- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Google 2025: AI, Quantum Computing, and Autonomous Driving Trio, Can They Continue to Lead in the Future?

Google has always been a leader in the technology industry, but its potential in the AI field has often been overlooked in recent years, especially when facing competition from OpenAI and Microsoft. With the arrival of 2025, Google has quickly consolidated its position in the AI field through new technologies such as Gemini 2.0, and has begun to vigorously layout future technologies such as Quantum Computing and autonomous driving.

Although the Anti-Trust case and Apple’s concerns have put pressure on Google, in the long run, Google’s investments in multiple cutting-edge fields make it a giant that investors cannot ignore. Next, let’s take a look at Google’s future potential and why it is still a worthy investment choice.

Leadership in AI: The Victory of Gemini 2.0

Google has always been synonymous with search engines, but in recent years, its progress in the field of AI has often been overshadowed by other technology companies. The collaboration between Microsoft and OpenAI, especially Microsoft’s breakthrough in generative AI, once made Google seem a bit “slow”. But with the release of Gemini 2.0, Google has basically allayed these concerns.

Gemini 2.0 is not a simple AI product, but a major upgrade for Google in the field of AI. It can not only process text, but also combine images and videos for more complex reasoning and problem solving. This MultiModal Machine Learning processing capability has enabled Google to stand firm in the competition of AI. Especially in the search engine business, the powerful functions of Gemini 2.0 have helped Google further enhance the intelligence level of search, thus ensuring its leadership position in the global market.

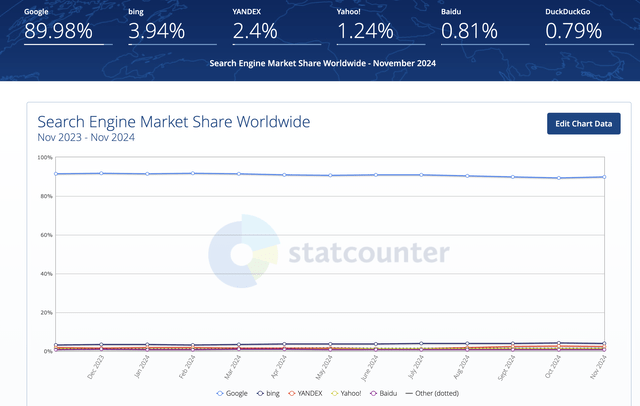

Speaking of market share, Google is still the absolute king of the search engine market. Despite the gradual introduction of AI elements into Microsoft’s Bing search in recent years, Google’s market share remains stable at around 90%, far ahead of Bing’s 3.9%. Even in the face of joint

pressure from OpenAI and Microsoft, Google’s 90% market share in the search field is still unshakable, which has gradually eliminated concerns about Google losing market share.

What’s more noteworthy is that Google’s progress in the AI field has helped it maintain its “voice over” over Apple. Apple receives more than $20 billion in “search engine licensing fees” from Google every year, which is a huge source of income for Apple. However, in the AI field, the benefits of generative AI are not as considerable as those of search engines. Therefore, Google’s AI breakthrough not only stabilizes its foothold in search, but also reduces its dependence on Apple’s cooperation. In other words, Google’s leadership in the AI field means that it does not have to continue to pay huge licensing fees to Apple in the future.

Anti-Trust Risk: Concerns from the US Government to Apple

Although Google’s solid position in AI and search has made it the focus of the market, it does not mean that its future is completely risk-free. In recent years, Google has faced Anti-Trust investigations from the US government, which may change its dominant position in the internet search market. In fact, the Anti-Trust case is becoming an important challenge that Google has to face, especially as the US Department of Justice reviews Google’s dominant position in search engines.

However, although there have been concerns about Google’s possible Anti-Trust split, Google’s AI technology and other businesses are helping it cope with these pressures. For example, the release of Gemini 2.0 not only maintains Google’s advantage in the search field, but also strengthens its overall layout in AI technology, further promoting Google’s innovation and development. This technological advancement gives us reason to believe that even in the face of Anti-Trust scrutiny, Google can remain competitive through its other businesses.

In addition, the relationship between Google and Apple is becoming increasingly complex. Apple receives more than $20 billion in “search engine licensing fees” from Google every year, which Google pays to ensure that its search engine appears as a default option on iPhone and Mac devices. However, with the development of AI, generative AI is not as profitable as traditional search, so Google’s breakthrough in this area may also make it no longer rely on this huge licensing fee.

Apple expressed concern about Google’s Anti-Trust case because if Google is forced to change its business model, it may affect this revenue. Therefore, Apple’s anxiety reflects Google’s importance in the market and shows us that Google’s technological advantage is not only reflected in its innovation, but also in its complex game with other tech giants.

Diversified Business: The Rise of YouTube and Google Cloud

Google not only relies on search engines and AI technology, but its layout in multiple fields is bringing more growth momentum to the company. In addition to AI, YouTube and Google Cloud are one of Google’s most important sources of revenue, especially in the past few years, their proportion in Google’s overall revenue has gradually increased. Let’s start with these two businesses, whose impact on Google’s future far exceeds ordinary people’s expectations.

YouTube: A Powerful Engine for Advertising Revenue

As the world’s largest video platform, YouTube not only attracts a large number of users, but also brings considerable advertising revenue to Google. In 2024, YouTube’s advertising revenue still accounts for a large part of Google’s total revenue. Despite facing competition from Short Video Platforms such as TikTok, YouTube still firmly holds the top spot in the global video advertising market with its huge user base and strong content ecosystem.

It is worth noting that YouTube is gradually increasing its cooperation with creators, optimizing content recommendation algorithms, and improving User Experience, all of which provide a solid foundation for its long-term growth. With the continuous expansion of the video advertising market, YouTube is expected to continue to be an important engine for Google’s growth.

Google Cloud: Huge growth potential

In addition to advertising revenue, Google Cloud is another growth area worth paying attention to. As one of the leaders in the Cloud Service market, Google Cloud has achieved rapid growth in the past few years and is expected to continue expanding its market share. Competing with Microsoft’s Azure and Amazon’s AWS, Google Cloud is gradually winning more and more large enterprise customers with its powerful data processing capabilities and AI technology.

In 2025, Google Cloud is expected to become an important part of Google’s revenue, especially in enterprise-level AI and data services. The potential of Google Cloud will be further unleashed. For investors, the growth of Google Cloud will greatly enhance Google’s long-term investment value.

Quantum Computing and Autonomous Driving: Future Possibilities

Google not only performs well in the Prior Art field, but its future layout is also exciting. Quantum Computing and autonomous driving are two fields that may greatly change the technology landscape in the next few years, and Google has been actively laying out in these two directions.

Quantum Computing Breakthrough: Release of Willow Quantum Chip

In recent years, Google has made a series of breakthroughs in the field of Quantum Computing, especially the Willow quantum chip released in 2024, which marks Google’s leading position in Quantum Computing technology. As an emerging computing method, Quantum Computing is expected to show great potential in solving tasks that traditional computers cannot efficiently complete, such as drug discovery, materials science, climate change prediction, and other fields.

Although the monetization process of Quantum Computing may take several years, Google has demonstrated its technological advantages to the market through the Willow chip, attracting investors’ attention. If Google can continue to innovate in the field of Quantum Computing and realize its practical application as soon as possible, it will greatly promote Google’s technological boundaries and market share, and is also expected to become an important driving force for future growth.

Strategic layout of autonomous driving: Waymo plans to expand in Miami

Google’s autonomous driving technology is also worth paying attention to. Its Waymo project has taken the lead in the field of autonomous driving and plans to enter the Miami market in 2025, becoming the sixth city to launch autonomous driving operations. Waymo’s progress is ahead of many peers, especially in the safety and technological maturity of autonomous cars, where Google’s advantages are very obvious.

Autonomous driving is not only a technological innovation, but also a potential huge market. With the change of global transportation demand, autonomous driving is expected to disrupt the traditional automobile industry in the next few years. Google’s layout in the field of autonomous driving through Waymo not only takes the lead in the market, but also may bring new sources of revenue. Investors can foresee that Waymo’s expansion will provide Google with sustained growth momentum, pushing Google towards new business models and markets.

Stock price and valuation: Is Google stock undervalued?

When it comes to Google’s investment value, we have to mention its current stock price and valuation. Although Google’s stock price has approached historical highs in the past few years, around $200, it still has the possibility of being undervalued in terms of its future potential.

Google’s current valuation: 18 times adjusted earnings per share (EPS) target

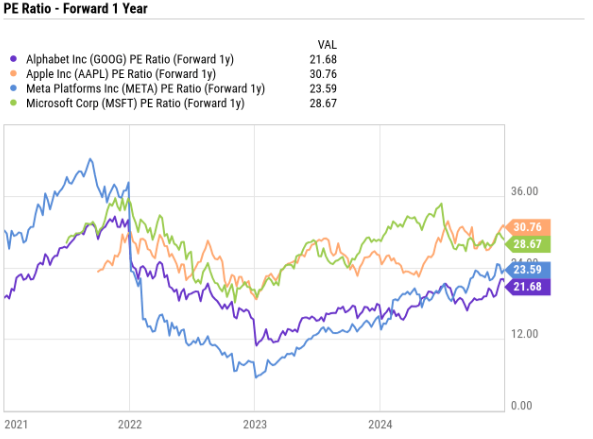

According to the latest financial report and analyst forecasts, Google’s adjusted earnings per share (EPS) target for 2025 is close to $9, and after deducting stock incentive expenses, non-GAAP EPS can even reach $11. Google’s current Price-To-Earnings Ratio (PE) is about 18 times, which is relatively low compared to other giants in the technology industry.

Compared with peers: Google’s valuation is more attractive

If we compare Google with other tech giants, especially Apple and Microsoft, its valuation appears particularly attractive. Apple and Microsoft’s Price-To-Earnings Ratio are around 30 times, while Google’s earnings per share target is less than 22 times, which means its stock price may not fully reflect the company’s future growth potential in multiple fields such as AI, Cloud Services, and Quantum Computing.

More importantly, Google’s current Price-To-Earnings Ratio is lower than many peers, indicating that the market has not fully digested Google’s future potential, especially considering Google’s leading position in multiple cutting-edge technology fields. This valuation gap provides investors with an opportunity to enter the market and may also mean that Google’s stock price has room to rise.

If you want to seize this rising space to invest in Google, BiyaPay’s multi-asset wallet provides you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account, making it convenient to invest in AMD. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Why is Google still worth investing in?

When evaluating Google’s investment value, we cannot ignore the multiple growth areas it is currently in. From AI to Quantum Computing, to autonomous driving, Google not only relies on a single technology or market, but has built a solid growth framework through diversified business layout. Despite facing the risk of Anti-Trust cases, Google still has strong technological innovation capabilities and diversified sources of income, making it a tech giant worth investing in.

Google’s layout in multiple future technology fields has given it strong growth momentum. The leading position of AI, the breakthrough progress of Quantum Computing, and the strategic expansion of autonomous driving will all drive up Google’s stock price. In 2025, as these technologies gradually mature, Google is expected to continue to attract investors’ attention and further consolidate its market position.

Although the Anti-Trust case may bring some short-term uncertainty to Google, the company has diversified its risks to multiple growth points through a diversified strategy. From Cloud Services to Quantum Computing, to autonomous driving, Google’s technological reserves and market layout enable it to cope with external pressures and continue to create value.

Overall, Google remains a leader in technology stocks with its layout in multiple fields such as AI, Quantum Computing, and autonomous driving. Despite facing challenges from the Anti-Trust case, its diversified business and strong growth potential make Google a worthwhile long-term investment choice.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.