- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Apple Pay Limit: How to Understand and Manage Your Transfer Limit

Image Source: unsplash

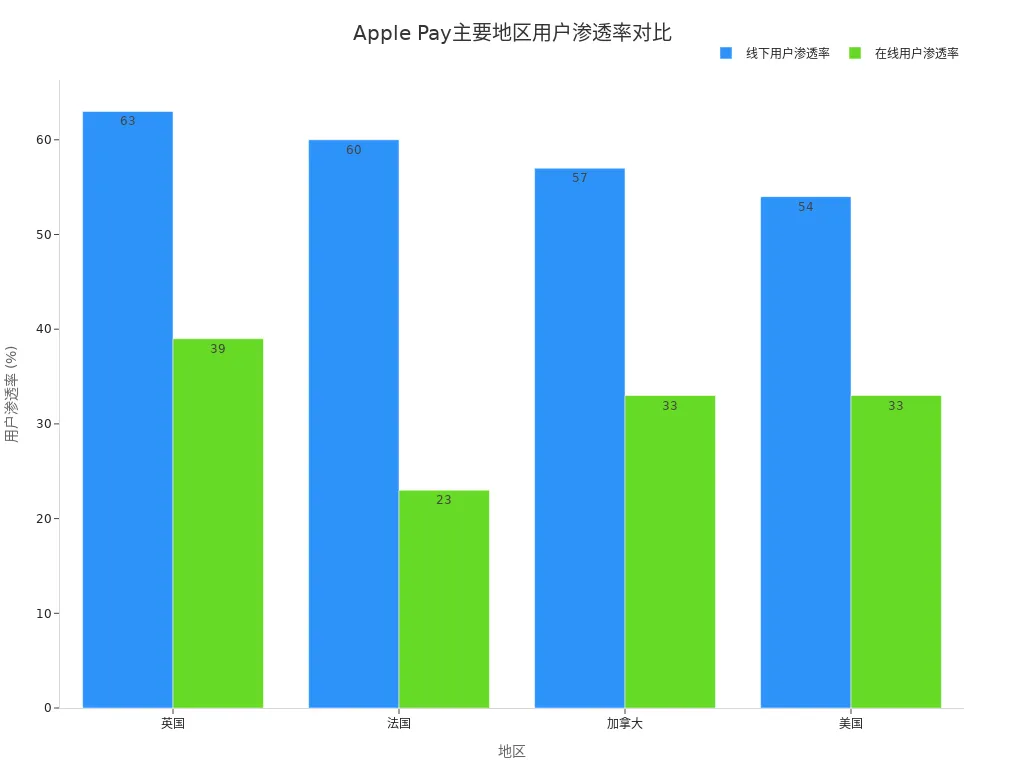

Apple Pay limits vary depending on the bank, region, and individual identity. When using Apple Pay for transfers, the actual limit is determined by the issuing bank and the region. For example, in the United States, an estimated 65.6 million users will use Apple Pay by 2025, with global payment volumes exceeding $6 trillion in 2022. You can refer to the chart below to understand Apple Pay user penetration rates in key regions:

You should pay attention to your bank and region’s specific regulations, check and manage your limits in a timely manner, and take appropriate actions when encountering restrictions.

Key Points

- Apple Pay limits vary by bank, region, and individual identity, so you need to understand the specific regulations before use.

- Single transaction, daily, and monthly transfer limits differ, and it’s recommended to consult your bank to confirm specific limits in advance.

- Regularly check your Apple Pay limits and plan your transfers to avoid transaction failures due to exceeding limits.

- When facing limit restrictions, you can request a temporary limit increase or choose alternative transfer methods to ensure smooth fund flow.

- Ensuring account security is a top priority; regularly review transaction records, update identity information promptly, and mitigate risks.

Apple Pay Limit Details

Image Source: pexels

Apple Pay limits are determined by the issuing bank, financial institutions, and region. Apple Pay itself does not directly set specific limits. When you use Apple Pay, the actual transfer limit is influenced by multiple factors, including bank policies, regional regulations, and individual identity. Different banks and regions set varying limit standards based on their risk management, regulatory requirements, and market competition.

Single Transaction Limit

When using Apple Pay for a single transfer, banks set a maximum amount limit. The table below shows single transaction limits for some regions and bank types:

| Region/Bank Type | Single Transaction Limit (USD) |

|---|---|

| United Kingdom | Supports any amount (some banks may have their own restrictions) |

| United States | $10,000 |

| Chinese Mainland | $10,000 |

When using Apple Pay in the UK, some banks allow transactions of any amount, but transactions exceeding £100 (approximately $127) may require entering a PIN or additional verification. Banks in the US and Chinese Mainland typically set a single transaction limit of $10,000. It’s recommended to consult your bank or merchant in advance to confirm specific single transaction limits and verification methods.

Tip: Some countries and regions may require you to enter a PIN, sign a receipt, or use other verification methods. Bank issuers and merchants may also set transaction restrictions or PIN requirements. You can contact your bank issuer or merchant for detailed information.

Daily Limit

The daily limit refers to the maximum cumulative transfer amount you can make through Apple Pay in a single day. Different banks and service types have varying regulations. The table below shows common daily limits:

| Bank Type | Daily Transfer Limit (USD) |

|---|---|

| US Mainstream Banks | $10,000 |

| Apple Cash | $10,000 |

| Apple Cash Family | $2,000 |

When using Apple Cash in the US, the daily transfer limit is $10,000. Apple Cash Family accounts have a daily limit of $2,000. Hong Kong licensed banks typically set daily limits between $10,000 and $20,000. In the Chinese Mainland, banks generally set a daily limit of $10,000.

Monthly Limit

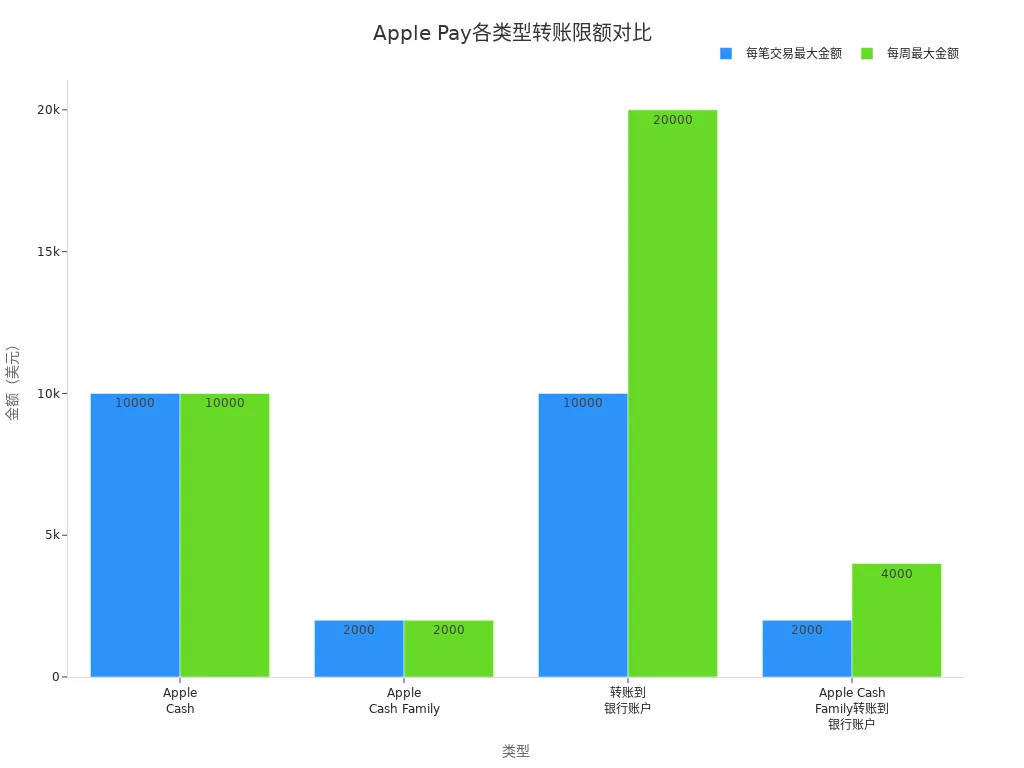

The monthly limit is the maximum cumulative transfer amount you can make through Apple Pay in a month. Some banks set monthly limits to enhance risk control. The Apple Pay platform itself sets a weekly maximum limit of $20,000, meaning your total transaction amount within any consecutive 7-day period cannot exceed $20,000. The chart below shows a grouped bar chart of daily and weekly transfer limits for different Apple Pay types:

When using Apple Cash, the weekly limit is $10,000. Transfers to bank accounts have a weekly limit of $20,000. Apple Cash Family accounts have weekly limits ranging from $2,000 to $4,000. You can plan your transfer frequency based on your needs to avoid transaction failures due to exceeding limits.

Regional and Bank Differences

Apple Pay limits vary significantly across regions and banks. When using Apple Pay in Hong Kong, the US, the UK, or the Chinese Mainland, limit standards and verification methods may differ. The table below compares contactless payment restrictions in major countries:

| Country | Contactless Payment Restriction |

|---|---|

| United States | Not specified |

| United Kingdom | PIN required for transactions over $127 |

| Chinese Mainland | Not specified |

Different banks in the same region may also set varying limits. For example, Hong Kong Licensed Bank A has a single transaction limit of $3,000-$10,000 and a daily limit of $10,000, while Hong Kong Licensed Bank B has a single transaction limit of $10,000-$20,000 and a daily limit of $20,000. When choosing a bank, you can prioritize those with higher limits based on your transfer needs.

Note: When setting Apple Pay limits, banks consider factors such as transaction amounts, payment methods, destination country, exchange rate fluctuations, and competitor analysis. For cross-border transfers, limits and fees may vary depending on the destination country and exchange rate changes.

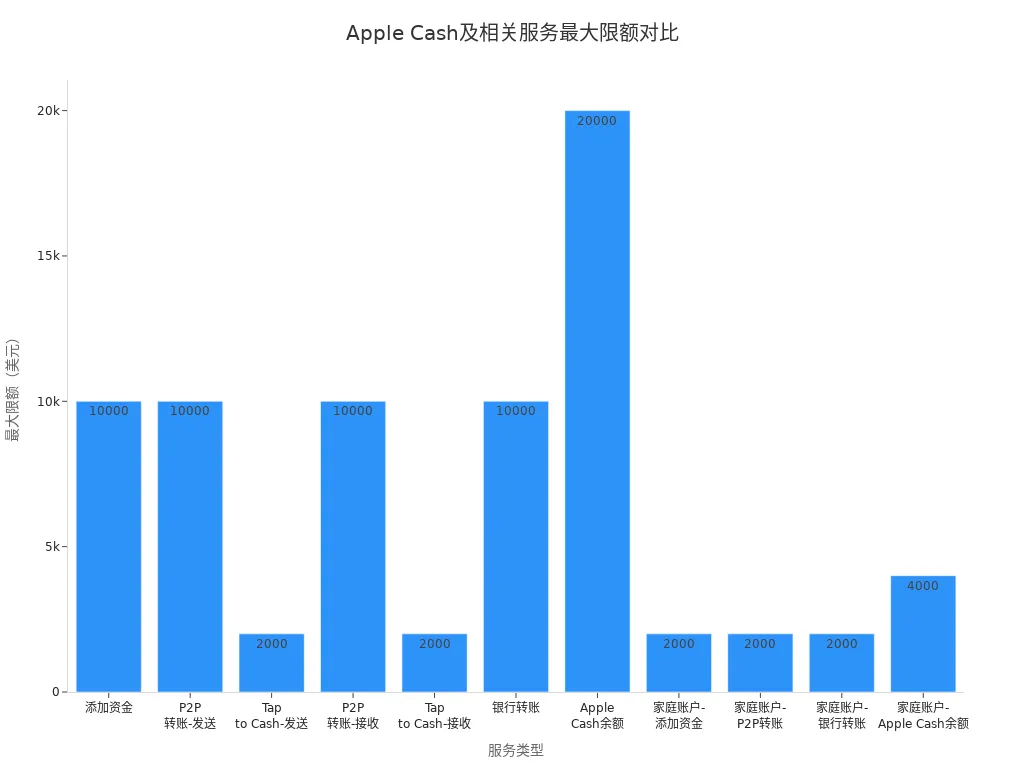

Apple Pay-related services like Apple Cash also have minimum limit requirements. The table below shows the minimum and maximum limits for Apple Cash and related services:

| Type | Minimum Limit (USD) | Maximum Limit (USD) | Weekly Limit (USD) |

|---|---|---|---|

| Add Funds | $10 | $10,000 | $10,000 |

| P2P Transfer - Send | $1 | $10,000 | $10,000 |

| Tap to Cash - Send | $1 | $2,000 | $2,000 |

| P2P Transfer - Receive | $1 | $10,000 | $10,000 |

| Tap to Cash - Receive | $1 | $2,000 | $2,000 |

| Bank Transfer | $1 | $10,000 | $20,000 |

| Apple Cash Balance | N/A | $20,000 | N/A |

| Family Account - Add Funds | $10 | $2,000 | $2,000 |

| Family Account - P2P Transfer | $1 | $2,000 | $2,000 |

| Family Account - Bank Transfer | $1 | $2,000 | $4,000 |

| Family Account - Apple Cash Balance | N/A | $4,000 | N/A |

When using Apple Pay, it’s recommended to regularly check your bank and region’s latest policies and plan your transfer limits accordingly. Apple Pay limits not only ensure your account security but also help mitigate financial risks. You can flexibly choose banks and service types based on your needs to enhance your payment experience.

Limit Checking

Image Source: pexels

When using Apple Pay, it’s crucial to understand your transfer limits. Different banks and regions have varying methods for checking limits. You can quickly obtain information about Apple Pay limit restrictions via your phone, bank app, or customer service. Below are three common methods for checking limits:

Phone-Based Checking

You can check your Apple Pay limits directly on your iPhone. Open the Wallet app and select your linked bank card. Some banks display the current single transaction and daily limits on the card details page. You can view limit information in the “Transaction Details” or “Card Information” section. If limits are not displayed, you can click the “More Information” or “Help” button to access the bank’s contact details.

Tip: Some banks do not display limit information directly in the Wallet app. You can use the app’s “Help” or “Contact Customer Service” feature to obtain more detailed limit information.

Bank App Checking

You can download and log into your bank’s official app to check Apple Pay-related limits. Hong Kong licensed banks typically provide “Payment Management” or “Limit Settings” features within the app. You can view single transaction, daily, and monthly limits in the “Account Management” or “Card Details” section. Some banks also allow custom limit settings, enabling you to adjust limits based on your needs.

- Common bank app checking steps:

- Log into the bank app

- Navigate to “Card Management” or “Payment Settings”

- View Apple Pay limit information

- Contact in-app customer service for questions

When using bank apps in the Chinese Mainland or the US, the checking process may vary slightly. Some banks display Apple Pay limits alongside regular card limits. It’s recommended to consult your issuing bank to confirm the specific checking process.

Customer Service Inquiry

You can directly inquire about Apple Pay limit restrictions via phone, online customer service, or at a bank branch. Call the bank’s customer service line and specify that you need to check your Apple Pay transfer limits. The representative will provide your current single transaction, daily, and monthly limits based on your account information. Some banks also offer online chat or email support, allowing you to choose the most convenient method.

Note: Checking methods may vary across banks. If you have questions, it’s recommended to contact your issuing bank for the most accurate limit information.

You can check Apple Pay limits through the following methods:

- Contact bank customer service

- Use the Wallet app

- Log into the bank app

It’s recommended to regularly check your limits and plan transfers accordingly. Apple Pay limits not only ensure fund security but also help prevent abnormal transaction risks. You can choose the most suitable checking method based on your needs to enhance your payment experience.

Limit Management

Requesting a Limit Increase

You can request an Apple Pay limit increase through the Apple Wallet app or by contacting Apple Support directly. Banks typically require you to specify the transaction type and average amount. Apple will review your request and may ask for additional documents. If approved, your limit may be increased, but success is not guaranteed. Banks regularly monitor your account activity and may adjust or revoke approved limits if abnormalities are detected.

- Brief application process:

- Submit a request via the Wallet app or bank app

- Provide transaction type and amount details

- Await review results

- Provide additional documents if needed

Setting Limits

You can set personal transfer limits for your Apple Card in the Wallet app on your iPhone. Follow these steps:

- Open the Wallet app and select Apple Card

- Tap the More button to access account details

- Select the participant’s name

- Tap Transaction Limit and set your desired amount

Some Hong Kong licensed banks also allow custom limit settings in their apps. You can adjust limits flexibly based on your needs to ensure fund security.

Document Preparation

When applying for a limit increase, you need to prepare business information such as transaction type and average amount. Banks may require income proof, identity information, or other documents. Providing detailed information can improve your approval chances.

| Required Document Type | Description |

|---|---|

| Transaction Type | Specify the purpose |

| Average Amount | Recent transfer amounts |

| Identity Information | ID, contact details |

| Income Proof | Pay stubs or bank statements |

Reasons for Failure

You may encounter failures when applying for an Apple Pay limit increase. Common reasons include:

- Merchants or countries/regions impose restrictions on electronic transfer amounts

- Incomplete or inaccurate information

- Abnormal transactions or security risks in the account

Tip: Apple Pay uses fingerprint and tokenization technology to ensure security. Keep the “Find My iPhone” feature enabled and notify your bank immediately if your device is lost. Setting reasonable limits helps prevent unauthorized transfer risks.

Handling Limits

Temporary Increase

When facing Apple Pay limit restrictions, you can request a temporary transfer limit increase. Some Hong Kong licensed banks allow you to apply for a temporary limit adjustment via their app or customer service hotline. You need to specify the transfer purpose and estimated amount. The bank will evaluate your request based on your account history and risk assessment to decide whether to approve the temporary increase. When using Apple Cash in the US, you can also request a temporary limit increase through Apple Support. Banks typically require additional identity information to ensure compliance. It’s recommended to prepare relevant documents in advance to improve approval efficiency.

Reminder: Temporary limit increases are special requests, and banks evaluate them based on your account security and transaction history. Plan your fund flow carefully to avoid frequent temporary increase requests.

Alternative Methods

When limited by Apple Pay restrictions, you can choose alternative transfer methods. Some banks support large transfers via online banking, branch services, or third-party payment platforms. You can split funds into multiple transfers to complete payments. Some Hong Kong licensed banks support SWIFT international remittance, suitable for large cross-border transfers. In the US, you can use ACH transfers or wire transfers for higher limit needs. When choosing alternatives, consider handling fees and transfer times to plan funds effectively.

- Alternative methods:

- Bank branch transfers

- Online banking split transfers

- SWIFT international remittance

- ACH or wire transfers

Security Tips

When increasing limits or using alternative methods, prioritize account security. Banks and Apple implement multiple measures to mitigate risks. When applying for a limit increase, you need to comply with identity verification, providing your name, address, and social security number. Devices automatically evaluate account usage patterns and generate risk reports to prevent fraud. Banks retain suspicious transaction records for further analysis to ensure fund security.

| Evidence Point | Description |

|---|---|

| Identity Verification | You must provide your name, address, and social security number, and the bank verifies identity to comply with regulations. |

| Anti-Fraud Measures | Devices assess account and device usage patterns, generating risk assessments to prevent fraud. |

| Transaction Record Retention | Suspicious transactions are retained, and banks analyze them in relation to users to ensure fund security. |

Tip: Regularly review account transaction records and update identity information promptly. If you encounter abnormal transactions or limit issues, contact your bank or Apple Support immediately to ensure compliance and fund safety.

You can regularly check your Apple Pay limits, set reasonable transfer limits, and ensure account security. If you encounter issues, proactively contact your bank or Apple Support for timely resolution. You can flexibly manage limits based on your needs to enhance your payment experience. The table below lists commonly used official resources to help you quickly access support:

| Resource Name | Link |

|---|---|

| Apple Pay Support | Apple Pay Support |

| Problems and Solutions for Apple Pay, Apple Card, and Apple Cash | Problems and their solutions for Apple Pay, Apple Card, and Apple Cash |

FAQ

What should you do if an Apple Pay transfer fails?

First, check your account balance and limit restrictions. If the limit is insufficient, contact your bank’s customer service or Apple Support for assistance and solutions.

How can you increase your Apple Pay transfer limit?

You can submit a limit increase request via the bank app or Wallet app. Banks may require additional identity information and income proof, with approval granted after review.

What are the Apple Pay limits for Hong Kong licensed banks?

Hong Kong licensed banks typically have single transaction limits of $3,000-$20,000 and daily limits of $10,000-$20,000. Check with your bank or app for specific limits.

Are there fees for Apple Pay transfers?

Some banks or services may charge fees for Apple Pay transfers. Check the bank app or official documentation for specific fee details.

How can you check your Apple Pay limits?

You can view limit information in the Wallet app or bank app. You can also call your bank’s customer service for detailed limit information and the latest policies.

Navigating Apple Pay’s transfer limits reveals key hurdles shaped by banks and regions—such as the $10,000 single-transaction cap or the $20,000 weekly aggregate, which can disrupt large-scale fund movements and introduce extra verification steps. For cross-border users, the unpredictability of these thresholds, coupled with steep fees, poses significant frustrations, particularly when handling remittances in markets like Hong Kong or the US. BiyaPay steps in as a tailored global payment solution, delivering transfers with fees as low as 0.5% and same-day send-and-receive capabilities across most countries worldwide, effectively sidestepping such constraints.

At its heart, BiyaPay excels in fluid multi-asset conversions: enabling instant swaps between various fiat currencies and digital currencies, with zero fees on contract orders for utmost clarity and speed. Its user-friendly quick signup takes mere minutes, granting access to real-time exchange rate checks to dodge volatility pitfalls. Uniquely, it lets you engage in US and Hong Kong stock trading via one platform, bypassing the need for offshore accounts to streamline payments and investments alike.

Don’t allow limits to constrain your worldwide financial operations. Head to BiyaPay right now to create an account and embrace borderless efficiency. Harness the Real-Time Exchange Rate Query for precise conversion opportunities that boost returns. Discover Stocks to oversee your portfolio effortlessly, merging transactions with portfolio expansion. With BiyaPay, limits transform from barriers into boundless potential!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.