- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tracking MoneyGram Remittances: Ensuring Funds Reach Bank Accounts Securely

Image Source: pexels

Are you worried about issues arising during a transfer? You can track the progress of your transfer anytime using MoneyGram’s website or app. By keeping the transaction reference number, you can monitor the status of your funds in real-time. MoneyGram covers over 200 countries and regions worldwide, supporting multiple currencies, including USD, EUR, GBP, CAD, AUD, and JPY.

The table below shows the global coverage of major transfer service providers, with MoneyGram leading in the number of countries and cash pickup locations:

| Service Provider | Number of Countries Covered | Number of Cash Pickup Locations |

|---|---|---|

| MoneyGram | 200+ | 350,000+ |

| Remitly | 170+ | N/A |

By securely keeping the reference number, you can ensure your funds safely reach a bank account or mobile wallet.

Key Points

- Use the MoneyGram website or app to track transfer progress, ensuring funds arrive securely.

- Retain the transaction reference number as the sole proof for tracking and receiving funds.

- Prepare personal information before transferring to ensure accuracy and avoid delays.

- Choose the appropriate payment method and understand the fee structure to avoid hidden costs.

- Stay vigilant to prevent fraud, ensuring transfers are made only to trusted recipients.

Transfer Tracking Methods

Image Source: unsplash

Tracking Steps

You can track your transfer progress anytime via the MoneyGram website or mobile app. The process is straightforward, whether or not you have a registered account.

If you have a MoneyGram account, follow these steps:

- Visit the MoneyGram official website.

- Log in to your account.

- Go to the “Transaction History” page to view your transfer status.

If you don’t have a registered account, you can use the “Track + Receive” tool directly on the website:

- Open the MoneyGram website and locate the “Track + Receive” section.

- Enter your transaction reference number and the recipient’s last name.

- The system will display the current transfer status, including whether the funds have arrived.

You can also track transfers through the MoneyGram mobile app. After downloading and installing the app, log in to your profile to check the transfer status anytime.

Reminder: Regardless of the method chosen, ensure the reference number and recipient information are accurate to avoid query failures due to incorrect details.

MoneyGram supports over 200 countries and regions worldwide. You can send funds to a bank account or opt for mobile wallet receipt. Whether you’re in China/Mainland China, Hong Kong, or the U.S., you can enjoy convenient transfer tracking services.

Role of the Reference Number

The reference number is the unique proof for tracking and receiving funds. Each transfer generates a distinct reference number. You must keep this number secure, as it plays a critical role throughout the transfer process.

When checking transfer progress, the system requires you to input the reference number. The recipient must also provide this number when collecting funds. The specific process is as follows:

- The recipient visits a designated bank branch or partner agent (e.g., a licensed bank in Hong Kong).

- If required, fill out the receipt form and enter the reference number provided by you.

- Present a valid photo ID.

- The staff verifies the information and completes the fund disbursement.

If the recipient opts for mobile wallet receipt, they must also enter the correct reference number and related information.

Note: Do not disclose the reference number to unrelated parties. Only you and the recipient should know this number to prevent unauthorized fund collection.

The reference number not only helps you track transfers in real-time but also ensures funds reach the recipient securely. After each transfer, it’s recommended to record the reference number in a safe place until the recipient successfully receives the funds.

Transfer Process

Information Preparation

Before initiating a transfer, you need to prepare relevant personal information and documents. MoneyGram requires accurate and valid information to ensure smooth transfers. The table below lists the main types of information required:

| Information Type | Description |

|---|---|

| ID Type | Government-issued ID, driver’s license, etc. |

| ID Number | The ID number to be provided |

| Country of Use | The country where the ID is used |

| Country of Birth | The individual’s country of birth |

| First Name | The individual’s first name |

| Middle Name | If applicable, the middle name on the ID |

| Last Name | The individual’s last name |

| Second Last Name | If applicable, provide the second last name |

| Date of Birth | The individual’s date of birth |

| Current Address | The individual’s residential address |

| Mobile Number | The individual’s mobile phone number |

You must ensure all information matches the details on your ID. Inconsistent information may affect the transfer process.

Account Details

You need to be extra cautious when entering the recipient’s account information. Common errors can lead to transfer failures or delays. Pay attention to the following:

- Entering incorrect account numbers or bank details may result in unprocessed transfers.

- Before sending, double-check the recipient’s information carefully.

- If an error occurs, MoneyGram will investigate, which may cause delays or complex transactions.

You can prioritize transferring funds to a licensed bank account in Hong Kong or opt for mobile wallet receipt. Regardless of the method, accuracy is critical. It’s recommended to verify each step carefully to avoid costly mistakes.

Submission and Confirmation

After completing all information, you need to submit the transfer request. MoneyGram offers multiple confirmation methods to help you track transfer progress:

- You can use the reference number to track the transfer status on the MoneyGram website or app.

- You can ask the recipient to check their bank account to confirm if the funds have arrived.

- If you have questions, contact MoneyGram customer support to verify if the transfer was successful.

- You can also review email or SMS confirmations sent by MoneyGram, which typically include transaction status and next steps.

After each transfer, always keep the reference number safe. This allows you to monitor fund progress and ensure secure delivery to the recipient’s account.

Delivery Time

General Processing Times

When using MoneyGram for transfers, your primary concern is how long it takes for funds to arrive. Delivery times vary depending on the transfer method. Refer to the table below for processing times of common methods:

| Transfer Method | Processing Time |

|---|---|

| Online Bank Transfer | Real-time, up to 2 business days |

| Transfers Between MoneyGram Accounts | Usually available within minutes |

| Other Receipt Methods | May take longer |

If you choose to transfer funds to a licensed bank account in Hong Kong, delivery typically takes 1-2 business days. If both you and the recipient use MoneyGram accounts, funds can arrive within minutes. For mobile wallet or other methods, delivery time may be longer.

Influencing Factors

Delivery speed is affected by several factors. You should note the following:

- The destination country and currency

- The amount sent

- The chosen payment method

- The recipient bank’s processing time

- Credit or debit card transactions are typically processed faster

- Bank transfers may require additional verification time

When filling out information, ensure accuracy. Processing speeds vary by country and bank, and choosing the right payment method can improve delivery efficiency.

Handling Delays

If your transfer hasn’t arrived within the expected time, you can take the following steps:

- First, carefully check transaction details to ensure the recipient’s name and location are correct.

- If the information is accurate, ask the recipient to contact the local MoneyGram branch or service provider to confirm fund availability.

- If the issue persists, contact MoneyGram customer support, providing the receipt number and transaction details for faster assistance.

Common reasons for delays include funds not being available promptly, inaccurate fund availability dates, or uninvestigated errors. Contacting official customer service promptly can effectively ensure fund security.

Fee Structure

Fee Breakdown

When using MoneyGram for international transfers, the fee structure is influenced by multiple factors. Understanding these factors helps you control transfer costs better. The table below summarizes the main factors affecting fees:

| Influencing Factor | Description |

|---|---|

| Amount Sent | Fees may vary depending on the amount sent. |

| Destination Country | Fee structures may differ by country. |

| Payment Method | Using a credit or debit card typically incurs higher fees than bank transfers. |

| Delivery Method | Fees for cash pickup and bank deposits may differ. |

| Exchange Rate | The exchange rate also affects overall costs. |

| Fee Estimator Tool | MoneyGram provides a fee estimator tool to help you understand costs in advance. |

Be particularly cautious when choosing a payment method. Using a credit card often incurs higher fees. Bank account transfers generally have lower fees. In some countries or regions, recipients may also need to pay withdrawal fees. Before transferring, compare all options carefully to avoid hidden costs.

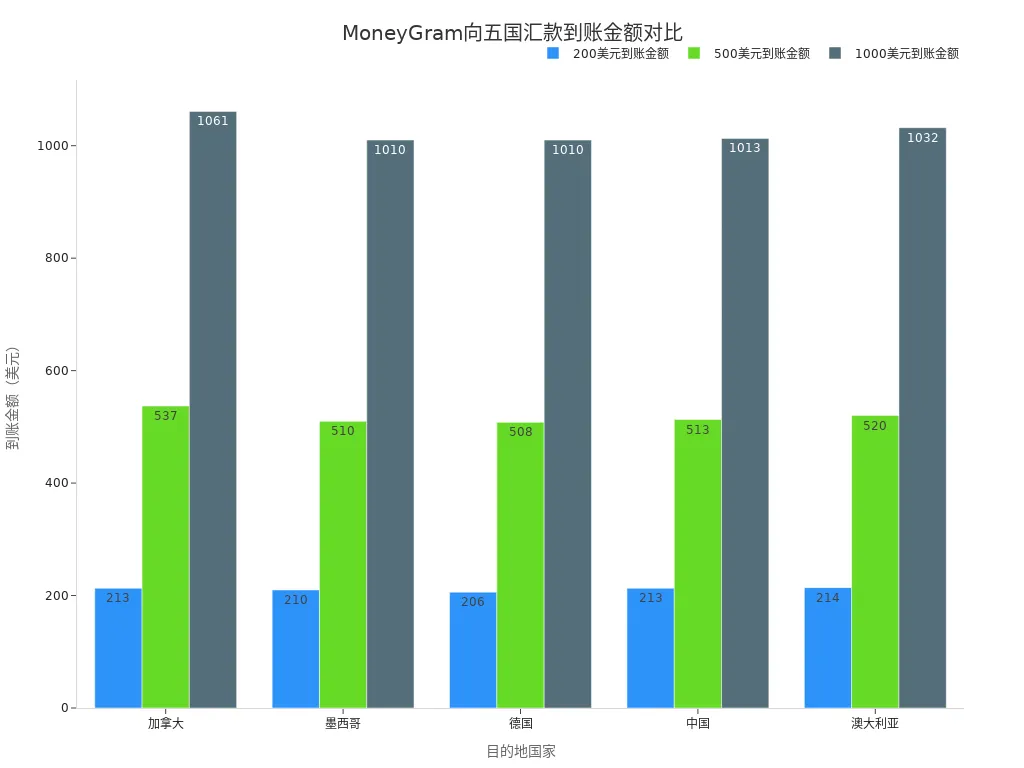

The table below shows the amounts received for different transfer amounts to various countries. You can see that the destination and amount affect the actual received amount:

| Destination Country | Send $200 | Send $500 | Send $1000 |

|---|---|---|---|

| Canada | $213 | $537 | $1061 |

| Mexico | $210 | $510 | $1010 |

| Germany | $206 | $508 | $1010 |

| China/Mainland China | $213 | $513 | $1013 |

| Australia | $214 | $520 | $1032 |

Reminder: Before transferring, verify all fee details to ensure secure and efficient delivery of funds.

Fee Inquiry Methods

You can check MoneyGram transfer fees through multiple methods. The most direct way is to use the fee estimator tool on the MoneyGram website or app. Follow these steps:

- Log in to the MoneyGram app or visit the official website.

- Select the “Send Money” function.

- Enter payment details, including the amount and destination country.

- Choose the payment and receipt methods (e.g., bank account, mobile wallet, or cash pickup).

- Compare all fees and exchange rates displayed by the system to select the best option.

You can also use international transfer comparison websites to compare MoneyGram’s fees with other providers. These tools help you make informed decisions and avoid unnecessary expenses.

It’s recommended to use the fee estimator tool before each transfer, especially for transfers to licensed bank accounts in Hong Kong or China/Mainland China. This allows you to understand all fees and received amounts in advance, ensuring secure and accurate fund delivery.

Security Measures

Image Source: pexels

Identity Verification

When using MoneyGram for transfers, you must undergo a strict identity verification process. MoneyGram requires both you and the recipient to present valid government-issued ID. This measure effectively prevents identity theft and fraud. Common types of ID include:

- U.S. Driver’s License

- Passport

- State ID

- U.S. Military ID

- Native American Tribal ID

- Welfare ID

- Prisoner (Post-Release) ID

- Resident Alien ID

- Seaman’s ID

- Border Crossing Card

- Temporary Resident ID

- Employment Authorization Card

- Mexican Voter ID

- Consular ID (Matricula Consular)

When collecting transfers at a licensed bank counter in Hong Kong, you must also present the above valid IDs. MoneyGram verifies ID information to ensure the authenticity and reliability of both you and the recipient, effectively preventing unauthorized fund collection and ensuring your fund security.

MoneyGram also employs multiple security protocols to protect your personal information and funds. The table below shows the main security measures:

| Security Protocol Type | Description |

|---|---|

| Encryption Technology | Protects customer information during transfers, preventing unauthorized access. |

| Advanced Fraud Detection Systems | Continuously monitors transactions, quickly identifying and preventing suspicious activities. |

| User Identity Verification Measures | Confirms the identity of senders and recipients, preventing unauthorized use. |

| 24/7 Monitoring | Monitors transactions around the clock, ensuring compliance with strict financial regulations. |

For each transfer, ensure the provided identity information is accurate and valid. MoneyGram continuously improves its customer due diligence and transaction monitoring processes in accordance with anti-money laundering (AML) regulations and the Bank Secrecy Act (BSA), effectively preventing money laundering and other illegal activities.

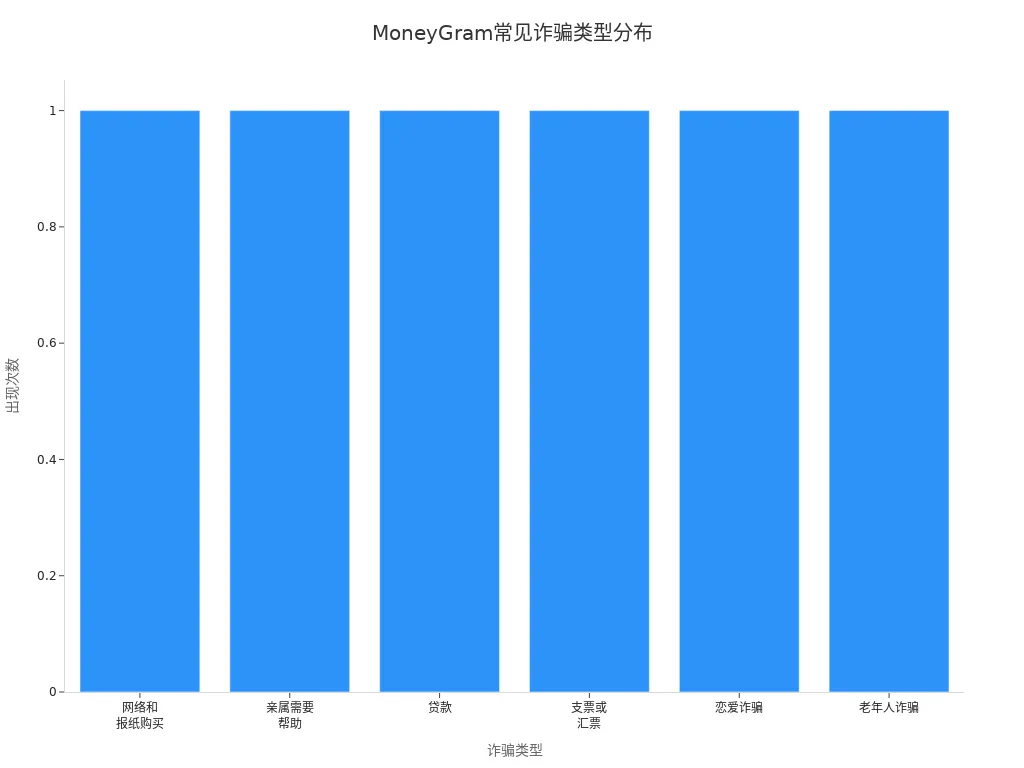

Fraud Prevention

During the transfer process, you must remain highly vigilant against various types of fraud. Scammers often exploit transfer channels to deceive you into transferring funds. Common fraud types are shown in the table below:

| Fraud Type | Description |

|---|---|

| Online and Newspaper Purchases | Scammers post low-priced items online or in newspapers, requiring payment via MoneyGram. |

| Relative in Need | Scammers pretend to be family members claiming emergencies, requiring verification through known contact methods. |

| Loans | Scammers request loan fees or other payments via mail or letter, typically requiring wire transfers. |

| Checks or Money Orders | Scammers send fake checks or money orders, asking consumers to cash them and transfer part of the funds to others. |

| Romance Scams | Scammers build relationships through personal ads or chats, then request funds for travel or financial support. |

| Elderly Scams | Scammers target seniors with phone scams, identity theft, etc., inducing them to hand over money or property. |

You can take the following measures to protect yourself from fraud:

- Only transfer funds to people you know and trust. Do not send money to strangers, no matter how convincing their stories seem.

- Be skeptical of urgent requests. Scammers often create fake emergencies to pressure you into transferring funds quickly.

- Do not send money for unexpected prizes or lottery winnings. Legitimate sweepstakes do not require upfront fees.

- Ignore any requests to help transfer funds. Participating in such activities may involve you in money laundering risks.

- Report suspicious activities immediately through MoneyGram’s official channels.

When transferring, keep the transaction reference number secure. The reference number is the unique proof for fund collection, linked to your and the recipient’s personal information. Only you and the designated recipient can use it to collect funds. MoneyGram employs multiple measures to prevent unauthorized use of reference numbers. If someone attempts to collect funds using your reference number fraudulently, the system will block it and may initiate a fraud investigation.

Customer Support Complaints

If you encounter any issues during the transfer process, you can seek help through MoneyGram’s official channels. MoneyGram offers multiple complaint and customer service options:

| Contact Method | Description |

|---|---|

| Phone | 2032238 |

| customerservice@moneygram.com | |

| Online Form | Submit complaints or feedback via an online form |

You can choose to call customer service, send an email, or fill out an online form on the website. The customer service team will assist you in checking transfer status, handling delays, and resolving disputes. When filing a complaint, it’s recommended to have the transaction reference number and relevant ID information ready to speed up the process.

MoneyGram continuously optimizes its customer service processes in accordance with regulatory requirements. Whether you’re in China/Mainland China, Hong Kong, or other regions, you can receive timely support through these channels. Contacting official customer service promptly is a key step in ensuring fund security when facing anomalies or questions.

When tracking transfers, you need to master the following key steps:

- Check your bank statement to confirm if the funds have arrived.

- Visit the MoneyGram website or use its app to track transfer progress in real-time.

- If you cannot find the transaction online, contact bank customer service or MoneyGram’s support team promptly.

- Double-check all transfer information to ensure accuracy.

Reminder: Keep the reference number secure during the process to prevent information leaks and ensure fund security. If you encounter delays or anomalies, take the following measures:

- If funds don’t arrive within 10 minutes of transaction completion, contact MoneyGram via chat or email (digitalsupport@moneygram.com).

- Have your name, email, phone number, and transaction ID ready for customer service to assist you quickly.

Through these methods, you can effectively ensure funds reach China/Mainland China or licensed bank accounts in Hong Kong securely and smoothly.

FAQ

How do I check the status of my MoneyGram transfer?

You can enter the transaction reference number and recipient’s last name on the MoneyGram website or app. The system will display the transfer progress. You can check without a registered account.

What should I do if I lose the reference number?

Contact MoneyGram customer service, providing your name, transfer details, and ID. The support team will help retrieve the reference number to ensure fund security.

How long does it take for a transfer to China/Mainland China or a licensed bank account in Hong Kong?

It typically takes 1-2 business days. Delivery to a mobile wallet may take longer, depending on the recipient bank’s processing speed.

What fees does MoneyGram charge?

Fees depend on the transfer amount, destination country, payment method, and receipt method. Use the fee estimator tool on the website or app to understand all costs in advance.

What should I do if there’s a delay or issue with the transfer?

First, verify all information. If the issue persists, contact MoneyGram customer service with the transaction reference number and personal details for assistance in resolving the problem.

While MoneyGram offers peace of mind with global reach and transaction tracking, high transfer fees (often 5–10%), hidden exchange rate markups, and delays in bank deposits (1–2 business days) can undermine efficiency—especially for users making frequent cross-border transfers, where intermediary charges, verification steps, and unclear rate structures often reduce the final amount received.

BiyaPay delivers a smarter alternative: cross-border transfers at fees as low as 0.5%, with same-day delivery to most countries, including real-time status tracking. Use the real-time exchange rate calculator to monitor fluctuations and execute conversions at optimal rates, eliminating hidden costs common with traditional providers.

Fast, digital onboarding ensures a seamless start. Beyond remittance, BiyaPay integrates investment—trade US and Hong Kong stocks directly without an overseas account, turning transferred funds into growth opportunities. Move beyond high-cost transfers. Sign up today and transform cross-border finance into a streamlined, value-generating experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.