- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Comprehensive Guide to Sending Money from the US to France: Fees, Timeframe and Precautions

Image Source: unsplash

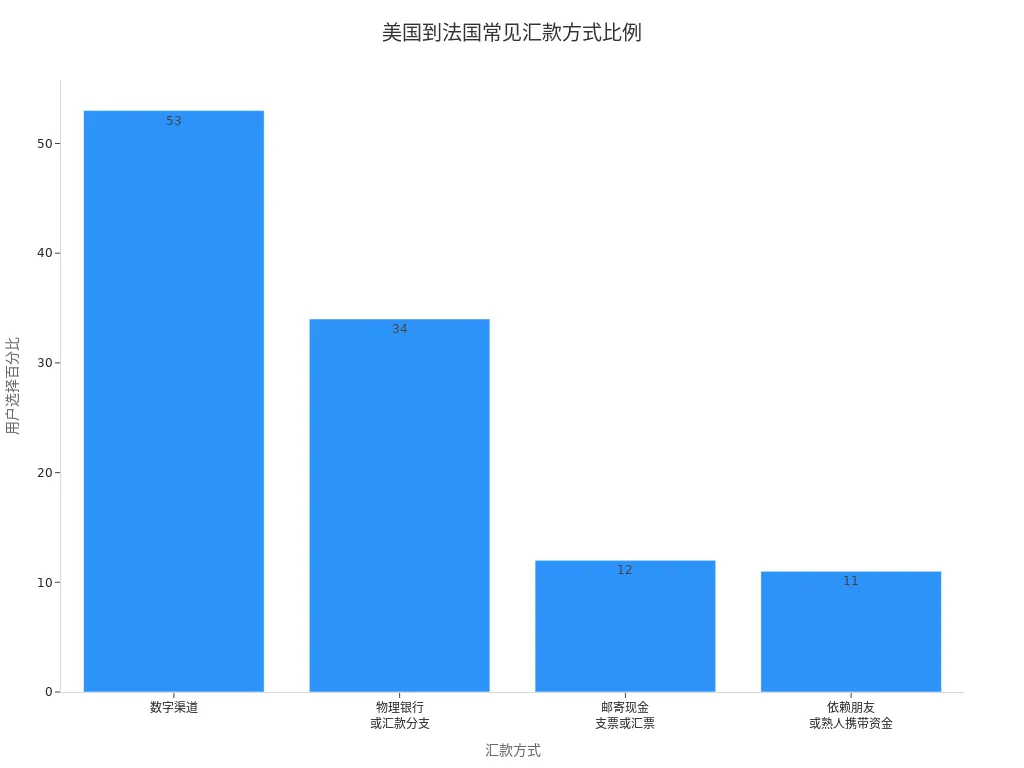

When you send money from the US to France through remittance, you have multiple options. Many people use digital channels, bank branches, or mail cash. The chart below shows that different users choose different methods:

Bank transfers typically have higher fees, with some banks charging between $25 and $110 per transaction, and the transfer usually takes 1 to 3 days. When choosing a remittance guide, you should focus on key factors such as fees, transfer time, and limits.

Key Takeaways

- When choosing a remittance method, focus on fees, transfer time, and limits. Different methods suit different needs.

- Using third-party platforms like Wise and Xoom typically offers lower fees and faster transfers, ideal for small amounts.

- Ensure recipient information is accurate to avoid transfer failures or delays due to errors.

- Pay attention to exchange rate fluctuations and choose platforms with transparent rates to reduce costs.

- Understand compliance requirements before transferring to ensure accurate and complete information, avoiding rejections or delays.

Remittance Methods Guide

Image Source: unsplash

When choosing a method to send money from the US to France, you can refer to the following remittance guide. Different methods suit different needs. Below are six common methods:

Bank Wire Transfer

Bank wire transfer is the most traditional remittance method. You can initiate an international transfer through a licensed Hong Kong bank’s counter or online banking. The bank transfers US dollars directly to the recipient’s account in France. This is suitable for large transfers or users with high security requirements. Note that bank wire transfers typically have higher fees and longer transfer times.

Wise

Wise is a third-party remittance platform. You can operate through its website or mobile app. Wise uses the mid-market exchange rate with transparent fees, suitable for users looking to save on fees. You only need to input recipient information and the amount, and the system automatically calculates fees and estimated transfer time. Wise is ideal for users with frequent small transfers.

Xoom

Xoom is another third-party platform supporting online and mobile operations. You can choose to transfer directly to a French bank account or allow the recipient to collect cash at designated locations. Xoom offers fast transfer speeds, suitable for urgent remittances. You should check daily transfer limits before using.

Western Union

Western Union supports cash and account transfers. You can initiate transfers at US locations or online. Recipients can collect cash at French locations or receive funds in their accounts. Western Union has wide coverage, ideal for recipients without bank accounts. Check fees and exchange rates in advance.

Revolut

Revolut is a digital banking app. You can perform international transfers through its platform. Revolut supports multi-currency accounts, suitable for users with frequent cross-border financial needs. You can view exchange rates and fees in real-time, with convenient operations.

SEPA Transfer

SEPA transfers are suitable for small, fast, and low-cost euro remittances.

- The SEPA system allows fast, secure, and low-cost euro transfers between participating countries.

- All transactions are standardized with consistent processes.

- Suitable for one-time small transfers with fast delivery.

When choosing a remittance method, you can refer to the table below to understand the main differences between traditional banks and third-party platforms:

| Feature | Traditional Bank Transfer | Third-Party Platform |

|---|---|---|

| Processing Speed | Slower | Faster |

| Fees | Usually higher | Potentially lower |

| Convenience | Requires bank visit or online banking | Online platform or mobile app |

| Security | Relies on bank security measures | Choose reputable providers |

| Transfer Amount Limit | Usually no limit | May have limits |

| Fraud Risk | Lower | Be cautious in choosing providers |

You can choose the most suitable method based on your needs and the remittance guide.

Fees and Time

Image Source: unsplash

Fees

When choosing a remittance method from the US to France, fees directly impact costs. Traditional banks often charge higher fixed fees, especially for international wire transfers through licensed Hong Kong banks, with fees ranging from $25 to $110 per transaction. Third-party platforms like Wise, Xoom, Western Union, and Revolut attract users with more transparent and lower fees. For example, Western Union’s international transfer fees typically range from $35-$50, depending on the amount, payment method, and other factors. Some platforms may also involve intermediary or recipient bank fees, which may be deducted directly from the transfer amount.

You can refer to the table below to understand the fee structures of different services:

| Service | Domestic Transfer Fees | International Transfer Fees | Notes |

|---|---|---|---|

| Western Union | $20-35 | $35-50 | Fees vary by amount, destination, and payment method; intermediary bank fees may apply |

| Wise | As low as $1-5 | $5-15 | Transparent fees, vary by amount and currency |

| Xoom | $4-10 | $10-30 | Fees vary by amount and delivery method |

| Revolut | $0-10 | $0-15 | Free quota for members, low fees for excess |

| SEPA | $0-5 | $0-5 | Eurozone only, very low fees, ideal for small, fast transfers |

Tip: When using third-party platforms, always check all fee details in advance to avoid receiving less than expected.

Exchange Rates

The exchange rate directly determines the actual euro amount the recipient receives. Traditional banks often add a markup to the exchange rate, increasing your costs. Third-party platforms like Wise use the mid-market exchange rate, ensuring a fairer conversion price. You can compare exchange rates and received amounts across providers in the table below:

| Provider | Exchange Rate | Received Amount (EUR) | Paid Amount (USD) | Fees | Speed |

|---|---|---|---|---|---|

| OFX | 0.8406 | €8,406.14 | $256.42 | No fees | 1-3 days |

| Venstar | 0.841 | €8,410.38 | $261.42 | No fees | 1-3 days |

When choosing a remittance service, compare exchange rate differences in addition to fees. Higher rate differences reduce the recipient’s received amount. Differences in rates and fees between banks and third-party platforms impact your total cost.

- Exchange rate fluctuations directly affect the received amount.

- Traditional bank rates are generally less favorable than third-party platforms.

- When using a remittance guide, prioritize platforms with transparent exchange rates.

Transfer Time

Transfer time is a key consideration when choosing a remittance method. Most bank wire transfers take 1-5 business days, while some third-party platforms like Xoom and Western Union support same-day or even instant transfers. SEPA transfers within the Eurozone typically arrive on the same day, ideal for urgent needs.

You can refer to the table below to understand the transfer speeds of different methods:

| Remittance Method | Delivery Time | Conditions |

|---|---|---|

| Bank Deposit | Minutes to 1-3 days | Depends on payment method and bank processing speed |

| Mobile Wallet | Minutes | Depends on platform and receipt method |

| Cash Pickup | Minutes | Depends on location and operating hours |

| Direct to Debit Card | Minutes | Depends on platform and card network |

| Door-to-Door Delivery | Within 24 hours | 80% of transfers arrive same day |

Reminder: Transfers initiated during holidays or non-working hours may experience delays.

Transfer Limits

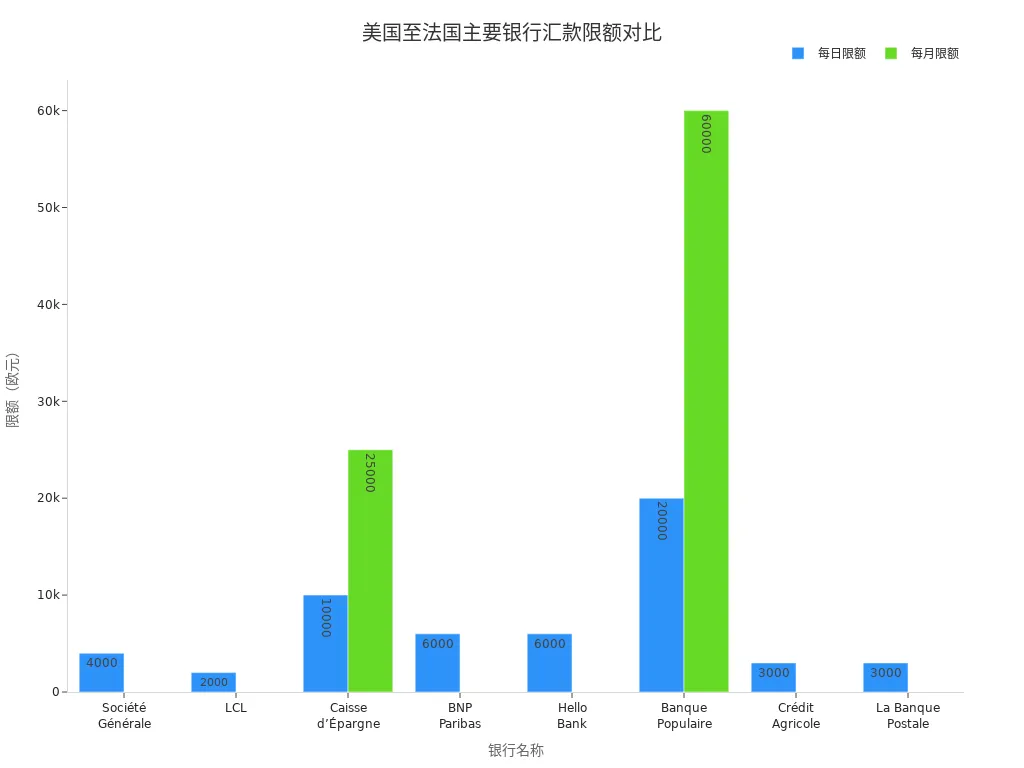

Different providers have varying daily and monthly transfer limits. Most banks have daily limits between $2,000 and $20,000, and some platforms impose limits on single or cumulative amounts. For large transfers, confirm limit policies in advance to avoid failures due to exceeding limits.

The chart below shows daily and monthly transfer limits for major banks from the US to France:

When operating, choose the appropriate method and amount based on your needs to ensure funds arrive safely and on time.

Operation Process Guide

Information Entry

When making international transfers from the US to France, you first need to prepare complete recipient and sender information. Pay special attention to the accuracy of each detail. Any small error may lead to transfer failure or delay. The table below summarizes the main information required and common errors:

| Required Information | Common Errors |

|---|---|

| Sender Information: ID (e.g., passport), tax ID number | Recipient name misspelled |

| Recipient Information: Name, address, bank name, account number, SWIFT/IBAN code | Incorrect or invalid account number |

| Missing or incorrect SWIFT/IBAN code |

When filling out this information, double-check to ensure it matches the recipient’s bank account details exactly. This significantly reduces the risk of transfer rejection or delay.

Application Steps

The operation process is similar across different remittance channels. Whether through a licensed Hong Kong bank counter, online banking, or third-party platform, follow these steps:

- Log in or visit the platform and select international remittance services.

- Enter recipient details, including name, address, bank account number, SWIFT/IBAN code, etc.

- Enter the transfer amount (in USD) and select the payment method.

- Carefully review all information and submit the application once confirmed.

- Save the transfer receipt for future reference.

Reminder: During the process, ensure all information complies with the remittance guide to avoid failures due to errors.

Common Issues

During the remittance process, you may encounter issues such as incomplete information, incorrect account numbers, or wrong SWIFT/IBAN codes, which can prevent funds from arriving. Some platforms may reject transfers due to exceeding limits or non-compliance. If issues arise, contact the platform’s customer service or bank staff for professional assistance.

Before operating, review each platform’s specific requirements and FAQ to improve transfer success rates and save time.

Pros and Cons Comparison

Fee Comparison

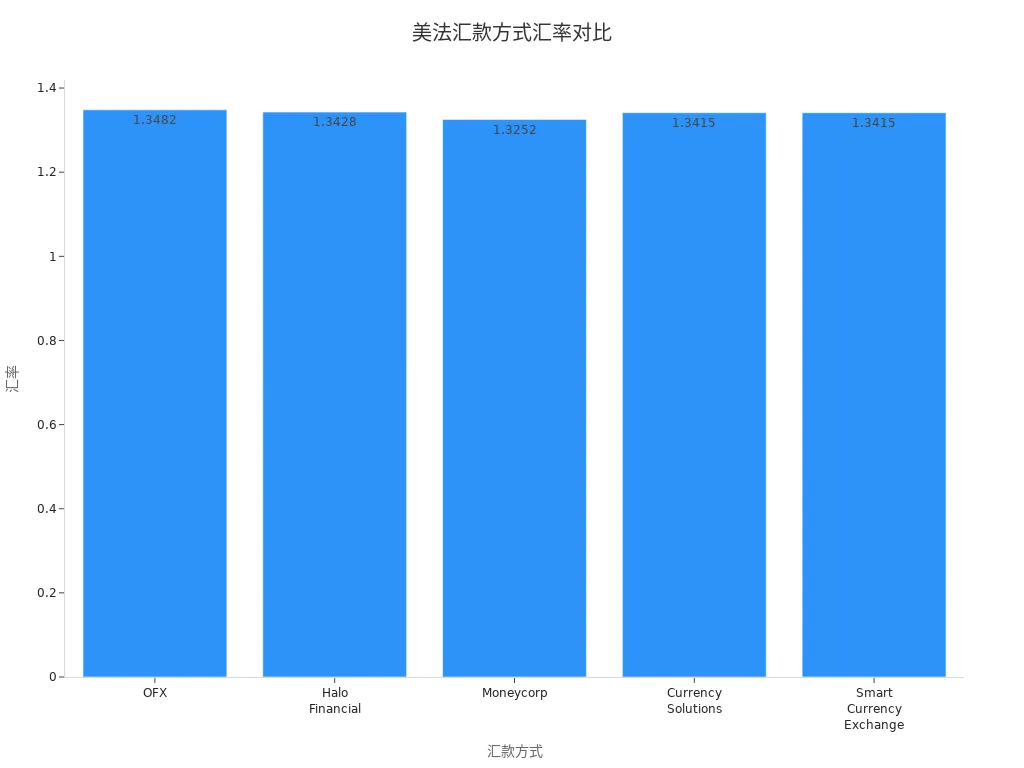

When choosing a remittance method, fees are a key consideration. Traditional bank wire transfers typically charge high fixed fees, ranging from $25 to $110 per transaction. Third-party platforms like Wise, Xoom, and OFX offer lower fees, with some even fee-free. Refer to the table below for fee and exchange rate details across services:

| Remittance Method | Fees | Exchange Rate | Speed |

|---|---|---|---|

| OFX | $0 | 1.3482 | 1-3 days |

| Halo Financial | $0 | 1.3428 | 1-3 days |

| Moneycorp | $0 | 1.3252 | 1-3 days |

| Currency Solutions | $0 | 1.3415 | 1-3 days |

| Smart Currency Exchange | $0 | 1.3415 | 1-3 days |

| PayPal | $0 | N/A | N/A |

You can also compare exchange rate differences visually in the bar chart below:

Tip: When using third-party platforms, check all fee details in advance to avoid receiving less than expected.

Time Comparison

Transfer time directly affects fund availability. Traditional bank transfers typically take 1-5 business days. Online services like PayPal and Wise can deliver in minutes or hours. Refer to the table below for transfer speeds:

| Transfer Method | Transfer Time |

|---|---|

| Online Transfer Services (e.g., PayPal, TransferWise) | Minutes to hours |

| Traditional Bank Transfer | 1-5 business days |

Reminder: Transfers during holidays or non-working hours may take longer.

Convenience

Convenience is a key factor during operations. Third-party platforms support online and mobile operations, eliminating the need to visit bank branches. You can complete the entire process on your phone or computer. Traditional banks require counter visits or online banking, which can be more cumbersome. The list below summarizes the convenience features of each platform:

- OFX, Halo Financial, Moneycorp, etc.: Support fully online operations with user-friendly interfaces, ideal for frequent cross-border transfers.

- PayPal: Suitable for small, frequent transfers with simple operations.

- Traditional Banks: Suitable for large amounts or high-security needs but slower processes.

Target Users

Choose the most suitable method based on your needs:

- If you prioritize low fees and favorable rates, third-party platforms like OFX and Wise are better.

- For fast delivery, choose online services like PayPal or Wise.

- For large amounts or high security, licensed Hong Kong bank wire transfers are more reliable.

- For recipients without bank accounts, Western Union’s cash pickup service is convenient.

Combine the remittance guide with considerations of fees, speed, and convenience to choose the best method.

Considerations

Security

When transferring money, prioritize information security. Use only official platforms or licensed Hong Kong bank channels. Avoid trusting unfamiliar remittance links or QR codes. Protect your account information and verification codes from disclosure. If you encounter suspicious activity, contact the bank or platform customer service immediately.

Tip: Regularly update passwords and enable two-factor authentication to prevent account theft.

Compliance Requirements

For cross-border remittances, comply with US and French legal regulations. Banks and platforms typically require identity proof, proof of funds, etc. Ensure all information is accurate and complete. Attempting to bypass regulations or providing false information may lead to rejection or delays.

Common compliance requirements include:

- Providing valid ID (e.g., passport)

- Entering accurate recipient information

- Specifying the transfer purpose

When facing compliance reviews, cooperate actively and provide required materials promptly.

Exchange Rate Risk

The USD-to-EUR exchange rate fluctuates daily. Check real-time rates before transferring. Rate changes directly affect the euro amount received in France. When the USD strengthens, you can exchange fewer dollars for more euros, reducing costs. When the USD weakens, you need more dollars for the same euro amount.

The table below shows the euros received for a $1,000 transfer at different rates:

| USD to EUR Rate | Euros Received for $1,000 |

|---|---|

| 0.90 | 900 |

| 0.95 | 950 |

| 1.00 | 1000 |

For large transfers, lock in rates or choose platforms with transparent rates to minimize losses.

Reasons for Failure

During transfers, funds may not arrive or may be returned. Common reasons include:

- Incorrect recipient name, account number, or SWIFT/IBAN code

- Exceeding platform or bank transfer limits

- Failure to provide required compliance materials

- Unclear transfer purpose or regulatory violations

Before operating, double-check all information and review platform requirements. If issues arise, contact bank or platform customer service for quick resolution.

When choosing a remittance method from the US to France, weigh fees, transfer speed, and limits based on your needs.

- Online transfer services typically offer low fees and fast delivery, ideal for daily small transfers.

- Wire transfers suit large amounts and high-security scenarios.

- Compare fees, rates, and delivery times across services and prepare all materials in advance.

- Choose reputable providers and review terms carefully to avoid hidden fees and compliance risks.

FAQ

What to do if a transfer fails?

First, verify recipient information and transfer amount. If correct, contact the platform or licensed Hong Kong bank customer service to identify the issue. Most platforms refund undelivered funds.

How long does a transfer take?

Transfer times vary by method. Bank wire transfers take 1-5 business days. Third-party platforms like Wise and Xoom can deliver in minutes. Holidays may cause delays.

What information is needed for a transfer?

You need the recipient’s name, address, bank account number, and SWIFT or IBAN code. You also need to provide your identity proof. Accurate information prevents delays.

Are there transfer amount limits?

Most platforms and banks impose limits on single or daily transfers. Check specific limits on the platform or licensed Hong Kong bank website to avoid failures due to exceeding limits.

How are transfer fees calculated?

Fees vary by service. Bank wire transfers often have fixed fees, while third-party platforms charge based on the amount. Review fee details before transferring to make informed choices.

Navigating remittance guides from the US to France highlights the drawbacks of bank wires—high fees ($25-110) and 1-5 day delays—while platforms like Wise or Western Union offer ease but with rate markups (up to 5%) and intermediary charges that erode net receipts, particularly for mainland China users with regular cross-border needs. BiyaPay delivers a refined solution: fees as low as 0.5%, same-day delivery across most global regions, including France, for swift, affordable USD-to-EUR transfers without IBAN formatting hassles or concealed costs.

BiyaPay’s essence is its fluid conversion engine: instant fiat-to-crypto swaps, zero-fee contract orders, and live rate monitoring to secure peak exchanges, evading traditional providers’ volatility traps. A quick signup in minutes enables trading US and Hong Kong stocks on one platform sans offshore accounts, channeling remittances into investments for amplified yields. Unlike cumbersome wire processes, BiyaPay’s digital ecosystem fits contemporary global flows.

Begin today—register at BiyaPay for an effortless US-France transfer journey. Harness the Real-Time Exchange Rate Query to track USD-EUR fluctuations and enhance value. Explore Stocks to unify transfers and trades, spurring wealth expansion. With BiyaPay, cross-border remittances shift from obstacles to opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.