- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Currency Usage and Payment Habits in France: Understanding Tipping, Exchange, and Withdrawal

Image Source: pexels

In daily life in France, you will find that currency use primarily relies on the euro, with both cash and bank cards being equally common. According to the latest data, approximately 36.6% of transactions in France are made with cash, while 37.4% use bank cards. Many newcomers to France may encounter issues such as the variety of payment methods, unfamiliarity with local bank cards (CB), and adapting to electronic payments. You need to understand in advance how to exchange euros, withdraw cash, and operate different payment methods to smoothly handle various consumption scenarios.

Key Takeaways

- In France, both cash and bank card payments are common. It’s advisable to carry some cash for small transactions and emergencies.

- When exchanging euros, always pay attention to exchange rates and fees. Choose transparent exchange points to avoid unnecessary costs.

- When withdrawing cash from ATMs, prioritize local bank ATMs and avoid withdrawals at airports or tourist areas to minimize fees.

- At restaurants, the bill already includes a service charge. You may leave a small tip if satisfied with the service, but it’s not mandatory.

- When carrying large amounts of cash into or out of France, amounts exceeding 10,000 USD must be declared in advance to avoid legal risks.

Currency Use and Denominations in France

Image Source: pexels

Euro Denominations

In daily life in France, you will primarily deal with euros. The currency in France is the euro, available in both banknotes and coins with various denominations. You can refer to the table below to learn about the currently circulating euro denominations:

| Type | Denominations |

|---|---|

| Banknotes | 5, 10, 20, 50, 100, 200, 500 euros |

| Coins | 1, 2, 5, 10, 20, 50 cents, 1, 2 euros |

You need to note that while 500-euro banknotes are still in circulation, many merchants do not accept these large-denomination notes. For daily transactions, it’s best to carry smaller denomination banknotes and coins for more convenient payments.

Cash Circulation

In France, cash remains common for small payments. You will find that cafes, bakeries, and markets often prefer cash, especially for smaller amounts. Many French people use cash to buy breakfast, newspapers, or small items. When using currency, carrying a moderate amount of cash allows you to handle various situations and avoid inconvenience due to the inability to use cards.

Counterfeit Detection

When using cash in France, you need to learn how to identify counterfeit notes. Below are some common methods to verify the authenticity of euro banknotes:

- Check the texture of the paper. Genuine banknotes feel firm and have a “crisp” texture under your fingers.

- Check if the large numbers and images on the banknote are slightly raised. You can feel them with your fingertips.

- Check the small denomination numbers on each side. They should match and form a complete printed number.

- Check the holographic symbols. Genuine banknotes will display a rainbow-like shimmer.

- Use color-changing counterfeit detection ink. Genuine banknotes will change from purple to green.

By developing a habit of checking banknotes in daily currency use, you can effectively avoid receiving counterfeit money.

Exchange and Withdrawals

Image Source: unsplash

Domestic Exchange

In mainland China, you can exchange euros through various channels. Common methods include bank counters, licensed foreign exchange points, and currency exchange services at some airports. When purchasing foreign currency at a bank, you need to prepare relevant documents. The table below lists the required documents for different transaction types:

| Transaction Type | Required Documents |

|---|---|

| Personal Foreign Exchange Purchase | Personal passport and valid visa (or endorsement); proof of overseas training expenses; fax copies if originals are unavailable. |

| Payment for Overseas Organization Fees | Valid personal identification; payment notice from the overseas organization; fax copies if originals are unavailable. |

| Support for Overseas Immediate Family | Valid personal identification; proof of family relationship and related documents; fax copies if originals are unavailable. |

| Overseas Mail Order | Valid personal identification; advertisements, orders, or other proof of expenses or fax copies. |

| Overseas Consulting | Written application; valid personal identification; contract (agreement), invoice (payment notice), and tax documents. |

You are entitled to an annual personal foreign exchange convenience quota equivalent to 50,000 USD. When exchanging, you need to provide valid identification documents. As long as you have legitimate needs, such as tuition or medical expenses, you can smoothly purchase foreign currency. When handling exchanges at banks or licensed exchange points in mainland China, you can generally obtain transparent exchange rates and fee information.

Tip: When exchanging euros in mainland China, it’s recommended to check the exchange rates and fees with banks or exchange points in advance to avoid unreasonable charges during last-minute transactions.

Exchange Points in France

Upon arriving in France, you can exchange euros at various locations. Common exchange points include airports, train stations, city-center currency exchange offices, and some banks. The table below lists several well-known currency exchange points in Paris and their contact information:

| Exchange Office | Address | Contact Information |

|---|---|---|

| Multi-change | 4 Rue de Tilsitt, 75008 Paris, France | +33 1 42 25 05 55 |

| International Currency Exchange | 9 Rue Berger, 75001 Paris | +33 1 42 36 08 77 |

| Cen-Change | 70 Boulevard de Strasbourg, 75010 | +33 1 40 05 07 11 |

| The Change Group France | 150 Av. des Champs-Élysées, 75008 Paris | +33 1 45 61 03 46 |

When exchanging euros in France, you must pay attention to exchange rates and fees. French law requires all currency exchange points to clearly disclose all fees before the transaction. You can see the fee details at the counter to avoid overpaying due to unclear information. When choosing an exchange point, compare several options to select one with better rates and lower fees.

- When exchanging in France, all fees must be disclosed in advance.

- You have the right to ask staff to explain all fee details.

- Exchange fees at airports and tourist areas are usually higher, so it’s recommended to use city-center exchange points.

ATM Withdrawals

In France, you can use international bank cards (such as UnionPay, Visa, or MasterCard) to withdraw cash directly from ATMs. During the process, you simply insert the card, enter the PIN, and select the withdrawal amount. When withdrawing cash from French bank ATMs, there are usually no additional fees, but your issuing bank may charge foreign exchange conversion fees and transaction fees. The table below shows typical fee structures for different banks (using the U.S. market as an example):

| Bank Name | Foreign Exchange Fee | Transaction Fee | Notes |

|---|---|---|---|

| Local French Banks | 0% | 0% | Cash only, no additional fees |

| Airport Exchange Points | N/A | N/A | May charge higher fees |

When withdrawing cash from ATMs in France, it’s recommended to prioritize local bank ATMs and avoid those in airports or tourist areas, as their fees are typically higher. When withdrawing, be mindful of your surroundings to prevent card skimming or fraud. To reduce fees from multiple withdrawals, consider withdrawing the needed amount in one transaction.

Reminder: When withdrawing cash from ATMs in France, it’s advisable to use international bank cards issued by licensed Hong Kong banks, as these typically support global ATM withdrawals with transparent fee structures. Check specific fees on the bank’s website or through customer service before withdrawing.

Declaration and Limits

When exchanging currency or withdrawing cash in France, you must comply with EU regulations. You must declare cash amounts exceeding 10,000 USD when entering or leaving France. For single exchanges or withdrawals exceeding 1,000 USD within France, declarations are also required. French law imposes strict penalties for undeclared or excessive cash. The table below lists related penalty types:

| Penalty Type | Description |

|---|---|

| Fine | Failure to declare cash exceeding 10,000 USD may result in hefty fines. |

| EU Watchlist | Violators may be placed on an EU watchlist for 5 years. |

| Sliding Sanctions | Repeated violations face escalating sanctions, potentially including full confiscation of funds. |

When handling large currency transactions in France, you must understand the declaration process in advance to ensure all actions are legal and compliant. All fees and exchange rate information should be disclosed before transactions. France’s CBPR2 regulations require all payment service providers to clearly inform you of currency conversion fees before transactions, protecting you from excessive charges. When making cross-border payments, carefully review all fee details to avoid unnecessary losses.

- When exchanging or withdrawing in France, keep all transaction receipts.

- Declaring large amounts of cash in advance when entering or leaving France can prevent legal risks.

Payment Methods and Currency Use

Cash Payments

In daily transactions in France, cash still plays an important role. Although card and mobile payments are increasingly popular, many small transactions still favor cash. When buying breakfast or small items at cafes, bakeries, or markets, cash payments are more convenient. French law requires most stores to accept cash, but some specialty stores and late-night businesses may refuse cash for safety reasons. The table below outlines different stores’ attitudes toward cash payments:

| Store Type | Cash Payment Requirement |

|---|---|

| General Stores | Legally required to accept cash |

| Specialty Stores | May refuse cash in specific cases |

| Late-Night Stores | May not accept cash for safety reasons |

When traveling in France, it’s recommended to carry a certain amount of cash. This ensures you can handle situations like digital payment system failures, power outages, or cyberattacks. Cash serves as a backup to ensure you can purchase essentials during issues.

Tip: Some merchants do not accept large-denomination notes (e.g., 500 euros), so it’s best to carry smaller denomination notes and coins for daily currency use.

Bank Card Payments

When shopping, dining, or staying in France, bank card payments are very common. The most widely used card type in France is the Carte Bancaire (CB), often co-branded with Mastercard or Visa. International bank cards (e.g., Visa, Mastercard, UnionPay) are accepted at most merchants but may incur currency conversion or withdrawal fees. Below are common scenarios for bank card payments in France:

- The most widely accepted bank card in France is the Carte Bancaire (CB), which can be used with Mastercard or Visa.

- Foreign bank cards may incur currency conversion and withdrawal fees.

- Some small merchants only accept local CB cards and may not support international cards.

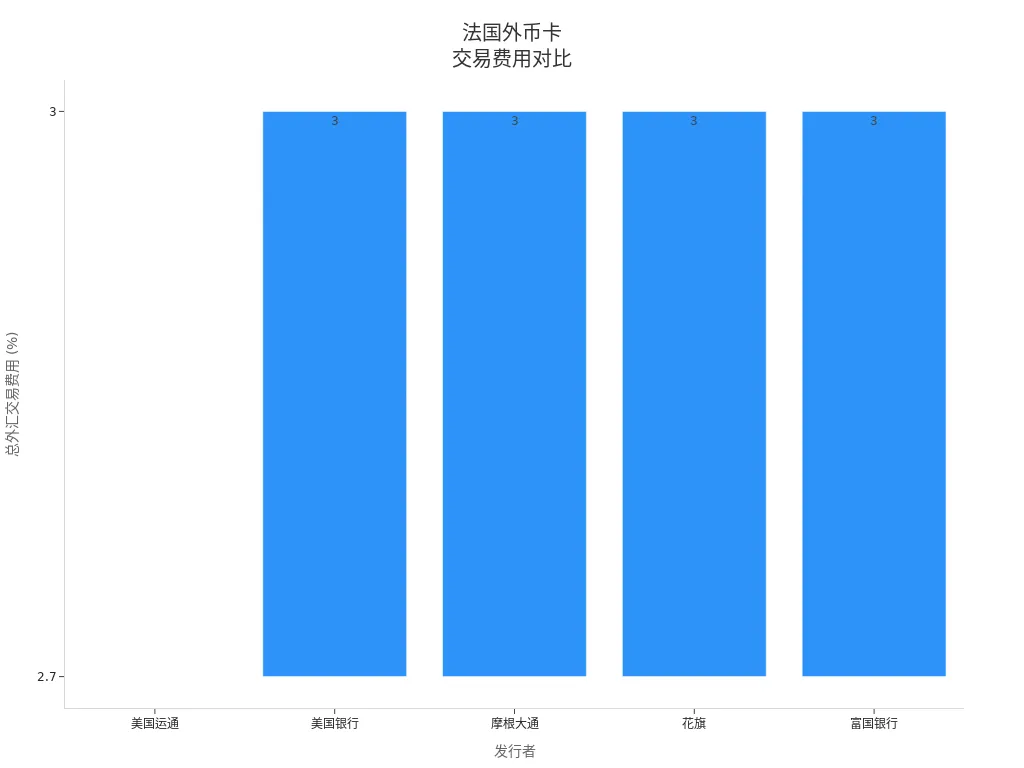

When using U.S.-issued bank cards in France, you may encounter the following fees:

| Issuer | Issuer Fee | Network Fee | Total Foreign Transaction Fee |

|---|---|---|---|

| American Express | 2.7% | – | 2.7% |

| Bank of America | 2% | 1% | 3% |

| Capital One | – | – | – |

| JPMorgan Chase | 2% | 1% | 3% |

| Citibank | 2% | 1% | 3% |

| Discover | – | – | – |

| Wells Fargo | 2% | 1% | 3% |

When using bank cards in France, it’s advisable to understand your issuing bank’s fee policies in advance. Note that some small merchants may not support credit card installments or high-value transactions.

Mobile Payments

You can also experience the convenience of mobile payments in France. With smartphone penetration reaching 85% in 2023, more French consumers are opting for contactless digital transactions. You can use Apple Pay, Google Pay, and other digital wallets at large supermarkets, chain restaurants, some metro stations, and airports. Digital wallets and QR code payments account for over 60% of digital transactions, reflecting France’s shift toward smart payment solutions.

| Evidence Type | Content |

|---|---|

| Mobile Payment Market | The mobile payment market is growing rapidly, with high smartphone penetration and over 60% of digital transactions using digital wallets and QR codes. |

When using mobile payments in France, you may encounter some challenges. For example, some elderly individuals and rural residents have lower acceptance of digital payments. Security concerns, limited platform interoperability, and regulatory ambiguities may also affect user experience. When using mobile payments, confirm in advance whether merchants support the relevant platforms.

Payment Comparison

When choosing payment methods in France, you can adjust based on the situation and personal needs. The table below compares the preference and convenience of three common payment methods:

| Payment Method | Consumer Preference (%) | Merchant Preference (%) | Additional Information |

|---|---|---|---|

| Card Payments | 72% | 67% | 90% of merchants believe cards’ value exceeds costs |

| Cash | Down 8% | N/A | Cash remains important for small transactions and emergencies |

| Mobile Payments | N/A | N/A | Rapidly growing market with expanding use cases |

You will find that 74% of consumers believe card payments offer better protection for returns or complaints, 78% trust card payments, and 57% see credit limits as a key advantage of cards. In daily transactions, card payments are the most common, but cash remains essential for small purchases, market stalls, or technical issues. Mobile payments offer greater convenience, especially for younger users and urban lifestyles.

- When traveling in France, it’s recommended to carry both bank cards and cash to handle different situations flexibly.

- In case of digital payment system disruptions, cash serves as an emergency backup to meet basic consumption needs.

In France’s currency use scenarios, choosing payment methods wisely can make your consumption experience smoother and safer.

Tipping Habits

Restaurant Tipping

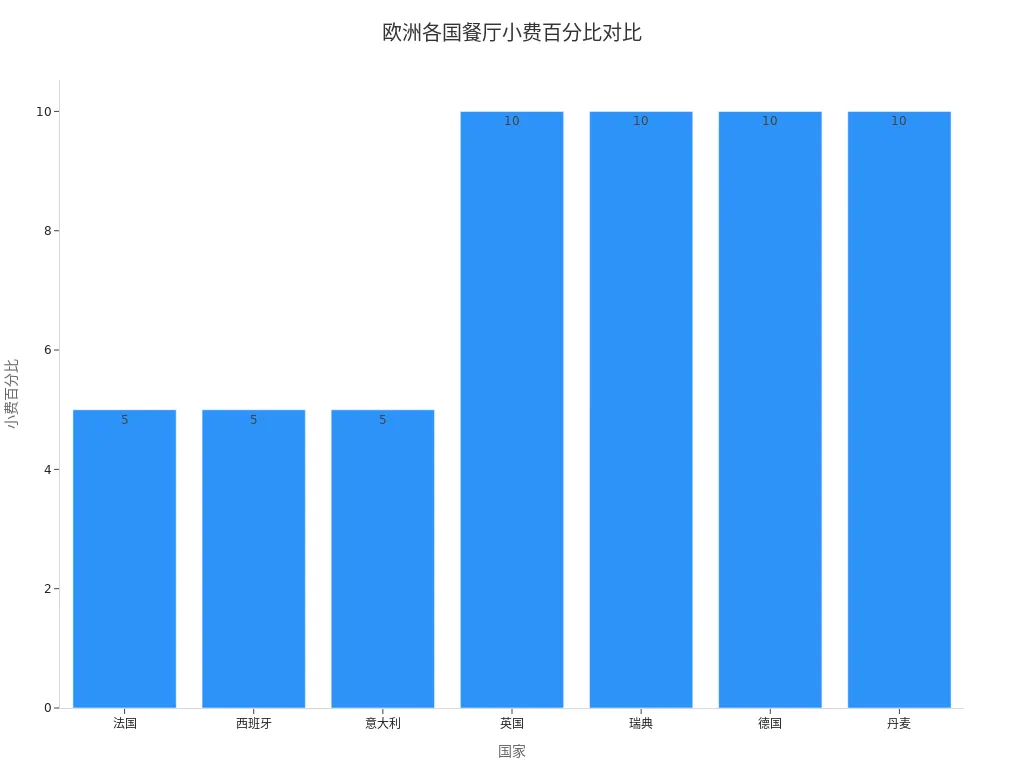

When dining at restaurants in France, you will notice that the bill typically includes a 15% service charge. French law mandates that menu prices include the service charge, and bills will indicate “service compris.” This means you have already paid the service fee through the bill, and tipping is not mandatory. If you are particularly satisfied with the service, you can leave an additional 1-2 USD (approximately 1-2 euros) as a reward. Tipping in French restaurants is generally lower than in other European countries. The table below shows common tipping percentages in different countries:

| Country | Tipping Percentage |

|---|---|

| France | 5% |

| Spain | 5% |

| Italy | 5% |

| United Kingdom | 10% |

| Sweden | 10% |

| Germany | 10% |

| Denmark | 10% |

Hotels and Taxis

When staying at hotels in France, tipping is also a way to acknowledge excellent service. You can choose an appropriate amount based on the service type and satisfaction level. The table below summarizes suggested tipping amounts for common services (in USD):

| Service Type | Tip Amount | Applicable Situations |

|---|---|---|

| Concierge/Receptionist | 10-15 USD | Tip for exceptional service; no tip needed for simple assistance. |

| Valet Parking Attendant | 5-10 USD | Tip each time the car is retrieved. |

| Taxi Driver | 10% (long trips) or round up | 10% for long trips; round up to the nearest amount for short trips. |

| Porter | 1-2 USD per bag | Tip for assistance with luggage. |

| Doorman | 1-2 USD | Tip for hailing a taxi or providing valet services. |

| Room Service | A few dollars | Tip for meal delivery. |

| Housekeeping | 2-4 USD daily | Tip directly or leave in an envelope. |

| Concierge | 5-20 USD | Tip based on the service provided. |

When taking a taxi, you can tip 10% for long trips or round up the fare to the nearest dollar for short trips.

Tipping Suggestions

When tipping in France, cash is typically used. Although some restaurants allow adding tips when paying by card, electronic tipping is not common. You can leave the tip on the table or round up the bill amount during payment. When staying at hotels, it’s recommended to leave 1-2 USD daily for housekeeping staff in the room. For exceptional service during dining or taxi rides, you can slightly increase the tip amount.

Note: Many tourists misunderstand France’s tipping culture. Tipping is not mandatory but is a recognition of good service. You don’t need to worry about tip percentages; simply decide the amount based on service quality and your feelings. Don’t overlook tipping hotel staff, and remember to express gratitude when rounding up the bill.

When using currency in France, you need to choose payment methods flexibly. France’s banking system is modernized, supporting various payment tools and electronic services. You can complete most transactions through bank transfers, letters of credit, or electronic payments.

When managing cash and payments in France, pay attention to safety. The table below summarizes common safety tips:

| Tip | Description |

|---|---|

| Carry Cash and Cards | Prepare both cash and bank cards for different situations. |

| Mix Denominations | Carry small and large denomination notes, avoiding exposing large amounts of cash in public. |

| Carry Only Essentials | Store valuables in the hotel safe to reduce risks when carrying items. |

| Stay Vigilant | Hold bags tightly in crowded places to ensure the safety of your belongings. |

When consuming in France, paying attention to tipping habits and safety details can make your travel experience smoother and worry-free.

FAQ

Can I use Chinese bank cards to withdraw cash in France?

You can use international bank cards issued in mainland China to withdraw cash at ATMs in France. Be aware that banks may charge foreign exchange conversion fees and transaction fees.

What fees should I watch for when exchanging euros in France?

When exchanging euros in France, you must pay attention to exchange rates and fees. All fees should be disclosed before the transaction, and fees at airports and tourist areas are usually higher.

What payment method is recommended for small transactions in France?

For small transactions in France, cash payments are more convenient. Many small merchants and market stalls prefer cash.

If the restaurant bill in France includes a service fee, do I still need to tip?

When dining at restaurants in France, the bill includes approximately a 15% service fee. If satisfied with the service, you can leave an additional 1-2 USD as a reward, but it’s not mandatory.

Do I need to declare large amounts of cash when entering or leaving France?

You must declare cash amounts exceeding 10,000 USD when entering or leaving France. Failure to declare may result in fines or confiscation of funds.

Navigating currency use in France can be costly with high exchange fees (especially at airports and tourist areas), rate markups (3-6%) for cross-border payments, and cash declaration limits (over $10,000). You need a low-cost, transparent, and efficient platform to streamline currency exchange and payments.

BiyaPay offers the ideal solution, featuring real-time exchange rate queries to track USD-to-EUR rates and convert fiat to crypto, minimizing volatility risks. Remittance and exchange fees start at just 0.5%, with zero-cost contract orders and global same-day delivery. Plus, you can invest in US and Hong Kong stocks on BiyaPay without an overseas account, enhancing your travel funds.

Sign up for BiyaPay today to unlock effortless cross-border finance! From exchanging euros to covering daily expenses, cut costs and boost efficiency for a worry-free France trip. Don’t let high fees and complex processes hinder your spending—join BiyaPay now for a smoother currency management journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.