- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Low P/E Ratio and High Returns: Missed Nvidia? Don’t Miss Out on AMD's Rebound Opportunity!

Not long ago, investing in semiconductor and AI stocks felt like a price competition. I remember mid-last year when Nvidia’s P/E ratio soared to 70 times, almost looking like a bubble stock. Meanwhile, AMD’s P/E ratio wasn’t far behind, surpassing 40 times; ASML was hovering around 35 times, and after a while, it broke through 45 times.

Wow, these companies had sky-high valuations! But don’t worry, the situation has improved—whether it’s strong fundamentals driving growth or stock prices finally returning to rational levels.

Now, Nvidia’s P/E ratio has dropped to 35 times, and ASML is staying below 30 times. The cheapest of them all is TSMC, with a P/E ratio under 20 times—basically a stock clearance sale! At present, SA is most optimistic about AMD, even though its P/E ratio is 27.7 times, it still seems to have plenty of “surprises” waiting to explode.

However, while AMD’s outlook seems promising, don’t forget there are some small factors that might affect your investment decisions. For example, Nvidia’s dominance in the GPU space is pretty secure, and it might continue to lead this market. Also, remember, the semiconductor industry is no smooth ride—it has its own cyclical fluctuations, and no one can guarantee profitability every quarter!

AMD’s “Shining Moment” in Data Centers

Speaking of data centers, GPUs, AI, and the entire semiconductor market, you’ll notice a trend that’s been apparent for years—the “golden track” we’re seeing now was predicted several years ago.

According to a report from Grand View Research, with the surge in AI workloads, cloud computing, cloud gaming, VR, and other technologies, the global data center GPU market is expected to see a huge explosion, with an annual growth rate reaching 28.5% by 2030! For the global AI chip market, the annual growth rate is also a stunning 28.9%, with revenues likely to surpass $320 billion!

In other words, the “big cake” of GPUs isn’t just for AI and data centers, it also covers gaming, video editing, and other tasks, with unlimited growth potential!

In its latest earnings report, AMD subtly revealed how it plans to capture these opportunities. Although gaming and embedded sectors have been impacted—due to reduced inventories at Sony and Microsoft, and product upgrades affecting revenues—AMD’s performance in the data center market has been impressive! Year-over-year growth reached 122%, and sequential growth surged by 25%!

Simply put, the data center “big cake” has helped AMD recover losses from other departments. While gaming and embedded performance may still influence market sentiment, overall, AMD remains strong.

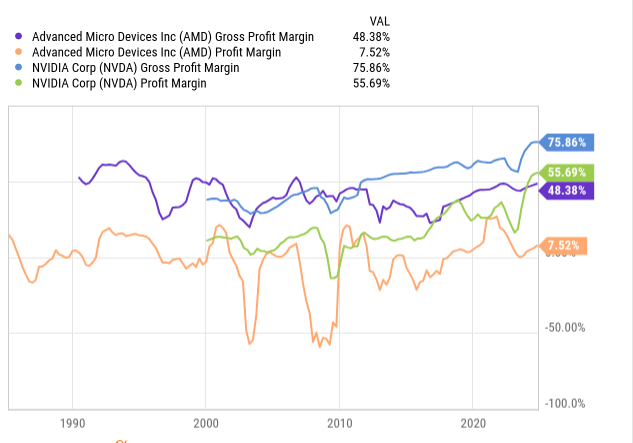

In addition to revenue growth, AMD has also shown a steady rise in its gross margin, now reaching 53.6%! This means AMD is successfully improving its profitability. As the data center market continues to boom, AMD expects its gross margin to keep rising, with a target of 54% in Q4.

Now, if you think AMD is just a money-making machine, you might have forgotten about “superstar” Nvidia. In the past 12 months, Nvidia’s gross margin approached 76%, a number that not only reflects its mature market position but also indicates that demand for its products is through the roof.

But Nvidia’s high margin is due to its massive investments and cyclical market demand—it’s in a “supercharged state.”

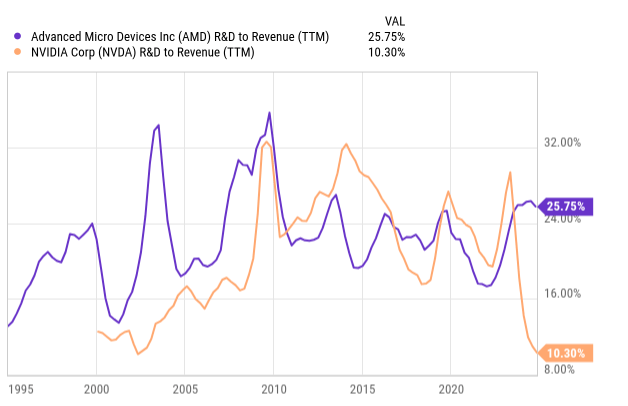

Compared to Nvidia, AMD’s gross margin is naturally a bit lower. However, it recently reported an 11% GAAP profit margin and 22% non-GAAP margin. Simply put, AMD’s profit margin is relatively lower because its products aren’t as mature as Nvidia’s, and its R&D investment is still quite high.

In the long run, AMD is likely to see more stable revenue growth. Revenue is expected to continue increasing, and gross margin will further improve. But since capital expenditures from big companies will normalize, the explosive growth in gross margin will face bottlenecks. More likely, AMD will gradually increase its net profit margin through efficiency improvements, optimized R&D investments, and cutting unnecessary expenses.

Overall, AMD’s future outlook can be described as “steady progress toward victory”! Hopefully, it will successfully capture the data center and AI “future engines” and continue to deliver more surprises for investors in the semiconductor sector.

“Bottom Exploration” in a Bear Market—Can a Rebound Be Expected This Time?

Let’s first look at AMD’s stock price trend—since the beginning of this year, the stock has experienced dramatic ups and downs. From a high of $230, it fell to around $116, a decline of over 50%. It seemed like a stock market earthquake, especially when we saw the price “heavily pressured” from $55–60 and even briefly breaking the “bear market bottom,” leaving many investors nervous.

But don’t rush—this adjustment could actually be a “golden opportunity.” From a technical analysis perspective, AMD’s stock price has recently hit a key point. We can see that AMD has finished the “fifth wave” of adjustment from the March high to the recent bottom, and many technical indicators show that AMD is now in an oversold condition, indicating it may be close to the bottom: RSI (Relative Strength Index) has dropped below 30, and CCI (Commodity Channel Index) has fallen to -300, marking a new low in over five years.

From these technical signals, it looks like AMD has hit bottom. And don’t forget, the price is already quite “tempting.” Combined with these strong technical signals, AMD is likely to begin a rebound and enter a new upward trend.

At such a market moment, it’s crucial to seize opportunities quickly and keep the cash flow moving. The BiyaPay multi-asset wallet is undoubtedly your ideal choice. It supports US stocks, Hong Kong stocks, and cryptocurrency transactions and can help you easily execute rapid fund inflows and outflows. Whether you want to convert cryptocurrency into USD or HKD or withdraw funds to your personal bank account, BiyaPay ensures fast and secure operations.

Moreover, BiyaPay’s transfers have no limits, and funds arrive very quickly. This means you can adjust your strategy at any time during rapid market fluctuations, seizing every investment opportunity.

AMD’s Upside Potential and High Safety Margin?

You might remember that AMD’s P/E ratio is lower than Nvidia’s, but this doesn’t mean AMD’s outlook is bleak. In fact, Nvidia deserves its premium—after all, it has created amazing returns for its shareholders and has a “monster” market cap. But AMD? It hasn’t fully tapped into its potential, and the future holds much promise. While AMD’s valuation isn’t as high as Nvidia’s, its upside potential is far from negligible.

Let’s start with financial numbers. If you believe Nvidia’s revenue grows 10% annually, its net income will likely grow by around 10% as well. Why? Because its profit margin is already near its peak, and there’s limited growth potential, possibly already close to the “ceiling.”

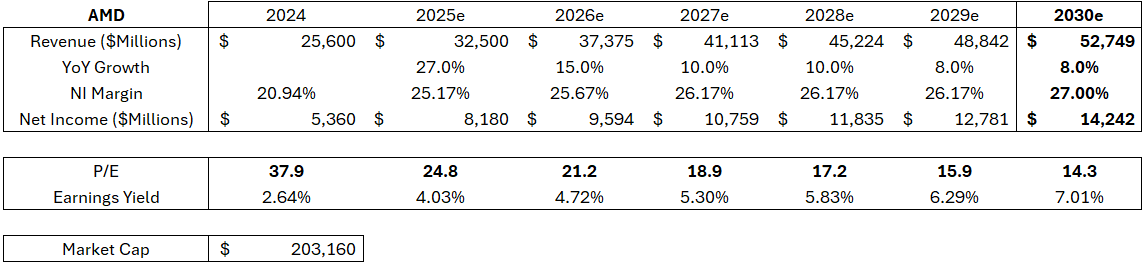

But if AMD’s revenue grows “only” 10% by 2025, assuming it maintains about 25% net income margin, its net income growth could reach 31.5%! This is still far below market expectations. You heard it right—market expectations for AMD’s 2025 revenue growth are about 27%, with net income growth possibly exceeding 50%. If these numbers come true, AMD’s P/E ratio could drop to around 25 times, which would still be considered “cheap.”

Looking further ahead, assuming AMD’s growth rate slows down year by year, by 2027 or 2026, its P/E ratio might fall below 20 times (of course, assuming a somewhat optimistic outlook). This would mean that in a few years, AMD’s annual return could approach 5%! And there could still be more investment potential to dig into.

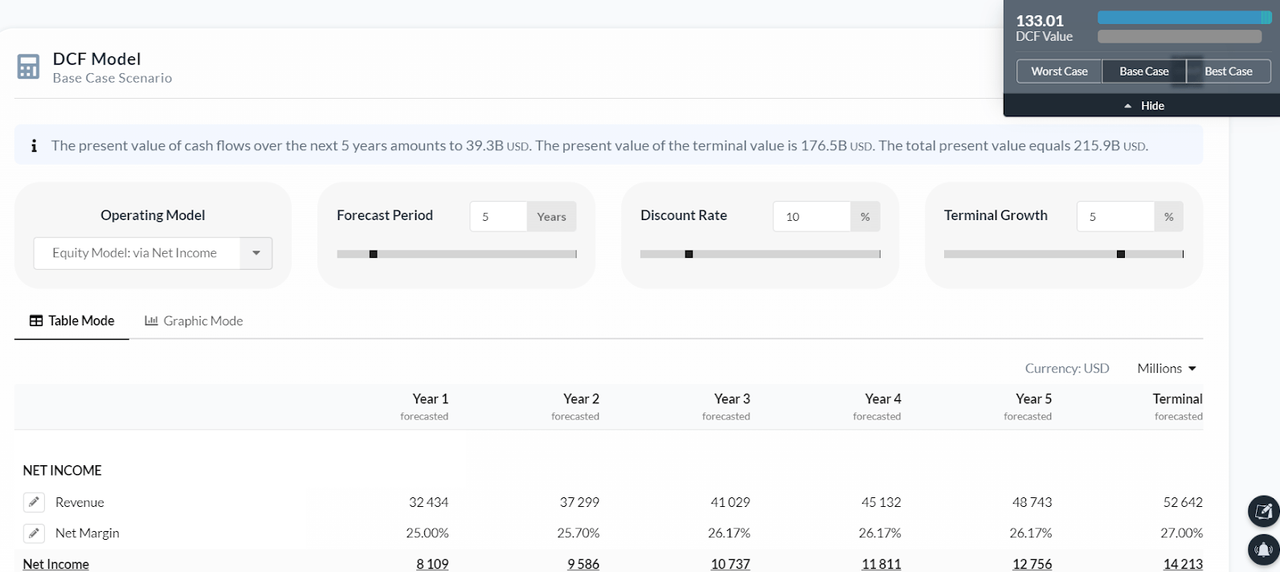

For investors, AMD’s outlook is far from “dead in the water”; on the contrary, it looks like a tree that’s continuously growing. While it hasn’t reached the towering heights of Nvidia, it has strong vitality. Additionally, AMD’s fair value appears to be quite solid—using the equity model assumptions, we find that AMD’s fair value is around $133. This price may not be a skyrocketing surge, but it carries a high “safety margin,” with very attractive annual returns.

AMD’s Investment Risks

Of course, there’s no such thing as absolute safety in the market. After all, all predictions carry some uncertainty. While AMD’s revenue growth has potential and net income margins are improving, in certain scenarios, such as a sudden reduction in capital expenditures by large tech companies or AMD needing to invest heavily in R&D to maintain market share, these negative factors could put pressure on margins and affect net income.

For investors, it’s important to remind ourselves that we are currently in a “golden period” in a cyclical market, and eventually, there will be a “dark period.” In other words, while AMD’s performance is solid now, in the future, it still has to face strong competitors like Nvidia, especially in the GPU market, where Nvidia is gaining more and more partners and scale advantages. This may affect AMD’s competitiveness.

Even so, AMD’s upside potential remains exciting. Even if we assume a bear market, AMD’s P/E ratio may not reach 27%, but if the market rebounds in a bull phase, AMD’s maturity will also increase, and a 30% profit margin will no longer be “out of reach” but an expected goal. By then, we might see its stock price experiencing a real “explosive moment.”

Overall, despite challenges ahead, AMD’s development and progress in both the AI and data center markets are impressive. The future of AMD holds great potential, and it’s worth watching closely. Whether the rebound comes in 2025 or 2026, it’s possible to see incredible returns on investments. Therefore, stay alert, seize opportunities, and have your strategy in place for a rewarding investment journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.