- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Most Suitable Way to Remit Money from the UK to the UAE?

Image Source: unsplash

When transferring money from the UK to the UAE remittance, online banking is currently the most popular choice. Many users favor this method for the following reasons:

- Fast transaction speeds, often with instant arrival

- Competitive exchange rates with low handling fees

- Real-time tracking of transfer status with notifications

When choosing a remittance method, you should consider key factors such as amount, transfer speed, and convenience to find the most suitable solution.

Key Points

- When selecting a remittance method, consider handling fees and exchange rates. Online remittance services typically have low fees and rates close to the market price.

- Transfer speed is a critical factor. Online services can achieve transfers within minutes, while bank transfers may take 5 to 7 business days.

- Ensure you choose legally compliant channels. Pay attention to the provider’s security measures to protect fund safety.

- When preparing remittance documents, verify recipient and bank information to ensure a smooth transfer.

- Based on your needs, balance fees, speed, convenience, and security to select the most suitable remittance method.

Mainstream Remittance Methods

Image Source: pexels

When transferring money from the UK to the UAE, you can consider the following mainstream methods. Each method has distinct features and applicable scenarios, and understanding these can help you choose the best remittance method.

Bank Transfer

Bank transfer is a traditional method familiar to many. You can transfer funds directly to the recipient’s account in the UAE through a UK local bank or a licensed Hong Kong bank. Bank transfers are suitable for large amounts and scenarios requiring high security. Typically, banks charge a fixed handling fee (e.g., USD 20–40), and exchange rates may not be as favorable as online services. The transfer time is generally 1–3 business days.

Tip: If you need to transfer large amounts, bank transfers are more suitable due to their robust compliance reviews for large transactions.

Online Remittance Services

Online remittance services (e.g., Paysend, TransferWise) have become very popular in recent years. You can complete transfers using a mobile phone or computer. Online services typically have lower handling fees (e.g., USD 2–10 per transfer) and exchange rates closer to the market price. Transfers are fast, with some platforms achieving arrival within minutes. These are suitable for users seeking speed and low costs.

International Money Order

An international money order is a more traditional paper-based remittance method. You can purchase an international money order at a bank and mail it to the recipient in the UAE. The recipient then presents the money order to a local bank for exchange. International money orders are suitable for users who are not in a rush for funds to arrive and distrust electronic channels. Handling fees are generally USD 10–30, with a longer arrival time, potentially 1–2 weeks.

Remittance Agents

Remittance agents (e.g., Western Union) have branches worldwide. You can visit an agent’s branch, fill out information, and pay in cash or by card, and the recipient can withdraw cash at a branch in the UAE. Agents are suitable for scenarios where the recipient lacks a bank account or needs cash. Handling fees vary by amount, typically USD 5–20, with fast transfer speeds, some services offering instant arrival.

Note: When choosing a remittance method, consider factors like amount, transfer speed, and convenience to find the most suitable solution.

Fee and Speed Comparison

Image Source: pexels

Handling Fees and Exchange Rates

When choosing a remittance method, handling fees and exchange rates are the most direct factors affecting costs. Bank transfers typically charge higher fixed handling fees, around USD 20–40 per transfer, with exchange rates that may not be as competitive as market rates. Online remittance services have lower fees, with some platforms charging only USD 2–10 per transfer, and exchange rates closer to real-time market rates. International money orders have handling fees of USD 10–30, plus mailing costs. Remittance agents’ fees vary by amount, typically USD 5–20, with fluctuating exchange rates.

Tip: If you want to save costs, prioritize online remittance services. Compare handling fees and exchange rates across platforms to find the best solution.

Transfer Time

Transfer speed directly impacts the recipient’s experience. You can refer to the following table to understand the average transfer times for different methods:

| Remittance Method | Average Time |

|---|---|

| Online Services | A few minutes |

| Traditional Bank Transfer | 5 to 7 business days |

The greatest advantage of online remittance services is their speed. After operating via mobile or computer, funds typically arrive within minutes. Bank transfers take longer, averaging 5 to 7 business days. International money orders have even longer arrival times, potentially 1–2 weeks. Remittance agents’ transfer speeds fall in between, with some services offering instant arrival, though others may take a few hours.

When choosing a remittance method, if you have high requirements for transfer speed, prioritize online remittance services. This ensures the recipient receives funds quickly, reducing wait times.

Security and Compliance

Regulatory Requirements

When choosing a remittance method, you must focus on security and compliance. Banks, online remittance services, and agents use various security measures to protect your funds. For example, banks and payment companies use encryption technologies, including AES-256 encryption for data at rest and TLS 1.2 and TLS 1.3 for data in transit. Some platforms also use mobile-to-individual matching technology to prevent unauthorized fraudulent activities.

In the UAE, all companies providing remittance services must obtain relevant licenses. Financial institutions must comply with KYC (Know Your Customer) and anti-money laundering regulations. Companies applying for licenses need to submit financial statements, business plans, and director lists. When remitting, ensure you choose legally compliant channels to effectively protect your funds.

Failure to comply with regulations may lead to severe consequences. The following table shows common legal penalties:

| Type | Details |

|---|---|

| Civil Penalties | Include written warnings, fines (USD 13,600 to USD 1,360,000), restrictions on working in regulated industries, etc. |

| Criminal Penalties | Include imprisonment and fines (USD 27,200 to USD 272,000) for failing to report suspicious transactions. |

| Other Consequences | May include arrests of management, restrictions on authority, license revocation, etc. |

User Information and Documents

When processing a remittance, you need to prepare relevant documents. Requirements vary slightly by method, but typically include the following information:

- Recipient’s name and address

- Bank name and address

- Bank Identification Code (SWIFT BIC)

- International Bank Account Number (IBAN)

- National Clearing Code (NCC), applicable for payments without IBAN

The following table summarizes common required information:

| Required Information | Description |

|---|---|

| Recipient’s Name and Address | Provide the recipient’s name and address |

| Bank Name and Address | Provide the receiving bank’s name and address |

| Bank Identification Code (SWIFT BIC) | Provide the bank’s SWIFT BIC code |

| International Bank Account Number (IBAN) | Provide the recipient’s IBAN number |

| National Clearing Code (NCC) | For payments without IBAN, provide the NCC and recipient’s bank account number. |

When preparing documents, verify all information in advance to ensure a smooth remittance. Legally compliant operations not only protect your funds but also avoid unnecessary legal risks.

Amount and Frequency Limits

Limits by Method

When choosing a remittance method, you must understand the amount limits of different channels. Each method has different regulations for single or daily transfer amounts. The following table summarizes the maximum transfer limits for common channels:

| Institution Type | Maximum Transfer Limit | Minimum Transfer Limit | Notes |

|---|---|---|---|

| General Banks | USD 32,000–USD 64,000 | N/A | Depends on the bank and account type |

| Licensed Hong Kong Bank Premium Accounts | USD 12,800,000 | N/A | Only for specific account types |

| Online Transfer Services | Set by the provider | N/A | Limits vary significantly by platform |

| International Money Orders | Set by the bank | N/A | Monitored by financial regulators |

When transferring from the UK to the UAE, there are no legal amount limits, but providers set daily, monthly, or annual limits based on risk management. Some banks set single transfer limits between USD 32,000 and USD 64,000. Premium accounts have higher limits, suitable for large fund needs. Online remittance services have flexible limits, which you should check with the platform.

Tip: For large remittances, consult the bank or platform’s customer service in advance to avoid transfer failures due to exceeding limits.

Frequency Regulations

When remitting, you also need to consider frequency limits. Most banks and online services set caps on the number of daily or monthly transfers. Common regulations include:

- General banks typically allow 3–5 international transfers per day.

- Online remittance services often have limits on total daily or monthly amounts but fewer restrictions on frequency.

- International money orders, due to their complex process, are recommended for occasional large transfers.

When choosing a remittance method, plan your transfer arrangements based on your frequency and amount needs. If you need frequent small transfers, online services are more flexible. For occasional large transfers, bank channels are more suitable.

Key Points for Choosing a Remittance Method

How to Choose a Remittance Method

When transferring money from the UK to the UAE, first clarify your core needs. Common priorities include cost, transfer speed, convenience, and security. The following table summarizes the aspects users most often consider when choosing a remittance method:

| Priority | Description |

|---|---|

| Cost | Fees and exchange rates directly affect the received amount; low fees may come with unfavorable rates, requiring comprehensive comparison. |

| Speed | For urgent transfers, choose instant or same-day services, which may have higher fees. |

| Convenience | Multiple withdrawal methods (e.g., cash, bank deposit, mobile wallet) provide flexibility for recipients. |

| Security | Choose reputable providers with encryption and identity verification processes to ensure fund safety. |

Based on your situation, weigh these factors. For example, if you prioritize transfer speed, consider TransferGo’s instant transfer services. If cost is your main concern, compare handling fees and exchange rates across platforms.

Tip: Comparing real-time exchange rates and fees across providers helps avoid losses due to poor choices.

Cost Priority

If you aim to minimize remittance costs, prioritize platforms with low handling fees and exchange rates close to the market price. Many online remittance services (e.g., Xoom) offer significant advantages in fees and rates. When using Xoom, you can see the exact fees and received amount for each transfer in real-time, and the platform strives to provide the best rates. You can use the platform to calculate fees and rates anytime for clarity.

- Recommendations for prioritizing cost:

- Compare handling fees and exchange rates across platforms.

- Note that some low-fee platforms may have less favorable rates, so calculate total costs comprehensively.

- Online services are typically more cost-effective than traditional banks and international money orders.

Speed Priority

If you urgently need the recipient to receive funds, transfer speed is your primary consideration. TransferGo’s app and card transfer methods can achieve arrival within minutes, with some platforms promising completion in 2–3 minutes. Remittances via Xe also offer same-day arrival options.

- Recommendations for prioritizing speed:

- Choose services supporting instant or same-day transfers.

- Note that some fast services may charge higher fees.

- Suitable for urgent family support, emergency medical needs, etc.

Convenience Priority

If you want simple operations and flexible receiving methods, prioritize platforms with high convenience. Many online remittance services support mobile and computer operations, with recipients able to choose bank accounts, cash withdrawals, or mobile wallets. Remittance agents (e.g., MoneyGram) also provide cash withdrawal services for recipients without bank accounts.

- Recommendations for prioritizing convenience:

- Choose platforms supporting multi-device operations.

- Consider the recipient’s withdrawal convenience in the UAE.

- Suitable for recipients unfamiliar with banking or without bank accounts.

Security Priority

If fund safety is your top concern, choose regulated, reputable providers. Licensed Hong Kong banks, well-known online remittance platforms, and large agents (e.g., MoneyGram) use multiple encryption and identity verification measures to ensure fund safety. You can check their security technologies and compliance qualifications on their official websites.

| Remittance Method | Security Description |

|---|---|

| Online Remittance | Offers encrypted transmission and multi-factor authentication, high security. |

| Bank Deposit | Processed directly by regulated banks, strong compliance and security. |

| Bank Transfer | Electronic payments with direct fund arrival, suitable for large amounts and high security needs. |

| Remittance Agents | Use global networks and security measures, suitable for cash receipt needs. |

Note: When choosing a remittance method, verify the provider’s qualifications and security measures to avoid fund risks.

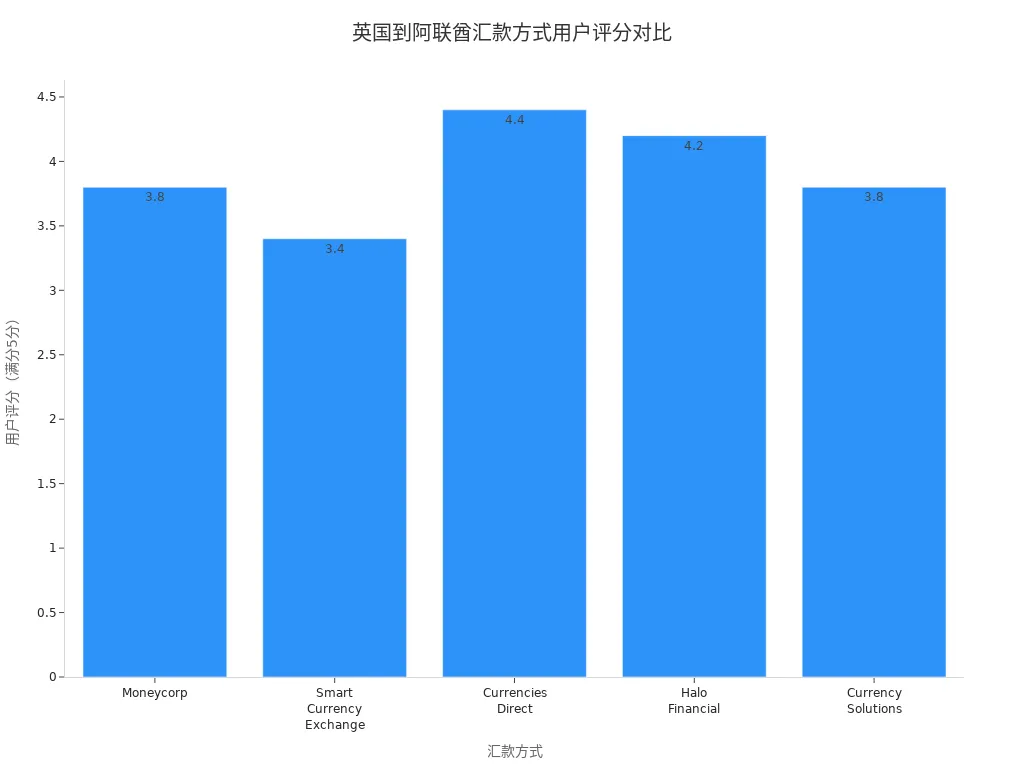

You can refer to the chart above; user ratings for different remittance methods vary significantly. Platforms like Currencies Direct and Halo Financial receive high user ratings due to their quality service and good experience.

Summary: When choosing a remittance method, consider your needs and weigh cost, speed, convenience, and security. The rise of digital remittance platforms and technological innovation gives you more options. Regardless of your priority, compare providers’ actual performance in advance to ensure fund safety, timely arrival, and convenient operations.

Precautions

Common Issues

When transferring money from the UK to the UAE, you may encounter practical issues. Understanding these can help you prepare and reduce unnecessary hassle.

- Exchange Rate Fluctuations: When converting GBP to AED, exchange rates may fluctuate, affecting the final received amount. You can choose to remit when rates are favorable or use rate-locking services.

- Fee Issues: Handling fees vary significantly across methods and institutions. You need to compare fee structures in advance to choose the best solution.

- Transfer Methods: Traditional bank transfers are slower and more expensive. You can consider online remittance platforms for faster and cheaper experiences.

- Compliance Requirements: You need to provide information on fund sources and purposes. Incomplete compliance documents may lead to transfer delays or rejections. Prepare relevant proof in advance.

Tip: Before choosing a remittance channel, thoroughly understand the platform’s requirements and processes to avoid delays due to incomplete information.

Risk Warnings

When conducting international remittances, you must be aware of potential risks. Proactive prevention can effectively protect your funds.

- Foreign Exchange Risk: Exchange rate fluctuations may reduce the received amount. You can monitor economic indicators and time your remittance to minimize losses.

- Transaction Delays: International transfers may be delayed due to bank reviews or compliance checks. You can choose platforms with fast transfer speeds to reduce wait times.

- Fraud Risk: Some unregulated platforms pose fraud risks. Choose regulated Hong Kong banks or reputable online remittance services and verify their qualifications to protect funds.

- Hidden Fees: Some providers may charge additional fees during the remittance process. Carefully review fee disclosures to understand all costs.

Before remitting, adopt effective foreign exchange risk management measures, reasonably predict rate changes, and choose compliant, secure channels. This minimizes risks and ensures funds arrive smoothly.

When transferring money from the UK to the UAE, you can refer to the following table to quickly understand the pros and cons of mainstream methods:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | Secure and reliable, convenient | Higher fees, potentially complex processes |

| Traditional Remittance Services | Many physical branches, fast arrival | Inconsistent fees, withdrawals limited by business hours |

| Online Transfer Services | Low fees, convenient, fast | Recipients need a bank account, limited countries |

You should consider your needs, focusing on fees, speed, security, and convenience, to rationally choose the most suitable remittance method. Verify platform regulations and document requirements in advance to ensure a smooth remittance.

FAQ

Do exchange rates change during remittance?

When remitting, exchange rates may fluctuate with the market. You can choose rate-locking services to reduce risks of changes in the received amount.

How long does it take for funds to arrive?

When using online remittance services, funds typically arrive within minutes. Bank transfers generally take 5 to 7 business days. You can choose the appropriate method based on your needs.

What documents are needed?

You need the recipient’s name, address, bank name, SWIFT BIC, IBAN, and other information. Verifying documents in advance can avoid remittance delays.

Are there limits on remittance amounts?

When using different channels, single or daily limits vary. General banks have limits of USD 32,000 to USD 64,000. You can consult platform customer service in advance.

How to choose a secure platform?

You can prioritize licensed Hong Kong banks or reputable online remittance services. Verify the platform’s qualifications to ensure fund safety.

Sending money from the UK to the UAE involves weighing exchange rates, fees (banks $20-$40, online $2-$10), transfer times (online minutes, banks 5-7 days), and compliance (KYC, anti-money laundering). Hidden rate markups (2-5%) often inflate costs. As an efficiency-focused user, you need a low-fee, fast platform to streamline cross-border transfers.

BiyaPay offers the ideal solution, with real-time exchange rate queries to track GBP-to-AED rates and convert fiat to crypto, mitigating volatility risks. Transfer fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From family support to business payouts, it cuts costs and boosts speed. Don’t let high fees and delays disrupt your UK-UAE connection—join BiyaPay today for a hassle-free remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.