- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding the Structure of IBAN in France: The Importance of Accuracy and Format

Image Source: pexels

When you make international transfers, the structure and format of France’s IBAN directly impact whether funds arrive accurately and securely. Many financial studies show that the uniqueness and standardized format of an IBAN help reduce error risks in cross-border transfers. The table below summarizes the core roles of IBAN in transfers:

| Evidence Point | Description |

|---|---|

| Uniqueness | Each IBAN is unique within a specific country and financial institution. |

| Standardized Format | IBAN has a consistent structure across all participating countries, facilitating validation. |

| Error Reduction | IBAN, containing country, bank, and account information, minimizes errors in international transactions. |

When you fill out a France IBAN, its standardized structure allows banking systems to automatically validate information, helping funds reach the designated account securely.

Key Takeaways

- The structure of France IBAN includes a country code, check digits, and basic bank account number, ensuring secure fund transfers.

- Correctly filling out the IBAN reduces errors in international transfers, avoiding delays or losses.

- Use official bank channels to obtain IBAN information to ensure accuracy and improve transfer success rates.

- Follow the standardized format, avoiding spaces or special characters in the IBAN to reduce processing errors.

- Double-check every character to ensure accuracy, guaranteeing smooth fund delivery.

France IBAN Structure

Image Source: pexels

Country Code and Check Digits

When you fill out a France IBAN, you’ll first notice the “FR” country code. These two letters follow the ISO 3166-1 alpha-2 standard, clearly identifying the account as belonging to France. Following this are two check digits. The check digits are generated through complex mathematical algorithms, primarily used to automatically detect errors in the IBAN. Banking systems use these two digits for validation, ensuring the IBAN you entered hasn’t been altered or mistyped. This significantly reduces the risk of fund loss or delays due to information errors.

Tip: The presence of check digits enables banking systems to automatically identify input errors, improving the efficiency and security of cross-border payments.

The table below summarizes the main components of a France IBAN:

| Component | Description |

|---|---|

| Country Code | Two letters using the ISO 3166-1 alpha-2 standard |

| Check Digits | Two digits representing the checksum of the bank account number |

| Basic Bank Account Number | Up to 30 alphanumeric characters, depending on the country |

Bank and Account Number

In a France IBAN, the country code and check digits are followed by the Basic Bank Account Number (BBAN). The BBAN includes the bank code, branch code, and account number. You can refer to the table below to understand the role of each part:

| Evidence Type | Description |

|---|---|

| Bank Code | A five-digit code indicating the bank holding the account. |

| Branch Code | The branch code provides details about a specific branch. |

| Account Number | The account number uniquely identifies the customer’s account. |

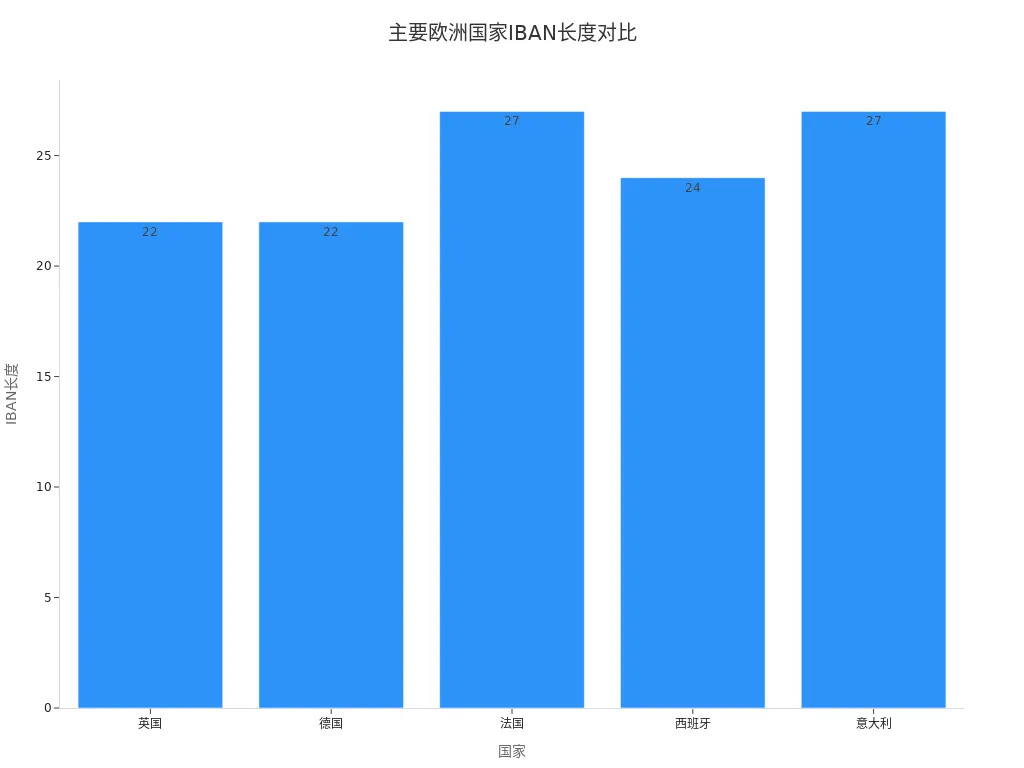

The total length of a France IBAN is 27 characters, using a mix of letters and numbers. This standardized design is part of the Single Euro Payments Area (SEPA), facilitating transfers between different countries. All France IBANs follow the same structure, allowing banking systems to quickly identify and verify account information, improving the efficiency of automated processing.

You can visually compare the IBAN lengths of France and other European countries through the image below:

The structure of France IBAN not only aids banks in automatically processing international transfers but also ensures your funds reach the designated account accurately and securely. When making cross-border payments, as long as you correctly fill out each part, you can significantly reduce the likelihood of errors.

France IBAN Format

Image Source: pexels

Character Types and Length

When filling out a France IBAN, you need to pay attention to the standards for character types and length. A France IBAN consists of letters and numbers with a strict structure. According to the European Committee for Banking Standards, the composition of a France IBAN is as follows:

| Component | Description |

|---|---|

| Country Code | Two letters, e.g., FR (France) |

| Check Digits | Two digits |

| Basic Bank Account Number | Up to 30 alphanumeric characters |

| Total IBAN Length | Up to 34 characters |

The actual length of a France IBAN is 27 characters, using only uppercase letters and numbers. When filling it out, you must not add or omit characters arbitrarily. The standardized character types and length help banking systems automatically recognize and validate account information, reducing transfer failures due to format errors.

Writing Standards

When writing a France IBAN, you must follow strict format requirements.

- Do not insert extra spaces or special characters in the IBAN.

- Systems typically group the IBAN into sets of four characters for readability, but you should input all characters continuously.

- IBANs are case-insensitive, but it’s recommended to use all uppercase letters to avoid confusion.

Note: Format issues (such as unwanted spaces or special characters) may cause IBAN processing errors. According to the European Payments Council, up to 8% of international payment transactions are delayed or rejected due to account information errors, including IBAN format mistakes.

The standardized IBAN format not only reduces errors but also enhances fund security. You can understand the benefits of standardization through the following points:

- IBAN significantly reduces the risk of transfer errors.

- The standardized format speeds up the processing of international transactions.

- A clear format makes it easier for banks to verify account information, improving transparency.

International payment systems automatically verify IBAN formats to prevent fraud and misdirected funds. In 2023, bank transfer fraud losses reached $312 million, with nearly half linked to fake IBANs. Systematic IBAN validation has become a necessary measure to ensure payment security. When making cross-border payments, properly filling out a France IBAN helps ensure funds reach the designated account accurately and securely.

Importance

Cross-Border Transfer Security

When making international transfers, security is always one of the top considerations. The structure and format of a France IBAN directly affect the secure flow of funds. Correctly filling out the IBAN allows banking systems to automatically identify account information, preventing funds from being transferred to the wrong account.

If you make a structural or format error when filling out the IBAN, you may face the following risks:

- Transaction delays, as banks require additional time to verify information.

- Funds may be mistakenly transferred to another person’s account, causing financial losses.

- You may need to pay additional handling fees, potentially affecting business relationships with partners.

- Banks may require you to supplement or correct information, slowing down the entire process.

- An incorrect IBAN may also lead to payment failure, incurring penalties and reconciliation delays.

You can see that every character in the IBAN is critical to fund security. Banking systems rely on standardized structures and formats for automatic validation, which maximizes the reduction of human errors and fraud risks.

Tip: During cross-border transfers, it’s recommended to double-check the IBAN to ensure every character is accurate, effectively avoiding unnecessary losses.

Accurate Fund Delivery

Whether funds arrive accurately depends directly on whether the IBAN you fill out is standardized. Many cases of international payment failures or delays are related to IBAN format errors.

According to recent bank reports, format errors account for a significant proportion of global cross-border payment issues. The table below shows relevant statistics:

| Statistic | Description |

|---|---|

| 14% | The average proportion of uncompleted global cross-border payments, leading to fees from banking partners. |

| 72% | 72% of respondents said the main failure stems from manual checks of bank beneficiary names and addresses. |

| IBAN Issues | Account number issues (including IBAN and non-IBAN) are one of the main causes of failures. |

You can see that IBAN-related issues are a major factor in international transfer failures. If you make a single digit or letter error when filling out a France IBAN, the bank may fail to identify the account, and funds may not arrive on time.

For example, if you’re paying a U.S. partner and the transaction fails due to an IBAN format error, you may incur additional fees (e.g., $25-$50 USD per transaction) and potentially delay cooperation progress.

Note: Even a small format error can cause your funds to be returned by the banking system, requiring the entire process to start over.

In practice, you should always obtain the France IBAN through official bank channels and strictly follow the standard format. This significantly improves the accuracy of fund delivery, ensuring your international transactions proceed smoothly.

Obtaining and Filling Out

Obtaining Channels

You can safely obtain valid IBAN information through the following steps:

- Choose a bank. You can open an account with a traditional bank or an online bank. Common options include large commercial banks, Hong Kong-licensed banks, or international online banks.

- Prepare relevant documents. You need to provide identification (e.g., passport), proof of residence (e.g., lease agreement or utility bill), and proof of income or student status (if applicable).

- Open an account. After submitting your documents, the bank will review your application. Once approved, you’ll receive account details, including the IBAN.

- Activate the account. Some banks require a small deposit to activate the account. Once activated, your IBAN can be used for transfers and receiving funds.

You can also check the IBAN through online banking, bank statements, or the front of your bank card. It’s recommended to carefully verify the IBAN before international transfers to avoid additional fees due to errors.

Filling Out Notes

When filling out an IBAN, you need to pay special attention to the following:

- Always obtain the IBAN through official bank channels to avoid using information from unofficial sources.

- When entering the IBAN, it’s recommended to copy and paste to reduce errors from manual input.

- Check that the account holder’s name matches the bank information (e.g., RIB). For company or association accounts, ensure the legal name is used.

- When filling out online, enter the IBAN continuously without spaces, avoiding special characters.

Tip: You can first verify the beneficiary’s details to ensure all information is accurate, effectively preventing payment rejections.

Common Errors

When filling out an IBAN, you may encounter the following common errors:

- Input errors. IBANs are long, making them prone to mistakes. It’s recommended to double-check after each entry.

- Incorrect format. Some users insert spaces or symbols in the IBAN, causing the system to fail to recognize it. Ensure the format is correct.

- Incomplete recipient information. Some banks require the recipient’s name or company name. Confirm all required fields in advance.

The table below summarizes common errors and corresponding suggestions:

| Error Type | Avoidance Method |

|---|---|

| Input Errors | Copy and paste or check character by character |

| Incorrect Format | Enter continuously without spaces or special characters |

| Incomplete Information | Confirm all recipient information is accurate and complete |

By following the above suggestions, you can significantly reduce the risk of transfer failures and delays.

When making cross-border transfers, correctly filling out the France IBAN is crucial.

- The 27-character structure, combining letters and numbers, enhances account identification accuracy.

- The standardized format reduces input errors, ensuring efficient and secure fund delivery.

- Each account can be uniquely tracked, facilitating payment verification.

It’s recommended to always obtain the IBAN through official channels and carefully verify every character to ensure smooth fund transfers.

FAQ

How is a France IBAN different from a China/Mainland China bank account number?

You’ll notice that a France IBAN includes a country code, check digits, and detailed bank information. China/Mainland China bank account numbers typically consist only of numbers and lack an international standardized structure.

Can I use a Hong Kong-licensed bank account to transfer to a France IBAN?

You can make international transfers through a Hong Kong-licensed bank. You need to provide the complete France IBAN and recipient information. The bank will automatically process the international transfer.

If I enter an incorrect France IBAN, will the funds be lost?

If you enter an incorrect IBAN, the bank will typically return the funds. You may need to pay additional handling fees. It’s recommended to carefully verify every character to ensure accuracy.

Does a France IBAN need regular updates?

You don’t need to regularly update a France IBAN. As long as the account information remains unchanged, the IBAN remains valid. If the bank changes the account or merges, they will notify you of the new IBAN.

Can I use a France IBAN to receive USD transfers from the U.S.?

You can use a France IBAN to receive USD transfers. You need to confirm that the French bank supports USD deposits. Some banks may charge USD settlement fees, subject to their specific policies.

Understanding the structure and importance of France’s IBAN ensures accurate and secure cross-border transfers, but the complexity of entering 27-character codes, potential formatting errors, and bank verification delays can complicate international remittances, especially for mainland China users frequently transferring to France or Europe. BiyaPay offers a streamlined alternative: fees as low as 0.5%, same-day transfers across most global regions, including France, eliminating IBAN-related errors and high cross-border costs.

BiyaPay stands out with its intelligent platform: enabling real-time fiat-to-crypto conversions, zero-fee contract orders, and live rate checks to lock in optimal exchange points, bypassing traditional bank markups (1%-5%). A swift signup in minutes grants access to trading US and Hong Kong stocks on a single hub without offshore accounts, transforming remittances into investment opportunities for enhanced returns. Unlike the intricacies of IBAN-based transfers, BiyaPay’s digital-first approach aligns with modern global needs.

Start today—register at BiyaPay for a seamless international transfer experience. Use the Real-Time Exchange Rate Query to navigate rate shifts and maximize efficiency. Discover Stocks to merge transfers with trading, fueling sustained wealth growth. With BiyaPay, cross-border remittances become simpler, safer, and a gateway to greater financial rewards!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.