- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Remitting Money from Vietnam to the United States: A Comparison of Multiple Methods and Their Advantages, Choosing the Best International Remittance Option

Image Source: unsplash

When you consider transferring money from Vietnam to the USA, you’re likely most concerned about choosing the most suitable method. You’ll focus on fees, delivery speed, security, and convenience, which are critical factors determining your remittance experience. There’s no absolute “best” method, as each has its own advantages and applicable scenarios. You need to weigh these key factors based on your needs to make an informed choice.

Key Takeaways

- When choosing a remittance method, consider fees, delivery speed, security, and convenience to meet your specific needs.

- Bank wire transfers are suitable for large transfers, offering high security but higher fees, with delivery in 1-3 business days.

- Online remittance services and digital payment platforms are ideal for small transfers, with low fees and fast delivery, some offering instant transfers.

- Before transferring, verify recipient information and bank codes to ensure accuracy and avoid fund losses.

- Prioritize regulated remittance providers to ensure fund security and avoid using unofficial channels.

Methods for Transferring Money from Vietnam to the USA

Image Source: pexels

When choosing to transfer money from Vietnam to the USA, you can consider several mainstream methods. Each method suits different needs and scenarios. Below is a detailed introduction to these common methods:

Bank Wire Transfers

Bank wire transfers are a traditional and commonly used method for international remittances. You can process them through Hong Kong-licensed banks, typically involving filling out recipient information, transfer amount, and destination. The bank will directly transfer funds from your account to the recipient’s account in the USA. Bank wire transfers are suitable for large transfers, offering high security, but fees are usually higher, with delivery typically taking 1-3 business days. You need to prepare the recipient’s bank account number and SWIFT code in advance.

Tip: When processing a bank wire transfer, make sure to verify recipient information to avoid transfer failures or delays due to errors.

Online Remittance Services

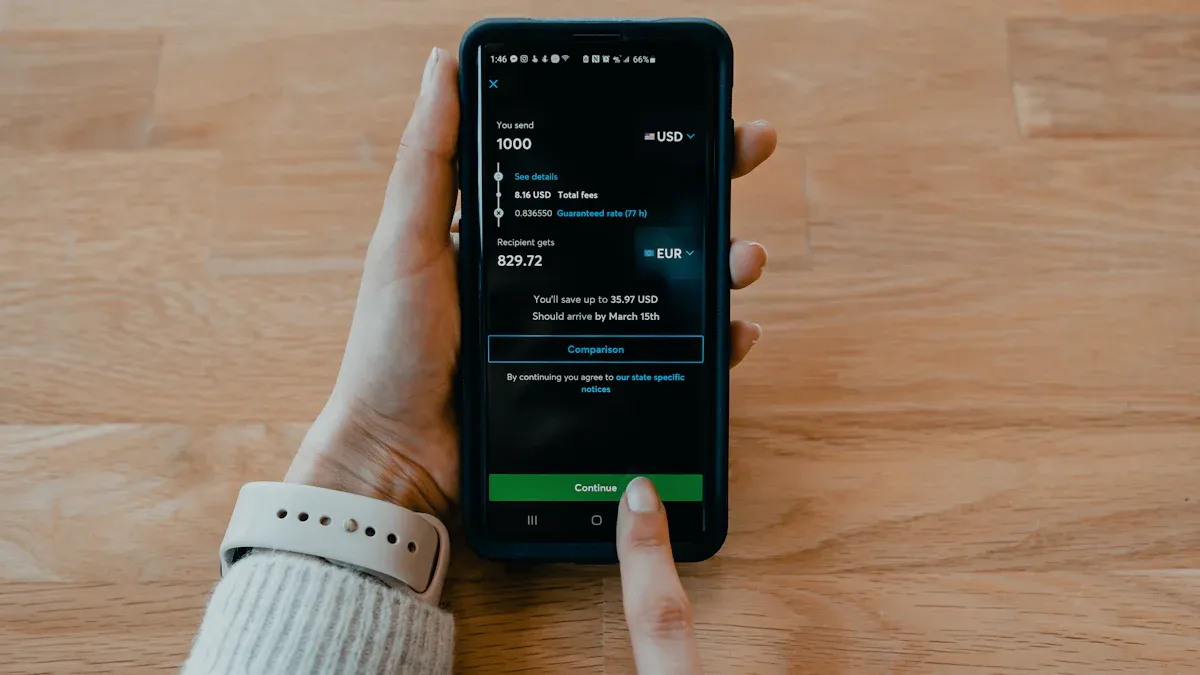

Online remittance services have become increasingly popular in recent years. You can use platforms like Wise, Xoom, or WorldRemit. The process typically involves registering an account, entering recipient information, selecting the transfer amount, and choosing a payment method. Online services are suitable for small to medium transfers, with lower fees and fast delivery, some platforms even offering same-day transfers. You can complete the process anytime, anywhere via mobile or computer, making it highly convenient.

- Remittance is the process of transferring funds internationally, typically involving sending money abroad.

- The foreign exchange remittance market is primarily driven by migrant workers, expatriates, or residents supporting family members.

- Remittances are used for purposes such as education, medical expenses, or investments.

- Remittances are a significant source of funds in many developing countries, often surpassing export revenues or foreign direct investment.

Digital Payment Platforms

Digital payment platforms like PayPal and Wise also support transfers from Vietnam to the USA. You simply register an account, link a bank card or credit card, and enter the recipient’s email or account information to send money. Digital payment platforms are suitable for small, daily expenses or urgent transfers, offering fast delivery and simple operations. Some platforms support instant transfers, but fees and exchange rates may be slightly higher than online remittance services.

Other Methods

In addition to the mainstream methods above, you can also choose traditional methods like cash remittances or mailed checks, but these are cumbersome and less secure and convenient. When choosing, you should prioritize security and fund traceability.

- Verify and confirm your fund’s destination. Carefully check the recipient’s contact information and details.

- Don’t trust offers that seem too good to be true. Be wary of highly attractive exchange rates or zero transaction fees.

- Never share your personal information. Protect your personal and financial data to avoid scams.

- Ensure you track your funds. Keep records of each transfer to track and dispute any suspicious transactions if issues arise.

When choosing a method to transfer money from Vietnam to the USA, you should combine your needs, transfer amount, and delivery time to select the most suitable solution.

Comparative Analysis of Methods

Image Source: unsplash

Fee Comparison

When choosing to transfer money from Vietnam to the USA, fees are one of the most direct factors influencing your decision. The fee structures of different methods vary significantly. Bank wire transfers typically charge higher fees and add a 4-6% markup on exchange rates. If you choose online remittance services like Wise, Xoom, or WorldRemit, fees are more transparent, with Wise using the mid-market exchange rate, avoiding hidden markups. Digital payment platforms like PayPal have fees that vary by payment method, with lower fees for bank accounts or PayPal balances and higher fees for credit or debit cards.

You can refer to the table below to understand the fee ranges of different methods:

| Service Type | Fee Range (USD) |

|---|---|

| Bank Account Transaction Fees | $0 - $10 |

| PayPal Balance Transaction Fees | $0 - $10 |

| Credit/Debit Card Transaction Fees | Minimum $1.99, potentially higher |

| Exchange Rate Markup | Approximately 4-6% |

When operating, you should use an online currency converter to check exchange rates to avoid additional losses from markups. Bank wire transfers are suitable for large transfers, offering high security despite higher fees. Online remittance services and digital payment platforms are better for small or daily transfers, with low and transparent fees.

Delivery Speed

Delivery speed directly impacts your fund usage plans. Bank wire transfers typically take 1-3 business days, suitable for large transfers that aren’t time-sensitive. Online remittance services like Xoom and WorldRemit, some of which offer same-day delivery or even completion within hours. Digital payment platforms like PayPal can offer instant transfers in some cases, ideal for urgent or small daily transfers.

When choosing, you can decide based on the urgency of the funds. If you need fast delivery, prioritize online remittance services or digital payment platforms. If you value fund security and large transfers, bank wire transfers remain a reliable choice.

Security

Security is a critical factor you must prioritize when transferring money from Vietnam to the USA. Bank wire transfers use multiple identity verifications and biometric authentication, especially for high-risk transactions (e.g., over 10 million VND). Online remittance services and digital payment platforms also prioritize security, employing KYC (Know Your Customer) policies to prevent money laundering and fraud. When using a new device for mobile payments, the system requires additional verification to ensure account security.

You can refer to the table below for common security measures:

| Security Measure | Applicable Conditions |

|---|---|

| Biometric Authentication | High-risk transactions (e.g., large international transfers) |

| First-Time Mobile Banking Payment | Transactions on any new device |

| Biometric Registration for Business Clients | Legal representatives of corporate accounts must register biometric data |

| Expired Identification Documents | Access to all payment channels will be suspended |

Additionally, the regulatory frameworks in Vietnam and the USA impact the security of cross-border transfers. Vietnam’s legal framework is less robust, and remittance providers must comply with anti-money laundering and data protection regulations. U.S. companies bear compliance costs, strictly adhering to data regulations. These measures collectively enhance the security of your funds.

Tip: Before transferring, verify recipient information and protect personal data to avoid losses due to information leaks.

Convenience

Convenience directly affects your remittance experience. Bank wire transfers require you to visit a bank branch or use online banking, which can be cumbersome. Online remittance services and digital payment platforms support mobile or computer operations, allowing you to initiate transfers anytime, anywhere. Some platforms like Western Union, Remitly, and MoneyGram excel in user satisfaction, with Apple App Store ratings of 4.6 or higher and Trustpilot scores as high as 4.9.

For small daily transfers, digital payment platforms and online remittance services are more convenient. You can complete transfers in just a few steps, ideal for frequent or urgent needs. Bank wire transfers, while more complex, are suitable for large transfers with high security requirements.

When choosing a method to transfer money from Vietnam to the USA, you should comprehensively consider fees, delivery speed, security, and convenience to make the best decision based on your needs.

Needs Analysis

Large Transfers

When handling large transfers, bank wire transfers are typically the preferred choice. Bank wire transfers are suitable for business professionals or users needing to transfer large sums at once. You can benefit from high security and fund traceability. Banks will require you to provide detailed recipient information and the purpose of the transfer. Delivery typically takes 1-3 business days. If you need to pay for real estate, investments, or tuition, bank wire transfers can meet your needs.

Small/Daily Transfers

For small or daily transfers, online remittance services and digital payment platforms are more suitable. You can use these methods to support family living expenses or tuition in the USA, helping students address financial challenges and ensuring their safety and stability abroad. You can complete transfers in just a few steps, with low fees and fast delivery. The table below shows the fee structures of common services:

| Service Name | Processing Fee (USD) | Notes |

|---|---|---|

| Panda Remit | 6.99 | New users can enjoy zero fees and exclusive exchange rates. |

| Funds can be received at major banks. |

You can choose the most suitable platform based on your needs to save costs and improve efficiency.

Urgent Needs

When facing urgent situations, you need reliable and fast remittance services. International remittance platforms like Western Union, MoneyGram, and digital services like Remitly or Wise offer fast delivery and transparent fees. You can enable recipients to access funds instantly via bank deposits, cash pickup points, or mobile wallets. Choosing platforms with 24/7 service, real-time tracking, and bilingual customer support ensures your transfer arrives smoothly.

Special Groups

If you’re a student, business professional, or require long-term cross-border transfers, you should choose methods based on your needs. Students can use online remittance services or digital payment platforms, which are convenient for daily expenses and tuition payments. Business professionals may prefer bank wire transfers for secure large transfers. You can flexibly choose the best solution based on transfer amount, timing, and convenience.

Selection Recommendations

Recommended Solutions

When choosing a method to transfer money from Vietnam to the USA, you should match your needs. Different solutions have unique advantages for various scenarios. The table below summarizes mainstream remittance solutions and their features to help you quickly identify the most suitable option:

| Remittance Solution | Features | Suitable Needs |

|---|---|---|

| MoneyGram | Low fees, favorable exchange rates, multiple sending and receiving methods, high security | Low-cost and fast transfers |

| Panda Remit | Low fees, fast delivery, convenient online operations, quick identity verification | Low-cost and fast transfers |

| Bank Wire Transfers | Extremely high security, suitable for large funds, traceable | Large transfers and security priority |

| PayPal | Simple operations, suitable for small and daily expenses, fast delivery | Small transfers and daily needs |

If you prioritize low costs and high speed, consider MoneyGram and Panda Remit first. If you need maximum security or large transfers, bank wire transfers are a safer choice. PayPal is suitable for small daily transfers, offering convenience and speed.

When choosing, it’s recommended to prioritize regulated international remittance providers. These platforms use encryption technology and transparent fees, effectively preventing fraud and fund risks.

Decision-Making Process

When deciding on a remittance method, you can follow these steps:

- Clarify the transfer amount and purpose. You need to determine if it’s for large investments, tuition payments, or daily expenses.

- Assess delivery speed needs. If you urgently need funds, choose fast-delivery services like MoneyGram or Panda Remit.

- Compare fees and exchange rates. You can use online tools to calculate fees and rates across platforms, selecting the lowest-cost option.

- Verify security. You should prioritize licensed, regulated remittance providers and avoid unofficial channels.

- Accurately enter recipient information. You can write the beneficiary’s name in Vietnamese and use the system’s automatic validation to avoid manual errors.

- Verify bank codes and account formats. You can copy and paste information from trusted sources to ensure accuracy.

- Use local payment partners. You can choose platforms supporting VND transfers to reduce currency conversion losses.

At every step, you should carefully verify information to ensure fund security and smooth delivery.

Risk Warnings

When transferring money from Vietnam to the USA, you should be aware of the following common risks:

- Corruption risks. Vietnam scores low on the international Corruption Perceptions Index, and some unofficial channels pose corruption risks.

- Compliance challenges. Vietnam’s regulatory environment is complex, and businesses or individuals may face compliance risks during cross-border transfers.

- Employee fraud. Some businesses face risks of employee theft or misappropriation, and dismissing non-compliant employees under labor laws can be challenging.

- Information errors. Manual entry of recipient information is prone to errors, potentially leading to fund losses or delays.

- Risks of unofficial channels. If you choose unverified platforms, you may face risks of funds being stolen or unrecoverable.

You can take the following measures to reduce risks:

- Always choose licensed, regulated international remittance providers.

- Ensure recipient information is accurate, using system automatic validation functions.

- Verify bank codes and account formats to avoid transfer failures due to errors.

- Send funds in VND whenever possible to minimize currency conversion issues.

- Keep records of each transfer for tracking and dispute purposes.

Before transferring, thoroughly understand the platform’s credentials and security measures to avoid compromising safety for low fees or high speed.

When choosing to transfer money from Vietnam to the USA, you can make a comprehensive judgment based on amount, delivery speed, fees, and convenience. In recent years, Vietnam’s remittance methods have become more standardized, and the popularization of mobile payment technology allows you to enjoy lower costs and higher efficiency. You can refer to the table below for official limits on transfers for education or medical purposes:

| Permitted Purpose | Overseas Remittance Limit (USD) | Notes |

|---|---|---|

| Education or Medical Treatment | Limited to per capita GDP income of the recipient’s country | Banks determine based on reasonable needs |

By rationally comparing these factors and prioritizing security, you can avoid blindly pursuing low fees or high speed. Combining your needs with the recommendations in this article, you can make an informed decision.

FAQ

1. What methods can you use to transfer money from Vietnam to the USA?

You can choose bank wire transfers, online remittance services, digital payment platforms, or cash remittances. Each method suits different needs, with varying fees and delivery speeds.

2. What information is needed to transfer money to the USA?

You need the recipient’s name, bank account number, SWIFT code, and recipient bank name. Verify information carefully to avoid errors.

3. What are the typical fees for transfers?

Bank wire transfer fees are typically around USD 10. Online remittance services and digital payment platforms have lower fees, starting as low as USD 1.99.

4. How long does it take for a transfer to arrive?

Bank wire transfers generally take 1-3 business days. Online remittance services and digital payment platforms can deliver on the same day, with some supporting instant transfers.

5. How can you ensure fund security during transfers?

You should choose regulated providers, verify recipient information, and use system automatic validation functions. Avoid unverified channels promising low fees or high exchange rates.

Sending money from Vietnam to the U.S. often comes with high fees, slow processing, and complex procedures. BiyaPay offers a smarter, more transparent alternative to help you overcome these challenges.

Convert between fiat and digital currencies like USDT seamlessly, bypassing traditional banking delays and enabling faster fund availability. Enjoy transfer fees as low as 0.5%—saving up to 90% compared to conventional methods. Use the real-time exchange rate tool to monitor market movements and avoid hidden costs.

Best of all, no overseas bank account is needed. Register in just minutes and gain access to same-day transfers to the U.S. and beyond. Manage both U.S. and Hong Kong stocks from one unified platform for streamlined global investing.

Sign up on BiyaPay today and take control of your international transfers and investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.