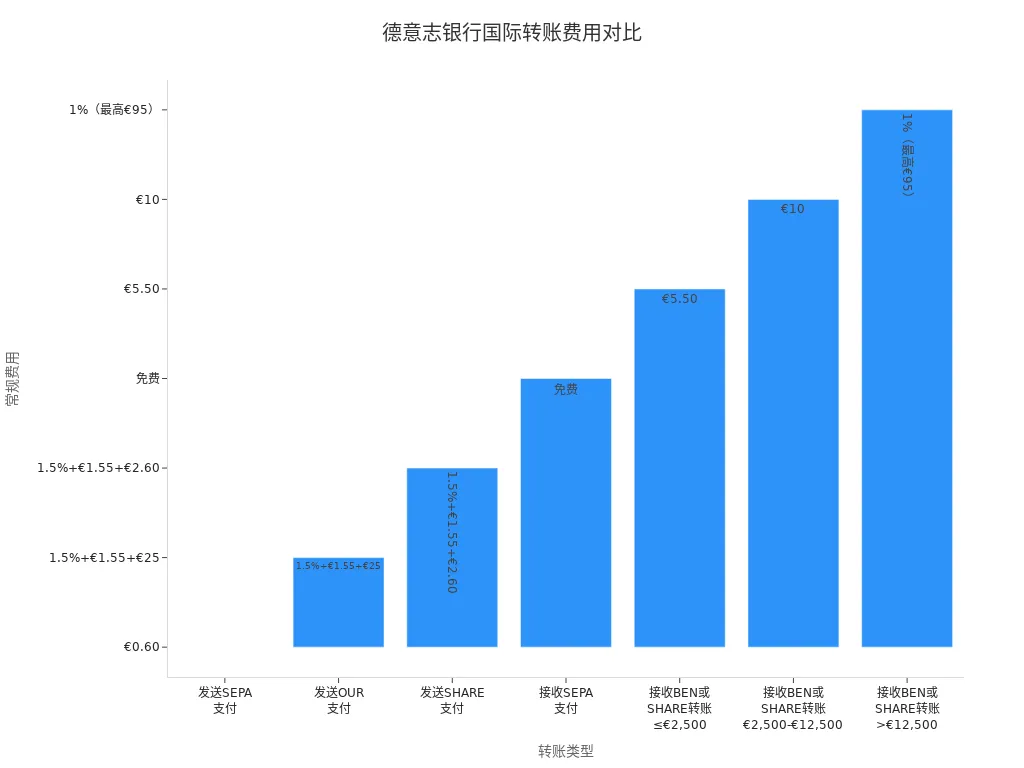

Transfer Fees

When making transfers with Deutsche Bank, fees vary based on the transfer type and amount. Sending SEPA payments (euro transfers within the EEA) costs $0.60. For OUR payments (paperless), the bank charges 1.5% of the total amount plus a $1.55 SWIFT fee and a $25 fixed fee. For SHARE payments, the fee is 1.5% of the total amount plus a $1.55 SWIFT fee and a $2.60 mailing fee. Receiving SEPA payments is free. For receiving BEN or SHARE transfers, fees are $5.50 for amounts up to $2,500, $10 for amounts between $2,500 and $12,500, and 1% of the total amount for amounts exceeding $12,500, capped at $95.

For cross-border transfers, you should review the fee structure in advance to plan fund flows effectively.

SWIFT and Correspondent Bank Fees

When making international remittances, Deutsche Bank charges SWIFT fees and correspondent bank fees. The SWIFT fee is $1.55, and the correspondent bank fee is $25. For OUR payment methods, all fees are borne by the sender. For SHARE or BEN payment methods, some fees are borne by the recipient. You can choose the most suitable payment method based on your needs to ensure funds arrive securely and on time.

Recommendation: For large international remittances, calculate all related fees in advance to avoid impacting the received amount due to fees.

Account Management

Account Unfreezing Process

If you find your account frozen, you should first identify the reason. Common reasons include suspected fraudulent activity by the bank, unpaid debts, unpaid taxes, or government-ordered freezes. You can attempt to unfreeze the account with these steps:

- Contact bank customer service to understand the specific reason for the freeze.

- If due to unpaid debts or taxes, settle the outstanding amounts promptly.

- If the bank suspects suspicious activity, cooperate with the bank’s investigation.

- Provide any additional documents or proof of funds as required by the bank.

Tip: The bank will only unfreeze the account after resolving the issue causing the freeze. You should actively cooperate with the bank and ensure all information is authentic and valid.

Account Closure Process

If you no longer need your Deutsche Bank account, you can follow these steps to close it:

- Log into online banking or visit a branch, fill out and submit the account closure form.

- Prepare valid photo ID (e.g., passport or driver’s license) and proof of address (utility bill or bank statement).

- Clear all outstanding debts and cancel all recurring payment instructions.

- Withdraw or transfer the account balance, confirming the destination for the transfer.

- Await bank confirmation of the account closure date.

You can also request assistance via email or secure chat channels. The bank will complete the closure after verifying the materials.

Balance Transfer

Before closing the account, you need to transfer all remaining balance. You can choose these methods:

- Transfer the balance to a designated account via online banking.

- Visit a branch to withdraw or transfer the balance in person.

Note: Verify the recipient account details in advance to ensure funds are transferred safely. After the balance is transferred, the bank will officially close your account.

Precautions

Common Issues

When opening an account with Deutsche Bank, you may encounter practical challenges. Understanding these issues helps you prepare in advance and avoid unnecessary trouble.

- Bureaucratic obstacles: The bank has strict requirements for processes and documents; any errors may lead to application rejection.

- Language barriers: If you are not fluent in German, communication may be challenging. Prepare English or Chinese translated documents in advance.

- Specific document requirements: The bank typically requires proof of address and a German tax number. In some cases, an official registration certificate (e.g., Meldebescheinigung), visa, or residence permit is also needed.

- Incomplete materials: If you fail to provide all required documents, the bank will reject your application.

Tip: Each time you change your address, you must resubmit local registration proof. The bank requires up-to-date residential information.

Practical Recommendations

You can improve account opening efficiency and avoid delays due to document or process issues with these methods:

- Choose a bank: Select a German local bank or a major international bank branch based on services and maintenance fees.

- Prepare documents: Gather identification (e.g., passport or national ID), proof of address (e.g., Meldebescheinigung), visa, or residence permit in advance. Some banks also require proof of income, especially for accounts with credit facilities.

- Complete the application: Carefully fill out the bank’s forms, ensuring all information is accurate and submitted with other materials.

- Initial deposit: For business accounts, the bank may require an initial deposit.

- Provide accurate data: When filling out the application, ensure all information is truthful and complete.

- Monitor fees: Understand account opening, annual, and transfer fees in advance to choose an account type wisely and avoid unnecessary costs.

Recommendation: Before visiting the bank, organize all materials and verify every detail. This significantly increases the success rate and saves time and effort.

When opening an account with Deutsche Bank, you can follow these key steps:

- Prepare all necessary documents, including a passport, proof of residence, Schufa credit score, proof of employment or study, and tax number.

- Choose a suitable bank and account type, such as BestKonto, AktivKonto, or the student account Das Junge Konto.

- Visit a bank branch or the official website to start the account opening process.

- Complete the application form, ensuring all information is accurate.

- Complete identity verification, with the bank reviewing your materials.

- Await account approval, after which you can start using the account.

By preparing materials in advance and paying attention to fees and account management details, you can effectively increase the success rate. If you encounter common issues, communicate with the bank promptly to ensure a smooth process.

FAQ

How long does it take to open an account?

You can typically complete the account opening in 1-3 business days. Online opening is faster, while offline may take longer. Complete materials expedite the review process.

Can I open an account without an address in China/mainland China?

You can open an account using proof of address in Germany. The bank requires valid proof of residence, such as a lease agreement or utility bill.

What account types can students apply for?

You can apply for student-specific accounts or regular current accounts. Student accounts are typically free of annual fees, suitable for use during studies.

How long does it take to receive the bank card after opening an account?

You generally receive the bank card within 5-10 business days. The bank will mail the card to the address you provided.

What should I do if my account is frozen?

You need to contact bank customer service to understand the reason for the freeze. After providing required materials or resolving the issue, the bank will assist in unfreezing the account.

Opening a Deutsche Bank account requires a valid passport, proof of address (recent 3-month bills), and funds proof (recommended 10536 USD deposit certificate), with online opening free but needing video/postal verification, approval in 14-25 days. Monthly fees like AktivKonto 6.90 euros, transfer fees such as SEPA 0.60 USD, international OUR 1.5%+25 USD fixed. As an efficiency-focused user, you need a transparent, low-cost platform to streamline fund management.

BiyaPay offers an effective solution, with real-time exchange rate queries to track EUR-to-USD rates and convert fiat to crypto, mitigating volatility risks. Transfer fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, smartly managing account funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From personal to business accounts, it cuts costs and boosts convenience. Don’t let high fees and complex verification stall your German banking journey—join BiyaPay today for smarter account management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.