- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Philippines Remittance Essentials: A Comprehensive Guide to Bank Transfers' Advantages, Fees, and Security

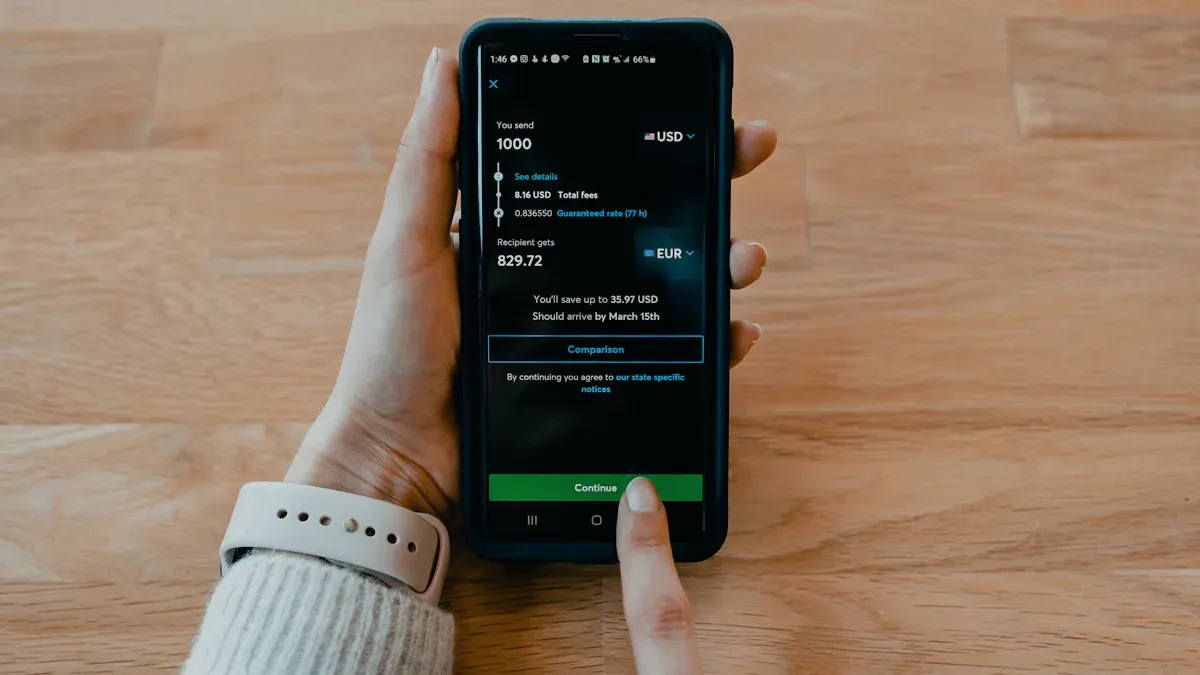

Image Source: unsplash

If you need to remit funds from the Philippines to China/mainland China, bank transfers are typically a safe and stable option. Bank channels are strictly regulated and offer wide service coverage. You can benefit from cost reduction and enhanced service accessibility as key bank transfer advantages, and many banks comply with international anti-money laundering standards to protect your funds. You can assess whether bank transfers are the most suitable remittance method based on your needs.

Key Takeaways

- Bank transfers are a safe and reliable option for remittances from the Philippines to China, with strict regulation and transparent fund flows.

- Choose reputable banks with user-friendly fund tracking systems to easily check remittance status at any time.

- Understand the fee structures for different transfer types; intra-bank transfers can significantly reduce costs, ideal for daily small remittances.

- Pay attention to exchange rates and hidden fees to avoid reduced received amounts due to lack of transparency, ensuring fund security.

- When choosing a remittance method, consider fees, security, and convenience comprehensively to make the wisest choice.

Comparison of Remittance Methods

Bank Transfer Advantages

When remitting funds from the Philippines to China/mainland China, bank channels are the most common choice. Bank transfers offer significant advantages, primarily providing high security. Banks are strictly regulated, ensuring transparent fund flows and low risk. You can track remittance progress at any time and receive professional customer support for any issues. Banks have extensive coverage and stable services, suitable for large and frequent remittance needs. When you process remittances through banks, fund tracking and information protection are more assured. Bank channels also comply with international anti-money laundering standards, effectively preventing illicit fund flows. If you prioritize fund security and service reliability, bank transfers are typically the preferred choice.

Tip: Bank channels dominate the Philippine market. According to market data, bank remittances account for over 80% of the market share, far exceeding other channels.

| Remittance Method | Market Share |

|---|---|

| Bank Remittance | Over 80% |

| Other Service Providers | N/A |

| Friends or Relatives | N/A |

Overview of Other Methods

You can also choose third-party platforms or cash remittances. Third-party platforms are typically user-friendly with lower fees, suitable for small remittances. Cash remittances are ideal for users without bank accounts, but they have limited security and fund tracking capabilities. If you choose these channels, you need to consider service coverage and fund security risks. Some third-party platforms may not be strictly regulated, making it harder to recover funds if lost. When choosing, weigh security, convenience, and costs based on your needs.

Bank Transfer Advantages

Image Source: pexels

Security

When choosing bank transfers in the Philippines, you benefit from multiple layers of security. Banks require you to set strong passwords and recommend enabling multi-factor authentication. Multi-factor authentication makes your account login process more secure, typically involving one-time passwords, biometric verification, or facial recognition. Even if someone knows your username and password, accessing your account is difficult. Banks encrypt all data, ensuring only you can access and manage account information. You can operate through secure financial apps, avoiding public Wi-Fi or shared devices for banking. Banks proactively send alerts to notify you of unusual account activity. You should also stay vigilant against phishing and other online scams, as banks regularly update security tips to help you mitigate risks.

Tip: When remitting, enable bank SMS or email alerts to stay informed of account activity in real time.

Bank transfer advantages extend beyond technical security measures to include a robust regulatory framework. The Bangko Sentral ng Pilipinas (BSP) oversees all bank remittance operations, requiring compliance with the Manual of Regulations for Banks (MORB) and the National Payment System Act. The table below outlines key regulatory bodies and standards:

| Regulatory Body | Standard Requirements |

|---|---|

| Bangko Sentral ng Pilipinas (BSP) | Compliance with the Manual of Regulations for Banks (MORB) and specific regulations on payment systems and anti-money laundering |

When you process remittances through banks, you can trust in fund security, as banks adhere to international standards for anti-money laundering and customer protection.

Service Stability

Bank transfer advantages also include service stability. When using bank channels in the Philippines to remit to China/mainland China, banks offer extensive network coverage and reliable services. Banks have fixed operating hours, with online platforms available 24/7. You can initiate remittances anytime via mobile or online banking without worrying about system failures or service interruptions. Banks regularly maintain systems to ensure smooth transactions. If you encounter issues, you can contact bank customer service for professional support. Bank channels are ideal for large and frequent remittances, with fast processing and standardized procedures. When choosing bank transfers, you can enjoy a stable and reliable remittance experience.

Note: For cross-border remittances, prioritize Hong Kong-licensed banks or other international bank channels for broader coverage and more efficient fund processing.

Fund Tracking

When you process remittances through banks, you can track fund movements in real time. Banks generate unique reference codes or tracking numbers for each remittance. You can use the bank’s website or mobile app to enter the tracking number and check transaction progress at any time. Some banks also notify you of each processing stage via SMS or email. Bank transfer advantages include transparent fund flows, allowing you to know exactly when funds arrive and file claims promptly if issues arise. When choosing remittance services, prioritize banks with robust fund tracking systems.

- Choose reputable banks or remittance providers with user-friendly tracking systems.

- After initiating a transfer, banks provide a reference code for easy tracking.

- You can check transaction status in real time via official bank platforms.

- Banks send proactive notifications to update you on fund processing progress.

Bank transfer advantages shine in international remittances. You benefit from secure, stable, and traceable services with transparent fund flows and controlled risks. When remitting from the Philippines to China/mainland China, bank channels are a trustworthy choice.

Fees

When choosing bank transfers in the Philippines, the fee structure directly impacts your remittance costs. Fees vary by bank and transfer type, and you need to understand intra-bank, inter-bank, and international transfer fees, as well as hidden costs and exchange rate differences, which affect the actual received amount.

Intra-Bank Transfer Fees

When transferring between accounts within the same bank, fees are typically the lowest. Most banks charge minimal fees for intra-bank transfers, and some even offer free services. If you frequently transfer within the same bank, you can save significant costs. Intra-bank transfers are ideal for daily small fund movements, with near-instant completion.

- When processing intra-bank transfers, check the bank’s specific fee schedule in advance.

- Some banks charge a percentage-based fee for large intra-bank transfers, but overall, intra-bank transfer costs are much lower than inter-bank or international transfers.

Tip: For frequent transfers, opening an account with the same bank can effectively reduce fees.

Inter-Bank Transfer Fees

When transferring between different bank accounts, fees are notably higher than intra-bank transfers. Philippine banks typically charge fixed fees for inter-bank transfers, and some add percentage-based fees based on the transfer amount. When choosing inter-bank transfers, consider the following:

- Inter-bank transfer fees generally range from USD1-3 per transaction, depending on bank policies and transfer channels.

- Online channels (e.g., mobile banking, online banking) may have slightly lower fees than in-branch processing.

- Inter-bank transfers typically take longer than intra-bank transfers, with some banks requiring 1-2 business days.

When performing inter-bank transfers, check fee schedules in advance to avoid cost accumulation from frequent transactions.

International Transfer Fees

When processing international remittances from Philippine banks to China/mainland China, the fee structure is more complex. Banks typically charge fixed fees and may add documentary stamp taxes or other service fees. The table below shows typical international remittance fee standards (in USD):

| Transfer Type | Typical Fee Standard (USD) |

|---|---|

| USD to Philippine Peso | 10 USD + 0.30 PHP documentary stamp tax per 200 PHP or fraction thereof |

| Third Currency to Third Currency or USD | 10 USD |

| Third Currency to Philippine Peso | 10 USD + 0.30 PHP documentary stamp tax per 200 PHP or fraction thereof |

When processing international remittances, beyond fixed fees, pay attention to exchange rate differences and hidden costs. Some banks add a forex markup to the exchange rate, which is often subtle but directly impacts the received amount.

Note: When choosing international remittance channels, ask the bank for detailed information on exchange rates and all related fees to avoid increased costs due to lack of transparency.

Hidden Costs and Exchange Rate Differences

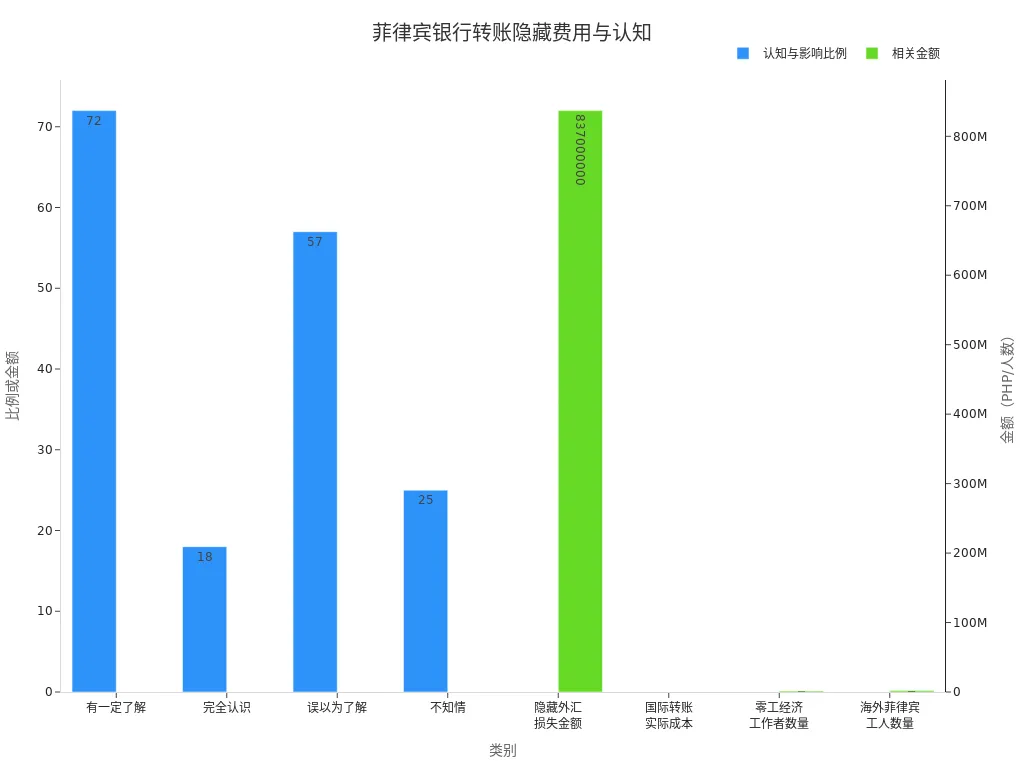

When processing international remittances through banks, beyond visible fees, be cautious of hidden forex markups. In 2023, Filipinos lost up to PHP 8.37 billion due to hidden forex fees. Many users are not fully aware of the true costs of international payments. The table below shows related statistics:

| Statistic | Description |

|---|---|

| PHP 8.37 billion | Amount lost by Filipinos to hidden forex fees in 2023 |

| 72% | Percentage of Filipinos who claim to have “some understanding” of international payment costs |

| 18% | Percentage of Filipinos fully aware of the impact of hidden forex markups |

| 57% | Percentage of Filipinos who believe they understand payment costs but do not |

| 25% | Percentage of Filipinos unaware of true remittance costs |

| 3.6% | Example forex markup percentage |

| PHP 21,187 | Actual cost of an international transfer with hidden forex markups |

| 1.5 million | Number of gig economy workers in the Philippines |

| 2 million | Number of Overseas Filipino Workers (OFWs) |

You can refer to the chart below for a visual representation of hidden fees and user awareness in Philippine bank transfers:

When processing international remittances, pay close attention to exchange rates and forex markups. Some banks add a 3%-4% markup to the exchange rate, which is often not separately listed in statements. If you overlook these costs, the actual received amount may be significantly reduced.

Recommendation: Before remitting, request a detailed fee breakdown and real-time exchange rate from the bank to avoid losses due to hidden costs.

Fee Comparison Recommendations

When choosing a remittance method, use a table to compare fee structures across banks and channels. This helps you visually assess which method best suits your needs. You can also consider exchange rates and processing times to evaluate overall costs and efficiency.

- If you prioritize cost control, opt for intra-bank transfers or low-fee online channels.

- For international remittances, pay close attention to exchange rates and all related fees to avoid increased costs due to lack of transparency.

When remitting from the Philippines to China/mainland China, fees and hidden costs directly impact fund security and received amounts. Learn to actively compare and inquire to make the wisest choice.

Security Measures

Bank Regulation

When remitting through bank channels in the Philippines, you benefit from stringent financial regulation. The Bangko Sentral ng Pilipinas (BSP) continuously oversees all banking operations. Banks must comply with the National Payment System Act and related regulations, ensuring every fund movement is under supervision. When you process remittances through banks, operations follow international standards, reducing money laundering and fraud risks. Banks undergo regular audits to ensure service compliance. You can confidently choose bank channels, as the regulatory framework provides robust protection for your funds.

Tip: For international remittances, prioritize banks with Hong Kong or international financial licenses, as they typically have higher compliance standards and more transparent services.

Anti-Money Laundering Mechanisms

Banks processing your remittances to China/mainland China strictly enforce anti-money laundering mechanisms. You must provide accurate identity information, and banks conduct enhanced scrutiny for high-risk clients and large transactions. Banks also monitor all transactions, reporting suspicious activities to the Anti-Money Laundering Council (AMLC). The table below outlines common anti-money laundering measures in Philippine banks:

| Anti-Money Laundering Mechanism | Description |

|---|---|

| Customer Due Diligence (CDD) and Know Your Customer (KYC) | Banks must verify customer identity before processing transactions. Enhanced due diligence (EDD) is required for high-risk clients and large transactions. |

| Suspicious Transaction Reporting (STR) | Banks must monitor transactions and report suspicious activities to the AMLC. Transactions involving large unexplained funds, sudden account activity spikes, or structured patterns require investigation. |

| Record-Keeping Obligations | All transaction records must be retained for at least five years for audits and investigations. Banks must ensure records are accessible to regulators when needed. |

| Cross-Border Transaction Monitoring | With the rise in international remittances, banks must track cross-border transactions to detect potential illicit activities. Financial institutions are encouraged to collaborate globally to enhance AML compliance. |

When remitting, provide accurate identity information to avoid delays or rejections due to incomplete documentation.

User Privacy

Banks place high importance on protecting your personal information. When processing remittances, banks encrypt all data to prevent leaks. Bank staff can only access your information when necessary, with all actions logged. You can set account security alerts via mobile or online banking to monitor activity in real time. Banks regularly update privacy policies to ensure your information meets international data protection standards.

- When using bank services, avoid connecting to unsecured Wi-Fi in public places.

- Never share account information or verification codes to prevent exploitation by malicious actors.

Note: If you receive suspicious SMS or calls, do not click unknown links or provide personal information. Contact the bank’s official customer service immediately if issues arise.

When remitting from the Philippines to China/mainland China through bank channels, regulatory oversight, anti-money laundering mechanisms, and privacy protections collectively safeguard your funds. By following operational guidelines and staying vigilant, you can significantly reduce the risk of fund loss.

Operating Procedures

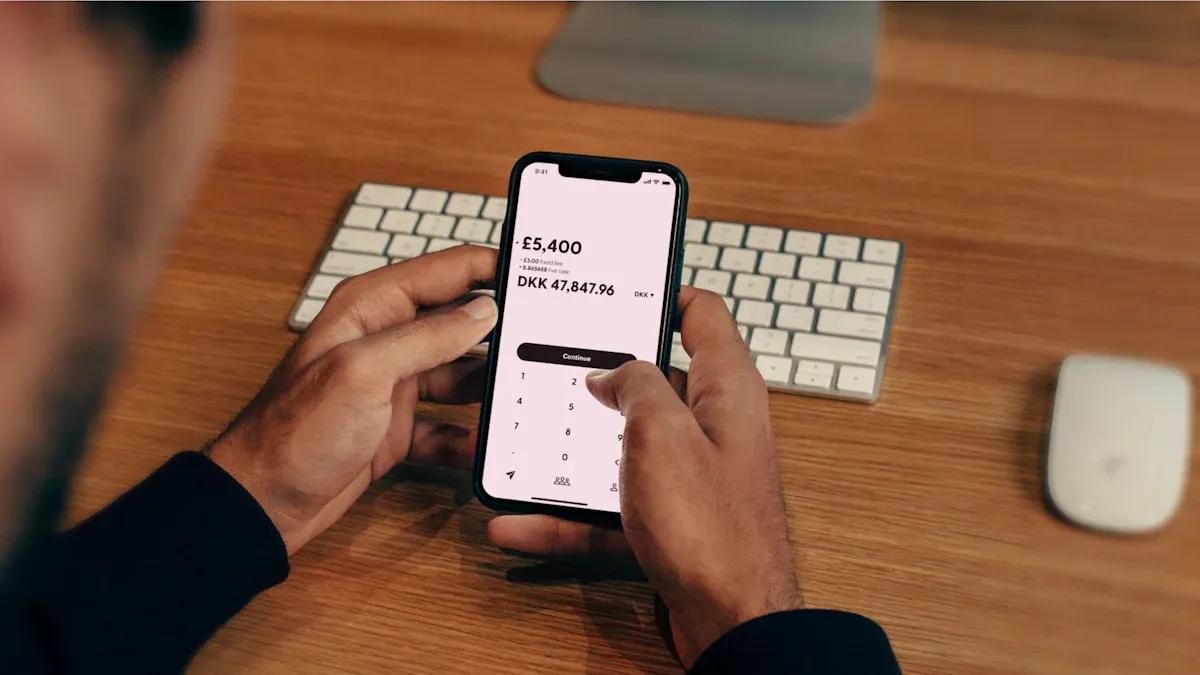

Image Source: unsplash

Account Opening Requirements

When processing bank remittances from the Philippines to China/mainland China, you first need to open a bank account. Required documents vary by account type. Refer to the table below for necessary documents:

| Account Type | Required Documents |

|---|---|

| Personal Account | 1. Two valid government-issued IDs 2. Proof of address (e.g., utility bill or lease agreement) 3. Alien Registration Certificate (if applicable) |

| Business Account | 1. Business registration documents (e.g., BIR and DTI documents) 2. Proof of business address 3. Tax Identification Number (TIN) 4. Authorized signatory’s ID 5. Bank application form |

| Other Required Documents | 1. At least one valid government-issued ID 2. Passport photo (depending on bank requirements) 3. Minimum deposit (varies by bank) |

When preparing documents, contact the bank in advance to confirm specific requirements. Some banks may request additional documents, especially for international remittances or business accounts.

Transfer Steps

After opening an account, follow these steps to process a bank transfer:

- Register and log into the bank’s online banking or mobile app.

- On the beneficiary management page, add a recipient in China/mainland China, entering detailed information.

- Return to the homepage and select the “Send” or “Transfer” function.

- Choose the remittance and payment method, then enter the USD amount to transfer.

- Select the recipient and specify the remittance purpose.

- Review all information and pay the fees upon confirmation.

- After completing the transfer, the bank provides a reference code for tracking fund status.

During the process, carefully verify recipient information to avoid delays or failures due to errors.

Processing Time

When initiating remittances through Philippine banks, processing times depend on bank operating hours and submission timing. Consider the following:

- Banks process transfers on business days. If you submit before the bank’s cutoff time, processing typically occurs the same day; submissions after the cutoff are deferred to the next business day.

- Banks do not process remittances on weekends or holidays. Transfers initiated on Friday afternoons may not arrive until Monday or later.

- Processing speeds vary slightly by bank. You can check estimated arrival times via bank customer service or online platforms.

Tip: Before remitting, check the bank’s operating hours and cutoff times to plan transfers and avoid delays.

For urgent or special cases, prioritize Hong Kong-licensed banks or international bank channels for higher processing efficiency.

Selection Recommendations

Applicable Scenarios

When remitting from the Philippines to China/mainland China, bank transfers offer clear advantages, especially in the following scenarios:

- Ideal for business purposes, such as paying suppliers or employee salaries.

- Suitable for large transactions, as bank channels ensure fund security and efficient delivery.

- Reliable for needs requiring fund tracking and compliance assurance.

- If you need stable, long-term remittance services, banks offer extensive coverage and consistent service.

In the Asia-Pacific region, digital apps are the preferred remittance channel. Data shows that 74% of Philippine users use digital channels for sending remittances, and 66% for receiving. You can choose the most suitable method based on your needs.

| Region | Sending Usage Rate | Receiving Usage Rate |

|---|---|---|

| Philippines | 74% | 66% |

| India | 74% | 76% |

| Singapore | 70% | 75% |

Advantages and Disadvantages

When choosing bank transfers, consider the following advantages and disadvantages:

Advantages:

- High security, with banks under strict regulation and transparent fund flows.

- Stable services, suitable for large and frequent remittances.

- Convenient fund tracking, with prompt claim options for issues.

Disadvantages:

- High transaction fees, with some banks charging significant amounts.

- Exchange rates may be less favorable, affecting received amounts.

- Transfer processes may face delays, especially for cross-border or holiday periods.

- Some users report security concerns, requiring attention to account protection.

User Recommendations

When selecting a remittance method, consider your situation comprehensively:

- Financial Situation: Assess your household financial capacity and risk tolerance to choose a cost-effective channel.

- Geographic Factors: The bank service coverage and socioeconomic conditions in your area affect remittance efficiency.

- Political and Cultural Factors: Consider local policies and cultural environments when evaluating investment risks and returns.

If you prioritize security and fund tracking, opt for bank channels, especially Hong Kong-licensed or international banks. If you focus on fees and processing speed, compare different channels to find the best fit.

Bank transfers remain a safe and reliable mainstream method for remitting from the Philippines to China/mainland China, particularly for large transactions and scenarios requiring compliance assurance. You benefit from fund tracking, strict regulation, and high security, but you must consider fees and processing speeds.

When choosing a remittance method, weigh fees, security, and convenience. Compare exchange rates and fees across channels, prioritizing reputable banks or compliant digital channels to ensure fund security and delivery efficiency.

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Secure, compliant, suitable for large amounts | Higher fees, slower speeds |

| Digital Wallet/Online Services | Low fees, fast delivery | Possible limits and security risks |

FAQs

What basic information is required for bank transfers to China/mainland China?

You need to provide the recipient’s name, bank account number, receiving bank name, and SWIFT code. Some banks also require the recipient’s address and remittance purpose.

How long does it take for remittances to arrive?

Remittances through Hong Kong-licensed banks to China/mainland China typically arrive within 1-3 business days. Delays may occur during holidays or special circumstances.

Are there amount limits for bank transfers?

Single and daily transfer limits are set by the bank. Most Hong Kong-licensed banks support higher limits; consult bank customer service in advance.

How are fees calculated, and are there hidden costs?

Fees include fixed charges and exchange rate markups. Some banks charge documentary stamp taxes. Ask for all fees to avoid hidden costs.

What to do if a remittance fails or is delayed?

Contact bank customer service with the reference code to check progress. Banks will help identify and resolve issues to ensure fund security.

Bank transfers from the Philippines to China/mainland China excel in safety and compliance, but steep fees ($10 plus documentary stamp tax), exchange rate markups (3-4%), and China’s annual forex cap ($50,000) often inflate costs or delay arrivals. These hurdles can disrupt your financial plans or urgent aid. As a user prioritizing secure efficiency, you need a low-cost, compliant platform to streamline cross-border remittances.

BiyaPay delivers the ideal fix, offering real-time exchange rate queries to track USD-to-CNY rates (around 7.05 now) and convert fiat to crypto, dodging adverse swings. Remittance fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From hefty business transfers to daily support, it cuts costs and boosts performance. Don’t let high fees and caps stall your fund flow—join BiyaPay today for a safer remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.