- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Transferring Money to GCash from the US: A Comprehensive Guide

Image Source: unsplash

Do you want to know the safest and fastest way to transfer money from the US to GCash? You can choose third-party platforms, e-wallet services, or international remittance companies. Simply prepare the recipient’s GCash mobile number, enter the amount, and confirm the details to complete the transaction. Most platforms support online operations, with simple processes and high security. You can select the most suitable channel based on your needs.

Key Points

- Choose the right transfer method. You can use third-party platforms, bank wire transfers, or Western Union, selecting the channel that best suits your needs.

- Ensure information accuracy. When filling in the recipient’s GCash mobile number and name, double-check to avoid transfer failures due to errors.

- Understand fees and transfer times. Different platforms have varying fees and transfer speeds, and knowing these in advance helps you plan your funds effectively.

- Complete KYC verification. Ensure your GCash account is fully verified to smoothly receive remittances from the US.

- Take advantage of promotions. Using platform promotional offers can reduce transfer fees and improve fund efficiency.

Methods for Transferring Money from the US to GCash

Third-Party Platforms

You can choose from various third-party platforms to transfer money from the US to GCash. These platforms typically support online operations, with simple processes, ideal for users seeking quick remittances. You only need to register an account, enter the recipient’s GCash mobile number and amount, and the system will automatically process the remittance. Most platforms set limits on per-transaction and monthly totals to ensure fund security.

| Transaction Type | Limit Amount |

|---|---|

| Maximum Per Transaction | $900 per recipient daily (first-time transfers to GCash accounts limited to $540 daily) |

| Recipient’s Monthly Income Limit | $1,800 per recipient monthly |

| GCash Wallet Limit | $1,800–$9,000 per GCash account (depending on recipient’s account status) |

When choosing a third-party platform, you can focus on the following security measures:

- Restricted Access: Only specific individuals can view your personal information.

- Encryption: Platforms encrypt your information to ensure secure data transmission and storage.

- Multi-Factor Authentication: You need to pass multiple identity verifications to access your account, further enhancing security.

Third-party platforms are suitable for users prioritizing convenience and speed. You can initiate transfers from the US to GCash anytime, anywhere, ideal for daily small-amount remittances or urgent funding needs. Some platforms support real-time transfers, but fees and exchange rates should be checked in advance.

Bank Wire Transfer

If you prefer traditional methods, you can opt for a bank wire transfer to send money from the US to GCash. You need to find a service provider that supports transfers from US bank accounts to GCash, register and link your US bank account, provide the bank routing number and account number, then enter the transfer amount and confirm details.

- You need to prepare your US bank account information, including the routing number and account number.

- You need to register and complete identity verification.

- You enter the transfer amount, confirm the recipient’s GCash mobile number, and other relevant information.

The advantage of bank wire transfers is the formal source of funds, making it suitable for large transfers and users with long-term financial transactions. The downside is longer transfer times, typically 1–5 business days, with higher fees, usually 3% to 10%. You need to plan your funds in advance to avoid delays impacting the recipient.

| Transfer Method | Processing Time | Fees |

|---|---|---|

| GCash | 1–2 business days, up to 5 days | 1% standard transaction fee for USD to PHP |

| Bank Wire Transfer | May take longer | 3% to 10% transaction fees |

| Remittance Center | May be faster | N/A |

Western Union

Western Union offers multiple convenient ways to transfer money from the US to GCash. You can choose to operate online, via mobile app, or at physical locations. Western Union has a global network of 500,000 agent locations, making it ideal for users without bank accounts or those needing cash-based operations.

| Transfer Method | Maximum Sending Limit |

|---|---|

| Sending to GCash Mobile | $500/day/card account |

- You can initiate transfers via Western Union’s website, mobile app, or physical locations.

- You only need to provide the recipient’s GCash mobile number and relevant information.

- Funds typically arrive within minutes, suitable for urgent remittance needs.

Western Union’s advantages include fast speed and operational flexibility. You can choose cash or card payments, ideal for recipients without e-wallets or bank accounts. The downside is lower daily limits, with fees varying based on the amount and payment method.

PayPal

PayPal provides a seamless experience for transferring money from the US to GCash. You simply link your PayPal account to GCash to transfer PayPal balances to GCash anytime. The process is straightforward, ideal for users frequently receiving PayPal payments or with international business transactions.

- You log into GCash and click on cash-in.

- Select global partners and remittances, then click PayPal.

- Enter the cash-in amount and click next.

- Review and confirm the amount to complete the transfer.

PayPal transfers to GCash have no withdrawal fees, as long as your PayPal balance is in PHP. If you hold USD or other foreign currency balances, you need to convert to PHP within PayPal, which incurs currency conversion fees.

| Feature | GCash | PayPal |

|---|---|---|

| Fees | Free account creation, minimal transaction fees, variable cash-in/out fees | Free account setup, business transaction fees, currency conversion fees, bank withdrawal fees |

| Security | Biometric authentication, PIN protection, real-time transaction notifications | Buyer and seller protection policies, two-factor authentication, encryption, and anti-fraud measures |

| Customer Support | 24/7 customer hotline, in-app support chat, email support | Online resolution center, email and phone support, community forum |

PayPal is suitable for users with international payment needs or frequent e-wallet usage. You can enjoy high security and convenient customer support. The downside is potential extra fees for currency conversion, with transfer speed depending on PayPal and GCash processing efficiency.

Steps for Transferring Money from the US to GCash

Image Source: unsplash

When transferring money from the US to GCash, you need to follow several key steps. Each platform’s specific process may vary, but the core steps are generally consistent. Below is a detailed explanation of each step to help you complete the remittance effortlessly.

Account Creation

You first need to create an account on the chosen platform. Whether it’s a third-party platform, bank wire transfer, or e-wallet service, you are required to provide basic information, including your name, email, and US bank account details. Some platforms may require you to upload identification documents to complete identity verification.

Tip: Ensure all information provided during registration is accurate to avoid delays in subsequent reviews.

GCash will send a verification code when you link your account, which you need to enter to confirm account security. After verification, you can proceed with transferring money from the US to GCash.

Information Entry

When filling in recipient information, you need to pay special attention to accuracy. Common requirements include:

- Entering the recipient’s name

- Entering the GCash mobile number

- Entering the GCash ID (required by some platforms)

- Entering the recipient’s email address (if applicable)

- Carefully verifying all information for accuracy

Incorrect information may lead to transfer delays or failures. You can refer to the platform’s entry guidelines to ensure every field is correct.

It’s recommended to double-check the recipient’s mobile number and name before submission to avoid delays due to minor errors.

Amount Selection

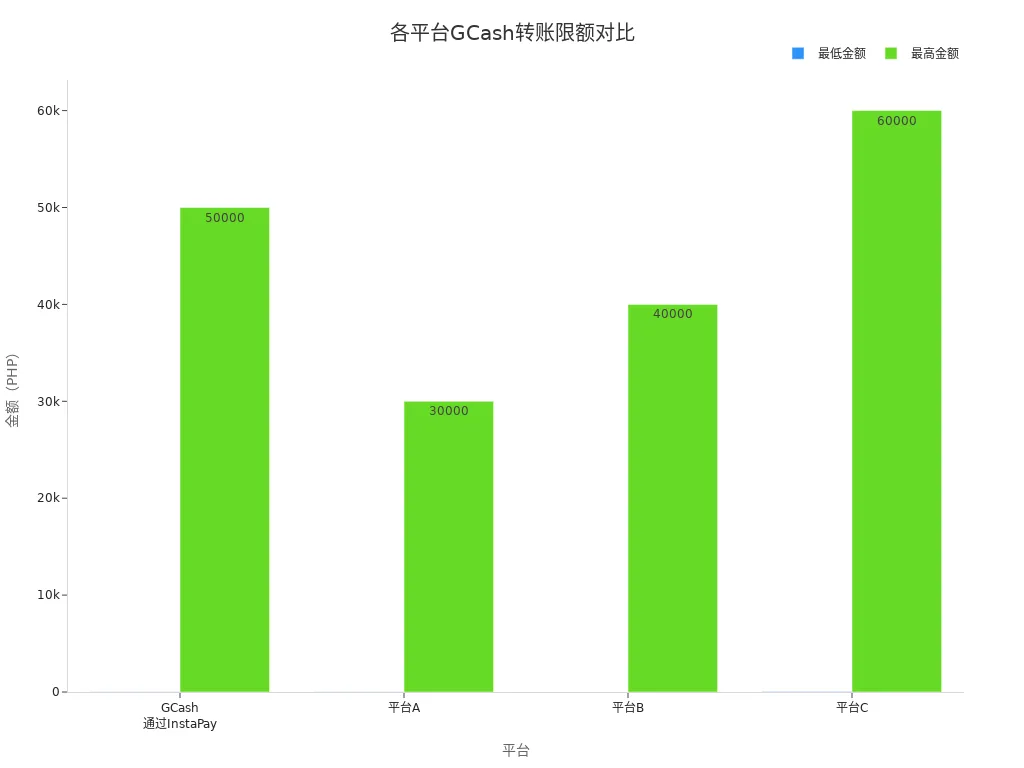

You can choose the transfer amount based on your needs. Different platforms have varying minimum and maximum amount restrictions. Below is a table of common platform amount limits (in USD):

| Cash-In Method | Minimum Amount | Maximum Amount |

|---|---|---|

| GCash via InstaPay | $0.27 | $900 |

| PayPal | $2 | $1,800 |

| Bank Wire Transfer | $10 | $9,000 |

Your daily transfer total must not exceed the platform’s daily limit. If you need to increase the limit, you can submit additional verification requests.

Different platforms have varying fees and limits, so it’s recommended to review relevant policies in advance to plan your funds effectively.

Details Confirmation

Before submitting the transfer, you need to carefully confirm all transaction details, including:

- Verifying the recipient’s GCash mobile number is correct

- Confirming the transfer amount and fees

- Checking the recipient’s account status

- Monitoring transaction confirmation emails or SMS notifications sent by the platform

Some platforms display estimated transfer times and possible small processing fees. You need to ensure the GCash wallet balance is sufficient to avoid transfer failures due to insufficient funds.

You can check the transaction status in your platform account at any time to stay updated on fund movements.

Reference Number

Every US-to-GCash transaction automatically generates a unique reference number. This number is used to track and verify transaction progress. You will receive this number after the transaction is completed, which can be provided to the platform or GCash customer service for quick issue resolution.

- The reference number is generated after transaction processing is complete

- Used to track transaction status and verify payments

- Required when contacting GCash customer service

It’s recommended to save the reference number for each transaction for future inquiries or disputes.

Common Challenges and Solutions

During the US-to-GCash transfer process, you may encounter some challenges. The table below summarizes common issues and explanations:

| Challenge Type | Details |

|---|---|

| Funding Method Restrictions | GCash can only be funded through Philippine bank accounts or local payment methods; US users need to select platforms supporting international remittances. |

| Security Concerns | You must comply with US and Philippine regulations, noting transaction amount limits and required documentation. |

| Transfer Failures | May occur due to insufficient account balance, network issues, or server failures; check account and network status in advance. |

You can reduce the risk of transfer failures by:

- Maintaining sufficient account balance

- Avoiding peak-hour operations to reduce network congestion

- Monitoring platform announcements for system maintenance schedules

The US-to-GCash transfer process is generally straightforward, with platforms offering multiple payment methods and security measures. By following the steps above, you can complete remittances smoothly.

Requirements and Verification

KYC Process

When transferring money from the US to GCash, you must complete the KYC (Know Your Customer) process. KYC is a critical step for ensuring account security and compliance. You need to follow these steps:

- Log into the GCash app and go to the profile page.

- Select “Verify Now” and click start.

- Read the verification requirements and click next.

- Enter the received verification code and proceed.

- Enter your birthdate and confirm you are a Philippine citizen.

- Select a government-issued ID for verification, upload ID photos, and complete a selfie scan.

- Review all account information and click submit.

After completing the KYC process, your GCash account will gain higher transfer limits and full functionality, allowing you to securely receive remittances from the US.

Account Verification

When using third-party platforms (e.g., Remitly) to transfer to GCash, you also need to complete account verification. You need to select the destination country and transfer amount on the platform, then choose GCash as the receiving method. The system will guide you to a secure login page to enter your GCash account credentials. After logging in, you need to authorize the platform to connect to your GCash account to ensure funds are transferred smoothly.

Account verification not only protects your funds but also prevents identity theft and illegal transactions. Always confirm the platform’s security and privacy policies during authorization.

Recipient Requirements

As a recipient, you must meet the following conditions to smoothly receive US remittances:

- Must have a fully verified GCash account.

- The received amount must not exceed the allowed wallet balance.

You need to check your GCash account status in advance to ensure all verification steps are completed. If your wallet balance is nearing its limit, it’s recommended to withdraw or transfer funds to a bank account promptly to avoid remittance failures due to balance restrictions.

Only by meeting all verification and account requirements can you efficiently and securely receive funds from the US to GCash.

Fees and Transfer Times

Fee Comparison

When choosing a channel for transferring money from the US to GCash, fees are a primary concern. Different platforms have varying fee structures and transparency. You can refer to the table below for a quick overview of the fee structures of major channels:

| Platform | Fee Type | Notes |

|---|---|---|

| GCash | Varies by payment method | Bank transfers are typically the cheapest option |

| Wise | Transparent fees | Many banks may have hidden fees |

| Other Banks | Low-fee advertising | May include hidden costs in exchange rates |

When using GCash or Wise, you can usually see detailed fee breakdowns. Some banks advertise low fees but may add extra costs through exchange rates during transactions. You can prioritize platforms with transparent fee structures to avoid unnecessary expenses.

It’s recommended to carefully review all fee details before transferring to ensure no hidden charges.

Transfer Times

Transfer times directly affect the efficiency of your fund usage. Different channels have noticeable differences in transfer speed. You can choose the appropriate method based on your needs:

- GCash Platform: Typically 1–2 business days, with some cases offering real-time transfers.

- Third-Party Platforms like Wise: Most complete within 1–3 business days.

- Bank Wire Transfers: May take 3–5 business days, slower during holidays or due to review processes.

- Western Union: Some channels enable transfers within minutes, ideal for urgent needs.

When selecting a channel, you can prioritize those with faster transfer times. If you have strict timing requirements, it’s advisable to avoid traditional bank wire transfers.

Supported Currencies

When transferring money from the US to GCash, the most commonly used currency is USD. Some platforms support multi-currency transfers, but funds are automatically converted to PHP. You can refer to the table below for common currencies and fee ranges:

| Supported Currency | Transfer Fee Range |

|---|---|

| USD | $3–$10 |

During transfers, platforms automatically convert based on real-time exchange rates. Some platforms charge currency conversion fees, so it’s advisable to review relevant policies in advance.

Choosing platforms that support multiple currencies with transparent fees can effectively reduce remittance costs and avoid exchange rate losses.

Receiving and Withdrawing in the Philippines

Image Source: pexels

GCash Withdrawal

After receiving a US remittance, you can withdraw funds directly from your GCash wallet. You can link your GCash account to a supported US bank or transfer to a licensed Hong Kong bank account. GCash supports withdrawals via local ATMs or counter services. You simply select “Cash Out” in the GCash app, enter the amount and bank details, and the system will process it automatically. Typically, funds arrive within 1–3 business days.

Ensure your account is fully verified before withdrawing to avoid failures due to unverified identity.

Bank Transfer

You can transfer your GCash balance to a licensed Hong Kong bank account. The process is simple: select “Bank Transfer” in the GCash app, enter the recipient bank account details and amount. The system will calculate fees and display the estimated transfer time. Bank transfers are suitable for large fund management, with fast transfer speeds. You can withdraw cash at bank counters or ATMs, offering convenience and flexibility.

It’s recommended to verify bank account details before transferring to ensure fund security.

Cash Pickup Points

You can also withdraw funds at GCash-partnered cash pickup points. Simply select “Cash Out” in the GCash app, generate a withdrawal code, and visit a designated location to process it. Note that GCash partner locations do not allow proxy or representative cash withdrawals; only fully verified users can complete withdrawals.

- You must personally visit to process cash withdrawals.

- You need to present valid identification and the GCash withdrawal code.

Notes

When withdrawing in the Philippines, you need to pay attention to fees and limits. The table below shows GCash ATM withdrawal fees and limits (in USD):

| Withdrawal Method | Fee Range (USD) | Maximum Per Withdrawal (USD) | Daily Maximum Withdrawal (USD) |

|---|---|---|---|

| GCash (ATM) | 0–0.32 | 355 | 710 |

Before withdrawing, ensure your account balance is sufficient to avoid failures due to limits. You should also protect personal information to avoid leaks of account details or withdrawal codes.

Fully verified GCash accounts enjoy higher withdrawal limits and more convenient services.

Comparative Analysis of Methods

Bank Remittance Comparison

When choosing a bank remittance method, you typically focus on fees, transfer speed, and convenience. Different platforms vary significantly. The table below helps you quickly compare major channels:

| Transfer Method | Fees | Speed | Convenience |

|---|---|---|---|

| Remitly | Varies by sending location, payment method, delivery speed, and amount | Economy may take days, express is near-instant | Requires account creation and recipient information entry |

If you choose a wire transfer through a licensed Hong Kong bank, you usually need to provide detailed account information, with stricter review processes. You can benefit from high fund security, but transfer times may be longer. Some third-party platforms offer more flexible options, suitable for users prioritizing speed and convenience.

Cash Channel Comparison

When considering cash channels, you’ll find digital and traditional cash channels each have pros and cons. Below is a list summarizing them:

- Advantages:

- You can conduct transactions anytime, anywhere, without visiting a bank.

- Transfers are fast, with some services arriving in minutes.

- Many services currently waive fees, saving costs.

- Disadvantages:

- Customer service response times can be slow, requiring patience for issue resolution.

- Systems may occasionally experience outages, affecting transaction progress.

- Digital channels carry certain security risks, so you need to protect your account.

If you value operational convenience and transfer speed, digital channels are preferable. If you prioritize fund security and face-to-face service, cash channels may be more suitable.

Promotional Offers

When using US-to-GCash transfer services, you can take advantage of periodic promotional offers. The table below summarizes common promotion types:

| Promotion Type | Description |

|---|---|

| Transfer Fee Discounts | GCash and US partners offer discounts on transfer fees. |

| Reward Points | Earn extra reward points when using the service. |

| Seasonal Promotions | Special promotions may be available during specific holidays or events. |

You can access more promotions by:

- Following GCash and international remittance service partnerships for transfer fee discounts.

- Earning reward points when using GCash as the receiving wallet.

- Regularly checking the GCash app or official website for the latest promotional updates.

By leveraging these promotions, you can effectively reduce transfer costs and improve fund efficiency.

When transferring money from the US to GCash, you should prioritize legitimate channels to ensure each step is secure. Carefully verify recipient information to avoid fund losses due to errors. You should also review each platform’s fees and transfer times to plan your funds effectively. It’s recommended to complete transactions via the GCash official website or partner platforms, and visit the site for assistance if issues arise.

FAQ

What basic information is needed for transferring money from the US to GCash?

You need the recipient’s GCash mobile number, name, and email. Some platforms also require the recipient’s GCash ID. Ensure all information is accurate.

It’s recommended to double-check the recipient’s mobile number and name before submission to avoid transfer failures.

How long does it take for a transfer to GCash to arrive?

Most platforms complete transfers in 1–2 business days. Some channels, like Western Union, arrive within minutes. Bank wire transfers may take 3–5 business days.

| Channel | Transfer Time |

|---|---|

| Third-Party Platforms | 1–2 business days |

| Bank Wire Transfer | 3–5 business days |

| Western Union | Minutes to 1 hour |

What verifications does a GCash recipient need to complete?

You need to complete GCash real-name verification and the KYC process. Only fully verified accounts can receive US remittances and enjoy higher limits.

After full verification, you can increase wallet limits for more convenient withdrawals.

Can I transfer directly from mainland China to GCash?

You cannot transfer directly from mainland China to GCash. You can use licensed Hong Kong banks or international third-party platforms, with funds settled in USD.

What are the fees for transferring to GCash?

You need to pay platform service fees and currency conversion fees. Fees vary by channel, typically ranging from $3–$10. Check fee details in advance.

| Fee Type | Range (USD) |

|---|---|

| Service Fee | $3–$10 |

| Currency Conversion Fee | Based on platform’s real-time exchange rate |

While services like Remitly, Western Union, and PayPal offer convenient ways to send money from the US to GCash, they often come with drawbacks—delays (1–3 days), hidden exchange rate markups (1–3%), and limited flexibility for withdrawals or investment use. If you’re seeking instant delivery, the best possible rates, or a way to turn remittances into growth, these platforms fall short.

BiyaPay delivers a smarter solution: fees as low as 0.5%, with same-day sending and same-day receipt across multiple regions, including seamless US-to-Philippines transfers. Use the real-time exchange rate calculator to lock in optimal USD-to-PHP conversion rates and avoid hidden spreads. Fast, fully digital onboarding gets you started in minutes—no US bank account or lengthy KYC required.

Beyond remittance, BiyaPay bridges payments and investing—trade US and Hong Kong stocks directly without a local PH account, with zero fees on contract orders. Turn cross-border transfers into growth opportunities. Whether for family support, overseas income management, or micro-investing, BiyaPay makes global money flows faster, smarter, and more rewarding. Sign up today and experience a new standard in cross-border finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.