- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Platforms for Quick Money Transfers to the Netherlands and an Analysis of Transfer Times

Image Source: unsplash

When you want to quickly remit to the Netherlands, you often need to balance speed, fees, exchange rates, and security. There are many mainstream services available, including Wise, Paysend, Remitly, PayPal, Western Union, and MoneyGram. The delivery times of different platforms vary significantly; some platforms deliver in seconds, while others require 1-2 business days. Choosing the best platform can help your funds reach the Netherlands faster and more securely.

Key Points

- Choosing online remittance services like Wise and PayPal usually offers faster delivery times and lower fees.

- Before remitting, be sure to compare the fees and exchange rates of different platforms to ensure maximum receipt amounts.

- Ensure you choose a regulated platform to safeguard your funds and avoid potential fraud risks.

- Select the appropriate receiving method based on the recipient’s needs to ensure funds arrive safely and on time.

- During the remittance process, carefully verify the recipient’s information to avoid delays or returns due to errors.

Best Platforms and Delivery Times

Image Source: unsplash

When choosing to remit quickly to the Netherlands, you first need to understand the delivery speed and service scope of different types of platforms. The following provides a detailed analysis of online remittance services, traditional banks, payment platforms, and remittance companies to help you find the best platform.

Online Remittance Services

Many users prefer online remittance services because these platforms typically offer fast speeds, low fees, and convenient operations. You can refer to the following popular services in the field of remittance to the Netherlands:

- Wise: You can enjoy remittance services with exchange rates close to the mid-market rate, with extremely fast delivery speeds; over 50% of transfers are completed within minutes, as short as 20 seconds, and no longer than 2 business days.

- CurrencyFair: You will find transparent fees and simple operations, suitable for frequent small-amount remittances.

- ING: As a local Dutch bank, it processes transactions quickly, typically arriving the next day.

- Xe: You can choose it for large-amount remittances, with delivery times generally ranging from 1-4 days.

- Moneycorp: Suitable for large-amount remittances, with stable services.

- Revolut: Suitable for small to medium-amount remittances, with instant transfers possible between Revolut users.

- TransferGo: You can enjoy real-time exchange rates, suitable for frequent cross-border remittances.

When you use these online services, you can usually experience the convenience of near-instant delivery. Platforms like Wise and WorldRemit complete most transfers within minutes. TransferGo and Revolut can also achieve real-time delivery, especially suitable for scenarios requiring urgent funds.

Traditional Banks

If you choose to remit through traditional banks, the delivery speed is usually slower, and fees are higher. Licensed banks in Hong Kong have certain advantages in cross-border remittances, but you still need to wait 1-2 business days for funds to arrive. Traditional banks are suitable for users with extremely high security requirements, but they are less competitive in terms of speed and fees compared to online remittance services.

- Traditional bank transfers are slower and have higher fees.

- You are not recommended to choose traditional banks as the best platform in urgent situations.

Payment Platforms

You can use payment platforms like PayPal for international remittances. PayPal processes transactions quickly, especially when the recipient already has a PayPal account, allowing funds to arrive almost instantly. PayPal’s Xoom service also supports multiple receiving methods, with delivery times varying depending on the specific method. When choosing a payment platform, you can flexibly adjust based on the recipient’s actual needs.

- When using PayPal to send international transfers, processing times are usually fast.

- With Xoom, the receipt time varies depending on the receiving method.

Remittance Companies

You can also choose professional remittance companies for cross-border transfers. Companies like Western Union and MoneyGram cover a wide range of countries and support cash pickup and bank account deposits. When you use these companies, cash transfers typically arrive within minutes, while bank transfers take 1-3 days. Remitly offers fast and economy services, with the fast mode arriving in minutes and the economy mode taking 3-5 days.

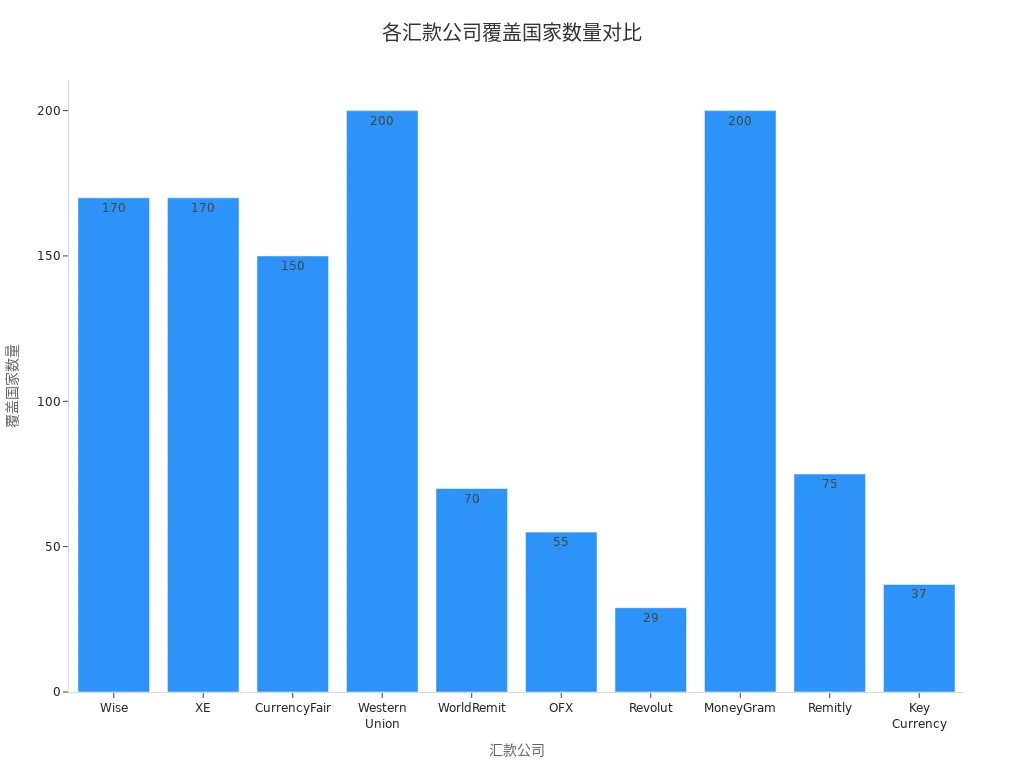

| Remittance Company | Transfer Speed | Countries Covered |

|---|---|---|

| Wise | 0-2 days (most within minutes) | 170 |

| XE | 1-4 days | 170 |

| CurrencyFair | 0-5 days | 150 |

| Western Union | Cash in minutes; bank 1-3 days | 200 |

| WorldRemit | 0-2 days (most within minutes) | 70 |

| OFX | 1-4 days | 55 |

| Revolut | Instant (between users); 1-2 days | 29 |

| MoneyGram | Cash in minutes; bank 1-3 days | 200 |

| Remitly | Fast in minutes; economy 3-5 days | 75 |

| Key Currency | 1-2 days | 37 |

You can refer to the chart below to understand the comparison of the number of countries covered by major remittance companies:

When choosing the best platform, you need to consider delivery speed, service scope, and receiving methods. Companies like Wise, WorldRemit, MoneyGram, and Western Union perform well in terms of speed and coverage, suitable for users with different needs. If you prioritize extreme speed, you can consider Wise and MoneyGram, which take as little as a few seconds to minutes.

| Platform | Minimum Transfer Time | Maximum Transfer Time |

|---|---|---|

| MoneyGram | A few hours | N/A |

| Wise | 20 seconds | 2 business days |

When operating in practice, you are recommended to prioritize platforms with fast delivery speeds and extensive country coverage to ensure funds reach the Netherlands safely and efficiently.

Fee Comparison

Image Source: unsplash

When choosing to remit to the Netherlands, fees are the most direct factor affecting your actual receipt amount. Different platforms have varying fee structures, exchange rate policies, and hidden fees. You need to fully understand these differences to select the best platform for your needs.

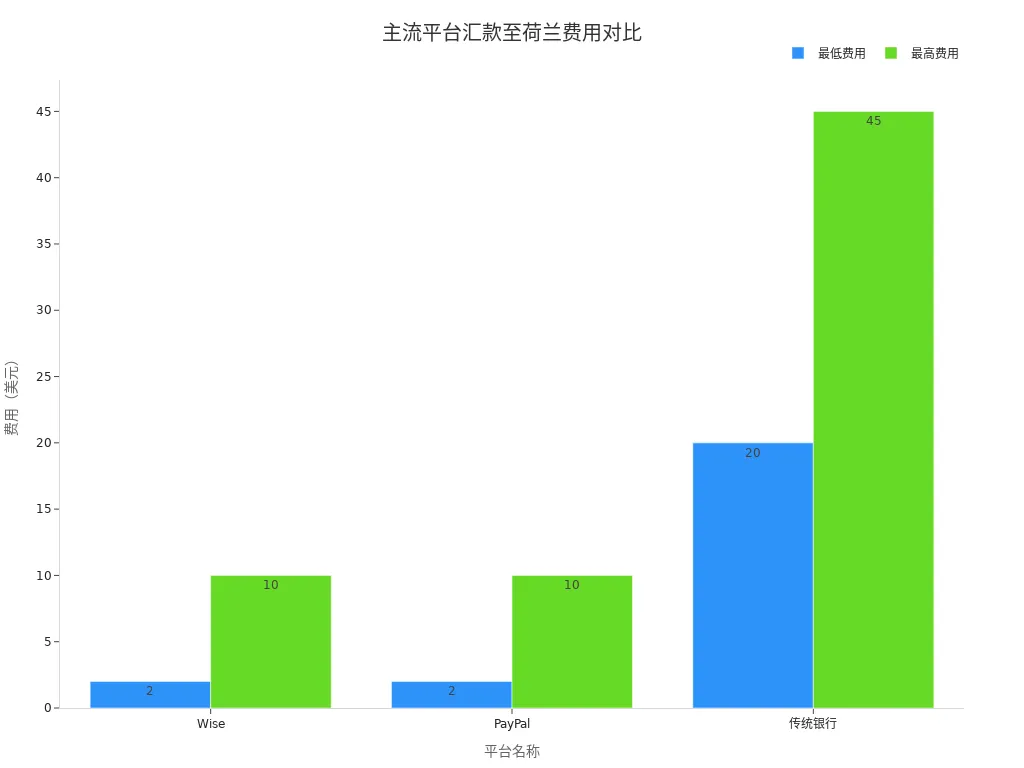

Transaction Fees

When using different remittance platforms, the first thing you encounter is transaction fees. Most online remittance services like Wise and PayPal have relatively low fees, typically ranging from $2 to $10. In contrast, traditional banks have significantly higher fees, usually between $20 and $45. You can refer to the table below to compare the fee structures of major platforms:

| Platform | Fee Range | Remarks |

|---|---|---|

| Wise | $2 to $10 | Uses real mid-market exchange rates |

| PayPal | $2 to $10 | Online platforms typically have lower fees |

| Traditional Banks | $20 to $45 | Higher fees, less favorable exchange rates |

You can see that choosing online platforms can usually save significant fees. Licensed banks in Hong Kong have lower or even no fees when receiving payments through the SEPA system, but fees can increase significantly for non-euro accounts or non-SEPA regions, ranging from $6 to $50 depending on the fee-sharing method you choose.

You can also refer to the chart below to compare the minimum and maximum fees for Wise, PayPal, and traditional banks:

Exchange Rate Differences

When remitting, in addition to transaction fees, you need to pay attention to exchange rates. The exchange rate policies of different platforms directly affect your actual receipt amount. Wise uses real mid-market exchange rates with transparent fees, allowing you to receive higher amounts. Some platforms manipulate exchange rates, offering low apparent fees but profiting from unfavorable rates.

| Platform | Exchange Rate | Transfer Fee | Recipient Receives |

|---|---|---|---|

| Wise | 1.00000 EUR | 0.95 EUR | 999.05 EUR |

You can see that Wise emphasizes exchange rate transparency, resulting in higher receipt amounts. Other platforms like CurrencyTransfer may have a slight exchange rate markup. When choosing a platform, you cannot only look at apparent fees but also calculate the actual costs caused by exchange rates.

Tip: Before remitting, you can use each platform’s remittance calculator to simulate the actual receipt amount to avoid overpaying due to exchange rate losses.

Other Fees

During the remittance process, you may also encounter some hidden fees. Different service providers charge varying additional fees based on transfer methods, delivery speeds, and payment options. Online remittance platforms generally have lower fees and better exchange rates, but you still need to carefully read the terms of service to understand all possible charges.

- If you choose direct transfers to Dutch bank accounts, you can reduce intermediary fees.

- Some platforms offer promotions or fee waivers on specific dates, and planning ahead can save costs.

- When using traditional banks, you may also encounter intermediary bank fees, which are deducted directly from the receipt amount.

When choosing the best platform, you are recommended to comprehensively consider transaction fees, exchange rates, and all possible additional fees. This way, you can ensure every dollar is used effectively, avoiding unnecessary losses.

Security Analysis

Regulatory Compliance

When choosing a remittance platform, you must pay attention to the platform’s regulatory qualifications. Legitimate platforms must obtain a Netherlands Payment Institution License to operate legally. The Dutch Central Bank (DNB) oversees these institutions, ensuring compliance with local laws and financial stability requirements. Platforms need to establish a local office, with teams experienced in fintech, and the application process typically takes 8 to 10 months. After obtaining a license, platforms must regularly submit operational reports, conduct customer due diligence, and strictly comply with anti-money laundering regulations. You can refer to the table below to understand the regulatory requirements for remittance platforms in the Netherlands:

| License Type | Description |

|---|---|

| Netherlands Payment Institution License | Allows fintech companies to provide various payment-related services, including account information services, cash deposits and withdrawals, and payment transaction execution. |

| Regulatory Authority | The Dutch Central Bank (DNB) oversees the issuance of payment institution licenses, ensuring compliance with Dutch laws and maintaining financial stability. |

| Application Requirements | Requires a local office, a team with relevant fintech experience, and an application process typically taking 8 to 10 months. |

| Compliance Obligations | After licensing, platforms must regularly submit operational reports, conduct customer due diligence, and comply with anti-money laundering regulations. |

When using licensed banks in Hong Kong for cross-border remittances, you must also ensure the bank is authorized by local regulatory authorities. The Dutch regulatory framework is primarily based on EU legislation, and authorization is only unnecessary if the client explicitly requests it. This ensures your funds’ safety and avoids legal risks.

Fund Protection

During the remittance process, platforms take multiple security measures to protect your funds and personal information. Mainstream platforms comply with EU regulations to ensure secure fund transmission and prevent fraudulent activities. Platforms also use advanced encryption technologies to protect your account and transaction data. Choosing regulated service providers, such as those certified by the FCA or DNB, offers additional fund protection. The table below shows the main security measures:

| Security Measure | Description |

|---|---|

| Compliance with EU Regulations | Ensures secure fund transmission and prevents fraudulent activities. |

| Encryption Technology | Uses advanced encryption to protect users’ funds and personal information. |

| Choosing Reputable Service Providers | Select regulated providers like FCA or DNB for an additional layer of protection. |

When remitting, you are recommended to prioritize compliant platforms with good reputations. This maximizes your fund security and reduces risks.

Risk Prevention

When conducting international remittances, you are prone to various fraud and information leakage risks. Common fraud types include:

- Impersonation Fraud: Scammers pretend to be someone you know, typically family or friends, requesting urgent help.

- Fake Investment and Lottery Scams: Promise huge returns or claim you won a prize, but you must pay fees first.

- Romance Scams: Scammers build online relationships and eventually request money.

- Phishing Links and Fake Websites: Scammers create fake websites nearly identical to real remittance services.

- Prepaid or Job Opportunity Scams: Target people seeking jobs or business opportunities.

You can take the following measures to protect yourself:

- Verify Identity: Always confirm the identity of the person you are remitting to.

- Use Trusted Services: Only remit through licensed, reputable providers.

- Enable Security Alerts: Turn on SMS or email notifications for each transaction.

- Do Not Share Sensitive Information: Never disclose one-time passwords, passwords, or login credentials.

- Report Fraud Immediately: Report to your bank, remittance provider, and authorities.

Reminder: Before remitting, be sure to verify recipient information to avoid losses due to negligence. Choosing legitimate platforms and enabling security alerts can effectively prevent most risks.

Exchange Rates and Conversion Experience

Real-Time Exchange Rates

When choosing a remittance platform, exchange rate transparency directly affects your actual receipt amount. Many mainstream platforms like Wise and Paysend provide real-time exchange rates and clearly display all fees before the transaction. Wise uses mid-market exchange rates with no hidden fees. Paysend offers competitive rates and shows specific rates and fixed fees before you initiate the transaction. You can refer to the table below to understand the exchange rate policies of various platforms:

| Platform | Exchange Rate Transparency | Fee Structure |

|---|---|---|

| Wise | Real-time mid-market exchange rate | No hidden fees |

| Paysend | Competitive rates, displayed before transaction | Fixed fees, varying by country |

When using these platforms, you can calculate the actual receipt amount in advance to avoid overpaying due to exchange rate losses. Some platforms like CurrencyFair also add a markup to exchange rates, but the markup is typically within 0.53%. If you choose traditional banks or certain remittance companies, you may encounter non-transparent exchange rates or higher markups, reducing the actual receipt amount.

Tip: Before remitting, you can use the platform’s exchange rate calculator to estimate the receipt amount in real-time, ensuring every dollar is used effectively.

Conversion Convenience

During the conversion process, the platform’s operational flow and user experience are equally important. Many online remittance services simplify the conversion steps, allowing you to complete transfers quickly on your phone or computer. For example, with Panda Remit and CurrencyFair, you only need to upload a valid ID, fill in the recipient’s information, and complete the remittance within 10 minutes to 1 hour. All fees are displayed in advance, and first-time users may enjoy fee waivers. You can refer to the table below to understand the conversion experience of different platforms:

| Feature | Panda Remit | CurrencyFair |

|---|---|---|

| Currency Conversion | Real-time exchange rate display | Competitive rates, as low as 0.53% markup |

| Fee Transparency | All fees displayed in advance, first-time fee waiver | Average fee USD3, bank fees up to 6% |

| Transfer Speed | Arrives within 10 minutes to 1 hour | Same-day arrival, depending on currency |

| Document Preparation | Only requires uploading valid ID | Simplified recipient information filling |

| Customer Support | Experienced customer service team | Trusted payment institution |

When operating in practice, you can feel the convenience brought by the platform. For example, user Marta once used bank transfers, which were cumbersome and expensive. After switching to Panda Remit, she only needed to upload her ID and could complete the transfer quickly on her phone, with faster speeds and more transparent fees.

When choosing a platform, you should also pay attention to common issues. Some users report that verification delays can prevent timely access to funds, and poor customer service communication can affect the experience. You can prioritize platforms with responsive customer service and simplified processes to enhance the overall conversion experience.

Reminder: When remitting, you are recommended to prepare your ID and recipient information in advance and choose platforms with transparent fees and real-time exchange rates to ensure funds reach the Netherlands faster and more securely.

Receiving Methods

When remitting to the Netherlands, you can choose from multiple receiving methods. Different methods suit different scenarios, and you need to select based on the recipient’s actual needs. Below introduces the most common receiving methods in the Netherlands, along with the information and precautions recipients need to prepare.

Bank Account

You can directly transfer funds to the recipient’s Dutch bank account. This method is safe and reliable, suitable for most people. Dutch banks support multiple receiving channels, including iDEAL, SEPA Direct Debit, and debit cards. iDEAL is the most popular online payment method in the Netherlands, with about 70% of e-commerce transactions using this method. SEPA Direct Debit is suitable for regular payments between EU countries. When using licensed banks in Hong Kong for cross-border remittances, you typically need the recipient’s bank account information, including account name, IBAN, and BIC. You must also ensure the recipient’s information is accurate to avoid delays or returns due to errors.

Tip: When filling in recipient information, you are recommended to verify IBAN and BIC in advance to ensure smooth fund arrival.

Cash Pickup

If you choose cash pickup services, you can collect cash in the Netherlands through companies like Western Union or MoneyGram. This method is suitable for recipients without bank accounts or those needing cash urgently. When arranging cash pickup, recipients need to provide the following information:

| Requirement/Restriction | Details |

|---|---|

| Sender’s Full Name | Requires the sender’s full name (first, middle, and last) |

| Sending Country | Requires the country from which funds are sent |

| Sending Amount | Requires the approximate amount sent |

| Transaction Unique Number | Requires the unique transaction number (MTCN) |

| ID Document | Requires a government-issued ID |

| Fund Delays | Funds may be delayed due to transaction conditions, regulatory issues, etc. |

When choosing cash pickup, you should remind recipients to prepare their ID and transaction number in advance. Funds usually arrive quickly, but delays may occur due to service point hours or regulatory requirements.

Other Methods

You can also choose digital wallets and online payment platforms as receiving methods. Dutch users commonly use PayPal, Apple Pay, Google Pay, and Klarna. PayPal supports online shopping and personal transfers, making it convenient. Apple Pay and Google Pay allow users to make secure payments via phone or other devices. Klarna and SOFORT offer installment payments and direct bank account payments. When using these platforms, you only need the recipient’s account or phone number to complete the transfer. Some platforms like Revolut and TransferWise also support mobile wallet receipts, suitable for younger users and cross-border payment scenarios.

Reminder: When choosing a receiving method, you are recommended to match it with the recipient’s actual needs and usage habits, preparing the required information in advance to ensure funds arrive safely and on time.

Selection Advice

Needs Matching

When choosing a remittance platform, you need to match it with your actual needs. Different platforms have advantages in speed, fees, and security. You can refer to the table below to quickly understand the three core selection criteria:

| Selection Criteria | Description |

|---|---|

| Fees | Compare transfer fees and exchange rates to ensure maximum value. |

| Speed | Online transfer services typically offer faster delivery times. |

| Security | Large banks offer higher security but have higher fees and longer processing times. |

If you need urgent remittances, you can prioritize platforms supporting expedited delivery options. For large-amount transfers, you are recommended to choose service providers with transparent fee structures and high security. For daily small-amount remittances, you can select platforms with convenient operations and low fees. You should also pay attention to whether the platform provides reliable customer support to get timely help when issues arise.

Reminder: When choosing a platform, you are recommended to first clarify your needs and then screen based on platform features. This ensures your funds reach the Netherlands faster and more securely.

Precautions

When operating remittances, you need to pay attention to the following key factors:

- Processing Time: You should understand the platform’s transfer time in advance, especially in time-sensitive scenarios.

- Fee Structure: You should choose providers that clearly list all fees to avoid hidden costs.

- Security: You must ensure the platform has a good security record and compliance qualifications.

- Customer Support: You can prioritize platforms with responsive customer service to resolve issues quickly.

- Delivery Options: In urgent cases, you can choose platforms supporting expedited delivery.

In urgent remittance scenarios, you can follow these steps to choose:

- Select platforms supporting expedited delivery options to ensure priority fund arrival.

- Pay attention to the platform’s fees and exchange rates, calculating the actual receipt amount.

- Understand the specific time required from sending to receiving funds to avoid delays.

Before remitting, you are recommended to stay updated on platform policies and fee changes. Some platforms adjust exchange rates or fees based on market changes. You can regularly check platform announcements to ensure your choice remains optimal. When filling in recipient information, you should carefully verify to avoid delays or returns due to errors.

Tip: During the remittance process, you are recommended to save all transaction records and notifications for easy tracking and appeals in case of issues.

When choosing a remittance platform, you can refer to the table below to quickly understand the advantages and disadvantages of each platform:

| Platform | Advantages | Disadvantages |

|---|---|---|

| PayPal | Free account registration, near-instant transfers, protects bank information | High international fees, foreign currency exchange markup, recipient needs an account |

| Bank Transfer | Free transfers between U.S. banks, funds protected by FDIC | May take 3 business days, high international fees and exchange rate costs |

You need to consider your needs, focusing on speed, fees, exchange rates, and security. Before remitting, you are recommended to check the platform’s latest policies to ensure funds reach the Netherlands safely and efficiently.

FAQ

How Fast Can Funds Arrive in the Netherlands?

When using Wise or MoneyGram, funds can arrive in as little as a few minutes. Some platforms, like licensed banks in Hong Kong, typically take 1-2 business days.

What Recipient Information Is Needed for Remittance?

You need the recipient’s bank account name, IBAN, and BIC. For cash pickup, you also need the recipient’s ID and transaction number.

How Are Remittance Platform Fees Calculated?

When remitting via Wise or PayPal, fees are generally $2-10 USD. Licensed banks in Hong Kong have higher fees, typically $20-45 USD.

How to Ensure Fund Safety During Remittance?

You should choose regulated platforms, such as licensed banks in Hong Kong or platforms with a Netherlands Payment Institution License. Enabling SMS or email notifications can enhance security.

Do Exchange Rate Changes Affect the Receipt Amount?

When remitting, platforms use real-time exchange rates. Exchange rate fluctuations directly affect the actual USD receipt amount. You are recommended to use the platform’s calculator to estimate the amount in advance.

When exploring top platforms for swift remittances to the Netherlands, Wise’s 20-second transfers and low fees ($2-10) stand out, yet Remitly’s rapid mode, though minutes-quick, carries 0.5%-3% rate markups, and MoneyGram or Western Union’s instant cash pickups incur $5-20 fees—challenges for mainland China users facing frequent transfers with verification delays or hidden intermediary costs. BiyaPay offers a superior fix: fees from 0.5%, same-day delivery across most global regions, including the Netherlands, ensuring fast, secure funds without cumbersome IBAN checks or extra charges.

BiyaPay’s strength lies in its multi-asset exchange platform: real-time fiat-to-crypto conversions, zero-fee contract orders, and live rate query tools to seize optimal euro rates, dodging traditional platforms’ volatility losses. A minutes-long signup unlocks a digital-first flow. Uniquely, trade US and Hong Kong stocks on one hub without offshore accounts, turning remittances into investments for enhanced yields. Outshining PayPal’s 5% international surcharges or banks’ 1-2 day waits, BiyaPay delivers speed and savings.

Start now—register at BiyaPay for a seamless Netherlands transfer journey. Use the Real-Time Exchange Rate Query to monitor euro trends and maximize value. Explore Stocks to fuse transfers with trading, sparking wealth growth. With BiyaPay, cross-border remittances transform from hurdles to high-impact opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.