- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The release of new products at NVIDIA's CES conference has sparked heated discussions. What is the outlook for short-term fluctuations?

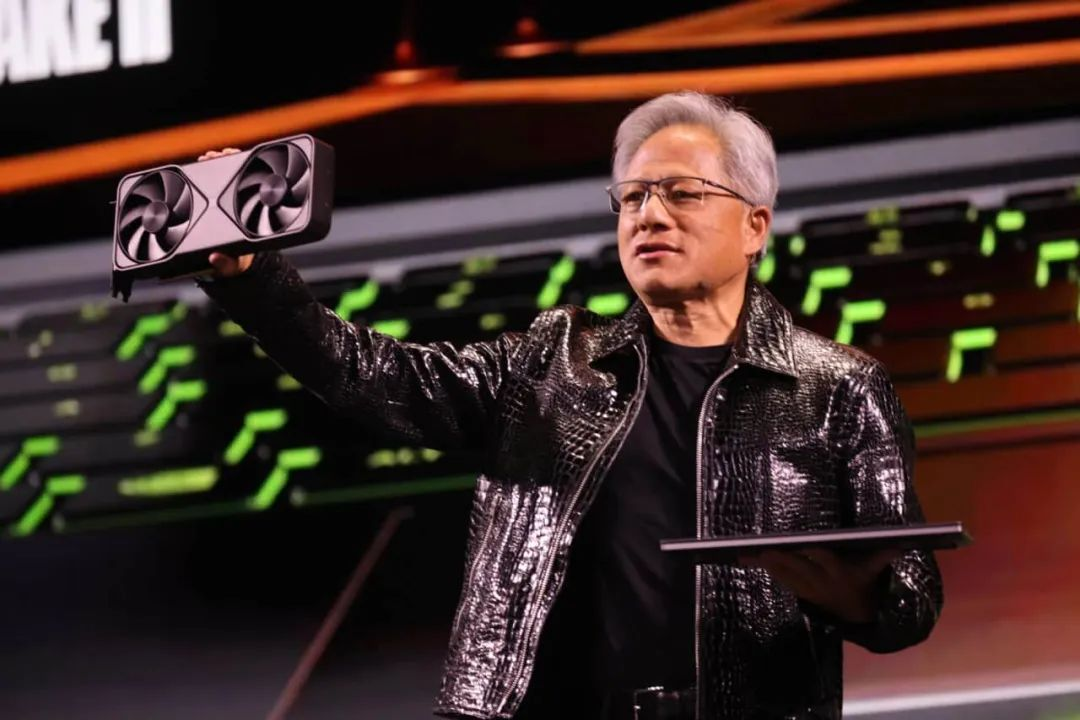

Nvidia CEO Huang Renxun delivered a keynote speech at the CES conference that opened on Monday, launching a series of new products, but it seems that it has not yet impressed stock market investors.

On Tuesday, January 7th, NVIDIA’s stock price opened high. It had risen nearly 2.5% at the beginning of the day, but then fell sharply. Less than half an hour after the opening, it turned downward and continued to decline. When the US stock market hit a new low at the end of the day, it fell 6.3% intraday and finally closed down 6.2%, the largest single-day decline since September 3, 2024.

CES conference and NVIDIA’s new product launch

Every January, the global technology industry focuses on Las Vegas, where the CES conference has become a showcase platform for new technologies and innovative products. In 2024, NVIDIA is undoubtedly a big star in this event. Although this new product launch did not launch a heavyweight GPU graphics card like in the past, NVIDIA still brought a series of dazzling technologies and products, showcasing its latest progress in AI hardware, AI software, and future computing technology.

NVIDIA’s innovative products debut at CES.

Firstly, NVIDIA launched a GPU based on Blackwell architecture - RTX 5090 at the conference. The performance of this graphics card has once again widened the gap with other products in the market, especially in processing high-load AI computing and Big data tasks. Compared with RTX 4090, RTX 5090 has significantly improved the acceleration of AI and Deep learning tasks, becoming another flagship work of NVIDIA’s GPU series.

In addition to RTX 5090, NVIDIA has also launched the world’s smallest personal AI supercomputer - Project Digits. The release of this device marks NVIDIA’s not only a place in the traditional PC market, but also a new attempt in the field of AI computing. Project Digits can not only provide developers with powerful computing power, but also provide great convenience and efficient support for AI application development at the personal level.

In addition, NVIDIA also showcased Agentic AI with Tea-Time Scaling function, which focuses on improving the training efficiency of AI models through self-learning and dynamically adjusting computing resources. This feature makes the training process of AI applications more intelligent, and can dynamically adapt to different computing environments to ensure efficient resource utilization and processing speed.

Creating the era of physical AI: Cosmos basic model

However, the most eye-catching highlight is undoubtedly NVIDIA’s launch of the world’s first basic model specifically designed to understand the physical world - Cosmos. With the widespread application of AI technology in various industries, NVIDIA sees a new breakthrough point - the deep integration of AI and physics, and the development of AI models that can “understand” the physical world.

The concept of physical AI means that AI is no longer limited to traditional fields such as data processing and image recognition. It will delve into fields such as manufacturing and logistics, helping enterprises to accurately model and predict in complex physical environments. NVIDIA believes that the emergence of physical AI will completely change the $50 trillion manufacturing and logistics industries, thereby promoting the transformation and upgrading of the global economy.

In his speech at CES, NVIDIA CEO Huang Renxun emphasized that physical AI can not only bring revolutionary changes to the industry, but also be applied to fields such as climate change, materials science, and energy efficiency, driving breakthroughs in scientific research and industrial manufacturing.

Stock price fluctuations: short-term positive news did not meet expectations

Despite the widespread attention and discussion caused by NVIDIA’s new product launch at CES, the stock market’s reaction surprised many investors. Despite NVIDIA’s release of a series of exciting new products and technologies, its stock price fell in the following trading days.

So, why did NVIDIA’s stock price decline in the short term despite its optimistic long-term prospects?

According to analysis, although NVIDIA’s long-term development is full of potential, investors have higher expectations for products and technological advances that can bring direct profits in the short term. Especially for NVIDIA’s current core profit source - the Blackwell AI processor used to train and run AI models. Although Huang Renxun mentioned in his speech that the processor has been fully put into production, he did not provide more specific progress and market feedback. This has disappointed some investors with the progress of AI hardware products in the short term.

Stifel Financial Corp.'s report pointed out that Nvidia’s release is significant for the company’s future development, but it is more suitable for long-term investors, and the short-term stock price increase space is not as large as some market expectations.

Benchmark analyst Cody Acree also mentioned in the report that many investors hope to see more specific progress about Blackwell AI chips, especially more information about the next-generation GPU platform Rubin. However, Nvidia’s news in this regard is relatively vague, making some short-term investors uncertain about the stock price performance in the coming months.

Analysts are optimistic about Nvidia’s future

Although the stock price did not rise as investors expected in the short term, many analysts still have confidence in Nvidia’s future development.

Hans Mosesmann, an analyst at Rosenblatt Securities, reiterated his buy rating on NVIDIA in the report and set a target price of $220. This means he expects NVIDIA’s stock price to rise more than 47% on the basis of hitting a historic high on Monday.

Mosesmann believes that NVIDIA’s continued innovation in AI hardware and software, especially its forward-looking layout for physical AI, will enable it to maintain its leadership position in the AI field.

In addition, Benchmark analyst Acree also holds an optimistic view on NVIDIA, giving it a “buy” rating with a target price of $190, which means it is 27% higher than Monday’s Closing Price. Wedbush analyst Daniel Ives believes that Huang Renxun’s speech demonstrates how NVIDIA can further consolidate its huge leading advantage in AI technology. He predicts that in the next few years, NVIDIA will be able to explore incremental market opportunities of about $1 trillion in emerging markets such as robotics and autonomous driving technology.

Even US Bank analyst Vivek Arya said that NVIDIA has demonstrated its dominance in AI hardware and software, and may expand its influence to more markets in the future, including enterprise and consumer products.

NVIDIA Valuation and Investment Prospects

Next, let’s take a look at NVIDIA’s investment prospects from a valuation perspective. NVIDIA’s market value has exceeded $1 trillion, making it one of the world’s most valuable semiconductor companies.

The latest financial report shows that NVIDIA’s revenue and profit maintain strong growth, especially in the AI chip and Data center businesses, which have become its most important sources of revenue.

From the perspective of PEG ratio, NVIDIA’s current high valuation means that the market has paid a premium for its future growth. This may cause short-term investors to have doubts about its valuation, especially when the company does not provide detailed progress on more next-generation products. However, in the long run, NVIDIA’s growth potential remains strong. With the surge in global demand for AI, NVIDIA’s technological advantages in AI inference and training will further consolidate its market share, especially with the support of Blackwell and Hopper architectures.

NVIDIA continues to expand in the fields of autonomous driving and data center, and is expected to gain more market share in these areas with technological development. The company is also expanding its hardware and software ecosystem through the Omniverse platform, further consolidating its industry-leading position while improving overall market competitiveness. Although the valuation is high, NVIDIA still has huge growth potential in the long run.

Compared to AMD, the latter’s progress in the GPU market should not be underestimated, especially in the gaming and high-performance computing fields. However, NVIDIA still maintains its industry leadership with its technological advantages in AI and data centers. The A100 and H100 are significantly better than AMD’s products in deep learning and inference acceleration.

Compared with Broadcom, although Broadcom performs well in network communication and storage solutions, NVIDIA’s dominant position in AI hardware and Data center fields makes its future growth potential greater. Especially in the context of explosive growth in AI, NVIDIA is expected to continue to expand its market share.

Overall, although NVIDIA has a high valuation, its technological advantages in cutting-edge fields such as AI and autonomous driving, as well as its leadership position in the data center and hardware ecosystem, still make it a unique investment value. For long-term investors, NVIDIA is undoubtedly a high-quality target worth paying attention to, especially with huge growth potential driven by future technology and market demand.

If you want to seize the investment opportunity of NVIDIA, BiyaPay’s multi-asset wallet provides convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting transactions of US and Hong Kong stocks and digital currencies.

Through it, investors can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to their personal bank accounts for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help investors seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Risk factors and challenges

Although NVIDIA has significant market advantages in multiple high-growth areas, any investment comes with certain risks. In future investment decisions, investors need to pay attention to the main risk factors faced by NVIDIA.

Technical risk

NVIDIA’s technological progress is a key driving force for the company’s success. However, technological development also comes with certain risks. For example, the rise of Quantum Computing may pose a certain threat to the traditional GPU market. Although NVIDIA has been investing in research and development in the field of Quantum Computing for many years, if there is a major breakthrough in Quantum Computing technology in the future, it may have an impact on the existing GPU market and affect NVIDIA’s business growth.

In addition, NVIDIA’s competitors are also constantly up the ante in terms of technological innovation. The technological progress of AMD and Intel in the GPU and processor fields may threaten NVIDIA’s market share, especially as AMD gradually narrows the gap with NVIDIA in the gaming and high-performance computing fields.

Market competition

In addition to technical risks, market competition is also an important challenge facing NVIDIA. Companies such as AMD, Google, and Intel are increasing their investment in the GPU and AI hardware markets, especially Google’s TPU (Tensor Processing Unit) and Intel’s GPU products, which have become important competitors for NVIDIA.

In addition, the competition in the field of autonomous driving is equally fierce. Companies such as Tesla and Google Waymo have also made significant progress in the research and development of autonomous driving chips. If NVIDIA fails to maintain its leading position in this market, it may have a negative impact on its future growth.

Policy and regulatory risks

With NVIDIA’s expansion in the global market, policy and regulatory risks cannot be ignored. Especially in the Anti-Trust field, NVIDIA may face regulatory pressure from multiple countries and regions around the world. As NVIDIA’s market share continues to increase, it may attract regulatory attention to its market monopoly, which may have a certain impact on its business.

In addition, NVIDIA’s acquisitions and partnerships may also face Regulatory Scrutiny. Especially for some important acquisitions (such as the acquisition of ARM), NVIDIA may encounter challenges from regulatory agencies. If these acquisitions fail to pass approval smoothly, it may affect NVIDIA’s long-term strategic plans.

In summary, NVIDIA still has huge growth potential in the future due to its technological advantages in fields such as AI. Despite its current high valuation, in the long run, driven by strong technological innovation and market demand, NVIDIA remains an attractive investment target. For investors seeking long-term growth opportunities, NVIDIA is undoubtedly a core choice worth paying attention to.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.