- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Detailed Explanation of MoneyGram Remittance Fees: How to Reduce Transfer Fees and Improve Efficiency

Image Source: unsplash

When you use MoneyGram, the transfer fee breakdown primarily includes service fees and exchange rate differences. Fees vary significantly depending on the payment method; for example, transferring from the U.S. to China using a debit card costs only 1.99 USD, while using a credit card can cost up to 32.99 USD. See the table below:

| Payment Method | Transfer Fee from U.S. to China |

|---|---|

| Bank Account Payment | 4.99 USD |

| Debit Card Payment | 1.99 USD |

| Credit Card Payment | 32.99 USD |

You need to consider factors such as the transfer amount, destination, and payment method. Choosing online transfers, taking advantage of promotions, and strategically planning transfer amounts can effectively reduce your transfer costs. Continue reading for a detailed fee breakdown and cost-saving tips.

Key Highlights

- Choosing bank account payments results in the lowest fees, as low as 1.99 USD, effectively saving on transfer costs.

- Pay attention to exchange rate differences and opt for platforms with transparent fees, like Wise, to avoid losses due to markups.

- Utilize online transfer services, which typically have lower fees and are convenient for most users.

- Regularly check MoneyGram’s promotional activities and make reasonable use of discount information to reduce transfer fees.

- Prepare all required transfer documents in advance to ensure accurate information and avoid delays or additional fees.

Transfer Fees Breakdown

Image Source: unsplash

When understanding MoneyGram’s transfer fee breakdown, you need to focus on three main components: service fees, exchange rate differences, and hidden fees. Each of these affects your final transfer costs. Below, I’ll use tables and examples to help you clearly understand the fee differences across various payment methods and transfer amounts.

Service Fees

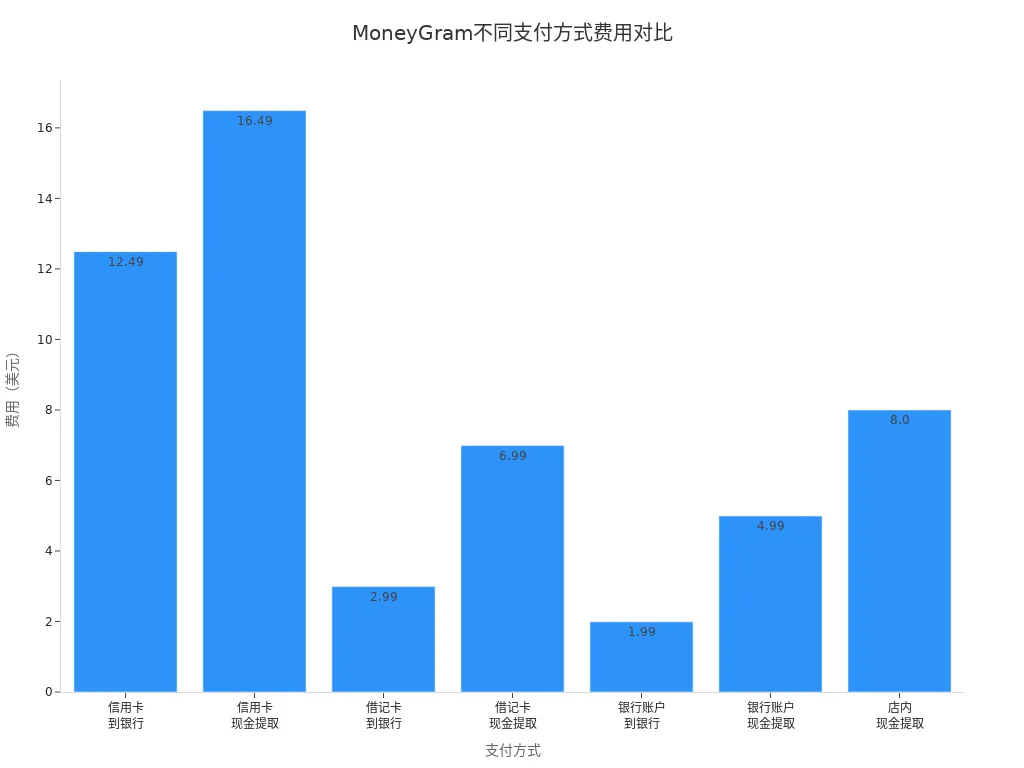

Service fees are the most straightforward cost when using MoneyGram. Fees vary significantly depending on the payment and withdrawal methods. You can refer to the table below for fees associated with common payment methods:

| Payment Method | To Bank Account (USD) | Cash Pickup (USD) |

|---|---|---|

| Credit Card | 12.49 | 16.49 |

| Debit Card | 2.99 | 6.99 |

| Bank Account | 1.99 | 4.99 |

| In-Store Cash | - | 8.00 |

When you choose bank account payments and transfer to a bank account, the service fee is the lowest, at just 1.99 USD. If you opt for a credit card and cash pickup, the fee can be as high as 16.49 USD. When planning transfers, you can prioritize bank account payments to save on service fees.

You also need to note that MoneyGram’s service fees increase with the transfer amount. For small transfers, fees are lower; for large transfers, fees are charged progressively based on tiers. For example, transferring 100 USD and 1000 USD may incur different fees. You can simulate different amounts on MoneyGram’s website to find the optimal solution.

Tip: Choosing online transfers is usually cheaper than in-store transfers and more convenient to operate.

You can also use the chart below to visually compare fee differences across payment methods:

Exchange Rate Differences

Exchange rate differences are an often-overlooked part of MoneyGram’s transfer fee breakdown. MoneyGram adds a markup to the actual exchange rate, reducing the amount received. For example, the USD to GBP exchange rate is 0.72729, and MoneyGram applies a 0.98% markup. This means for every 1000 USD transferred, the received amount is 9.8 USD less than the mid-market rate.

| Currency Pair | Exchange Rate | Markup |

|---|---|---|

| USD - GBP | 0.72729 | -0.98% |

When choosing a transfer service, you can compare exchange rates across platforms. For instance, Wise uses the mid-market exchange rate without markups, offering more transparent fees. You can select the most suitable platform based on your needs.

Hidden Fees

When using MoneyGram, in addition to service fees and exchange rate differences, you should be aware of hidden fees. For example, some banks (such as licensed Hong Kong banks) may charge incoming transfer fees. When paying with a credit card, the issuing bank may also charge additional cash advance fees.

You should also note that MoneyGram’s fee structure differs from other platforms. The table below compares the main fee characteristics of MoneyGram and Wise:

| Feature | MoneyGram | Wise |

|---|---|---|

| Transfer Fees | Varies | Starts from 0.57% |

- MoneyGram adds markups to exchange rates, resulting in higher overall fees.

- Wise uses the mid-market exchange rate, with transparent fees, ideal for users seeking low costs.

When choosing a transfer service, it’s advisable to understand all potential fees in advance to avoid unnecessary expenses. You can compare multiple platforms to find the most suitable transfer method.

Factors Affecting Fees

When using MoneyGram, the transfer fee breakdown is influenced by multiple factors. By understanding these factors, you can plan your transfers strategically to reduce costs.

Transfer Amount Range

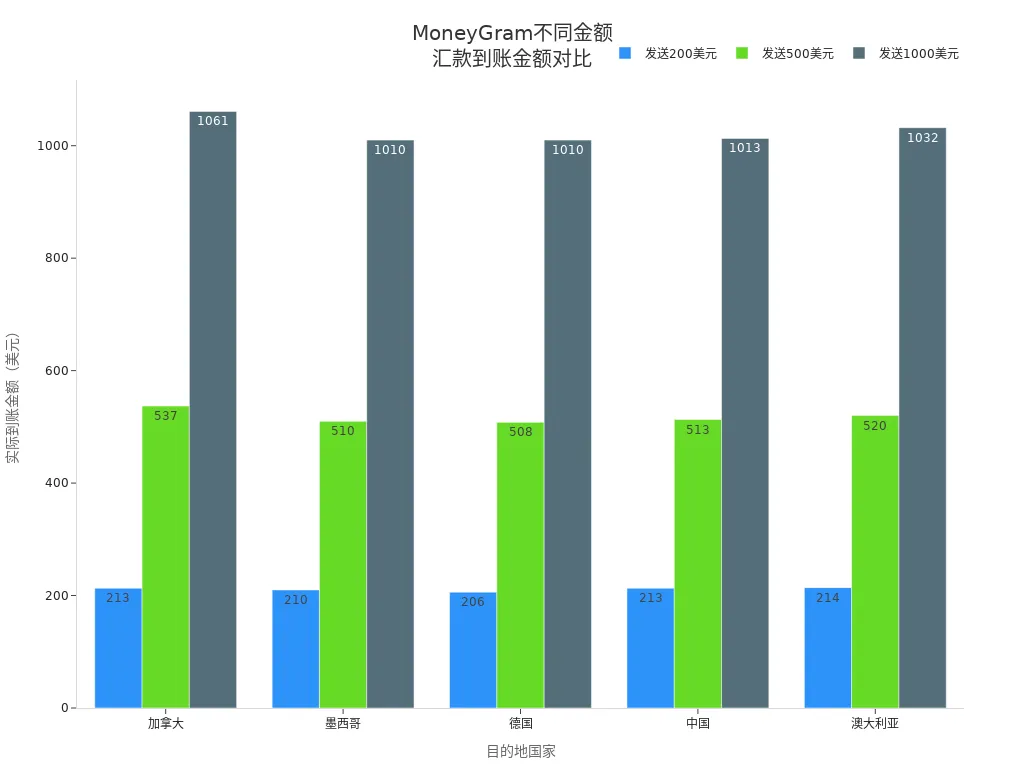

The amount you transfer directly affects service fees and received amounts. MoneyGram uses tiered pricing, where larger amounts may incur higher fees. You can refer to the table below to understand how received amounts vary by transfer amount and destination:

| Destination Country | Sending 200 USD | Sending 500 USD | Sending 1000 USD |

|---|---|---|---|

| Canada | 213 USD | 537 USD | 1061 USD |

| Mexico | 210 USD | 510 USD | 1010 USD |

| Germany | 206 USD | 508 USD | 1010 USD |

| China | 213 USD | 513 USD | 1013 USD |

| Australia | 214 USD | 520 USD | 1032 USD |

You can observe that as transfer amounts increase, the received amount does not grow linearly. Service fees adjust based on the amount.

Destination

The recipient country you choose affects the final fees. Regulatory requirements and MoneyGram’s operational costs vary by country, leading to differences in service fees and exchange rates. For example, transfers to China and Australia result in different received amounts. Some countries also face increased regulatory pressures, raising service costs and ultimately affecting the fees you pay.

Many banks have faced increased regulatory pressure for currency service businesses, closing related accounts, which raises costs for institutions like MoneyGram, leading to fee changes.

Payment Method

The payment method you choose affects service fees. MoneyGram supports bank accounts, debit cards, credit cards, and other payment methods. Fee differences are significant across methods. You can refer to the table below to understand the fee impact of each payment method:

| Payment Method | Fee Impact |

|---|---|

| Transfer Amount | Fees vary by transfer amount |

| Payment Type | Different payment types may incur different fees |

| Delivery Method | Delivery method affects final fees |

| Withdrawal Location | Different withdrawal locations may lead to fee variations |

Choosing bank account payments typically results in the lowest fees. Credit card payments incur higher fees.

Receiving Method

The receiving method you choose also affects fees. MoneyGram supports bank transfers, cash pickups, and mobile wallets. You can refer to the table below for fee characteristics of different receiving methods:

| Receiving Method | Fee Characteristics |

|---|---|

| Bank Transfer | Usually lower fees, suitable for non-urgent transfers. |

| Cash Pickup | Higher fees but fast, ideal for urgent needs. |

| Mobile Wallet | Fees depend on transfer amount, destination country, and payment method. |

Choosing bank transfers results in lower fees and is suitable for non-urgent needs. Cash pickups, while more expensive, offer fast delivery. Mobile wallet fees depend on specific circumstances.

Ways to Reduce Fees

Image Source: pexels

When using MoneyGram, you can effectively reduce transfer costs through various methods. Understanding these methods allows you to flexibly choose the most suitable transfer plan, minimizing unnecessary expenses.

Online Transfers

Choosing online transfers typically allows you to enjoy lower fees. MoneyGram’s online service fees are significantly lower than in-store fees. You can easily compare different amounts and exchange rates from home to find the optimal plan. In-person transfers require you to visit a designated location, involving higher operational costs and thus higher fees. By using MoneyGram’s website or app, you save both time and fees.

- Online transfers have lower fees, suitable for most users.

- You can compare different transfer amounts and exchange rates anytime, anywhere, adjusting plans flexibly.

- Online platforms often offer exclusive promotions, further reducing your transfer costs.

You can also benefit from the convenience of emerging technologies. Mobile payments and blockchain technologies continuously optimize the transfer process, improving transparency and reducing overall fees. Choosing online channels allows you to experience these innovative services faster.

Promotions

Before transferring, it’s advisable to check MoneyGram and other platforms’ promotional activities. Many platforms periodically offer fee waivers, exchange rate discounts, and other promotions. By making reasonable use of these promotions, you can directly reduce transfer costs.

- Check MoneyGram’s website and app for the latest promotional information.

- Subscribe to platform emails or SMS notifications to receive promotion updates promptly.

- Compare real-time promotions across platforms to choose the most cost-effective transfer timing.

You can also enhance your decision-making by gaining financial knowledge. Understanding transfer fee breakdowns helps you evaluate which promotions are truly valuable. You can also follow financial inclusion policies to improve your financial literacy and make more informed choices.

Transfer Planning

Strategically planning transfer frequency and amounts can effectively reduce fees. MoneyGram uses tiered pricing, and multiple small transfers may result in higher total fees than a single large transfer. You can calculate fees for different amounts in advance to choose the optimal combination.

- Avoid peak times and choose periods with favorable exchange rates for transfers.

- Plan transfer frequency rationally to reduce unnecessary small, frequent transactions.

- Combine transfer needs with family or friends to share service fees.

You can also compare different service providers. The more competitive the market, the more likely fees will decrease. Comparing multiple transfer services helps you find lower fees and better services. You can also explore neutral channels like licensed Hong Kong banks to understand fee differences across receiving methods.

Tip: Preparing recipient information and required documents in advance can improve transfer efficiency and avoid additional fees due to incomplete information.

By applying these methods, you can effectively reduce transfer costs while ensuring fund security, enhancing the overall experience.

Efficiency Improvement Tips

Process Comparison

When choosing MoneyGram for transfers, you can compare online and offline processes. Online transfers are typically faster, especially for cash pickup services, which can arrive in minutes. You can refer to the table below for processing times of different transaction methods:

| Transaction Method | Processing Time |

|---|---|

| Online Transaction (Cash Pickup) | A few minutes |

| Online Transaction (Bank Deposit or Mobile Wallet) | A few hours to days |

| Offline Transaction | N/A |

Choosing online transfers saves time and allows you to operate anytime, anywhere. MoneyGram’s “10-minute arrival” service is ideal for urgent needs. In-store transfers require queuing and waiting, making them less efficient.

Document Preparation

Preparing documents in advance can effectively avoid delays. MoneyGram requires you to provide valid identification, with common documents including:

- U.S. Driver’s License

- Passport

- State ID

- U.S. Military ID

- Native American Tribal ID

- Welfare ID

- Prison Release ID

- Foreign Resident ID

- Mariner’s ID

- Border Crossing Card

- Temporary Resident ID

- Employment Authorization Card

- Mexican Voter ID

- Consular ID

You also need to accurately provide the recipient’s full name, address, and transfer amount. Accurate information ensures timely fund arrivals. You can choose the “arrives in minutes” service for urgent needs.

Common Pitfalls

When transferring, be cautious of the following common pitfalls:

- Only transfer to people you know and trust to avoid sending money to strangers.

- Be wary of urgent requests to prevent scammers from creating fake emergencies.

- Do not transfer money for unexpected prizes or lottery winnings, as legitimate activities do not require upfront payments.

- Refuse to assist others with transfers to avoid involvement in money laundering risks.

- Contact MoneyGram customer service immediately (1-800-926-9400) if you notice suspicious activity.

Following these suggestions can effectively ensure fund security and improve transfer efficiency.

By choosing online transfers, leveraging promotions, and planning amounts strategically, you can effectively reduce MoneyGram transfer fees.

- MoneyGram offers fee waivers and discounts for first-time users, with lower fees for bank transfers.

- Subscribing to newsletters or following social media provides timely access to the latest promotions.

Before transferring, it’s recommended to follow these steps to compare and avoid unnecessary expenses:

- Log in to the MoneyGram app or website

- Enter payment and recipient information

- Compare different fees and exchange rates to choose the optimal plan

If you encounter delays or fee issues, contact platform customer service promptly to protect your rights.

| User Complaint Type | MoneyGram’s Response Measures |

|---|---|

| Improper Transfer Handling | Pay fines and undergo compliance monitoring |

| Failure to Investigate Errors Timely | Comply with consumer protection laws, addressing transfers and refunds promptly |

| Delayed Refunds | Ensure timely fund transfers and refund processing |

FAQ

How long does it take for MoneyGram transfers to arrive in mainland China?

Choosing online cash pickup services allows funds to arrive in minutes. Bank account deposits typically take a few hours to days, depending on the receiving method and bank processing speed.

What are the common fees for MoneyGram transfers?

You need to pay service fees and exchange rate differences. In some cases, licensed Hong Kong banks may charge incoming transfer fees. When using a credit card, the issuing bank may also charge additional fees.

How can I access MoneyGram’s latest promotions?

You can follow MoneyGram’s website and app or subscribe to email or SMS notifications. The platform periodically offers fee waivers and exchange rate discounts. Comparing multiple platforms helps you choose the best option.

What documents are required for transfers?

You need to provide valid identification, such as a passport or IDs recognized by licensed Hong Kong banks. You must also accurately provide the recipient’s name, address, and transfer amount to ensure accuracy.

What are the common risks of MoneyGram transfers?

You should only transfer to trusted individuals. Verify the identity of urgent transfer requests. Avoid transferring for strangers or suspicious activities to prevent scams or involvement in illegal fund flows.

Exploring MoneyGram’s remittance fees reveals its cost pitfalls—fees ranging from $1.99 to $32.99 and exchange rate markups up to 5% can inflate expenses, particularly for mainland China users juggling frequent cross-border transfers, where credit card charges or hidden bank fees further erode budgets. BiyaPay offers a cost-efficient alternative: transfer fees as low as 0.5%, same-day processing across most global regions, enabling swift, affordable international fund flows while dodging MoneyGram’s rate surcharges and concealed costs.

BiyaPay stands out with its dynamic conversion platform, supporting instant fiat-to-digital currency swaps and zero-fee contract orders for transparent, streamlined transactions. A quick signup in minutes grants access to real-time rate checks to seize optimal exchange moments. Uniquely, trade US and Hong Kong stocks on one platform without offshore accounts, turning remittances into investment opportunities for enhanced returns. Unlike MoneyGram’s tiered pricing, BiyaPay’s low fees and adaptability cater to ongoing global needs.

Start now—register at BiyaPay for a seamless, budget-friendly transfer experience. Use the Real-Time Exchange Rate Query to navigate rate shifts and maximize value. Discover Stocks to blend transfers with trading, fueling sustained wealth growth. With BiyaPay, every remittance becomes a strategic step toward efficiency and prosperity!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.