- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Open a Bank Account in Dubai: A Detailed Guide and Advice

Image Source: pexels

To open a bank account in Dubai, you need to prepare the following core documents:

- Valid residence visa

- UAE ID card

- Original passport

- Age of 18 or older (some banks require 21)

- Proof of address

- Initial deposit (varies by bank, typically priced in USD)

These conditions are the focus of bank reviews. Preparing the required documents in advance can significantly improve the efficiency of opening an account.

Key Points

- Before opening a bank account in Dubai, ensure you have prepared core documents such as a valid residence visa, UAE ID card, and original passport.

- When choosing a suitable bank, compare services, fees, and account types to meet personal or business needs.

- When submitting an account opening application, ensure all documents are authentic, complete, and accurate to increase approval chances.

- Understand the bank’s minimum deposit requirements and plan the initial deposit amount reasonably to avoid additional fees due to insufficient balance.

- During the account opening process, actively cooperate with the bank’s due diligence and keep information updated to reduce approval risks.

Bank Account Opening Process

Personal Account Opening Steps

To open a bank account in Dubai, you first need to meet the residence visa, UAE ID card, and age requirements (typically 18 or 21). The process consists of the following steps:

- Choose a suitable bank. You can research the services and account types of major banks, comparing their fees and convenience.

- Gather required documents. You need to prepare a valid passport, proof of residence, UAE ID card, proof of employment (if applicable), and a completed account opening application form.

- Book an appointment and visit a bank branch. Some banks support online booking, allowing you to schedule a time in advance to avoid long waits.

- Fill out the application form. You need to accurately provide personal information and the purpose of the account, ensuring all details are correct.

- Attend an interview. Banks typically arrange an identity verification interview to confirm your documents and the purpose of opening the account.

- Deposit initial funds. Once the account is approved, you need to deposit the minimum amount required by the bank.

- Receive account information. The bank will provide you with the account number and online banking access.

- Start using the account. You can use the account for transfers, receiving funds, and other financial operations.

Tip: If you opt for digital account opening, the average processing time is about 14 days; in-person applications may take 25 business days or longer. You can refer to the table below for average processing times of different application methods:

| Application Method | Average Processing Time |

|---|---|

| Digital Application | Approximately 14 days |

| In-Person Application | May take 25 business days or longer |

Business Account Opening Process

Opening a business bank account in Dubai is more complex than a personal account. You need to prepare all relevant legal documents for the company in advance. The specific process is as follows:

- Obtain a commercial license. You must hold a valid commercial license, which is a prerequisite for opening a business account.

- Gather required documents. You need to prepare the company registration certificate, business license, articles of association, memorandum of association, UAE ID copies of shareholders’ representatives, a detailed business plan, and the account opening application form.

- Check visa requirements. Some banks require the company’s major shareholders or directors to have a UAE residence permit.

- Choose a bank. You can select a bank and account type based on your business needs.

- Start the application process. After preparing all documents, you can formally submit the account opening application, and the bank will conduct due diligence and background checks.

The approval time for business accounts varies depending on the company type. You can refer to the table below for estimated account opening times for different company types:

| Company Type | Estimated Time |

|---|---|

| Offshore Company | 1 to 2 months |

| Mainland Company | 2 to 4 weeks |

Note: During business account opening, banks focus on reviewing the company structure, fund sources, and business compliance. You need to ensure all documents are authentic and complete to avoid delays due to missing or inaccurate information.

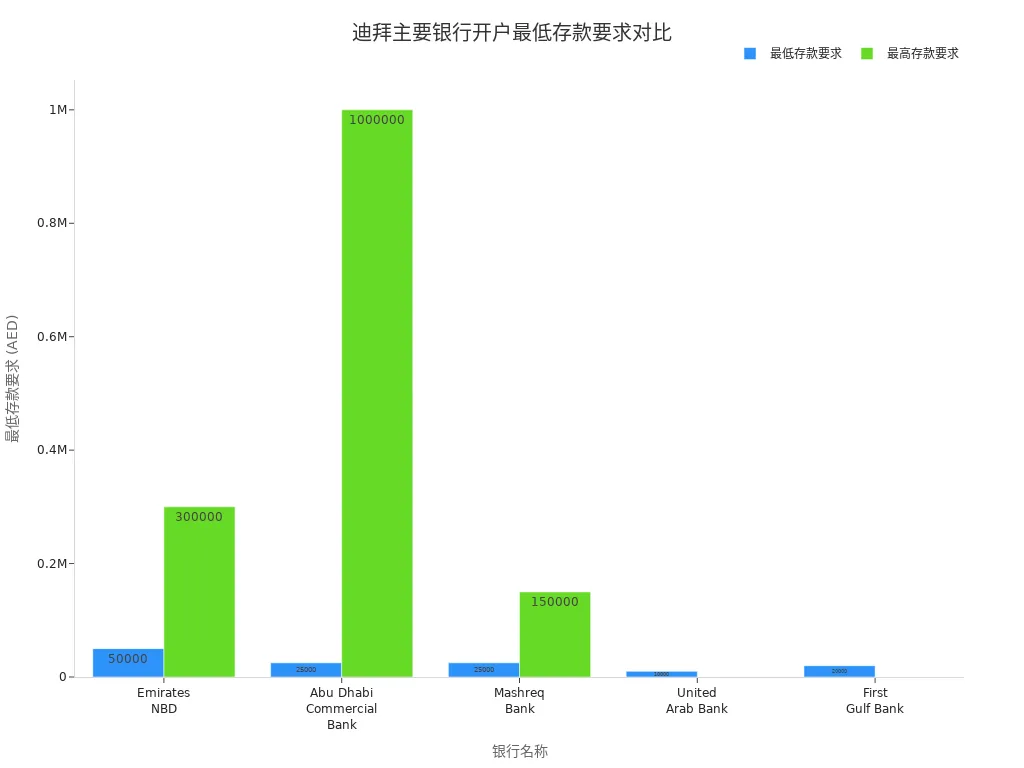

Initial Deposit Requirements

When opening a bank account in Dubai, banks typically require an initial deposit. The minimum deposit amount varies significantly by bank and account type. Below are the minimum deposit requirements for several major banks (priced in USD, for reference only):

| Bank Name | Minimum Deposit Requirement (USD) |

|---|---|

| Emirates NBD | 13,600 - 81,600 |

| Abu Dhabi Commercial Bank | 6,800 - 272,000 |

| Mashreq Bank | 6,800 and 40,800 |

| United Arab Bank | 2,700 |

| First Gulf Bank | 5,400 |

When choosing a bank and account type, you should plan the initial deposit amount based on your financial situation and business needs. Some banks have higher minimum deposit requirements for business accounts, so it’s advisable to consult with the bank in advance to confirm specific amounts and related policies.

Reminder: Some banks may adjust minimum deposit requirements based on account type and client background. You can consult the bank’s relationship manager before opening an account to obtain the latest policy information.

Account Opening Conditions and Documents

Image Source: pexels

When opening a bank account in Dubai, you must prepare all necessary documents in advance. The requirements vary depending on your identity and account type. Below, I will detail all required documents for personal and business account openings, with a special reminder that, as a foreigner, you must first obtain a UAE ID card to successfully open a bank account.

Residence Visa Requirements

You need to prepare the appropriate residence visa and supporting documents based on your identity type. Banks strictly verify your residence status. Refer to the table below for specific requirements for different applicant types:

| Applicant Type | Required Documents |

|---|---|

| Citizen | Copy of passport or family book, proof of salary, or no-objection letter from employer |

| Resident | Copy of passport with valid residence visa, UAE ID card copy, proof of salary, or no-objection letter from employer/sponsor |

As a foreign national, you must first obtain a UAE residence visa and apply for a UAE ID card. Banks will only accept your account opening application after you have these documents. Some banks may also require a no-objection letter from your employer or proof of salary to verify your legal residence and income source.

Tip: If you do not yet have a UAE ID card, it’s recommended to complete the relevant application process before considering opening a bank account.

ID and Passport

Banks have strict requirements for identity verification documents. You need to prepare the following documents based on your situation:

- Passport or UAE ID card: These are the primary identity documents for personal account openings. UAE nationals must provide a UAE ID card, while foreign nationals need to provide a passport and, if available, a UAE ID card.

- Dual nationality holders: You need to provide and verify copies of both passports.

- UAE nationals: If a UAE ID card is temporarily unavailable, you can use a family book, marsoum, or driver’s license as a substitute, but original documents must be verified on-site.

- Non-resident accounts: You need to provide additional proof of address documents and ensure all identity documents are valid.

Banks will verify the original documents on-site to ensure accurate identity information. When preparing documents, check the validity period to avoid account opening failures due to expired documents.

Proof of Address

When opening a bank account in Dubai, you must provide valid proof of address. Banks typically accept the following types of documents:

| Proof of Address Document Type | Description |

|---|---|

| Utility Bill or Account Statement | Includes bills from electricity, water, gas, or telecom providers |

| Government-Issued Documents | Includes municipal tax records or other local and national government documents |

| Registered Property Purchase, Lease, or Tenancy Agreement | Legal documents proving the customer’s address |

| Regulated Third-Party Financial Institution Documents | Includes bank statements, credit or debit card statements, insurance policies, etc. |

You can choose a bill or official document from the past three months as proof of address. Banks prefer original documents or certified copies. Ensure the name and address on the documents match your identity proof.

Business Account Documents

Opening a business bank account in Dubai requires more complex documentation than personal accounts. You need to prepare the following documents based on the company type:

| Type | Document List |

|---|---|

| Mainland Company | Passport copies, UAE visa copies or tourist visa page, UAE ID card (if applicable), local sponsor documents (if applicable), articles of association, trade name reservation certificate, preliminary DED approval, Ejari (office lease contract), notarized lease agreement |

| Free Zone Company | Passport copies of all shareholders, recent white-background photos, CVs of shareholders (some zones), business plan (some licenses), no-objection certificate (NOC) if a UAE resident, free zone authority application form, preliminary approval, and trade name certificate |

Additionally, banks may require the following documents:

- Valid company trade license

- CVs of all shareholders and executives

- Bank statements from the past six months

- Utility bill

- Detailed business plan

When preparing business account documents, ensure all files are authentic and complete. Specific requirements may vary by bank and company type. It’s advisable to consult with the bank’s relationship manager in advance to confirm the latest policies and document list.

Note: During business account opening, banks focus on reviewing the company structure, fund sources, and business compliance. You need to provide all information accurately to avoid delays due to incomplete or inaccurate documents.

Bank Selection

Image Source: pexels

Major Banks

When opening a bank account in Dubai, you can choose from several well-known banks. Each bank offers different service advantages and features. The table below lists major banks with significant market share in Dubai and their key advantages:

| Bank | Key Advantages | Digital Banking | Sharia-Compliant | Best For |

|---|---|---|---|---|

| Emirates NBD | Extensive network | Excellent | Yes | General banking, digital users |

| First Abu Dhabi Bank | Global coverage | Strong | Yes | Businesses, expatriates |

| ADCB | Competitive loans | Award-winning | Yes | Tech-savvy clients |

| Dubai Islamic Bank | Pioneer in Islamic finance | Strong | Yes | Sharia-compliant banking |

| Mashreq Bank | Digital innovation | Leading | Yes | Tech-savvy individuals |

| HSBC Middle East | Investment services | Strong | No | Investors, expatriates |

| Emirates Islamic | Sharia-compliant products | Good | Yes | Ethical banking |

| RAKBANK | SME support | Excellent | Yes | Small businesses |

| Standard Chartered | Global expertise | Good | Yes | International clients |

| Commercial Bank of Dubai | Customer service | Strong | Yes | Personalized banking |

You can choose a bank based on your needs. For example, if you value digital services, consider Emirates NBD or Mashreq Bank. If you prioritize Sharia-compliant financial products, Dubai Islamic Bank and Emirates Islamic are good options.

Account Types

Major banks in Dubai offer various account types for different customer groups. You can choose the appropriate account based on your identity and needs. The table below summarizes main account types and their features:

| Account Type | Features | Eligibility Requirements |

|---|---|---|

| Current Account | Comprehensive banking services, including checks and debit cards | Requires a valid residence visa |

| Savings Account | Basic functions, provides debit card and ATM access | Suitable for residents and non-residents |

| Business Account | Tailored accounts for business operations | Business registration and related documents |

| Offshore Account | For managing international investments or optimizing tax benefits | For clients with specific qualifications |

If you are an individual, you typically choose a current or savings account. If you are a business owner, you can apply for a business account. Some banks also offer offshore accounts for clients with international business needs.

Selection Tips

When choosing a bank and account type, you can consider the following key factors:

- Ease of account opening. You should prioritize banks with straightforward processes and clear document requirements.

- Bank fees and transaction costs. You need to compare account management fees, transfer fees, and other charges across banks.

- Digital and online banking capabilities. You can choose institutions supporting mobile and online banking to improve daily operational efficiency.

- Availability of business loans and credit facilities. If you have financing needs, focus on banks’ loan products and approval speed.

- Customer support and relationship management. You can select banks with responsive services and professional relationship managers.

- International banking services. If you have cross-border business, opt for banks with global networks.

Tip: Before formally opening a bank account, consult the bank’s relationship manager to understand the latest policies and service details. This can help avoid delays due to incomplete information.

Non-Resident and Minor Account Opening

Non-Resident Account Requirements

If you do not have UAE residency, you can still open an account with some Dubai banks. You need to be at least 18 years old and prepare valid identity proof and proof of address. Common identity proofs include a passport, driver’s license, or national ID card, while proof of address can be a bank statement or utility bill. Some banks may also require proof of income and wealth sources, as well as a reference letter from a bank in your home country. You also need to be aware of minimum deposit and account activity requirements. For example, some banks require at least one transaction per quarter.

The table below summarizes several banks supporting non-resident account opening and their main eligibility requirements:

| Bank | Eligibility Requirements |

|---|---|

| RAKBANK | Requires valid identity proof and proof of address; refer to the bank’s website for specific requirements. |

| HSBC | Applicants must be 18 or older, provide valid identity proof and proof of address; requirements may vary by application location. |

During the application process, banks may require higher minimum balances, and available account types may be limited. It’s advisable to consult with the bank in advance to confirm all documents and specific policies.

Tip: Non-resident account opening processes are typically stricter than those for residents. The more complete your document preparation, the higher the success rate.

Minor Account Opening Process

If you want to open a bank account for a child under 18 in Dubai, you need to meet specific legal requirements. Banks typically allow minors aged 15 to 18 to open accounts but require parental or guardian consent and signatures. As a guardian, you need to accompany the minor to the bank, submit relevant documents, and sign consent forms.

The table below lists the main requirements for minor account opening:

| Age Group | Requirements |

|---|---|

| 15-18 Years | Requires parental or guardian consent and signature to open an account |

You need to prepare the minor’s passport, UAE ID card (if applicable), guardian’s identity proof, and proof of relationship. Some banks may also require proof of enrollment or a school letter. Before applying, consult the bank to confirm the latest policies and required documents.

Supplementary Card Applications

You can apply for supplementary debit cards for family members to facilitate household financial management. Banks allow you to apply for supplementary cards for children aged 13 or older, with a maximum of 4 cards. Supplementary cards are available for spouses, parents, siblings, children under 18, and household helpers (e.g., nannies or drivers). You need to provide passport and UAE ID copies (for residents) or passport copies (for non-residents) for the supplementary applicants. Most banks offer supplementary debit cards free of charge.

The table below outlines the main conditions for supplementary card applications:

| Application Condition | Description |

|---|---|

| Age Limit | Minimum age of 13 |

| Application Quantity | Up to 4 supplementary cards |

| Eligible Applicants | Includes family members and household helpers |

| Application Documents | Requires passport and UAE ID copies |

| Fees | Supplementary debit cards are free |

Note: The usage limits and permissions for supplementary cards are typically set by the primary account holder. You can flexibly manage supplementary cards based on family members’ actual needs.

Common Issues and Considerations

Reasons for Application Rejection

When applying for a bank account in Dubai, you may face application rejections. Banks typically reject applications for the following reasons:

- Your submitted documents are incomplete or missing.

- You have previously had an account closed by a UAE bank due to suspicious activity.

- You are unwilling to attend the bank’s required interview.

- You cannot prove the source of funds or previous business activities.

- Your account balance is insufficient or there is infrequent fund activity.

- Certain special identities (e.g., foreign politicians or violators) are ineligible for banking services.

It’s recommended to carefully verify all documents before applying, ensure information is authentic and complete, and actively cooperate with the bank’s interview and due diligence.

Common Mistakes

During the account opening process, you may make some common mistakes. The table below summarizes the main mistakes and corresponding suggestions:

| Common Mistake | Suggestion |

|---|---|

| Articles of Association Lack Necessary Clauses | Work with legal experts to ensure comprehensive articles |

| Ignoring Detailed Business Plan Preparation | Prepare a detailed business plan covering models and projections |

| Inaccurate Company Structure Information | Verify company structure details for consistency |

| Not Researching Bank-Specific Requirements | Understand the target bank’s account opening policies |

| Insufficient Proof of Address | Provide recent, accurate proof of address |

| Non-Compliance with UAE Regulatory Requirements | Adhere to all relevant regulations |

| Failing to Update Signatory Information Promptly | Notify the bank and update information promptly |

| Handling the Process Alone | Seek assistance from professional advisors |

| Overly Lengthy Business Description | Keep it concise, highlighting key points |

| Unstable Client or Supplier Lists | Prepare stable lists with references |

| Incomplete Transaction Records | Maintain detailed transaction records |

| Not Following Up on Application Status | Regularly contact the bank to track progress |

| Ignoring Bank Fee Structures | Review account fees and terms |

| Insufficient Legal and Tax Compliance | Comply with all legal and tax obligations |

| Not Understanding Currency Exchange Policies | Familiarize yourself with the bank’s international transaction policies |

| Not Utilizing Digital Banking Features | Explore and use digital banking services |

Risk Mitigation Tips

You can adopt several strategies to reduce account opening risks and improve success rates. Banking professionals suggest:

| Strategy | Description |

|---|---|

| Work with Experts | Engage professional agencies to assist with document preparation and compliance, reducing delays and rejection risks. |

| Choose Cost-Effective Banks | Compare banks’ minimum balance requirements (e.g., USD 13,600) and select one that suits your needs. |

| Plan Ahead | Prepare documents 2-3 months in advance, reserving time for notarization and processing. |

| Use Local Resources | Hire local translators and notaries to streamline legalization processes. |

| Address Rejections | Review applications before submission to resolve potential issues promptly. |

You also need to prioritize compliance management. Banks use AML systems to identify and mitigate financial crime risks. You should actively cooperate with customer due diligence (KYC), use UAE government services for identity verification, and keep information updated. This can effectively avoid application failures and financial losses due to compliance issues.

When opening a bank account in Dubai, you need to follow these key steps:

- Choose a suitable bank, comparing services and fees across different banks.

- Select an account type that meets your needs, such as current, savings, or offshore accounts.

- Prepare and submit valid passport, residence visa, UAE ID card, proof of address documents.

You should also note the following considerations:

- Ensure all documents are authentic, complete, and accurate.

- Understand the bank’s compliance and KYC requirements and prepare financial history in advance.

- Maintain the minimum balance as required by the bank to avoid additional fees.

- Provide clear personal or business information to increase approval chances.

By doing so, you can efficiently complete the account opening process and successfully use Dubai banking services.

FAQ

Can I use a China/mainland China ID card to open an account?

You need to provide a UAE ID card and passport. A China/mainland China ID card cannot be used as the primary document for account opening. Banks only accept internationally recognized documents.

Tip: You can apply for a UAE ID card in advance to improve account opening efficiency.

What restrictions apply to non-resident accounts?

You can only choose certain banks and account types. Banks typically require higher minimum balances (e.g., USD 13,600) and limit account functionalities. You need to maintain regular account activity.

| Account Type | Minimum Balance (USD) | Main Restrictions |

|---|---|---|

| Non-Resident Account | 13,600 | Limited account functionalities |

What additional documents are needed for business account opening?

You need to prepare the company registration certificate, business license, articles of association, shareholder identity proof, and a detailed business plan. Banks will review the company structure and fund sources.

Suggestion: Consult the bank’s relationship manager in advance to confirm the latest document list.

Can a reference letter from a Hong Kong licensed bank be used for account opening?

You can submit a reference letter from a Hong Kong licensed bank. Some Dubai banks accept reference letters from international banks, which can help increase approval chances.

Note: Ensure the reference letter is authentic and complete.

How long after opening an account can I use online banking services?

You typically receive online banking access within 3 to 5 business days after account activation. You can manage your account via mobile or computer.

Reminder: Set up your online banking password promptly to ensure account security.

Opening a bank account in Dubai requires a residence visa, Emirates ID, passport, and minimum deposits ($2,700-$272,000), with fees like maintenance charges (~$5-$50/month) and potential forex markups (2-5%). Approval takes 14 days to 25 days (in-person), adhering to AML/KYC rules. As an efficiency-focused user, you need a transparent, convenient platform to streamline fund management.

BiyaPay offers an optimal solution, with real-time exchange rate queries to track USD-to-AED rates (currently ~3.67) and convert fiat to crypto, mitigating volatility risks. Transfer fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, flexibly managing account funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From personal savings to business accounts, it simplifies processes and cuts costs. Don’t let high fees and complex approvals derail your Dubai banking journey—join BiyaPay today for smarter account management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.