- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

MoneyGram Remittance Discounts: How to Save on Remittance Fees with Promotions

Image Source: unsplash

Want to save on MoneyGram remittance fees? You can pay attention to MoneyGram remittance discounts and limited-time promotions. You can register for a loyalty program to enjoy long-term fee reductions. You can also choose bank transfers or debit cards for payments, which typically have lower fees. Regularly checking the latest promotions and flexibly adjusting your remittance method can help you complete cross-border transfers with less money.

Key Points

- Pay attention to MoneyGram’s promotional activities, as holidays and special periods often offer fee reductions.

- Choose the appropriate payment method, as debit cards and bank transfers usually have lower fees, and avoid using credit cards.

- Use MoneyGram’s fee calculator to estimate remittance fees in advance to avoid unexpected expenses.

- Register for the loyalty program, where completing transfers earns points that can be redeemed for future fee discounts.

- Regularly check MoneyGram’s official website and social media for the latest discount codes and event information.

MoneyGram Remittance Discounts and Fee Structure

Transaction Fees

When using MoneyGram for international transfers, the first cost you encounter is the transaction fee. The fee amount depends on several factors, such as the transfer amount, the recipient’s country, the payment method, and the service type. Generally, smaller transfer amounts have lower fees, while large transfers or payments made with credit cards significantly increase the fees. According to public data, MoneyGram’s average international transfer fees range between $5 and $100. You can refer to the following table to understand the fee structure:

| Fee Component | Description |

|---|---|

| Transfer Fee | Determined by the sender’s and recipient’s location, transfer amount, payment method, and service type. |

| Service Type | Different service types (e.g., expedited services) may incur different fees. |

| Payment Method Fee | Using credit or debit cards may incur additional fees. |

| Receiving Location | The recipient’s specific location may affect the fee structure and additional charges. |

| Receiving Option Fee | Different receiving methods (e.g., cash pickup, bank deposit) may have different fees. |

| Additional Service Fees | Other services (e.g., bill payments and money orders) may have their own fees. |

You can use the fee calculator on MoneyGram’s website or app to estimate the fees for each transfer in advance, avoiding unexpected expenses. MoneyGram remittance discount campaigns sometimes offer fee reductions or discounts for specific amounts or countries, which is an important way to save costs.

Exchange Rate Differences

In addition to transaction fees, exchange rate differences are a significant factor affecting your actual remittance costs. MoneyGram typically adds a markup to the mid-market exchange rate during currency conversion, which is a source of profit for the platform. This markup varies depending on the currency and country. Even if the transaction fee is low, the exchange rate markup may increase your total costs. You can refer to the table below:

| Service Provider | Fee Structure |

|---|---|

| Remitly | First transfer is free, subsequent fees vary by destination and amount, with exchange rate markups up to 3%. |

| MoneyGram | Fixed fee of about $1.99 for common transfer routes, 2% fee for transfers over $500, $5 for small transfers (below $50), with exchange rate markups up to 5%. |

Exchange rate differences have a particularly significant impact on large transfers. Even small fluctuations in the exchange rate can affect the amount the recipient actually receives. When choosing MoneyGram remittance discounts, in addition to focusing on fees, you should compare exchange rates across platforms to ensure the lowest overall cost.

Tip: Before transferring, you can use MoneyGram’s exchange rate checker tool to view real-time rates and compare them with other platforms to make an informed choice.

Hidden Fees

During the remittance process, you may also encounter hidden fees. These include credit card processing fees, currency exchange rate differences, and potential receiving bank fees. While MoneyGram is relatively transparent about fees, you still need to carefully review the fee details for each transaction to avoid oversights. Common hidden fees include:

- Additional fees for credit card payments

- Exchange rate differences during currency conversion

- Receiving bank or institution fees for incoming transfers

You can identify and avoid hidden fees through the following methods:

- Use the fee calculator on MoneyGram’s website or app to estimate all fees in advance

- Carefully review the transfer summary to confirm each fee

- Consult the recipient’s bank to understand potential additional charges

- Compare multiple platforms to choose the best MoneyGram remittance discounts and exchange rates

By using these methods, you can maximize fee transparency, effectively utilize MoneyGram remittance discounts, and reduce unnecessary expenses.

MoneyGram Remittance Discount Campaigns

Image Source: unsplash

Promotional Activities

You can enjoy MoneyGram remittance discounts through various promotional activities. MoneyGram frequently launches limited-time offers, such as during holidays or back-to-school seasons, when transaction fees are significantly reduced. Some promotions target specific countries or transfer amounts, helping you save more in specific scenarios. For example, after registering for the MoneyGram Plus Rewards program, you can enjoy a 20% fee discount on your next transfer, and accumulated points can be redeemed for future fee reductions. If you invite friends to use MoneyGram, both parties can receive a fee-free transaction opportunity after the friend completes their first transfer.

Tip: You can follow MoneyGram’s official website and social media to stay updated on the latest promotions and avoid missing cost-saving opportunities.

Common promotional activities include:

- Seasonal fee discounts during holidays or back-to-school periods

- Exclusive offers for specific countries or amounts

- Zero-fee transfers for both parties after referring a friend to register

- Points rewards program, where accumulated points can be redeemed for fee discounts

Discount Code Usage

You can use discount codes provided by MoneyGram during transfers to further reduce fees. Discount codes are typically released through the official website, emails, or social media. You simply enter a valid discount code on the transfer page to enjoy fee reductions. New users often receive exclusive discount codes, while existing users can obtain limited-time codes during holidays or special events.

Discount code usage rules generally include:

- Limited to fee reductions

- Must be used within the validity period

- Sometimes applicable only to first-time transfers or specific amounts

The table below shows the average savings from using discount codes:

| Best Discount | Average Savings |

|---|---|

| 20% | $2.14 |

You can regularly check MoneyGram’s official channels to obtain and use the latest discount codes, enjoying more MoneyGram remittance discounts.

New User Offers

If you are a first-time MoneyGram user, you can access exclusive offers. MoneyGram provides new users with benefits such as free first transfers, welcome gifts, or exclusive discount codes. After registering, you can typically enjoy a fee reduction on your first transaction. In some cases, you may also receive a gift card as a reward.

The table below compares new user offers from different remittance platforms:

| Service Provider | New User Offer |

|---|---|

| Western Union | $20 Amazon gift card upon registration |

| MoneyGram | Free first transfer |

| BOSS Revolution | Free first transfer |

You can also earn additional rewards by referring friends. Invite up to five friends to register, and after they complete their first transfer, both parties can enjoy a fee-free transaction. Ensure your friends complete registration and transfer within 30 days to receive the reward.

Regular Promotions

MoneyGram regularly launches various promotional activities to help you continuously enjoy remittance discounts. Common regular promotions include referral programs, exclusive discounts for frequent users, online transaction fee reductions, and seasonal offers. You can stay informed about promotions through the following methods:

- Follow MoneyGram’s blog and news pages

- Subscribe to email newsletters

- Follow MoneyGram’s social media accounts

You can find the latest activities on MoneyGram’s blog under the “Money Transfers & Financial Insights” section or the news and promotions page. Through these channels, you can flexibly choose the most suitable offers to maximize savings on remittance costs.

The MoneyGram Plus Rewards program offers additional benefits for frequent users. Each completed transfer earns points, which can be redeemed for future fee discounts. After reaching premium status, you can enjoy a 40% fee discount every five transfers. Simply register and continue using MoneyGram services to accumulate benefits.

Choosing Remittance and Payment Methods

Image Source: unsplash

Online vs. Offline

You can choose online or offline methods for MoneyGram transfers. Online transfers are convenient for anytime, anywhere operations, with typically lower fees, especially when combined with promotional activities to enjoy MoneyGram remittance discounts. Offline transfers require visiting physical locations, suitable for users without easy internet access, but fees are often higher. When choosing, prioritize online channels and combine them with holiday or country-specific promotions to save more.

Payment Method Selection

Different payment methods significantly affect fees. When using a credit card, in addition to MoneyGram’s service fees, you may incur cash advance fees from the card issuer, increasing total costs. Debit cards and bank transfers generally have lower fees, making them ideal for cost-conscious users. The table below compares the fee characteristics of common payment methods:

| Payment Method | Fee Characteristics | Notes |

|---|---|---|

| Credit Card | Typically higher fees, may include additional processing or cash advance fees | Increases costs |

| Debit Card | Lower fees, direct deduction, simple processing | More economical |

| Bank Transfer | Fees vary by bank, generally transparent | Check specific bank fees |

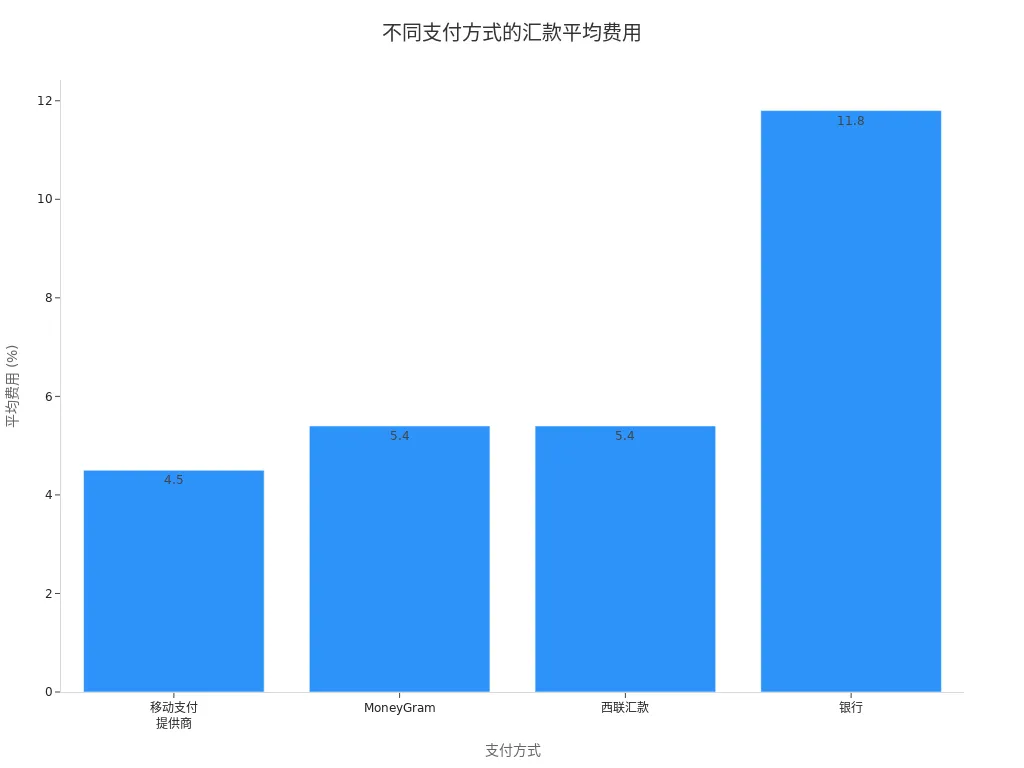

You can see that debit cards and bank transfers are more economical choices. The chart below shows a comparison of average fees for different payment methods:

Receiving Method Selection

You can also choose different receiving methods. Bank deposits are suitable for large transfers with lower fees. Cash pickups are ideal for small, urgent transfers but have higher fees. Mobile wallets are flexible, with fees varying by service. The table below summarizes the fee impact of common receiving methods:

| Receiving Method | Fee Impact |

|---|---|

| Bank Deposit | Lower fees, suitable for large transfers |

| Cash Pickup | Higher fees, suitable for small transfers |

| Mobile Wallet | Flexible fees, depending on the service |

You can choose the most appropriate method based on the recipient’s needs. To maximize savings, consider combining online transfers, debit card/bank transfer payments, and bank deposit receiving methods, and take advantage of MoneyGram remittance discount campaigns to further reduce fees.

Money-Saving Tips and Practical Advice

Transfer Amount Strategy

You can reduce overall costs by optimizing transfer amounts. Many remittance platforms charge different fees based on the amount. You can refer to the following methods:

- Compare fees for different amounts and choose the optimal range for transfers.

- Avoid frequent small transfers; combine multiple transfers into one larger amount to dilute fees.

- Choose bank transfers, which are typically cheaper than credit or debit cards.

- Avoid peak times like weekends or holidays, as some platforms may increase fees.

- Use online services, which often have lower fees than physical locations.

By using these strategies, you can effectively utilize MoneyGram remittance discounts to reduce the total cost of each transfer.

Fee Comparison

Before transferring, you should compare fees and exchange rates across multiple platforms. Different providers have varying fee structures and exchange rate markups. You can use a table like the one below to record and compare:

| Platform | Fee (USD) | Exchange Rate Markup (%) | Other Fees (USD) |

|---|---|---|---|

| Platform A | 8 | 2.5 | 0 |

| Platform B | 10 | 2.0 | 1 |

| Platform C | 7 | 3.0 | 0 |

You can select the platform with the lowest total cost based on the actual transfer amount and receiving method. This helps avoid focusing solely on one fee while overlooking overall expenses.

Stay Updated on Promotions

You should regularly check MoneyGram’s website, social media, and email notifications. The platform often launches fee reductions, exclusive discount codes, and other promotions during holidays or back-to-school seasons. You can set reminders to stay informed about limited-time offers and seize cost-saving opportunities.

Tip: Some promotions are limited to specific countries or amounts, so read the rules carefully before transferring to ensure eligibility.

Loyalty Program

You can register and participate in MoneyGram’s loyalty program. Each completed transfer earns points, which can be redeemed for future fee discounts. After reaching premium status, you can enjoy a 40% fee discount every five transfers, along with exclusive customer service and promotions.

- Personalized benefits and faster transaction processing

- Exclusive promotions and priority event participation

- Dedicated customer service hotline

When using MoneyGram remittance services long-term, the loyalty program helps you continuously reduce fees and enhance the overall experience.

You can take advantage of MoneyGram remittance discounts, actively participate in promotional activities, choose appropriate transfer and payment methods, and join the loyalty program to consistently save on fees. The table below shows common discount types and savings:

| Discount Type | Description |

|---|---|

| 20% OFF | 20% discount on the second transfer after registration |

| 40% OFF | 40% fee discount after every five transfers |

| $0 FEES | First international online transfer is fee-free |

| 15% OFF | 15% discount on domestic and international transfers |

You can stay updated on the latest offers and flexibly choose the best options based on your needs to maximize savings on remittance costs.

FAQ

What is the lowest MoneyGram remittance fee?

You can use a discount code during promotions, with fees as low as $0. New users typically enjoy fee-free first transfers. Check specific amounts on MoneyGram’s website.

Note: Fees vary based on transfer amount and recipient country.

How can I get the latest MoneyGram remittance discount information?

You can follow MoneyGram’s official website, subscribe to email newsletters, or browse social media. MoneyGram regularly posts limited-time promotions and discount codes. You can also check the latest activities in the app.

What are the advantages of receiving funds through licensed Hong Kong banks?

Choosing licensed Hong Kong banks for receiving funds typically offers lower incoming fees and faster processing times. Bank services are transparent, with clear fee structures, helping you save costs.

Can multiple discounts be used simultaneously for a single transfer?

You can only use one discount code or promotion per transfer. MoneyGram does not support stacking multiple discounts. Choose the most suitable discount option for your needs.

Do exchange rate changes affect the actual received amount?

During transfers, the exchange rate directly determines the USD amount received by the recipient. MoneyGram settles based on real-time exchange rates. You can check exchange rates in advance to ensure the received amount meets expectations.

Leveraging MoneyGram’s remittance discounts can yield appealing perks like fee waivers for first-time users or 20% off referrals, yet exchange rate markups (up to 5%) and hidden charges (such as credit card processing fees) frequently drive up true costs, particularly for mainland China users with recurring cross-border needs where large transfers strain budgets. BiyaPay, a streamlined global payment gateway, counters this with a superior low-expense model: fees starting at 0.5%, same-day processing worldwide across most countries, empowering you to bypass rate pitfalls and achieve genuine savings.

BiyaPay’s strength lies in its savvy conversion engine: enabling instant fiat-to-digital asset exchanges with zero-fee contract listings for fully transparent dealings. A swift signup in minutes unlocks real-time rate monitoring to capture peak values, sidestepping MoneyGram’s concealed surcharges. Exclusively, trade US and Hong Kong stocks on a single hub without offshore setups, transforming remittances into investment fuel for amplified gains. Unlike MoneyGram’s episodic deals, BiyaPay’s enduring low rates suit ongoing operations.

Act now—register at BiyaPay to embrace affordable cross-border transfers. Harness the Real-Time Exchange Rate Query for vigilant rate tracking that optimizes your capital. Engage Stocks to unify transfers and trades, propelling steady asset expansion. Opt for BiyaPay, where every remittance turns into a smart savings and growth strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.