- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram Remittance Tracking: How to Monitor Remittance Status in Real - Time and Ensure Smooth Transfers

Image Source: unsplash

You can monitor the status of your remittance in real-time through the MoneyGram website, app, or customer service phone, with simple and efficient operations. After registering an account, complete identity verification, fill in recipient details, select the remittance method and currency (e.g., USD), and pay attention to fees. The table below shows user satisfaction with different international remittance platforms, with MoneyGram receiving praise for its ease of use and high efficiency:

| Service | TrustScore | User Feedback |

|---|---|---|

| MoneyGram | 4.3/5 | The platform is user-friendly with competitive exchange rates, but there are some negative reviews regarding account closures and customer service experiences. |

| Ria | N/A | More delays and unexpected fees, with mixed user reviews. |

MoneyGram remittance tracking allows you to stay informed about transfer progress, ensuring fund security.

Key Points

- Through the MoneyGram website, app, or customer service phone, users can conveniently track remittance status in real-time, ensuring fund security.

- When checking remittance status, always keep the reference number (MTCN) and sender’s last name to accurately obtain information.

- When filling in recipient details, ensure all information is accurate to avoid delays or failed transfers due to errors.

- Regularly monitor remittance progress, especially for large amounts, and contact customer service promptly to address any issues.

- Stay vigilant to prevent various types of fraud, ensuring personal information security during remittance and tracking processes.

MoneyGram Remittance Tracking Methods

Image Source: pexels

You can track your MoneyGram remittance through three main methods: website lookup, app monitoring, and customer service phone. These methods are convenient and suitable for different user preferences. Regardless of the method chosen, you need to enter the reference number (MTCN) and the sender’s last name to accurately check the remittance status.

Website Lookup

You can visit the MoneyGram website directly and find the “Track a Transfer” feature. After entering your reference number and sender’s last name, the system will display the current remittance status. The website interface is clean and straightforward, with all functions clearly visible. You don’t need complex operations to quickly access the required information. Many users report that MoneyGram’s digital tools, like those of MoneyGram, focus on complete functionality and a simple interface, providing a very user-friendly tracking experience.

App Monitoring

If you prefer using your phone, you can download the MoneyGram app. After logging in, select the “Track a Transfer” feature and enter the reference number and sender’s last name. The app interface is intuitive, with all main functions centralized on the homepage. You can check remittance progress anytime, anywhere. Users generally find the MoneyGram app convenient, clear, and comprehensive, without causing confusion.

Customer Service Phone

You can also call MoneyGram’s customer service phone line and follow the voice prompts to enter the reference number and sender’s last name. Customer service staff will assist you in checking the remittance status and answering your questions. This method is suitable for those who cannot access the internet or use the app. You can communicate directly with customer service to receive detailed assistance.

Tip: Regardless of the MoneyGram remittance tracking method chosen, always keep the reference number (MTCN) and related information secure to ensure fund safety.

MoneyGram Remittance Tracking Operations

Image Source: pexels

Before starting MoneyGram remittance tracking, you need to complete a series of preparatory steps. You must register an account and pass identity verification to ensure a secure and compliant remittance process. The following sections detail each step to help you smoothly track your remittance status.

Obtaining the Reference Number

After initiating a remittance on the MoneyGram platform, the system will automatically generate a unique reference number (MTCN). This number is the key to tracking your remittance status. You need to securely store the reference number and avoid disclosing it to unrelated individuals.

When registering an account, you need to provide the following information:

- Full name

- Residential address (cannot be a P.O. box)

- Phone number

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Date of birth

- Valid, unexpired government-issued identification (e.g., passport, U.S. driver’s license, state ID, etc.)

If you already have a MoneyGram profile, you only need to provide the remaining information to complete identity verification. MoneyGram uses industry-recognized encryption technology to protect your personal data security.

Tip: Identity verification is a legal requirement to ensure every remittance can be traced to a real user, preventing identity theft.

Entering Information for Lookup

After obtaining the reference number, you can check the remittance status through the MoneyGram website, app, or customer service phone. Each time you check, you need to enter the reference number and the sender’s last name.

When filling in recipient details, ensure the information is accurate. You need to prepare the following:

- Recipient’s full name

- Recipient’s contact information

- Recipient’s bank account details (if choosing bank transfer, preferably a licensed Hong Kong bank account)

- Remittance method (e.g., cash pickup, bank transfer, etc.)

- Remittance currency (e.g., USD)

- Remittance amount

Additional information may be required depending on the remittance method and amount. When selecting a remittance method, choose based on the recipient’s actual needs and convenience.

Note: Incorrect information may cause delays or failed transfers, so double-check all details.

Status Indicators

After completing the lookup, the system will display the current status of the remittance. Common statuses include “Processing,” “Sent,” “Received,” or “Pending Pickup.” You can judge the remittance progress based on the status.

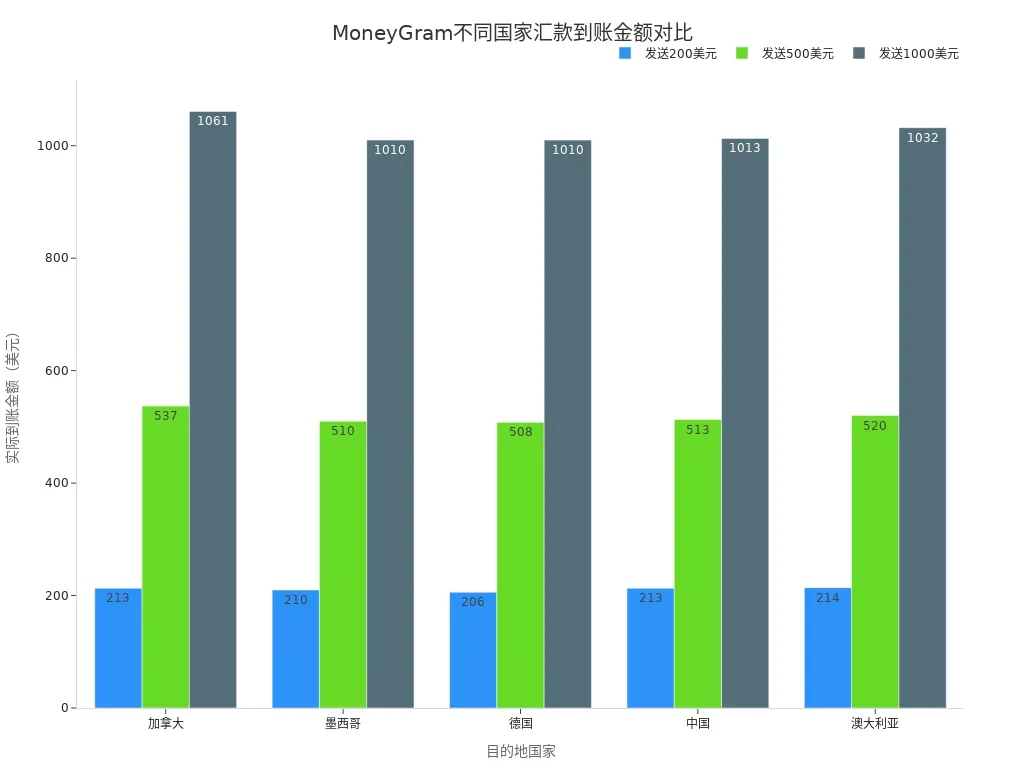

During the MoneyGram remittance tracking process, fees and exchange rates will affect the amount received. The table below shows the amounts received for different countries and remittance amounts (in USD):

| Destination Country | Sending $200 | Sending $500 | Sending $1,000 |

|---|---|---|---|

| Canada | $213 | $537 | $1,061 |

| Mexico | $210 | $510 | $1,010 |

| Germany | $206 | $508 | $1,010 |

| China | $213 | $513 | $1,013 |

| Australia | $214 | $520 | $1,032 |

You can visually understand the differences in amounts received for different amounts and destinations through the chart below:

MoneyGram’s international transfer fees vary based on the remittance amount, destination country, payment method, and transfer speed. Generally, higher amounts incur higher fees. MoneyGram does not use the mid-market exchange rate but adds a markup, which affects the actual amount received.

Suggestion: Before each remittance, carefully compare fees and exchange rates to ensure both you and the recipient are clear about the amount received.

By following these steps, you can efficiently complete MoneyGram remittance tracking, monitor fund movements in real-time, and ensure smooth transfers.

Common Issues and Solutions

Status Not Updated

When tracking a MoneyGram remittance, you may encounter a status that remains unchanged for a long time. Common reasons are listed in the table below:

| Reason | Description |

|---|---|

| Identity Re-verification | The system periodically requires you to re-verify your identity to ensure account and fund security, preventing fraud. |

| Expired ID | If your ID has expired, you need to upload a new valid document promptly. |

| System Error | Sometimes system errors occur; you can try logging back into your account and initiating a new one-time transfer, and the transaction usually resumes automatically. |

If you encounter these issues, first check if your profile and documents are valid. If the problem persists, contact MoneyGram customer service promptly, providing the reference number and relevant information for assistance.

Information Errors

When filling in recipient details or tracking, errors due to oversight are common. Typical errors include inconsistent recipient name spelling, incorrect address, or wrong bank account numbers. You can take the following steps:

- Contact the service provider immediately to inquire about correcting the information.

- Confirm the recipient’s name and address, ensuring consistency with official documents.

- If the funds have not been released, corrections to the transfer are usually possible.

- Submit an error notification to customer service, requesting investigation and resolution.

Always double-check all details before initiating a remittance, especially bank account numbers. If funds are transferred to the wrong account due to errors, recovery may not be possible. You can also correct some information yourself through the MoneyGram website or app to improve processing efficiency.

When recipients collect funds, they must provide the correct reference number and valid identification. The process is as follows:

- The recipient must provide the reference number or transaction code to allow the agent to locate the transaction.

- The recipient must present a valid government-issued ID, with the name matching the transfer record.

- In some countries, proof of relationship with the sender may be required.

- It’s recommended to check with the local agent in advance for acceptable ID types and procedures.

Fraud Prevention

During the remittance and tracking process, stay vigilant against various types of fraud. Common fraud types include:

- IRS Extortion Scam: Impersonating tax authorities to demand payments.

- Refund Scam: Pretending to be a regulatory agency promising refunds to obtain bank details.

- Disaster Relief Scam: Exploiting disaster events to induce donations, recommended to operate through trusted organizations.

- Foreign Lottery Scam: Claiming you’ve won a prize but need to pay fees.

- Relative Assistance Scam: Impersonating family members requesting urgent funds.

- Phishing: Posing as financial institutions to send fraudulent messages, inducing disclosure of sensitive information.

- App Fraud: Tricking you into authorizing fund transfers to criminals’ accounts.

You can take the following preventive measures:

- Be aware of common fraud tactics and stay vigilant.

- Do not trust calls or messages from strangers, especially those involving fund requests.

- Verify the recipient’s identity and the authenticity of the request before transferring funds.

If you encounter suspicious activity or suspect fraud, contact MoneyGram’s official customer service immediately to protect your funds.

Tips for Smooth Remittances

Accurate Information

When filling in recipient details, ensure all information is accurate. Both MoneyGram and MoneyGram require recipients to provide valid identification to prevent identity theft and fraud. You need to verify the recipient’s name, contact information, and bank account details, preferably using a licensed Hong Kong bank account for transfers. If you plan to send over $15,000, the system will require additional verification steps. Each remittance is checked for identity verification to ensure transaction safety and accuracy.

Tip: Incorrect information may lead to delays or failed transfers. Double-check all details before submission to ensure consistency with official documents.

- Verify the recipient’s name matches their ID.

- Confirm contact information and bank account details.

- Choose the appropriate remittance method and currency (e.g., USD).

Secure Storage of Information

During the remittance process, you will receive a reference number (MTCN), the unique credential for tracking transfer status. You need to securely store the reference number and personal information, avoiding disclosure to unrelated individuals. MoneyGram uses industry-recognized encryption technology to protect your data. The platform also maintains robust information security procedures to ensure compliance with data protection standards.

The table below outlines the platform’s data security measures:

| Security Measure | Description |

|---|---|

| Encryption Technology | Uses industry-recognized database and network technology to encrypt and protect consumer data. |

| Information Security Procedures | Maintains robust information security procedures to ensure compliance with data protection standards. |

Suggestion: Record the reference number and important information in a secure location, avoiding sharing via social media or email.

Status Monitoring

You can use the reference number to check the remittance status anytime on the MoneyGram website, app, or customer service phone. It’s recommended to regularly monitor remittance progress, especially for large amounts or when the recipient urgently needs funds. The platform offers a “minutes-to-delivery” service, which can reduce delays if selected. If you notice a status hasn’t updated for a long time or encounter issues, contact official channels promptly.

The table below lists official contact methods for quick assistance:

| Contact Method Type | Details |

|---|---|

| Phone | 2032238 |

| customerservice@moneygram.com | |

| Online Form | Contact via the “Contact Us” form on the MoneyGram website or app. |

Tip: Regularly check the remittance status and contact official customer service promptly for delays or issues to ensure funds arrive safely and smoothly.

You can track fund movements in real-time with MoneyGram remittance tracking. Follow these steps:

- Log in to the MoneyGram website or app, enter the reference number and sender’s last name to check the transfer status anytime.

- Without an account, you can also use the “Track + Receive” tool to check directly.

You need to complete registration and pass identity verification, submitting valid identification documents. MoneyGram employs strict identity verification and encryption technology to protect your funds. Ensure all information is accurate and regularly monitor the remittance status. If issues arise, contact official customer service promptly to ensure smooth transfers.

FAQ

How do I check the status of a MoneyGram remittance?

You can enter the reference number (MTCN) and sender’s last name on the MoneyGram website or app. The system will immediately display the transfer progress. Customer service phone support can also assist with checking.

What should I do if I lose the reference number?

Contact MoneyGram customer service, providing your registration details and identity verification documents. They will assist in retrieving the reference number to ensure fund safety.

How long does it take for a remittance to arrive?

In most cases, funds arrive within minutes. Some countries or special circumstances may require longer. You can check the status anytime.

What should I do if I enter incorrect remittance information?

If you notice incorrect information, contact MoneyGram customer service immediately. They will assist in correcting details to minimize the risk of delays.

What precautions should I take for remittances to mainland China?

Ensure the recipient’s name matches their ID. It’s recommended to use USD as the remittance currency. The recipient must present a valid ID and reference number to collect funds.

While mastering MoneyGram’s remittance tracking offers the convenience of minute-level delivery and real-time status updates, its steep fees ($1.99 to $32.99), exchange rate markups (up to 5%), and potential verification delays can inflate costs and complexity, particularly for mainland China users managing frequent international transfers. BiyaPay delivers a superior alternative: fees as low as 0.5%, same-day transfers across most global regions, ensuring swift, secure, and budget-friendly fund flows without hidden charges or cumbersome validations.

BiyaPay shines with its smart conversion platform and all-in-one functionality: enabling instant fiat-to-crypto exchanges with zero-fee contract orders for transparent, efficient transactions. A quick signup in minutes unlocks real-time rate monitoring to capture optimal exchange points, dodging MoneyGram’s currency fluctuation losses. Uniquely, trade US and Hong Kong stocks on one hub without offshore accounts, transforming remittances into investment opportunities for amplified returns.

Take control today—register at BiyaPay for a frictionless cross-border transfer experience. Leverage the Real-Time Exchange Rate Query to navigate rate shifts and maximize value. Discover Stocks to merge transfers with trading, fueling sustained wealth growth. With BiyaPay, remittance tracking becomes simpler, cheaper, and a gateway to greater financial rewards!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.