- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Netherlands Payment Methods: Diverse Payment Choices and Advantages of the Financial System

Image Source: pexels

Netherlands payment methods encompass iDEAL, bank cards, mobile payments, and cash, catering to diverse user payment needs. Data shows that cash market share has dropped to 20%, digital payment transactions have reached 5.5 billion, and online banking service usage exceeds 90%. The Dutch financial system is renowned for its high security, convenience, and innovation.

| Payment Method | Market Share Change |

|---|---|

| Cash | 20% (down from 30%) |

| Total Digital Payments | 5.5 billion transactions (up 13% year-over-year) |

| Online Banking Service Usage | Over 90% |

The Netherlands leads Europe in consumer fintech adoption, with the fintech industry continuously expanding, and the government and regulators actively promoting innovation. Readers can flexibly choose the most suitable payment method based on their needs.

Key Points

- The Netherlands offers diverse payment methods, including iDEAL, bank cards, mobile payments, and cash, meeting various user needs.

- iDEAL is the most popular online payment method in the Netherlands, valued for its security and convenience, as users do not need to enter sensitive information.

- Bank cards are widely used in physical store transactions, simple to operate, suitable for daily shopping, and support contactless payments.

- Mobile payments are rapidly growing in the Netherlands, allowing users to complete payments easily via mobile apps, ideal for young and frequent online shoppers.

- Despite the dominance of digital payments, cash remains essential in specific scenarios, suitable for older users or small transactions.

Overview of Netherlands Payment Methods

Image Source: unsplash

iDEAL

iDEAL, as a cornerstone of Netherlands payment methods, has long held a dominant position. Data indicates that iDEAL accounted for 69% of the online payment market share in 2020. In the most recent year, approximately 70% of e-commerce payments were completed via iDEAL through interbank transfers. iDEAL, with its efficiency, security, and convenience, has become the preferred payment tool for Dutch consumers and businesses.

| Payment Method | Market Share |

|---|---|

| iDEAL | 70% |

| Credit Card | 8% |

The widespread adoption of iDEAL not only improves checkout efficiency but also reduces transaction costs. Users can complete payments directly through online banking without entering credit card information, significantly enhancing payment security.

Bank Cards

Bank cards are also widely used in the Netherlands, particularly in physical store transactions. Dutch residents commonly hold debit cards, while credit card usage is relatively low, accounting for only 8% of the e-commerce market. Bank card payments are straightforward, suitable for daily shopping and service consumption. Most merchants support card swiping or insertion, with some offering contactless payment options, further enhancing convenience.

Mobile Payments

Mobile payments have seen rapid growth in the Netherlands in recent years. Consumers can complete transfers and payments via banking apps or third-party payment tools on their smartphones. Mobile payments integrate technologies such as QR codes and NFC, applicable to both online and offline scenarios. The innovation of the Dutch financial system has driven the adoption of mobile payments, continuously optimizing user experience.

Cash

Despite the dominance of digital payments, cash still holds a certain market share in the Netherlands. Data shows that cash transactions have dropped to 20%, but cash remains essential in small shops, market stalls, or specific service scenarios. Cash payments require no electronic devices, making them suitable for older users or temporary payment needs.

Other Methods

In addition to mainstream methods, the Netherlands supports various alternative payment tools. For example, some users opt for bank transfers, digital wallets, or prepaid cards. Compared to other European countries, Netherlands payment methods demonstrate greater diversity and innovation:

- iDEAL accounted for 69% of the online payment market share in 2020.

- Across Europe, 27% of e-commerce transactions use digital wallets, 25% use credit cards, 17% use debit cards, and 14% use bank transfers.

The diverse payment methods in the Netherlands provide flexibility for consumers and businesses, with the financial system’s efficiency and convenience standing out in the European market.

Detailed Analysis of Payment Methods

Advantages of iDEAL

iDEAL, as a core Netherlands payment method, is widely recognized for its efficiency, security, and convenience. Users generally experience lower psychological burden when conducting online transactions with iDEAL. Compared to cash payments, iDEAL offers a more convenient experience. iDEAL allows users to complete payments directly through their bank accounts without entering card numbers or other sensitive information, effectively reducing the risk of data breaches.

| Advantage | User Feedback |

|---|---|

| Low Psychological Burden | Simple payment process, reducing operational stress |

| High Convenience | More convenient than cash payments |

| High Security | No need to enter sensitive information, reducing risks |

Many businesses simplify their checkout processes through iDEAL.

Convenience of Bank Cards

Bank cards hold a significant position in the Netherlands’ payment system. Debit cards are the most common in face-to-face transactions, with many merchants supporting contactless payments, further increasing checkout speed. Users can complete payments by swiping or tapping a terminal, suitable for high-frequency scenarios like daily shopping or transportation.

The main advantages of bank cards include:

- Simple operation, suitable for users of all ages.

- Fast transaction speed, reducing queue times.

- High debit card penetration, covering most consumption venues.

However, credit card usage is relatively low, with only about 40% of Dutch people owning a credit card, and 28% actually using one. Some merchants do not accept credit cards, so users should confirm accepted payment methods in advance.

Mobile Payment Experience

Mobile payments are growing rapidly in the Netherlands, with solutions like Apple Pay and Google Pay expanding their market size. Data shows that the mobile payment market reached $4.253 billion in 2024, expected to grow to $13.945 billion by 2032, with a compound annual growth rate of 16.0%.

| Year | Market Size (USD Billion) | CAGR |

|---|---|---|

| 2024 | 4.253 | - |

| 2032 | 13.945 | 16.0% |

Dutch consumers rate the mobile payment experience highly:

- Users prefer intuitive interfaces and straightforward operations.

- 72% of consumers are willing to pay directly through bank accounts.

- Satisfaction with specific solutions like iDEAL reaches 84%.

- 90% of consumers are open to trying new financial management tools.

Mobile payments are ideal for users seeking efficiency and convenience, particularly among younger demographics and frequent online shoppers. Business users report lower satisfaction with iDEAL, at 50%, reflecting higher efficiency and cost demands in payment processes.

Cash Use Cases

Despite the prevalence of digital payments, cash retains an irreplaceable role in Netherlands payment methods. Cash is commonly used in the following scenarios:

- As a backup for electronic payments, ensuring payment continuity.

- A necessary option for vulnerable groups, meeting the needs of those without bank accounts.

- A public payment method, convenient for small transactions and market stalls.

- Cash payments have no transaction fees, suitable for low-income or low-digital-skill groups.

- Cash helps users intuitively manage funds, avoiding overspending.

Cash payments provide a sense of security and convenience for some users, particularly in scenarios with limited digital skills or temporary payment needs.

Other Methods as Supplements

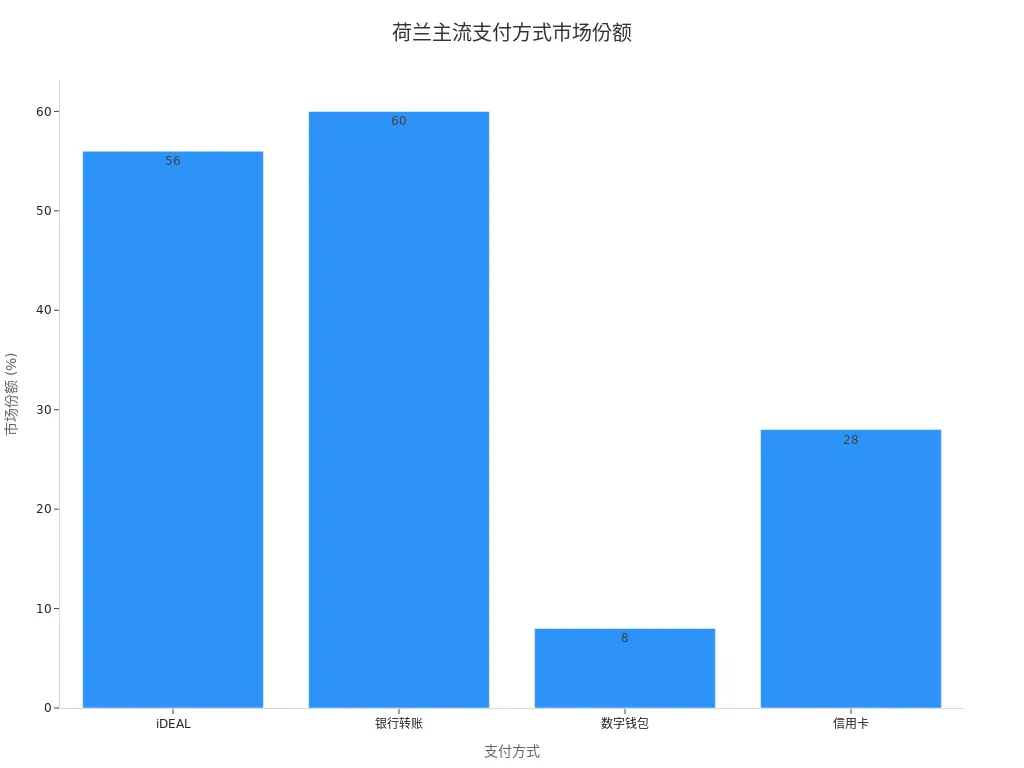

Netherlands payment methods exhibit high diversity. Beyond mainstream options, bank transfers, digital wallets, and buy-now-pay-later (BNPL) services hold certain market shares. Data shows bank transfers account for 60%, digital wallets 8%, and credit cards 28%.

| Payment Method | Market Share |

|---|---|

| iDEAL | 56% |

| Bank Transfer | 60% |

| Digital Wallet | 8% |

| Credit Card | 28% |

These alternative methods meet the specific needs of different users. For example, debit cards are most common in face-to-face transactions, with Maestro and Vpay debit cards being highly popular. iDEAL enables instant payments via bank transfers, meeting consumer demand for efficient settlements. Due to low credit card usage, many merchants do not accept them, so users should choose appropriate payment tools based on the situation.

Advantages of the Financial System

Image Source: pexels

Security Assurance

The Dutch financial system places a high priority on user fund security. Banks and payment providers employ multiple security measures, including strong passwords, biometric technology, and multi-factor authentication. Most users set daily spending limits for debit cards and bank accounts, with 80% reporting this increases their sense of security. Banks and customers share security responsibilities, with customers required to protect digital “keys” like login information and authorization methods. The Dutch Transaction Monitoring Network (TMNL) enables timely detection of suspicious transaction patterns through interbank data sharing. Mainstream payment methods like iDEAL use secure data transmission technology to ensure online payment safety. The table below shows the international credit ratings of major Dutch banks:

| Bank Name | Credit Rating (S&P) | Credit Rating (Moody’s) | Credit Rating (Fitch) |

|---|---|---|---|

| NWB Bank | AAA | Aaa | AAA |

| BNG Bank | AAA | Aaa | AAA |

Convenience and Efficiency

Netherlands payment methods are renowned for their efficiency. 72% of consumers are accustomed to paying directly through bank accounts, far higher than in France, Switzerland, and Spain. Open banking technology is increasingly adopted, with usage expected to reach 29% by 2027. Payment systems reduce transaction times by lowering fees and subsidizing merchant debit card terminals. Since the 2016 European Payment Services Directive, non-bank third parties can initiate bank payments, further accelerating settlement speeds. Consumers prefer bank transfers and debit cards, driving rapid payment system development.

Innovation-Driven

Dutch banks and fintech companies continuously drive innovation in the payment sector. Technological advancements, regulatory support, and market trends collectively foster innovation. iDEAL collaborates with major banks, allowing users to transfer funds directly within online banking environments. Fintech companies leverage data analytics and AI to provide personalized services and prevent fraud. Blockchain technology simplifies processes and reduces costs. Mobile payment adoption is high, with 66% of customers regularly using mobile banking apps. P2P lending services are emerging, enriching the financial ecosystem.

E-commerce Promotion

Modern payment methods have significantly boosted the Dutch e-commerce market. iDEAL, due to its security and convenience, is the most popular payment choice, used by over 60% of online shoppers. Credit cards and PayPal offer flexibility for international transactions. E-commerce businesses integrate mainstream payment methods to enhance transaction smoothness and customer experience. The Netherlands leads Europe in instant payments, with 1.3 billion instant payment transactions in 2023, totaling $1.921 trillion. By 2028, transaction volume is expected to exceed 4.1 billion, with a total value of $10.109 trillion. Instant payments have become the market norm, enhancing local business competitiveness.

Selection Recommendations

Individual Users

Individual users should focus on security, user experience, and acceptance when choosing Netherlands payment methods. iDEAL, integrated with banking apps, offers a secure and convenient payment experience. Many users prefer quick payments via banking apps, simplifying the shopping process. PayPal is suitable for online shopping and personal transfers, while Klarna offers flexible “buy now, pay later” options.

- Trust and Security: iDEAL relies on bank security infrastructure, boosting user confidence.

- User Experience: Banking apps are user-friendly with smooth payment processes.

- Low Fees: iDEAL and debit cards have transparent fees, suitable for daily consumption.

- Acceptance: Most merchants support iDEAL and debit cards, with some international platforms supporting PayPal and Klarna.

Electronic payment solutions account for 76% of online purchases in the Netherlands, reflecting a strong user preference for digital payments.

| Payment Method | Usage Frequency |

|---|---|

| Electronic Payment Solutions | 76% |

Business Users

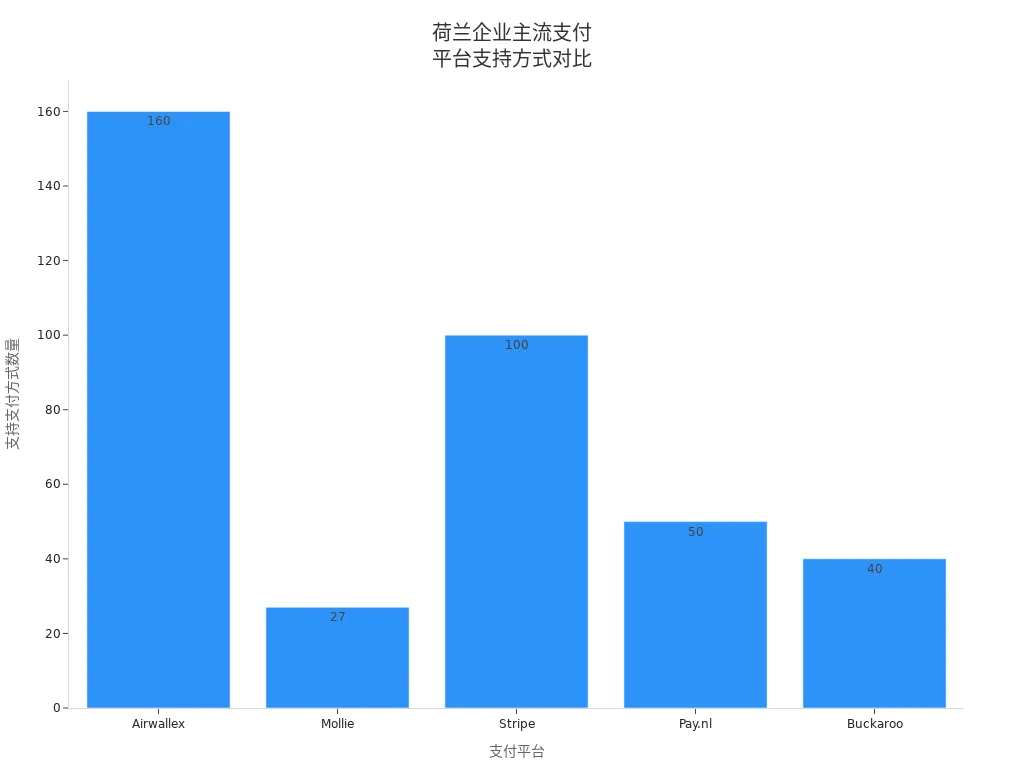

Business users should flexibly integrate multiple payment methods based on customer demographics and business needs. Choosing the right payment platform can enhance operational efficiency and customer satisfaction.

Below is a comparison of mainstream payment platforms:

| Provider | Platform Fees (USD) | Number of Payment Methods | Settlement Time | Local Support | Integration Method | Supported Currencies |

|---|---|---|---|---|---|---|

| Airwallex | $0/month + $0.25 + payment method fee | 160+ | Instant to 11 business days | English support | API/No-code | 130+ |

| Mollie | $0.25 + payment method fee | 27+ | 1 day to monthly | English support | API/No-code | 29+ |

| Stripe | $0.25 + 1.5-3.25% | 100+ | 3-7 days | English support | API/Pre-built | 135+ |

| Pay.nl | $0/month + $0.05/transaction + 0.25% | 50+ | Contact provider | English/Dutch support | API/No-code | 4 |

| Buckaroo | $4.50/month + payment method fee | 40+ | Contact provider | English/Dutch support | API/No-code | 8 |

Businesses should prioritize transparent pricing, settlement speed, and localized support. Integrating local payment methods like iDEAL and multi-currency settlement can improve customer satisfaction and conversion rates.

Cross-Border Payments

Cross-border payments face challenges like foreign exchange markups, slow settlements, and compliance risks. Businesses and individuals should prioritize transparent, low-cost, and fast-settling payment methods. SEPA Direct Debit is suitable for low-cost transfers within the Eurozone, while credit and debit cards are ideal for international transactions. iDEAL and mobile payments offer secure and convenient experiences for Dutch customers. Klarna’s “buy now, pay later” can reduce cart abandonment rates. Cryptocurrencies and PaySafeCard cater to customers prioritizing privacy and innovation.

| Payment Method | Applicable Scenarios and Advantages |

|---|---|

| iDEAL | Preferred for local Dutch payments, secure and convenient for online transactions |

| Mobile Payments | Fast settlement, suitable for tech-savvy customers |

| Credit/Debit Cards | Globally accepted, suitable for cross-border consumption |

| SEPA Direct Debit | Low-cost Eurozone transfers with transparent settlement |

| Klarna | Buy now, pay later, enhancing customer flexibility |

| Cryptocurrencies/PaySafeCard | Suitable for innovative and privacy-conscious customers |

For cross-border payments, prioritize providers supporting multi-currency, transparent settlement, and compliance to improve cash flow efficiency and reduce operational risks.

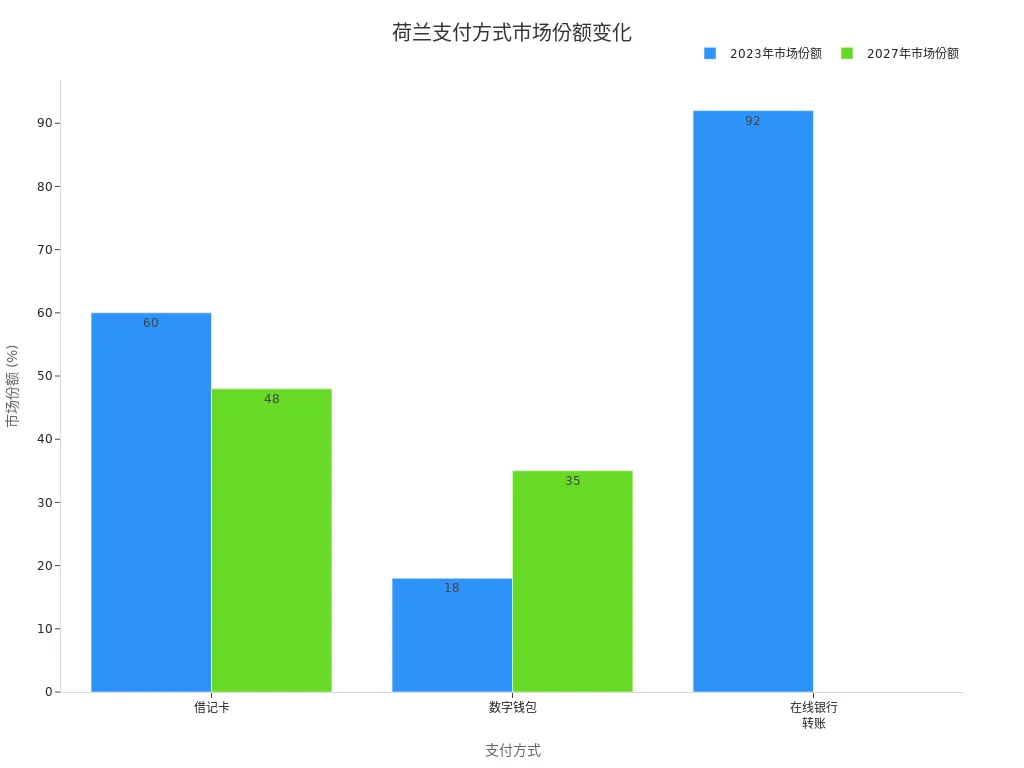

Netherlands payment methods demonstrate high diversity, significantly enhancing payment convenience. Debit cards dominate in-store payments, while digital wallets and online bank transfers continue to grow. The table below shows market share changes for major payment methods:

| Payment Method | 2023 Market Share | 2027 Market Share |

|---|---|---|

| Debit Card | 60% | 48% |

| Digital Wallet | 18% | 35% |

| Online Bank Transfer | 92% | N/A |

The Dutch financial system excels in security, innovation, and convenience. iDEAL simplifies the payment process, allowing users to authorize transactions within familiar banking portals, meeting the demand for reliable and simple payment methods. Readers can flexibly choose based on their needs to enhance their payment experience.

FAQ

Is iDEAL suitable for mainland Chinese users?

iDEAL primarily serves holders of Dutch bank accounts. Mainland Chinese users without a Dutch bank account typically cannot use iDEAL for payments.

What should I note when using bank cards for payments in the Netherlands?

Dutch merchants widely accept debit cards. Some merchants do not support credit cards. Users should confirm accepted card types in advance to avoid payment issues.

Are mobile payments in the Netherlands secure?

The Dutch financial system employs multiple security measures. Mobile payment platforms generally support biometric and multi-factor authentication, ensuring user fund safety.

Is cash still widely used in the Netherlands?

Cash is still used in some small shops and market stalls in the Netherlands. Most large merchants prefer digital payments. Users should carry small amounts of cash for emergencies.

How can I reduce fees for cross-border payments?

Users can opt for SEPA Direct Debit or multi-currency payment platforms. Some Hong Kong-licensed banks offer low-fee cross-border transfer services with faster settlement speeds.

Navigating the Netherlands’ diverse payment methods highlights iDEAL’s 70% market share and minute-fast transactions, yet cross-border payments still grapple with forex markups (0.5%-3%), high fees (bank transfers $20-45), and compliance delays, particularly for frequent international transfers. BiyaPay offers a streamlined alternative: fees from 0.5%, same-day delivery across most global regions, including the Netherlands, ensuring swift, secure funds without manual IBAN entry or extra verification costs.

BiyaPay’s strength is its smart multi-currency platform: real-time fiat-to-crypto swaps, zero-fee contract orders, and live rate tools to capture optimal euro exchanges, dodging traditional platforms’ volatility losses. A minutes-long signup unlocks a fully digital flow. Uniquely, trade US and Hong Kong stocks on one hub without offshore accounts, turning transfers into investments for enhanced yields. Outpacing PayPal’s 5% international surcharges or banks’ 1-2 day waits, BiyaPay delivers speed and savings.

Start now—register at BiyaPay for a seamless Netherlands payment journey. Use the Real-Time Exchange Rate Query to track euro trends and boost value. Explore Stocks to merge transfers with trading, fueling wealth growth. With BiyaPay, cross-border payments shift from hurdles to high-impact opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.