- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money Efficiently and Safely from the US to GCash in the Philippines: A Comprehensive Analysis of Time, Limits, and Fees

Image Source: unsplash

When you want to send money from the US to Philippines GCash, choosing an efficient and secure remittance channel is crucial. You should focus on transfer speed, fee transparency, remittance limits, and fund security. In the past, many overseas Filipino workers used banks and wire transfer services for remittances, with fees as high as 15%, but technological advancements and market competition have significantly reduced costs and improved service accessibility. With simple operations, you can enjoy fast transfers and clear fee structures.

- When selecting a channel, you can refer to the following criteria:

- Cost reduction

- Service accessibility

- Regulatory compliance

- The role of technology and competition

Key Points

- When choosing a remittance channel, focus on transfer speed, fee transparency, and security to ensure fund safety.

- Using mainstream platforms like Remitly, Wise, or WorldRemit offers fast transfers and low fees for a seamless remittance experience.

- Before sending money, verify recipient information to ensure accuracy and avoid delays or losses.

- Understand each platform’s remittance limits and fee structures to select the account tier that suits your needs.

- Stay vigilant and protect against cyber fraud to ensure secure remittance operations.

Efficient and Secure Remittance Methods

Image Source: pexels

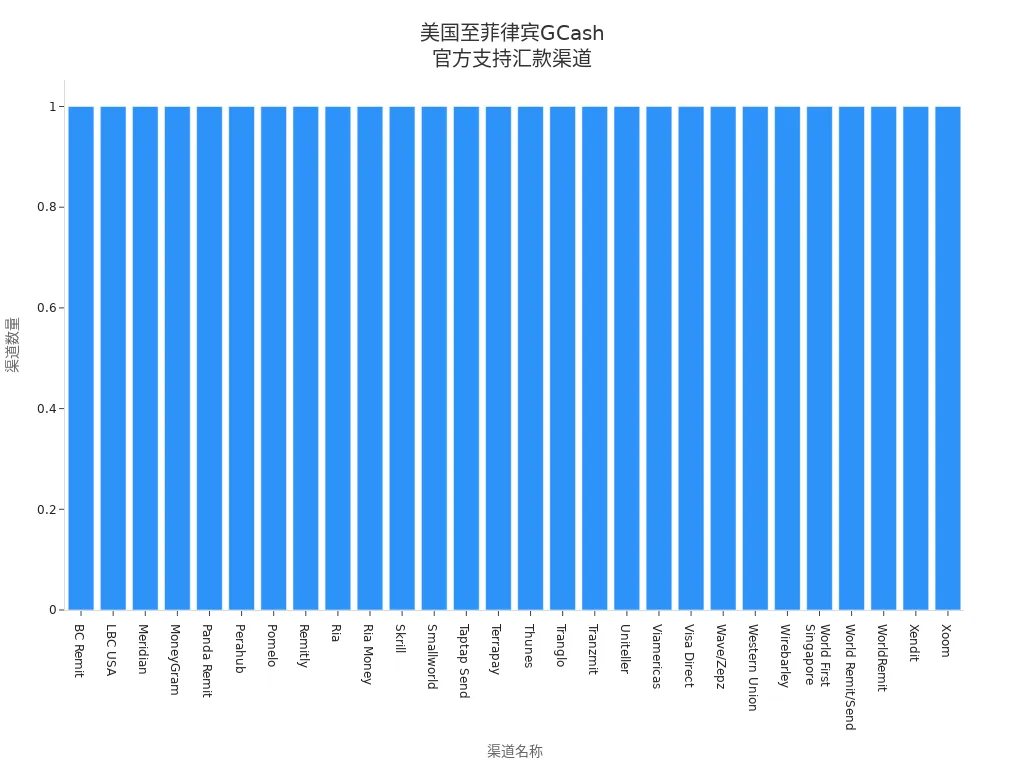

When sending money from the US to Philippines GCash, you can choose from various efficient and secure remittance channels. You need to consider transfer speed, fee transparency, and security. GCash’s officially supported channels are numerous, and below is a list of some mainstream channels:

| Channel Name |

|---|

| BC Remit |

| LBC USA |

| Meridian |

| MoneyGram |

| Panda Remit |

| Perahub |

| Pomelo |

| Remitly |

| Ria |

| Ria Money |

| Skrill |

| Smallworld |

| Taptap Send |

| Terrapay |

| Thunes |

| Tranglo |

| Tranzmit |

| Uniteller |

| Viamericas |

| Visa Direct |

| Wave/Zepz |

| Western Union |

| Wirebarley |

| World First Singapore |

| World Remit/Send |

| WorldRemit |

| Xendit |

| Xoom |

You can see that Remitly, Wise, and WorldRemit are among the officially supported channels. These channels enable efficient and secure remittances, meeting your needs for transfer speed and fee transparency.

Remitly Channel

Remitly is one of the commonly used efficient and secure remittance channels for US users. You can choose between economy or express transfer options. The economy option has lower fees but slightly longer transfer times, while the express option has slightly higher fees but typically arrives in GCash within minutes. Remitly is regulated by the FCA, ensuring high security. You can operate via the mobile app or website, with a simple process. Remitly supports 170 recipient countries, making it suitable if you have family or friends in multiple locations.

| Service Provider | Sending Countries | Receiving Countries | Transfer Options | Security |

|---|---|---|---|---|

| Remitly | 28 | 170 | Economy, Express | High security standards, regulated by FCA |

When using Remitly, remittance fees and exchange rates are displayed upfront, with no hidden fees. You can check exchange rates and fees anytime to ensure fund security and cost control.

Wise Channel

Wise (formerly TransferWise) is known for its transparent exchange rates and low fees. You can send money directly in USD, and Wise will convert it to Philippine Pesos at the real-time exchange rate for deposit into GCash. Wise uses the mid-market rate with no markups, and its fee structure is clear. You can operate via the Wise website or app, entering the recipient’s GCash account details to complete the transfer in a few steps. Wise supports multi-currency transfers, ideal for cross-border financial needs.

Wise’s transfer speed is typically between a few minutes to a few hours, depending on bank processing times. You can track transfer progress in real-time to ensure fund security. Wise is regulated by multiple global financial authorities with strict user verification, safeguarding your funds.

WorldRemit Channel

WorldRemit is another popular choice for efficient and secure remittances. You can choose cash pickup, bank transfer, or direct deposit to GCash. WorldRemit supports 130 recipient countries, offering flexible services. When sending money from the US, you can operate via the app or website, entering the recipient’s GCash account details for a straightforward process.

| Service Provider | Sending Countries | Receiving Countries | Transfer Options | Security |

|---|---|---|---|---|

| WorldRemit | 50 | 130 | Cash pickup, Online transfer | Strict user verification, regulated by FCA |

WorldRemit displays all fees and exchange rates upfront, with no hidden costs. You can clearly understand the cost of each remittance, avoiding unexpected expenses.

Other Channels

In addition to the three major channels above, you can also choose other officially supported efficient and secure remittance channels like MoneyGram, Western Union, and Xoom. These channels also support GCash deposits and have extensive service networks, suitable for specific needs or offline preferences.

Tip: GCash itself does not charge transfer fees, but foreign exchange conversions may incur small fees. Many actual costs are hidden in exchange rate markups and intermediary bank deductions, which are not always disclosed upfront. When choosing a channel, pay attention to exchange rate markups to avoid foreign exchange losses.

When selecting an efficient and secure remittance channel, prioritize platforms with fast transfer speeds, transparent fees, and no hidden costs. You can choose flexibly based on your needs to ensure fund security and cost control.

Operation Process

Image Source: unsplash

Remittance Steps

When using an efficient and secure remittance channel from the US to Philippines GCash, you typically need to follow these steps:

- Log in to your chosen remittance platform (e.g., Remitly, Wise, or WorldRemit).

- Select the Philippines as the recipient country and GCash as the receiving method.

- Enter the remittance amount, and the system will automatically display the real-time USD to PHP exchange rate and fees.

- Fill in the recipient’s information, including the GCash registered phone number and name. Ensure the information is accurate.

- Upload required documents, such as a passport copy or proof of address (some platforms require this for first-time transfers).

- Review all information and confirm the remittance.

- After the remittance is completed, you can click “Cash In” in the GCash app, select “Global Partners” and “Remittance”, then go to “Online Remittance Claim” and select the corresponding channel (e.g., WorldRemit), follow the prompts to enter information, and click “Next” to complete the deposit.

Throughout the process, you can track the remittance progress, and some platforms offer real-time notifications of the transfer status. Efficient and secure remittance platforms typically display all fees upfront, avoiding hidden costs.

Precautions

During the process, you need to pay special attention to the following:

- Remittance companies set minimum and maximum limits for each transfer, so check the regulations in advance.

- The recipient information submitted must be accurate, especially the GCash phone number and name. Verify multiple times before confirming to avoid delays or losses due to errors.

- Some platforms require uploading identification documents, so prepare a passport or proof of address in advance.

- Remittance fees are typically higher than local transfers in China/Mainland China, so choosing a legitimate, secure platform effectively ensures fund safety.

- It’s recommended to test with a small amount first, confirming recipient information before making large transfers.

- Familiarize yourself with GCash’s dispute resolution process and customer support channels to seek help promptly if issues arise.

- Keep all transaction records, screenshots, and reference numbers for future inquiries and disputes.

Tip: When choosing an efficient and secure remittance channel, pay attention to the platform’s security certifications and user reviews to avoid losses due to operational errors or unreliable platforms.

Transfer Times

Transfer Speeds by Channel

When sending money from the US to Philippines GCash, transfer speed is one of your primary concerns. Processing times vary across channels. You can refer to the table below for the average transfer times of major platforms:

| Service | Average Time |

|---|---|

| Remitly | May be instant or 1-2 business days |

| Wise | Usually within one business day |

| WorldRemit | Usually within one business day |

When choosing Remitly, express transfers typically arrive in GCash within minutes. Economy transfers may take 1-2 business days. Wise and WorldRemit generally complete transfers within one business day. You can select the appropriate channel based on your needs to ensure timely fund arrival.

Tip: When sending money efficiently and securely, check each platform’s specific transfer times in advance to avoid inconvenience due to urgent fund needs.

Factors Affecting Transfer Times

During the remittance process, you’ll find that transfer times depend not only on the platform but also on various factors. Common factors include:

- The complexity of cross-border payments may lead to processing delays.

- Transactions involving multiple intermediaries may introduce their own deadlines and compliance checks.

- Lack of synchronized settlement systems between countries can affect the actual speed of fund movement.

- Different regulatory frameworks and compliance requirements may cause delays.

- Weekends and holidays may delay processing, with transfers handled on the next business day.

When choosing a transfer time, you can avoid weekends and holidays to improve transfer efficiency. You can also verify recipient information in advance to reduce delays due to compliance reviews. Understanding these factors helps you plan transfer times better, ensuring secure and timely fund arrival.

Fees and Exchange Rates

Fee Comparison

When choosing a remittance channel, fees are a key factor affecting costs. Fee structures vary significantly across platforms. Wise typically charges a transfer fee of $12.66, while Remitly sometimes waives fees. WorldRemit’s fees vary based on the amount and receiving method. You can refer to the table below for a quick comparison of fees and received amounts for major channels:

| Provider | Arrival Time | Exchange Rate | Transfer Fees | Recipient Receives |

|---|---|---|---|---|

| Wise | 23 hours | 57.0655 | 12.66 USD | 56,343.05 PHP |

| Remitly | - | 55.4314 | 0.00 USD | 55,431.37 PHP |

You can see that while Wise has higher fees, its exchange rate is more favorable. Remitly, when fee-free, delivers a slightly lower amount. You need to balance fees and exchange rates based on your needs.

Exchange Rate Differences

Exchange rates directly determine how many Pesos the recipient receives when you send money to GCash. Wise uses the mid-market exchange rate, which is generally more transparent than other platforms. Remitly and WorldRemit may include slight markups in their rates. You should check the platform’s displayed real-time exchange rate before sending. Exchange rate fluctuations also affect the final amount received. The table below summarizes key factors affecting exchange rates and received amounts:

| Factor | Description |

|---|---|

| Current Exchange Rate | Higher rates yield more Pesos. |

| Fees | High fees reduce the amount received by the recipient. |

| Transfer Timing | Peak times may have less favorable rates; non-peak times are more cost-effective. |

| Economic Conditions | Strong US and Philippine economies may result in better rates. |

| GCash Agent Availability | Fewer agents in remote areas may lead to lower exchange rates. |

You can choose to send money during periods with higher exchange rates and lower fees to maximize the recipient’s benefits.

Hidden Fees

When sending money, be wary of hidden fees. Some platforms add markups to exchange rates or deduct additional fees through intermediary banks. You should prioritize platforms with transparent fees to avoid reduced amounts due to hidden costs. Wise and Remitly display all fees and exchange rates upfront, helping you make informed choices. Before sending, carefully review the platform’s fee disclosures to ensure an efficient and secure remittance experience.

Tip: Before sending money, compare multiple platforms and choose those with no hidden fees and transparent exchange rates to maximize the Pesos received.

Remittance Limits

Limit Requirements

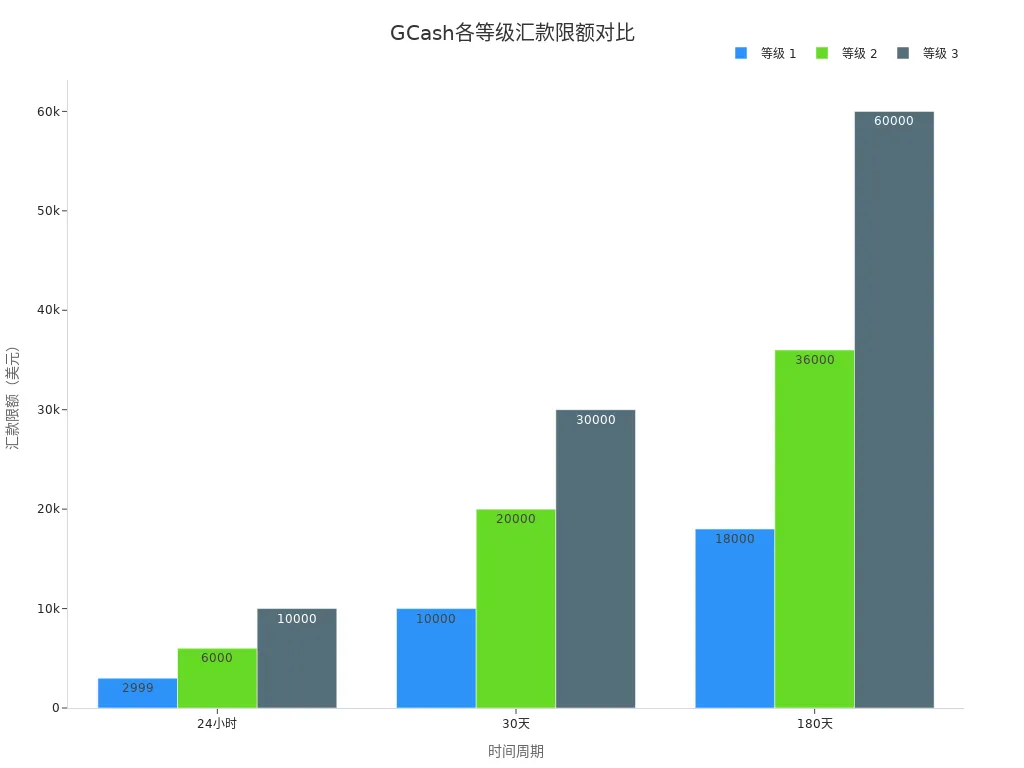

When sending money from the US to Philippines GCash, platforms set limits for each transaction and periodic remittances. GCash accounts have different tiers, each with corresponding remittance limits. You can refer to the table below for GCash’s specific limits:

| Sending Limit | Tier 1 | Tier 2 | Tier 3 |

|---|---|---|---|

| 24 Hours | $2,999 | $6,000 | $10,000 |

| 30 Days | $10,000 | $20,000 | $30,000 |

| 180 Days | $18,000 | $36,000 | $60,000 |

You can choose the appropriate account tier based on your remittance needs. If you need higher limits, you can upgrade your account tier.

Account Verification

To increase your GCash account’s remittance limits, you must complete account verification. The verification process not only raises limits but also enhances account security. After verification, you can access more services and higher fund liquidity. Key benefits of account verification include:

- After verification, GCash account remittance limits increase, suitable for large or frequent transfers.

- Fully verified accounts can use additional services like GSave, GCredit, and international remittances.

- Account verification is crucial for businesses and individuals with frequent remittances.

- After verification, you can send and receive funds more smoothly, reducing restrictions and enhancing security.

Before sending money, it’s recommended to complete GCash account verification to ensure smooth transactions.

Recipient Requirements

When sending money from the US to Philippines GCash, the recipient needs to follow the platform’s process. You can refer to the table below for specific recipient steps:

| Step | Description |

|---|---|

| 1. Open the GCash App | Access the GCash app and click “Cash In.” |

| 2. Select Global Banks and Partners | Choose “Global Banks and Partners” from the “How to Cash In” menu. |

| 3. Select Remittance Partner | Choose a remittance partner under “Global Partners > Online Remittance Claim.” |

| 4. Enter Details | Input the cash-in amount and account details, then click “Next.” |

| 5. Follow Instructions | Click “Next” to proceed with the transaction. |

| 6. Enter One-Time Password | If additional verification is needed, a one-time password will be sent via SMS. |

| 7. Success | A confirmation message will be sent to the in-app inbox, and transaction history will show the receipt status. |

You should remind the recipient to accurately enter information and complete verification promptly to ensure smooth fund receipt.

Risks and Security

Fraud Prevention Tips

When sending money from the US to Philippines GCash, you must prioritize fund security. Although GCash uses advanced encryption protocols and two-factor authentication to protect your transactions, you still need to be vigilant against various cyber frauds. Common risks include digital wallet fraud and phishing attacks, which could lead to stolen funds or compromised accounts.

You can take the following measures to prevent fraud:

- Do not click on unknown or suspicious links to avoid falling into phishing traps.

- Never share your MPIN, one-time password (OTP), or bank card CVV information.

- Before transferring, carefully check the recipient’s or seller’s reviews to verify their identity.

- Only make donations or payments through official GCash channels, avoiding third-party platforms.

- Regularly check your account security settings to detect anomalies promptly.

- Do not sell or lend your GCash account to prevent misuse by malicious actors.

- Learn about common fraud tactics, especially scams impersonating official personnel.

- Verify all communication sources and stay cautious of suspicious messages.

- Use secure network environments and avoid remittance operations on public Wi-Fi.

- Report any anomalies or suspicious activities to GCash immediately.

Tip: GCash monitors suspicious activities in real-time and takes prompt action in case of risks, but your own vigilance is equally important.

Platform Selection

When choosing a remittance platform, security and reliability are primary considerations. Mainstream platforms like Remitly, Wise, and WorldRemit implement strict security measures. For example, Remitly will not request your password, full Social Security number, or irrelevant credit card information via email or phone. Platforms only request identification through secure channels, ensuring your personal information remains protected.

These platforms also use strong passwords and two-factor authentication to secure your account. Remitly and others employ advanced technology to detect unusual account activity and have strict verification processes. You can use these platforms with confidence for an efficient and secure remittance experience.

User reviews indicate that Pomelo is praised for its speed, no fees, and favorable exchange rates. Many users report that Pomelo’s services provide peace of mind, with funds typically arriving within hours and no additional fees. You can choose reputable platforms with transparent fees based on your needs to further reduce risks.

Recommendation: When selecting a platform, prioritize those with legitimate financial licenses, high user ratings, and transparent fees to ensure every remittance is safe and reliable.

You can choose GCash’s partnered international remittance services for fast, low-cost, and convenient transfers.

- GCash supports real-time fund receipt with high security.

- You should verify recipient information, choose legitimate channels, and pay attention to account limits and fee details.

- You can compare different services and choose flexibly based on your needs to maximize fund value and avoid common risks.

- Develop a contingency plan and learn fraud prevention knowledge to handle system failures promptly.

FAQ

What are the requirements for a GCash recipient?

You need to ensure the recipient has completed GCash account verification. The recipient must be at least 18 years old, and their phone number must be registered with GCash. The recipient also needs to be able to log into the GCash app normally.

What should I do if a remittance fails?

You can first check if the recipient’s information is correct. You can also contact the remittance platform’s customer service and provide the transaction number. The platform will assist in identifying the issue and resolving it.

How long does it take for a remittance to arrive?

When choosing Remitly’s express option, funds arrive in minutes. Wise and WorldRemit generally deliver within one business day. You can track progress in real-time on the platform.

Is there a minimum remittance amount?

For most platforms, the minimum remittance amount is typically $1 USD or higher. You can check the platform’s regulations before sending to avoid failures due to amounts being too low.

How can I avoid being scammed during a remittance?

You should verify recipient information and avoid transferring to strangers. Do not share account passwords or verification codes. Operate only through official channels and contact customer service promptly if anomalies occur.

Sending money from the US to Philippines GCash involves key factors like arrival times (minutes to 2 days), limits (24-hour $2,999-$10,000 by account tier), and fees (Remitly 0-12.66 USD, Wise ~12.66 USD), but rate markups (3-4%) and China’s annual forex cap ($50,000) often raise costs or cause delays. Compliance verification and anti-fraud steps are essential. As an efficiency-focused user, you need a low-cost, transparent platform to simplify remittances.

BiyaPay delivers the ideal solution, offering real-time exchange rate queries to track USD-to-PHP rates (around 57.01 now) and convert fiat to crypto, dodging adverse swings. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to daily transfers, it cuts costs and boosts speed. Don’t let fees and caps hinder your GCash remittances—join BiyaPay today for a more secure journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.