- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money to France: Advantages and Disadvantages of Choosing International Remittance Services and Banks

Image Source: unsplash

When you send money to France via remittance, you often focus on fees, transfer speed, security, and convenience. Different channels have distinct features, making it crucial to choose the right method. According to recent data, the amount of overseas remittances received in France fluctuates significantly each month. The table below shows remittance amounts for selected months in recent years (in millions of euros):

| Time | Remittance Amount (EUR Million) |

|---|---|

| July 2025 | 28 |

| December 2002 | 87 |

| January 2021 | 19 |

| Average (1997-2025) | 45.50 |

You can weigh the pros and cons of different services based on your needs to make an informed choice.

Key Points

- When choosing a remittance method, consider fees, transfer speed, and security. International remittance services typically have lower fees and faster transfers, making them suitable for small amounts and urgent remittances.

- Bank transfers are ideal for large transactions, offering higher security, but fees are higher, and transfer times are longer. Be sure to understand all fees in advance.

- When using international remittance services, pay attention to exchange rates and hidden costs. A transparent fee structure can help you avoid unexpected losses.

- Ensure accurate recipient information, including name, IBAN, and SWIFT codes, to avoid delays or returns.

- Choose reputable service providers and enable two-factor authentication to ensure fund security and smooth transfers.

Methods for Sending Money to France

Image Source: unsplash

When sending money to France, you can choose from various methods. Each method has different processes and applicable scenarios. You need to select the most suitable channel based on your needs.

International Remittance Services

International remittance services like Wise, Revolut, and Western Union offer diverse remittance options. You can complete remittances through cash pickup, bank transfers, mobile payments, or mobile top-ups. The table below outlines common service types and their descriptions:

| Remittance Service Type | Description |

|---|---|

| Cash Pickup | Cash can be collected at designated locations |

| Bank Transfer | Direct transfer to a bank account |

| Mobile Payment | Transfer to a mobile wallet |

| Mobile Top-Up | Recharge a mobile phone account |

When using international remittance services, you typically need to follow these steps:

- Understand that French banks primarily use euros (EUR) and prepare for currency conversion.

- Choose a suitable remittance service and review its exchange rates and fees.

- Confirm the recipient’s bank information and account details.

This method is ideal for situations requiring fast transfers or when the recipient does not have a bank account. You can operate online, and the process is simple, suitable for users in mainland China.

Bank Transfers

Bank transfers typically involve wiring funds directly to the recipient’s bank account in France via bank wire. When processing through licensed banks in mainland China or Hong Kong, you need to provide the recipient’s name, address, IBAN number, and BIC or SWIFT code. The process is as follows:

- Check the required information to ensure a successful transaction.

- Provide the transfer amount and recipient’s bank details.

- Ensure sufficient funds in your account, considering exchange rates and transfer fees.

- Choose the transfer method: online, bank counter, or through a remittance agency.

Bank transfers are suitable for large fund transfers or when the recipient only accepts bank account deposits. You need to be mindful of foreign exchange costs and transfer times.

Money Orders

A money order is a traditional remittance method. You can purchase a money order at a bank, then mail or carry it to France, where the recipient can exchange it at a local bank. Money orders are suitable for carrying abroad or non-urgent situations. You need to be aware of declaration requirements, such as declaring USD 10,000 or more to customs.

Tip: If you choose cash remittances or carry money orders, make sure to understand declaration regulations in advance to avoid unnecessary trouble.

Fee Comparison

When choosing a channel to send money to France, fees are one of the most direct factors influencing your decision. You need to focus on transaction fees, exchange rates, and hidden costs, as these will affect the final amount received by the recipient.

Transaction Fees

When using international remittance services and bank wires, transaction fees vary significantly. International remittance services typically charge lower fixed fees, while bank wire fees have a wider range and may include multiple charges. The table below shows common fee ranges:

| Service Type | Fee Range |

|---|---|

| International Bank Wire | 5 USD to 75 USD |

| Receiving International Transfer Fees | Up to 25 USD |

| Intermediary Bank Fees | Possible additional processing fees |

| Exchange Rate Markup | Banks may add a markup to the mid-market exchange rate |

When processing wire transfers through licensed banks in Hong Kong, fees are typically higher than those of international remittance services. Some banks also charge intermediary bank fees, which are hard to estimate before transferring. International remittance services like Wise and Remitly have more transparent fee structures, allowing you to see all fees before initiating the transfer.

Tip: Before sending money, you can check all fees through the service provider’s website or app to avoid reduced recipient amounts due to intermediary bank fees.

Exchange Rates

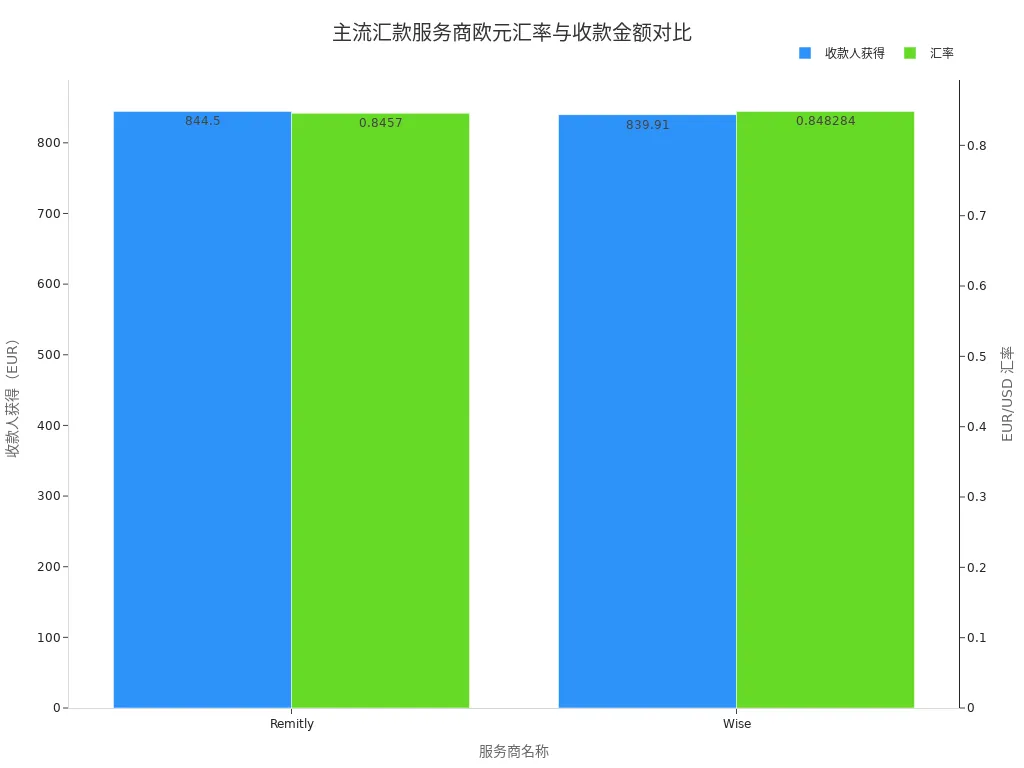

Exchange rates directly affect how much EUR your USD transfer will yield. International remittance services typically use the mid-market exchange rate, while banks add a markup to the rate. The table below compares exchange rates and received amounts for major providers and banks:

| Provider | Exchange Rate | Transfer Fee | Recipient Receives |

|---|---|---|---|

| Remitly | 0.8457 EUR/USD | None | 844.50 EUR |

| Wise | 0.848284 EUR/USD | 9.87 USD | 839.91 EUR |

| Xe | Real-time rate | N/A | N/A |

When using Wise, you can get an exchange rate close to the mid-market rate. Remitly offers exchange rate discounts for new customers. Banks typically add a markup to the mid-market rate, resulting in fewer EUR received by the recipient. Xe provides real-time exchange rates, allowing you to compare over 100 currencies and choose the best time to send money.

You can see that international remittance services offer better exchange rates, resulting in higher amounts received by the recipient. Banks’ exchange rate markups are a hidden cost that is easily overlooked.

Hidden Costs

When sending money to France, besides explicit transaction fees and exchange rates, you need to watch out for various hidden costs. Common hidden fees in banks include:

- Processing fees

- Currency conversion markups

- Recipient bank fees

- Unfavorable exchange rates

Many banks charge additional fees during international transfers. While upfront fees may seem low, intermediary and recipient banks may deduct further amounts. Banks typically use exchange rates with added profit margins, reducing the recipient’s final amount. When transferring between different banking networks, you may also encounter intermediary bank fees, which are often opaque and difficult to know in advance.

International remittance services have clearer fee structures, typically without intermediary bank deductions, allowing the recipient to receive the full amount. When choosing a service, prioritize channels with high fee transparency to minimize unnecessary losses.

Note: Hidden costs have a greater impact on large remittances. It’s advisable to consult the service provider in advance to confirm all possible fees.

Transfer Speed

Image Source: unsplash

When sending money to France, transfer speed is one of your primary concerns. Different channels have significant variations in transfer times, and choosing the right method can ensure the recipient receives funds faster.

International Remittance Service Speed

When using international remittance services, funds typically arrive in the recipient’s account in France within 1 to 3 business days. Many providers use direct debit payments to streamline the process, improving transfer speed and accuracy. Some providers offer expedited options, but these come with higher fees. Standard international transfers are generally completed within three business days, and SWIFT transactions can be processed as quickly as 24 hours.

- International remittance services typically take 1-3 business days to complete.

- Direct debit payments enhance operational efficiency.

- SWIFT transactions can arrive in as little as 24 hours.

Bank Transfer Times

When processing wire transfers through licensed banks in Hong Kong, transfer times are typically longer. International bank transfers generally take 1 to 5 business days, depending on the bank’s processing speed and the number of intermediary banks involved. Bank wires involve multiple steps, which may cause delays, especially during public holidays or due to time zone differences.

| Method | Speed |

|---|---|

| Bank Wire | Typically completed within 1-5 business days |

| International Remittance Service | Typically completed within 1-3 business days |

You need to note that bank processing times are not fixed and may exceed 5 business days in some cases.

Influencing Factors

Transfer speed is affected by multiple factors. When sending money, the following situations may cause delays:

- Different bank processing times, as international transfers often involve multiple banks.

- Time zone differences affect the processing speed of banks in different countries.

- Public holidays may cause banks to close, delaying transfers.

- Compliance checks, such as anti-money laundering (AML) and know-your-customer (KYC) procedures, increase review time.

- Incorrect recipient information may lead to delays or returns.

- Intermediary bank involvement adds extra steps and time.

- Technical issues or fraud prevention measures may cause reviews and delays.

- Banks have cutoff times for processing transfers, and transactions submitted after these times will be deferred to the next business day.

When choosing a remittance method, you can prioritize international remittance services with fast transfer speeds and streamlined processes. If you need to transfer large amounts or the recipient only accepts bank account deposits, bank wires are an option, but you should allow extra time.

Security and Compliance

Security Measures

When choosing international remittance services, security is one of the most critical factors. Reliable providers implement multiple measures to protect your funds and information. You can enhance remittance security through the following methods:

- Choose reputable service providers. You can review user feedback and regulatory qualifications to ensure the provider has a good industry reputation.

- Providers implement robust security measures, such as encryption technology to protect your account and transaction information, preventing data breaches.

- You need to understand relevant regulatory requirements. Compliant providers adhere to international financial standards to ensure fund security.

- You can monitor exchange rate trends to avoid large remittances during volatile rate periods, reducing risks.

Reminder: When using licensed banks in Hong Kong or international remittance services, it’s recommended to enable two-factor authentication and regularly update passwords to prevent account theft.

Regulatory Requirements

When sending money to France, you must comply with local and international regulations. The French government enforces strict compliance policies for international remittances. You need to note the following:

- The French government requires financial institutions and remittance services to implement “know your customer (KYC)” and “anti-money laundering (AML)” policies. You must submit detailed identity information before transferring.

- Expatriates need to provide additional documents, including proof of income, proof of residence, and valid identification. When preparing documents, consult the provider in advance to avoid delays due to incomplete materials.

- Financial institutions and remittance services verify your details before processing transactions. You need to ensure all information is accurate and valid.

- New compliance regulations may cause processing delays. For urgent remittances, allow extra time to avoid delays due to review processes.

When choosing a remittance channel, pay attention to the provider’s compliance qualifications and security measures. Compliant services not only ensure fund security but also improve remittance efficiency.

Convenience Experience

Operational Process

When choosing a channel to send money to France, the ease of the operational process directly impacts your experience. International remittance services typically provide customized user interfaces, reducing manual input and offering more intuitive steps. You only need to enter recipient information, select the amount and currency, and the system automatically calculates fees and exchange rates. The process is straightforward and suitable for first-time users.

In contrast, the traditional remittance process of licensed banks in Hong Kong may be more complex. You need to verify your identity multiple times and provide detailed recipient information, including IBAN and SWIFT codes. Bank system interfaces are relatively traditional, with more steps and stricter verification processes. You may need to spend more time and effort during the process.

| Feature | International Remittance Services | Bank Services |

|---|---|---|

| User Interface | Customized experience, minimal manual input | Traditional interface, more steps |

| Transaction Speed | Fast settlement, often instant | Longer settlement, depends on bank processing |

| Verification Process | Simplified verification, user-friendly | Multiple verifications, cumbersome process |

Tip: When choosing a channel, prioritize services with simple processes and user-friendly interfaces to improve remittance efficiency.

Online/Offline Services

You can choose online or offline remittance methods based on your needs. Online remittances allow you to complete the process from home or the office without visiting a bank or agency. You submit orders through a website or app, and the system processes them automatically, offering fast transfers and competitive fees. Online services typically use advanced encryption to ensure fund security.

Offline remittances require you to visit a bank counter or remittance agency in person. You need to queue, fill out forms, and undergo manual reviews. Offline services generally have higher fees and longer processing times. In some cases, offline remittances are less secure and convenient than online channels.

| Feature | Online Remittance | Offline Remittance |

|---|---|---|

| Cost | Lower fees, competitive | Higher bank fees |

| Speed | Fast transfers, near-instant | May take longer |

| Convenience | Easy operation from home or office | Requires in-person visit to bank or agency |

| Security | Uses encryption for safety | Relies on traditional processes, moderate security |

When choosing online or offline services, consider your schedule and convenience needs, prioritizing online channels for a better overall experience.

Service Coverage and Support

Countries and Currencies

When choosing a channel to send money to France, service coverage and currency support are crucial. International remittance services typically cover most countries globally and support multiple currency conversions. You can easily transfer USD from mainland China or Hong Kong to France, with the recipient receiving EUR directly. Major international remittance services support over 120 countries and more than 40 currencies. When sending money, you don’t need to worry about destination or currency restrictions, offering flexibility for various needs.

| Supported Currencies | Supported Countries |

|---|---|

| 40+ | 120+ |

Bank transfers can also meet your needs for sending money to France. Licensed banks in Hong Kong typically support major international currencies like USD, EUR, and GBP. When processing, you can choose the appropriate currency based on the recipient’s account. Bank transfers have broad coverage, but some less common countries and currencies may not be supported. For large or niche currency transfers, consult the bank in advance to confirm support.

Tip: When choosing a remittance channel, prioritize services with wide coverage and diverse currency options to enhance flexibility.

Customer Support

When you encounter issues during the remittance process, timely assistance is essential. International remittance services typically offer multiple customer support channels, including online help centers, email, phone, and live chat. You can contact customer service through the website or app to resolve issues related to accounts, exchange rates, or transfer status. Some providers also offer multilingual support, convenient for users in different countries.

| Service Provider | Support Channels |

|---|---|

| WorldRemit | Help center, online contact |

| BOSS Money | Online contact |

| Azimo | Live chat, email, phone (business days) |

Bank transfer customer support primarily relies on phone and counter services. When processing through licensed banks in Hong Kong, you can seek help via customer service hotlines or in-person at bank counters. Bank service hours are typically limited to business hours, and some issues may require waiting for manual processing. In contrast, international remittance services’ online support is more convenient, offering quick responses to your needs.

Reminder: Before sending money, review the provider’s customer support channels to ensure timely assistance and fund security.

Remittance Scenarios for Sending Money to France

Small/Large Remittances

When sending money to France, the amount significantly influences the best choice. Small remittances are typically used for family support, gifts, or daily expenses. You can prioritize international remittance services like Wise, Remitly, and WorldRemit, which offer low fees and transparent exchange rates, ideal for frequent small transfers. You can operate via mobile or computer, and the recipient receives funds quickly.

Large remittances are common for tuition, property purchases, or commercial payments. When processing through licensed banks in mainland China or Hong Kong, you gain higher security. Bank wires are suitable for large funds, especially when the recipient only accepts bank account deposits. You need to note that bank wire fees are higher, exchange rate markups are significant, and transfer times may be longer. For large remittances, consult all fees in advance to avoid hidden costs affecting the received amount.

Tip: If you plan to carry large money orders abroad, comply with declaration regulations. Carrying USD 10,000 or more requires customs declaration to ensure compliance.

Urgent/Regular Needs

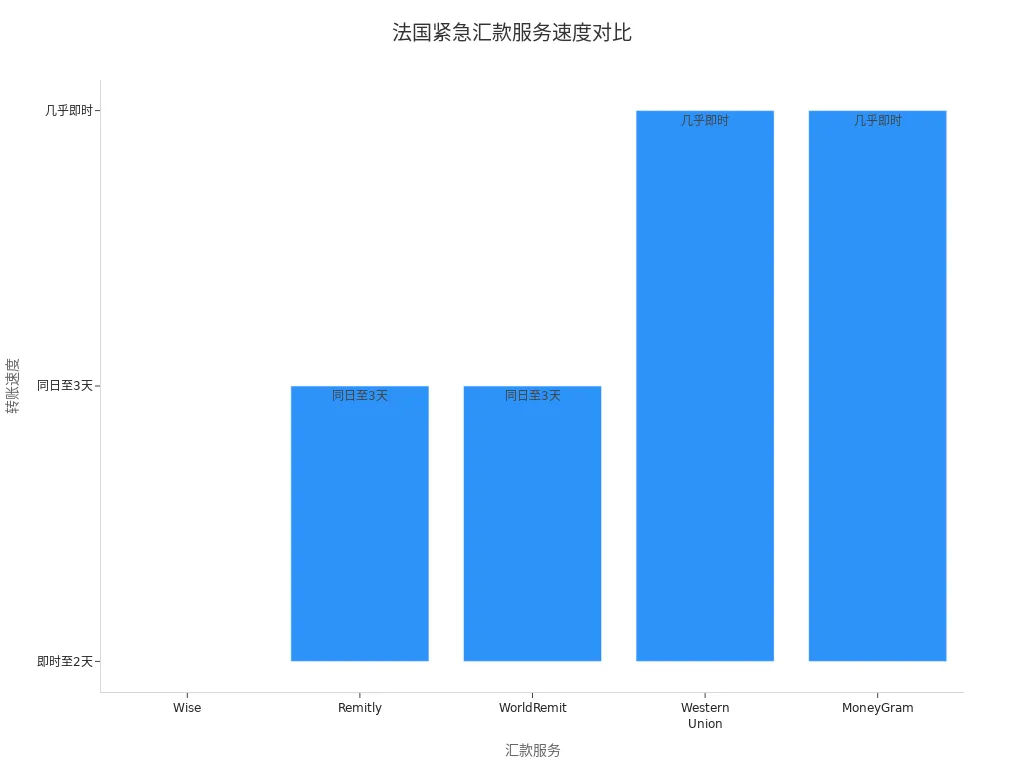

When facing urgent needs, such as family emergencies or immediate tuition payments, transfer speed becomes the top priority. Some international remittance services offer near-instant transfers, greatly improving fund turnover efficiency. The table below compares transfer speeds for major services:

| Remittance Service | Speed | Notes |

|---|---|---|

| Wise | Instant to 2 days | Suitable for fast transfers |

| Remitly | Same day to 3 days | Cash pickup can be completed in minutes |

| WorldRemit | Same day to 3 days | Offers flexible receiving options |

| Western Union | Near-instant | Suitable for urgent cash needs, higher fees |

| MoneyGram | Near-instant | Wide global coverage, suitable for urgent transfers |

You can see that Western Union and MoneyGram are ideal for extremely urgent cash needs but have higher fees. Wise, Remitly, and WorldRemit balance speed and cost, suitable for most urgent scenarios. For regular needs, you can choose services with lower fees and 1-3 day transfer times, balancing cost and efficiency.

Suggestion: For urgent cases, prioritize international remittance services with fast transfers. For regular needs, compare fees and exchange rates to choose cost-effective channels.

Recipient Types

When sending money to France, the recipient type also affects your choice. Individual recipients are often family members, friends, or students. You can prioritize convenience and low fees, focusing on exchange rates and transfer costs. International remittance services support various receiving methods, including bank accounts, cash pickup, and mobile wallets, suitable for individual daily needs.

If the recipient is a business or institution, such as paying suppliers, tuition, or employee wages, bank wires are more appropriate. Commercial remittances involve different regulations and potential tax implications. When processing, you can benefit from batch transfer options and better exchange rates but need to prepare relevant documentation. The table below summarizes the characteristics of different recipient types:

| Type | Purpose | Fees and Regulations | Processing Method |

|---|---|---|---|

| Individual Remittance | Family support, gifts, or travel expenses | Typically prioritizes convenience and lower fees | Focus on exchange rates and transfer fees |

| Commercial Remittance | Paying suppliers or employees | Involves different regulations and potential tax implications | May benefit from batch transfers and better rates |

Reminder: When sending money to businesses or institutions, confirm the recipient’s account requirements and relevant regulations in advance to ensure smooth transfers.

When choosing a method to send money to France, consider the amount, urgency, and recipient type to flexibly adjust your approach. For small, urgent, or individual remittances, prioritize international remittance services. For large, commercial, or specific needs, bank wires and money orders are more suitable. This maximizes fund security and transfer efficiency.

When sending money to France, you can weigh different methods based on your needs. The table below summarizes the main pros and cons of banks and international remittance services:

| Method | Advantages | Disadvantages |

|---|---|---|

| Bank | High security, reliable | High fees, less favorable rates, slow transfers |

| Remittance Service | Fast, low fees, good rates | May lack the perceived security of banks |

You can consider the following factors when choosing:

- Exchange rates and fees affect the received amount

- Speed determines transfer time

- Convenience and security ensure fund safety

FAQ

How do I choose the best method for sending money to France?

You can choose based on the amount, transfer speed, and recipient needs. For small and urgent remittances, use international remittance services. For large or business remittances, use bank wires.

How do fees differ between international remittance services and bank wires?

International remittance services typically charge lower fixed fees with more transparent exchange rates. Bank wires have higher fees, possible intermediary bank charges, and significant exchange rate markups.

What basic information is needed to send money to France?

You need the recipient’s name, bank account, IBAN number, and SWIFT code. Some services also require the recipient’s address. Accurate information prevents delays or returns.

How long does it take for a remittance to arrive in France?

International remittance services typically take 1-3 business days. Bank wires usually take 1-5 business days. Holidays or incorrect information may extend transfer times.

Is sending money to France safe?

Choosing compliant international remittance services or licensed banks in Hong Kong ensures fund security. Enable two-factor authentication to protect personal information.

Remitting to France often faces high fees (banks $5-$75, online 0.2%-5%), opaque rate markups (up to 6%), and delays (banks 1-5 days). Compliance checks, like KYC for large transfers, add complexity. As an efficiency-driven user, you need a low-cost, fast, and trustworthy platform to streamline cross-border payments.

BiyaPay offers a seamless solution with real-time exchange rate queries to track USD-to-EUR rates and convert fiat to crypto, minimizing volatility risks. Remittance fees start at just 0.5%, with zero-cost contract orders and global same-day delivery. Plus, you can invest in US and Hong Kong stocks on BiyaPay without an overseas account, optimizing your funds.

Sign up for BiyaPay today to unlock effortless cross-border finance! From tuition to business payments, cut costs and speed up transfers for a hassle-free experience. Don’t let high fees and complex processes slow your fund flow—join BiyaPay now for a smoother France remittance journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.