- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Remitting Money to the UAE: Choosing the Right Method, Fees, and Security Measures

Image Source: unsplash

When you consider remitting to the UAE, you should focus on remittance methods, fee structures, and security measures. The UAE’s remittance inflows and outflows continue to grow, driven by a large migrant community and digital transformation. Bank transfers are suitable for large transactions, while online platforms like Wise offer higher fee transparency and speed. You can choose the most appropriate channel based on the recipient’s needs and your circumstances to ensure fund safety and reasonable costs.

Key Points

- When choosing a remittance method, consider bank transfers, online platforms, and cash remittances. Each method suits different needs, ensuring you select the most appropriate channel.

- Online remittance platforms like Wise offer transparent fees and fast delivery, ideal for frequent small remittances. Compare fees and exchange rates across platforms to secure the best deal.

- Use legitimate channels to ensure the platform meets regulatory standards, protecting fund safety. Pay attention to KYC processes and transaction monitoring to prevent money laundering and fraud risks.

- Remittance fees include handling fees and exchange rate margins; understanding these fees helps reduce total costs. Choosing digital platforms typically saves more.

- Stay vigilant to prevent remittance scams. Avoid clicking unknown links, verify suspicious payment requests, and ensure personal information security.

Remittance Methods to the UAE

Image Source: pexels

When choosing a method to remit to the UAE, you can consider bank transfers, online remittance platforms, and cash remittances with agency services. Each method has distinct features and applicable scenarios. You need to make the best choice based on your needs and the recipient’s preferences.

Bank Transfers

Bank transfers are a preferred choice for many when remitting to the UAE. You can process international remittances through Mainland China or licensed Hong Kong banks. The advantage of bank transfers is high security and transparent fund flows, suitable for large remittances. Banks typically use the SWIFT system to ensure funds reach the recipient’s account accurately.

| Advantages | Disadvantages |

|---|---|

| Secure and reliable | High fees |

| Easy to use | Slower processing times |

| Uses SWIFT system | May require in-person visits to branches |

When processing bank transfers, you typically need to provide recipient information and bank account details. Processing times vary depending on the bank and transfer type. Below are common processing times:

| Transfer Type | Processing Time |

|---|---|

| Mainland China Transfers | Processed same day, cutoff at 5:00 PM |

| International Transfers | Processed same day, cutoff at 2:00 PM |

| Other Transfers | Processed next business day (after cutoff or on holidays) |

Traditional international remittances may take several hours to five business days, depending on time zones and payment details. If you need fast delivery, you can consult bank staff in advance.

Online Remittance Platforms

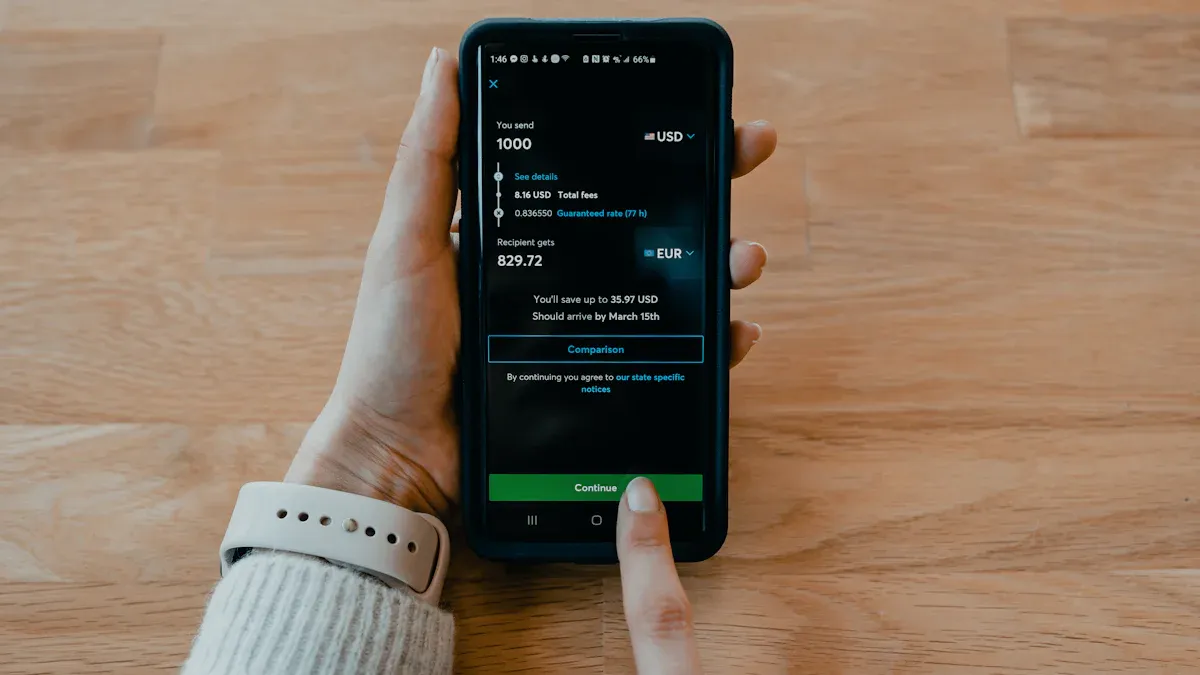

Online remittance platforms offer a more convenient option for remitting to the UAE. You can operate via mobile or computer without visiting a bank. Many platforms like Wise, Remitly, and TalkRemit provide transparent fee structures and real-time exchange rates. You can clearly see all fees and the received amount before remitting.

| Platform | Features | Fees | Security |

|---|---|---|---|

| TalkRemit | Fast, secure, low-cost | Low fees, no hidden fees | Offers refund guarantees |

| Remitly | Fast, affordable, secure | Provides fees and delivery times | Reliable transfer process |

When using these platforms, you can enjoy fast delivery and low-cost services. Wise offers transparent fees and real-time exchange rate comparisons. For example, Wise’s exchange rate is 3.67300 AED, with a transfer fee of 12.52 USD, and the recipient receives 3,627.01 AED. Other platforms’ rates and fees may vary slightly, but you can choose the most suitable platform based on your needs.

- Wise: Transparent fees, real-time exchange rates, ideal for frequent remittances.

- Payit: Multiple delivery options, fast transfers.

- Western Union: Extensive network, flexible payments.

- Al Ansari: Competitive exchange rates, multiple payment methods.

If the recipient prefers digital payments, you can prioritize online platforms. Data shows that 57% of UAE recipients prefer using digital apps for international remittances, finding them user-friendly, secure, and convenient for family and friends. In the future, the use of digital remittances will continue to rise.

Cash Remittances and Agency Services

Cash remittances and agency services are suitable for recipients without bank accounts or in urgent situations. You can send cash directly to the recipient through agency institutions. This method is simple and fast but carries higher risks.

- Cash transactions are prone to being used for money laundering and terrorist financing.

- Transactions are simple, allowing criminals to easily transfer and conceal funds.

- Remittance agencies have limited knowledge of customer risks, and regulatory differences may be exploited.

When choosing cash remittances, you need to pay special attention to security risks. Regulatory standards vary across jurisdictions, potentially increasing fund safety concerns. It’s recommended to prioritize legitimate channels to ensure fund security.

Tip: When choosing a remittance method to the UAE, the recipient’s preferences are crucial. If the recipient prefers digital apps, prioritize online platforms. If the recipient needs cash or lacks a bank account, agency services may be more suitable. Choose the optimal method based on the remittance amount, transfer speed, and recipient needs.

Remittance Fees to the UAE

Handling Fees

When choosing a remittance method to the UAE, you should first focus on handling fees. Fee differences across channels are significant. The average fees for bank transfers, online platforms, and cash remittance services are generally similar, ranging from $10-$30. You can refer to the table below for a quick overview of fee ranges for each method:

| Transfer Method | Average Fee Range |

|---|---|

| Bank Transfers | $10 - $30 |

| Online Platforms | $10 - $30 |

| Cash Remittance Services | $10 - $30 |

Bank transfers are suitable for large remittances but have higher fees. Online platforms like Wise and Remitly offer more transparent fee structures, ideal for frequent small remittances. Cash remittance services are convenient but have non-negligible fees. When choosing, weigh the impact of fees against the remittance amount and transfer speed.

Some banks and platforms charge different fees based on the destination, amount, and service type. For example, some licensed Hong Kong banks offer varied fees for different countries, and some even provide free services for specific destinations. Before processing, it’s recommended to inquire about detailed fee breakdowns to avoid unexpected expenses.

Tip: Some platforms offer fee waivers or discounts for new or referred users. Pay attention to this information and use promotions to save costs.

Exchange Rates and Hidden Costs

In addition to visible handling fees, exchange rates and hidden costs also affect the actual amount you send. Banks and online platforms often include a margin in the exchange rate, which is not easily noticeable. You can refer to the table below for common exchange rate margins and hidden costs:

| Fee Type | Amount |

|---|---|

| Transfer Fee | $14.80 |

| Exchange Rate Margin | 0.68% below mid-market rate |

| Fees within Exchange Rate | $35.00 |

| Total Fees | $49.80 |

| Received Amount | $1,347.80 |

When operating, you may find that the platform’s displayed exchange rate is below the mid-market rate, reducing the amount received by the recipient. Some banks and platforms also charge additional “fees within the exchange rate,” further increasing total costs.

Exchange rate policies vary across banks and platforms. For example, some licensed Hong Kong banks offer free services for specific countries but may charge hidden fees through exchange rate margins. When choosing, prioritize platforms with transparent fee structures to ensure all costs are clear.

Note: Exchange rate fluctuations directly affect your and the recipient’s interests. Rate changes not only impact the received amount but may also increase transfer costs. Monitor exchange rate trends in advance and choose optimal timing to reduce losses.

Cost-Saving Methods

You can reduce the total cost of remitting to the UAE through various methods. Below are several common and effective cost-saving strategies:

- Use digital-first platforms. Digital platforms typically offer the lowest remittance fees, avoiding the high handling fees of traditional banks.

- Avoid bank transfers for small payments. Banks have high fixed fees, so choosing fintech services can save costs.

- Compare exchange rates. Use online tools to compare real-time exchange rates across platforms to secure the best deal.

- Consolidate remittances. Plan to send larger amounts at once to reduce repeated fees from multiple small remittances.

When choosing platforms, focus on fee transparency. Aspora, in collaboration with the UAE Central Bank-regulated Lulu International Exchange LLC, offers high operational transparency. Panda Remit emphasizes fee reduction and recommends economy services. You can prioritize these platforms with transparent fees to avoid unnecessary losses.

Recommendation: Before remitting, compare fees and exchange rates across multiple providers. Online platforms are generally more cost-competitive than traditional banks. Some platforms offer special discounts for new or referred users, which you can use to further reduce costs.

If you can master exchange rate patterns and choose optimal remittance timing, you can effectively increase the amount received by the recipient. Understanding how exchange rates work helps you mitigate risks from rate fluctuations, ensuring more funds reach the UAE safely.

Security Measures

Image Source: pexels

Identifying Legitimate Channels

When choosing a remittance service, you must prioritize legitimate channels. Compliant remittance platforms need to meet multiple international and UAE local regulatory standards, including:

- Registration requirements, where platforms must obtain licenses from relevant financial regulators.

- Customer Due Diligence (KYC), where platforms verify your identity information, such as name, address, and identification documents.

- Transaction monitoring, where platforms monitor fund flows in real-time to prevent illegal activities.

- Reporting obligations, where all transfer data must be uploaded daily to the UAE Central Bank.

- Compliance with anti-money laundering and counter-terrorism financing measures to ensure the legitimacy of fund sources and purposes.

You can judge a platform’s legitimacy by whether it requires a KYC process. Compliant platforms collect and verify your identity information to prevent money laundering and terrorist financing, protecting your fund safety. Legitimate channels also ensure compliance with laws and regulations, reducing legal risks.

Tip: All service providers conducting Hawala activities in the UAE must hold a certificate issued by the UAE Central Bank. Before remitting, proactively verify the provider’s credentials to ensure fund safety.

Preventing Remittance Scams

During the remittance process, you need to be vigilant against various common scam tactics. Below are the main scam types targeting UAE remittances:

- Phishing: Scammers impersonate trusted platforms to trick you into revealing login credentials or bank information.

- Fake Payment Requests: Someone poses as a supplier or acquaintance, requesting urgent transfers.

- Investment Scams: Promises of high returns to lure you into transferring money to fake accounts.

- Lottery and Prize Scams: Claims that you’ve won a prize but require payment of “handling fees” or “taxes” first.

- Parcel Delivery Scams: Sending fake notifications requiring you to provide personal information and pay fees.

You can take the following measures to prevent scams:

- Avoid clicking unknown links or downloading attachments.

- Do not disclose personal or bank information to strangers.

- Verify the identity of the requester through other channels when receiving suspicious payment requests.

- If you notice anomalies, contact the bank immediately and temporarily flag the account.

Note: Under UAE law, illegally retaining funds that do not belong to you, even if received by mistake, may result in fines or imprisonment. Return mistakenly received funds promptly to avoid legal liability.

Information Security Measures

When choosing a remittance platform, you should focus on its information security measures. Mainstream platforms typically adopt the following international standards and technologies:

| Legal Framework | Data Transfer Conditions |

|---|---|

| PDPL | Data transfers are allowed only if the recipient has adequate data protection laws or bilateral agreements, or with safeguards like contracts or user consent. |

| DIFC DP Law | Data transfers are allowed only if the recipient has adequate data protection laws, or with safeguards like legally binding contracts or corporate rules. |

| ADGM | Data transfers are allowed only to jurisdictions recognized for adequate data protection, or with safeguards like legally binding tools or corporate rules. |

You should also check whether the platform adopts the following security technologies:

- Advanced encryption technology to protect your personal and financial information.

- Multi-factor authentication protocols to enhance account security.

- Real-time fraud detection systems to promptly identify and block suspicious transactions.

- Compliance with international security standards to build user trust.

Choosing legitimate platforms that prioritize security can effectively prevent information leaks and fund losses. Platforms also regularly upgrade cybersecurity systems and collaborate with regulators to continuously enhance protection capabilities.

When choosing a remittance method to the UAE, you can refer to the table below for a quick overview of each channel’s advantages and disadvantages:

| Remittance Method | Advantages | Disadvantages |

|---|---|---|

| Bank Transfers | Secure and reliable, suitable for large remittances | Slow processing, high fees, unfavorable exchange rates |

| Digital Platforms | Transparent pricing, fast transfers, ideal for cross-border transactions | Transfer limits, account creation required |

| Virtual Accounts | Low transaction fees, fast transfers, multi-currency support | Registration and verification required |

| Cryptocurrency | Instant transfers, low-cost secure option | High price volatility, requires operational familiarity |

When making decisions, you should focus on the following factors:

- Trust and security

- Remittance speed

- Total costs and exchange rates

- Ease of use and customer experience

You can prioritize legitimate channels based on the amount, transfer speed, and recipient preferences, focusing on fee transparency and security measures.

FAQ

How quickly can a remittance to the UAE arrive?

When using online platforms, funds typically arrive within minutes to 24 hours. Bank transfers generally take 1 to 5 business days. Transfer times depend on the provider and remittance timing.

Tip: Holidays and time zone differences may affect transfer speed.

What information is required to remit to the UAE?

You need to provide the recipient’s name, bank account number, bank name, and SWIFT code. Some platforms also require the recipient’s address and contact details. The more complete the information, the smoother the remittance.

Are there limits on remittance amounts?

When using banks or online platforms, single remittance amounts typically have limits. Banks require additional reviews for large remittances. Online platforms are more flexible for small remittances but also have maximum limits.

| Channel | Single Transfer Limit (USD) |

|---|---|

| Bank Transfers | 10,000+ |

| Online Platforms | 2,000-5,000 |

How can I track remittance progress?

You can log in to the remittance platform or bank website and enter the order or reference number to check progress. Some platforms notify you of the remittance status via SMS or email.

What should I do if a remittance fails?

If a remittance fails, contact the provider’s customer service promptly. Verify that the recipient’s information is correct. Banks and platforms typically refund funds that fail to arrive.

Remitting to the UAE requires attention to fees (banks $10-$30, online $10-$30), rate spreads (banks 3-6%, online 0.5-3%), and transfer times (banks 1-5 days, online minutes to 1 day). Compliance includes full identity details for transfers over $950, with daily limits of ~$6,800-$13,600. As an efficiency-focused user, you need a low-fee, fast platform to streamline cross-border transfers.

BiyaPay offers an optimal solution, with real-time exchange rate queries to track USD-to-AED rates and convert fiat to crypto, mitigating volatility risks. Remittance fees start at just 0.5%, with zero charges for contract orders, covering global same-day delivery. Plus, trade US and Hong Kong stocks directly without overseas accounts, smartly managing remittance funds.

Sign up for BiyaPay now to unlock seamless cross-border finance. From personal transfers to business payouts, it cuts costs and boosts speed. Don’t let high fees and delays disrupt your fund flow—join BiyaPay today for a hassle-free remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.