- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Ways of Quick Remittance: How to Choose an Efficient Remittance Method That Suits Your Needs

Image Source: pexels

When choosing a fast remittance method, you need to consider delivery speed, fees, security, and applicable scenarios. The global remittance market is vast, with data showing:

| Source | Statistics |

|---|---|

| World Bank | The global remittance market is expected to generate $800 billion |

| Visa | The global remittance market is $905 billion, with 771 million people participating in cross-border transactions |

| Coinlaw | Annual growth rate of 6%, expected to reach $1 trillion by 2030 |

You can make judgments based on your needs, such as the amount, urgency, recipient’s location, and fee sensitivity. Common factors influencing the choice include:

- Education

- Cost

- Accessibility

- Financial development of the recipient country

Different methods have their pros and cons, and you need to weigh them rationally to avoid common pitfalls and risks.

Key Points

- When choosing a remittance method, consider delivery speed, fees, security, and applicable scenarios to ensure it meets your personal needs.

- Bank wire transfers are suitable for large and urgent transfers, typically taking 1-5 business days to arrive, with high security.

- Online remittance services and third-party payment platforms offer fast, low-cost transfer options, suitable for daily small payments.

- Before remitting, verify all fee details to avoid hidden fees affecting the receipt amount.

- Ensure recipient information is accurate to reduce delays or failures due to operational errors.

Overview of Fast Remittance Methods

Image Source: pexels

Bank Wire Transfers

You can achieve fast remittance through bank wire transfers. Licensed banks in Hong Kong typically support wire transfer services, allowing you to transfer funds directly from one bank account to another. Wire transfers are suitable for large, urgent international transfers. You can complete the remittance on the same day or within 1-2 business days. Wire transfers use the SWIFT network, covering over 11,000 financial institutions globally, supporting multiple currencies. Bank wire transfers offer high security and reliability, suitable for important commercial transactions and cross-border payments. The table below summarizes the key features of bank wire transfers:

| Key Feature | Description |

|---|---|

| Global Coverage | SWIFT network, supports multiple currencies and transaction types |

| Security | Strong encryption and strict security protocols |

| Speed | Domestic in hours, international in 1-3 days |

| Reliability | Almost guaranteed delivery after authorization |

| Irreversibility | Cannot be reversed after completion |

| Regulatory Oversight | Regulated by national authorities to prevent fraud and money laundering |

| Identity Verification | “Know Your Customer” procedures to prevent unauthorized transactions |

| Applicable Cases | Cross-border transactions such as international supplier payments and overseas client receipts |

Online Remittance Services

You can choose online remittance services as another fast remittance method. Through these services, you can complete remittances from home using a phone or computer without visiting a bank. Online platforms like TransferWise and Airwallex typically complete transfers within minutes or hours. You can choose various payment methods, including credit cards, debit cards, or digital wallets. Online remittance services generally have lower fees and more competitive exchange rates, suitable for users needing high efficiency and convenience. For recipients without bank accounts, some platforms also support cash pickup.

Third-Party Payment Platforms

Third-party payment platforms are also a common fast remittance method. You can use platforms like PayPal and Stripe for international transfers. These platforms support multiple currencies and provide advanced security features, such as encryption and fraud protection. You can complete payments using credit cards, debit cards, or digital wallets. The table below shows the main advantages of mainstream third-party payment platforms:

| Platform | Main Advantages |

|---|---|

| PayPal | Multiple payment options, security features, supports 26 currencies |

| Stripe | Efficient payments, supports 130 currencies, strong security |

| Square | Credit card processing, detailed payment analysis, supports 130 currencies |

| Braintree | Multiple payment methods, security features, supports 130 currencies |

These platforms are suitable for daily consumption, cross-border small payments, and freelancer receipts.

Remittance Companies

You can also choose remittance companies as a fast remittance method. Companies like Western Union and MoneyGram cover over 200 countries globally. You can remit through online platforms, mobile apps, or physical locations. Most transactions are completed within minutes, suitable for urgent transfers and recipients without bank accounts. Remittance companies typically have quick verification processes and support multiple payment methods. Some companies also use blockchain technology to enhance cross-border payment efficiency.

Digital Wallets

Digital wallets provide a convenient fast remittance method. You can manage multiple bank cards in one app, simplifying the payment process. Digital wallets improve the efficiency of financial transactions, saving time on cash and credit card processing. Although digital wallets have multiple security measures, you should remain vigilant about data breaches and cyberattacks. Digital wallets are suitable for daily consumption, mobile payments, and small cross-border transfers.

Speed and Fee Comparison

Image Source: pexels

Speed Analysis

When choosing a fast remittance method, delivery speed is often one of the most critical factors. The transfer speed varies significantly across different channels. You can refer to the table below to understand the average delivery times of mainstream remittance methods:

| Provider | Estimated Transfer Time |

|---|---|

| Bank - via SWIFT | 1-5 business days |

| Wise | Seconds to 2 business days |

| Western Union | Minutes to 5 business days (bank transfer); minutes to 4 business days (cash pickup) |

| MoneyGram | 1 hour to the next business day |

| WorldRemit | Usually within minutes |

| Xoom | Bank transfers in hours; cash pickup in minutes |

| XE | 1 to 4 business days |

| Remitly | Fast service in minutes; economy transfers in 3 to 5 business days |

You can see that some online remittance services and remittance companies support delivery within minutes, ideal for urgent needs. If you choose bank wire transfers, they typically take 1-5 business days. Some banks and platforms support same-day ACH or instant bank transfers, as long as both sending and receiving banks support Faster Payment Services (FPS), allowing you to complete transfers in hours or even instantly. However, transfer amounts are subject to instant transaction limits.

Tip: If you need real-time delivery, it’s recommended to prioritize online services or remittance companies that support instant transfers.

Fee Structure

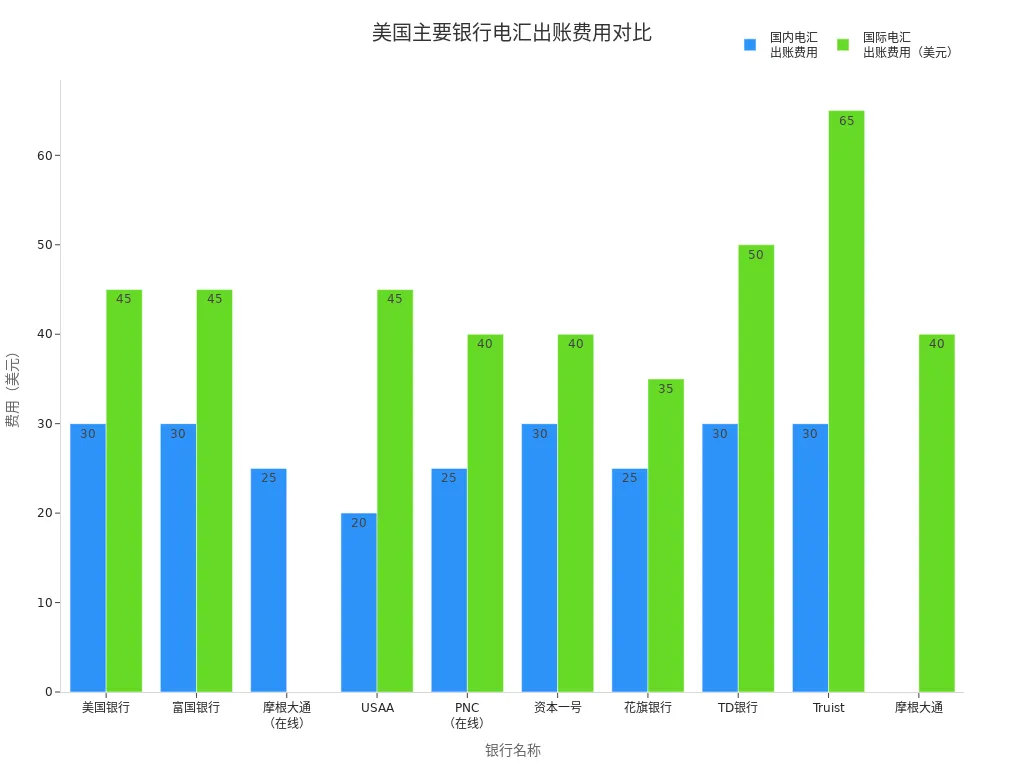

When choosing a fast remittance method, in addition to speed, you need to consider the fee structure. The fees and exchange rate differences vary significantly across channels. The table below shows the wire transfer fees (in USD) for major U.S. banks:

| Bank Name | Domestic Wire (Outgoing) | International Wire (Outgoing) |

|---|---|---|

| Bank of America | $30 | $45 (USD), $0 (foreign currency) |

| Wells Fargo | $30 | $45 (USD), $35 (foreign currency) |

| JPMorgan Chase | $25 (online) or $35 (in-person) | $40 (USD), $5 (foreign currency) |

| USAA | $20 | $45 |

| PNC | $25 (online) or $30 (agent-assisted) | $40 (online) or $45 (agent-assisted) |

| Capital One | $30 | $40 |

| Citibank | $25 | $35 |

| TD Bank | $30 | $50 |

| Truist | $30 | $65 |

You also need to note that, in addition to explicit fees, exchange rates of different services affect the total cost. Many platforms add a profit margin to exchange rates, reducing the amount the recipient actually receives. You can reduce fees through the following methods:

- Compare the fees and exchange rates of different services to choose the option with the lowest total cost.

- Choose to remit in the recipient’s local currency to reduce additional fees.

- Pay attention to the fee differences for payment and receiving methods, as credit card payments and cash pickups are typically more expensive.

Recommendation: Before remitting, verify all fee details to avoid increased costs due to hidden fees.

Security and Applicable Scenarios

Security Analysis

When choosing a fast remittance method, security is one of the most important considerations. Mainstream remittance service providers adopt various security measures to protect your funds and personal information. The table below summarizes common security measures:

| Security Measure | Description |

|---|---|

| End-to-End Encryption | Ensures all information is securely transmitted between kiosks and service provider servers. |

| Tokenization | Replaces sensitive card information with unique digital tokens to reduce the risk of data interception. |

| Secure Server Communication | Uses HTTPS and VPN tunnels to protect data and prevent unauthorized access. |

| Tamper-Evident Seals | Clearly indicate whether a kiosk has been opened or altered. |

| Locked Compartments | Protect internal cash storage and hardware modules. |

| Surveillance Cameras | Typically installed around kiosks to deter criminal activities. |

| Anti-Fraud Technology | Prevents criminals from attaching fake card readers. |

| PCI DSS Compliance | Regulates the storage and transmission of card data. |

| Anti-Money Laundering (AML) | Requires transaction monitoring to prevent illegal fund flows. |

| Know Your Customer (KYC) | Requires collecting sender identity information to verify legitimacy. |

You also need to understand that international remittance services are subject to strict compliance regulations. Key compliance requirements include:

- Providing disclosures on transaction terms, error resolution, and cancellation

- Establishing error resolution procedures

- Establishing cancellation and refund policies

- Clarifying remittance service providers’ liability for agent actions

- Providing pre-payment disclosures listing key transaction terms upon customer request

- Providing post-payment receipts with error resolution rights and other information after the transaction

These measures collectively ensure the safety of your funds and reduce risks during the remittance process.

Reminder: When using any fast remittance method, verify the service provider’s security measures and compliance policies to ensure the safety of your personal information and funds.

Typical Scenarios

In real life, you will encounter different remittance needs. Each fast remittance method has its applicable scenarios:

- Bank Deposits: Suitable for large transfers, such as business payments or property purchases.

- Mobile Payment Transfers: Suitable for daily consumption and small payments, such as dining with friends or shopping.

- ATM Card Transfers: Suitable when recipients need cash, offering flexibility and convenience.

- Prepaid Cards: Suitable for recipients without bank accounts, easy to manage and use remittances.

- Bill Payment Services: Suitable for directly paying recipients’ bills, ensuring funds are used for specific purposes.

- Automated Clearing House (ACH) Transfers: Suitable for large or recurring remittances, often used for cross-border family support.

You can flexibly choose the most suitable method based on the amount, urgency, and recipient’s needs. This not only improves efficiency but also ensures fund safety.

Comparison and Selection Advice for Fast Remittance Methods

Comparative Analysis

When choosing a fast remittance method, you often focus on speed, cost, security, and convenience. Different methods have their pros and cons, suitable for different scenarios. The table below summarizes the core comparison of mainstream remittance methods:

| Remittance Method | Speed | Cost | Security | Convenience |

|---|---|---|---|---|

| Bank Transfer | May take days | High fees, poor exchange rates | Highly secure, regulated | Traditional method, high familiarity |

| Online Remittance Service | Instant or same-day transfer | Low fees, good exchange rates | Relies on technology, high security | Operable anytime, anywhere |

| Remittance Operators (MTOs) | Same-day or instant transfer | High fees, poor exchange rates | Cash pickup carries risks | Wide physical locations, high flexibility |

| Cryptocurrency Transfer | Completed in minutes | Low fees | Decentralized, varying regulation | Requires technical knowledge |

| Prepaid Debit Card | Depends on usage | May have multiple fees | Offers security features | Convenient, suitable for those without bank accounts |

You can also refer to the advantages and disadvantages of different payment methods to better understand the applicability of each method:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Credit Card | 1. Helps build credit history 2. Reduces risk of carrying cash 3. Offers income opportunities through rewards and miles 4. Delays use of personal capital | 1. May lead to over-borrowing 2. Merchants pay processing fees 3. High interest (15% to 25% APR) 4. Affects credit report |

| Debit Card | 1. Convenient for ATM withdrawals or purchases 2. Typically no annual or transaction fees 3. Limits overspending 4. No interest charges | 1. Limited fraud protection 2. Limits spending capacity 3. May incur overdraft fees 4. Does not build credit score |

| Cash | 1. Eliminates hidden fees 2. Facilitates budgeting 3. No need for internet or tech access | 1. Does not build credit score 2. May incur ATM fees for withdrawals 3. High risk of theft 4. No expenditure records |

| Mobile Payment | 1. Fast transactions 2. Enhances financial security 3. No need to carry extra items | 1. Still developing, limited acceptance 2. Only supports specific phones 3. Relies on phone, cannot pay if lost 4. May require specific apps |

| Check | 1. Low or no fees 2. Offers protection 3. Generates proof of payment | 1. Potentially high costs 2. Long processing times 3. Susceptible to fraud |

| Electronic Funds Transfer | 1. Fast fund transfers 2. Supports automatic payments 3. Allows investigations and disputes | 1. Requires immediate funds 2. Some transfers may be non-recoverable 3. May incur high transaction fees |

| Cryptocurrency | 1. Modern transaction method 2. Blockchain-based security | N/A |

You can see that bank transfers and electronic funds transfers are highly secure, suitable for large and important transactions. Online remittance services and mobile payments are fast and low-cost, ideal for daily and small remittances. Remittance operators are suitable for scenarios without bank accounts or requiring cash pickup. Cryptocurrencies and prepaid debit cards are suitable for users with specific needs or technical knowledge.

Selection Advice

When making your actual choice, you should consider your needs and the recipient’s situation, comprehensively evaluating the following key factors:

- Amount Size

- Large Remittances: You can prioritize bank transfers or international wire transfers. These methods are highly secure, suitable for important scenarios like business payments or property purchases, but fees are higher.

- Small Remittances: You can choose online remittance services, mobile payments, or prepaid debit cards. These methods have low fees and fast delivery, suitable for daily life and family support.

- Urgency

- Urgent Needs: You can choose online remittance services, remittance operators, or cryptocurrency transfers that support instant delivery. These methods can be completed in minutes, ideal for emergencies.

- Non-Urgent Needs: You can opt for lower-cost international ACH or checks, suitable for recurring remittances or scenarios where delivery time is not critical.

- Recipient’s Location

- China/Mainland China: You can choose online remittance services or local mobile payment platforms supporting RMB to ensure recipients can easily withdraw and use funds.

- U.S. and Other Countries: You can choose bank transfers, remittance operators, or cryptocurrencies based on local financial infrastructure.

- Fee Sensitivity

- Cost Priority: You can compare fees and exchange rates across platforms to choose the lowest total cost. Online remittance services and international ACH typically have lower fees.

- Convenience Priority: You can choose platforms supporting mobile operations and anytime remittances, such as mobile payments or digital wallets.

- Recipient’s Account Type

- With Bank Account: You can directly choose bank transfers, international wire transfers, or ACH.

- Without Bank Account: You can choose remittance operators’ cash pickup, prepaid debit cards, or mobile payments.

Reminder: When choosing a fast remittance method, it’s recommended to first clarify your needs, then consider the recipient’s situation, and comprehensively compare speed, fees, security, and convenience. You can use online comparison tools to check platform fees and exchange rates in real-time to avoid increased costs due to hidden fees.

You can refer to the following common matching suggestions to make quick decisions:

- International Wire Transfer: Suitable for large, urgent, and highly secure cross-border transactions.

- International Money Order: Suitable for secure remittances when electronic methods are unavailable, but slow.

- International ACH: Suitable for recurring small remittances, low cost, moderate speed.

- Prepaid Debit Card: Suitable for recipients without bank accounts, convenient and flexible.

- Online Remittance: Suitable for personal and small business remittances, fast and low-cost.

- Paper Check: Suitable for specific scenarios, slow and high-risk.

You can choose the most suitable fast remittance method based on the above analysis and your actual situation.

Risk Prevention and Common Pitfalls

Exchange Rates and Fees

When conducting international remittances, you often encounter exchange rate fluctuations and fee traps. Exchange rates determine the value between different currencies, and even small changes can significantly affect the amount received. You need to be aware of the following common risks:

- International remittances involve fluctuating exchange rates, directly impacting the final receipt amount.

- Currency conversion incurs additional fees, and banks and service providers often add a markup to exchange rates.

- Hidden fees may increase transaction costs, such as intermediary bank fees or expedited service fees.

- Transfer fees vary across banks or financial institutions, potentially including fixed and variable fees.

| Fee Type | Description |

|---|---|

| Fixed Fees | Charged per transaction, independent of amount. |

| Variable Fees | Depend on the amount sent or method used. |

| Exchange Rate Markup | Service providers add a margin to exchange rates, affecting total cost. |

| Additional Fees | Include credit card fees, cash pickup fees, expedited fees, etc. |

Recommendation: Before remitting, understand the current exchange rate and all related fees to avoid reduced receipt amounts due to hidden costs.

Compliance and Security

When choosing a remittance method, compliance and security are equally important. International remittances must comply with anti-money laundering (AML) and Know Your Customer (KYC) regulations. Financial institutions collect and verify your identity information and continuously monitor transactions to prevent illegal fund flows. You also need to guard against fraud:

- Verify the legitimacy of service providers through official channels.

- Be cautious of strangers or unclear requests, especially involving urgent remittances.

- Consult family or professionals before remitting to avoid scams.

- Avoid financial operations on public Wi-Fi to protect personal information.

- Limit transfer amounts, especially for first-time transactions with new recipients.

You need to be aware of common fraud tactics, such as impersonating relatives, fake law enforcement, or false prize/charity requests. Educating yourself and your family to recognize these risks is key to preventing financial losses.

Operational Details

When filling in remittance information, accuracy is critical. Errors in data entry can lead to delayed or failed deliveries. Common operational mistakes include:

- Incorrect account information, causing payments to fail matching.

- Incomplete remittance notifications, affecting timely confirmation by recipients.

- Manual data entry errors, impacting financial record accuracy.

- Fund allocation errors, potentially preventing recipients from receiving funds.

| Operational Error | Solution |

|---|---|

| Data Entry Errors | Carefully verify account and recipient information to avoid spelling mistakes. |

| Processing Delays | Choose automated systems to improve efficiency. |

| Fund Allocation Errors | Use automated tools to reduce human intervention. |

Before each remittance, carefully verify all information to ensure the account, amount, and recipient name are correct. Using automated tools can reduce errors and improve remittance efficiency and security.

When choosing an efficient remittance method, you need to comprehensively consider speed, fees, security, and applicable scenarios. You can focus on the following points:

- Evaluate urgency and amount to choose the appropriate delivery speed and fee structure.

- Compare exchange rates and transfer limits across services to ensure fund safety.

- Pay attention to new industry trends like mobile apps, blockchain, and digital remittances.

- Keep records of each transfer and stay informed about service and policy changes, proactively seeking assistance when in doubt.

Rational decision-making can help you better meet your actual needs and ensure fund safety.

FAQ

How Fast Can a Remittance Arrive?

When choosing online remittance services or remittance companies, some platforms can deliver within minutes. Bank wire transfers typically take 1-5 business days. Delivery speed depends on the service type and recipient’s location.

How to Calculate Total Remittance Costs?

You need to consider fees and exchange rate margins. Some platforms add a markup to exchange rates. You can check fee details before remitting to choose the lowest total cost.

What to Pay Attention to When Filling in Recipient Information?

You must ensure the recipient’s name, account number, and bank information are accurate. Errors can lead to delayed or failed deliveries. It’s recommended to carefully verify all information before remitting.

Can Recipients Without Bank Accounts Receive Funds?

You can choose remittance companies supporting cash pickup or prepaid debit cards. Some digital wallets and mobile payment platforms also support receipt without bank accounts, suitable for flexible fund use.

When you need fast, reliable international transfers, BiyaPay offers a smarter alternative to traditional remittance services. Say goodbye to high fees and slow processing times.

Convert between fiat and digital currencies like USDT seamlessly, bypassing costly intermediary banks. Enjoy transfer fees as low as 0.5%—saving up to 90% compared to conventional methods. Use the real-time exchange rate tool to lock in favorable rates and maximize your transfer value.

No overseas bank account? No problem. Sign up in under 3 minutes and send money globally with same-day delivery. Plus, manage both U.S. and Hong Kong stocks from one integrated platform for greater financial control.

Start today on BiyaPay and experience faster, more affordable, and secure cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.