- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use MoneyGram Online Remittance Service Securely and Conveniently: Five Practical Tips

Image Source: pexels

When using MoneyGram online transfers, your primary concern is undoubtedly how to use the service safely and conveniently. The following five practical tips are worth noting:

- Choose official channels to ensure secure account registration.

- Set a strong password and enable account protection.

- Use a secure network environment and regularly monitor your account.

- Download the official app to experience convenient mobile operations.

- Focus on transparent fees and verify recipient information.

Key Points

- Register your MoneyGram account through official channels to avoid phishing and information leaks.

- Set a strong password and enable two-factor authentication to enhance account security and prevent unauthorized access.

- Regularly monitor account activity to promptly detect anomalies and ensure fund safety.

Safe and Convenient Account Registration

Official Channel Registration

When registering a MoneyGram account, you should first choose official channels. Be sure to register through the MoneyGram official website or app, avoiding third-party websites or unknown links. This can effectively prevent phishing and information leaks. Common risks include:

- Phishing is a type of online fraud, where attackers impersonate MoneyGram to send emails, luring you to click on fake website links.

- These fake websites steal your username, password, and credit card information.

- If you receive an email requesting sensitive information, carefully verify the sender and website URL.

Tip: Check the browser address bar to confirm the URL is moneygram.com to avoid fake pages. Staying vigilant helps you use MoneyGram services safely and conveniently.

Identity Verification

When registering an account, you need to provide accurate personal information and complete identity verification. MoneyGram’s official requirements are as follows:

| Required Information | Description |

|---|---|

| Name | Full name must be provided. |

| Residential Address | Must be a physical address, not a P.O. Box. |

| Phone Number | A valid contact phone number must be provided. |

| Social Security Number or ITIN | Required for identity verification. |

| Date of Birth | Birth date must be provided. |

| Government-Issued Valid ID | A valid, unexpired ID must be provided. |

| Additional Information | Additional information or documents may be required if necessary. |

You also need to create a username and password and link a credit or debit card as a payment method. Ensure you operate in a secure network environment and avoid using public Wi-Fi. After registration, regularly monitor account activity and contact customer service promptly if anomalies are detected. This further ensures your account security.

Password and Account Protection

Strong Password Setup

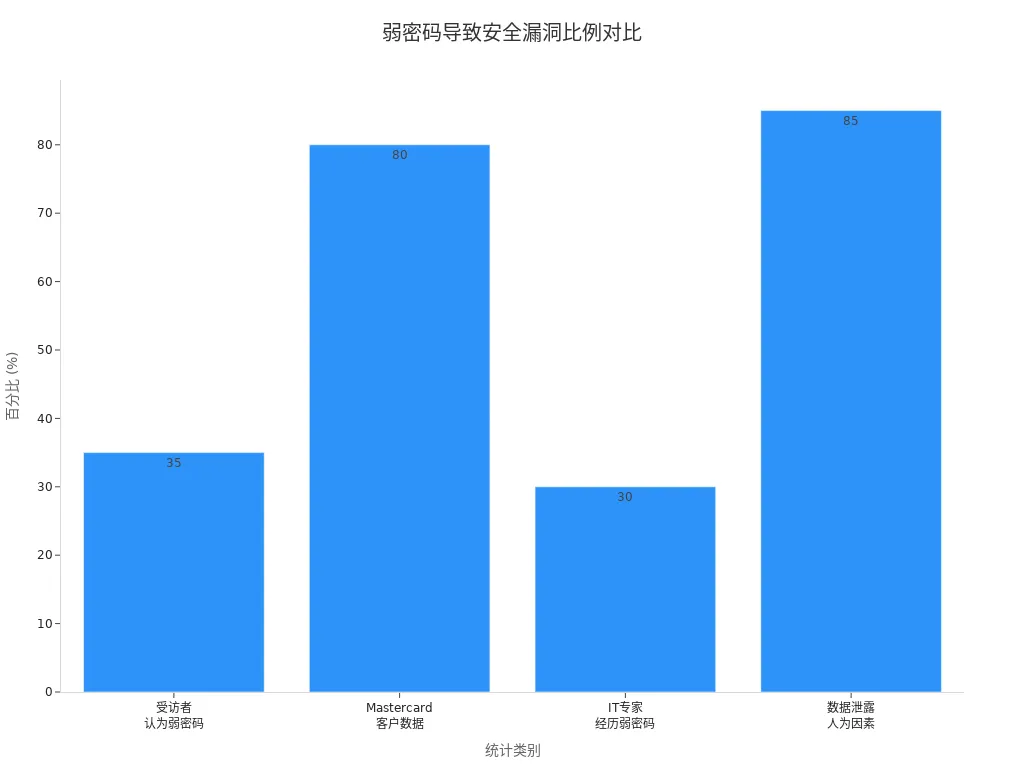

When setting your MoneyGram account password, choose a combination of uppercase letters, lowercase letters, numbers, and special characters. The password should be at least 8 characters long. You should also change your password regularly and avoid reusing old passwords. Many accounts are compromised due to overly simple passwords. According to statistics, 35% of users believe weak passwords are a primary cause of security breaches, and 80% of Mastercard customer data breaches are linked to weak or stolen passwords. 30% of IT experts and organizational leaders have experienced security issues due to weak passwords. Data also shows that 85% of data breaches involve human factors, such as phishing and stolen credentials.

| Statistic | Description |

|---|---|

| 35% | Respondents believe weak passwords are a primary cause of security vulnerabilities. |

| 80% | Mastercard customer-confirmed data breaches are related to weak or stolen passwords. |

| 30% | 30% of IT experts, employees, and organizational leaders report security breaches due to weak passwords. |

| 85% | 85% of data breaches involve human factors, such as phishing and stolen credentials. |

Only by adopting good password habits can you safely and conveniently use MoneyGram’s online transfer services.

Two-Factor Authentication

You can further protect your account by enabling two-factor authentication (2FA). 2FA requires a one-time verification code during login or operations. This ensures that even if your password is compromised, others cannot easily access your account. Financial service platforms recommend the following practices:

- When registering an account, enable 2FA to protect your financial data.

- Understand how 2FA works and how it enhances security.

- Choose a verification method that suits you, such as SMS, app, or hardware token.

- Use platforms that support multiple authentication methods for greater flexibility.

- Choose secure, technologically advanced financial software to simplify 2FA operations.

Each time you log in or transfer funds, 2FA adds an extra layer of protection. You can confidently transfer money between accounts in mainland China or licensed Hong Kong banks, reducing the risk of theft. Only by doing so can you truly use MoneyGram services safely and conveniently.

Network and Account Monitoring

Secure Network Environment

When using MoneyGram online transfers, choosing a secure network environment is crucial. Public Wi-Fi, while convenient, poses multiple network attack risks. Common network attack methods include:

- Man-in-the-Middle Attack: Hackers intercept communication between you and the server, stealing sensitive data.

- Evil Twin: Attackers create fake Wi-Fi networks to lure you into connecting, then steal information.

- Packet Sniffing: Hackers capture unencrypted data packets, analyzing them to obtain your account information.

- Session Hijacking: Attackers use intercepted data to hijack your online session.

- Shoulder Surfing: Someone observes your input of sensitive information to attack.

- DNS Spoofing: Hackers manipulate DNS settings to redirect you to malicious websites.

- Wi-Fi Phishing: Fake hotspots are set up to steal your sensitive data.

- Rogue Access Points: Fake hotspots in public places monitor your data transmission.

- Keyloggers: Record your account and password inputs.

You should avoid transferring money over public Wi-Fi. Use encrypted home Wi-Fi or mobile data to ensure secure data transmission.

Account Activity Monitoring

You need to regularly check your MoneyGram account’s login and transfer records. MoneyGram provides various account monitoring tools to help you detect anomalies promptly:

| Monitoring Tool/Feature | Description |

|---|---|

| Encryption Technology | Protects your personal and financial information, reducing fraud risks. |

| Fraud Detection System | Continuously updated to identify and prevent suspicious activity on your account. |

Additionally, the MoneyGram app offers real-time fraud monitoring, alerting you immediately if anomalies are detected. If you notice suspicious activity, take the following steps promptly:

- Contact MoneyGram customer service immediately to report the issue.

- Change your account password and review recent transaction records.

- Enable two-factor authentication to enhance account security.

- Report to local law enforcement and financial regulators if necessary.

- Document all relevant information to assist with subsequent investigations.

By regularly monitoring your account, you can better ensure fund safety and confidently enjoy MoneyGram’s online transfer services.

Safe and Convenient Mobile Use

Image Source: pexels

Official App Download

When using MoneyGram’s mobile services, ensure you download the app only through the MoneyGram official website or authorized app stores. Avoid third-party websites or unknown links to prevent malware and information leaks. You should also regularly check for app updates, as timely updates provide the latest security patches and feature optimizations. Some users have expressed concerns about the security measures of MoneyGram’s mobile app, with some unable to complete online payments due to network interruptions. If you encounter similar issues, pay attention to official announcements and avoid critical operations during unstable network conditions.

Tip: Search for “MoneyGram” in the App Store or Google Play, ensuring the developer is officially verified to guarantee a secure download channel.

Biometric Login

You can enable fingerprint or facial recognition to enhance account security and convenience. Biometric authentication allows quick account access without entering a traditional password, reducing the risk of unauthorized use. The MoneyGram app integrates fingerprint and facial recognition technology to protect your sensitive financial data. The following table outlines common biometric technologies and their trends:

| Biometric Technology | Description | Future Trends |

|---|---|---|

| Multimodal Biometrics | Combines facial, fingerprint, and voice recognition for enhanced security and accuracy. | Expected to be widely adopted in financial institutions by 2025. |

| Behavioral Biometrics | Continuously verifies identity by analyzing user behavior patterns. | Needs protection against hacker manipulation risks. |

| AI-Driven Authentication | Uses artificial intelligence to improve recognition speed and accuracy. | Makes authentication smarter and more secure. |

When transferring money between accounts in mainland China or licensed Hong Kong banks, enabling biometric features allows you to use MoneyGram’s mobile services safely and conveniently. Fingerprint and facial recognition are now mainstream for financial apps, with more innovative technologies expected to further secure your account in the future.

Fees and Recipient Information

Image Source: unsplash

Fee Transparency

When using MoneyGram for international transfers, your top concern is likely fee and exchange rate transparency. MoneyGram’s fees vary based on payment method, transfer amount, and destination country. You can clearly see all fees before confirming the transfer, offering high transparency.

- MoneyGram recommends using its online estimation tool to obtain accurate transfer fees and real-time exchange rates in advance.

- For smaller transfer amounts, especially those involving currency conversion, fees may be relatively high.

- In comparison, Remitly offers more transparent fee structures for large transfers, while Wise uses mid-market exchange rates with lower, transparent fees and no hidden markups.

| Service Provider | Fee Structure Description | Notes |

|---|---|---|

| MoneyGram | Exchange rates include a markup, with higher fees for credit card payments or instant cash pickups. | Fees can be relatively high. |

| Wise | Uses mid-market exchange rates with transparent upfront fees. | High fee transparency. |

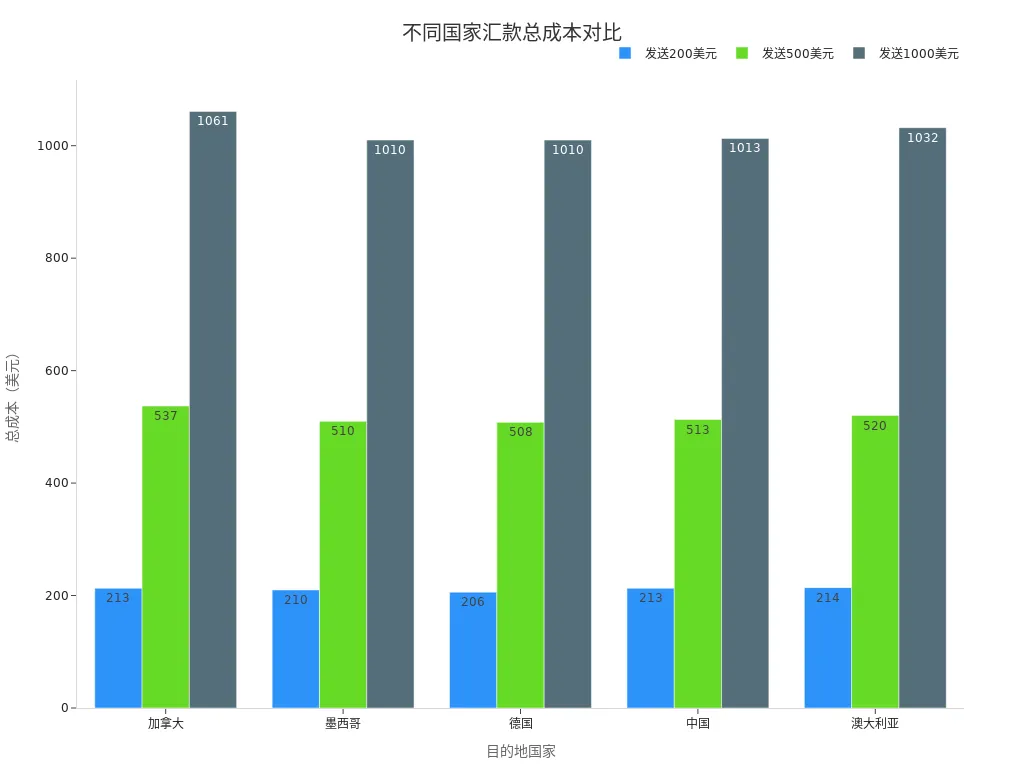

The table below compares the total cost of transfers (in USD) to different countries:

| Destination Country | Sending $200 | Sending $500 | Sending $1,000 |

|---|---|---|---|

| Canada | $213 | $537 | $1,061 |

| Mexico | $210 | $510 | $1,010 |

| Germany | $206 | $508 | $1,010 |

| China | $213 | $513 | $1,013 |

| Australia | $214 | $520 | $1,032 |

Tip: Before transferring, compare fee structures across providers, check MoneyGram’s official website for real-time promotions, and choose payment methods wisely to reduce costs.

Recipient Verification

When entering recipient information, ensure all details are accurate. MoneyGram requires the recipient to hold a valid photo ID, and the name on the ID must match the transfer record exactly.

- Inaccurate information can lead to transaction delays, cancellations, or funds being sent to the wrong account, resulting in irretrievable losses.

- Identity verification processes may vary by country and agent, so confirm specific requirements with the local MoneyGram agent in advance.

- Common errors, such as misspelled names or incorrect ID numbers, can cause compliance risks, transaction delays, and financial liability.

| Risk Type | Description |

|---|---|

| Compliance Violation | Incorrect information may lead to legal scrutiny, fines, or restrictions on future transfers. |

| Transaction Delay | Mismatched information can cause delays, rejections, and additional fees. |

| Financial Liability | Recovering funds from erroneous transfers is difficult and may involve legal processes. |

| Documentation Issues | Inaccurate reporting can trigger tax and audit problems. |

By carefully verifying the recipient’s name and ID details before each transfer, you can effectively avoid unnecessary risks, ensuring funds arrive safely and smoothly.

By following these five practical tips, you can safely and conveniently use MoneyGram’s online transfer services. With just a few clicks at home, you can complete transfers with transparent fees and fast speeds. You should also regularly check official security updates to protect account information and enhance your transfer experience.

FAQ

How do I confirm the MoneyGram app is the official version?

You can search for “MoneyGram” in the App Store or Google Play, ensuring the developer is officially verified to avoid third-party downloads.

What payment methods does MoneyGram support?

You can use credit cards, debit cards, or bank transfers for payments. Some licensed Hong Kong bank accounts also support online transfers.

How long does it take for funds to arrive after a transfer?

In most cases, funds arrive within minutes. The exact time depends on the recipient’s country and bank processing speed.

While services like MoneyGram offer convenience, they often come with high fees and unclear exchange rates. For a smarter, more cost-effective way to manage cross-border transfers, consider BiyaPay.

We enable seamless conversion between fiat and digital currencies like USDT, helping you avoid hidden intermediary costs. Enjoy transfer fees as low as 0.5%—a significant saving compared to traditional providers. Use our real-time exchange rate tool to lock in favorable rates and maximize your transfer value.

No overseas bank account? No problem. Register in under 3 minutes and send money to most countries worldwide with same-day delivery. Plus, manage both U.S. and Hong Kong stocks from one integrated platform for greater financial flexibility.

Start today on BiyaPay and discover a faster, more transparent way to send money and invest globally.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.