- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Achieving Fast and Secure International Fund Transfers through Visa Money Transfer

Image Source: pexels

You can easily transfer funds worldwide through Visa remittances. The Visa Direct service allows you to experience transfers that arrive in minutes, meeting your efficiency needs. A global network and multiple security measures work together to ensure the safety of your funds. You can confidently complete international remittances anytime, anywhere.

Key Points

- Visa remittances allow you to complete international money transfers in minutes, ideal for urgent needs.

- When registering and logging in, ensure you provide accurate information to avoid transfer failures.

- When adding a recipient, ensure the name and card number match exactly to guarantee a smooth transfer.

- When using Visa remittances, pay attention to transaction fees and exchange rates, and choose the most suitable platform.

- Stay vigilant to prevent fraud and ensure the safety of your personal information and funds.

Visa Remittance Process

Image Source: unsplash

Registration and Login

You need to first select a platform that supports Visa remittances. Common platforms include online banking from Hong Kong-licensed banks, mobile apps, or third-party remittance services. During registration, you must provide basic information and complete account verification. The platform typically requires you to submit identity proof and contact details.

During the login process, the system will ask for your username and password, and some platforms may also require two-factor authentication, such as an SMS verification code or email confirmation. The registration and login process involves multiple forms and verifications, detailed as follows:

| Form Name | Main Requirements |

|---|---|

| Solution Requirements Form | You need to fill out this form for the platform to configure your account in the Visa system. |

| Visa Direct Account and Wallet API Registration Form | You need to register and select the Visa Direct API to be used. |

| Visa Direct Payment API Server Certificate | You need to upload a server certificate issued by an authorized institution. |

During registration, the platform employs various verification methods to ensure account security:

| Verification Method | Description |

|---|---|

| Account Verification | Checks whether your account is valid. |

| Address Verification | The system verifies the billing address you provided. |

| Card Verification Value (CVV2) | You need to enter the CVV2 code on the back of the card. |

| Account Name Inquiry | The system verifies account name information to enhance security. |

Adding a Recipient

You can enter recipient information on the platform’s “Add Recipient” page. The platform requires you to provide the recipient’s 16-digit Visa debit card number. The recipient’s name and card number must match the information on the Visa card exactly. You only need to provide these two pieces of information to complete adding a recipient.

- Recipient Name (must match the card exactly)

- 16-digit Visa Card Number

The platform automatically validates recipient information to ensure the transfer does not fail due to incorrect details.

Entering the Amount

You can enter the transfer amount on the remittance page. The platform will automatically display the current USD-to-target-currency exchange rate and the estimated amount to be received. The exchange rate is obtained in real-time via a forex API, with the process detailed as follows:

| Step | Description |

|---|---|

| 1 | The platform initiates a forex rate request, including the source currency (USD), target currency, and amount. |

| 2 | Visa returns the target amount and real-time exchange rate, which the platform displays to you. |

| 3 | After you confirm the amount, the platform submits the payment request. |

| 4 | Visa routes the request to the recipient’s bank or card network, responding in real-time. |

| 5 | The platform receives the payment result and expected arrival date, which is shown to you. |

You can decide whether to proceed with the remittance based on the platform’s displayed exchange rate and expected amount.

Confirmation and Submission

After filling in all information, you need to carefully verify the recipient’s name, card number, transfer amount, and exchange rate. The platform will require you to confirm all details are correct.

Common confirmation steps include:

- Verify recipient information

- Check the transfer amount and exchange rate

- Specify the purpose of the remittance

- Confirm all information

- Submit the remittance request

You should note that if the information is incorrect during submission, the system will display an error code. For example, mismatches between the recipient’s card number and name, frozen accounts, or missing information can lead to transfer failure. The platform will provide detailed error messages to help you correct issues promptly.

| Error Code | Description |

|---|---|

| RE457 | Incorrect combination of recipient identification number and bank account number |

| RE470 | Recipient’s bank account is frozen |

| RE503 | Missing recipient name |

| RE601 | Incorrectly filled information |

| RE607 | Transaction amount exceeds the limit |

| RE605 | Missing required fields |

You can correct the information based on the prompts to ensure a successful remittance.

Progress Tracking

After submitting the remittance, the platform will generate a unique transaction reference number. You can enter this number on the platform’s website or mobile app to check the remittance status in real-time. Some platforms will also notify you of the fund’s arrival progress via SMS or email.

- You can check the transaction status on the platform at any time

- The platform will send SMS or email reminders about the fund’s arrival

- The transaction reference number facilitates communication with customer service to resolve issues

Visa remittances typically arrive within minutes, and in some regions, such as the US, they can arrive in as little as 1 minute. You can choose Visa remittances for urgent situations to quickly complete international money transfers.

Fees and Timing

Transaction Fees

When using Visa remittances, the platform typically charges a transaction fee. Fees vary depending on the platform, transfer amount, and destination. Most Hong Kong-licensed banks and third-party platforms will clearly display fees before you submit the remittance. You can view detailed fee information on the remittance page to ensure you understand every expense.

Conversion Fees

When making international remittances, the platform converts currencies based on real-time exchange rates conversion. Visa remittances involve two main types of conversion fees: credit card processor currency conversion fees and dynamic currency conversion fees (DCC). The table below shows the typical fee ranges:

| Fee Type | Percentage Range |

|---|---|

| Credit Card Processor Currency Conversion Fee | Approximately 1% |

| Dynamic Currency Conversion Fee (DCC) | 3% to 12% |

You can also compare exchange rates across platforms. For example, Visa’s AUD-to-GBP exchange rate is 0.558852, while Wise’s is 0.540236. For 100 AUD converted to GBP, Visa yields 55.88 GBP, and Wise yields 54.02 GBP. Visa’s fee is approximately 2% (about 2 AUD), while Wise’s is about 0.44 AUD. You can choose the appropriate platform based on your needs.

Visa Remittance Arrival Time

When using Visa remittances, funds typically arrive within minutes. The Visa Direct service generally completes transfers within 30 minutes. In some regions, such as the US, transfers can arrive in as little as 1 minute. The table below shows arrival times for different methods:

| Transfer Method | Time Frame |

|---|---|

| Visa Direct | Typically within 30 minutes |

| Mastercard Send | Typically within 30 minutes |

In contrast, international wire transfers typically take 1-5 business days to arrive. You can choose the appropriate remittance method based on urgency.

Influencing Factors

The speed of arrival is affected by multiple factors. You should consider the following:

- Complexity of payment systems

- Compliance and regulatory burdens

- Interoperability between payment systems

- Differences in regulatory requirements across countries

- Barriers to new service providers entering the market

Regulatory requirements in different regions can lead to processing speed variations. Fintech standardization helps improve global remittance efficiency. When choosing a service, you can prioritize arrival speed and compliance to ensure funds arrive safely and promptly.

Security and Privacy

Image Source: pexels

Security Measures

When using Visa remittances, the platform employs multiple security technologies to protect your funds. Platforms typically use encrypted transmission technology to ensure your transaction information is not stolen by third parties. When logging into your account, the system will require a password and sometimes an SMS verification code for two-factor authentication. Platforms also monitor unusual transactions to promptly detect suspicious activities. You can confidently use these security measures, as they effectively prevent account misuse.

Tip: You should regularly change your password and avoid performing remittances on public networks.

Privacy Protection

The platform strictly protects your personal information. Your submitted identity proof, contact details, and bank card numbers are encrypted and stored. Only authorized personnel can access your sensitive information. The platform complies with relevant laws and regulations to prevent data leaks. You can check the privacy policy in your account settings to understand how the platform collects and uses your data.

| Protection Measure | Description |

|---|---|

| Data Encryption | Prevents unauthorized access to information |

| Access Control | Restricts employee access permissions |

| Compliance Review | Adheres to legal regulations |

Fraud Prevention Tips

You should stay vigilant against various fraud schemes when making remittances. Common fraud types include:

- Family Emergency Scam: Someone pretends to be your family or friend, claiming an emergency to trick you into sending money.

- Investment Scam: Someone promotes high-return investment schemes that are actually fraudulent.

- Romance Scam: Scammers build emotional relationships online to gain your trust and money.

- Cryptocurrency Scam: Someone lures you into investing in fake cryptocurrency projects.

- Technical Support Scam: Someone poses as a technician, demanding payment or account information.

- Extortion and Blackmail Scam: Scammers use threats to coerce you into transferring money.

- Prize Scam: Someone claims you’ve won a prize but requires you to pay a fee first.

- Employment Scam: Someone offers fake job opportunities, requiring you to pay upfront.

You should remain cautious when strangers request remittances. Do not trust high-return promises or casually disclose personal information. If you encounter suspicious situations, you can contact the platform’s customer service or a Hong Kong-licensed bank for verification.

Use Cases

Typical Uses

You can use Visa remittances to meet various international money transfer needs. Many users choose this method to provide financial support for family or to make urgent transfers. You can also use it to pay tuition fees for children studying abroad. The table below shows common remittance purposes and source regions:

| Remittance Purpose | Source Region |

|---|---|

| Family Support | North America and CEMEA to Asia |

| Emergency Transfers | Overseas workers sending funds to their home country |

| Tuition Support | Sending funds to children studying abroad |

You can refer to the following use case descriptions to understand the practical applications of Visa remittances:

- Remittances are mainly used for family support, helping meet basic needs like food, healthcare, and education.

- Emergency transfers provide necessary financial support for families.

- Funds can also be used to support children studying abroad.

Service Comparison

When choosing an international remittance method, you can compare Visa remittances with other mainstream services. Visa remittances are fast, typically completing in minutes, making them suitable for urgent needs. Traditional international wire transfers take 1-5 business days, which is slower. Some third-party platforms like Panda Remit also offer relatively fast arrival times, but fees and exchange rates may vary. The table below briefly compares several common methods:

| Service Type | Arrival Time | Fees (USD) | Exchange Rate Transparency | Suitable Scenarios |

|---|---|---|---|---|

| Visa Remittance | Minutes | 2-10 | High | Urgent, family support |

| International Wire Transfer | 1-5 business days | 10-30 | Medium | Large, non-urgent |

| Third-Party Platforms | 1 hour-1 day | 1-8 | High | Daily small remittances |

You can choose the most suitable service based on arrival time, fees, and exchange rate transparency.

Selection Tips

When choosing an international remittance service, you need to consider arrival time, fees, and security. Visa remittances are ideal for urgent transfers and daily family support. If you’re more concerned about fees, you can compare the fees and exchange rates of different platforms. You can prioritize Hong Kong-licensed banks or compliant third-party platforms to ensure fund safety. Platforms like Panda Remit are also worth considering for daily small remittances. You should select a service with fast arrival, reasonable fees, and high security based on your actual needs.

Tip: You can research each platform’s fees and arrival times in advance to avoid delays due to unclear information.

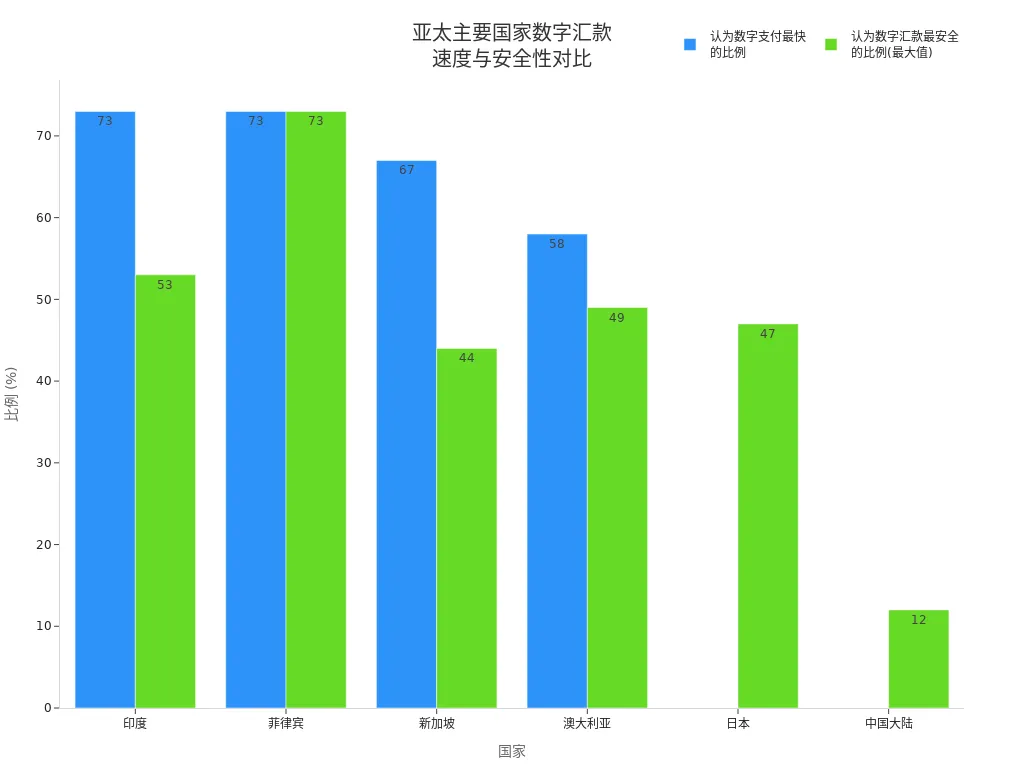

When choosing an international money transfer method, Visa remittances offer a fast, secure, and convenient experience. A recent survey in the Asia-Pacific region shows that digital remittance apps have a usage rate of up to 74% in India and the Philippines, with over half of users considering digital payments the fastest method, and their security is also highly recognized.

| Country | Digital Remittance App Usage Rate | Proportion Considering Digital Payments Fastest | Proportion Considering Digital Remittances Safest |

|---|---|---|---|

| India | 74%/76% | 73% | 50%/53% |

| Philippines | 74%/66% | 73% | 73%/73% |

| Singapore | 70%/75% | 67% | 44%/42% |

| Australia | N/A | 58% | 49%/45% |

| Japan | N/A | N/A | 47%/42% |

| Mainland China | N/A | N/A | 10%-12% |

When evaluating international remittance methods, you can focus on the following key elements:

- Transaction security to protect your personal and financial information.

- Transaction speed to ensure funds arrive quickly.

- Transfer costs, including fees and exchange rates.

- Understanding the laws and regulations of China/mainland China and the recipient country.

You can flexibly choose the most suitable international remittance service based on your actual needs to ensure funds are secure, arrive promptly, and have reasonable fees.

FAQ

Which countries and regions does Visa remittance support?

You can transfer funds to most countries and regions worldwide via Visa remittances. The platform will display available destinations on the remittance page. You need to confirm in advance whether the recipient’s location supports Visa card payments.

Are there limits on remittance amounts?

Each remittance has minimum and maximum amount limits. The platform will display specific limits on the submission page. Generally, the maximum per transaction is up to 10,000 USD, and the minimum is 10 USD. You can choose an appropriate amount based on your needs.

How to track remittance progress?

You can enter the transaction reference number on the platform’s website or mobile app to view the remittance status in real-time. Some platforms will also notify you of the fund’s arrival progress via SMS or email. You can stay updated on the funds’ status at any time.

What to do if a remittance fails?

If a remittance fails, you can check the reason based on the platform’s error code prompts. Common reasons include incorrect information, frozen accounts, or exceeding amount limits. You can revise the information and resubmit or contact the platform’s customer service for assistance.

Are additional documents required for remittances?

For first-time use, the platform may require you to upload identity proof and address proof. Subsequent remittances typically do not require resubmission. You can check the required document list in your account settings to ensure all materials are complete.

While Visa’s remittance services offer rapid, minute-level transfers and global reach, the steep fees (like 3%-12% dynamic currency conversion costs) and intricate verification steps can inflate expenses, particularly for frequent cross-border transactions from China/mainland China. BiyaPay presents a smarter solution: transfers with fees as low as 0.5%, same-day delivery across most global regions, ensuring cost-effective and swift fund flows. Whether for urgent transfers or family support, BiyaPay meets your needs with ease.

BiyaPay excels with its integrated features: real-time fiat-to-crypto conversions, zero-fee contract orders, and live exchange rate checks to shield against volatility. Its quick signup takes mere minutes, enabling you to trade US and Hong Kong stocks on one platform without an overseas account, merging remittances with investment growth. Unlike Visa’s costly structure and complex processes, BiyaPay guarantees transparency and compliance for secure transactions.

Take charge today—sign up at BiyaPay for a seamless global transfer experience. Use the Real-Time Exchange Rate Query to lock in optimal rates, minimizing conversion losses. Discover Stocks to channel funds into global markets, boosting wealth creation. With BiyaPay, international remittances become effortless, cost-efficient, and a catalyst for financial success!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.