- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Dutch Banking Sector Fund Management and Investment Opportunities: A Comprehensive Analysis of Savings, Remittances, and Financial Advice

Image Source: pexels

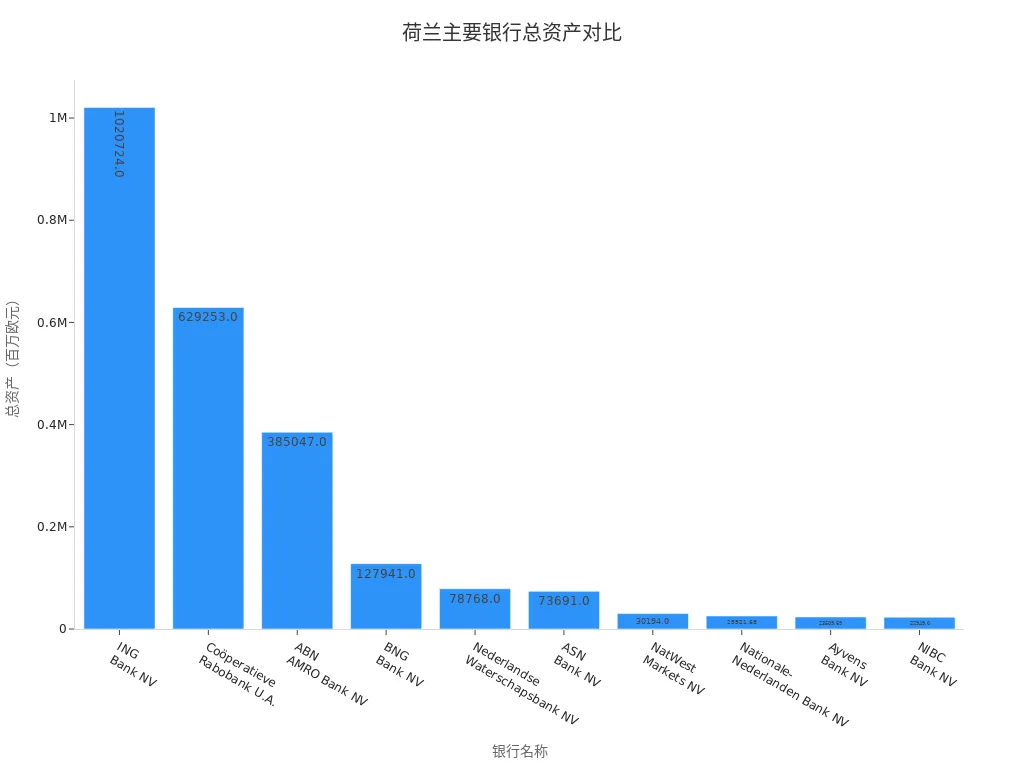

When managing funds in the Netherlands, you need to focus on selecting banking services and controlling risks. The Netherlands has 100 banks, with a total banking asset-to-GDP ratio as high as 262.86%, indicating a stable financial system. The table below shows the total assets and market share of major banks:

| Bank Name | Total Assets (Million Euros) | Market Share |

|---|---|---|

| ING Bank NV | 1,020,724.00 | 37.06 % |

| Coöperatieve Rabobank U.A. | 629,253.00 | 22.84 % |

| ABN AMRO Bank NV | 385,047.00 | 13.98 % |

| BNG Bank NV | 127,941.00 | 4.64 % |

| Nederlandse Waterschapsbank NV | 78,768.00 | 2.86 % |

| ASN Bank NV | 73,691.00 | 2.68 % |

| NatWest Markets NV | 30,194.00 | 1.10 % |

| Nationale-Nederlanden Bank NV | 25,521.68 | 0.93 % |

| Ayvens Bank NV | 23,509.69 | 0.85 % |

| NIBC Bank NV | 22,949.00 | 0.83 % |

You can combine savings interest rates, investment products, and digital tools to enhance asset growth and financial security.

Key Points

- Choose the right bank account type: current accounts are suitable for daily expenses, savings accounts for long-term savings, and investment accounts for investment needs.

- When opening a bank account in the Netherlands, preparing identification, proof of address, and proof of income can expedite the process.

- Pay attention to savings account interest rates and flexibility; flexible savings accounts suit short-term needs, while fixed-term accounts are ideal for long-term goals.

- Using digital financial tools and mobile banking services can simplify fund management, improve efficiency, and keep you updated on account activities.

- For international remittances, choose legitimate channels, compare fees and transfer times to ensure fund security and avoid fraud risks.

Bank Account Types

Account Categories

In the Netherlands, you can choose from various bank accounts to meet different fund management needs. The table below summarizes the main account types and their features:

| Account Type | Description | Features |

|---|---|---|

| Current Account | Used for daily transactions, such as payments and receipts | Comes with a debit card, supports online and mobile banking |

| Savings Account | Designed for savings, with higher interest rates than current accounts | Limits withdrawal frequency, encourages fund accumulation |

| Investment Account | For investing in stocks, bonds, funds, and other financial products | Provides investment tools for easy asset allocation |

| Business Account | Serves freelancers and business owners | Separates personal and business finances, supports invoicing and expense management |

| Children’s Account | Educates children on financial management, with interactive features | Personalized debit card, with savings goal rewards |

You can select the appropriate account type based on your needs. For example, current accounts are suitable for daily expenses, savings accounts for long-term savings, and investment accounts offer diverse financial products and tools for investment needs.

Account Opening Process

To open a bank account in the Netherlands, you need to prepare the following documents:

- Valid identification (e.g., passport, European ID, or Dutch residence permit)

- Proof of Dutch address (e.g., rental contract or recent utility bill)

- Proof of income (e.g., payslip or employment contract)

- BSN (Citizen Service Number)

You can submit applications through bank branches or, for some banks, online platforms. Certain banks offer English-language services for non-residents and expatriates, and some allow EU residents without a Dutch BSN to open accounts. Note that traditional banking systems may occasionally experience delays due to technical or procedural issues, and improper account use may trigger further reviews.

Tip: Preparing all required documents in advance can significantly shorten the account opening process and avoid delays due to incomplete information or system issues.

Fund Security

The Dutch banking sector places a high priority on fund security. All banks are regulated by the Dutch Financial Supervision Act (WFT) and must participate in the deposit guarantee scheme. Your deposits in Dutch banks are protected with compensation up to $100,000. If a bank fails, the compensation process is automatically initiated, and authorities will notify you of the specific claim steps.

Banks are also required to comply with strict compliance and anti-money laundering obligations, including customer due diligence, risk assessments, and reporting unusual transactions. While enjoying convenient digital services, you should remain vigilant against cyber fraud and account information leaks. Dutch banks generally employ advanced fraud detection technologies and collaborate closely with regulators to continuously enhance fund security.

Savings Options

Image Source: unsplash

Savings Account Comparison

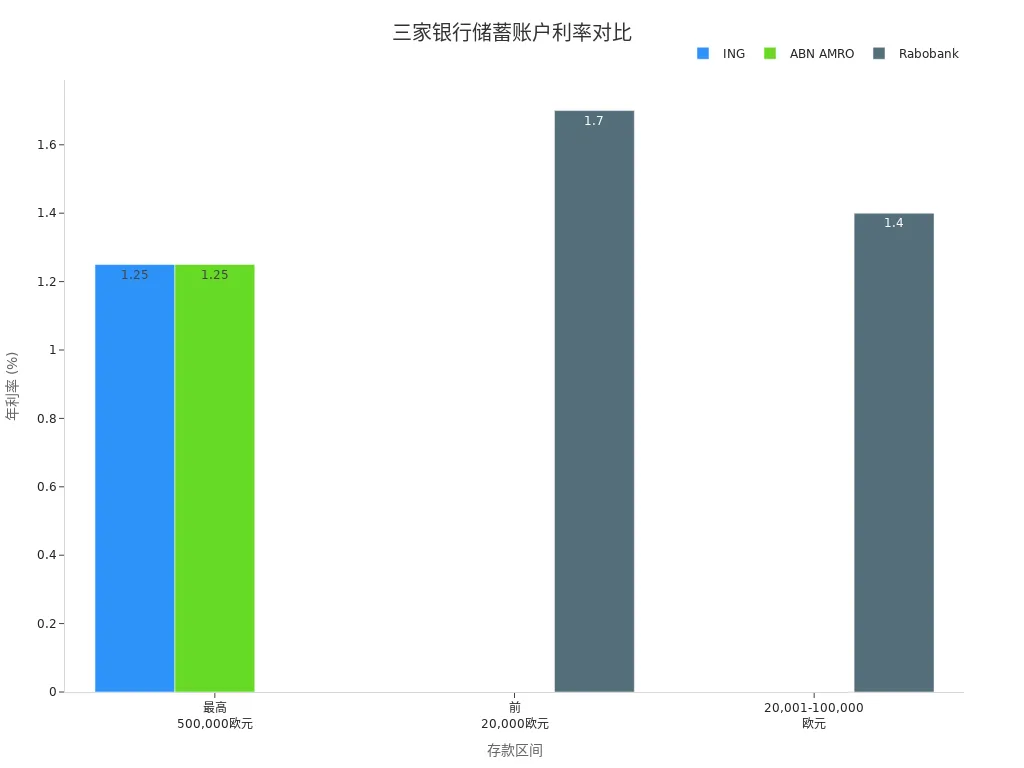

When choosing a savings account in the Netherlands, you typically focus on interest rates, deposit conditions, and account security. The three major Dutch banks—ING, ABN AMRO, and Rabobank—offer different interest rate structures and account conditions for savings customers. The table below shows the interest rates and applicable deposit ranges for major banks’ savings accounts:

| Bank | Interest Rate | Account Conditions |

|---|---|---|

| ING | 1.25% | Applies to deposits up to 500,000 euros |

| ABN AMRO | 1.25% | Applies to deposits up to 500,000 euros |

| Rabobank | 1.7% (first 20,000 euros) | Drops to 1.4% for deposits over 20,000 euros (up to 100,000 euros) |

You can visually compare the interest rate differences across banks for various deposit ranges in the bar chart below:

Rabobank offers higher interest rates for smaller deposits (up to 20,000 euros), making it suitable for short-term fund management needs. ING and ABN AMRO provide stable performance for larger deposits with flexible account conditions, ideal for long-term fund accumulation.

Interest Rates and Flexibility

When choosing a savings account, in addition to interest rates, you should consider account flexibility. Dutch banks typically offer two types of savings accounts: flexible savings accounts and fixed-term savings accounts. The table below summarizes the deposit and withdrawal flexibility of these account types:

| Account Type | Deposit Flexibility | Withdrawal Flexibility |

|---|---|---|

| Flexible Savings Account | Deposits can be made anytime, no minimum amount required | Withdrawals can be made anytime without penalties |

| Fixed-Term Savings Account | Funds must be locked, typically for at least one year | Early withdrawals may result in loss of interest and penalties |

Flexible savings accounts are suitable for adjusting your fund management strategy at any time, meeting daily or short-term savings needs. Fixed-term savings accounts are ideal for those with clear long-term savings goals, willing to lock funds for higher interest rates. When choosing, you should balance interest rates with liquidity needs and financial planning.

Expert Advice: If you anticipate large expenses or investment plans in the near future, prioritize flexible savings accounts. For locking in interest rates and achieving asset growth, consider fixed-term savings accounts, but plan fund liquidity in advance.

Target Audience

Different savings accounts suit different types of customers. You can choose the most appropriate savings plan based on your financial goals and fund management needs:

- If you’ve just arrived in the Netherlands and have high liquidity needs, opt for a flexible savings account for easy deposits and withdrawals.

- If you have a stable income and plan to accumulate assets long-term, consider ING or ABN AMRO’s large-deposit savings accounts for stable interest rates and high deposit limits.

- If you seek higher interest rates in the short term, Rabobank’s small-deposit high-interest accounts are more suitable.

- If you have specific financial goals, such as buying a home or funding education, fixed-term savings accounts can lock in interest rates and enhance asset growth efficiency.

When developing a fund management strategy, you should consider your life stage, income status, and future plans to flexibly adjust account types. Properly utilizing bank savings products can enhance fund security and asset growth.

Fund Management Services

Investment Products

In Dutch banks, you can choose from a variety of investment products to meet different fund management goals. Mainstream banks typically offer the following types of investment products:

| Investment Product Type | Description |

|---|---|

| Equity Funds | Mutual funds investing in stocks and shares, aiming for long-term growth through capital appreciation. |

| Bond Funds | Invest in bonds and other debt instruments, paying periodic dividends, such as interest payments. |

| Mixed Funds | Invest in a combination of stocks and bonds. |

| Hedge Funds | Private investment funds limited to select investors, potentially offering higher returns but with higher fees, less regulation, and greater risks. |

You can also invest in ETFs (exchange-traded funds) through bank platforms, which have become highly popular among Dutch retail investors in recent years. ETFs cover various asset classes and investment strategies, enabling diversified investing. Since 2022, the Dutch market has seen over 400,000 new investors, with expectations of further growth in the coming year. You can conveniently manage and purchase these products through digital platforms.

If you focus on long-term security, banks also offer pension accounts and related financial plans. You can flexibly allocate different types of investment products based on your risk tolerance and financial goals.

Risk Management

When managing funds, identifying and controlling risks is crucial. Dutch banks provide professional risk assessment tools to help you understand the risk levels of different products. You should focus on the following aspects:

- Market Risk: Fluctuations in stock and fund prices may lead to changes in asset value.

- Interest Rate Risk: Bonds and fixed-income products are significantly affected by interest rate changes.

- Liquidity Risk: Some investment products may have restrictions on early redemption.

- Regulatory and Tax Risks: Tax policies for investment products can impact your actual returns.

When investing in the Netherlands, tax planning is equally important. Below are key tax considerations:

- U.S. citizens residing in the Netherlands for over 183 days are generally considered Dutch tax residents and must declare global income, including investments, rentals, and pensions.

- U.S.-sourced pensions withdrawn as a Dutch tax resident are taxable, with withdrawals exceeding approximately $75,000 taxed at 49.5%.

- Roth IRA income is not taxed in the Netherlands, and withdrawals are exempt from Dutch income tax.

- Dutch-sourced pensions are taxed only in the Netherlands.

- From 2025, the Dutch government will implement significant changes to mutual funds and exempt investment institutions (EII), with 2024 as a transition period.

- Fiscal investment institutions (FII) will no longer directly invest in real estate, and the EII regime will no longer apply to private (family) capital investments.

- Following a 2021 court ruling, Box 3 tax methods changed, requiring differentiation between savings and investments. From 2023, taxes are strictly based on asset types, potentially increasing tax bills for investors while reducing rates for savers.

- The Netherlands imposes a 15% withholding tax on dividends paid by resident companies to residents or non-residents, unless reduced or exempted by applicable tax treaties. Resident individuals can offset domestic withholding tax against their total income tax.

When allocating assets, you should consider your risk tolerance, investment horizon, and tax implications, diversifying investments scientifically to reduce risks from single-market fluctuations.

Tip: Regularly communicate with bank financial advisors to adjust your investment portfolio, ensuring your fund management plan aligns with market changes and personal goals.

Investment Advice

When managing funds in the Netherlands, digital innovations offer greater convenience. Many banks and fintech companies provide advanced online financial tools and mobile banking services. The table below summarizes some mainstream digital financial platforms and their features:

| Bank Name | Main Services | Features |

|---|---|---|

| OneSafe | Traditional and Web3 financial services | Multi-currency support, global account management |

| bunq | Digital banking experience | Quick registration, eco-friendly investment options |

| Knab | Services for self-employed individuals | 12 months of free banking services, financial management tools |

| Revolut | Comprehensive financial services | High savings interest rates, global ATM withdrawals |

| N26 | Modern banking services | High-interest savings accounts, investment opportunities |

| Monese | Mobile banking alternative | Multi-currency accounts, discounted international transfers |

You can use these platforms for account management, investment transactions, budgeting, and international remittances. Mobile banking apps support bill payments, transfers, and budget management. Some banks, like bunq, allow account opening in minutes and multi-currency payments with lower fees. Mobile payment technologies, such as QR codes and NFC, enable contactless payments in stores.

When developing investment strategies, you can focus on the following trends:

- ETFs have become a mainstream choice for Dutch retail investors, covering various asset classes and strategies.

- More investors are managing ETF products through digital platforms, improving fund management efficiency.

- The number of investors in the market continues to grow, with digital financial tools becoming key assistants in asset allocation.

When selecting investment products and digital tools, you should consider your needs and risk preferences, diversify assets reasonably, monitor tax changes, and continuously optimize your fund management plan. You can use mobile banking and online financial platforms to stay updated on account activities and respond flexibly to market changes.

International Remittances

Image Source: pexels

Remittance Methods

When making international remittances in the Netherlands, you can choose from various methods. Common channels include bank transfers, online remittance services, and wire transfer services. The table below compares the convenience, fees, speed, and applicable scenarios of these three mainstream methods:

| Service | Ease of Use | Fees | Speed | Summary |

|---|---|---|---|---|

| Bank Transfer | Requires an account, supports online or app operations | Higher fees, average exchange rates | Slower, especially for non-EU regions | Highest security but higher costs and time consumption |

| Online Remittance Service | Requires an account, supports online or app operations | Lower fees, better exchange rates | Fast transfers | Ideal for cost- and time-conscious users, but transfer limits apply, with slightly lower security than banks |

| Wire Transfer Service | Account optional, supports multiple operation methods | Varying fees, average exchange rates | Fast transfers | Suitable for users without bank accounts, convenient but requires caution against fraud risks |

You can flexibly choose the appropriate method based on remittance amount, transfer speed, and security needs. For remittances to China/Mainland China, prioritize legitimate banks or well-known online platforms to ensure fund security.

Fees and Delivery Time

The fees and delivery times vary significantly across remittance methods. When choosing a service, you should focus on total costs and delivery efficiency. The table below summarizes the fee ranges and transfer times of mainstream service providers:

| Service Provider | Fee Range (USD) | Transfer Time |

|---|---|---|

| Traditional Banks | $20 - $45 | 2-5 business days |

| TransferWise | $2 - $10 | Minutes to 24 hours |

| PayPal | $2 - $10 | Minutes to 24 hours |

| Western Union | N/A | Minutes to 24 hours |

| MoneyGram | N/A | Minutes to 24 hours |

Traditional bank remittances typically incur higher handling fees and longer delivery times. Online services like TransferWise and PayPal offer lower fees and faster delivery, ideal for small, frequent remittances. Some wire transfer services, such as Western Union and MoneyGram, also enable quick delivery but require attention to terms and fee structures.

Expert Advice: For large remittances, compare the total costs and exchange rates of different channels in advance to avoid losses due to fees and exchange rates affecting the actual received amount.

Remittance Security

When making international remittances, fund security is critical. Dutch banks and mainstream remittance platforms generally adopt multiple security measures to protect your funds and information. Common security mechanisms include:

| Security Measure | Description |

|---|---|

| Two-Factor Authentication (2FA) | Requires secondary verification during login or transfers, reducing risks even if passwords are compromised. |

| Encryption Technology | Uses advanced encryption protocols to protect transaction data, preventing leaks of personal and financial information. |

| Fraud Detection Systems | Monitors unusual transactions in real-time, identifying and blocking suspicious activities to reduce fraud risks. |

Before making a remittance, verify the recipient’s information and avoid using unverified channels. Regularly update account passwords and enable all available security verification features. In case of anomalies, promptly contact the bank or platform’s customer service to ensure fund security.

Reminder: When choosing remittance services, prioritize platforms with robust security systems and good reputations, and avoid trusting strangers or unofficial channels to prevent cross-border fraud risks.

Fund Management Tips

Practical Advice

When managing funds in the Netherlands, you can adopt various practical methods to improve financial efficiency. You can use budgeting apps, spreadsheets, or personal finance software to track every income and expense, fostering good financial habits. Familiarizing yourself with Dutch banks’ online services and mobile payment tools can simplify daily transaction processes. Setting clear financial goals, such as planning pensions or exploring private pension schemes, helps achieve long-term asset growth. For international remittances, compare fees and exchange rates to choose cost-effective channels, especially for fund flows involving China/Mainland China. When facing complex financial issues, consult professional international financial advisors for tailored advice for expatriates.

Tip: Regularly review your budget and expenses to identify shortcomings in fund management, adjust strategies, and enhance fund security and asset growth.

Common Pitfalls

During financial management in the Netherlands, you may encounter common pitfalls. Not understanding local living costs can lead to budget imbalances. Failing to open a local bank account promptly can hinder daily fund flows and financial efficiency. Ignoring tax filing obligations may result in additional fines or tax risks. Underestimating medical expenses can increase financial pressure in emergencies. Not planning transportation costs may disrupt overall fund management plans.

| Common Pitfall | Impact Description |

|---|---|

| Not Understanding Living Costs | Budget overruns, difficulty achieving savings goals |

| Not Opening a Local Account | Limited fund flows, inconvenient financial management |

| Ignoring Tax Obligations | Potential fines and legal risks |

| Underestimating Medical Expenses | Unexpected expenses impacting asset security |

| Not Planning Transportation Costs | Unreasonable fund allocation, budget imbalances |

When developing a fund management plan, familiarize yourself with local Dutch policies and lifestyle details in advance to avoid these pitfalls and ensure asset security and financial health.

When managing funds in the Netherlands, you should select appropriate banking products based on your financial goals. The high penetration of digital banking tools has profoundly influenced your decision-making and asset allocation:

| Influencing Factor | Description |

|---|---|

| Digital Banking Penetration | Over 95% penetration rate for internet banking in the Netherlands |

| Enhanced Customer Experience | Personalization and AI integration optimize financial decision-making processes |

| Changing Competitive Landscape | Continuous improvement in service quality meets your expectations for efficiency and convenience |

You should continuously monitor digital innovations, risk management, and asset allocation, responding flexibly to market changes to ensure fund security and compliance.

FAQ

How to Choose the Right Dutch Bank Account Type?

You should select an account based on fund usage and liquidity needs. Use current accounts for daily expenses, savings accounts for long-term savings, and investment accounts for investment needs. Consult bank advisors for personalized recommendations.

What Documents Are Needed to Open a Bank Account in the Netherlands?

You typically need valid identification, proof of Dutch address, proof of income, and a BSN number. Some banks support online account opening. Preparing documents in advance can expedite the process.

What Should I Consider for International Remittances to China/Mainland China?

Verify recipient information and choose legitimate banks or well-known online platforms. Pay attention to exchange rates, fees, and delivery times. Prioritize services with robust security measures.

How Do Dutch Bank Savings Interest Rates Vary?

Interest rates vary significantly across banks and account types. Flexible savings accounts offer lower rates, while fixed-term accounts provide higher rates. Regularly monitor bank announcements to adjust savings strategies.

What Are the Risks of Investing in Dutch Bank Financial Products?

You should consider market fluctuations, liquidity, and tax policy changes. Diversify investments and regularly assess risks to reduce potential losses. Consult professional advisors if needed.

Exploring Netherlands banking for fund management and investment reveals ING and Rabobank’s competitive savings rates (1.25%-1.7%) and diverse products (like ETFs and bond funds), yet international remittances face steep fees (banks $20-45), rate markups (0.5%-3%), and 2-5 day delays, particularly for frequent cross-border transfers. BiyaPay delivers a superior solution: fees from 0.5%, same-day delivery across most global regions, including the Netherlands, ensuring swift, secure funds without complex IBAN checks or hidden intermediary costs.

BiyaPay’s core is its multi-asset exchange platform: instant fiat-to-crypto conversions, zero-fee contract orders, and real-time rate tools to capture optimal euro exchanges, dodging traditional platforms’ volatility losses. A minutes-long signup unlocks a seamless digital workflow. Uniquely, trade US and Hong Kong stocks on one hub without offshore accounts, transforming remittances into investments for enhanced returns. Unlike TransferWise’s minute-fast transfers with higher caps (~$1,000 per transaction), BiyaPay’s low costs and flexibility excel for diverse financial needs.

Start now—register at BiyaPay for a streamlined Netherlands fund management journey. Use the Real-Time Exchange Rate Query to track euro trends and maximize value. Explore Stocks to blend transfers with trading, fueling wealth growth. With BiyaPay, cross-border fund management shifts from complexity to high-impact opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.