- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money to Canada: Efficient and Secure International Transfer Methods

Image Source: unsplash

When transferring money to Canada via remittance, you can choose bank transfers, wire transfers, or online remittance services. Bank transfers are suitable for large amounts and urgent needs, typically with higher fees and a processing time of 1-5 business days. Online remittance platforms and international money transfer companies offer fast processing with fees as low as 0.85-80 USD. The table below shows that the market size in 2024 reached 5.2 billion USD, with each mainstream method having its pros and cons:

| Feature | ACH | EFT | Wire Transfer |

|---|---|---|---|

| Speed | 1-3 days | 1-4 days | 1-5 days |

| Fees (USD) | 0.85 | Free or low | 30-80 |

| Purpose | Business | Salaries, bills | Large payments |

Key Points

- When choosing a transfer method, consider fees, speed, and security. Bank transfers are suitable for large amounts, while online remittance services have lower fees and faster delivery.

- When using online remittance platforms, compare fees and exchange rates to select the most cost-effective service.

- Before transferring, prepare recipient information and proof of funds to ensure a smooth process and avoid delays.

- Pay attention to compliance requirements, especially for large transfers, which need declaration to ensure legal fund sources and avoid legal risks.

- Stay vigilant and choose regulated platforms to protect personal information and funds, preventing scams and data breaches.

Money Transfer Methods to Canada

Image Source: unsplash

When choosing to transfer money to Canada, you typically encounter three mainstream methods: bank transfers, online remittance services, and international money transfer companies. Each method has distinct features and applicable scenarios. Below, we detail these methods to help you choose based on your needs.

Bank Transfers

Bank transfers are a preferred choice for many when transferring money to Canada. You can use banks in mainland China or Hong Kong-licensed banks to send funds directly to the recipient’s account in Canada. Bank transfers are suitable for large amounts and users with high security requirements. When processing a bank transfer, you typically need to provide the recipient’s name, account number, bank details, and SWIFT code. Fees and processing times vary across banks. The table below shows transfer fees and processing times for some major banks, with amounts in USD for your reference:

| Bank Name | Transfer Fees (USD) | Processing Time |

|---|---|---|

| RBC | Less than $2,500: $11 | Same-day (Canada or US) |

| $2,500-$10,000: $15 | 1-2 business days (other destinations) | |

| Over $10,000: From $34 | ||

| TD Canada Trust | Registered account transfer fee: $115 | |

| CIBC | International wire transfer fee: $23-$61 | |

| Airwallex | Fees not specified | As fast as 1 business day |

When choosing bank transfers, in addition to fees and speed, prioritize security. Canadian banks typically implement the following measures to ensure your funds’ safety:

- Adhere to strict regulatory laws to ensure compliance for international transfers.

- Use advanced encryption technology to protect your financial information.

- Provide 24/7 customer support to help resolve unexpected issues.

Bank transfers offer high security and are suitable for large fund movements but come with relatively high fees and potentially longer processing times.

Online Remittance Services

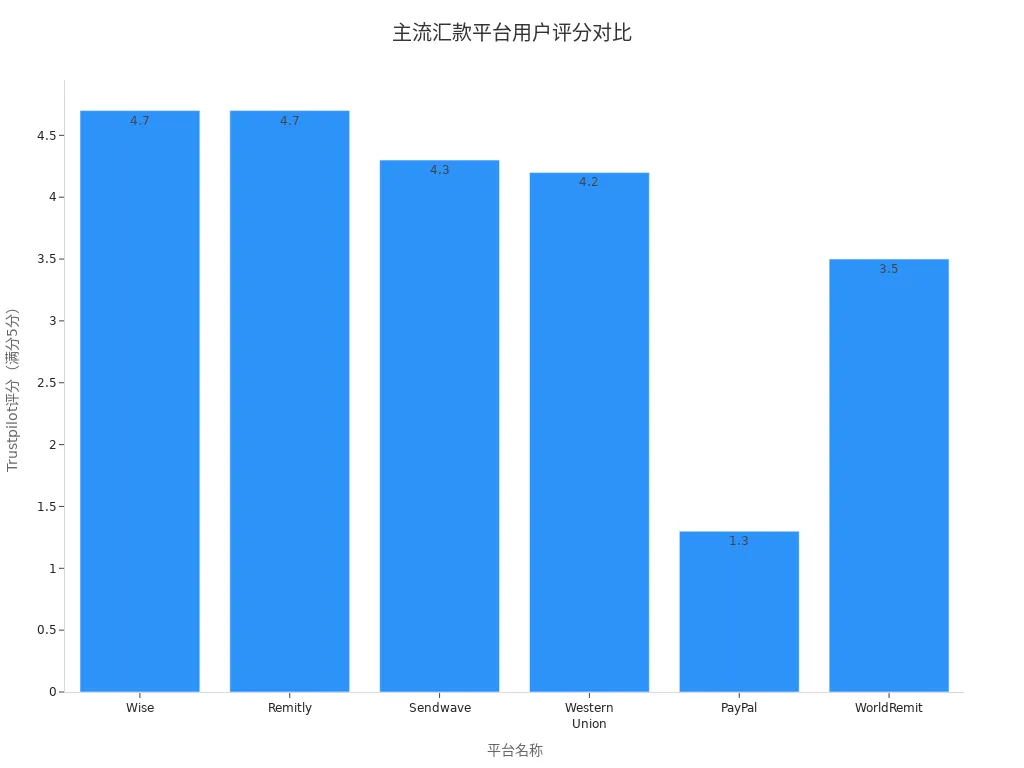

Online remittance services have become increasingly popular in recent years. You can easily transfer money to Canada via mobile phone or computer. Common platforms include Wise, Remitly, Sendwave, Western Union, PayPal, and WorldRemit. These platforms are user-friendly, with transparent fees and fast delivery. The table below shows user ratings for major online remittance platforms to help you assess their service quality:

| Platform | User Rating (Trustpilot) |

|---|---|

| Wise | 4.7/5 (67,000+ reviews) |

| Remitly | 4.7/5 (67,000+ reviews) |

| Sendwave | 4.3/5 (19,900+ reviews) |

| Western Union | 4.2/5 (102,600+ reviews) |

| PayPal | 1.3/5 (31,500+ reviews) |

| WorldRemit | 3.5/5 (88,000+ reviews) |

When using online remittance services, you typically find the following advantages:

- Fees are lower than traditional banks, with some platforms’ fees as low as 1 USD.

- Exchange rates are more competitive, saving you more costs.

- Delivery is fast, with some platforms offering instant or same-day transfers.

- The process is simple, supporting mobile apps and web interfaces.

When choosing a platform, compare fees and exchange rates to select the most suitable service.

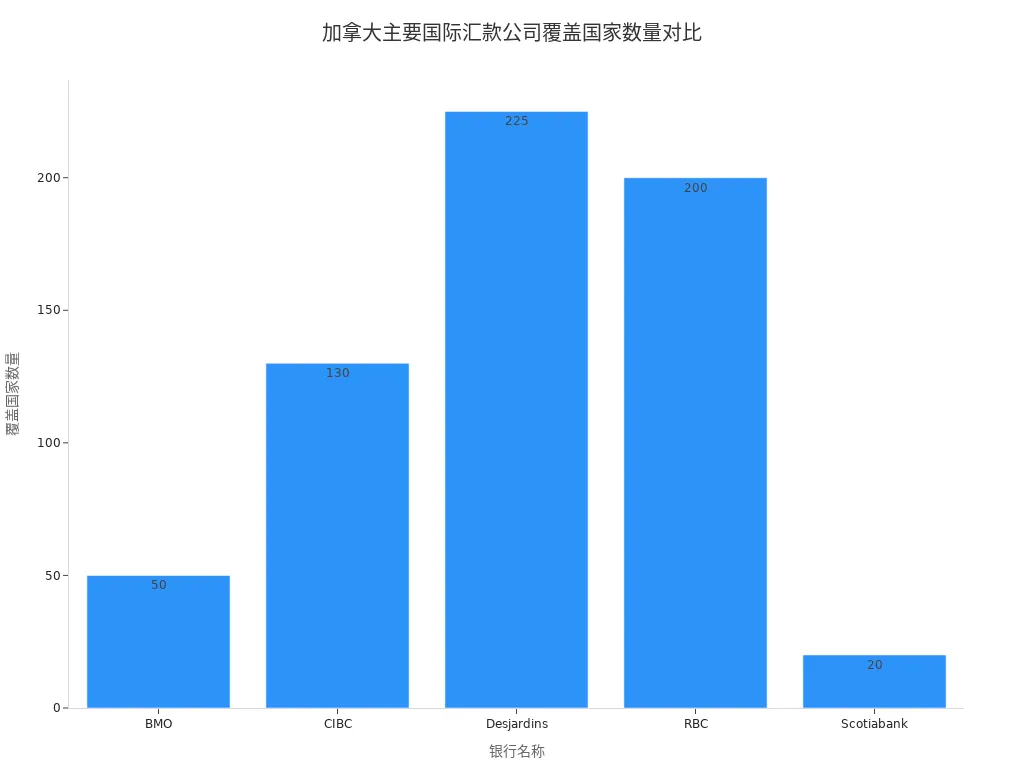

International Money Transfer Companies

International money transfer companies offer more diverse options, especially for users needing to transfer across multiple countries and regions. Major Canadian international transfer companies have extensive coverage, with some banks supporting transfers to over 200 countries and regions. The table below shows the coverage of major Canadian international transfer companies:

| Bank/Company | Number of Countries Covered |

|---|---|

| BMO | 50 |

| CIBC | Over 130 |

| Desjardins | 225 |

| RBC | Over 200 |

| Scotiabank | 20 |

When choosing an international money transfer company, you can compare based on coverage, fee structures, and delivery speed. Some companies also support multi-currency settlements and real-time exchange rate checks, enhancing flexibility and transparency.

Tip: When transferring to Canada, regardless of the method, understand the fees, exchange rates, and delivery times in advance to ensure secure and efficient transfers.

Transfer Method Breakdown

Process

When transferring money to Canada, you can choose bank transfers, online remittance services, or international money transfer companies. Each method follows a similar process with slight variations. Below are the common steps:

- Choose a reliable transfer service. You can select banks in mainland China or Hong Kong, well-known online platforms, or international transfer companies.

- Set up transfer details. You need to provide the recipient’s name, account details, bank information, and SWIFT code. Some platforms support online, phone, email, or in-person processing.

- Select a payment method. You can use cash, checks, debit cards, or credit cards to pay the transfer amount.

- Confirm transaction details. Carefully verify the transfer amount, recipient information, and fees before submitting.

- Obtain a receipt and transaction number. Use these to track the transfer progress.

- Understand transfer fees and exchange rates. Compare fees and rates across services to choose the best option.

When processing a transfer, you typically need to provide proof of funds. The table below lists common proof of funds methods and their descriptions:

| Proof of Funds Method | Description |

|---|---|

| Bank Letter | Letter from your bank in mainland China or Canada |

| Cash | Funds provided in cash |

| Traveler’s Checks | Traveler’s checks as proof of funds |

| Bank Draft | Draft issued by a bank |

| Travel or Forex Card | Prepaid travel or forex card |

| International Money Order | Money order for international transfers |

| Stocks, Bonds, or Liquid Assets | Investments that can be quickly liquidated |

Tip: Prepare required documents in advance to ensure a smooth transfer process.

Delivery Time

When choosing a transfer method, delivery time is a key consideration. The average delivery times for different methods are shown below:

| Transfer Method | Average Time |

|---|---|

| Mainland China Wire Transfer | A few hours to one business day |

| International Wire Transfer | 1 to 5 business days |

Delivery speed is influenced by several factors:

- Processing times of sending and receiving banks. Bank business hours affect delivery progress.

- Type of transfer. Domestic and international transfers have different speeds.

- Whether currency conversion is involved. Currency conversion may increase processing time.

- Bank holidays. Holidays in mainland China or Canada may delay delivery.

- Cut-off times. Most banks have deadlines for processing wire transfers.

- Time zone differences. International wire transfers may involve banks across multiple time zones.

- Compliance and verification. International transfers must comply with regulatory and anti-money laundering measures, potentially extending delivery time.

During operations, consult the service provider in advance to understand expected delivery times and plan fund usage accordingly.

Fee Structure

When transferring money to Canada, the fee structure varies significantly by method. The table below compares the fee characteristics of common methods:

| Transfer Method | Fee Characteristics | Notes |

|---|---|---|

| Bank | Fixed fees up to $45, exchange rate spreads, SWIFT intermediary fees | Typically high fees and slower processing |

| Wise | Mid-market rates with transparent low fees | Best value, clear fee structure |

| WorldRemit | Fast, flexible, slightly higher fees | Suitable for quick transfers and cash pickups |

| OFX | Better rates and support for large transfers, may have minimum requirements | Ideal for large transfers |

| Western Union | Cash pickup services, high fees, poor rates | Suitable for urgent cash needs, global coverage |

| PayPal and Xoom | Convenient for small online transfers, less cost-effective | Ideal when both parties use PayPal |

When choosing a service, watch for these hidden fees:

- Currency conversion fees are a common hidden cost, affecting the final amount received.

- International transfers via the SWIFT network may incur high wire and intermediary bank fees.

- Exchange rate fluctuations and intermediary bank differences can cause fee variations.

- Some services advertise low rates but may include additional fees in transactions.

- Receiving banks may charge fees for international transfers, reducing the final amount.

Before transferring, review all fee details to avoid losses from hidden costs.

Security

When transferring money to Canada, security is a top priority. Mainstream transfer services typically implement multiple security measures:

- Major transfer services use encryption to ensure the security of your financial information during transfers.

- Most companies are subject to strict regulation by US and Canadian authorities, ensuring compliant operations.

- These regulations require companies to follow stringent secure transaction standards, enhancing fund safety.

When selecting a service, prioritize regulated, reputable platforms or banks. Keep transaction receipts and personal information secure to prevent data breaches.

Reminder: During the transfer process, never share account passwords or verification codes, and contact official customer service immediately if you encounter suspicious activity.

Fee and Speed Comparison

Image Source: unsplash

Fee Comparison

When choosing a transfer method, fees are a key consideration. Bank wire transfers typically charge high fixed fees, up to 45 USD, plus SWIFT intermediary fees. Online platforms like Wise and Remitly offer transparent fees, with some as low as 1 USD. International money transfer companies have varying fees depending on the service type and delivery method. You also need to consider exchange rates. Exchange rates play a crucial role in transfers to Canada. The rate used determines the proportion of funds converted from the sender’s currency to CAD. Since rates fluctuate daily, the rate applied at transfer directly affects the amount received.

- Exchange rate fluctuations affect the amount received.

- Transfer service fees may be influenced by exchange rates.

- Hidden fees can reduce the overall value of the transfer.

Before transferring, carefully compare platform fees and exchange rates to avoid losses from hidden costs.

Speed Comparison

Delivery speed directly impacts your fund usage plans. Bank wire transfers typically take 2 to 5 business days. Some online platforms and digital account transfers can achieve instant delivery, especially with automatic crediting enabled. During operations, you may encounter delays due to:

- Weekends or holidays causing delays. Transfers are typically processed on business days.

- Manual errors, such as incorrect account or routing numbers.

- Additional paperwork. Large cross-border transactions may require extra documents.

- Time zone differences. Time differences between countries affect delivery progress.

Choose a method based on your urgency to ensure the fastest delivery.

Security Comparison

Security is a critical factor when transferring money to Canada. Different methods have distinct security levels.

| Transfer Method | Security Description | Notes |

|---|---|---|

| Wire Transfer | Offers tracking and bank-level security | Suitable for large, infrequent transfers |

| Digital Account Transfer | Conducted via online banking with bank-level security | Similar to wire transfers |

| Cash Pickup or Transfer Apps | Higher risk, some third-party platforms lack robust security | Not recommended for high-security needs |

Be cautious of these risks:

- Exchange rate fluctuations may reduce the CAD amount received.

- Cybercriminals may target the transfer process.

- Some services charge high fees, eroding fund value.

- Choosing regulated, compliant services reduces legal and security risks.

Reminder: Prioritize regulated, reputable banks or platforms to ensure fund safety.

Selection Tips

Amount Needs

When choosing a method to transfer money to Canada, the amount is a primary consideration. For large transfers, focus on:

- Exchange Rates: Always monitor current rates, as changes directly affect the amount received.

- Fees and Taxes: Understand all potential costs, including transaction, receiving, and intermediary fees.

- Security and Regulations: Choose secure, reliable institutions and understand regulations in China/mainland China and Canada for large transfers.

Canada has no explicit limit on single transfer amounts, but transactions over 10,000 CAD must be reported to FINTRAC and the Canada Revenue Agency. Some banks or platforms may set daily or single-transaction limits. Consult your chosen bank or platform in advance to ensure smooth large transfers.

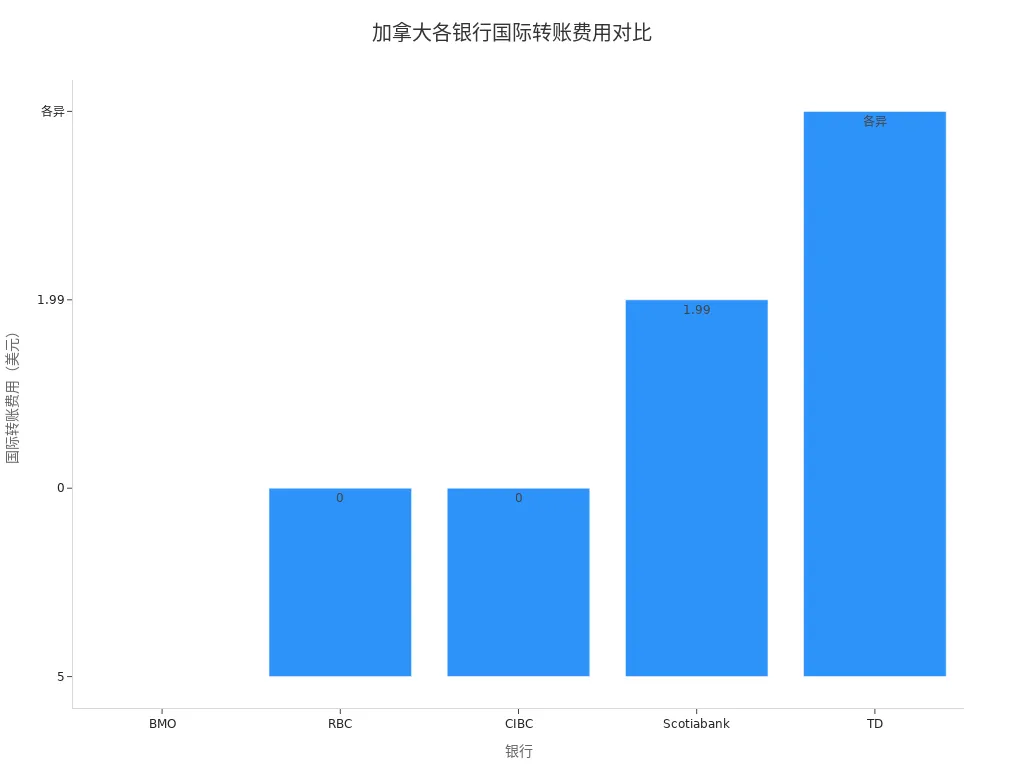

Speed Needs

If you prioritize delivery speed, opt for services with fast processing. The table below compares international transfer fees and delivery times for major Canadian banks:

| Bank | International Transfer Fee | Transfer Duration |

|---|---|---|

| BMO | $5 | 1-3 business days |

| RBC | $0 | 2-5 business days |

| CIBC | $0 | 1-3 business days |

| Scotiabank | $1.99 | Up to 5 business days |

| TD | Varies | 1-5 business days |

You can also use Canada Post’s MyMoney transfer service, with fees as low as $4 and up to $100, delivering in as fast as 10 minutes without requiring a bank account. For urgent needs, choose platforms with fast delivery and transparent fees, and initiate transactions early on business days.

Fee Needs

If you’re sensitive to fees, opt for online platforms with low fees and transparent exchange rates. Compare fees, rates, and hidden costs across platforms. Some platforms have fees as low as $1, ideal for small, frequent transfers. Bank wire transfers have higher fees, suitable for large or high-security scenarios. Watch for currency conversion fees and additional charges from receiving banks.

Use a platform’s fee calculator before transferring to understand all costs and avoid losses from hidden fees.

Personalized Needs

When choosing a transfer method, adjust based on personalized needs:

- Choose platforms with 24/7 customer support for timely assistance.

- If visiting a bank is inconvenient, opt for services supporting mobile apps or web operations.

- Select international transfer companies with broad coverage and multi-currency support based on the recipient’s location.

- For urgent needs, prioritize platforms with dedicated hotlines or instant chat support.

Each method has unique advantages. Choose the most suitable channel based on your needs to ensure secure and efficient transfers.

Precautions for Transferring Money to Canada

Identity Verification

When transferring money to Canada, identity verification is the first step. You must comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act to ensure legal and compliant operations. When providing personal information, submit only necessary details and securely destroy them when no longer needed. Be aware of Quebec’s specific regulations on biometric data. If using third-party services, confirm that the service agreement complies with Canadian privacy requirements. Obtain clear consent statements before submitting sensitive information.

- Understand relevant regulations to ensure compliance

- Manage personal information carefully to avoid leaks

- Choose legitimate channels to ensure data security

Exchange Rates and Costs

When processing a transfer, exchange rates and costs directly affect the amount received. Rates vary across platforms and banks, and some services charge currency conversion fees. Compare rates and fees in advance to select the best option. Watch for hidden costs, such as intermediary bank fees or additional charges from receiving banks.

Use a fee calculator to verify all costs in advance to avoid losses from rate fluctuations or hidden fees.

Tax Compliance

When transferring money to Canada, tax compliance is critical. Canada requires reporting for transfers exceeding 10,000 CAD. Declare large fund movements accurately to avoid investigations due to incomplete information. Understand tax regulations in China/mainland China and Canada to ensure legal fund sources.

- Keep transfer receipts for future reference

- Consult professionals for the latest tax policies

- Comply with both countries’ laws to avoid legal risks

Risk Prevention

During the transfer process, risk prevention is essential. Carefully verify recipient information to avoid transferring to the wrong account. Choose regulated platforms with encryption and anti-fraud measures, and avoid unknown channels. Stay vigilant against scams and verify suspicious or urgent fund requests.

- Verify recipient identity to ensure accurate account details

- Choose secure platforms, prioritizing regulated banks or services

- Beware of scams and reject suspicious requests promptly

Reminder: Stay vigilant throughout the transfer process to protect personal and financial security.

When transferring money to Canada, focus on fees, delivery speed, and security. Choose the most suitable method based on your needs. Prepare documents in advance and select legitimate channels to reduce risks. Pay attention to compliance requirements and protect personal information. This way, you can ensure funds reach Canada securely and efficiently.

FAQ

What basic information is needed for transferring money to Canada?

You need to prepare the recipient’s name, bank account number, bank details, SWIFT code, and identity proof. Some platforms may also require proof of fund sources.

How long does it take for a transfer to reach Canada?

Bank wire transfers typically take 1 to 5 business days. Online remittance platforms can deliver as fast as the same day.

Are there limits on transfer amounts?

In China/mainland China, single transactions and annual totals have restrictions. Canada requires reporting for transfers exceeding 10,000 USD.

How can you ensure fund security during transfers?

Choose regulated banks or platforms. Keep personal information secure and avoid sharing account passwords or verification codes.

How do you calculate total transfer costs?

Use a platform’s fee calculator. Pay attention to fees, exchange rate spreads, and potential intermediary costs to calculate total expenses in advance.

When sending money to Canada, high fees, fluctuating exchange rates, and delayed transfers can be major concerns. BiyaPay offers a streamlined solution designed to address these challenges efficiently.

With support for converting between fiat and digital currencies like USDT, you can bypass the complexities of traditional banking, ensuring faster fund availability. Enjoy transfer fees as low as 0.5%, saving up to 90% compared to conventional methods. Utilize the real-time exchange rate tool to monitor market movements and avoid hidden costs.

No need for an overseas bank account; sign up in just minutes and start sending money globally with same-day transfer capabilities. Ensure timely payments while managing both U.S. and Hong Kong stocks from one unified platform.

Get started today on BiyaPay and simplify your international transactions with secure, cost-effective solutions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.