- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Efficiently Manage Bank Transfers from the U.S. to the Philippines: Taxation, Convenience, and Fees

Image Source: unsplash

To efficiently manage bank transfers, you need to focus on channel selection, fees and exchange rates, tax compliance, fund security, and real-time tracking. You can compare different transfer methods, reasonably control costs, ensure information security, and avoid compliance risks. By mastering these key elements, you can enhance cross-border transfer efficiency.

Key Points

- Choosing the right transfer method is the first step in efficiently managing bank transfers. Compare the fees and transfer speeds of different channels to select the most suitable method.

- Pay attention to fees and exchange rates, and understand the fee structures of different providers. Choose platforms with transparent fees to avoid hidden costs.

- Comply with US and Philippine tax regulations to ensure compliant operations. Prepare necessary documents to avoid fines due to non-compliance.

- Select reliable providers to protect fund security. Prioritize financial institutions with international credentials and good reputations.

- Track transfer progress in real-time to stay informed about fund status. Use the online tracking features of mainstream remittance platforms to address delays promptly.

Transfer Method Selection

Image Source: unsplash

When conducting bank transfers from the US to the Philippines, selecting the appropriate method is the first step in efficient management. Different channels vary in fees, transfer speed, and convenience. You can choose the most suitable transfer method based on your needs.

Traditional Banks and Wire Transfers

Traditional bank account transfers and wire transfers are familiar methods for many. You can operate directly through a bank account, debit card, or credit card, with a standardized process and high security. However, you should note that traditional bank transfers typically have higher fees and longer transfer times. Generally, bank transfers take 1-5 business days to complete. If you choose SWIFT international transfers, the transfer time may be 3 to 5 business days. The table below compares the characteristics of common bank transfer methods:

| Transfer Method | Description | Processing Time |

|---|---|---|

| Bank Account Transfer | Directly use a bank account, debit card, or credit card for transfers, with a simple and efficient process but higher fees. | 1-5 business days |

| SWIFT International Transfer | Suitable for large amounts, globally accepted, but involves complex procedures and slower transfers. | 3-5 business days |

| PayPal | Send and receive funds via PayPal, with simple operations and support for USD to PHP conversion. | 1-2 business days |

| MoneyGram | Offers multiple transfer methods, including debit card, credit card, and cash, with secure and reliable services. | Minutes to days |

If you don’t require fast transfers and are transferring large amounts, bank wire transfers are a good choice. However, if you aim to efficiently manage bank transfers, you need to consider fees and transfer times.

Online Remittance Platforms

Online remittance platforms such as Wise, Remitly, Western Union, and MoneyGram offer more flexible options. These platforms typically support multiple payment methods, including bank accounts, credit cards, and debit cards. You can view exchange rates and fees in real-time on the platform, making it easy to compare costs.

- Wise: Fees are fixed or percentage-based, with transfer times depending on the specific method.

- Remitly: Charges upfront transfer fees, with transfer times varying by method.

- Western Union: Charges upfront transfer fees, with transfers typically arriving within minutes to days.

- MoneyGram: Fees are fixed or percentage-based, with transfer times ranging from minutes to days.

You can refer to the table below for fees and transfer times of different platforms:

| Platform | Fee Type | Processing Time |

|---|---|---|

| Wise | Fixed or percentage-based fees | Depends on the transfer method |

| Remitly | Upfront transfer fees | Depends on the transfer method |

| Western Union | Upfront transfer fees | Usually minutes to days |

| MoneyGram | Fixed or percentage-based fees | Minutes to days |

If you seek efficient bank transfer management, online platforms allow better control over costs and time, suitable for daily small or medium transfers.

Mobile Apps and Digital Wallets

Mobile apps and digital wallets provide a more convenient cross-border transfer experience. You can complete transfers anytime, anywhere via mobile or computer. Popular digital wallets in the Philippines include GCash, PayMaya, and Coins.ph. You simply link a funding source (e.g., debit card or bank account) to the recipient’s phone number or wallet account for easy transfers.

- Digital wallets are mobile apps that allow you to store and manage funds electronically.

- You can indirectly use wallets like GCash through partnerships with remittance services (e.g., MoneyGram or Western Union).

- Key advantages include fast speed, ease of use, and low fees.

- Transfers are usually instant or completed within hours, ideal for urgent situations.

- Compared to traditional banks, digital wallets have lower fees.

If you aim to efficiently manage bank transfers, digital wallets and mobile apps are highly recommended options.

Cryptocurrency Transfers

Cryptocurrency transfers have emerged as a new option in recent years. You can use digital currencies like Bitcoin or Ethereum to transfer funds from the US to the Philippines. Cryptocurrency transfers are not restricted by traditional banking systems, have lower fees, and offer fast transfer times. According to market data, cryptocurrency remittances are expected to account for 3-6% of the global remittance market in 2025. In 2024, the Philippines’ remittance total reached $38.34 billion, showing the growing potential of cryptocurrencies in cross-border transfers.

If you are familiar with cryptocurrency operations and want to further reduce costs and increase transfer speed, you can try cryptocurrency transfers. However, you need to be aware of exchange rate fluctuations and platform security.

Convenience and Transfer Speed

When selecting a transfer method, transfer speed and convenience are important considerations. Different methods have significantly different transfer times:

| Transfer Method | Average Transfer Time |

|---|---|

| Western Union | Generally arrives within minutes |

| BPI (First-Time Recipient) | May take up to 2 hours |

| Landbank | Transfers between 10 PM and 1 AM may be delayed |

| SWIFT (International Transfer) | Typically takes 3-5 business days |

| Cash Pickup | Usually available within minutes |

| Bank Deposit (Some Banks) | Some banks process in minutes, others take hours |

| Mobile Wallet Transfer | Usually completed within minutes |

If you need funds to arrive quickly, you can choose Western Union, MoneyGram, digital wallets, or cash pickup methods. If transfer time is not a priority, you can opt for traditional banks or SWIFT international transfers.

Tip: When efficiently managing bank transfers, consider your needs and balance fees, transfer speed, and convenience. For daily small transfers, prioritize online platforms or digital wallets; for large amounts, consider bank wire transfers or SWIFT. Flexible channel selection can effectively enhance your cross-border transfer experience.

Fees and Exchange Rates

Image Source: unsplash

When efficiently managing bank transfers, fees and exchange rates are key factors affecting the final amount received. Different channels and providers have varying fee structures, exchange rate policies, and hidden costs. You need to understand these differences to make informed choices.

Fee Comparison

When choosing a transfer channel, you should first focus on fees. Traditional banks, wire transfers, online remittance platforms, and digital wallets have distinct fee structures. Some platforms charge fixed fees, while others charge a percentage of the transfer amount. You can refer to the table below for fees and received amounts (in USD) from major remittance providers:

| Provider | Exchange Rate | Fees | Received Amount (PHP) | Transfer Time |

|---|---|---|---|---|

| OFX | 56.547 | None | ₱565,469.56 | 1-3 days |

You can see that some platforms like OFX charge no fees, but the actual amount received is still affected by exchange rates. When choosing a provider, don’t just look at surface fees; consider exchange rates and hidden costs as well.

Tip: You can prioritize online services and mobile apps, which typically offer better exchange rates and lower fees than traditional banks. Western Union and MoneyGram are also optimizing fees and exchange rates for international transfers. Before transferring, compare multiple providers to choose the best option.

Exchange Rate Differences

Exchange rates directly determine how many Philippine Pesos you receive. Different providers may offer significantly different rates. You should compare real-time exchange rates across platforms before transferring. The USD to PHP exchange rate is influenced by factors such as interest rates, inflation, and market demand. For example, changes in interest rates affect foreign capital inflows, impacting exchange rates. Currencies in countries with lower inflation rates tend to appreciate. You can predict USD strength by comparing inflation rates in the US and the Philippines.

Historical data shows significant USD to PHP exchange rate fluctuations:

- 2005: PHP 56.28

- 2014: PHP 43.60

- 2021: PHP 50.99

- 2023: PHP 55.46

These data indicate that market conditions and economic factors cause notable exchange rate changes. When transferring, monitoring current rates and market trends can help you achieve higher received amounts.

You can adopt the following strategies to maximize the received amount:

- Understand the impact of exchange rates on transfer amounts.

- Check current currency trends and transfer when rates are favorable.

- Look for platforms specializing in remittances, which may offer better rates than traditional banks.

- Compare exchange rates across banks and platforms before transferring to avoid losses due to rate differences.

Actual Amount Received

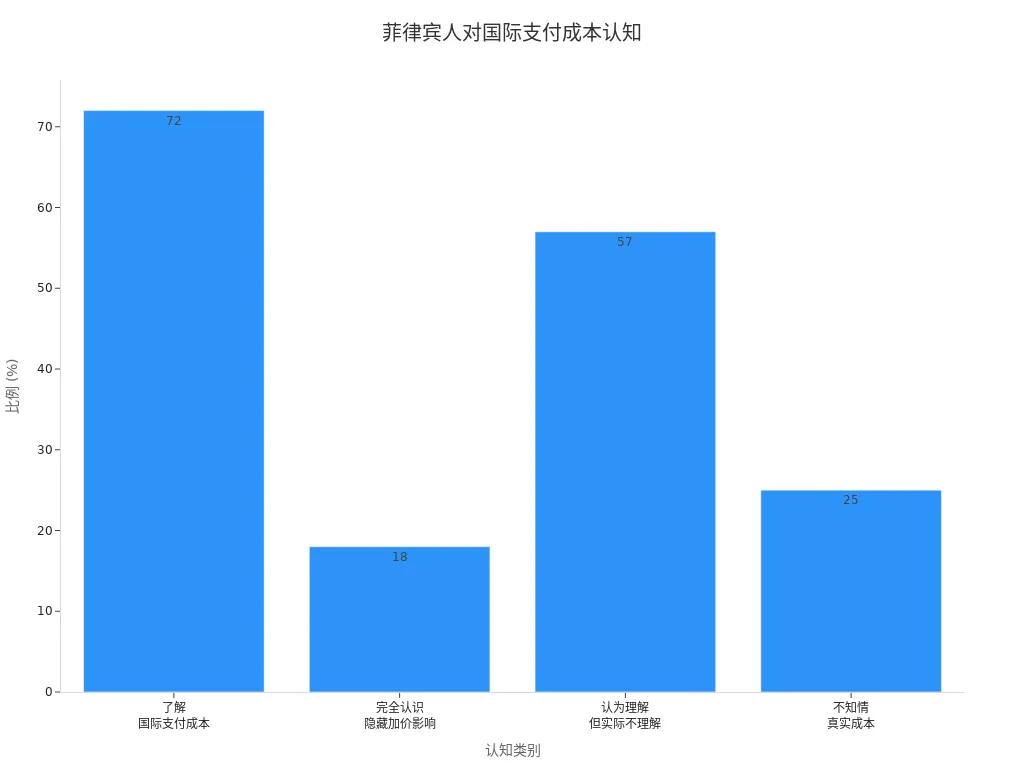

The final amount you receive is affected not only by fees and exchange rates but also by hidden fees and rate markups. In 2023, the Philippines lost PHP 8.37 billion due to hidden foreign exchange fees. Many users have limited understanding of international payment costs, with only 18% fully aware of the impact of hidden exchange rate markups. The table below shows relevant statistics:

| Statistic | Description |

|---|---|

| 2023 Philippines Losses from Hidden Forex Fees | PHP 8.37 billion |

| Percentage of Filipinos Aware of International Payment Costs | 72% |

| Percentage Fully Aware of Hidden Forex Markup Impact | 18% |

| Percentage Who Think They Understand Payment Costs but Don’t | 57% |

| Percentage Unaware of True Remittance Costs | 25% |

When efficiently managing bank transfers, you must pay attention to all possible fees, including exchange rate markups and platform hidden costs. You can maximize the received amount with these methods:

- Compare exchange rates and fees across providers.

- Pay attention to hidden fees and carefully read service terms.

- Choose platforms offering competitive exchange rates to save on transfer costs.

If you master the core knowledge of fees and exchange rates, you can better control cross-border transfer costs and improve fund utilization efficiency.

Taxes and Compliance

US Tax Requirements

When conducting cross-border transfers from the US, you must comply with US tax regulations. The IRS requires that if you own or control foreign bank accounts with funds exceeding $10,000 in a tax year, you must file an FBAR report. The FBAR report must be submitted online separately by April 15 each year. After receiving an international wire transfer, the IRS considers you to have a foreign account, so you must declare it accurately to avoid fines for non-compliance. If you make single or cumulative transfers exceeding $10,000, you must also report to the Financial Crimes Enforcement Network (FinCEN). These regulations help prevent money laundering and tax evasion. When efficiently managing bank transfers, you must prepare relevant documents in advance, including proof of identity and fund source explanations.

- You need to file an FBAR report (for amounts exceeding $10,000).

- You need to report large transfers to FinCEN.

- You need to prepare proof of identity and fund source documents.

Tip: Before transferring, consult a professional tax advisor to ensure all declaration materials are complete and avoid fines due to oversight.

Philippine Declaration Requirements

When receiving funds in the Philippines, you must comply with local foreign exchange and declaration regulations. The Bangko Sentral ng Pilipinas (BSP) allows residents to freely use foreign exchange income from non-trade sources. You can choose to convert foreign exchange to pesos, retain it, or deposit it into a foreign currency account. If you carry more than $10,000 in foreign currency into or out of the Philippines, you must declare it in writing in advance. When purchasing foreign exchange at a bank, you must comply with KYC policies and anti-money laundering rules and submit relevant documents. The table below summarizes key regulations:

| Regulation | Description |

|---|---|

| Foreign Exchange Receipt | Freely use foreign exchange income, convert, retain, or deposit into foreign currency accounts. |

| Foreign Currency Carrying | Amounts exceeding $10,000 require prior declaration. |

| Foreign Exchange Purchase | Must comply with KYC and anti-money laundering policies and submit relevant documents. |

When receiving funds, you should prepare proof of identity and explanations of fund use in advance to ensure smooth declaration.

Compliance and Anti-Money Laundering

During cross-border transfers, you must strictly comply with compliance and anti-money laundering regulations. The Philippine Anti-Money Laundering Act (AMLA) requires all financial transactions to be compliant. You need to conduct Customer Due Diligence (CDD), identifying and verifying identities to ensure information accuracy. For single or cumulative transactions exceeding PHP 500,000 (approximately $10,000), you must submit a suspicious transaction report. The table below lists key compliance requirements:

| Compliance Requirement | Description |

|---|---|

| Anti-Money Laundering Act (AMLA) | All financial transactions must comply with Philippine anti-money laundering regulations. |

| Customer Due Diligence (CDD) | Identify and verify customer identities to ensure information accuracy. |

| Suspicious Transaction Report | Transactions exceeding PHP 500,000 require reporting. |

When handling large transfers, you need to prepare proof of identity, fund source documents, and regularly update customer information. Non-compliance may result in hefty fines. For example, in 2015, a 7% penalty was imposed on international remittances unable to confirm legal US status, with 5% in 2022 and 10% in 2023. If you strictly comply with tax and anti-money laundering regulations, you can effectively mitigate risks and achieve efficient bank transfer management.

Efficient Bank Transfer Security Management

Choosing Reliable Providers

When efficiently managing bank transfers, you should first choose trusted financial institutions. You can prioritize Hong Kong-licensed banks or well-known payment platforms with international credentials and good reputations. This reduces the risk of processing errors and fund loss. When selecting a provider, consider the following:

- Whether the provider has international security certifications and compliance credentials.

- Whether encryption technology is used to protect your funds and personal information.

- Whether there is robust customer support and dispute resolution mechanisms.

Tip: Avoid using unknown or uncertified remittance platforms. Choosing providers with transparent fee structures and clear service terms helps ensure your funds’ safety.

Account and Information Security

When conducting international transfers, protecting your account and personal information is critical. Common security risks include:

- Fraudulent phishing: Emails, texts, or websites impersonating remittance services to trick you into entering sensitive information.

- Malware attacks: Hackers stealing account data and passwords through malware.

- Account takeovers: Hackers accessing accounts for unauthorized transactions.

You can take the following measures to enhance security:

- Regularly update account passwords, using complex and unique passwords.

- Enable two-factor authentication to add an extra layer of account protection.

- Log in and operate only through official channels, avoiding suspicious links.

- Use encrypted email to transmit sensitive information.

- Regularly check account transaction records and contact the bank immediately if anomalies are detected.

You should always operate through trusted devices and networks, avoiding public Wi-Fi for transfer-related activities.

Anti-Fraud Recommendations

When efficiently managing bank transfers, you need to be vigilant about various fraud risks. Common online scams include fake websites, malicious apps, and urgent transfer requests. You can follow these recommendations:

- Carefully verify the recipient’s name, account, and bank information to ensure accuracy.

- Be cautious of urgent or immediate transfer requests, and don’t be rushed.

- Avoid transferring money to strangers or unverified entities.

- Learn about common scam tactics to improve recognition skills.

- If you encounter suspicious transactions or requests, pause operations and contact the provider immediately.

Once a wire transfer is completed, funds are difficult to recover. You should verify information carefully before each transfer to ensure every step is secure and reliable.

Fund Tracking and Support

Real-Time Tracking Progress

When conducting bank transfers from the US to the Philippines, real-time tracking of progress helps you stay informed about fund status, enhancing efficient bank transfer management. Major remittance platforms provide convenient online tracking features. You can enter the transfer reference number on the platform’s website or mobile app to check the processing status in real-time. The table below shows tracking services for common platforms:

| Remittance Platform | Tracking Features |

|---|---|

| Western Union | Offers online tracking options |

| MoneyGram | Offers online tracking options |

| Xoom | Offers online tracking options |

| Customer Service | Obtain transfer status updates via customer service |

When using these platforms, you can obtain the latest progress by entering the relevant information. If delays occur, common reasons include transfers initiated at the end of a business day, SWIFT network intermediary bank processing, different countries’ transfer regulations, global events (e.g., pandemics), bank holidays, weekend transfers, and time zone differences. You can avoid these peak times to reduce waiting periods.

Tip: Before transferring, check the target country’s bank operating hours and holiday schedules to avoid unnecessary delays.

Customer Support Channels

When you encounter transfer issues or need assistance, you can access help through various customer support channels. Major remittance platforms offer the following support methods:

- Live chat support: You can get immediate assistance on the platform’s website or mobile app.

- Phone support: You can call customer service directly to speak with a representative for personalized solutions.

- Email support: You can send detailed inquiries, and the platform will respond via email.

- Frequently Asked Questions (FAQ): You can find answers to common questions on the platform’s website for quick self-service solutions.

When choosing support channels, you can select based on the urgency of the issue and personal preferences. For complex or urgent issues, prioritize live chat or phone support for faster resolutions.

To efficiently manage bank transfers, you need to focus on the following:

- Understand all fees and exchange rates to optimize each transfer’s cost.

- Comply with US and Philippine regulations to ensure compliant operations.

- Choose reliable international remittance providers to protect fund security.

- Use secure payment methods to prevent personal information leaks.

- Stay informed about policy and market changes to adjust transfer strategies promptly.

You can do the following:

- Carefully read terms before transferring to understand all fees and exchange rates.

- Choose providers with transparent fees to avoid hidden costs.

- Keep detailed transfer records for compliance checks.

You can also follow financial news to stay updated on new federal remittance taxes and tariff policies and compare the latest offerings from different providers. This way, you can continuously optimize your transfer experience.

FAQ

How quickly can a bank transfer from the US to the Philippines arrive?

If you choose online remittance platforms or digital wallets, transfers can arrive in minutes. Traditional bank wire transfers typically take 1-5 business days. You can select the appropriate method based on urgency.

How can I avoid high transfer fees?

You can compare fee structures across different platforms. Prioritize providers with transparent fees and favorable exchange rates. Understanding all potential hidden fees can effectively save costs.

Are there limits on transfer amounts?

For transfers through regulated channels, single or cumulative amounts exceeding USD 10,000 require declaration. You should prepare relevant documentation in advance to ensure compliance and avoid delays or investigations.

How can I ensure fund and information security?

You should choose regulated Hong Kong-licensed banks or well-known platforms. Enable two-factor authentication and regularly change passwords. Avoid operating on public networks to prevent information leaks.

Who can I contact if I encounter transfer issues?

You can get help through the platform’s online customer service, phone, or email. For urgent issues, prioritize live chat or phone support for faster resolution of your concerns.

Efficiently handling bank transfers from the US to the Philippines streamlines your finances, yet cross-border remittances often grapple with steep fees, volatile exchange rates, and the 2025 remittance tax (3.5% federal levy) compliance hurdles. These can erode received amounts, causing delays or surprise costs. As a convenience-driven global user, you merit a low-cost platform to ease processes while ensuring regulatory adherence and security.

BiyaPay delivers the perfect fix, with real-time exchange rate queries for instant USD-to-PHP monitoring (around 57.5 now), plus fiat-to-crypto swaps to evade rate dips. Fees for remittances are merely 0.5% minimum, zero for contract orders, reaching same-day arrivals across most countries and regions. Plus, bypass overseas account needs to trade US and Hong Kong stocks on-site, nimbly augmenting transfer funds.

Enroll in BiyaPay straight away to harness these perks. From navigating new tax rules to routine sends, it boosts your operations and returns. Shun fee and tax pitfalls in your cross-border aid—sign on with BiyaPay today for a sharper remittance era!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.