- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Remitly: Combining Offers and Convenience for International Remittances at Lower Costs

Image Source: unsplash

Do you want to save more on international remittances? Remitly offers allow you to enjoy low fees, no hidden charges, and a fee-free first transfer for new users. You can complete a transfer in just a few steps, with simple operations and fast delivery. With the increasing popularity of digital remittance methods, more users are choosing convenient and efficient platforms, reducing both time and financial costs. Now, online remittance services not only lower fees but also make cross-border transfers easier.

Key Takeaways

- Using Remitly for international remittances, you can enjoy low fees and transparent pricing, avoiding hidden charges.

- New users can enjoy a fee-free first transfer after registering, saving more costs.

- Remitly supports multiple payment methods, allowing you to choose the most suitable remittance option based on your needs.

- Transfers are delivered quickly, with some countries receiving funds in minutes, ideal for urgent needs.

- Pay attention to exchange rate fluctuations and promotional offers to further reduce costs by timing your transfers wisely.

Remitly Overview

Image Source: pexels

Service Coverage

You can use Remitly to send money to over 170 countries and regions worldwide. Remitly supports more than 100 currencies, offering extensive coverage. You don’t need to visit physical locations; you can complete international transfers using your phone or computer. The table below shows Remitly’s service coverage:

| Number of Receiving Countries | Number of Supported Currencies |

|---|---|

| 170+ | 100+ |

You can send US dollars to regions such as Asia, Europe, Africa, and the Americas. Whether you’re in mainland China, Hong Kong, or the US, you can easily use Remitly for cross-border transfers. Remitly’s services are ideal for users sending money to family, friends, or business partners.

Key Features

Remitly focuses on digital remittance services. You can initiate transfers anytime, anywhere. Remitly has no physical branches, and all processes are completed online. You only need a few steps to submit a transfer request. The system automatically calculates exchange rates and fees, so you know every expense clearly.

Remitly has a strong reputation in international remittances. You can enjoy fast delivery, with some countries and regions receiving funds in minutes. You can also choose from multiple payment methods, including credit cards, debit cards, and bank transfers. Remitly offers a transparent fee structure with no hidden charges. You can track transfer progress in real-time to ensure funds are secure.

Tip: Choosing a digital remittance platform saves time and costs, making your international transfers more efficient and convenient.

Fee Structure

Image Source: unsplash

Transfer Fees

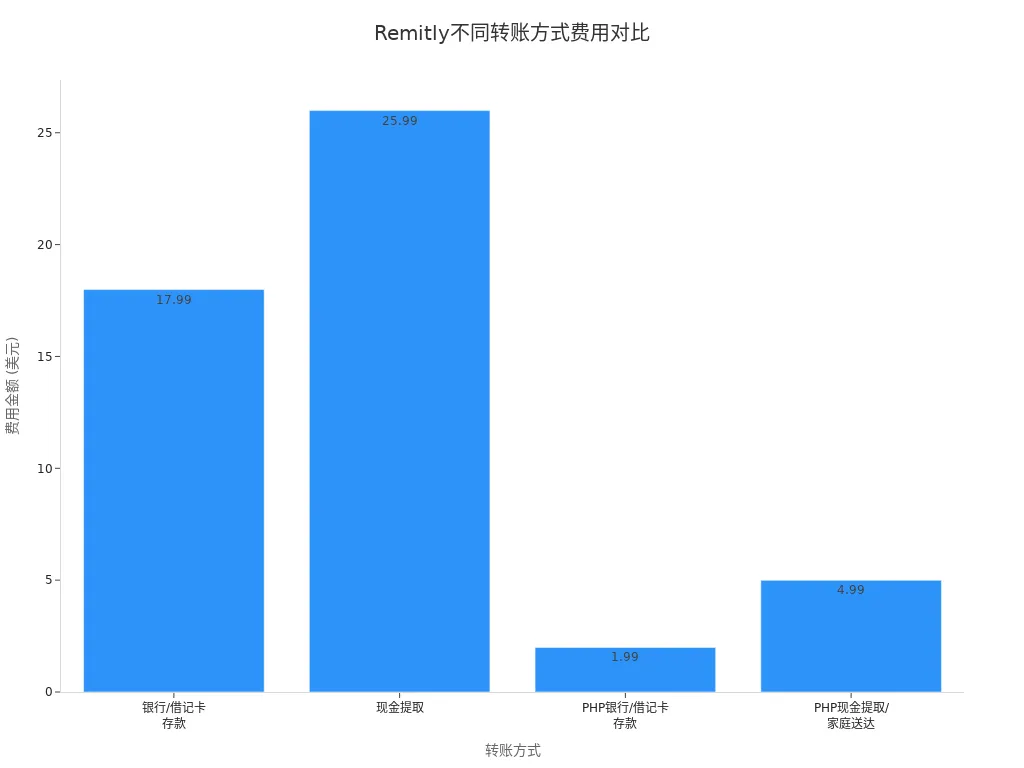

When using Remitly for international transfers, fees vary based on the transfer amount, destination, and receipt method. Remitly’s fee structure is generally more competitive than traditional banks. You can choose bank/debit card deposits, cash pickups, or local currency receipts, with clear fees for each method. The table below shows typical fees for different transfer methods and amounts:

| Transfer Amount | Fee Type | Fee Amount (USD) |

|---|---|---|

| 2000 USD | Bank/Debit Card Deposit | $17.99 (0.75% + $2.99) |

| 2000 USD | Cash Pickup | $25.99 (1.25% + $2.99) |

| 2000 USD | Local Currency (PHP) Bank/Debit Card Deposit | $1.99 |

| 2000 USD | Local Currency (PHP) Cash Pickup/Home Delivery | $4.99 |

You can visually compare the fee differences for various transfer methods in the chart below:

Remitly’s fees remain transparent globally. You can see all fees clearly before transferring, with no worry about additional charges later. For new users, Remitly offers include a fee-free first transfer, allowing you to experience the service without paying any fees.

Tip: Choosing bank transfers typically incurs lower fees. If you use a credit card, there may be an additional 3% surcharge. Compare payment method fees carefully before transferring.

Exchange Rates

When using Remitly for transfers, the exchange rate is a key factor affecting total costs. Remitly adds a margin to the mid-market exchange rate, typically between 1% and 2%. You can see the exchange rate directly before confirming the transfer, and Remitly does not hide any rate information. The list below summarizes Remitly’s exchange rate features:

- Remitly includes a 1-2% margin above the mid-market rate in its offered rates.

- The rate margin covers operational costs and profit, ensuring sustainable platform operations.

- You can view the exchange rate in real-time before transferring, avoiding unexpected losses due to rate fluctuations.

Remitly’s exchange rate transparency surpasses many traditional banks. You can always check the latest rates to ensure competitive pricing for each transfer. Remitly offers not only apply to fees but also to exchange rates, keeping your overall costs lower.

Note: Exchange rate margins are common among international remittance platforms. Remitly informs you of the actual rate in advance, helping you make informed choices.

Hidden Fees

When using Remitly, you don’t need to worry about hidden fees. Remitly displays all fees clearly before the transfer, including transaction fees and rate margins. You can see the full fee breakdown before sending, ensuring the recipient receives the expected amount. The list below summarizes Remitly’s transparency advantages:

- Remitly provides clear, upfront fee disclosure with no hidden charges.

- All fees and rates are shown before the transfer, aiding informed decision-making.

- Real-time updates to rates and fees ensure you benefit from Remitly offers with every transfer.

Transparency is crucial when choosing a remittance service. Remitly builds user trust with clear fee displays and real-time rates. You can confidently use Remitly for international transfers without worrying about unexpected costs.

Tip: Take advantage of the fee-free first transfer and discount code promotions to further reduce remittance costs. Remitly offers make your transfers convenient and cost-effective.

Remitly Offers

Fee-Free First Transfer

After registering with Remitly, you can enjoy an exclusive offer of a fee-free first transfer. This Remitly offer is only for new users registering through a specific link and completing their first and second transfers. The system automatically waives the fee for the first successful transfer deposited into the recipient’s account or mobile wallet or withdrawn at a partner location. Credit card payments are not eligible for this offer. You can participate from June 26, 2025, to December 31, 2026. Each user is limited to one use. If you cancel the transfer or have insufficient funds, you will not qualify for the fee waiver.

The table below summarizes the fee-free first transfer terms:

| Term | Description |

|---|---|

| Eligibility | New users only, must register via specific link and complete first and second transfers |

| Successful Transfer Definition | Transfer must be deposited into recipient’s account or mobile wallet or withdrawn at partner location |

| Fee Waiver | First successful transfer is fee-free; credit card transactions excluded |

| Special FX Rate | Applies to first eligible transfer, subject to promotional cap |

| Transfer Discount | Applies to next eligible transfer after successful first transfer |

| Promotion Period | June 26, 2025, to December 31, 2026 |

| Other Restrictions | One-time use per person; canceled transfers or insufficient funds disqualify |

You can use the fee-free first transfer to experience Remitly’s low-cost international remittances. This allows you to save a fixed fee when transferring from mainland China or Hong Kong to the US, the Philippines, or other destinations.

Tip: For the first transfer, choose bank or debit card payment to avoid ineligibility due to credit card use.

Discount Code Promotions

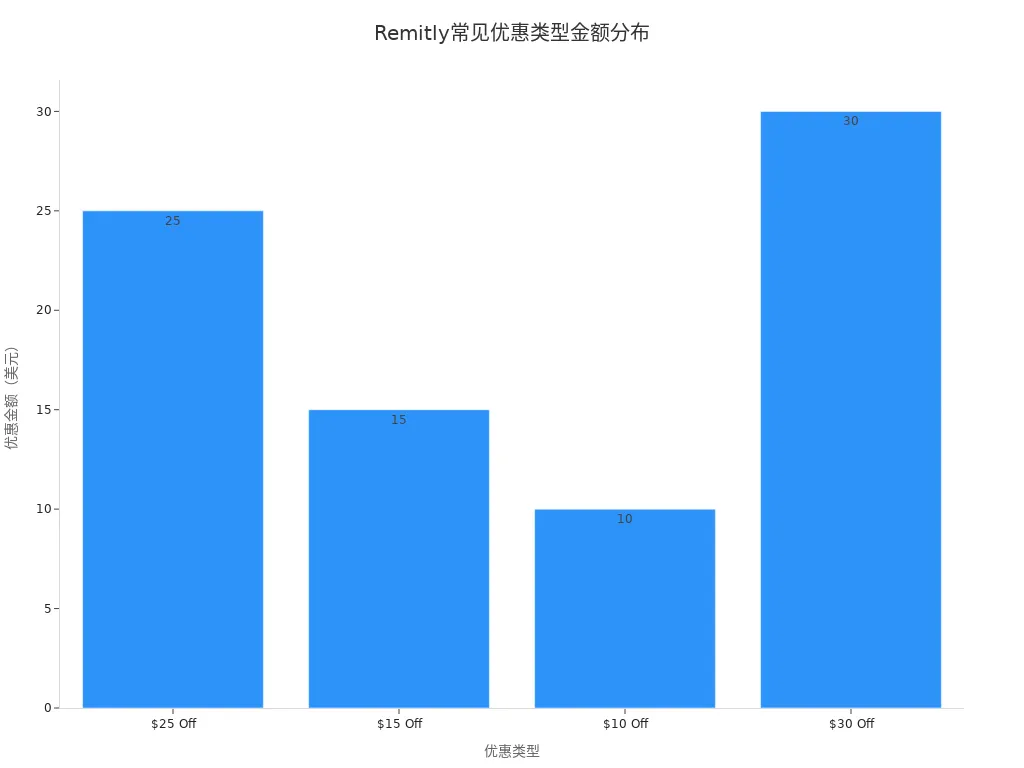

When using Remitly, you can also benefit from discount code promotions for additional savings. Remitly offers extend beyond the fee-free first transfer, frequently including fixed-amount discounts or percentage-based reductions. You can enter a discount code for specific transfer amounts to enjoy immediate fee reductions. For example, $15 off for transfers of $100 or more, $10 off for orders of $88 or more, and $10 off for first transfers to Pakistan. Some codes like POLBENEFIT offer up to $50 off.

The table below shows common discount codes and their conditions:

| Promo Code | Discount Amount | Conditions |

|---|---|---|

| POLBENEFIT | $50 | Specific transfer amounts |

| 15% Off | 15% | Orders of $100 or more |

| $10 Off | $10 | Minimum order of $88 |

| $15 Off | $15 | Orders of $100 or more |

| $10 Off | $10 | First transfer to Pakistan |

| $15 Discount | $15 | First transfer of at least $100 |

You can choose the appropriate discount code based on your transfer needs. Remitly offers include fixed-amount reductions and percentage discounts. The bar chart below shows the distribution of discount amounts across different offer types:

During promotional periods, using discount codes can significantly reduce fees and total costs. Remitly offers are frequent, so check for the latest promotions before transferring. This allows you to save more when sending money to family, friends, or partners, enjoying tangible financial benefits.

Tip: Prepare discount codes in advance and time your transfers to maximize Remitly offers and save more.

Convenience

Operation Process

When using Remitly for international transfers, you can follow these steps to complete the process:

- Create an account. You can register on the Remitly website or mobile app using your email address.

- Select the transfer currency, amount, and delivery speed. You can choose between economy or express options based on your needs.

- Choose the receipt method. You can select debit card deposits, cash pickups, or direct bank account deposits based on the recipient’s location.

- Enter the recipient’s name and relevant information. Ensure the details are accurate.

- Enter your payment information, confirm the transfer, and send.

The process is straightforward. You can complete all steps in minutes without complicated procedures. The system guides you through each step to ensure a smooth transfer.

Tip: Prepare recipient information and payment method in advance to complete the transfer faster.

Payment Methods

Remitly supports multiple payment methods to meet your needs in mainland China, Hong Kong, or the US. You can choose the most suitable option based on your situation:

- Cash pickup

- Mobile payment

- Home delivery

- Debit card deposit

- Direct bank account deposit

You can pay using a debit card or bank account from a licensed Hong Kong bank. Each method has different delivery speeds and fees. You can review details before transferring to select the best payment method.

Delivery Time

Remitly offers two delivery speed options. You can choose based on the urgency of your transfer:

| Transfer Option | Speed | Fees |

|---|---|---|

| Economy | A few days | Lower |

| Express | Within minutes | Higher |

If you choose economy transfers, delivery typically takes a few days. If you choose express transfers, recipients can receive funds in minutes, but fees are higher. Remitly’s delivery speed exceeds industry averages, especially for urgent transfers.

- Remitly economy transfers suit non-urgent needs with lower fees.

- Express transfers are ideal for immediate delivery, with slightly higher fees.

Limits

Remitly sets minimum transfer amounts for different countries to comply with local regulations and banking standards.

When transferring from mainland China or Hong Kong, you can select the appropriate amount based on platform prompts. Remitly adjusts maximum limits based on your account level and transfer history. You can check your transfer limits on the account page to ensure compliance.

Note: For large transfers, check limit policies in advance and plan transfer frequency and amounts accordingly.

Cost-Saving Tips

Exchange Rate Monitoring

Before transferring, closely monitor exchange rate changes. Remitly provides real-time rate updates, keeping you informed of market trends. You can view rates before transferring to understand costs clearly. Compared to traditional banks, Remitly’s rates are typically more competitive. Transparent pricing lets you choose optimal transfer times, avoiding losses from rate fluctuations.

- Remitly updates rates in real-time, ensuring access to current market prices.

- You can view rates before transferring to make informed decisions.

- Transparent fees and rates clarify every expense.

Tip: Use Remitly’s rate alert feature to set a target rate and transfer when it’s reached.

Timing Transfers

You can save costs by timing transfers wisely. Exchange rates fluctuate daily, and experienced users transfer when rates are favorable. You can set rate alerts and wait for optimal timing. If you plan multiple transfers, consider consolidating them. Remitly sometimes offers fee waivers or discounts for large transfers, so combining small transfers into one larger one can maximize savings.

- Strategically time transfers to choose favorable rate periods.

- Consolidate multiple transfers to leverage large-amount promotions and reduce total fees.

Tip: Plan transfers in advance to avoid frequent small transfers during unfavorable rates or without promotions.

Leveraging Promotions

You can further reduce costs by participating in Remitly’s promotional offers. Remitly launches “no transfer fee” promotions during holidays, cultural events, or global campaigns. Stay updated via app notifications, emails, or social media for the latest offers. New users typically enjoy a fee-free first transfer, limited to one use per customer. Some promotions require claiming codes via specific links and entering them during transfers.

- Monitor promotions during holidays or special events.

- Stay updated via app notifications, emails, or social media.

- New users can claim a fee-free first transfer by using the provided code.

Reminder: Leverage Remitly offers to save more on transfers.

Comparison Analysis

Fee Comparison

When choosing an international remittance service, fees are a key factor. Remitly’s fee structure is generally more favorable than traditional banks. The table below compares fee differences across services:

| Service Type | Average Fee (%) | Traditional Bank Fee (USD) |

|---|---|---|

| Remitly | 6.65 | N/A |

| Traditional Bank | N/A | 15 - 65 |

For a $200 transfer via Remitly, the average fee is 6.65%. Traditional bank fees typically range from $15 to $65. Remitly’s fees are transparent, with all costs disclosed upfront. You won’t face hidden charges.

- Remitly’s fees are generally lower than traditional banks.

- You can see all fees clearly before transferring.

- Traditional banks have high fees and complex processes.

Convenience Comparison

When using Remitly, you experience the convenience of digital operations. You can complete transfers on your phone or computer without visiting physical branches. Remitly supports multiple payment methods, including debit cards or bank accounts from licensed Hong Kong banks, cash pickups, and more. You can flexibly choose delivery methods based on recipient needs. For delivery speed, Remitly’s express service completes transfers in minutes, while economy options suit non-urgent needs.

In contrast, traditional banks often require in-person visits, with cumbersome procedures and longer delivery times. Other digital platforms may offer online operations but have inconsistent delivery speeds or limited payment options. Remitly excels in global coverage and delivery speed, ideal for diverse remittance needs from mainland China or Hong Kong.

Tip: For efficiency and flexibility, Remitly’s digital process and diverse payment options enhance your transfer experience.

User Experience

User experience is critical when choosing a remittance platform. Remitly is praised for its user-friendly interface and fast, reliable service. The table below compares the pros and cons of different platforms:

| Service Provider | Pros | Cons |

|---|---|---|

| Remitly | Easy to use, fast and reliable, competitive rates | Account suspensions, verification delays, some high fees, occasional technical issues |

| Western Union | Fast and reliable | High fees, average customer service |

| Wise | Low fees, easy to use, fast transactions | Account closures, slow customer service response |

Remitly’s strengths include a friendly interface, competitive rates, fast delivery, and wide global coverage. You can complete operations easily and track progress in real-time. Some users note room for improvement in account verification and customer support. Prepare required documents in advance and contact customer service promptly if issues arise.

Note: When choosing a platform, consider fees, convenience, and user experience to select the best international remittance service.

With Remitly, you can enjoy low fees, transparent rates, and diverse transfer options. The table below compares Remitly’s key advantages with traditional services:

| Feature | Remitly | Traditional Services |

|---|---|---|

| Fees | Low, no hidden charges | High, often with hidden fees |

| Speed | Minutes to deliver | May take days |

| User Experience | User-friendly platform, convenient operations | In-person visits, cumbersome processes |

You can regularly monitor fees and rates and time transfers to improve efficiency. Choosing the right service makes remittances from mainland China or Hong Kong more cost-effective and hassle-free.

FAQ

What payment methods does Remitly support?

You can use credit cards, debit cards, bank accounts, or debit cards from licensed Hong Kong banks. Each method has different delivery speeds and fees. You can choose flexibly based on your needs.

How long does it take for a transfer to arrive?

With express delivery, recipients can receive funds in minutes. Economy delivery typically takes a few days. You can check estimated delivery times before transferring.

How do I use the fee-free first transfer offer?

After registering with Remitly, complete your first transfer via the specified link and ensure successful delivery to enjoy the fee waiver automatically. Note that credit card payments are not eligible.

Are there minimum or maximum transfer limits?

Each transfer has a minimum amount, typically starting at 5 USD. Maximum limits vary based on your account level and transfer history. You can check specific limits on the account page.

How do I contact customer service if I encounter issues?

You can reach Remitly’s customer service via the website, in-app chat, or email. Have your account details and transfer reference number ready for quick assistance.

While Remitly offers transparent fees and fast transfers, its average 6.65% cost, 1–2% exchange rate markup, and economy delivery taking several days can hinder efficiency for frequent or high-volume transfers. If you’re seeking lower fees, real-time rate control, and investment flexibility, traditional remittance platforms fall short.

BiyaPay delivers a smarter solution: fees as low as 0.5%, with same-day transfers to most countries. Use the real-time exchange rate calculator to lock in optimal fiat-to-crypto conversion rates and avoid hidden spreads. Fast, fully digital registration gets you started in minutes—no lengthy verification needed.

Beyond sending money, BiyaPay enables zero-fee contract orders and direct access to US and Hong Kong stocks without an overseas account—turning transfers into growth opportunities. Seamlessly manage global payments and investments in one place. Sign up today and transform cross-border finance into a low-cost, high-efficiency experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.