- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Efficiently Manage Remittances to France: Canceling Transfers, Tax Clauses and the Best Exchange Rate Timing

Image Source: unsplash

When efficiently managing remittances, you need to master four key aspects: selecting the right channel, understanding how to cancel a transfer, complying with tax regulations, and choosing the optimal exchange rate timing. Preparing necessary documentation, monitoring fund arrivals, and establishing customer support mechanisms can all reduce risks. Remittance amounts from the U.S. to France fluctuate significantly, reaching 28 million EUR in July 2025, with a historical average of 45.5 million EUR.

| Time | Remittance Amount (EUR Million) |

|---|---|

| July 2025 | 28 |

| Historical Average | 45.50 |

| Highest | 87.00 (December 2002) |

| Lowest | 19.00 (January 2021) |

Key Points

- Choose the appropriate remittance channel. Banks are suitable for large amounts and compliance needs, while third-party platforms are ideal for fast and low-cost transfers.

- Prepare all necessary documentation, including identification and recipient information, before transferring to avoid delays.

- Understand the tax regulations for remittances. The U.S. and France have different reporting requirements for large transfers to ensure compliance and avoid penalties.

- Monitor exchange rate changes and choose the optimal timing for remittances. Use online tools to check exchange rates in real-time to optimize transfer costs.

- In case of issues, promptly contact the bank or platform’s customer service and provide the transaction reference number to expedite resolution.

Choosing Channels for Efficient Remittance Management

When efficiently managing remittances, you need to understand the mainstream remittance channels in France. Common methods include international remittances through banks or financial institutions and using third-party platforms. Each channel has distinct features and applicable scenarios. You can choose the most suitable method based on your needs.

Bank Transfers

Bank transfers are a formal channel. You typically need to provide detailed recipient information, such as their name, bank account number, and the receiving bank’s address. Licensed banks in Hong Kong can provide international remittance services. The advantages of bank transfers include high security and a mature system, making them suitable for large fund transfers.You need to pay attention to fees and transfer times.

You can usually receive funds within 1 to 3 days, but in special cases, the transfer time may extend to 10 days. Bank transfers are suitable for users who prioritize compliance and fund security.

Third-Party Platform Transfers

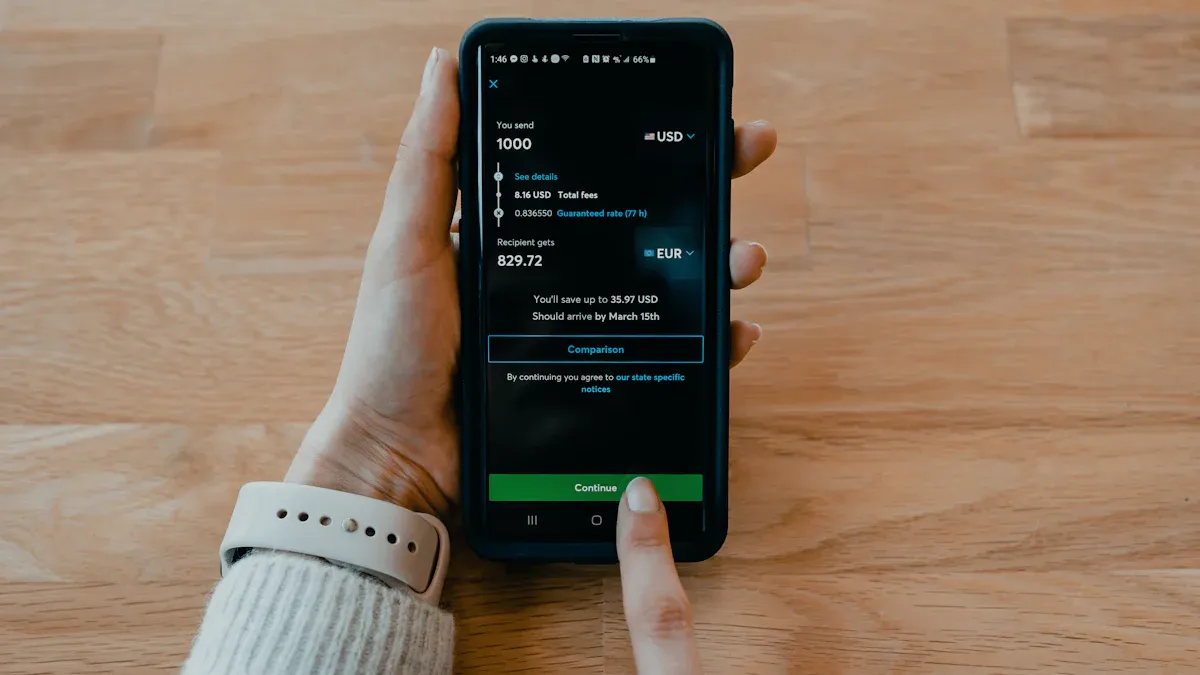

Third-party platforms offer more flexible remittance options. You can achieve fast transfers through digital technology and extensive networks. Common platforms like PayPal and Wise support remittances from mainland China and the U.S. to France.

The advantages of third-party platforms include fast processing, lower fees, and more competitive exchange rates. You can complete a transfer in minutes, making them ideal for urgent fund needs. Security depends on the platform’s encryption technology and anti-fraud measures.

Below is a comparison of banks and third-party platforms:

| Type | Third-Party Platform | Bank |

|---|---|---|

| Speed | Funds can arrive in minutes | Usually takes several days |

| Security | Relies on digital technology and extensive networks | Offers a more mature system |

| Fees | Generally lower fees and more competitive exchange rates | Typically higher fees and longer processing times |

You can search online for nearby agent locations, bring valid identification or a phone number, and use cash or a U.S. bank-issued debit card for transfers. The platform will provide a unique tracking number to monitor progress.

Channel Selection Tips

When choosing a remittance channel, you need to consider the following factors:

- Reliability: Choosing a reliable platform is key to ensuring fund security.

- Security Measures: The platform should have strong encryption and anti-fraud mechanisms.

- Fees: Compare transfer fees across channels to find the most cost-effective option.

- Transfer Speed: Choose a fast or economical method based on your needs.

- Ease of Use: The platform’s user-friendliness affects your experience.

Tip: When efficiently managing remittances, prioritize compliance and fund security. For fast transfers, choose third-party platforms. For fund security and compliance, bank transfers are more suitable. You can flexibly select a channel based on the transfer amount, urgency, and personal preferences.

Efficient remittance management goes beyond choosing a channel; you also need to focus on fees, transfer speed, and security. By comparing different channels, you can find the most suitable remittance method to achieve efficient fund flow.

Canceling Transfer Process and Precautions

Bank Cancellation Process

If you need to cancel an international bank transfer, you must act immediately. Once the bank processes the transfer, the funds may already be in the recipient’s account, making cancellation more difficult. You can follow this standard process:

- Contact the bank immediately. Time is critical. The sooner you contact the bank, the higher the chance of successful cancellation.

- Provide all necessary information. You need to prepare the transfer reference number, sender and recipient account details, and the exact amount.

- Clearly explain your situation. Accurately state the reason for cancellation to help the bank process your request faster.

- Be prepared to pay fees. The bank may charge additional fees based on the contract, with specific amounts subject to the bank’s announcement.

When handling international remittances through licensed Hong Kong banks, you can typically request cancellation via phone, online banking, or at a branch. The bank will determine if cancellation is possible based on the transfer status. If the funds have already arrived, the bank can only assist in communicating with the recipient for a refund. You should review the bank’s service terms and fee standards, as cancellation fees for some banks range from $20.00 to $50.00 USD.

Tip: When efficiently managing remittances, double-check recipient information before transferring to reduce the risk of needing to cancel.

Platform Cancellation Process

When canceling a transfer through third-party platforms (e.g., PayPal, Wise), the process differs from banks and is generally more convenient. You can log into the platform account, locate the “Transaction History” or “Transfer History,” and select the order to cancel. The platform will display the current status, and if the transaction is not yet complete, you can click the “Cancel” button.

Note that some platforms do not allow cancellations after funds have been sent. The platform will automatically determine if cancellation is possible based on the transaction status. You can contact platform customer service for assistance, providing the order number, account details, and cancellation reason. Platform cancellation fees are generally low, with some charging between $5.00 and $15.00 USD.

When using third-party platforms in mainland China or the U.S., it’s advisable to review the platform’s cancellation policy in advance. Platforms typically detail the cancellation process and fees in their help center or FAQ section.

Cancellation Precautions

When canceling a transfer, pay attention to the following key points:

- Time Window: Banks and platforms require cancellation requests before the transaction is complete. The earlier you act, the higher the success rate.

- Accurate Information: You must provide complete and accurate transaction details, including the reference number, account information, and amount.

- Fees: Banks and platforms may charge different cancellation fees. Review the terms in advance to avoid unexpected costs.

- Fund Security: In some cases, funds that have already arrived cannot be directly reversed. You’ll need to negotiate with the recipient for a refund, with banks and platforms offering assistance.

- Compliance Risks: Frequent cancellations of large transfers may trigger compliance reviews. Plan fund flows carefully to avoid unnecessary risks.

Note: When efficiently managing remittances, plan the transfer amount and recipient information in advance to minimize cancellations. If issues arise, promptly contact bank or platform customer service for professional support.

Through proper planning and timely communication, you can effectively reduce the risks of canceling transfers, ensuring fund security and achieving efficient remittance management.

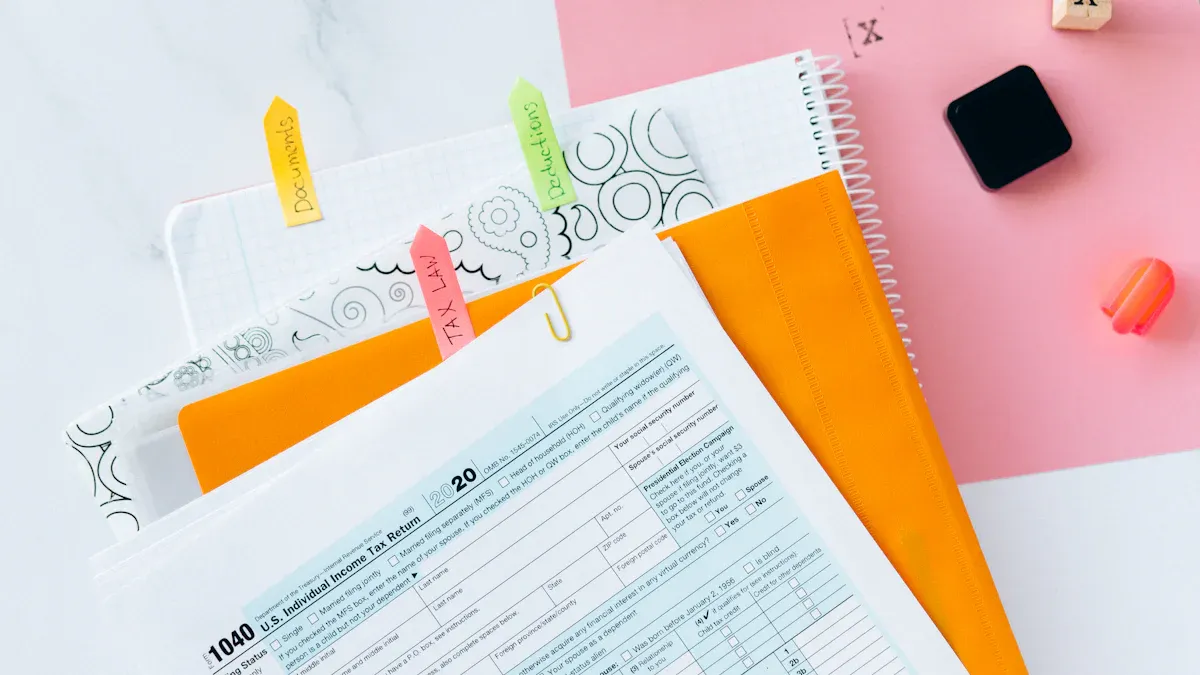

Remittance Tax Regulations and Compliance

Image Source: pexels

Amount and Reporting

When efficiently managing remittances, you must understand the reporting requirements of different countries. The U.S. mandates reporting any single transfer exceeding $10,000 through the Financial Crimes Enforcement Network (FinCEN). In France, if you receive remittances from the U.S. or China/mainland China, small amounts typically classified as gifts are tax-exempt. However, large amounts or funds deemed income or commercial transactions require reporting under French tax law. Consult a professional in advance to ensure compliance for large remittances.

- U.S.: Transfers exceeding $10,000 must be reported.

- France: Gift remittances have a tax-exempt threshold; amounts exceeding this or for commercial purposes must be reported.

Individual and Business Taxation

As an individual or business, you face different tax requirements. Individuals receiving remittances from relatives or friends can usually enjoy tax exemptions if the amount is small and has a reasonable explanation. Businesses receiving cross-border funds, especially those related to operations, must accurately report and pay taxes per French tax law. When remitting from China/mainland China or the U.S. to France, retain all transaction records for tax audits.

Compliance and Risks

Failure to comply with reporting requirements or other regulations may result in penalties from French tax authorities. The table below summarizes common violations and corresponding fines:

| Violation | Fine Amount and Description |

|---|---|

| Non-registration or Late Registration | Subject to standard VAT non-payment or late payment fines |

| Incomplete or Incorrect VAT Declaration | 40% of the VAT due for intentional errors; 80% for legal abuse or fraud |

| Minor Violations | Typically $15, minimum $60, maximum $10,000 |

| Non-compliance with Invoicing and Accounting Obligations | $15 per missing or incorrect invoice, with total fines not exceeding one-quarter of the invoice amount |

| Non-payment or Late Payment of VAT | 5% of the VAT due, plus 0.40% monthly interest for late payments |

| Non-submission or Late Submission of VAT Declaration | 10% of the VAT due for non-submission or late submission; up to 40% or 80% if not submitted within 30 days of a reminder |

You must prioritize compliance to avoid hefty fines. Efficient remittance management involves not only focusing on fund flow but also strictly adhering to reporting and tax regulations to ensure fund security.

Optimal Exchange Rate Timing and Cost Control

Image Source: pexels

Factors Affecting Exchange Rates

When efficiently managing remittances, you should pay attention to the main factors affecting USD to EUR exchange rates. Exchange rates fluctuate daily, and understanding these factors can help you choose a better transfer timing.

- Interest Rates: Changes in U.S. or French interest rates cause currency value fluctuations.

- Inflation: High inflation devalues a currency, affecting the amount you receive.

- Political Stability: Political turmoil in a country reduces investor confidence, causing significant exchange rate fluctuations.

- Economic Performance: Strong economic growth typically increases a currency’s value.

- Transfer Costs: Fees charged by different providers affect the final exchange rate.

- Transfer Timing: Frequent exchange rate fluctuations mean choosing the right time can yield better rates.

- Market Expectations: Market views on future economic trends also influence exchange rates.

By monitoring these factors, you can plan remittance timing to improve fund efficiency.

Exchange Rate Query Tools

When planning remittances to France, you can use various tools to check exchange rates and transfer fees in real-time. The table below lists several common tools and their features to help you make informed choices:

| Tool Name | Key Features | Fees (USD) | Transfer Time |

|---|---|---|---|

| TorFX | Competitive rates, no transfer fees, flexible options | $0 | 2-3 days |

| XE | Transparent pricing, real-time tracking, supports international payroll | $0 | Same day |

| Revolut | Flexible conversions, supports multiple payment methods | $0 | 0-3 days |

| Instarem | Real-time rates, zero fees, supports small transfers | $4.90 | 0-3 days |

| Wise | Transparent fees, mid-market rates, fast delivery | $0 | Same day or instant |

You can choose the right tool based on your needs to stay updated on exchange rate changes and optimize remittance costs.

Cost Reduction Tips

When efficiently managing remittances, you can adopt several strategies to reduce costs.

- Choose experienced third-party providers or licensed Hong Kong banks, as these institutions are familiar with international transaction processes and can ensure secure and fast fund delivery.

- Select remittance providers with strong local relationships in France, as they understand local regulations and can facilitate smoother transactions.

- Monitor exchange rate changes and plan transfer timing to avoid unfavorable rates.

Tip: Compare fees and exchange rates from different providers in advance to choose the best option. This not only saves costs but also improves remittance efficiency.

Document Preparation and Fund Arrival

Required Documents

When efficiently managing remittances, you must prepare relevant documentation in advance. Banks and third-party platforms typically require proof of remittance purpose, recipient information, and proof of fund source. Licensed Hong Kong banks may also request identification and a statement of fund purpose. When remitting from China/mainland China or the U.S. to France, organize all documents in advance to avoid delays due to incomplete materials.

You can follow these steps to prepare documentation:

- Collect materials related to the remittance purpose, such as contracts, invoices, or gift proofs.

- Prepare recipient identification and bank account details.

- Provide proof of fund source, such as payslips or bank statements.

- Retain all transaction records for future reference and tax reporting.

Tip: Submit documents in English or French to improve review efficiency. Banks and platforms prioritize applications with complete and properly formatted information.

Handling Fund Arrival Issues

After a remittance, you may encounter delays in fund arrival. Common reasons for delays in France include lack of investment in postal services, staff shortages, strikes, weather conditions, and other operational challenges. If funds do not arrive on time, you can take the following steps:

- Check transfer details to ensure no input or spelling errors.

- Confirm sufficient funds in the account to avoid cancellation due to insufficient balance.

- Request confirmation from the sender to verify the transfer was sent.

Proactively contact bank or third-party platform customer service, providing the transaction reference number and relevant documents to assist in resolving the issue quickly. Licensed Hong Kong banks typically provide feedback within 1 to 3 business days. In special cases, such as strikes or weather disruptions, remain patient and follow up consistently.

Through standardized document preparation and timely communication, you can improve the success rate of efficient remittance management and ensure secure fund delivery.

Customer Support and FAQs

Customer Support Mechanisms

When efficiently managing remittances, you can seek customer support whenever issues arise. Many providers offer 24/7 customer service teams accessible via phone, email, or online chat. Websites typically include detailed FAQ sections to help you find solutions quickly. You can also get personalized support through social media platforms, where customer service teams actively respond to queries.

Tip: If you encounter delays, information errors, or issues with fund arrival, contact official customer service first. Prepare the transaction reference number and relevant documents to speed up resolution.

When using licensed Hong Kong banks or third-party platforms, familiarize yourself with their customer support channels in advance. This ensures quick access to professional assistance in emergencies, safeguarding your funds.

Frequently Asked Questions

When remitting to France, you may have common questions. Below are the most frequently asked questions with brief answers:

- What is the cheapest way to send money to France?

Compare fees from licensed Hong Kong banks and third-party platforms; platforms typically offer lower fees and better rates. - How long does a remittance take?

Bank transfers usually take 1 to 3 days, while third-party platforms can deliver in minutes, though delays may occur in special cases. - Are there hidden fees for remittances?

Review service terms carefully, as some providers charge handling fees or exchange rate margins; understanding these in advance avoids unexpected costs. - Can I remit in different currencies?

You can choose USD, EUR, or other currencies, with some platforms supporting automatic conversions; monitor real-time rates. - How do I use Western Union for remittances?

You can process online or at an agent location, providing recipient details and valid identification. - What are the fees and exchange rates for remittances to France?

Use online tools to check in real-time; fees and rates vary by provider, so compare in advance. - Is it possible to remit to a French company?

You can remit to French companies, providing their account details and proof of purpose. - What specific information is needed for a remittance?

Prepare the recipient’s name, bank account number, bank address, and proof of purpose. - Can I pay French suppliers in EUR?

You can pay in EUR, with some platforms supporting multi-currency transfers. - Do I need to pre-fund an account in France?

Generally, no pre-funding is required, but ensure recipient account details are accurate. - How fast is international payment processing?

Most platforms and banks complete transfers in 1 to 3 days, with some offering instant delivery.

Tip: When efficiently managing remittances, always check transaction confirmation receipts and use reference numbers or tracking codes to monitor status online. Choose trusted providers and avoid sharing personal information with strangers. Follow local and international laws to ensure compliance and avoid fraud risks.

By leveraging customer support and FAQs, you can quickly resolve remittance issues and improve fund flow efficiency.

When efficiently managing remittances, focus on compliance, security, and cost-efficiency. You can flexibly choose licensed Hong Kong banks or third-party platforms based on your needs, plan transfer timing, and monitor policies and exchange rate changes. Prepare valid identification, recipient bank details, and proof of fund source in advance. If issues arise, seek help from bank or platform customer service or use financial literacy training and technical resources to improve remittance efficiency.

- Document Preparation Tips:

| Resource Name | Link |

|---|---|

| Remittance Prices Worldwide | https://remittanceprices.worldbank.org/resources |

| Migrants’ Remittances from France | https://remittanceprices.worldbank.org/sites/default/files/migrants_remittances_france.pdf |

Through standardized operations and proactive communication, you can improve remittance success rates and ensure fund security.

FAQ

How to Choose the Most Suitable Remittance Channel?

Compare fees, speed, and security of licensed Hong Kong banks and third-party platforms. Banks are suitable for large amounts and compliance needs, while platforms are ideal for fast and low-cost transfers.

Tip: Check real-time fees and exchange rates for each channel before deciding.

What Documents Are Needed for Remittances to France?

Prepare a government-issued photo ID, recipient bank details, and proof of fund source. Large remittances may require income proof or bank statements.

| Required Documents | Description |

|---|---|

| Identification | Passport or ID card |

| Bank Information | Recipient account, SWIFT/IBAN |

| Fund Source | Payslips or bank statements |

What to Do If a Remittance Is Delayed?

Verify transfer details and ensure sufficient account balance. For delays, contact licensed Hong Kong banks or platform customer service with the transaction reference number to track progress.

Do I Need to Report Remittances Exceeding $10,000 USD?

You must report remittances exceeding $10,000 USD in the U.S. Large amounts received in France also require reporting to avoid tax risks. Consult a professional in advance.

Do Exchange Rate Changes Affect the Received Amount?

Exchange rates directly impact the received amount. Use online tools to check rates in real-time and choose favorable timing for transfers.

Efficiently managing remittances to France often hits snags like cancellation hurdles (bank fees $20-$50, platforms $5-$15), complex tax reporting (>$10,000 needs FinCEN filing), and tricky rate timing (volatility causing 3-6% losses). Compliance checks delay arrivals, raising fund risks. As a convenience-driven user, you need a low-cost, clear, and adaptable platform to ease the process.

BiyaPay delivers a comprehensive solution, with real-time exchange rate queries to seize optimal moments and convert fiat to crypto, dodging rate swings. Remittance fees start at just 0.5%, with zero-cost contract orders and global same-day delivery. Plus, you can invest in US and Hong Kong stocks on BiyaPay without an overseas account, enhancing fund allocation.

Sign up for BiyaPay today to unlock streamlined cross-border finance! From cancellations to tax optimization, cut costs and speed up transfers for dependable support. Don’t let reporting delays and rate pitfalls weigh you down—join BiyaPay now for a fluid France remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.