- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram Exchange Rate Guide - How to Get the Best Remittance Deals and Save Costs

Image Source: unsplash

When you are remitting money globally, you often focus on how to get the best remittance deal and save on fees with MoneyGram. MoneyGram currently ranks 6th in the global remittance market, holding significant market influence. You can check exchange rates and fees in real-time through the MoneyGram website or app. Fees and exchange rates vary significantly among different providers. For example, MoneyGram’s average fees range from $1.99-$6.99, with a global average fee of 6.49% and an average of 4.6% for digital remittances. Choosing the right channel and timing can help you reduce costs.

Key Points

- Before remitting, always check the latest exchange rates on the MoneyGram website or app to ensure you get the best deal.

- Choose the right remittance timing, monitor exchange rate changes, and avoid remitting during periods of high volatility to save on costs.

- Compare fees and exchange rates of different remittance providers using tools like Monito to find the most suitable channel for you.

- Pay attention to MoneyGram’s promotional activities, join reward programs, and use discounts to reduce remittance fees.

- Beware of hidden fees and carefully review all fee structures to ensure transparency and safety for every remittance.

Getting the Best Remittance Deal

Image Source: unsplash

Real-Time Exchange Rate Checking

Before remitting, you should prioritize checking the latest exchange rates on the MoneyGram website or app. MoneyGram adjusts exchange rates in real-time based on market conditions, often changing hourly or even minute by minute. You can compare MoneyGram’s rates with other providers (such as the Monito exchange rate comparison tool) to find the best remittance deal.

Tip: You can directly enter the remittance amount and currency on the MoneyGram homepage, and the system will automatically display the current exchange rate and estimated received amount. This way, you can clearly understand the actual cost of each remittance.

You can also use third-party platforms to check real-time exchange rates and fees of different providers. This allows you to quickly identify channels with better rates and lower fees, improving remittance efficiency.

Factors Affecting Exchange Rates

When seeking the best remittance deal, you need to understand the main economic factors affecting MoneyGram exchange rates. The table below summarizes common factors and their explanations:

| Economic Factor | Explanation |

|---|---|

| Market Exchange Rate | Exchange rates fluctuate constantly based on the supply and demand of different currencies, potentially changing within a day or even an hour. |

| MoneyGram Fees | Include operational fees, foreign exchange transaction fees, and other costs related to processing international transfers. |

| Destination Country and Currency | The country receiving funds may have stricter regulations or higher fees, affecting the final exchange rate. |

You also need to pay attention to global economic trends and geopolitical events when remitting. Exchange rates play a critical role in international remittances, directly affecting your remittance costs and the received amount. MoneyGram converts funds based on the current exchange rate into the recipient’s local currency. Exchange rate fluctuations are influenced by market conditions, global economic trends, and geopolitical events. For example, significant policy changes in the U.S. market may cause USD exchange rates to fluctuate significantly, increasing the cost of cross-border payments.

- Exchange rate fluctuations may lead to higher fees.

- MoneyGram applies the current exchange rate when converting funds, which may increase the overall transfer cost.

- Policy changes in the destination country also affect exchange rates and fees.

Choosing Remittance Timing

When aiming for the best remittance deal, choosing the right timing is crucial. Exchange rates change daily, and you can monitor them for a period to select times with higher rates or lower fees for remitting.

Tip: You can follow the exchange rate trends on the MoneyGram website and combine them with historical data from tools like Monito to gauge recent rate movements. If you find favorable rates, remitting promptly can effectively save costs.

You can also predict potential exchange rate movements based on U.S. market economic news or major events. In most cases, avoiding periods of high exchange rate volatility and choosing times when rates are stable or rising can offer better value. By flexibly choosing remittance timing and combining real-time checking with multi-channel comparisons, you can continuously improve your remittance experience and achieve the best deal.

Fees and Savings

Image Source: pexels

Fee Structure

When using MoneyGram for international remittances, fees consist of two main components: fixed transaction fees and exchange rate margins. MoneyGram charges different fees based on your remittance amount, destination country, and payment method. You can refer to the table below to understand the fee structure for different scenarios:

| Amount Sent | Destination Country | Payment Method | Fee |

|---|---|---|---|

| 500 USD | Mexico | Credit Card | 25 USD |

| 500 USD | Mexico | Cash | 5 USD |

| Various Amounts | Various Countries | Various Methods | 4.99-49.99 USD |

You also need to note that MoneyGram adds a margin to the exchange rate. This fee is not separately displayed but is reflected in the actual amount converted.

- MoneyGram does not use the mid-market exchange rate but adds a markup to the rate.

- This markup increases your total remittance cost.

- The exchange rate margin directly affects the amount the recipient actually receives.

When choosing the best remittance deal, you must consider both transaction fees and exchange rate margins. This allows you to calculate your actual costs more accurately.

Fee Comparison

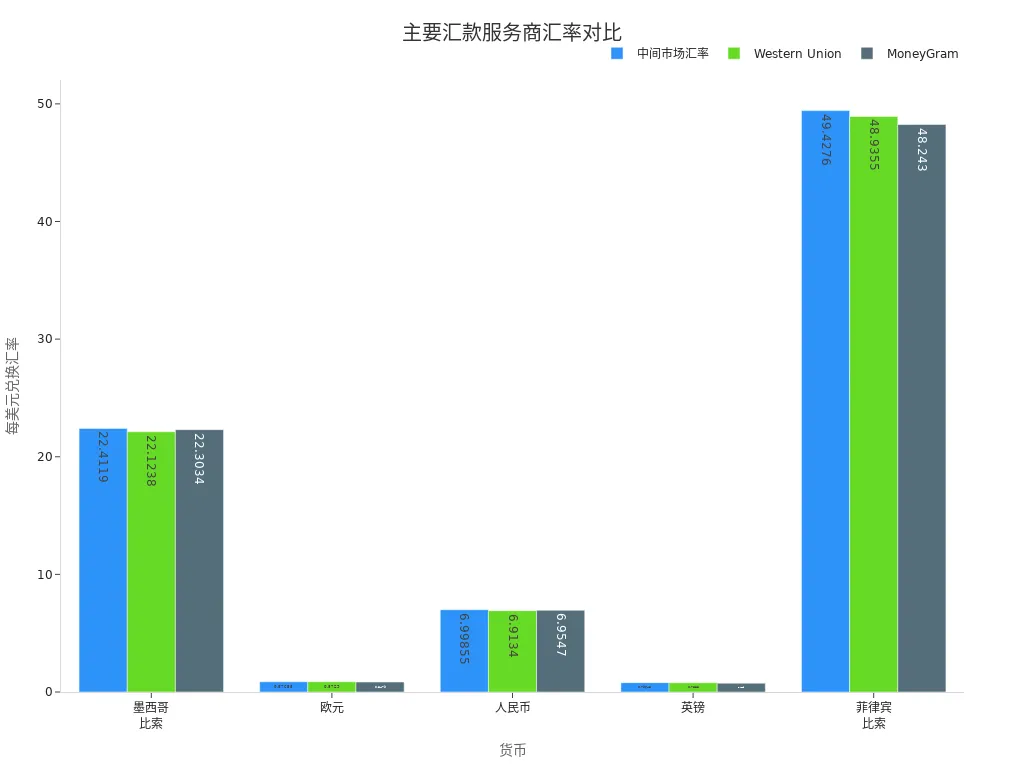

To achieve the best remittance deal, you should compare fees and exchange rates across different remittance providers. The table below shows a comparison of MoneyGram with other major providers for different currencies:

| Provider | You Pay | Exchange Rate | Fee | Recipient Receives |

|---|---|---|---|---|

| Western Union | USD1,000 | 22.1238 | No Fee | MXN22,124.00 |

| Wise | USD1,000 | 22.4230 | USD11.11 | MXN22,173.88 |

| Currency | Mid-Market Rate | Western Union Rate | MoneyGram Rate |

|---|---|---|---|

| Mexican Peso | 1USD=22.4119 | 1USD=22.1238 | 1USD=22.3034 |

| Euro | 1USD=0.87658 | 1USD=0.8729 | 1USD=0.8479 |

| Chinese Yuan | 1USD=6.99855 | 1USD=6.9134 | 1USD=6.9547 |

| British Pound | 1USD=0.79648 | 1USD=0.7888 | 1USD=0.7509 |

| Philippine Peso | 1USD=49.4276 | 1USD=48.9355 | 1USD=48.2430 |

You can use third-party tools like Monito to quickly compare MoneyGram’s fees and rates with other providers to find the most suitable channel. For example, Monito displays real-time fees and exchange rates of major providers, helping you make informed choices.

| Service Provider | Comparison Link |

|---|---|

| MoneyGram | MoneyGram vs Xoom |

When comparing, it’s advisable to consider fees, exchange rates, and transfer speed simultaneously. This allows you to make a comprehensive judgment and choose the most cost-effective remittance deal.

Promotional Offers

MoneyGram frequently launches promotional activities to help you save on remittance fees. You can access more discounts through the following methods:

| Promotion Type | Details |

|---|---|

| MoneyGram Plus Rewards | Register to receive a 20% discount on your next transfer fee, with accumulated points redeemable for future transfer discounts. |

| Refer-a-Friend Program | Invite friends to complete their first transfer, and both parties can enjoy a fee-free transaction. |

| New User Offers | First-time users can receive welcome gifts, special promo codes, or fee waivers for their first transaction. |

You can also enjoy free transfers or special discounts during holidays or the start of the academic year. MoneyGram shares the latest promotional information through its website, social media, and email.

Tip: You can register for the MoneyGram Plus Rewards program to receive a 20% discount on transfer fees and accumulate rewards with each transaction for additional benefits.

MoneyGram’s promotional offers are frequently updated and vary by region. You should regularly check the MoneyGram website and social media for the latest discount information. This can further reduce your remittance costs on top of achieving the best deal.

Avoiding Hidden Fees

When remitting, in addition to focusing on visible transaction fees and exchange rates, you must beware of hidden fees. Common hidden fees include:

- Transaction fees

- Currency exchange markups

- Cancellation fees (typically between 15 USD and 35 USD)

You can identify and avoid these hidden fees through the following methods:

- Specify the payment amount

- Choose online or offline processing methods

- Pay attention to payment methods (e.g., credit card, debit card, cash)

- Understand the different fees for receiving and payment methods

- Note whether currency conversion is involved

You can use MoneyGram’s fee estimator tool to understand all potential fees in advance. MoneyGram also implements several transparency measures to help you avoid unexpected costs:

| Transparency Measure | Explanation |

|---|---|

| Regular Fee Checks | MoneyGram recommends checking the latest fees and exchange rates before transferring to avoid unexpected costs. |

| Email Notifications | You can subscribe to email notifications for real-time updates on fees and promotions. |

| Understand Fee Structure | Ensure you understand the full fee structure before initiating a transaction to avoid surprises. |

When choosing a remittance channel, prioritize platforms with transparent fee structures and no hidden costs. This ensures that every remittance is efficient, secure, and truly low-cost, achieving the best deal.

Operation Process

Account Registration and Verification

Before using MoneyGram for remittances, you need to register an account on the MoneyGram website and complete identity verification. The registration process is straightforward and typically includes the following steps:

- Enter your full name, residential address, phone number, and email address.

- Create a username and password for future account login.

- Link a payment source, such as associating a credit or debit card with the account.

- Upload identification documents, such as a driver’s license or passport, for identity verification.

You need to prepare the following information for identity verification:

| Required Information | Explanation |

|---|---|

| Name | Must provide full name |

| Residential Address | Cannot be a P.O. box |

| Phone Number | Must provide a valid phone number |

| Social Security Number or ITIN | Used for identity verification |

| Date of Birth | Must provide date of birth |

| Valid Government-Issued ID | Must provide a valid and unexpired ID |

Filling in Information

After registration, you need to fill in recipient details and remittance information. This mainly includes:

- Recipient details (e.g., name, address, contact information)

- Payment information (e.g., remittance amount, currency)

- In some cases, the system may require additional information to ensure fund safety and compliance

You should ensure all information is accurate to avoid delays or failures in the remittance.

Choosing a Method

You can choose different payment and receiving methods based on your needs. Common payment methods include:

- Online payment using credit or debit cards (Visa, MasterCard)

- Some countries/regions also support other online payment options

Different payment methods affect fees and transfer speed. You can refer to the table below:

| Payment Method | Fee | Transfer Speed |

|---|---|---|

| Direct Transfer to Debit Card | Cheapest option | Usually completed within minutes |

| Cash Pickup | Significantly higher fees | May take one or several days |

| Standard Service | Moderate fees | May take several days to complete |

You can choose the most suitable method based on your needs, balancing cost and transfer speed.

Checking Rates and Fees

After selecting the payment and receiving method, the system will automatically display the real-time exchange rate and fees. You can:

- Track transfer progress online to check the latest rates and fees at any time

- Compare transfer fees and exchange rates of different providers to choose the most cost-effective option

- Note that rates and fees may change at any time, so verify again before confirming

Friendly Reminder: Before each remittance, always verify all fees and exchange rates to ensure fund safety and accurate received amounts.

Risks and Compliance

Preventing Fraud

When using MoneyGram for remittances, you must remain highly vigilant against various fraud schemes. Common tactics used by scammers include:

- Posting low-priced items online or in newspapers, requiring payment via MoneyGram.

- Posing as relatives or lawyers, claiming urgent need for funds to resolve issues.

- Requesting fees under the guise of loans.

- Sending fake checks or money orders, inducing you to cash them and transfer funds.

- Building relationships via social platforms and then requesting remittances.

- Targeting seniors for identity theft or financial fraud.

You should carefully verify recipient information before remitting. Stay cautious when strangers request funds. Always confirm recipient details. If you suspect fraudulent activity, contact MoneyGram customer service immediately and report suspicious transactions.

Compliance Requirements

During the MoneyGram remittance process, you must comply with international anti-money laundering and anti-fraud regulations. MoneyGram strictly enforces compliance procedures, with specific measures as follows:

| Compliance Requirement | Specific Measures |

|---|---|

| Legal Compliance | Understand and adhere to local laws and regulations |

| Company Policies | Follow MoneyGram’s internal policies and procedures |

| Anti-Money Laundering Standards | Implement strict anti-money laundering and anti-fraud standards |

| System Protection | Prevent illegal activities and protect employee and customer data |

| Information Review | Regularly review compliance processes and conduct anti-money laundering training |

You need to complete identity verification and submit valid identification documents during remittances. MoneyGram regularly reviews compliance procedures to ensure every transaction is legal and compliant. When conducting related transactions with mainland China or Hong Kong licensed banks, you must also comply with local regulatory requirements.

Information Security

When remitting via the MoneyGram platform, the security of your personal information and funds is critical. MoneyGram employs multiple security technologies to protect your data:

- Uses advanced encryption technology to secure sensitive information.

- Implements strict access controls, allowing only authorized employees to view user information.

- Continuously monitors systems to detect suspicious activity promptly.

- Employs firewall technology to prevent unauthorized access.

- Complies with relevant privacy laws and regulations to ensure compliant information handling.

In the event of a data breach or security incident, MoneyGram will proactively notify you and recommend closely monitoring your account statements and credit reports. The company also provides two years of identity protection and credit monitoring services at no cost to affected users. You should remain vigilant, regularly check your accounts, and guard against potential risks.

You can check exchange rates in real-time through the MoneyGram website and app, compare providers, and choose the best remittance timing. You should pay attention to transaction fees and exchange rate margins, using promotional offers to reduce costs. Regularly check for fee changes to avoid hidden costs. Combine your needs with the tips in this guide. Continuously monitor market dynamics and reasonably mitigate risks to ensure the safety of your funds.

FAQ

How do I check MoneyGram’s real-time exchange rates and fees?

You can log into the MoneyGram website or app, enter the remittance amount and currency, and the system will automatically display the current exchange rate and fees. You can also use third-party tools for comparisons.

What information is needed for remittances to mainland China or Hong Kong licensed banks?

You need to provide the recipient’s name, bank account number, bank details, and contact information. Ensure all information is accurate to avoid remittance delays.

What are MoneyGram’s remittance limits?

The per-transaction limit is typically USD10,000. Specific limits vary by destination country and payment method. You can check detailed regulations on the MoneyGram website.

How can I avoid hidden fees during remittances?

You should carefully review all fees, including transaction fees and exchange rate margins, before remitting. Use MoneyGram’s fee estimator tool and choose transparent remittance channels to avoid unexpected costs.

What happens to funds if a remittance fails?

If a remittance fails, MoneyGram will refund the funds to the original payment account. You can contact MoneyGram customer service to check the refund status and reasons to ensure fund safety.

Are you tired of high fees and unclear exchange rates with traditional remittance services like MoneyGram? For a smarter, more cost-effective way to send money abroad, consider BiyaPay.

We enable seamless conversion between fiat and digital currencies like USDT, helping you bypass costly intermediaries. Enjoy transfer fees as low as 0.5%—saving up to 90% compared to conventional methods. Use our real-time exchange rate tool to lock in favorable rates and maximize your transfer value.

No overseas bank account? No problem. Sign up in under 3 minutes and send money globally with same-day delivery. Plus, manage both U.S. and Hong Kong stocks from one integrated platform for greater financial flexibility.

Start today on BiyaPay and discover a faster, more transparent way to transfer money and invest across borders.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.