- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send Money to Family in Germany? Master These Key Points for Easy Global Transfers

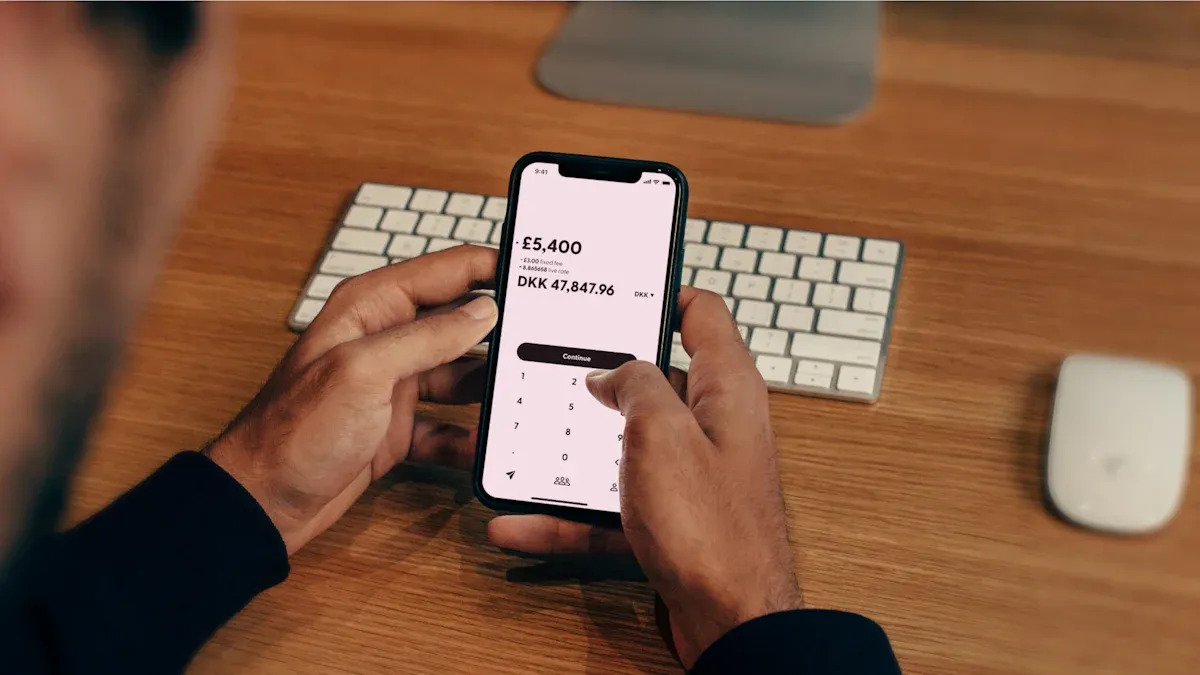

Image Source: unsplash

When you want to send money to family in Germany (remittance), you can first choose an appropriate channel, such as digital wallets, money transfer operators, or bank transfers. You need to prepare identification and recipient information, fill out the relevant details, and complete the transfer. Digital wallets are very popular in Germany, and exchange rates and fees will affect the amount received. You should focus on fund security, choose the most suitable method based on your needs, and avoid delays due to incorrect information.

Key Points

- Choose an appropriate remittance method, such as bank transfers, digital wallets, or remittance services, to meet your needs.

- Prepare recipient information and identification, ensuring every detail is accurate to avoid delays.

- Monitor exchange rates and fees, compare the fee structures of different providers, and choose the most favorable transfer timing.

- Use reputable platforms to ensure fund security and avoid sharing personal information on unsafe channels.

- Understand relevant regulations and tax requirements before transferring to ensure compliance and avoid legal risks.

Process

Main Steps

When sending money to family in Germany, you can follow these steps:

- Choose a Remittance Method

You can choose bank transfers, remittance service companies, or digital platforms. For example, you can initiate a transfer through the counter, online banking, or mobile banking of a Hong Kong-licensed bank. You can also use the website or app of international remittance providers or opt for digital platforms like PayPal. - Gather Necessary Information

You need to prepare the recipient’s full name, address, bank account details (such as IBAN, BIC/SWIFT code), and your identification documents.

Tip: Preparing all documents in advance can significantly reduce filling and review time.

- Initiate the Transfer

You need to fill out relevant forms or enter details online, specify the transfer amount and currency (e.g., USD), and pay the corresponding fees. - Confirm and Track

Before submitting, you should double-check all information. Most platforms provide transfer status tracking, allowing you to monitor progress anytime.

Common errors include entering incorrect recipient information (e.g., name, bank account, IBAN), exceeding the transfer limits of the provider or bank, or delays due to compliance issues. You should pay special attention to these details to avoid delays or unrecoverable funds.

Information Entry

When filling out remittance information, you need to ensure the accuracy of every detail. The following are commonly required information and their explanations:

| Required Information | Description |

|---|---|

| Full Name | Recipient’s full name |

| Address | Recipient’s address |

| Bank Name and Address | Name and address of the recipient’s bank |

| IBAN or Bank Account | Recipient’s International Bank Account Number or bank account number |

| Sort Code | Bank’s sort code |

| BIC / SWIFT | Bank’s BIC or SWIFT code |

| AWV Report | Required for transfers exceeding $12,500 |

When filling out this information, you must ensure every detail is accurate.

- Bank account numbers, IBAN, and BIC/SWIFT codes must exactly match the recipient’s account.

- If the amount exceeds $12,500, you also need to file an AWV report in compliance with German regulations.

If the information you provide is incorrect, it may lead to transfer delays or funds being sent to the wrong account, creating a risk of unrecoverable funds. In some cases, banks may cancel the transfer due to unverifiable information, further delaying delivery.

Throughout the process of sending money to family in Germany, you must repeatedly verify all information to ensure every step is accurate. This can significantly reduce risks, ensuring your funds reach your family safely and smoothly.

Remittance Methods

Image Source: unsplash

When sending money to family in Germany, you can choose from various mainstream channels. Each method has different features, fees, and use cases. You need to select the most suitable remittance method based on your needs and your family’s receiving preferences.

Bank Wire Transfer

Bank wire transfers are the most traditional method for international remittances. You can initiate a transfer through the counter, online banking, or mobile banking of a Hong Kong-licensed bank. Banks use secure global financial communication networks like SWIFT to ensure fund security. Bank wire transfers are strictly regulated, making the transaction process safe and reliable.

Common bank wire transfer methods include:

- Traditional bank transfers (using IBAN and BIC/SWIFT codes)

- Cash transfer operators (e.g., MoneyGram and Western Union, suitable for fast transfers but with higher fees)

When choosing bank wire transfers, you need to note the following:

- Banks typically charge additional fees on top of the mid-market exchange rate. For example, some banks set their own rates and charge conversion fees.

- International wire transfer sending fees generally range from 5 USD to 75 USD, with receiving fees for international transfers reaching up to 25 USD.

- Bank wire transfer processing times typically take 1 to 5 working days, with some banks extending to 5 working days.

| Type | Fee Range |

|---|---|

| International Wire Transfer Sending Fee | 5 USD to 75 USD |

| Receiving International Transfer Fee | Up to 25 USD |

| Remittance Method | Processing Time |

|---|---|

| Bank Transfer | Typically takes 1 to 3 working days, possibly extending to 5 working days |

Bank wire transfers are suitable for large transfers and scenarios requiring high security. If you need to send large sums or want funds to go directly to your family’s bank account, this method is reliable.

Tip: When filling out recipient bank information, carefully verify the IBAN and BIC/SWIFT codes to avoid delays or loss of funds due to errors.

Mobile Apps

With technological advancements, mobile apps have become a popular choice for many. You can use apps like TransferGo, Wise, Western Union, PayPal, WorldRemit, or Xoom for remittances. These apps typically support online peer-to-peer transfers with competitive exchange rates, ideal for sending money from China/Mainland China or non-Eurozone countries to Germany.

Advantages of mobile apps include:

- Convenient operation, allowing transfers anytime, anywhere

- Fast processing times, with some apps completing transfers in hours or even instantly

- Transparent exchange rates, with some apps offering real-time rate checks

| Application | Transaction Limit |

|---|---|

| TransferGo | EUR 2,500 |

| Wise | N/A |

| Western Union | N/A |

| PayPal | N/A |

| WorldRemit | N/A |

| Xoom | N/A |

| Remittance Method | Processing Time |

|---|---|

| Online Services | Typically completed on the same day or within 1 to 2 days |

When using mobile apps, you need to pay attention to transaction limits and fees. Some apps have restrictions on single transfer amounts, making them suitable for daily expenses, tuition, or other small to medium transfers. You should also check the app’s security measures, such as encryption and multi-factor authentication, to ensure fund safety.

It’s recommended to choose reputable apps and carefully verify recipient information to avoid losses due to operational errors.

PayPal and Cryptocurrency

PayPal and cryptocurrency offer more diverse remittance options. PayPal supports fast transfers, with some transactions exempt from fees, but uses PayPal’s exchange rates. You can initiate transfers using PayPal balance, bank accounts, or credit cards. Xoom, a PayPal service, supports multiple receiving methods for international remittances.

PayPal’s fee structure is as follows:

| Scenario | Typical Fees | Currency Conversion Fees |

|---|---|---|

| Receiving International Payments | Standard domestic commercial rate (e.g., 2.99% or 3.49% + fixed fee like $0.49 USD) + international commercial transaction fee (e.g., 1.5%) | 3.0% fee when converting received currency to the primary holding currency |

| Sending Payments via PayPal Payouts | Varies; typically a per-payment fee (percentage or fixed amount) | 3.0% fee if the sent currency differs from the funding source |

| Transfers via Xoom | Transaction fees (highly variable) + exchange rate markup (Xoom sets its own rate) | Markup included in Xoom’s exchange rate |

| Sending to Friends or Family | Typically 5% of the amount, minimum $0.99, maximum $4.99 (funded by PayPal balance or bank account) | N/A |

Cryptocurrency remittances offer decentralization and global circulation. You can transfer funds to your family’s cryptocurrency account in Germany through exchanges or wallets. Cryptocurrency transactions are typically fast and low-cost but are subject to significant price volatility.

When using PayPal or cryptocurrency, you need to understand relevant regulations and tax requirements:

| Topic | Details |

|---|---|

| Regulatory Authority | The German Federal Financial Supervisory Authority (BaFin) is the primary regulator for digital assets |

| Cryptocurrency Classification | Cryptocurrencies are considered financial instruments or assets in Germany, not legal tender |

| Anti-Money Laundering Regulations | Cryptocurrency exchanges and service providers must implement KYC procedures and transaction monitoring |

| Tax Requirements | Capital gains tax applies to cryptocurrencies held for less than one year |

| Transaction Reporting | Cryptocurrency transactions must be reported to tax authorities, with penalties for non-compliance |

When choosing PayPal or cryptocurrency for remittances, you should consider fees, exchange rates, and compliance requirements. PayPal is suitable for small, fast transfers, while cryptocurrency suits scenarios with specific speed and cost needs, though you must account for price volatility and tax reporting.

Reminder: When sending money to family in Germany, always choose legitimate channels, understand the fees and regulations of each method, and ensure fund security and compliance.

Fees and Exchange Rates for Sending Money to Family in Germany

Exchange Rate Comparison

When sending money to family in Germany, exchange rates are a key factor affecting the amount received. Exchange rates fluctuate daily, influenced by the following economic factors:

- Interest rate changes

- Inflation levels

- Political stability

- Economic performance

The level of the exchange rate directly determines the amount your family receives in local currency. If you transfer when the exchange rate is high, your family will receive more local currency. Conversely, a lower rate results in less received. Banks and remittance providers typically charge international transaction fees, which may be fixed or a percentage of the transfer amount. You can compare real-time exchange rates from different providers to choose the most favorable transfer timing.

Tip: Transfer timing is critical, as market dynamics cause exchange rate fluctuations, and choosing the right time can optimize the amount received.

Fee Optimization

When choosing a remittance channel, fees are a key focus. Fees include not only explicit transfer charges but also potential hidden costs. Common hidden fees include:

- Exchange rate markups

- Transfer fees

- Receiving fees in Germany

Some providers may attract you with low fees but compensate with unfavorable exchange rate markups. You need to carefully review the fee structures of different providers and prioritize platforms with transparent fees and competitive rates.

Methods to optimize fees include:

- Compare different international remittance services to find the lowest-cost option.

- Choose providers with transparent fee structures to avoid hidden costs.

- Check if the provider’s exchange rate is reasonable to avoid rate markups.

- Use digital transfer platforms, which typically have lower and more transparent fees.

- Look for low-fee or fee-free providers, as some offer free transfers under specific conditions.

You can prioritize online or mobile banking services from Hong Kong-licensed banks or opt for international digital transfer platforms. Regardless of the method, understand all fees in advance to ensure your family receives the maximum amount.

Documents and Verification

Image Source: pexels

Identification

When sending money to family in Germany, identity verification is the first step. Most remittance channels, including Hong Kong-licensed banks and international remittance platforms, require you to provide valid identification documents. Common identity verification documents include:

| Document Type | Description |

|---|---|

| Passport | Valid identification document |

| EU/EEA ID Card | Applicable for EU or EEA residents |

| German Permanent Residence Card | Proof of legal residence in Germany |

| Emergency Travel Document | Usable in special circumstances |

| Foreigner Travel Document | Identification for non-citizens |

| Swiss ID Card | Applicable for Swiss citizens |

You also need to provide personal information such as place of birth, nationality, and residential address. Some providers may require you to upload a photo ID with an address or provide utility bills, bank statements, or similar documents for address verification.

Tip: Ensure all documents are valid and clearly readable. Mismatched or expired documents may cause transfer delays.

Recipient Information

When filling out recipient information, you must ensure every detail is accurate. Key details include:

- Recipient’s full name

- Bank account number (or IBAN)

- Bank Identification Code (BIC/SWIFT)

- Recipient’s address

- Recipient’s bank name

This information is critical for banks and remittance platforms to verify the destination of funds. You may also need to explain the source of funds, and some platforms require a brief description of the transfer purpose.

It’s recommended to confirm all information with your family in advance to avoid delays or returns due to errors.

Throughout the documents and verification process, you must repeatedly check all materials and information. This significantly reduces risks, ensuring your remittance to family in Germany is completed smoothly.

Security and Compliance

Fund Security

When sending money to family in Germany, fund security is the most critical aspect. Choosing legitimate channels can effectively reduce risks. You can prioritize reputable remittance services with strong customer reviews and secure transaction histories. You should confirm that the provider uses secure SSL encryption to protect your personal information and funds from being compromised.

You can use platforms with transaction tracking to monitor fund status in real-time, ensuring a transparent and controllable transfer process. You should avoid sharing personal financial information on unsafe platforms and refrain from sending money to unknown recipients.

You should note that a global survey of financial services consumers shows that people sending money abroad face a fourfold higher risk of financial fraud compared to those who don’t. Over the past three years, 29% of German remitters experienced financial fraud, compared to only 8% of those not using peer-to-peer payments.

Common fraud types in Germany include impersonation and investment scams. These scams are often initiated by native German speakers, making them seem legitimate. You should carefully verify the recipient’s identity before transferring to avoid becoming a fraud target.

- Choose reputable remittance services

- Verify the provider’s encryption standards

- Use platforms with transaction tracking

- Avoid sharing financial information on unsafe platforms

- Do not send money to unknown recipients

Regulations and Restrictions

When making international remittances, you must understand relevant regulations and amount restrictions. Different countries have varying regulatory requirements for cross-border transfers. When sending money from China/Mainland China to Germany through Hong Kong-licensed banks, you need to comply with local and international anti-money laundering regulations.

You should pay attention to tax reporting requirements, especially for large transfers. Some countries impose consumption taxes on cross-border remittances, and businesses must withhold and remit taxes quarterly. For transfers initiated from the U.S., a new consumption tax policy applies, with the tax rate reduced from 5% to 1%.

You can refer to the table below for common tax reporting requirements:

| Scope | Description |

|---|---|

| New Consumption Tax | Applies to cross-border remittances initiated from the U.S., affecting all remittance providers. |

| Taxable Entities | Includes U.S. citizens, residents, and immigrants, regardless of whether the recipient is American or foreign. |

| Tax Rate | Reduced from 5% to 1%. |

| Reporting Requirements | Businesses must withhold and remit taxes quarterly, with specific reporting guidelines pending. |

When sending money to family in Germany, you must check if the transfer amount exceeds local limits. You should also be aware of Germany’s tax reporting requirements to ensure the legality and compliance of fund sources.

It’s recommended to consult professionals or official customer support if you’re unsure, to avoid delays or legal risks due to unclear regulations.

Common Issues

Cancellation and Modification

During the remittance process, you may need to cancel or modify a transfer. Most remittance services allow you to request cancellation before the funds are delivered. You should contact the provider as soon as possible, providing your name, email address, and transfer reference number. You also need to describe the reason for cancellation or modification in detail. If you know the recipient’s contact information, you can provide it as well.

Tip: Once funds are deposited into the recipient’s account, they typically cannot be canceled or recovered. You should carefully verify all information before proceeding to minimize the need for modifications.

Progress Tracking

You can track the remittance progress at any time to ensure funds reach your family’s account safely. You will receive a confirmation number or transaction ID when initiating the transfer. You can check the transfer status in real-time using the following methods:

- Log into the remittance company’s online platform or mobile app and enter the confirmation number to check progress.

- Monitor email or SMS notifications for timely updates on status.

- Contact customer support for detailed assistance if you have questions.

These methods help you stay informed about the fund’s status and reduce unnecessary concerns.

Handling Exceptions

If you encounter delays, failed transfers, or incorrect amounts, you need to take action promptly. You should contact the provider immediately, providing your name, email, transfer amount, and reference number. You also need to describe the specific issue and reason, along with the recipient’s name and contact information (if known).

- After explaining the issue, the provider will assist in identifying the cause and proposing solutions.

- If you need to cancel the transfer, request it as soon as possible before the funds are delivered.

It’s recommended to keep all transfer receipts and communication records to facilitate faster resolution of issues. For complex problems, seek support from professionals or official customer service to ensure your funds’ safety.

When sending money to family in Germany, you need to focus on the legitimacy of the channel, security measures, and fee transparency. You can compare exchange rates, fees, and transfer speeds of different online remittance services to choose the most suitable method.

- Online remittance services typically offer low fees and competitive exchange rates

- Multi-currency accounts help save on conversion fees

- Bank international wire transfers use encryption protocols to protect information

If you encounter issues, consult professionals or official customer support promptly to ensure funds arrive safely.

FAQ

What should I do if a remittance fails?

You should first check if the information provided is correct. If the information is accurate, contact the remittance provider or Hong Kong-licensed bank’s customer service promptly, explain the situation, provide transfer receipts, and await further processing.

Can I send large amounts to Germany at once?

You can send large amounts, but you must comply with regulations in China/Mainland China and Germany. Some channels have limits on single transfers. You should consult the bank or provider in advance and prepare proof of fund sources.

How long does it take for a remittance to arrive?

Transfer times vary by channel. Bank wire transfers typically take 1 to 5 working days. Mobile apps and digital platforms are often faster, sometimes arriving on the same day. You can track progress via the platform.

Are taxes required for remittances?

Some countries impose taxes on large transfers. You need to understand tax regulations in China/Mainland China and Germany. It’s recommended to consult professionals to ensure compliance and avoid tax risks.

Can I use a credit card for remittances?

You can use a credit card for remittances through some digital platforms or apps. Be aware that credit card transfers may incur additional fees. You should carefully read the terms of service and choose the most suitable method.

Sending money to family in Germany involves weighing exchange rates (current EUR/USD ~1.1753), fees (banks $5-$75, online platforms $5-$25), transfer times (banks 1-5 days, digital platforms 64% instant), and compliance (>$10,000 requires FinCEN reporting). Hidden rate markups (3-6%) often inflate costs. As an efficiency-focused user, you need a low-fee, transparent platform to streamline cross-border transfers.

BiyaPay offers the ideal solution, with real-time exchange rate queries to track USD-to-EUR rates (around 1.1753 now) and convert fiat to crypto, mitigating volatility risks. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to bill payments, it cuts costs and boosts speed. Don’t let high fees and delays disrupt your US-Germany connection—join BiyaPay today for a hassle-free remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.