- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Efficiently Convert US Dollars to Philippine Pesos: Exchange Rates, Fees, and Remittance Platforms Explained

Image Source: pexels

When you exchange USD to Philippine Peso (converter), you can choose efficient online platforms or Hong Kong-licensed banks. You need to pay attention to real-time exchange rates and fees to avoid unnecessary losses. You can quickly obtain the latest data through authoritative currency converters. Please prepare the recipient’s bank account details and SWIFT code in advance to ensure the remittance arrives smoothly. You should also ensure the platform’s legal compliance to protect the security of your funds.

Key Points

- Choose online platforms for USD to PHP exchange, which typically offer lower fees and faster transfer times.

- Focus on real-time exchange rates and fees, using authoritative tools to obtain the latest data and avoid unnecessary losses.

- Ensure you have the recipient’s bank account details and SWIFT code to guarantee smooth remittance delivery.

- Select legally compliant platforms to ensure fund security and avoid losses due to operational errors.

- Use multi-platform comparison to choose platforms with better exchange rates, plan exchange timing wisely, and reduce costs.

USD to Philippine Peso Exchange Methods

Image Source: pexels

Online Platforms vs. Traditional Banks

When exchanging USD to Philippine Peso, you can choose online remittance platforms or Hong Kong-licensed banks. Online platforms like Remitly, Airwallex, and WorldFirst typically offer lower fees and faster transfer times. You can exchange currency anytime through these platforms, whether on weekdays or holidays, enjoying 24-hour services. Platforms also support limit orders and AI-driven exchange rate predictions to help you seize the best exchange opportunities.

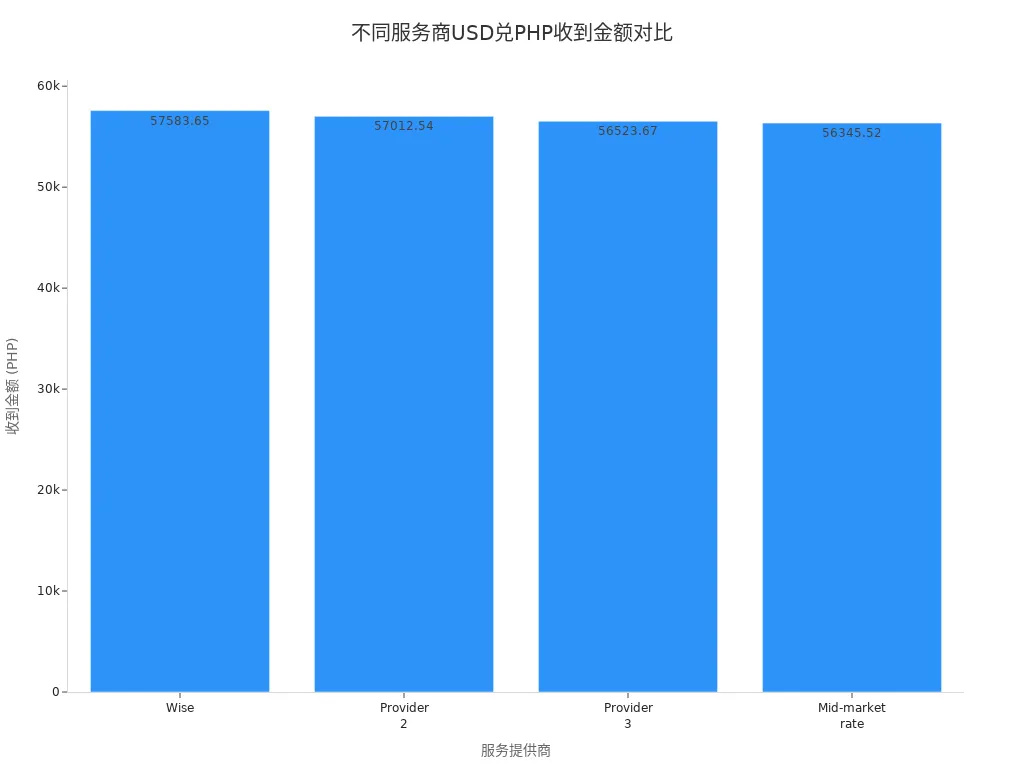

The table below compares the exchange rates, transfer fees, and actual received amounts across different providers (in USD), allowing you to clearly understand each platform’s advantages:

| Service Provider | Exchange Rate | Transfer Fee | Amount Received |

|---|---|---|---|

| Wise | 57.5836 | 0.00 USD | 57,583.65 PHP |

| Provider 2 | 57.1262 | 1.99 USD | 57,012.54 PHP |

| Provider 3 | 56.5237 | 0.00 USD | 56,523.67 PHP |

| Mid-market rate | 57.0680 | 12.66 USD | 56,345.52 PHP |

You can further compare the actual amounts received across platforms using the chart below:

Hong Kong-licensed banks, while highly secure, typically charge higher fees and have longer processing times. The table below shows the differences in fees and processing times between online platforms and traditional banks:

| Platform | Fee Type | Processing Time |

|---|---|---|

| Remitly | Lower fees for bank deposits | Faster processing time |

| Traditional Bank | Potentially higher fees | Longer processing time |

When choosing a platform, you can prioritize those with high customer satisfaction. For example, Wise has received over 155,400 five-star ratings, indicating a positive user experience.

Innovative features of online platforms are also worth noting:

- You can perform real-time exchanges anytime without waiting for bank operating hours.

- Platforms consistently offer market-leading exchange rates, reducing exchange rate losses.

- You can set limit orders to automatically exchange at your desired rate.

- AI analysis and prediction tools help you optimize exchange timing.

Remittance Process Overview

When exchanging USD to Philippine Peso, you need to prepare the recipient’s bank account details and SWIFT code in advance. This ensures the remittance arrives smoothly. After entering the relevant information on the platform, the system will automatically calculate the exchange rate and fees, displaying the actual amount to be received.

The remittance process typically includes the following steps:

- You log in to the online platform or the remittance system of a Hong Kong-licensed bank.

- You enter the recipient’s details, including bank account number and SWIFT code.

- You select the remittance amount, and the platform automatically displays the real-time exchange rate and fees.

- You confirm the information is correct and submit the remittance request.

- The platform processes the remittance, and the funds arrive within the specified time.

You need to note that traditional banks’ processing times may be affected by cut-off times, weekends, and holidays. The involvement of intermediary banks may also cause delays in delivery. Online platforms, however, can provide faster transfer times, reducing wait times.

Tip: When remitting, ensure all information is accurate to avoid delays or returns due to errors. You should also choose legally compliant platforms to ensure fund security.

Throughout the USD to Philippine Peso exchange process, it is recommended to prioritize platforms with low fees, fast transfers, and high customer ratings, while planning remittance timing wisely to minimize unnecessary losses.

Exchange Rate Inquiry and Analysis

Image Source: unsplash

Real-Time Exchange Rate Access

When exchanging USD to Philippine Peso, you should first focus on real-time exchange rates. Accurate exchange rate information can help you make better exchange decisions. You can use professional currency converters or online platforms to check the latest data anytime. The table below shows the current USD to PHP exchange rates and features of major platforms:

| Platform | Current Exchange Rate | Features |

|---|---|---|

| XTransfer | 1 USD = 56.859 PHP | Offers real-time rates, AI analysis, historical data, and tracks economic data and policy trends. |

| Wise | 1 USD = 57.07 PHP | Provides mid-market rates, multi-currency accounts, and real-time rate tracking. |

You can choose these platforms to access the latest exchange rate information anytime. XTransfer emphasizes AI predictions and historical data analysis, while Wise supports multi-currency accounts and real-time rate tracking. Before exchanging, it is recommended to compare rates across platforms to select the one with the best rate and minimize losses.

Tip: When checking exchange rates, it’s advisable to focus on whether the platform displays mid-market rates to more accurately understand the actual exchange cost.

Historical Exchange Rate Reference

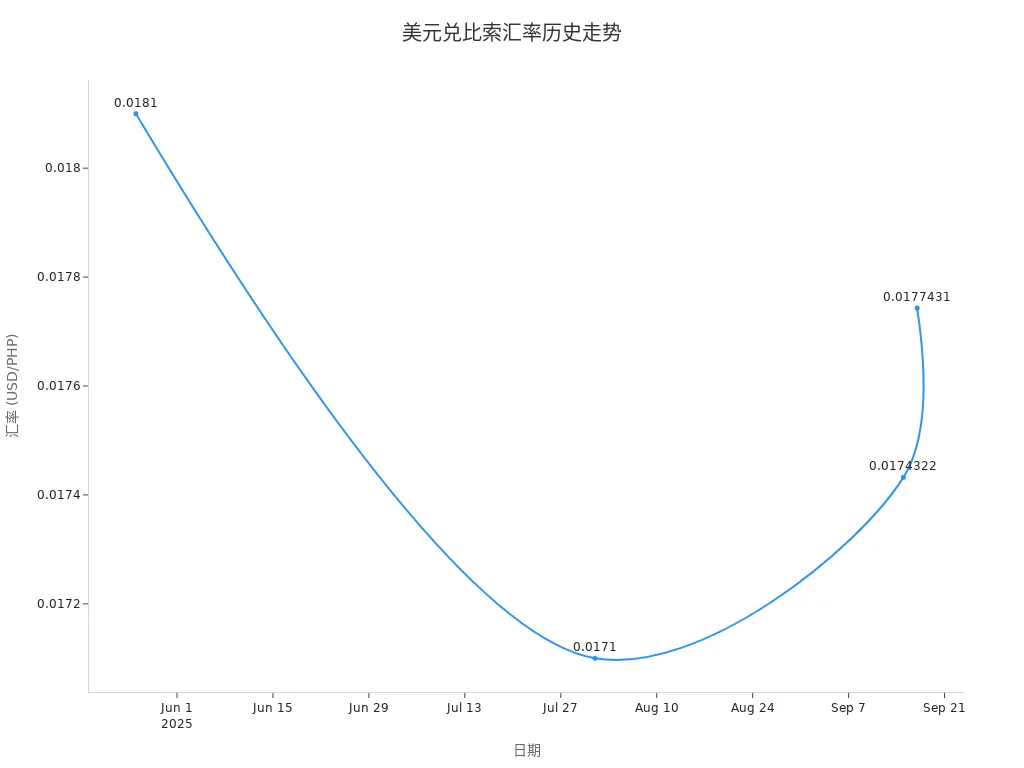

When analyzing USD to Philippine Peso exchanges, you should not only look at real-time rates but also refer to historical data. Over the past five years, the USD to PHP exchange rate has remained relatively stable, fluctuating between 55 and 57. This stability indicates that the exchange rate is resilient, with limited impact from economic and policy changes.

- You can observe high and low points and trends through historical exchange rate charts.

- Understanding past trends can help you predict potential future exchange rate movements.

The table below shows some historical exchange rate data:

| Date | Exchange Rate | Change |

|---|---|---|

| 2025-09-17 | 0.0177431 | High |

| 2025-09-15 | 0.0174322 | Low |

| 2025-05-26 | 0.0181 | Highest |

| 2025-08-01 | 0.0171 | Lowest |

You can combine the line chart below to visually understand the trend of exchange rate changes over time:

When planning your exchange, it is recommended to combine historical data with current economic conditions to choose a more suitable time for exchanging USD to Philippine Peso.

Fees and Transfer Speed

Fee Analysis

When exchanging USD to Philippine Peso, the fee structure is a key factor affecting costs. Different payment methods and platforms charge varying fees. You can use the table below to understand the fee structures of mainstream remittance methods:

| Payment Method | Fee Structure |

|---|---|

| Direct Debit and Debit Card | $3.50 + 0.90% |

| Wire Transfer | $3.50 + 0.75% |

| Credit Card | $3.50 + 2.60% |

When choosing a payment method, it is recommended to prioritize direct debit or wire transfers, as these methods have lower fees. Credit cards, while convenient, have the highest fees and are suitable for emergencies.

You also need to be cautious of hidden fees. Many platforms advertise “no fees” but charge additional costs through exchange rate markups. You can refer to the following common hidden fees:

- In 2023, Filipinos lost PHP 83.7 billion due to hidden foreign exchange fees.

- 72% of Filipinos say they “somewhat” or “fully” understand international payment costs, but only 18% fully recognize the impact of hidden forex markups.

- An advertised “no-fee” international transfer (USD 10,000, ~PHP 578,000) may incur an additional PHP 21,187 due to a 3.6% markup.

Before remitting, it is recommended to carefully check the platform’s actual exchange rate and final amount received. Don’t focus solely on advertised fees; also check for exchange rate markups. You can use the platform’s rate calculator or third-party tools for comparison to ensure cost transparency.

Tip: When choosing a platform, prioritize those with clear fee structures and transparent exchange rates to avoid unnecessary losses due to hidden fees.

Transfer Time Comparison

When exchanging USD to Philippine Peso, transfer speed is also a key consideration. Different platforms and payment methods have varying processing times. You can use the table below to understand the average processing times of mainstream platforms and banks:

| Platform/Bank | Processing Time |

|---|---|

| Remitly (Bank Transfer) | Typically slower, may take 1–5 working days |

| Remitly (Cash Pickup) | Typically faster, sometimes completed in minutes |

| Traditional Bank | Typically takes 1–5 working days |

| Western Union | Sometimes completed in minutes |

| Xoom | Sometimes completed in minutes |

When choosing a remittance method, you can select based on the recipient’s actual needs. If the recipient urgently needs funds, opt for cash pickup or platforms like Western Union or Xoom, which can often complete transfers in minutes. If there’s no urgency, bank transfers are cheaper but take longer.

Transfer speed can also be affected by the following factors:

- Bank processing times and cut-off times

- Presence of intermediary banks

- Weekends and holidays

- Time zone differences

- Compliance verification

When using Hong Kong-licensed banks for USD to PHP exchanges, it typically takes 1–5 working days. Banks process transfers based on their own schedules and cut-off times. If transfers occur during weekends or holidays, delivery times may be extended. Some platforms offer expedited services, but fees may be higher.

Note: Before remitting, it’s advisable to understand the platform’s transfer times and factors that may affect delivery speed to plan fund flows and avoid delays impacting the recipient’s plans.

You can also pay attention to promotional rates and expedited transfer options offered by platforms. Some platforms provide special rates or fee waivers for new customers or first-time transfers. For example:

| Service Name | Promotional Rate | Notes |

|---|---|---|

| Pangea | Special rate | Applies to first transfer for new customers, up to $500 USD, then standard rates apply. |

| Xoom | Best rate | Offers the best rate for receiving options. |

| Ria | Exclusive rate | First transfer with code: HELLORIA, $0 fee. |

| BOSS Money | $0 fee for first three transactions | Future transfer fees start from $0.00. |

You can take advantage of these promotions to reduce remittance costs and speed up transfers. Some platforms also offer limited-time expedited transfer services, ideal for users with urgent needs.

Tip: When choosing a platform, pay attention to new customer promotions and special rates to save on fees and improve transfer efficiency.

Platform Security and Compliance

Risk Prevention

When choosing a platform for USD to Philippine Peso exchanges, you must prioritize fund security. Legitimate platforms are subject to strict oversight by multiple regulatory authorities. The table below outlines major regulatory bodies and their requirements:

| Regulatory Authority | Related Requirements |

|---|---|

| Anti-Money Laundering Council of the Philippines (AMLC) | Transactions exceeding PHP 500,000 (~$10,000 USD) must be reported, requiring detailed information on fund sources and transfer purposes. |

| U.S. Department of the Treasury | Under the Bank Secrecy Act, financial institutions must report transactions exceeding $10,000 USD. |

When using mainstream online platforms or Hong Kong-licensed banks, you can benefit from multiple layers of security. Platforms typically implement the following measures:

- User-friendly payment systems allow flexible fund management, suitable for remote workers and freelancers.

- Low fees and instant processing times enhance user experience, reducing wait times and costs.

- You can withdraw funds directly to local bank accounts or crypto wallets, increasing control over your funds.

When operating, always verify the platform’s credentials and regulatory information to ensure secure and reliable fund transfers.

Compliance Requirements

When exchanging USD to Philippine Peso, you need to comply with relevant laws and regulations. Different platforms impose varying limits on remittance amounts, typically between $2,000 and $10,000. You need to prepare identification and proof of fund sources, and platforms will conduct reviews based on anti-money laundering regulations. Some platforms only accept specific currencies, such as USD.

You should also pay attention to the following compliance details:

- For single transactions exceeding $10,000, platforms will report to relevant regulatory authorities to ensure the legality of fund sources.

- Daily transactions exceeding PHP 500,000 (~$10,000 USD) also require reporting to prevent money laundering risks.

- If the total remittances in a year exceed $15,000, the excess may be subject to gift tax. Philippine recipients are generally exempt from gift tax if the remittance comes from someone residing abroad long-term.

- Recipients may sometimes need to pay related fees and taxes imposed by the Philippine government.

Before remitting, it is recommended to thoroughly understand the platform’s compliance requirements and prepare necessary documents in advance to avoid delays or returns due to incomplete materials. Choosing compliant and transparent platforms can effectively reduce financial risks and protect your interests.

Cost-Saving Tips and Precautions

Mitigating Exchange Rate Fluctuations

When exchanging USD to Philippine Peso, exchange rate fluctuations may affect the actual amount received. To minimize losses, you can adopt the following strategies:

- You can exchange in batches to avoid the exchange rate risks of large one-time exchanges.

- You can monitor promotional rates on platforms and choose optimal exchange timing.

- You can use currency hedging tools, such as futures or options, to lock in future rates and reduce uncertainty.

- You can consider establishing production facilities locally to reduce sensitivity to exchange rate fluctuations.

- You can also invest in U.S. market S&P 500 index funds to diversify foreign currency risks.

Tip: Before exchanging, it’s advisable to closely monitor exchange rate trends and economic policy changes to plan exchange timing effectively.

Cost-Saving Methods

When performing USD to Philippine Peso exchanges, you can save costs through the following methods:

- You can compare rates across multiple platforms, researching and comparing exchange rates and fees.

- You can notify Hong Kong-licensed banks in advance to negotiate better rates or fee waivers.

- You should avoid exchanging currency at airports, hotels, or tourist areas, as these typically offer unfavorable rates.

- You can opt to withdraw PHP at local ATMs in the Philippines, which is often more cost-effective than exchanging in the U.S.

- You should prioritize reputable exchange services to ensure fund security.

- You should pay attention to all fees during exchanges, including transaction fees and exchange rate spreads, to avoid hidden costs.

Common operational mistakes can also increase costs:

- Many people focus only on advertised rates, ignoring actual exchange rate spreads.

- Some underestimate fees and transaction costs, leading to reduced received amounts.

- Some users fail to research rates in advance, exchanging at unfavorable times and increasing losses.

Recommendation: Before each exchange, thoroughly review all fee details, choose transparent and compliant platforms, and avoid unnecessary losses due to operational errors.

When exchanging USD to Philippine Peso, you can reduce costs and enhance fund security by selecting suitable platforms and monitoring real-time exchange rates. You should proactively develop cash flow management strategies, using tools like forex forward contracts and interest rate swaps to optimize fund flows for businesses and individuals. You should also comply with regulatory requirements and plan exchange methods flexibly to ensure every fund transfer is efficient and reliable.

FAQ

What recipient information is needed for USD to Philippine Peso exchanges?

You need to prepare the recipient’s bank account details and SWIFT code. This ensures smooth remittance delivery and reduces delay risks.

Which is better for exchanging USD: online platforms or Hong Kong-licensed banks?

You can choose online platforms for lower fees and faster transfers. Hong Kong-licensed banks offer high security but typically have higher fees and longer processing times.

Do exchange rates change daily?

You can observe daily changes in the USD to PHP exchange rate. You can use currency converters to check the latest data and choose optimal exchange timing.

Are there limits on remittance amounts?

On most platforms, single remittances typically do not exceed 10,000 USD. For amounts exceeding the limit, platforms will require proof of fund sources and purposes.

How can I avoid hidden fees?

You can carefully review the platform’s exchange rates and fees. Choose platforms with transparent fee structures to avoid losses due to exchange rate markups or other hidden costs.

Converting USD to Philippine peso (PHP) demands focus on live rates (current USD/PHP ~57.01), fees (online 0-12.66 USD, banks $10-$35), and hidden markups (3.6% can erode ~$366 on $10,000), often trimming net receipts. China’s annual forex cap ($50,000) requires compliant planning. As an efficiency-driven user, you need a low-cost, transparent platform to streamline conversions.

BiyaPay offers a complete solution, with real-time exchange rate queries to monitor USD-to-PHP rates (around 57.01 now) and swap fiat to crypto for optimal timing. Fees start at just 0.5%, with zero charges for contract orders, spanning same-day delivery to most countries and regions. Plus, trade US and Hong Kong stocks directly on the platform without overseas accounts, adeptly managing converted funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family remittances to business payouts, it slashes costs and amps up speed. Don’t let fees and rate swings diminish your fund value—join BiyaPay today for a more secure conversion path!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.