- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Ways to Repay Capital One Credit Card Debt and Tips for International Fund Transfers

Image Source: unsplash

When repaying credit card debt, you can typically choose methods such as U.S. local account payments, international wire transfers, or third-party payment platforms. If you are in China, cross-border fund transfers face practical challenges, such as different regulatory policies across countries, strict compliance requirements, complex processes, high fees and exchange rate losses, and uncertain delivery times. You also need to guard against cross-border remittance scams and often face difficulties obtaining transparent and accurate fee and delivery information. Choosing the right channel to ensure fund security and efficient operations is crucial.

Key Points

- If you have a U.S. local bank account, you can use ACH automatic transfers, check payments, or other methods to repay credit card debt quickly with low fees.

- In mainland China, international wire transfers and third-party payment platforms (e.g., Wise) are the main options for repaying Capital One credit cards, with attention to fees and delivery times.

- Balance transfers can help you consolidate debt and reduce interest expenses, making it important to choose the right credit card for transfers.

- Having a trusted friend or family member repay on your behalf is a viable option, but you must ensure trust and retain transfer proof to avoid compliance risks.

- When making international remittances, always focus on exchange rates and fees, choosing transparent payment channels to reduce costs and risks.

Methods to Repay Credit Card Debt

Image Source: pexels

Local Account Repayment

If you have a U.S. local bank account, you can repay credit card debt through various methods. Common methods include ACH automatic transfers, check payments, and automatic debits. These methods are suitable for people living long-term in the U.S. with a U.S. bank account.

You can follow these steps:

- Log in to your online banking account.

- Select the Capital One credit card account to be repaid.

- Enter the bank account information for payment.

- Choose the payment amount. You can select the minimum payment, full statement balance, or a custom amount (minimum $35).

- Confirm the setup. The system will automatically deduct the payment on the monthly due date.

Tip: You can set up automatic payments to avoid late fees or interest due to missed payments.

Local account repayments are typically fast with low fees, suitable for those with U.S. bank accounts. If you are in mainland China, you generally cannot directly use local accounts for repayment and need to consider international channels.

International Channel Repayment

When in mainland China, you can repay credit card debt using international wire transfers or third-party payment platforms.

Common channels include:

- Using SWIFT international wire transfers to send funds from mainland China or a licensed Hong Kong bank to a Capital One account. You need to provide Capital One’s SWIFT code, your credit card account number, and routing number.

- You can visit a bank branch to process the transfer or contact Capital One via email (e.g., BusinessWireRequests@capitalone.com) for specific guidance.

- Some third-party platforms (e.g., Wise) support cross-border remittances to U.S. credit card accounts, but you need to confirm in advance if the platform supports credit card repayments.

Note: International wire transfers typically take 1-5 business days to arrive, with high fees (generally USD 15-50 per transaction), and you need to consider additional costs from exchange rate fluctuations. You should plan ahead to avoid credit record issues due to delayed delivery.

Balance Transfer

If you have multiple credit cards in the U.S., you can repay Capital One credit card debt through balance transfers. Balance transfers are suitable when you want to consolidate debt and reduce interest expenses.

The process is as follows:

- Log in to your Capital One account and select the credit card for the balance transfer.

- In the account menu, find the “Offers and Upgrades” section and click “Transfer Balance.”

- Review the current balance transfer offers, including interest rates and fee information. Some cards offer a 0% APR introductory period (e.g., 15 months), but typically charge a transfer fee.

- Enter the name of the other card issuer, account number, payment address, and transfer amount, then confirm, and the system will process the balance transfer automatically.

| Credit Card Name | Introductory APR | Annual Fee | Other Benefits |

|---|---|---|---|

| Capital One VentureOne Rewards Credit Card | 0% (15 months) | None | 20,000 miles welcome bonus, 5x points on hotels and car rentals |

| Capital One Quicksilver Cash Rewards Credit Card | 0% (15 months) | None | $200 welcome bonus, 1.5% cash back |

| Capital One SavorOne Cash Rewards Credit Card | 0% (15 months) | None | Rewards for dining, entertainment, streaming, and groceries |

The balance transfer amount cannot exceed your approved credit limit. You need to carefully read the fee and interest rate terms and plan your repayment strategy reasonably.

Friend or Family Repayment

If you are in mainland China and cannot directly transfer funds to the U.S., you can ask a trusted friend or family member in the U.S. to repay your credit card debt. You can convert RMB to USD and transfer it to the friend or family member via a licensed Hong Kong bank or third-party platform, who then uses a U.S. local account to repay on your behalf.

Risk Warning: Friend or family repayment involves fund security and compliance risks. You should ensure mutual trust and retain transfer proof. U.S. banks conduct compliance reviews for large or frequent third-party repayments, so avoid frequent use of this method.

When choosing a method to repay credit card debt, you should consider your fund sources, time requirements, and fee sensitivity to select the most suitable channel.

International Fund Transfer Channels

Image Source: unsplash

Bank Wire Transfer

You can use a bank wire transfer to send funds from mainland China or a licensed Hong Kong bank to the U.S. to repay credit card debt. Bank wire transfers are a traditional method, typically requiring you to visit a bank branch in person. You need to provide recipient information, including Capital One’s SWIFT code and your credit card account number. Bank wire transfers generally take 1-5 business days to arrive, with high fees starting at USD 40. Some banks also charge exchange rate markups based on their policies. You should understand the bank’s policies in advance to avoid delays or excessive fees impacting your repayment plan.

| Transfer Method | Fees | Notes |

|---|---|---|

| Capital One | USD 40 upfront fee | Requires visiting a branch for international transfers |

| Third-Party Fees | May apply | Depends on the specific transfer method and bank policy |

| Exchange Rate Markup | May apply | Depends on market rates and bank’s exchange rate policy |

Third-Party Platforms like Wise

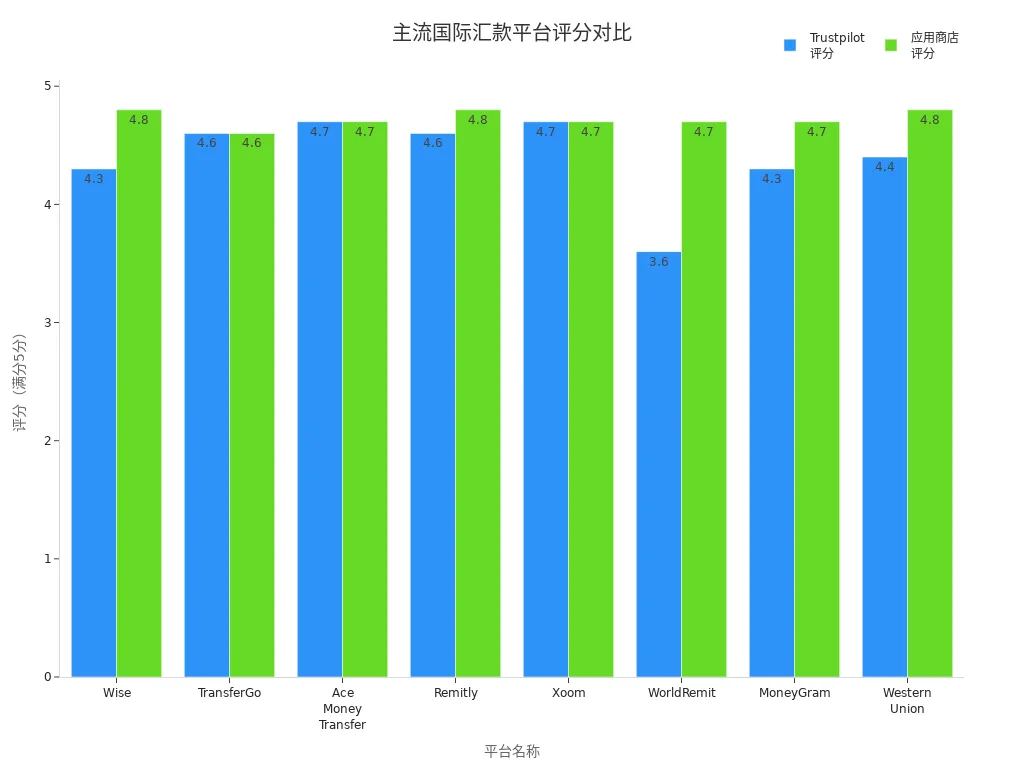

You can also choose third-party cross-border remittance platforms such as Wise, TransferGo, or Remitly. These platforms support online operations and are user-friendly. You only need to register an account, enter recipient information, select the transfer amount, and the platform will automatically calculate fees and exchange rates. Delivery times are typically from minutes to two days, with lower fees than bank wire transfers. These platforms are highly secure and have good user satisfaction. You can refer to the table below for ratings of major platforms:

| Platform | Trustpilot Rating | App Store Rating |

|---|---|---|

| Wise | 4.3 | 4.8 |

| TransferGo | 4.6 | 4.6 |

| Ace Money Transfer | 4.7 | 4.7 |

| Remitly | 4.6 | 4.8 |

| Xoom | 4.7 | 4.7 |

| WorldRemit | 3.6 | 4.7 |

| MoneyGram | 4.3 | 4.7 |

| Western Union | 4.4 | 4.8 |

Alipay/WeChat Cross-Border Remittance

You can use Alipay or WeChat’s cross-border remittance services to convert RMB to USD and transfer to a U.S. bank account. Some licensed Hong Kong banks collaborate with these platforms to support cross-border transfers. You need to verify your identity, enter recipient information, and the platform will calculate fees and exchange rates. Delivery typically takes 1-3 business days, suitable for small transfers. You should pay attention to the platform’s compliance requirements and transfer limits to ensure fund security.

Channel Comparison

When choosing an international fund transfer channel, you should focus on delivery speed, fees, security, and operational convenience. Bank wire transfers are suitable for large transfers, offering high security but higher fees and slower processes. Third-party platforms like Wise have low fees, fast delivery, and high user satisfaction, making them ideal for routine credit card repayments. Alipay and WeChat are convenient for small transfers but have lower limits. You should choose a reliable platform based on your needs to avoid fund risks.

Operation Process and Precautions

Bank Wire Transfer Process

When processing a bank wire transfer from mainland China or a licensed Hong Kong bank, you need to prepare Capital One’s recipient information in advance. You can follow these steps:

- Visit a bank branch or use online banking services.

- Enter the recipient’s name, Capital One’s SWIFT code, credit card account number, and recipient bank address.

- Specify the transfer amount (in USD), confirm fees, and exchange rates.

- Carefully verify all information and submit the transfer request.

Tip: Wire transfers are like sending cash; once sent, they are hard to recover. You should only proceed if you fully trust the recipient. Be extra cautious with urgent payment requests or unknown recipients to avoid scam traps.

Third-Party Platform Operations

You can also use third-party platforms like Wise for international remittances. The operation process typically includes:

- Register and log in to the third-party platform account.

- Select “Transfer to the U.S.” and enter recipient bank information.

- Enter Capital One credit card account information and transfer amount.

- The platform will display real-time exchange rates and transparent fees; confirm and submit.

- Platforms like Wise typically use mid-market exchange rates with low fees, and delivery is fast.

When using third-party platforms, they will require identity verification to ensure compliance and fund security. You need to follow the platform’s regulations and local laws.

Filling Out Remittance Information

When filling out remittance information, pay special attention to the following:

- The recipient’s name, account number, SWIFT code, etc., must be accurate.

- The purpose of the transfer should be truthfully specified as “credit card repayment.”

- Use trusted financial institutions to avoid fund loss due to errors.

- Do not rush; consult the bank or professionals if you have questions.

Common errors include incorrect recipient information, mismatched account number digits, or unclear purpose descriptions, which may lead to delays or unrecoverable funds.

Repayment Confirmation

After the funds arrive, you need to log in to your Capital One account promptly to confirm whether the repayment has been credited. You can check repayment records and remaining balances on the account page. If there are delays or discrepancies, contact the bank or platform’s customer service immediately. Retaining all remittance proof helps with follow-up inquiries and claims.

Recommendation: You can set up SMS or email alerts to stay updated on repayment progress and avoid credit record issues due to delays.

Risk and Fee Recommendations

Exchange Rates and Fees

When transferring funds internationally from mainland China or a licensed Hong Kong bank, exchange rates and fees directly affect the total cost of repaying credit card debt.

- Dynamic Currency Conversion (DCC) may incur up to 7% additional fees, increasing your repayment burden.

- Foreign transaction fees add extra costs to international transactions.

- Choosing credit cards without foreign transaction fees can effectively reduce costs.

You can minimize losses through the following methods:

- Compare different third-party payment platforms and choose services with better exchange rates and transparent fees.

- Consider opening a multi-currency account for easier multi-currency operations.

- Monitor emerging payment products and adjust remittance channels promptly.

Fraud Prevention

When making cross-border remittances, beware of phishing and identity theft. Scammers often impersonate banks or government agencies, using fake emails, texts, or calls to obtain your account information. They may request private communication, gift card payments, or use stolen information to gain trust. Scams targeting international students are common, often sent under the guise of Chinese consulates with fake notices. You should verify every remittance request and avoid entering personal information on unknown websites.

Interest Assessment

You can use an interest calculator to plan repayment progress scientifically.

| Input Item | Description |

|---|---|

| Current Balance | Enter your current credit card balance |

| Interest Rate | Enter the credit card’s annual percentage rate (APR) |

| Monthly Payment Amount | Estimate the monthly repayment amount |

| Estimated Interest Cost | Calculate the interest cost based on the current balance and rate |

| Repayment Time | Estimate the time required to pay off the current balance |

| Additional Information | Assumes no new transactions or balance transfers |

You should input your balance and interest rate to understand monthly interest and avoid accumulating interest by only paying the minimum amount.

Compliance and Security

When making international remittances, you must comply with Chinese and U.S. regulations.

- Understand China’s foreign exchange control policies to ensure large transfers are compliant.

- Choose payment providers with encryption and compliance certifications to protect your financial data.

- Implement two-factor authentication to enhance account security.

- Follow Know Your Customer (KYC) and Anti-Money Laundering (AML) principles to ensure every transaction is legal.

Only by prioritizing compliance and security can you complete cross-border fund transfers smoothly.

When repaying credit card debt, you should choose the appropriate channel based on your needs. The table below compares the pros and cons of common methods:

| Repayment Method/International Transfer Channel | Advantages | Disadvantages |

|---|---|---|

| Capital One Credit Card | No foreign transaction fees | May incur cash advance fees for cash withdrawals |

| Wise Multi-Currency Card | Uses mid-market exchange rates, low fees | May have withdrawal fees; requires understanding fee structures |

You should also monitor policy changes. For example, FATF requires detailed information for cross-border payments exceeding USD 1,000. The CFPB is also increasing oversight of large online platforms. You should closely follow platform rules to ensure fund security.

FAQ

How can I repay a U.S. Capital One credit card from mainland China?

You can use SWIFT international wire transfers, third-party platforms (e.g., Wise), or a licensed Hong Kong bank for remittances. You need to accurately fill in recipient information to ensure funds arrive smoothly.

How long does an international remittance take to arrive?

Bank wire transfers typically take 1-5 business days. Third-party platforms like Wise generally take 1-2 days. You should plan ahead to avoid credit record issues due to delays.

What fees should I watch for during remittances?

You need to consider bank or platform fees, exchange rate differences, and potential intermediary bank fees. Fees vary significantly across channels, so compare in advance.

How do I calculate the repayment amount?

You should log in to your Capital One account to check the statement balance. You can choose the minimum payment, full balance, or a custom amount. It’s recommended to repay the full amount to reduce interest expenses.

Is friend or family repayment safe and compliant?

You can have a U.S. friend or family member repay on your behalf, but ensure mutual trust. U.S. banks review large or frequent third-party repayments for compliance. You should retain transfer proof to mitigate risks.

Paying off your Capital One credit card from abroad doesn’t have to be expensive or slow. High fees, unclear exchange rates, and delayed transfers are common pain points—but BiyaPay offers a smarter alternative.

Convert between fiat and digital currencies like USDT seamlessly, bypassing traditional banking delays. Enjoy transfer fees as low as 0.5%, saving up to 90% compared to conventional methods. Use the real-time exchange rate tool to monitor fluctuations and avoid hidden costs.

No U.S. bank account? No problem. Sign up in minutes and start sending money globally with same-day transfer support, helping you meet payment deadlines and protect your credit. Manage both U.S. and Hong Kong stocks from one integrated platform for greater financial control.

Get started today on BiyaPay and simplify your international payments and global investing.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.