- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Does Portugal Use the Euro? Exploring the Impact of the Euro on Portugal’s Economy and International Remittances

Image Source: pexels

You may wonder whether Portugal currently uses the euro. The answer is straightforward: Portugal’s official currency is the euro. You will use the euro for shopping, dining, or paying for services locally. The euro’s impact on Portugal’s economy is significant. Although the euro was expected to drive economic growth, data shows that Portugal’s GDP growth rate has not significantly increased, and there have been slight economic losses due to private consumption and net exports. You will find that the euro’s actual circulation affects the lives of Portuguese people and the way international remittances are conducted.

Key Takeaways

- Portugal has been using the euro since 2002, becoming a member of the Eurozone, simplifying daily transactions and payment processes.

- The euro’s unified monetary policy has enhanced Portugal’s economic stability, reducing inflation risks.

- Through the SEPA system, international remittances in Portugal have become more efficient, with lower fees and faster fund transfers.

- The euro facilitates trade by eliminating uncertainties caused by exchange rate fluctuations, enhancing the international competitiveness of businesses.

- Despite the euro’s benefits, Portugal faces challenges such as the loss of monetary policy autonomy, which requires a rational approach.

Portugal’s Official Currency

Image Source: pexels

Euro Adoption Timeline

When traveling or living in Portugal, you will notice that all goods and services are priced in euros. Portugal officially adopted the euro in 2002, becoming a member of the European Monetary Union (Eurozone). You can directly use euros for payments at supermarkets, restaurants, transportation, and other places.

The euro is managed by the European Central Bank (ECB) under a floating exchange rate system. When using the euro in Portugal, you don’t need to worry about the complex process of currency exchange.

After joining the Eurozone, Portugal’s monetary policy became more stable. You will find that the euro’s circulation strengthens economic ties between Portugal and other Eurozone countries.

- Portugal is a member of the European Monetary Union (Eurozone).

- Portugal uses the euro as its official currency.

- The euro is controlled by the European Central Bank (ECB) with a floating exchange rate.

Currency Transition

You might be curious about what currency Portugal used before adopting the euro. In the past, Portugal’s official currency was the Escudo. As global economic integration accelerated, Portugal joined the European Union in 1986. You will find that after joining the EU, Portugal faced new economic challenges. The Escudo lacked competitiveness in international markets, with significant exchange rate fluctuations.

The Portuguese government aimed to achieve economic stability and growth through currency transition. You can see that adopting the euro has made Portugal’s monetary system more robust, better equipped to handle pressures from globalization.

- Portugal joined the EU in 1986, promoting economic integration.

- Currency stability became a key goal in addressing global economic challenges.

- The Escudo gradually exited the historical stage due to global economic pressures.

You now understand the evolution of Portugal’s official currency and the euro’s significant role in Portuguese society.

Euro Circulation and History

Joining the Eurozone

Do you want to know why Portugal became a Eurozone member? Portugal underwent several key historical events, gradually integrating into the European economic system.

- On March 28, 1977, Portugal formally applied to join the EU.

- On January 1, 1986, Portugal and Spain became EU member states together.

- In 1992, Portugal ratified the Maastricht Treaty, laying the foundation for the Economic and Monetary Union.

- In 1997, Portugal ratified the Amsterdam Treaty, further advancing economic policy integration.

These historical milestones show Portugal’s active participation in European integration. You will find that after joining the Eurozone, Portugal’s financial system became more stable. The euro’s impact on Portugal’s economy is evident in trade, investment, and policy coordination. When living in Portugal, you can feel the convenience and security brought by the euro.

You may notice that Portugal’s entry into the Eurozone was not only an economic choice but also a key strategic move for national development. After the euro became Portugal’s official currency, both residents and businesses benefited from the unified monetary policy.

Daily Use

In your daily life in Portugal, you will frequently use the euro. Whether buying groceries, using transportation, or paying for services, the euro is the only accepted currency.

- The euro simplifies all transaction processes. You don’t need to worry about the hassle of currency exchange.

- You can pay with cash, bank cards, or digital wallets, offering flexibility and convenience.

- Both tourists and residents enjoy a unified payment experience, reducing errors and inconveniences.

You will find that the euro’s circulation strengthens economic ties between Portugal and other Eurozone countries. The euro’s impact on Portugal’s economy is not only at the macro level but also permeates every individual’s daily life. When shopping or dining in Portugal, you can experience the efficiency and transparency brought by the euro.

The Euro’s Impact on Portugal’s Economy

Economic Stability

You will find that the euro’s impact on Portugal’s economy is primarily reflected in economic stability. Since joining the Eurozone in 2002, Portugal’s financial system has become more robust. The euro’s unified monetary policy has helped Portugal better control inflation, reducing the risk of currency devaluation. You can see that between 2005 and 2017, Portugal’s export share of GDP increased by 16 percentage points to 43%. This growth reflects a structural shift toward tradable sectors, predating the international financial crisis. Over the past 15 years, Portugal has also implemented several labor market reforms, enhancing flexibility and adaptability. Banking stability and governance reforms have provided a solid foundation for economic recovery and growth.

- From 2005 to 2017, the export share of GDP increased by 16 percentage points to 43%.

- Labor market reforms enhanced economic adaptability.

- Improved banking governance promoted economic recovery.

When living in Portugal, you will feel the economic security brought by the euro. The unified monetary policy allows you to face international market fluctuations with greater confidence.

Trade Facilitation

The euro’s impact on Portugal’s economy is also evident in trade facilitation. When doing business or engaging in import/export activities in Portugal, you will find that trade with other Eurozone countries has become more efficient. The unified currency eliminates uncertainties caused by exchange rate fluctuations, reducing transaction costs. Data shows that from 1995 to 2008, Portugal’s export contribution to GDP rose from 22% to 32%, while imports increased from 28% to 41%. Although exports grew at an average annual rate of 5.1%, the current account balance did not significantly improve. Between 2005 and 2007, the trade balance improved, but due to increased transfer payments to other countries, the current account deficit remained above 10% of GDP.

- From 1995 to 2008, export contribution to GDP rose from 22% to 32%.

- Import share increased from 28% to 41%.

- Trade facilitation improved, but the current account deficit persisted.

When trading within the Eurozone, you don’t need to worry about currency exchange or exchange rate risks, significantly enhancing the international competitiveness of Portuguese businesses.

Price Changes

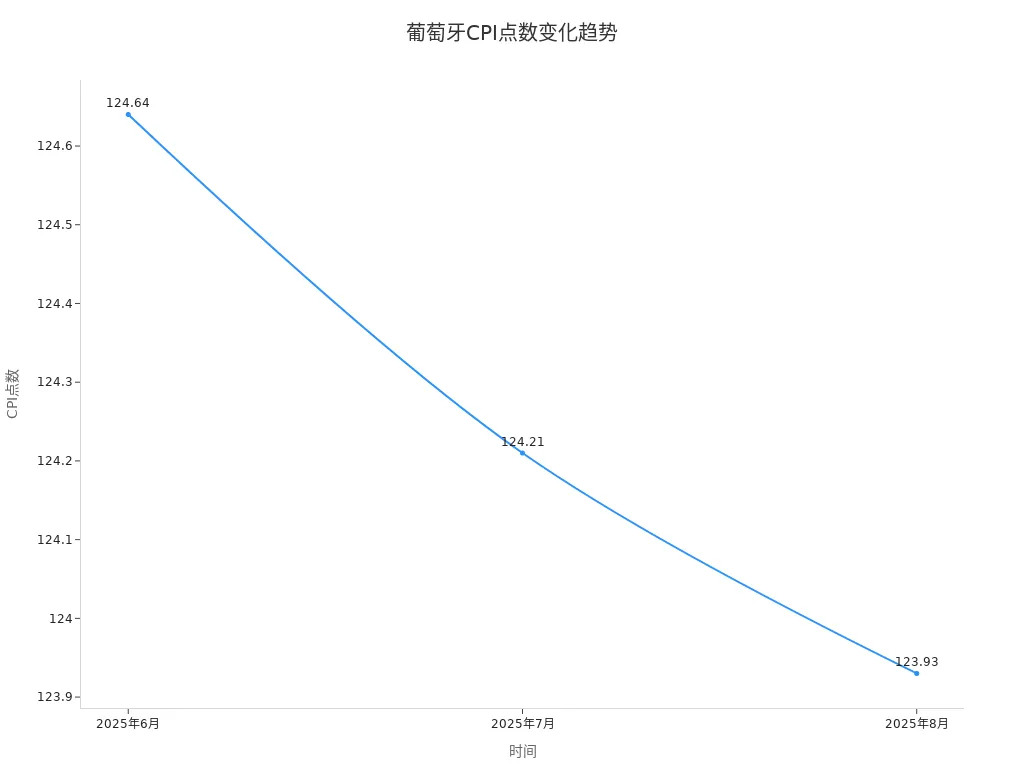

You may be concerned about whether the euro’s impact on Portugal’s economy leads to price fluctuations. After the euro’s introduction, Portugal’s Consumer Price Index (CPI) and Harmonized Consumer Price Index (HICP) experienced changes. In August 2025, Portugal’s CPI was 123.93 points, down from 124.21 points in July. In June 2025, the CPI reached 124.64 points, marking a historical high. Economic models predict that the CPI will reach 126.86 points in 2026 and 129.27 points in 2027. In August 2025, Portugal’s producer prices fell by 4.3% year-on-year, mainly due to declines in chemical pulp, paper, and electricity prices.

| Time | HICP Annual Change Rate | CPI Points |

|---|---|---|

| August 2025 | 2.5% | 123.93 |

| July 2025 | 2.5% | 124.21 |

| June 2025 | N/A | 124.64 |

| May 2025 | N/A | N/A |

| April 2025 | N/A | N/A |

In your daily life, you will notice that while prices fluctuate, overall inflation remains within a controllable range. The euro’s introduction has brought price transparency and market confidence to Portugal.

Tourism and Employment

The euro’s impact on Portugal’s economy is also evident in tourism and employment. When traveling in Portugal, you will find payments more convenient, attracting more international tourists. In 2023, Portugal’s tourism industry performed strongly, with 77.1 million overnight stays and over 30 million visitors, roughly double the figures from a decade ago. Tourism contributed $38.4 billion to the economy, accounting for 19.1% of economic activity. In terms of employment, tourism provided 1.05 million jobs, representing 21.8% of all jobs. In 2018, tourism growth was 8.1%, with an expected 5.3% growth in 2019.

| Indicator | Value |

|---|---|

| Tourism Contribution to Economy | $3.84B USD |

| Share of Economic Activity | 19.1% |

| Employment | 1.05M (21.8% of all jobs) |

| 2018 Growth Rate | 8.1% |

| Expected 2019 Growth Rate | 5.3% |

You will see that the euro’s circulation has made Portugal a popular destination for European tourists, driving prosperity in related industries. Increased employment opportunities and rising resident incomes further promote economic development.

The Euro’s Impact on International Remittances

Image Source: pexels

Remittance Convenience

When living or working in Portugal, you may need to send money to other countries. The euro’s unified circulation makes remittances more efficient and secure. You can transfer funds directly to other Eurozone countries through banks or online platforms.

The Eurozone has adopted the SEPA (Single Euro Payments Area) system. When using SEPA transfers in Portugal, you only need to provide the recipient’s IBAN and BIC information. SEPA covers 36 countries, ensuring a consistent payment experience across Eurozone countries.

SEPA makes remittances between Portugal and other Eurozone countries simple, with faster fund transfers. You don’t need to worry about complex cross-border procedures or security issues.

Remittance Fees

When sending money from Portugal, you are likely most concerned about fees. The average fee for remittances within the Eurozone is 6.49%. You can refer to the table below to understand the fee differences across remittance methods:

| Remittance Fees | Description |

|---|---|

| 6.49% | This is the average fee for remittances from Portugal to other Eurozone countries. |

When using traditional banks, fees are typically higher than online services. Transfers via online platforms or ATMs incur lower fees. Some banks may charge fixed fees, while others charge a percentage of the transfer amount. You should also note that intermediary banks may incur additional fees.

When handling international transfers through Portuguese banks, fees vary based on the bank type, transfer amount, and payment method. You can compare different channels to choose the most suitable remittance method.

| Fee Type | Eurozone Countries | Non-Eurozone Countries |

|---|---|---|

| Additional Fees | None | Yes |

| Bank Transfer Fees | Lower | Higher |

| Online Service Fees | Lower | Higher |

Exchange Rate Fluctuations

When sending remittances from Portugal to other Eurozone countries, you don’t need to worry about exchange rate fluctuations. As a unified currency, the euro eliminates exchange risks. You can make cross-border payments directly in euros, and the amount received will not decrease due to exchange rate changes.

If you need to send money to non-Eurozone countries, banks will convert based on real-time exchange rates. You may encounter uncertainties due to exchange rate fluctuations, which could affect the final amount received. You can monitor exchange rate trends and choose an optimal time for remittances to minimize losses.

Intra-Eurozone Remittances

When sending money from Portugal to other Eurozone countries, the euro’s unified system offers great convenience. You can quickly complete cross-border transfers via the SEPA system without additional fees or concerns about fund security.

The SEPA system covers all banks offering euro-denominated direct debits. When using SEPA transfers in Portugal, the payment process is consistent, with high security and convenience. You can confidently send funds to France, Germany, Spain, or other Eurozone countries, enjoying the same experience as local transfers.

When making intra-Eurozone remittances from Portugal, funds arrive quickly, fees are low, and the process is transparent. The unified payment standard makes cross-border fund flows more efficient.

Pros and Cons Analysis

Advantages

When using the euro in Portugal, you will notice several significant advantages. The euro not only makes shopping and payments more convenient but also brings tangible benefits to businesses and consumers:

- The euro allows you to easily compare prices across countries, fostering fiercer competition among businesses, ultimately enabling you to enjoy more favorable prices.

- Price stability is enhanced, reducing the risk of economic fluctuations. You are less likely to encounter sudden price increases in daily life.

- Businesses find it easier, cheaper, and safer to trade within the Eurozone. If you run a business in Portugal, you can collaborate more smoothly with other Eurozone countries.

- Financial market integration improves efficiency. When investing or managing finances, you can experience a more stable environment.

- As the world’s second-largest reserve currency, the euro enhances Portugal’s influence in the global economy.

- The elimination of exchange rate fluctuation costs protects your and businesses’ interests.

- Trade and investment become more convenient, encouraging economic exchanges between countries.

You can refer to the table below to understand the specific benefits of euro stability:

| Benefit | Description |

|---|---|

| Reduced Currency Exchange Risk | The euro eliminates exchange rate fluctuations between European currencies, reducing transaction uncertainty. |

| Promotes Financial Stability | A unified currency allows businesses to focus on growth without worrying about exchange rate changes. |

| Encourages Cross-Border Investment | A stable currency environment boosts investor confidence, driving economic growth. |

When living in Portugal, you can feel that inflation has dropped to 2.5%, food and housing costs have decreased, household financial pressure has eased, and consumer confidence has strengthened.

Challenges

While enjoying the euro’s convenience, you may also encounter some challenges. After adopting the euro, certain economic issues in Portugal have become more pronounced:

- You will find that Portugal has lost monetary policy autonomy. The government cannot address domestic economic changes by adjusting interest rates or money supply.

- In a low-interest-rate environment, debt levels for businesses, households, and the government have risen. When borrowing or investing, you may face higher debt risks.

- Wage growth has outpaced productivity growth, making Portuguese products more expensive on international markets, reducing export competitiveness.

- Portugal experienced a severe economic recession, with growth rates even lower than during the U.S. Great Depression. You may feel pressure on employment and income.

- Misdirected foreign capital inflows have led to declining productivity and weakened manufacturing resources.

- Government tax increases have reduced labor participation, exacerbating resource misallocation. After 2010, the Eurozone debt crisis led to further tax hikes, with austerity measures hindering economic recovery.

When living in Portugal, you may notice constrained economic policies, employment pressures, and price fluctuations. The challenges brought by the euro require you to respond rationally and make reasonable choices based on your needs.

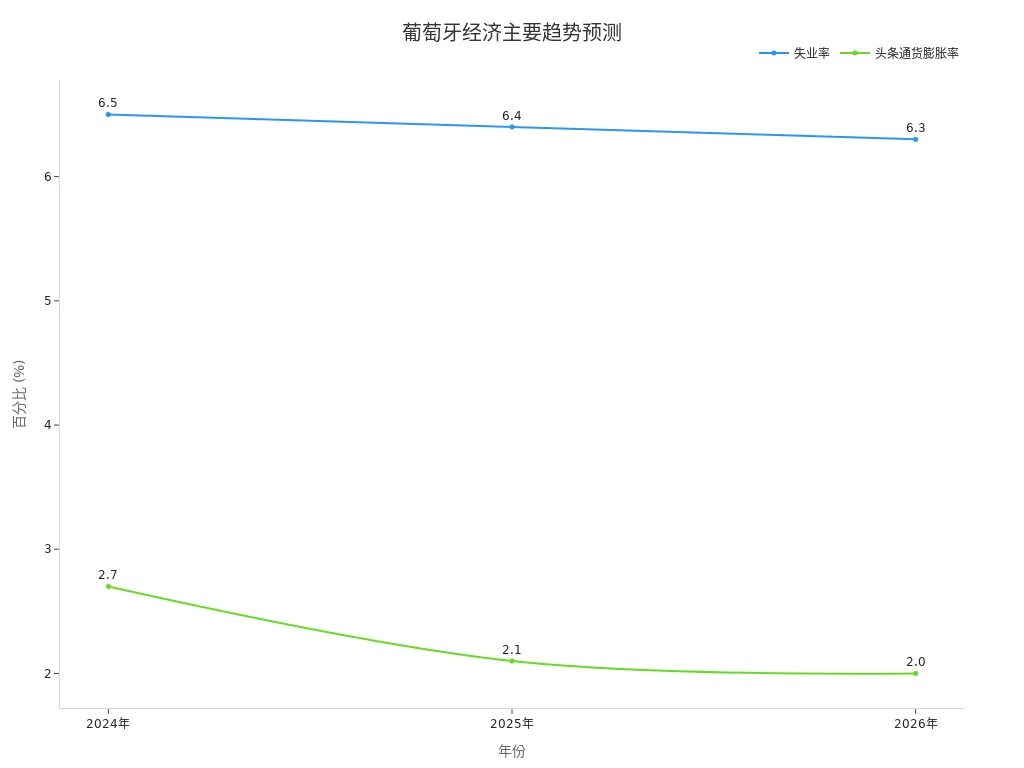

When using the euro in Portugal, you will experience positive effects such as economic stability, trade facilitation, and efficient international remittances. The euro’s impact on Portugal’s economy is reflected in declining unemployment rates and low inflation. The table below shows the economic changes in Portugal and other Eurozone countries after adopting the euro:

| Country | Economic Impact | Private Consumption Change | Net Export Change |

|---|---|---|---|

| Portugal | Slightly Negative Impact | Decline | Decline |

| Ireland | Significant Positive Impact | Increase | Increase |

You can refer to Portugal’s economic trends for the next three years:

When making international remittances, it is recommended to pay attention to hidden costs, choose transparent platforms, and consider locking in exchange rates to reduce risks. The digital euro and SEPA system will further enhance cross-border payment efficiency. You can analyze the pros and cons of the euro based on your needs and make the most suitable choices.

FAQ

Can I Use U.S. Dollars in Portugal?

You can only use euros for payments in Portugal. U.S. dollars are not accepted by merchants. You need to exchange for euros in advance to shop and dine smoothly.

How to Choose a Bank for Remittances from Mainland China to Portugal?

You can choose a licensed Hong Kong bank for international remittances. The bank will provide USD to EUR conversion services. You need to prepare the recipient’s information and relevant documents.

Are Prices High in Portugal?

When buying food and housing in Portugal, prices are lower than in some U.S. cities. Prices are influenced by the euro exchange rate. You can refer to local CPI data to understand trends.

How Much Are International Remittance Fees Charged by Portuguese Banks?

When sending money from Portugal through a licensed Hong Kong bank, the average fee is 6.49% (in USD). Fees vary by bank and remittance method. You can consult the bank in advance.

Will Euro Exchange Rates Affect My Remittance Amount?

When sending money from mainland China to Portugal, banks convert based on real-time USD/EUR exchange rates. Exchange rate fluctuations will affect the final amount received. You can monitor exchange rate changes and choose an optimal time for remittances.

Navigating Portugal’s use of the euro and its economic and remittance impacts highlights SEPA’s efficiency (free intra-eurozone transfers) and trade benefits, yet international remittances face high fees (6.49% average), rate markups (0.5%-3%), and 1-5 day delays for non-eurozone transfers. BiyaPay offers a streamlined solution: fees from 0.5%, same-day delivery across most global regions, including Portugal, ensuring swift, secure funds without complex IBAN checks or hidden intermediary costs.

BiyaPay’s strength lies in its multi-asset exchange platform: instant fiat-to-crypto conversions, zero-fee contract orders, and real-time rate tools to capture optimal euro exchanges, sidestepping traditional platforms’ volatility losses. A minutes-long signup unlocks a seamless digital workflow. Uniquely, trade US and Hong Kong stocks on one hub without offshore accounts, transforming remittances into investments for enhanced returns. Unlike MoneyGram’s instant transfers with high fees (5-10%), BiyaPay’s affordability and flexibility excel for cross-border needs.

Start now—register at BiyaPay for a seamless Portugal fund management experience. Use the Real-Time Exchange Rate Query to track euro trends and maximize value. Explore Stocks to blend transfers with trading, fueling wealth growth. With BiyaPay, cross-border fund management shifts from complexity to high-impact opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.