- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Currency System of the Netherlands and the Use of the Euro: Enhancing Economic Stability and Financial Services

Image Source: unsplash

The Dutch monetary system has demonstrated greater economic stability since adopting the euro. The euro has brought trade convenience and exchange rate stability, helping Dutch businesses reduce transaction costs. Eurobarometer data shows that nearly 70% of Dutch people believe the euro is beneficial to the country. Even during financial crises, public confidence in the euro remained strong. The Economic and Monetary Union has boosted Dutch exports to other eurozone countries, promoting financial service innovation. The euro has effectively enhanced the overall performance of the Dutch economy and financial services.

Key Points

- The introduction of the euro has enhanced Dutch economic stability, reduced transaction costs, and promoted business exports and financial service innovation.

- Dutch businesses, by using the euro, avoid the hassle of currency conversion, enhancing trade convenience with eurozone countries.

- The unified payment system (SEPA) makes cross-border financial transactions more efficient, reduces operational costs, and enhances market competitiveness.

- The stability of the euro has increased investor confidence in the Dutch market, attracting more foreign direct investment.

- The Dutch financial system continues to innovate under the backdrop of euro integration, promoting fintech development and service efficiency.

The Dutch Monetary System and the Euro

Image Source: pexels

System Structure

The Dutch monetary system consists of several core components. The table below outlines the main structures and their relationship with the euro:

| Component | Description |

|---|---|

| Use of the Euro | The Netherlands is one of the founding members of the euro, officially adopting it on January 1, 1999, and introducing euro banknotes and coins on January 1, 2002. |

| Currency Conversion | During the transition period, the euro existed as the official currency but only in “book money” form until the dual circulation period ended on January 28, 2002. |

| Dutch Central Bank | The Dutch Central Bank (DNB) continued to exchange Dutch guilder coins until January 1, 2007, and will continue to exchange guilder banknotes until 2032. |

The regulatory mechanism of the Dutch monetary system is highly robust. According to Article 127 of the Treaty on the Functioning of the European Union, the European System of Central Banks (ESCB) aims to maintain price stability. The ESCB is responsible for formulating and implementing EU monetary policy, conducting foreign exchange operations, managing official foreign exchange reserves, and promoting the smooth operation of payment systems.

- The Dutch Central Bank (DNB) participates in the implementation of eurozone monetary policy as the national prudential banking regulator.

- The Dutch Authority for the Financial Markets (AFM) supervises financial institutions and market operations, part of the European Securities and Markets Authority (ESMA) system.

- As a founding EU member state, the Netherlands actively participates in the monetary policy oversight of the European Central Bank (ECB).

Euro Introduction

The introduction of the euro brought significant changes to the Dutch monetary system.

- The Dutch money market achieved full integration in a very short time, forming a unified eurozone money market.

- The establishment of the TARGET system interconnected large national payment systems, making cross-border payments more convenient.

- The euro eliminated barriers posed by national currencies, promoting cross-border integration of European banking.

These changes enhanced the efficiency and stability of the Dutch monetary system. Dutch businesses and financial institutions can better participate in eurozone economic activities, benefiting from exchange rate stability and payment convenience.

Euro Application

Trade Convenience

The introduction of the euro has greatly enhanced trade convenience between the Netherlands and other eurozone countries. Businesses and consumers can settle transactions directly in euros without frequent currency conversion. This not only saves time on currency exchange but also reduces transaction costs. The unified euro system reduces uncertainties caused by exchange rate fluctuations, enabling Dutch businesses to better plan exports.

Data shows that the proportion of Dutch service exports to GDP was 15% in 2000, rising to 25% by 2023. This indicates that the euro’s application has driven sustained growth in Dutch service trade. The table below presents the relevant data:

| Year | Proportion of Dutch Service Exports to GDP |

|---|---|

| 2000 | 15% |

| 2023 | 25% |

As a key eurozone exporter, the Netherlands recorded total exports of €866 billion in 2023, second only to Germany.

| Type | Value (€ Billion) |

|---|---|

| Dutch Exports | 866 |

| German Exports | 1562 |

The widespread use of the euro has also boosted tourism and cross-border consumption. Tourists and businesses traveling or purchasing within the eurozone no longer need to worry about exchange rate fluctuations, resulting in a smoother consumption experience.

Cross-Border Finance

The unified euro payment system has brought significant advantages to Dutch financial institutions. Cross-border financial transactions have become more efficient and secure. SEPA (Single Euro Payments Area) provides Dutch banks with standardized payment processes.

- Credit transfers within SEPA are typically completed within one banking day, significantly increasing the speed of fund transfers.

- Businesses and individuals making transfers within the eurozone do not need to pay additional cross-border fees, reducing operational costs.

- Unified account identifiers (such as IBAN and BIC) simplify payment processes and reduce operational errors.

- SEPA transactions are protected by strict regulations, ensuring fund security and reducing fraud risks.

- The standardized financial services framework enhances market competition, allowing businesses and consumers to choose from multiple service providers and enjoy better services.

These advantages enable the Dutch monetary system to operate efficiently within the eurozone. Dutch financial institutions can better participate in international financial markets, improving service levels.

Bond Market

The application of the euro has had a profound impact on the Dutch bond market. In a unified currency environment, Dutch businesses and the government can issue bonds in the eurozone more conveniently, attracting more international investors. Bond pricing and trading processes are more transparent, allowing investors to clearly understand risks and returns.

Authoritative institutions like ING note that the liquidity and scale of the eurozone bond market continue to expand. As a core eurozone member, the Netherlands has seen sustained growth in bond issuance. The stability of the euro reduces interest rate fluctuation risks, boosting investor confidence.

The euro also simplifies cross-border bond circulation. Investors can freely buy and sell bonds within the eurozone without worrying about currency conversion or exchange rate fluctuations. This advantage enhances the international competitiveness of the Dutch bond market.

Economic Stability

Exchange Rate Risk

The introduction of the euro has significantly reduced exchange rate risks for Dutch businesses. In the past, businesses trading with other European countries often needed to monitor currency value fluctuations. The euro unified the currency system, reducing uncertainties caused by exchange rate changes. Businesses can more accurately set prices and budgets, minimizing losses due to exchange rate fluctuations.

The table below shows changes in market risk exposure and foreign exchange risk for Dutch businesses after the euro’s introduction:

| Evidence Type | Description |

|---|---|

| Market Risk Exposure | The introduction of the euro significantly reduced market risk exposure for Dutch businesses. |

| Foreign Exchange Risk | Although changes in foreign exchange risk are statistically and economically small, they represent an absolute reduction in risk. |

| Scope of Impact | Mainly concentrated among companies within the eurozone and non-eurozone companies with significant exports or assets in Europe. |

The euro, through unified monetary policy, promotes economic integration, reducing currency exchange risks. Businesses and the government can plan with greater confidence, further enhancing economic stability. A stable currency environment attracts foreign direct investment, as investors feel safer about exchange rate uncertainties.

Investment Confidence

The stability of the euro has increased investor confidence in the Dutch financial market. Many investors consider the eurozone market more reliable than the U.S. market. Data shows that 40% of investors have become more positive about investing in Europe. A quarter of investors have increased their purchases of European investments in the past six months.

- 40% of investors have become more positive about investing in Europe.

- A quarter of investors increased their purchases of European investments in the past six months.

- Investors generally consider the European market more stable and reliable than the U.S. market.

The adoption of the euro has also driven foreign direct investment inflows into the Netherlands. The table below shows changes in FDI inflows from EU and eurozone member states after the euro’s introduction:

| Source | FDI Inflow Change |

|---|---|

| EU Countries | Increased by 43.9% |

| Eurozone Member States | Increased by 73.7% |

The monetary union enhances the eurozone’s attractiveness as a production hub. Studies show that the adoption of the euro has a positive impact on FDI from both eurozone and non-eurozone countries.

Crisis Response

The euro has enhanced the risk resilience of the Dutch monetary system. During major events like the global financial crisis, the eurozone’s unified monetary policy provided strong support for the Netherlands. The European Central Bank can take timely measures to stabilize market sentiment and prevent the spread of financial risks. As a eurozone member, the Netherlands can share the eurozone’s financial resources and policy tools.

A unified monetary policy and stable financial environment enable the Netherlands to demonstrate greater resilience in the face of external shocks. Businesses and investors can recover confidence more quickly, allowing economic activities to continue.

Supported by the euro, the Dutch monetary system exhibits higher stability and risk resilience, laying a solid foundation for the long-term development of the Dutch economy.

Financial Service Innovation

Image Source: pexels

Digital Payments

The Netherlands excels in digital payments. Most residents are willing to try a digital euro, although it has not yet been officially launched. The digital euro will be issued by the central bank, retaining the main characteristics of cash. In the future, the digital euro is expected to become the first digital retail payment method covering all eurozone member states, providing users with a modern alternative to cash.

The Netherlands has a mature digital payment infrastructure. The iDEAL system accounts for 70% of the market share in online shopping, making it the most commonly used payment method. In contrast, credit cards hold only an 8% market share. iDEAL, developed jointly by Dutch banks, may be replaced by a unified EU payment system in the future.

Digital payment innovations allow Dutch residents and businesses to enjoy more convenient and secure payment experiences, promoting the modernization of financial services.

Service Efficiency

The introduction of the euro has improved the overall efficiency of Dutch financial services. Banks and financial institutions adopt unified payment standards, simplifying cross-border transaction processes. Customers experience significantly reduced waiting times when conducting transactions, improving the service experience.

The table below shows changes in customer satisfaction with Dutch financial services:

| Customer Type | Current Satisfaction | Last Year’s Satisfaction | Industry Average Satisfaction |

|---|---|---|---|

| Private Customers | 78.6 | 78 | 68.2 |

| Commercial Customers | 78.4 | 77.4 | 66.2 |

Satisfaction among both private and commercial customers exceeds the industry average. The unified financial environment of the eurozone brings continuous optimization to Dutch financial services, providing customers with higher-quality services.

Central Bank Policy

The application of the euro presents new policy challenges and opportunities for the Dutch Central Bank. Studies show that major carbon-emitting companies in Europe are starting to pay higher interest rates, reflecting the impact of climate risks on financing costs. The Dutch Central Bank must consider new risks posed by climate change when managing interest rates. Financial markets have incorporated climate-related risks into pricing systems, affecting corporate financing decisions.

| Evidence Content | Description |

|---|---|

| Price pressures in the eurozone continue to ease, giving European Central Bank policymakers confidence that inflation will return to target levels next year. | This indicates that the euro’s influence provides the Dutch Central Bank with greater flexibility in managing inflation. |

The unified monetary policy of the eurozone enhances the Dutch Central Bank’s ability to address inflation and interest rate changes. The Netherlands can better adapt to global economic changes, maintaining financial system stability.

Future Outlook

Continuous Innovation

The Dutch financial system continues to drive innovation under the backdrop of euro integration. The number of fintech companies is steadily increasing, boosting industry vitality. In 2023, the number of Dutch fintech companies reached 861, a significant increase from 2019. In the first half of 2024, investment in the fintech sector grew by 39%. The government invested $200 million through the Dutch Future Fund II to support startup development. The Netherlands has become the second-largest fintech industry in the EU. The government also actively improves communication between fintech companies and regulators, encouraging compliant innovation.

| Evidence Type | Details |

|---|---|

| Number of Fintech Companies | 635 in 2019, 861 in 2023 |

| Investment Growth | 39% increase in the first half of 2024 |

| Government Support | $200 million Dutch Future Fund II to support startups |

| EU Ranking | Second-largest fintech industry in the EU |

| Innovation Policy | Government strengthens ties between companies and regulators |

The Netherlands is home to the world’s oldest stock exchange and Europe’s first options exchange. The banking sector is highly concentrated, with the three largest banks holding an 85% market share, demonstrating strong financial strength. As an early eurozone member, the Netherlands enjoys advantages such as no restrictions on capital and profits. Euro-related financial products continue to grow, promoting market diversification and internationalization.

Potential Challenges

While the Dutch monetary system pursues innovative development, it also faces multiple challenges.

- The eurozone’s governance structure remains imperfect, lacking political integration, affecting decision-making efficiency.

- Significant differences in economic policies among member states lead to instability and crisis risks.

- There is a lack of effective mechanisms to address economic and budgetary disparities among member states.

- Key economic decisions are often made at the national level, highlighting budget and policy divergences.

- Any small increase in the EU budget triggers strong opposition from member states.

Future changes in eurozone monetary policy may also pose risks. Tariff and interest rate adjustments will affect the Dutch economic environment. The Dutch economy, highly dependent on global trade, may face increased vulnerability due to European Central Bank policy changes. Tariff adjustments are expected to reduce Dutch exports to the U.S. by 1.6%. Global economic weakness will also indirectly impact the export-driven Dutch economy.

The Dutch financial system must balance innovation and risk management, actively addressing new challenges brought by eurozone integration.

The euro helps the Netherlands maintain economic stability, with financial service efficiency continuing to improve. Data shows that the Dutch economy performed the same after adopting the euro as it did before, outperforming countries like Belgium and France.

| Country | Economic Impact |

|---|---|

| Netherlands | Economic performance same as before adopting the euro |

| Belgium | Worse economic performance after adopting the euro |

| France | Worse economic performance after adopting the euro |

| Germany | Worse economic performance after adopting the euro |

| Italy | Worse economic performance after adopting the euro |

| Ireland | Better economic performance after adopting the euro |

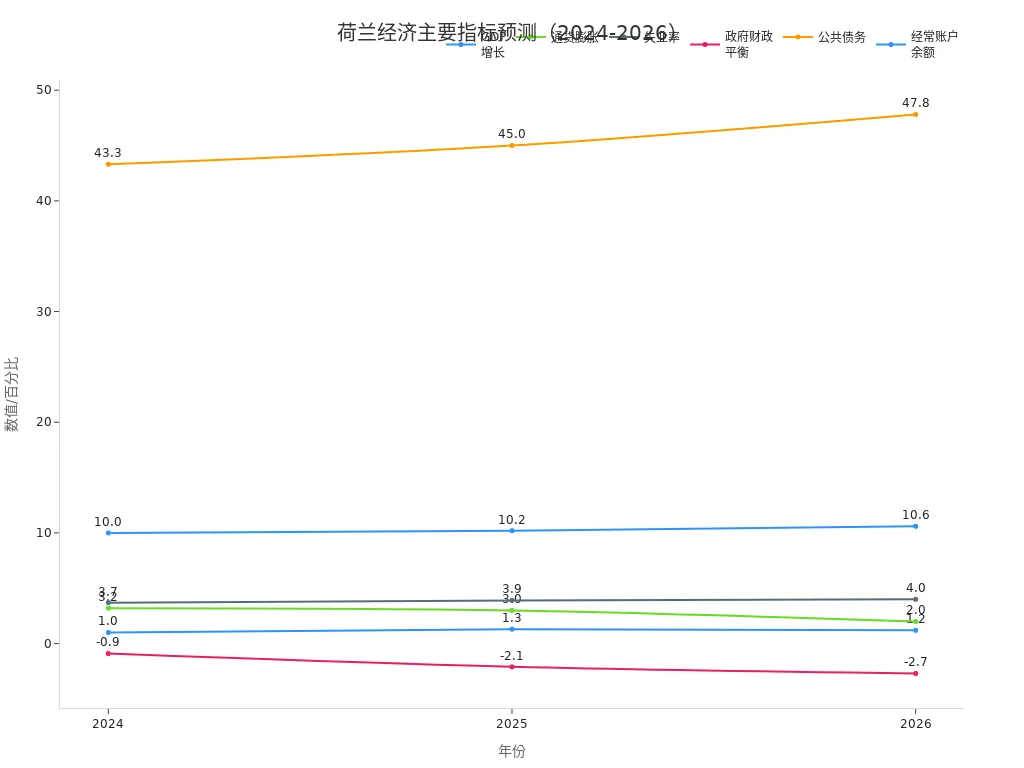

Over the next three years, Dutch GDP is expected to grow steadily, with inflation and unemployment remaining low.

The euro provides a stable foundation for the Netherlands, offering new opportunities for financial innovation and economic development.

FAQ

How does the euro impact Dutch trade convenience?

The euro unifies the currency, allowing Dutch businesses to trade with eurozone countries without currency conversion. This saves time and costs, improving trade efficiency.

Why can Dutch financial services maintain high efficiency?

The Netherlands adopts a unified euro payment system. Banks use standardized processes, enabling faster customer transactions and better service experiences.

What role does the euro play in the Dutch bond market?

The euro enhances bond market liquidity. Investors can freely buy and sell bonds within the eurozone without worrying about exchange rate fluctuations.

How will the digital euro impact payment methods in the future?

The digital euro, issued by the central bank, will allow users to make payments as conveniently as with cash, expected to further enhance payment security and efficiency.

How does the Netherlands address risks from eurozone policy changes?

The Netherlands closely monitors eurozone policies. The government and financial institutions adjust strategies promptly to maintain economic and financial system stability.

The Netherlands’ adoption of the euro has boosted trade convenience through exchange rate stability, but cross-border remittances still grapple with high fees (banks $25-$50, online 0.2%-5%), hidden markups (3-6%), and policy uncertainties (eurozone governance gaps). As a stability-focused user, you need a low-cost, transparent, and efficient platform to enhance financial services.

BiyaPay offers the perfect solution, with real-time exchange rate queries to monitor EUR-to-USD rates and convert fiat to crypto, minimizing volatility risks. Remittance fees start at just 0.5%, with zero-cost contract orders and global same-day delivery. Plus, you can invest in US and Hong Kong stocks on BiyaPay without an overseas account, optimizing your funds.

Sign up for BiyaPay today to unlock streamlined cross-border finance! From trade settlements to investment planning, cut costs and boost stability for smoother Dutch operations. Don’t let high fees and policy risks curb your economic opportunities—join BiyaPay now for a smarter euro management experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.